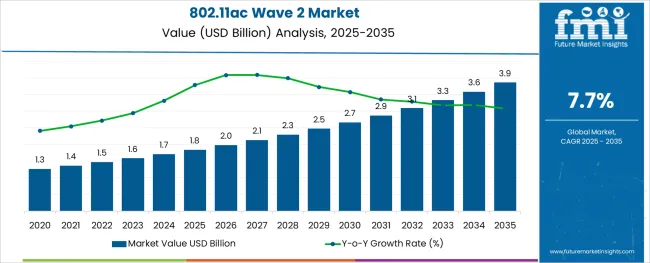

The 802.11ac Wave 2 Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 3.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period.

The 802.11ac Wave 2 market is witnessing sustained demand due to the growing need for high-capacity wireless connectivity in enterprise and public environments. The market’s momentum is fueled by the increased usage of high bandwidth applications such as video conferencing, real-time collaboration tools, and cloud-based services.

Organizations are prioritizing infrastructure upgrades to accommodate mobile first workforces and the proliferation of IoT devices, both of which require enhanced wireless throughput and reduced latency. Regulatory emphasis on secure and high speed wireless infrastructure, particularly across educational, healthcare, and industrial sectors, is further supporting growth.

With its advanced MU-MIMO capabilities and support for higher user densities, 802.11ac Wave 2 technology is being adopted as a scalable and cost-efficient solution for next-generation enterprise networks. The market outlook remains optimistic, driven by ongoing digital transformation, demand for low latency connectivity, and the shift toward hybrid work environments requiring resilient wireless infrastructure.

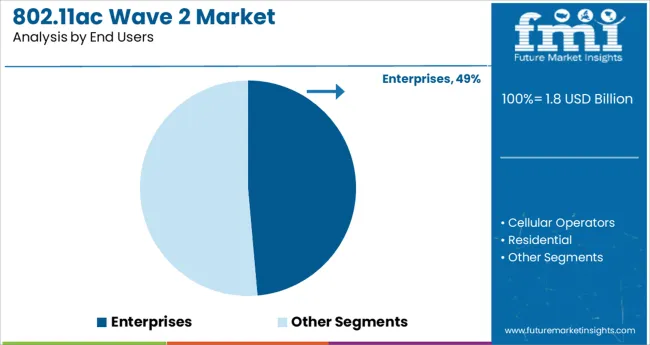

The market is segmented by End Users and region. By End Users, the market is divided into Enterprises, Cellular Operators, Residential, and Public Areas. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

It has been observed that the enterprise segment holds 48.60% of the overall market revenue within the end-user category, establishing itself as the leading contributor to demand for 802.11ac Wave 2 solutions. This dominance is attributed to the growing reliance on cloud-hosted applications, unified communications, and mission critical wireless infrastructure.

Enterprises have prioritized Wave 2 upgrades to manage increasing device density and ensure seamless performance in large, high-traffic environments such as offices, campuses, and data centers. The ability of Wave 2 technology to support multiple concurrent users through MU-MIMO has enabled IT departments to optimize bandwidth and maintain consistent performance across distributed networks.

Additionally, cost effectiveness and backward compatibility have facilitated adoption without requiring complete infrastructure overhauls. These factors, combined with long-term IT planning cycles and compliance requirements, have reinforced the enterprise segment’s leadership position within the 802.11ac Wave 2 market.

The global demand for over-the-air software updates is projected to increase at a CAGR of 7.70% during the forecast period between 2025 and 2035, reaching a total of USD 2,879.10 Million in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2024, sales witnessed significant growth, registering a CAGR of 4.40%.

Since its certification as the 802.11 standards, Wi-Fi technology has experienced amazing evolution. The 802.11ac Wi-Fi standard was released in the commercial sector in two independent waves, named Wave 1 and Wave 2, both of which offer considerable performance improvements over previous standards.

With over 60 client devices and 25 routers supported, the 802.11ac Wave 2 Wi-Fi standard is swiftly establishing itself in the commercial sector and is likely to become the most widely used Wi-Fi standard in the next years.

In 2020, the Wi-Fi Alliance, a global nonprofit group of corporations that determines Wi-Fi technology compatibility, ratified the 802.11ac Wave 2 standard. Wave 2 builds on Wave 1 with several substantial advancements such as support for speeds of up to 2.34 Gbps in the 5 GHz band, support for multiuser multiple input, multiple outputs (MU-MIMO), and improved performance with the option of employing 160-MHz-wide channels and a fourth spatial stream.

High Growth in Mobile Video Usage and VoIP Services to Accelerate the Market Growth

The high growth in mobile video usage and VoIP services, the continued shift to end-user mobility, increasing volumes of Wi-Fi-enabled Internet of Things (IoT) devices, and demand for high-speed delivery of large files and data access and movement are the major factors driving the global 802.11ac Wave 2 market.

Because it enables multiuser multiple inputs, and multiple outputs, the Wave 2 standard allows for a higher density of linked devices than the Wave 1 standard (MU-MIMO). This enables optimal spectrum usage for various connected devices, giving consumers alternatives for conveniently getting their gadgets on and off the network. Other software advances in MU-MIMO include the ability to group/schedule the kind of traffic for each device, dynamic modulation and coding adaption, and sounding rate management.

Furthermore, the trend of using several connected devices per user, as well as traction toward the all-wireless office user experience, is likely to drive market development throughout the forecast period.

Lack of Compatibility with the Existing Clients to Impede the Market Growth

One major barrier to wave 2 adoption is the fact that many current Wi-Fi clients lack forward compatibility with the new wave 2 capabilities. As with most new technologies, it will take some time for wave 2 standard acceptances and wave 2-enabled hardware to become available.

Growing Use of Cloud-Based Services to Fuel the Market Growth

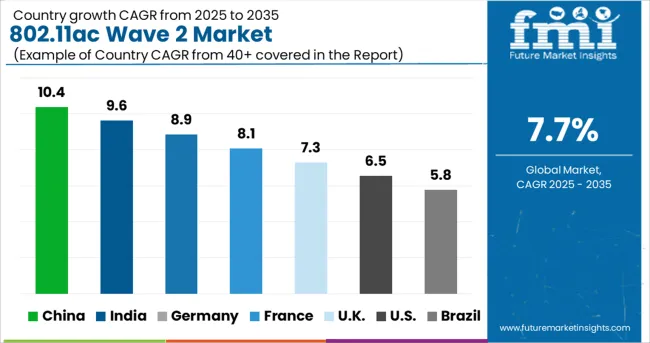

The 802.11ac Wave 2 market in Asia Pacific is expected to accumulate a significant market share of 15% in 2025 and is expected to continue to maintain the trend over the forecast period as well.

During the forecast period, Asia Pacific is expected to be the fastest expanding region in the 802.11ac Wave 2 market. Asia Pacific is the primary center for information technology and telecommunications.

Cloud-based services are the most appealing investment destination in this area, boosting the 802.11ac Wave 2 market's development prospects throughout the projection period.

In comparison to other regions with a high proportion of dependent persons, this region has a big working population. It is expected that the worldwide 802.11ac Wave 2 market would increase significantly during the forecast period due to the concentration of a large number of rising economies such as China, India, and South Korea, which have significant growth prospects.

Thriving End-user Sectors in the Region to Accelerate Market

The 802.11ac Wave 2 market in Europe is expected to accumulate a market share value of 25.80% in 2025.

Europe is a promising market for the 802.11ac Wave 2 market as well. Europe has thriving banking, healthcare, and telecommunications industries, and with increased investment prospects, the region is expected to develop at a steady pace during the projected period.

Presence of Industry Giants in the Region to Fuel the Market Growth

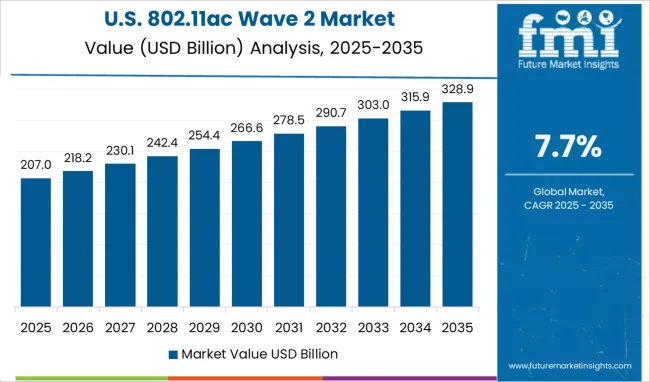

The 802.11ac Wave 2 market in North America is expected to accumulate the highest market share of 33.5% in 2025.

In 2024, North America had the biggest share in the 802.11ac Wave 2 market owing to the region's concentration of significant market participants. During the projection period, technical improvements, a developed country, and an IT center due to major industrialization, as well as the presence of several IT organizations that use 802.11ac Wave 2 for various reasons, would drive regional market expansion.

The Enterprises Segment to Drive the 802.11ac Wave 2 Market

Rising internet usage and increased investment in communications networks extend the market prospects for the enterprise segment. Consumers are spending a greater amount of their money on mobile devices such as laptops, smartphones, and tablets.

Though network facilities have substantially improved in the age of 3G and 4G network connections, Wi-Fi has become a viable alternative for most enterprises. Wi-Fi is capable of providing higher-speed internet connections and also covers a vast region.

Internet access may be supplied in public places such as restaurants, parks, and metro stations via Wi-Fi, and this aspect is driving the segment’s growth which is in turn driving the 802.11ac Wave 2 market throughout the projection period.

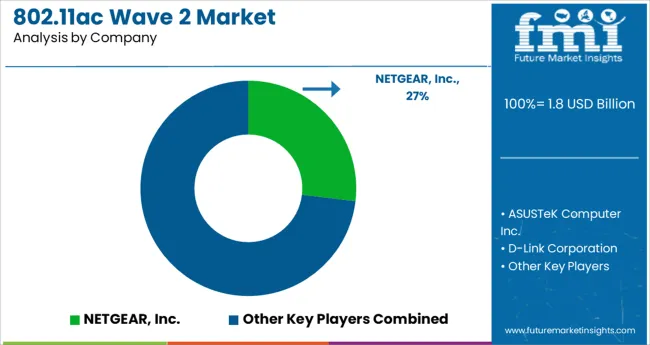

NETGEAR, Inc., Cisco Systems, ASUSTeK Computer Inc., D-Link Corporation, TP-Link, Linksys, and Buffalo Americas, Inc. are a few of the prominent participants in the worldwide 802.11ac wave 2 market.

Recent Developments:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 7.70% from 2025 to 2035 |

| Market Value in 2025 | USD 1.8 billion |

| Market Value in 2035 | USD 3.9 billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | End-Users, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific Excluding Japan; Japan; The Middle East and Africa (MEA) |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Russia, Poland, China, Japan, South Korea, India, ASIAN, Oceania, GCC Countries, South Africa, Turkey |

| Key Companies Profiled |

|

The global 802.11ac wave 2 market is estimated to be valued at USD 1.8 USD billion in 2025.

It is projected to reach USD 3.9 USD billion by 2035.

The market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types are enterprises, cellular operators, residential and public areas.

segment is expected to dominate with a 0.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Waveguide Components and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Wavefront Aberrometers Market Size and Share Forecast Outlook 2025 to 2035

Wavelength Division Multiplexing (WDM) Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

mmWave Radar Module Market Size and Share Forecast Outlook 2025 to 2035

Mid Wave Mid-IR Supercontinuum Laser Market Forecast and Outlook 2025 to 2035

Dual Wavelength Raman Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Long Wave Infrared Supercontinuum Laser Market Forecast and Outlook 2025 to 2035

Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Microwave Monolithic Integrated Circuits Market Size and Share Forecast Outlook 2025 to 2035

Microwave Cable Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Microwave Oven Market Size and Share Forecast Outlook 2025 to 2035

Microwaveable Stuffed Animal Toys Market Size and Share Forecast Outlook 2025 to 2035

Shortwave Infrared (SWIR) Market Size and Share Forecast Outlook 2025 to 2035

Microwave Ablation Devices Market Size and Share Forecast Outlook 2025 to 2035

Microwave Market Size and Share Forecast Outlook 2025 to 2035

Microwave Backhaul System Market Size and Share Forecast Outlook 2025 to 2035

Microwave Device Market Size and Share Forecast Outlook 2025 to 2035

Microwave-Safe Utensils Market Size and Share Forecast Outlook 2025 to 2035

Microwave Absorbing Material Market Size, Growth, and Forecast 2025 to 2035

Microwave Power Meter Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA