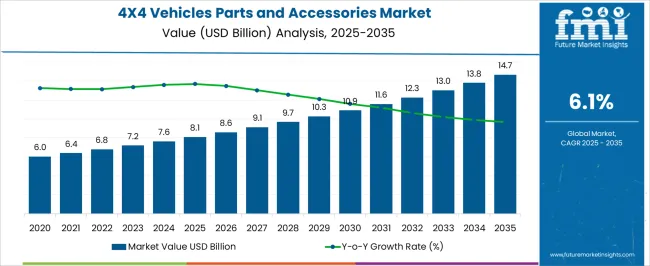

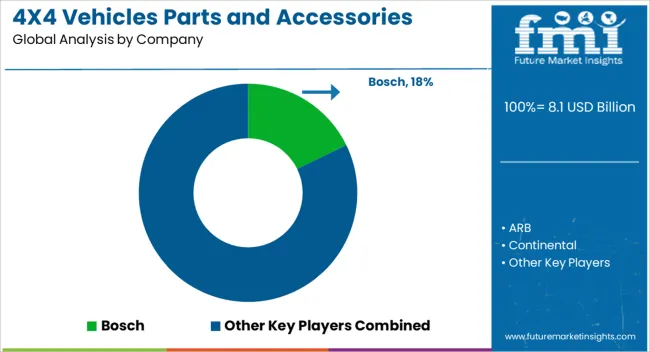

The 4X4 vehicles parts and accessories market is estimated to be valued at USD 8.1 billion in 2025 and is projected to reach USD 14.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. The year-on-year (YoY) growth analysis of the 4X4 vehicles parts and accessories market indicates a steady and consistent upward trend. This trajectory reflects increasing consumer and commercial reliance on specialized parts and accessories for off-road vehicles, where durability, performance, and adaptability in rugged terrains are critical considerations for both enthusiasts and fleet operators. By 2035, the 4X4 vehicles parts and accessories market is projected to reach USD 14.7 billion, highlighting the continued demand for high-quality, reliable, and functional components. The steady YoY growth pattern indicates that manufacturers offering certified, robust, and versatile products are likely to capture a significant share of the market.

Products such as suspension systems, all-terrain tires, drivetrain components, and protective accessories are anticipated to drive adoption as off-road and utility vehicle users focus on performance, reliability, and operational longevity. The outlook suggests that market expansion will be shaped by both aftermarket upgrades and OEM integration, reinforcing the importance of dependable and well-engineered vehicle components across the sector.

The 4X4 vehicles parts and accessories market is a specialized segment within the broader automotive aftermarket, where it currently holds approximately 6-7% share, driven by the growing demand for customization, maintenance, and performance enhancement of four-wheel-drive vehicles. Within the off-highway and off-road vehicles market, these parts and accessories represent about a 5-6% share, as they are critical for enhancing durability, traction, and functionality in challenging terrains. In the automotive components and parts market, the share is roughly 4-5%, reflecting their importance in ensuring vehicle performance, safety, and reliability for both standard and high-performance 4X4 vehicles.

Within the recreational vehicles market, 4X4 accessories account for around 5-6% share, catering to enthusiasts who require specialized equipment such as winches, suspension kits, and protective gear for adventure and off-road activities. Meanwhile, in the commercial and utility vehicles market, the segment holds approximately 3-4% share, supporting fleet vehicles and utility vehicles used in construction, agriculture, and mining operations where off-road capability is essential. Collectively, these parent markets highlight the growing significance of 4X4 vehicles parts and accessories in enhancing vehicle performance, durability, and customization options. With increasing off-road vehicle adoption, rising consumer interest in recreational and adventure vehicles, and the expansion of aftermarket services, the market is expected to grow steadily, strengthening its share across these parent sectors over the coming decade.

| Metric | Value |

|---|---|

| 4X4 Vehicles Parts and Accessories Market Estimated Value in (2025 E) | USD 8.1 billion |

| 4X4 Vehicles Parts and Accessories Market Forecast Value in (2035 F) | USD 14.7 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The 4X4 vehicles parts and accessories market is witnessing robust growth, supported by expanding off-road vehicle adoption, increased customization trends, and advancements in aftermarket component technology. Market performance is being shaped by rising consumer interest in vehicle personalization, enhanced durability requirements, and the integration of high-performance components to improve safety and efficiency.

Established manufacturers are optimizing distribution networks and expanding product portfolios to meet diverse application needs across recreational, utility, and commercial sectors. Raw material advancements and manufacturing automation are enabling cost efficiencies, while regional demand is being bolstered by growing outdoor recreation activities and infrastructure development in rural and rugged terrains.

Competitive intensity remains high, with players focusing on innovation, modular designs, and strategic collaborations with OEMs and aftermarket distributors. Over the forecast period, a combination of technological upgrades, consumer lifestyle shifts, and supportive regulatory frameworks for vehicle modifications is expected to maintain market momentum, ensuring sustained revenue growth and expanded global reach.

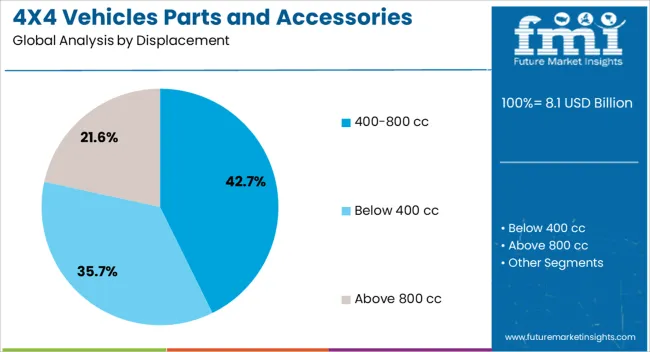

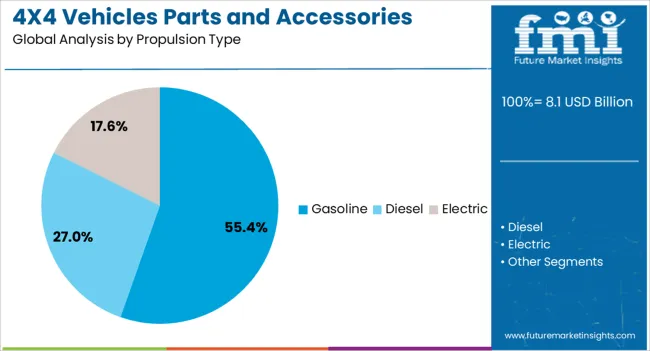

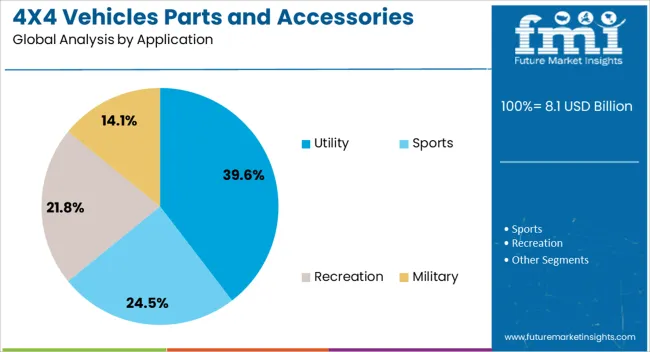

The 4X4 vehicles parts and accessories market is segmented by displacement, propulsion type, application, and geographic regions. By displacement, the 4X4 vehicles parts and accessories market is divided into 400-800 cc, Below 400 cc, and Above 800 cc. In terms of propulsion type, 4X4 vehicles parts and accessories market is classified into Gasoline, Diesel, and Electric. Based on application, 4X4 vehicles parts and accessories market is segmented into Utility, Sports, Recreation, and Military. Regionally, the 4X4 vehicles parts and accessories industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 400–800 cc segment, holding 42.70% of the displacement category, is leading due to its balanced performance capabilities, fuel efficiency, and suitability across a broad range of utility and recreational applications. This range offers optimal torque and power output for challenging terrains while maintaining manageable operational costs. Adoption has been supported by growing demand from the agricultural, forestry, and construction sectors, where versatility and reliability are critical.

Manufacturers have been focusing on improving engine design, thermal management, and maintenance accessibility to enhance product lifespan. The segment benefits from compatibility with a wide range of aftermarket performance upgrades, enabling customization for both personal and professional use.

Export potential remains strong as demand in emerging economies rises alongside the popularity of affordable, mid-range powertrains. Technological improvements in emission control and compliance with evolving environmental standards are further reinforcing its dominance in the market.

The gasoline segment, accounting for 55.40% of the propulsion type category, maintains its leadership through its proven efficiency, ease of refueling, and widespread availability of supporting infrastructure. Gasoline-powered systems are favored for delivering consistent performance across variable terrains, with lower noise levels and smoother operation compared to some alternative propulsion systems.

Cost-effectiveness in terms of initial purchase and maintenance continues to influence buyer preference, particularly in regions where electric or hybrid charging infrastructure is limited. The segment has also benefited from ongoing refinements in engine efficiency, emission reductions, and improved fuel management technologies.

Demand resilience is being strengthened by compatibility with a wide range of aftermarket enhancements, supporting both performance optimization and aesthetic customization. While hybrid and electric adoption is growing, gasoline remains the preferred choice for long-distance and heavy-duty use, securing its dominant market position in the near to mid-term.

The utility segment, representing 39.60% of the application category, leads due to its extensive use in industries such as agriculture, mining, construction, and emergency services. Its dominance is supported by the need for vehicles capable of operating efficiently in demanding environments with heavy payloads and extended operational hours.

Market demand is driven by the versatility of utility-focused 4X4 vehicles, which can be adapted with specialized accessories and equipment to meet sector-specific needs. Manufacturers are focusing on strengthening chassis durability, load-bearing capacity, and component resilience to ensure reliability in harsh conditions.

Aftermarket offerings for utility vehicles are expanding, providing operators with tailored solutions such as reinforced suspension systems, protective guards, and enhanced lighting systems. The segment’s stability is further reinforced by recurring replacement cycles, government procurement programs, and infrastructure development projects, ensuring consistent demand across both developed and developing regions.

The 4X4 vehicles parts and accessories market is expanding due to growing off-roading and adventure tourism. Opportunities exist in customized and high-performance upgrades, while trends highlight electrification-compatible and safety-enhanced components. Challenges include high costs, supply chain constraints, and regulatory compliance. Overall, market growth is supported by increasing consumer demand for durable, versatile, and innovative vehicle parts and accessories that enhance performance, safety, and off-road experiences worldwide.

The 4X4 vehicles parts and accessories market is being driven by increasing popularity of off-roading, adventure tourism, and recreational vehicle use. Consumers are seeking performance-enhancing components, such as suspension upgrades, skid plates, all-terrain tires, and off-road lighting systems. Growing interest in recreational travel, overlanding, and adventure sports is fueling demand for aftermarket parts that improve durability, safety, and vehicle versatility. OEMs and aftermarket suppliers are expanding offerings to meet these evolving consumer preferences, supporting sustained market growth globally.

Significant opportunities exist in providing customized and high-performance parts for 4X4 vehicles. Specialty components like reinforced axles, lift kits, performance exhausts, and specialized drivetrain systems are increasingly adopted by enthusiasts seeking enhanced capability and personalization. E-commerce platforms and specialty retail stores facilitate wider access to aftermarket products. Additionally, manufacturers offering modular, durable, and lightweight accessories tailored to specific vehicle models can capture niche markets. The growing off-road sports and adventure tourism segments further expand opportunities for innovation and premium product offerings in the 4X4 accessories market.

A prominent trend is the integration of electrification-compatible and safety-enhanced accessories. As electric and hybrid 4X4 vehicles enter the market, parts manufacturers are developing components that support battery protection, regenerative braking, and lightweight construction. Advanced safety features, such as enhanced traction control, roll bars, and collision mitigation accessories, are gaining traction among consumers. These trends reflect the market’s shift toward performance-oriented, safe, and future-ready vehicle solutions. Connectivity-enabled accessories, including GPS systems and vehicle monitoring tools, are also being incorporated to provide a more intelligent and immersive off-roading experience.

The 4X4 vehicles parts and accessories market faces challenges due to high manufacturing costs, particularly for premium and specialty components. Price-sensitive consumers in certain regions may prefer standard or OEM parts, limiting the adoption of high-end aftermarket solutions. Supply chain disruptions for metals, polymers, and electronic components can delay production and distribution. Additionally, varying regulatory standards across countries for vehicle modifications pose compliance challenges. Manufacturers must focus on cost optimization, quality assurance, and efficient logistics to overcome these barriers and maintain competitiveness in global markets.

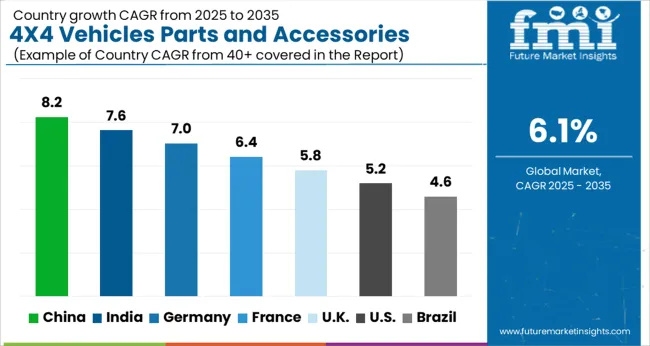

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The global 4X4 vehicles parts and accessories market is projected to grow at a CAGR of 6.1% from 2025 to 2035. China leads with a growth rate of 8.2%, followed by India at 7.6% and France at 6.4%. The United Kingdom records a growth rate of 5.8%, while the United States shows the slowest growth at 5.2%. Expansion is supported by rising demand for off-road vehicles, increasing adventure tourism, and growing aftermarket customization trends. Emerging markets such as China and India benefit from rising disposable income, expanding automotive production, and enthusiasm for off-road activities, while developed countries like the USA, UK, and France focus on premium accessories, performance enhancements, and vehicle maintenance solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The 4X4 vehicles parts and accessories market in China is growing at 8.2% CAGR, the highest among leading nations. Growth is driven by increasing off-road vehicle sales, expanding adventure tourism, and growing popularity of aftermarket customization. Consumers are adopting performance-enhancing accessories, durable parts, and specialty components for off-road vehicles. Manufacturers are introducing advanced, reliable, and high-quality components to meet diverse consumer needs. Rising disposable income and enthusiasm for outdoor recreational activities further accelerate market expansion.

The 4X4 vehicles parts and accessories market in India is advancing at 7.6% CAGR, fueled by growing automotive production, rising off-road vehicle demand, and expanding adventure tourism. Adoption of aftermarket performance parts, safety enhancements, and durable accessories is increasing. Manufacturers focus on cost-effective, high-quality solutions tailored to Indian terrain and consumer preferences. Rising disposable income and awareness of vehicle performance upgrades further support steady market growth.

The 4X4 vehicles parts and accessories market in France is growing at 6.4% CAGR, supported by premium vehicle ownership, performance upgrades, and recreational off-road activities. Adoption of specialized parts and accessories for customization, durability, and safety is increasing among enthusiasts. Manufacturers focus on high-quality, innovative, and reliable components to meet market expectations. Retail and online distribution channels facilitate access to a wide range of aftermarket products, enhancing market penetration.

The 4X4 vehicles parts and accessories market in the United Kingdom is expanding at 5.8% CAGR, influenced by growing recreational off-road activities, aftermarket customization, and vehicle maintenance demand. Adoption of performance parts, durable accessories, and safety enhancements is increasing. Manufacturers emphasize high-quality, reliable components for domestic and imported 4X4 vehicles. Enthusiasts and professional off-road operators drive demand for specialized parts and maintenance solutions, supporting steady market growth.

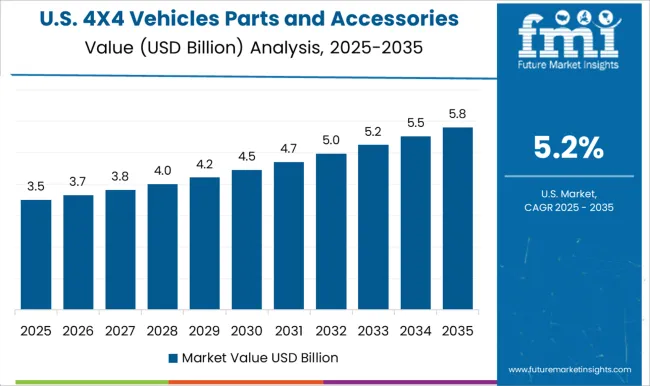

The 4X4 vehicles parts and accessories market in the United States is growing at 5.2% CAGR, the slowest among leading nations. Growth is driven by off-road vehicle demand, aftermarket customization, and recreational outdoor activities. Adoption of performance-enhancing, durable, and safety-focused accessories is rising. Manufacturers focus on premium, high-quality components to meet consumer expectations for reliability and durability. Retail and online channels, along with professional off-road service providers, further support market growth.

Leading companies in the 4X4 vehicles parts and accessories market, such as Bosch, ARB, and Continental, are competing by offering high-performance components that enhance off-road capability, durability, and safety. Bosch emphasizes advanced braking systems, electronic controls, and sensors, with brochures highlighting reliability and precision in challenging terrains. ARB focuses on rugged suspension, recovery equipment, and off-road accessories, marketing products that combine strength, versatility, and ease of installation. Continental and Denso target drivetrain, tire, and engine components, emphasizing durability and optimized performance under extreme conditions. Other key players, including FCA US LLC, Fox Factory Holding, and Magna International, differentiate through specialized suspension systems, custom parts, and modular accessory solutions.

Valeo and ZF Friedrichshafen highlight advanced electronics and adaptive systems that improve safety and handling in off-road scenarios. Hyundai leverages its OEM expertise to integrate durable aftermarket-ready components for 4X4 models. Product brochures consistently emphasize reliability, endurance, and compatibility with diverse vehicle models. Market competition is driven by technical innovation, performance assurance, and the ability to deliver components that improve off-road experience while maintaining vehicle integrity and safety standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.1 Billion |

| Displacement | 400-800 cc, Below 400 cc, and Above 800 cc |

| Propulsion Type | Gasoline, Diesel, and Electric |

| Application | Utility, Sports, Recreation, and Military |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch, ARB, Continental, Denso, FCA US LLC, Fox Factory Holding, Hyundai, Magna International, Valeo, and ZF Friedrichshafen |

| Additional Attributes | Dollar sales by product type (suspension, drivetrain, tires, exterior accessories) and vehicle type (SUV, pickup, off-road) are key metrics. Trends include rising demand for performance-enhancing and aftermarket customization, growth in off-roading activities, and increasing preference for durable, high-quality components. Regional adoption, technological advancements, and lifestyle-driven trends are driving market growth. |

The global 4X4 vehicles parts and accessories market is estimated to be valued at USD 8.1 billion in 2025.

The market size for the 4X4 vehicles parts and accessories market is projected to reach USD 14.7 billion by 2035.

The 4X4 vehicles parts and accessories market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in 4X4 vehicles parts and accessories market are 400-800 cc, below 400 cc and above 800 cc.

In terms of propulsion type, gasoline segment to command 55.4% share in the 4X4 vehicles parts and accessories market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

In Vehicles Payment Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Vehicles Market Trends – Growth & Forecast 2025 to 2035

Off Road Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Finished Vehicles Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Passenger Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Road-Rail Vehicles Market

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Vehicles Market Growth - Trends & Forecast 2025 to 2035

Off Highway Vehicles Brake Systems Market Size and Share Forecast Outlook 2025 to 2035

Mild Hybrid Vehicles Market

CNG and LPG Vehicles Market Trends - Growth & Forecast 2025 to 2035

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Marine Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Aerial Vehicles (UAV) Commercial Drone Market Size and Share Forecast Outlook 2025 to 2035

Compact Utility Vehicles Market Growth - Trends & Forecast 2025 to 2035

Alternative Fuel Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Electric Utility Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Automated Guided Vehicles (AGV) Market Growth - Trends & Forecast 2025 to 2035

Middle East/North Africa (MENA) Commercial Vehicles Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA