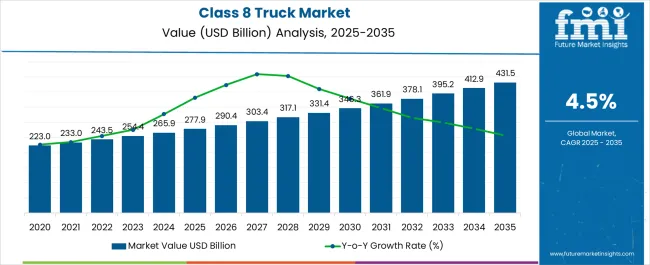

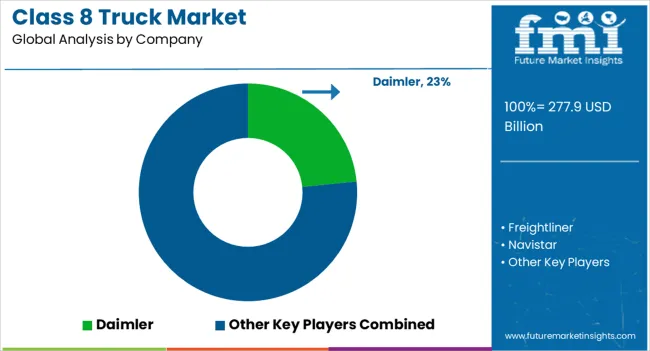

The Class 8 Truck Market is estimated to be valued at USD 277.9 billion in 2025 and is projected to reach USD 431.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. A steady trajectory has been observed, with conventional diesel power remaining dominant while newer powertrains are phased in under tightening United States and European Union heavy duty emissions rules adopted in April and May 2024. These policies place long term compliance pressure on diesel and support a gradual mix shift.

Battery electric trucks are expected to gain share through the 2030s as charging networks scale and total cost of ownership improves in targeted duty cycles. Multiple outlooks indicate electric truck sales shares could approach roughly 30 percent globally by 2035, with higher shares in the United States and China in that timeframe, while diesel remains significant in many fleets. Fuel cell trucks are advancing as a complementary long haul option, illustrated by customer trial fleets and liquid hydrogen road testing, while connectivity and driver assistance suites such as Detroit Connect and Volvo Connect expand service and software revenue layers. In Europe at present, diesel continues to account for a very large share of new truck registrations, underscoring the early stage of the transition.

| Metric | Value |

|---|---|

| Class 8 Truck Market Estimated Value in (2025 E) | USD 277.9 billion |

| Class 8 Truck Market Forecast Value in (2035 F) | USD 431.5 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The Class 8 truck market is growing steadily, supported by long-haul freight demand, infrastructure investment, and advances in powertrain and digital controls. These heavy-duty trucks remain essential to logistics and supply chains in North America, and road freight is also a leading inland mode across much of Europe, where over-the-road transportation remains dominant.

The rise of e-commerce and expectations for faster delivery are reinforcing the need for efficient, reliable tractors and trailers. Fleet operators are sharpening total cost of ownership through specification optimization, fuel-saving aerodynamics and tires, and wider use of telematics for routing, maintenance, and driver performance. While the industry is piloting battery-electric and hydrogen fuel-cell models, diesel remains the primary fuel in the near term thanks to energy density, range, and ubiquitous refueling infrastructure. The outlook remains favorable, underpinned by rising freight volumes, continued investment in transportation networks, and ongoing replacement cycles tied to emissions, safety, and uptime requirements.

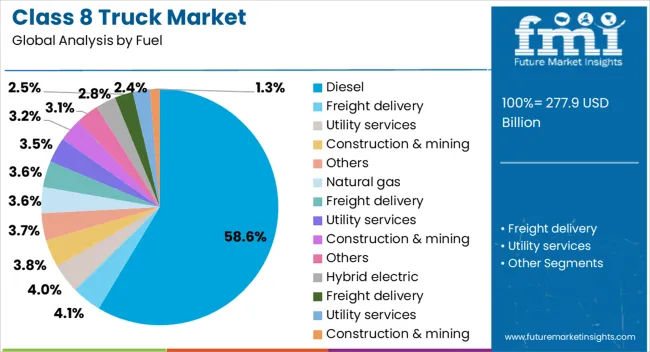

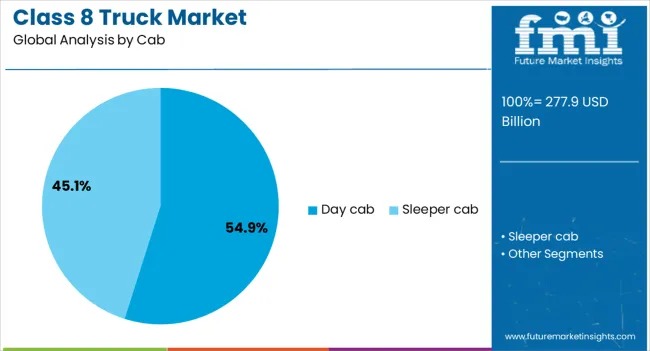

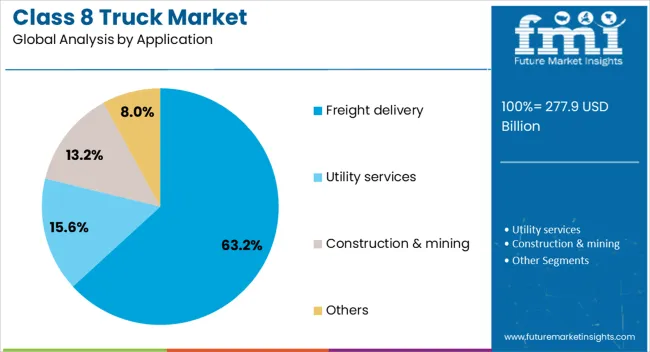

The class 8 truck market is segmented by fuel, cab, application, axle, horsepower, ownership, and region. By fuel, the market is divided into diesel, natural gas (CNG or LNG), battery electric, hydrogen fuel cell, and hybrid. By cab, it is classified into day cab and sleeper cab. By application, it is segmented into freight delivery, utility services, construction and mining, and others. By axle, it is segmented into 4x2, 6x2, and 6x4. By horsepower, it is segmented into below 300 HP, 300–400 HP, 400–500 HP, and 500 HP and above. By ownership, it is segmented into fleet operator and independent operator. Regionally, the industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa. (Class 8 refers to vehicles with GVWR greater than 33,001 lb in the U.S. classification.

The diesel fuel segment is expected to account for 58.60% of the total class 8 truck market by 2025; this numeric share is retained as a working assumption. Diesel remains the dominant fuel in heavy trucks because it offers high energy density, mature refueling networks, and high-torque performance that suits long haul and vocational duty cycles. This dominance is reflected in current registrations, with diesel accounting for about 95.7 percent of new EU truck registrations in 2023, indicating that the transition is still at an early stage for heavy vehicles.

Within cabs, the day cab segment is projected to contribute 54.90% of total market revenue by 2025; this figure is treated as a working assumption. Day cabs are widely specified for regional haul, pickup and delivery, less-than-truckload, and drayage routes that do not require overnight rest facilities, supporting lower purchase cost, reduced maintenance, and better maneuverability and payload efficiency in congested corridors. OEM literature positions day-cab configurations and regional haul use cases together for leading class 8 models, reinforcing the operational fit cited here.

The freight delivery application is projected to hold 63.20% of total class 8 market revenue by 2025; this percentage is retained as a working assumption. Freight movements rely heavily on trucks for domestic shipments, and public statistics show that trucks carry roughly two-thirds of U.S. freight by tonnage and the largest share by value, underscoring the central role of heavy trucks in both full truckload and less-than-truckload networks that serve manufacturers, wholesalers, retailers, and third-party logistics providers. As logistics networks scale and service levels tighten, class 8 capacity remains a core enabler of long distance and regional freight flows.

The market has gained prominence as demand for heavy-duty freight transport across long-haul and regional routes continues to increase. These trucks are crucial for logistics, construction, and industrial activity. Their ability to move bulk loads while improving fuel efficiency, safety, and performance supports adoption. Regulatory policies, fleet modernization, and the integration of telematics and emerging alternative powertrains have further strengthened demand. As freight networks expand globally, Class 8 trucks remain a cornerstone of commercial transportation.

The market is driven by sustained growth in freight movement across domestic and cross-border trade. Class 8 trucks are indispensable for transporting bulk commodities, raw materials, and consumer goods over long distances. Expansion in e-commerce, industrial output, and international trade reinforces reliance on efficient road-freight systems. Fleet operators prioritize Class 8 equipment for its payload capacity, duty-cycle suitability, and ability to support just-in-time logistics. The balance between fuel efficiency and payload performance is central to procurement decisions. Large logistics providers continue to upgrade fleets to manage rising cargo volumes, strengthening demand and positioning Class 8 trucks as a primary choice across multiple industries.

Tightening emission standards and corporate decarbonization goals are accelerating development of natural gas, battery-electric, and hydrogen fuel-cell Class 8 offerings. Battery-electric models are gaining traction first in urban and regional-haul duty cycles where predictable routes and depot charging are feasible, while hydrogen fuel-cell concepts target longer-range and heavier-load applications as infrastructure scales. Hybrid solutions remain niche but are used in specific stop-start operations. In parallel, manufacturers continue to improve the efficiency and aftertreatment performance of diesel powertrains, which remain the near-term standard due to energy density, range, and ubiquitous refueling. The regulatory push and technology advances together are reshaping the long-term propulsion mix and enabling sustainable fleet modernization.

Telematics integration has transformed operational efficiency. Fleet managers increasingly rely on real-time tracking, predictive maintenance, and driver-behavior monitoring to optimize asset utilization and safety. Connectivity enables improved route planning, reduced idle time and fuel burn, and better compliance with hours-of-service and safety programs. Enhanced diagnostics and automated reporting minimize downtime by enabling proactive maintenance scheduling. The incorporation of AI and analytics helps identify bottlenecks, benchmark performance, and lower total cost of ownership. As digital transformation accelerates, connected Class 8 trucks are strategic assets for logistics optimization and competitive differentiation.

Infrastructure investment plays a vital role in shaping demand. Highway expansion, port upgrades, and new logistics hubs in emerging economies have boosted heavy-truck utilization, while mature markets support demand through replacement cycles and technology refreshes aligned to safety and emissions. Economic growth drives higher consumption and manufacturing output, increasing freight activity and tractor-trailer demand. Class 8 trucks also underpin large construction programs by moving heavy equipment and raw materials efficiently. Macro conditions, ranging from trade flows to public works spending, remain influential in the global Class 8 market outlook.

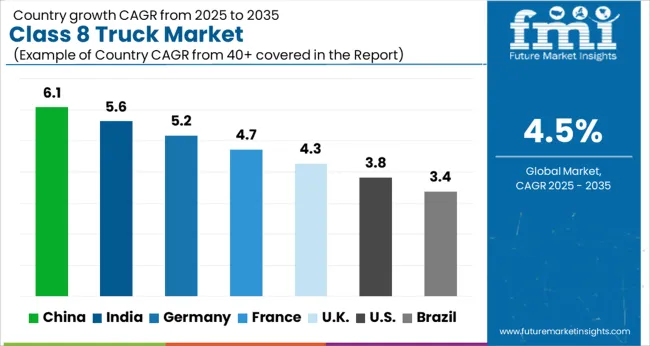

The market is projected to record a CAGR of 4.5% between 2025 and 2035, influenced by freight transportation demand, infrastructure investment, and fleet modernization. China, with a 6.1% CAGR, develops the market through large-scale logistics expansion and domestic production capacity. India follows at 5.6%, strengthening its position with government-backed highway projects and rising goods movement. Germany grows at 5.2%, advancing through engineering innovation and adoption of alternative fuel trucks. The UK, at 4.3%, supports growth with fleet replacement strategies and regulatory compliance. The USA, at 3.8%, contributes steadily through long-haul freight demand and gradual electrification efforts. This report covers 40+ countries, with the top markets highlighted here for reference.

China is projected to lead the market with a CAGR of 6.1% between 2025 and 2035. Expanding logistics networks, growth in heavy-duty freight movement, and rising demand from construction and mining sectors are fueling the adoption of Class 8 trucks. Domestic manufacturers are investing in advanced powertrain technologies and alternative fuel-based models to meet emission norms. Infrastructure development programs and increasing e-commerce activity are reinforcing demand for long-haul transport solutions.

India is expected to witness a CAGR of 5.6% in the Class 8 truck segment, supported by economic expansion and rising logistics demand. Increasing reliance on road transport for freight movement and growth in industrial production are driving demand. Government-backed infrastructure development and Make in India initiatives are further boosting domestic truck manufacturing. Long-haul routes and growing adoption of fleet management technologies are strengthening market opportunities.

Germany is anticipated to grow at a CAGR of 5.2% over the forecast horizon. Robust manufacturing and export-oriented industries are generating significant demand for long-haul heavy-duty trucks. Strict emission norms are accelerating the adoption of fuel-efficient and electric Class 8 trucks. Investments in autonomous driving technologies and connected truck solutions are advancing market competitiveness. Demand is also supported by regional logistics and Pan-European trade routes.

The United Kingdom is forecast to expand at a CAGR of 4.3%, with growth driven by logistics modernization and increasing construction activity. Class 8 trucks are being utilized to support distribution networks linked to retail and e-commerce expansion. Manufacturers are focusing on alternative fuels and connected fleet technologies to meet emission reduction targets. Strategic investments in charging infrastructure for heavy vehicles are reinforcing future growth prospects.

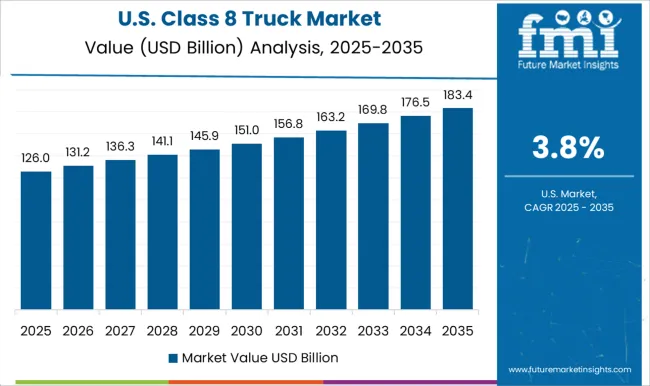

The United States is expected to grow at a CAGR of 3.8%, supported by increasing demand for freight mobility and modernized logistics operations. Expansion of interstate transport and long-haul shipping is creating consistent demand. Regulations on emissions and fuel efficiency are driving innovations in hybrid and electric Class 8 trucks. Technological advancements in telematics, predictive maintenance, and autonomous driving are shaping the competitive landscape.

Leadership in North America is held by Daimler Truck through Freightliner, recognized for fuel-efficient designs and connected technology. Durable Class 8 portfolios with growing electric and hybrid options are offered by Volvo Trucks and Mack Trucks. Safety systems, driver comfort and integrated powertrains are emphasized to raise logistics efficiency across regions. Strong reliability and aftermarket support keep Navistar, Kenworth and Peterbilt competitive in long-haul fleets and construction applications. European engineering strength is brought by Scania and MAN, with low-emission heavy-duty transport and digital fleet management tools.

Market diversity is supported by Isuzu Motors with dependable platforms for regional and specialized use cases. Industry direction continues to be set by electrification, automation and tighter emission norms. Telematics, lightweight materials and autonomous-ready features are shaping competition and prompting investment in next-generation platforms and lifecycle services.

| Item | Value |

|---|---|

| Quantitative Units | USD 277.9 Billion |

| Fuel | Diesel, Freight delivery, Utility services, Construction & mining, Others, Natural gas, Freight delivery, Utility services, Construction & mining, Others, Hybrid electric, Freight delivery, Utility services, Construction & mining, Others, Others, Freight delivery, Utility services, Construction & mining, and Others |

| Cab | Day cab and Sleeper cab |

| Application | Freight delivery, Utility services, Construction & mining, and Others |

| Axle | 4x2, 6x4, and 6x2 |

| Horsepower | Below 300HP, 300HP - 400HP, 400HP - 500HP, and 500HP & Above |

| Ownership | Fleet operator and Independent operator |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daimler, Freightliner, Navistar, Isuzu Motors, Kenworth, Mack Trucks, MAN, Peterbilt, Scania AB, and Volvo Trucks |

| Additional Attributes | Dollar sales by truck class and application, adoption across long haul, regional distribution, construction, and heavy duty freight operations, influence of fleet electrification and hydrogen fuel cell integration, penetration of advanced driver assistance systems and connected telematics, impact of regulatory mandates on emissions reduction and fuel efficiency, regional consumption trends across North America, Europe, and Asia-Pacific, role of autonomous trucking pilots and platooning technologies, growth in aftermarket services and leasing models, competitive dynamics among OEMs and component suppliers, and lifecycle considerations including total cost of ownership, maintenance intervals, and residual value performance. |

The global class 8 truck market is estimated to be valued at USD 277.9 billion in 2025.

The market size for the class 8 truck market is projected to reach USD 431.5 billion by 2035.

The class 8 truck market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in class 8 truck market are diesel, freight delivery, utility services, construction & mining, others, natural gas, freight delivery, utility services, construction & mining, others, hybrid electric, freight delivery, utility services, construction & mining, others, others, freight delivery, utility services, construction & mining and others.

In terms of cab, day cab segment to command 54.9% share in the class 8 truck market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Classic Organic Pigments Market Size and Share Forecast Outlook 2025 to 2035

Class D Audio Amplifiers Market is Segmented by Type, End Use and Region through 2025 to 2035

Classified Platform Market Analysis by Type, Application, and Region Through 2035

Class 7 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 3 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 5 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 1 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 2 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 4 Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Class 6 Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Air Classifying Mill Market Size and Share Forecast Outlook 2025 to 2035

Smart Classroom Market Size and Share Forecast Outlook 2025 to 2035

Virtual Classroom Market Trends – Size, Demand & Forecast 2024-2034

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Fault Detection and Classification Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

802.15.4/ZigBee Market Size and Share Forecast Outlook 2025 to 2035

802.11ac Wave 2 Market Size and Share Forecast Outlook 2025 to 2035

8K Technology Market

Ga 68 DOTATOC Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA