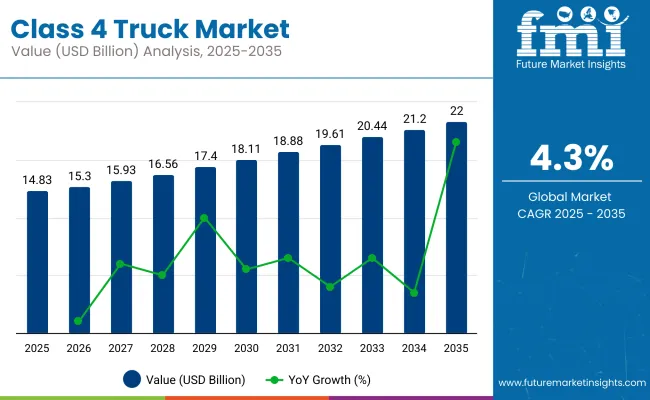

In 2025, the class 4 truck market was valued at USD 14.83 billion and is likely to reach USD 22.54 billion by 2035, registering a CAGR of 4.3%.The rolling CAGR assessment indicates a stable expansion path, influenced by replacement cycles, operational cost efficiency, and compliance with tightening emission norms. From 2025 to 2028, moderate gains are anticipated as logistics operators and municipal service providers invest in newer fleets with enhanced payload capacity and improved fuel efficiency. This period also benefits from early-stage adoption of electric and hybrid Class 4 trucks in high-density commercial routes.

From 2028 to 2031, growth momentum is supported by expanding e-commerce deliveries, regional distribution needs, and the use of Class 4 platforms in last-mile freight operations. The transition to advanced propulsion systems and integration of connected telematics strengthen market positioning. Between 2031 and 2035, steady replacement demand combines with innovations in driver assistance, route optimization, and load management to sustain the rolling CAGR.

The analysis suggests that this market will maintain resilience through operational diversification and technology-driven upgrades, ensuring a consistent role for Class 4 trucks across logistics, retail distribution, and public service applications.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 14.83 billion |

| Industry Value (2035F) | USD 22.54 billion |

| CAGR (2025 to 2035) | 4.3% |

The class 4 truck market accounted for around 33% share within the broader class 4-8 truck category in 2024, driven by demand for mid-range payload capabilities and maneuverability in urban delivery. Diesel-powered variants represented nearly 83% of sales due to fuel availability and operational efficiency, while electric models began gaining share, crossing 5% in select fleets. Freight delivery accounted for about 33% of Class 4 truck usage, supported by e-commerce and regional distribution hubs. Asia Pacific led the market with approximately 46% share, followed by North America with 35%, driven by logistics network expansion and fleet renewal programs.

Electrification and hybrid integration trends have been accelerating due to stricter emissions regulations and urban low-emission zones. Fleet operators have been adopting telematics and AI-enabled route optimization to improve asset utilization and reduce operating costs. OEMs have expanded electric Class 4 offerings, targeting last-mile logistics in dense city areas.

Demand in Asia Pacific has been reinforced by infrastructure investments and cross-border trade routes. North America’s market has been influenced by replacement cycles and advanced driver-assistance system integration. A steady CAGR through 2035 is expected as vehicle technology, powertrain diversity, and fleet automation enhance operational efficiency across industries.

The class 4 truck market has been influenced by procurement patterns within logistics, municipal, and industrial sectors. Trucks in this category, weighing between 14,001 and 16,000 pounds’ gross vehicle weight rating, have been preferred for medium-distance cargo transport due to flexibility and cost efficiency.

Diesel powertrains dominate the market, though hybrid and electric options are increasingly included in public fleet renewals. Regulatory updates in OECD countries have affected vehicle replacement timing, while industrial expansion and infrastructure investments in ASEAN countries have driven market penetration. The rise of e-commerce has also expanded use in last-mile delivery services.

The market expansion for class 4 trucks has been supported by investments in infrastructure and efforts to update commercial fleets. In OECD regions, updated safety and emission regulations have encouraged the adoption of trucks that meet newer standards. ASEAN economies have seen demand grow due to new industrial zones and improved freight corridors.

Fleet managers have focused on vehicles that offer better fuel efficiency, improved suspension, and torque optimized for various terrains. Technology integration, including GPS and predictive maintenance, has enhanced route efficiency and fleet utilization. Increased competition in logistics has led to shorter replacement cycles, providing steady demand for class 4 trucks suited to diverse transport needs.

The class 4 truck market has faced challenges related to regulatory compliance and cost management. Advanced safety and emission requirements in OECD countries have increased upfront costs for fleet acquisition. ASEAN markets have been affected by tariffs and uneven access to financing, which have limited purchases by smaller operators. Higher initial investments are required for electric and hybrid trucks, influencing procurement decisions, particularly among budget-constrained buyers.

Maintenance costs for these vehicles have also been higher in regions lacking specialized services. Fuel price volatility impacts diesel fleets’ operational budgets, while insurance costs have risen in certain transport sectors, constraining profit margins and slowing rapid fleet turnover.

The growth of e-commerce has created new demand channels for class 4 trucks in both OECD and ASEAN countries. These trucks’ size allows for efficient urban deliveries while accommodating adequate payloads for bulk shipments. Retail and distribution centers have implemented dedicated class 4 fleets to improve delivery speed and accuracy. Route optimization technologies have increased efficiency in dense urban networks.

Regulations targeting urban emissions have encouraged hybrid truck adoption. Increased cross-border trade within ASEAN has created opportunities for short-haul international freight. Seasonal variations and just-in-time logistics have supported steady fleet utilization, positioning class 4 trucks as vital to modern logistics chains.

Electrification has progressed steadily in the class 4 truck market due to reduced battery costs and improved charging infrastructure. Public and utility fleets have increased allocation for electric vehicles to meet emission targets. Hybrid trucks remain an alternative for operators seeking fuel savings without range limitations. Telematics use has expanded significantly, enabling real-time monitoring of vehicles and drivers.

Analytics platforms help optimize asset usage and reduce downtime. Collaboration between manufacturers and technology providers has accelerated innovation in connected vehicle systems. Retrofitting older trucks with partial electrification and telematics has become common. These developments have enhanced the adaptability of class 4 trucks in urban and regional freight operations.

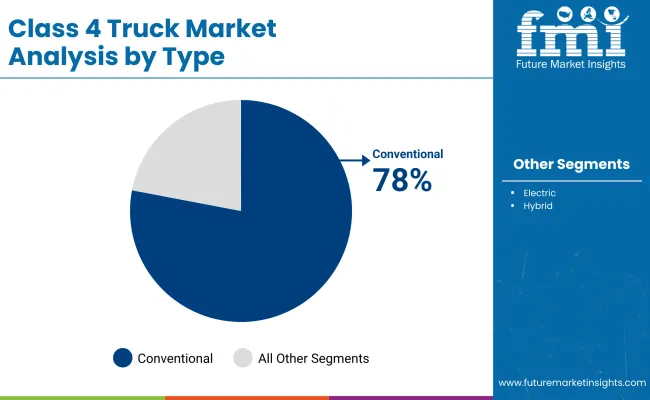

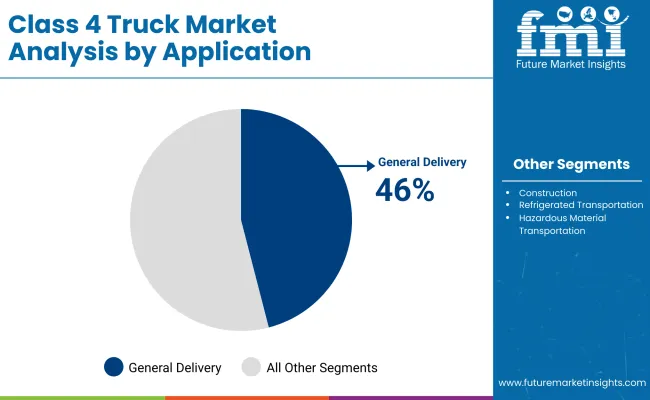

The class 4 truck market in 2025 is shaped by conventional types and diesel powertrains dominating their respective segments. General delivery applications constitute the largest share, driven by urban logistics and last-mile delivery growth. Payload capacity between 12,501 and 14,500 lbs is preferred for operational flexibility. Box trucks lead the body type segment due to their versatility in cargo protection. While electric and hybrid options remain smaller shares, their presence is expanding gradually supported by emission regulations and cost efficiency improvements in key markets.

Conventional Class 4 trucks hold a dominant 78% market share, favored for reliability and established fueling infrastructure. Leading manufacturers such as Ford, Freightliner, and Isuzu have focused on improving fuel efficiency, driver comfort, and safety systems for these models. Conventional trucks are widely used in urban and regional logistics where durability and maintenance network coverage are priorities. Incremental advances in engine technology and lightweight materials have also extended their market presence despite rising interest in electric alternatives. Fleet operators value the total cost of ownership advantages offered by these conventional powertrains.

General delivery applications capture 46% of the class 4 truck market, driven by growth in e-commerce, food delivery, and local courier services. OEMs including Hino Motors, Chevrolet, and Ram Trucks provide models optimized for urban maneuverability, cargo space, and fuel efficiency. Demand is concentrated in densely populated regions where last-mile delivery challenges require reliable and versatile trucks. Expansion of regional warehouses and omni-channel retail strategies have further increased requirements for this segment. Regulatory policies encouraging lower emissions in cities are gradually influencing fleet upgrades towards cleaner powertrains.

Payload capacity between 12,501 and 14,500 lbs holds 34% market share, preferred for balancing cargo volume and vehicle maneuverability. Manufacturers such as Freightliner, Ford, and International Trucks offer multiple configurations within this range to meet varied operational needs. This capacity suits general delivery, construction material transport, and refrigerated goods movement efficiently. Fleet operators benefit from improved fuel economy relative to higher payload trucks and greater load flexibility compared to smaller classes. This segment has seen steady growth driven by last-mile delivery and construction sector demands in North America and Europe.

Box trucks command 33% of the Class 4 truck body type segment due to their cargo protection and loading efficiency. Key players like Isuzu, Mitsubishi Fuso, and Ford supply box trucks tailored for urban delivery, retail logistics, and moving services. These trucks are preferred where security and weather protection are critical for transported goods. Innovations in lightweight composite materials and aerodynamic designs have improved fuel efficiency and payload capacity. Box trucks also support modular cargo systems facilitating diverse commercial uses from parcel delivery to foodservice distribution.

Diesel remains the dominant class 4 powertrain at 64% share due to its torque, range, and refueling speed advantages. Manufacturers including Freightliner, International Trucks, and Hino continue to enhance diesel engine emissions technology to meet tightening environmental regulations. Diesel trucks serve diverse applications requiring dependable performance and lower total operating costs in heavy-use fleets. Though gasoline and electric alternatives are growing, diesel’s widespread fueling infrastructure and established service networks sustain its leadership. Fleet owners value the combination of performance and operational efficiency that diesel powertrains provide.

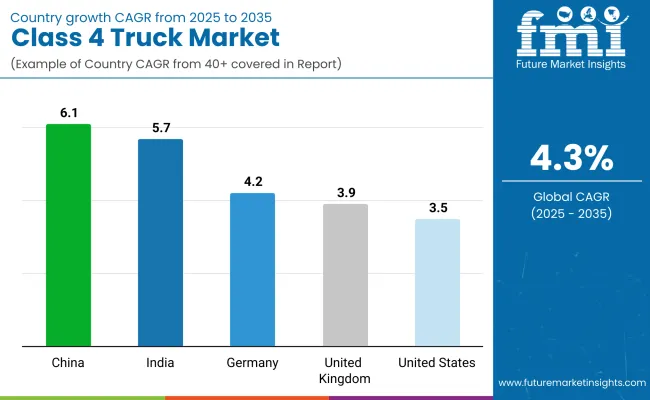

The global market is expected to grow at a CAGR of 4.3% over the forecast period, below the broader global CAGR benchmark of 6%. Among key markets analyzed, China leads with a CAGR of 6.1%, closely aligning with the higher growth rates seen in BRICS economies. India follows at 5.7%, reflecting strong demand from the expanding ASEAN region. Germany posts a moderate CAGR of 4.2%, slightly below the global market average, while the United Kingdom and United States lag further behind at 3.9% and 3.5%, respectively.

These figures demonstrate a 42% premium for China relative to the global class 4 truck CAGR, whereas India shows a 32% premium. In contrast, Germany, the UK, and the USA display slower growth by 2%, 10%, and 19%, respectively, consistent with trends in mature OECD markets. Growth in emerging markets is driven by rising infrastructure investments and urbanization, while developed countries face saturation and stricter regulations limiting expansion.

The class 4 Truck Market in China is expanding at a CAGR of 6.1% due to ongoing improvements in logistics infrastructure and supportive regulations favoring medium-duty commercial vehicles. Increased demand from manufacturing and e-commerce sectors is driving the need for trucks that combine cargo capacity with enhanced fuel efficiency and reduced emissions.

Technological upgrades such as telematics and advanced safety systems are becoming standard in new models. Regional governments are promoting cleaner transport to improve logistics efficiency, which supports market expansion. These factors are expected to sustain the upward growth trend throughout the forecast period.

The class 4 truck market in India is growing at a CAGR of 5.7%, supported by rising demand for medium-duty trucks in intra-city transport and commercial distribution. Industrial growth and expansion of logistics centers require versatile and fuel-efficient vehicles capable of navigating congested roads. Fleet replacement initiatives focusing on newer emission-compliant trucks add momentum. Demand also stems from logistics companies optimizing delivery routes within urban and semi-urban areas. Infrastructure improvements are facilitating smoother supply chains, encouraging adoption of Class 4 trucks over the forecast period.

The class 4 truck market in Germany is projected to grow at a CAGR of 4.2%, driven by strong industrial manufacturing and efficient regional logistics. Strict emission standards encourage adoption of advanced, fuel-efficient trucks with higher payloads. Increasing demand for electric and hybrid medium-duty trucks is supported by government incentives. Germany’s well-developed road infrastructure enables efficient freight transport, benefiting the market. The industry is moving toward vehicles equipped with advanced driver assistance and telematics systems, enhancing operational efficiency and compliance.

The class 4 truck market is expected to expand at a CAGR of 3.9%, influenced by evolving urban delivery demands and regulatory changes. Medium-duty trucks optimized for maneuverability and payload efficiency in congested areas are preferred. Emission regulations have shifted purchases toward cleaner fuel technologies, while diesel remains predominant due to existing infrastructure. Investment in electric class 4 trucks is increasing, driven by government funding and market adaptation. The sector is responding to the rising needs of last-mile delivery services, impacting truck specifications and sales trends.

The industry in United States is projected to grow at a CAGR of 3.5%, driven by expanding regional freight movement and commercial deliveries. Medium-duty trucks are valued for operational flexibility in urban and short-haul applications. Regulatory focus on emissions and fuel efficiency has led to increased adoption of hybrid and electric trucks. Fleet operators emphasize cost-effective, reliable vehicles for last-mile deliveries. Infrastructure improvements and telematics integration are supporting market growth by improving safety and fleet management capabilities.

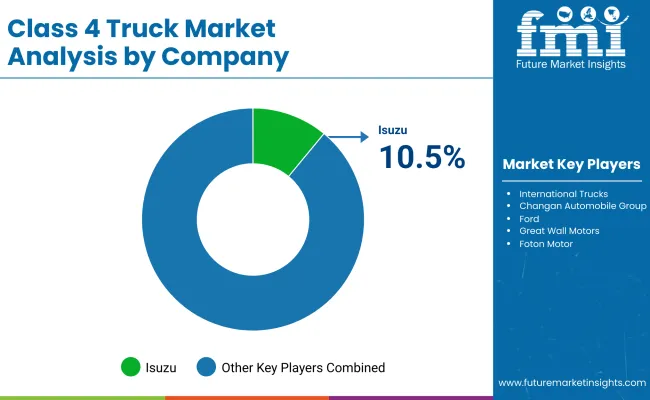

The market is dominated by established manufacturers such as Isuzu, Ford, and Hino Motors, alongside emerging players like JAC Motors and Great Wall Motors. Isuzu maintains a strong position with its N-Series trucks, known for reliability and fuel efficiency, while Ford competes aggressively with its F-650, targeting vocational and fleet buyers. Hino Motors, a Toyota subsidiary, emphasizes durability in its Class 4 lineup, catering to commercial and logistics applications.

The Chinese automakers like Foton and Dongfeng are expanding globally through competitive pricing and partnerships, particularly in emerging markets. These manufacturers drive growth through strategic product launches, such as Ford’s updated F-650 with enhanced powertrain options, and Isuzu’s introduction of cleaner diesel engines to meet evolving regulations.

Emerging players are gaining traction by focusing on cost-effective solutions and regional market needs. JAC Motors, for example, has entered Latin America and Africa with competitively priced Class 4 trucks, while Great Wall Motors is investing in R&D to improve vehicle performance and durability. Mitsubishi Fuso and UD Trucks leverage their parent companies’ resources (Daimler Truck and Volvo Group, respectively) to enhance technology and dealer networks.

Distributors and suppliers play a key role by expanding aftermarket support and financing options, helping fleets adopt newer models. As competition intensifies, manufacturers are prioritizing localized production, fleet customization, and stronger dealer networks to secure market share.

Recent Developments The class 4 truck market is expanding with new electric models targeting North America. In December 2024, The Shyft Group launched the Blue Arc Class 4 EV to improve logistics operations. Earlier, in August 2024, Bollinger introduced a Class 4 electric truck with a 158-kWh battery for extended range. Rizon also entered the segment in April 2024 with a new Class 4 electric truck lineup designed for Canadian customers.

Established players like Isuzu, Ford, and Hino continue leading with diesel models, while Chinese automakers like JAC Motors and Foton compete with cost-effective solutions in emerging markets. Manufacturers are focusing on product launches, regional adaptations, and fleet customization to strengthen their positions.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 14.83 billion |

| Projected Market Size (2035) | USD 22.54 billion |

| CAGR (2025 to 2035) | 4.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume units as applicable |

| Type Segments (Segment 1) | Conventional, Electric, Hybrid |

| Application Segments (Segment 2) | General Delivery, Construction, Hazardous Material Transportation, Refrigerated Transportation |

| Payload Capacity Segments (Segment 3) | 10,001 - 12,500 lbs, 12,501 - 14,500 lbs, 14,501 - 16,500 lbs, 16,501 - 18,500 lbs |

| Body Type Segments (Segment 4) | Dry Van, Flatbed, Refrigerated Van, Dump Truck, Box Truck |

| Powertrain Segments (Segment 5) | Diesel, Gasoline, Electric |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific; Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, China, Japan, India, UAE, South Africa |

| Key Players | JAC Motors, Nissan, Mitsubishi Fuso, Isuzu, Dongfeng, Hino Motors, UD Trucks, Foton, International Trucks, Changan Automobile Group, Ford, Great Wall Motors, SAIC Motor, Beiqi Foton Motor, Chevrolet, GMC |

| Additional Attributes | Dollar sales by vehicle type (cargo, delivery vans), end-use across logistics and retail, demand driven by last-mile delivery growth, regional expansion in North America, innovation in electric drivetrains and telematics, environmental gains via reduced emissions, and emerging use in urban logistics and e-commerce. |

The market is expected to grow at a CAGR of 4.3% during 2025-2035.

The market was valued at USD 14.83 billion in 2025.

Conventional trucks dominate with a 78% market share in 2025.

Asia Pacific leads with approximately 46% market share.

Isuzu holds a 10.5% share of the class 4 truck market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Classic Organic Pigments Market Size and Share Forecast Outlook 2025 to 2035

Class D Audio Amplifiers Market is Segmented by Type, End Use and Region through 2025 to 2035

Classified Platform Market Analysis by Type, Application, and Region Through 2035

Class 7 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 8 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 3 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 5 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 1 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 2 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 6 Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Air Classifying Mill Market Size and Share Forecast Outlook 2025 to 2035

Smart Classroom Market Size and Share Forecast Outlook 2025 to 2035

Virtual Classroom Market Trends – Size, Demand & Forecast 2024-2034

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Fault Detection and Classification Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

4-Allylanisole Market Size and Share Forecast Outlook 2025 to 2035

433MHz Active RFID Reader Market Size and Share Forecast Outlook 2025 to 2035

4-Wheel Mobility Scooters Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

4X4 Vehicles Parts and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA