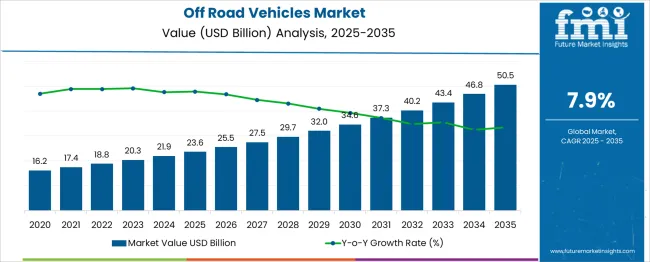

The Off Road Vehicles Market is estimated to be valued at USD 23.6 billion in 2025 and is projected to reach USD 50.5 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period. A half-decade weighted growth analysis reveals disproportionate acceleration in the latter segments of the timeline. From 2025 to 2030, the market advances from USD 21.9 billion to 32.0 billion, contributing USD 10.1 billion or roughly 37% of the total incremental opportunity, driven by rising recreational demand, utility applications, and initial electrification adoption in all-terrain vehicles and side-by-sides. Weighted growth in this phase is steady, with annual additions averaging USD 2.02 billion, signaling a demand environment influenced by economic cycles and rural mobility requirements. In contrast, the 2030–2035 period adds USD 18.5 billion, nearly 63% of the total increase, marking a sharp slope in the growth curve as electric drivetrains, advanced suspension systems, and telematics-integrated vehicles penetrate mainstream off-road ecosystems.

Average annual additions rise above USD 3.7 billion, demonstrating compound elasticity supported by higher unit pricing and expanded application in adventure tourism and commercial fleets. This weighted acceleration pattern underscores the necessity for OEMs to scale capacity and diversify product portfolios early to capture the surge-driven profitability phase post-2030.

| Metric | Value |

|---|---|

| Off Road Vehicles Market Estimated Value in (2025 E) | USD 23.6 billion |

| Off Road Vehicles Market Forecast Value in (2035 F) | USD 50.5 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

The off road vehicles market is a complete and distinct segment within the broader automotive domain. Within the ATV and UTV market, off road vehicles account for approximately 70–75% as most ATVs and UTVs are purpose built for off road terrain and utility applications. In the wider recreational and sports vehicle market, off road vehicles represent about 35–40%, highlighting strong adoption for trail riding, motorsports, and outdoor adventure activities as consumer interest in off road recreation continues to grow. In the construction and agriculture utility vehicle market, off road vehicles make up roughly 15–20%, where they replace traditional equipment for transportation across rugged worksites, farms, and forestry operations.

Within the emerging electric off road vehicle market, these vehicles contribute around 20–25%, reflecting growing availability of EV powered ATVs, UTVs, and side by sides driven by electrification trends and low emission use cases. The off road vehicle segment shows steady growth, supported by consumer demand for outdoor mobility, versatility in industrial roles, and increased penetration of electric variants. These factors position off road vehicles as a critical component of both recreational and utility transportation ecosystems worldwide.

The off-road vehicles market is witnessing robust traction as recreational demand surges, rural mobility infrastructure expands, and utility-based transport becomes increasingly mechanized across sectors like agriculture, defense, and mining. A combination of terrain adaptability, towing capacity, and customization flexibility has made these vehicles integral to both recreational and operational activities.

Government programs aimed at boosting rural development and infrastructure access have also supported broader utility vehicle deployment. Innovations in suspension systems, four-wheel-drive technologies, and integrated telemetry are enabling enhanced performance across diverse geographies. Electrification trends and off-road racing exposure are expected to influence both the design and adoption of newer vehicle formats within this market.

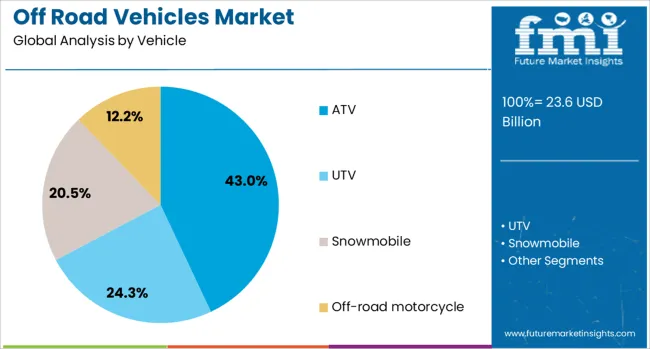

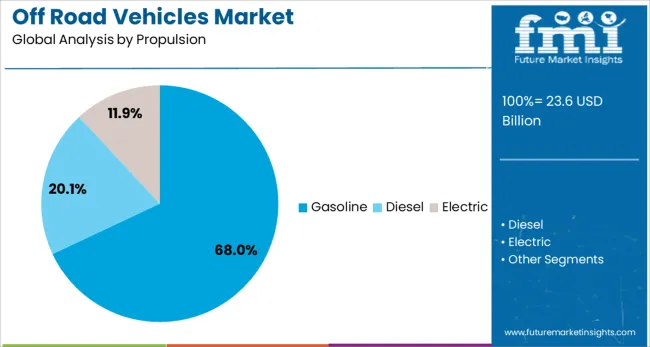

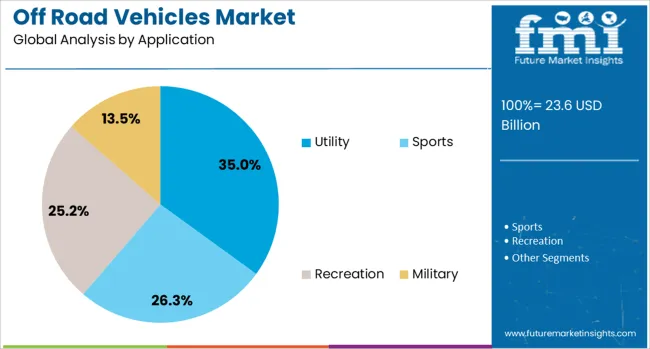

The off road vehicles market is segmented by vehicle, propulsion, application, and geographic regions. The off-road vehicle market is divided into ATVs, UTVs, Snowmobiles, and off-road motorcycles. In terms of propulsion, the off-road vehicles market is classified into Gasoline, Diesel, and Electric. Based on the application, the off-road vehicles market is segmented into Utility, Sports, Recreation, and Military. Regionally, the off-road vehicles industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

All-Terrain Vehicles (ATVs) are anticipated to hold 43.00% of the revenue share in 2025, making them the leading vehicle type in the off-road vehicles market. The versatility and maneuverability ATVs are supporting this dominance offer across rugged terrains, recreational parks, and farm landscapes.

Their compact design and ease of customization have enabled widespread use in agriculture, patrolling, tourism, and forestry applications. Safety feature enhancements, better torque delivery, and growing interest in off-road sports have added to the adoption curve.

Increasing availability of entry-level models and multi-utility versions with cargo capacity are further expanding ATV deployment beyond leisure to commercial usage.

Gasoline-powered off-road vehicles are projected to account for 68.00% of the total market share in 2025, sustaining their position as the leading propulsion type. This share is driven by widespread availability of fuel, lower upfront vehicle costs, and simplified powertrain architecture compared to electric alternatives.

The reliability of gasoline engines in extreme temperatures and terrain, coupled with lower maintenance frequency, continues to favor their usage in off-grid and remote applications.

As long-range travel and payload capabilities remain top priorities in off-road scenarios, gasoline propulsion is expected to maintain its relevance despite emerging electric competition.

Utility applications are expected to represent 35.00% of the market share in 2025, leading all other use cases in the off-road vehicles market. This segment’s strength stems from rising deployment of utility vehicles in agriculture, mining, and construction operations, where equipment hauling, towing, and terrain access are critical.

Municipal bodies and industrial estates are increasingly adopting off-road vehicles for maintenance, patrolling, and logistics.

Design advancements such as cargo beds, reinforced chassis, and multi-seat configurations have made these vehicles essential for transporting personnel and equipment in unpaved or difficult-to-reach environments.

Off road vehicles include ATVs, UTVs, dirt bikes, and specialty trucks designed for rugged terrains and recreational as well as utility purposes. These vehicles are widely used in adventure sports, agriculture, forestry, and defense operations due to their high torque and traction capabilities. Market growth has been supported by the rising popularity of outdoor recreational activities, expansion in rural transportation needs, and increasing adoption in military and industrial sectors. Manufacturers are focusing on vehicle durability, advanced suspension systems, and integration of digital features to enhance performance and rider experience.

Adoption of off road vehicles has been driven by increasing consumer interest in adventure tourism, motorsports, and recreational trails. Rising demand for utility terrain vehicles in agricultural and forestry operations has reinforced market expansion. These vehicles are preferred for their ability to operate in extreme conditions where conventional vehicles cannot function efficiently. Defense agencies have also contributed to demand for all-terrain vehicles used in tactical and transport missions. Growth of organized off-road racing events and community riding experiences has further boosted the market, encouraging OEMs to introduce performance-enhanced models with specialized drivetrain configurations.

Market growth has been limited by safety concerns associated with high-speed off-road activities, which often result in severe injuries or fatalities. Stringent regulatory restrictions on vehicle emissions and noise levels have impacted product design and development cycles. The lack of well-developed off-road trails and recreational parks in certain regions has reduced participation rates. Maintenance costs and durability concerns, especially in extreme weather conditions, have added to ownership challenges. Limited financing options and higher initial costs compared to standard vehicles also discourage adoption among cost-sensitive consumers, particularly in emerging markets.

Significant opportunities exist in the development of electric off-road vehicles that offer reduced operational noise and enhanced torque for rugged terrains. Integration of connected technologies such as GPS navigation, telematics, and rider-assist systems provides differentiation and enhances safety features. Growth of eco-tourism and private adventure parks creates demand for low-emission vehicles tailored for controlled environments. OEMs have scope to expand into subscription-based ownership models for recreational fleets. Partnerships with rental services, resorts, and outdoor activity providers can further boost accessibility and brand visibility. Development of modular platforms allows manufacturers to produce multiple variants, optimizing production efficiency.

Recent trends emphasize the use of lightweight aluminum frames and composite panels to improve handling and fuel efficiency without compromising strength. Advanced suspension systems with adaptive damping and electronic stability control are being introduced for better comfort and control in uneven terrains. Integration of digital dashboards and smartphone connectivity is becoming standard in premium models. Increasing popularity of electric powertrains reflects the industry’s focus on low-noise, high-torque solutions for performance enthusiasts. Growth of aftermarket customization kits and accessories for off-road vehicles demonstrates rising consumer demand for personalized experiences and enhanced functional capabilities.

|

Country |

CAGR |

|---|---|

| China | 10.7% |

| India | 9.9% |

| Germany | 9.1% |

| France | 8.3% |

| UK | 7.5% |

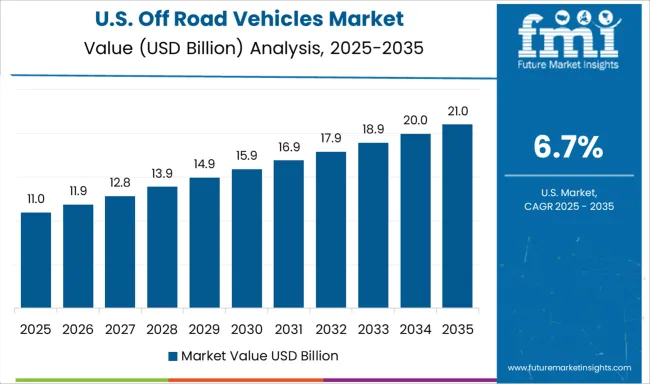

| USA | 6.7% |

| Brazil | 5.9% |

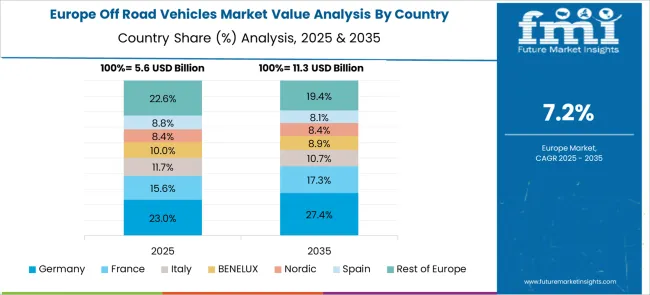

The off road vehicles market is projected to grow globally at a CAGR of 7.9% from 2025 to 2035. Among the leading markets, China leads at 10.7%, followed by India at 9.9%, while France posts 8.3%, the United Kingdom records 7.5%, and the United States stands at 6.7%. These growth rates indicate a premium of +35% for China and +25% for India compared to the global baseline, while France remains slightly ahead at +5%, and the UK and US trail at –5% and –15%, respectively. Divergence reflects strong recreational vehicle demand and agriculture mechanization in BRICS markets, whereas OECD nations maintain moderate adoption driven by premium utility vehicles and adventure tourism trends. The analysis covers over 40 countries, with the top markets detailed below..

China is forecasted to grow at a CAGR of 10.7% through 2035, driven by increasing rural mobility requirements, agricultural modernization, and a rising adventure tourism culture. Domestic manufacturers are ramping up production of all-terrain vehicles (ATVs) and utility task vehicles (UTVs) to cater to both commercial and recreational segments. Electrification of off road vehicles is emerging as a significant trend, supported by government incentives for green mobility solutions. Expansion of local assembly plants by global brands and technological advancements in suspension systems, traction control, and GPS-based navigation are further driving adoption. E-commerce channels are also playing a critical role in market penetration across remote regions.

India is projected to grow at a CAGR of 9.9% through 2035, supported by the growth of agriculture mechanization, rural connectivity programs, and increasing recreational demand among younger consumers. Off road vehicles are widely used in farm operations, mining activities, and adventure sports, creating diverse market opportunities. Local manufacturers are focusing on affordable UTVs and compact ATVs with low-maintenance designs, while international brands introduce advanced suspension systems and hybrid powertrains to address high-performance needs. Government investments in rural infrastructure and road networks further boost adoption. Adventure tourism hubs in hill regions are also contributing significantly to the recreational segment’s growth.

France is expected to achieve a CAGR of 8.3% through 2035, driven by strong demand for utility vehicles in forestry, agriculture, and defense applications. The recreational off road segment is also expanding due to increased participation in motorsport events and outdoor leisure activities. French manufacturers prioritize compliance with EU emission norms by integrating advanced engine systems and hybrid technology. Adoption of safety enhancements, including rollover protection systems and stability controls, is becoming standard across high-performance models. Distribution partnerships with dealerships and expansion of rental service networks for ATVs and UTVs are reinforcing accessibility for both individual and commercial users.

The United Kingdom is forecasted to record a CAGR of 7.5% through 2035, supported by increasing adoption in agricultural operations, construction activities, and countryside tourism. Demand for electric and hybrid off road vehicles is gaining momentum as environmental standards influence equipment selection in commercial fleets. UTVs and side-by-side models are witnessing strong growth due to their adaptability for hauling and terrain navigation in rugged landscapes. British suppliers are introducing advanced telematics and GPS-enabled systems to optimize utility operations, while aftermarket services such as leasing and maintenance packages are becoming key differentiators in the competitive landscape.

The United States is projected to grow at a CAGR of 6.7% through 2035, driven by the popularity of recreational sports, hunting activities, and utility usage in agriculture and construction. The premium ATV and UTV segment continues to dominate due to rising consumer interest in adventure sports and off road racing. USA manufacturers are focusing on integrating digital diagnostics, smart displays, and improved suspension systems to deliver superior performance and safety. Electrification is gradually emerging, with several OEMs introducing electric off road models targeting eco-conscious consumers. Regional dealerships and financing programs are critical to market penetration in both rural and suburban areas.

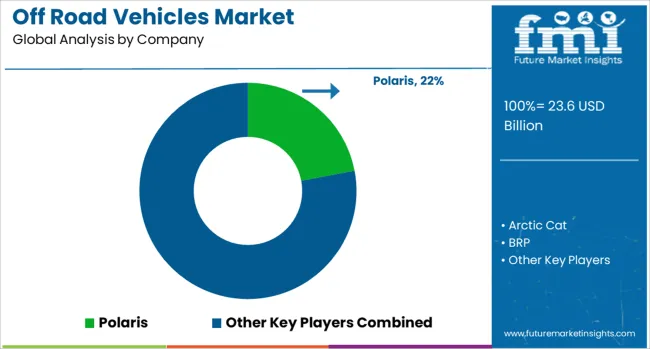

The off road vehicles market is dominated by global powersports and motorcycle manufacturers delivering ATVs, UTVs, dirt bikes, and electric off-road models for recreational and utility applications. Polaris leads the market with its broad range of all-terrain and utility vehicles, including the RZR and Ranger series, leveraging advanced suspension systems and smart connectivity for enhanced performance. BRP (Bombardier Recreational Products) competes strongly with its Can-Am lineup, offering high-powered ATVs and side-by-sides tailored for adventure and commercial use. Arctic Cat, under Textron, emphasizes durable off-road vehicles for recreational riders and hunters, supported by robust dealer networks in North America.

Honda, Yamaha, and Kawasaki maintain strong global positions with diverse off-road motorcycle and ATV portfolios, focusing on engine efficiency, rider safety, and durability. KTM dominates the off-road motorcycle segment with performance-driven designs for professional racing and trail riding. KYMCO targets price-sensitive markets with compact, affordable ATVs and scooters adapted for light off-road use. Emerging brands like Hisun are gaining traction in entry-level segments through cost-competitive offerings. Zero Motorcycles pioneers electric off-road motorcycles, capitalizing on rising demand for eco-friendly powersports vehicles. Competitive differentiation revolves around engine performance, suspension technology, safety features, and electrification capabilities. Barriers to entry include high product development costs, compliance with emissions and safety regulations, and the need for strong distribution networks. Strategic initiatives focus on introducing electric UTVs, integrating smart connectivity for performance tracking, and expanding product lines for utility and recreational use across global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 23.6 Billion |

| Vehicle | ATV, UTV, Snowmobile, and Off-road motorcycle |

| Propulsion | Gasoline, Diesel, and Electric |

| Application | Utility, Sports, Recreation, and Military |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Polaris, Arctic Cat, BRP, Hisun, Honda, Kawasaki, KTM, KYMCO, Yamaha, and Zero Motorcycles |

| Additional Attributes | Dollar sales by vehicle type (ATVs, UTVs, off-road motorcycles, electric off-road vehicles) and application (recreational, utility, sports). Demand dynamics are driven by rising outdoor recreation activities, farm mechanization, and increasing interest in powersports tourism. Regional trends highlight North America as the largest market due to strong off-roading culture, while Asia-Pacific is emerging as a growth hub supported by rising disposable incomes and rural applications. Innovation trends include development of electric and hybrid powertrains for off-road vehicles, lightweight frame construction for enhanced maneuverability, and advanced suspension systems for improved ride comfort. |

The global off road vehicles market is estimated to be valued at USD 23.6 billion in 2025.

The market size for the off road vehicles market is projected to reach USD 50.5 billion by 2035.

The off road vehicles market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in off road vehicles market are atv, utv, snowmobile and off-road motorcycle.

In terms of propulsion, gasoline segment to command 68.0% share in the off road vehicles market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Offshore Fibre Optic Cable Lay Market Size and Share Forecast Outlook 2025 to 2035

Office Supply Market Forecast and Outlook 2025 to 2035

Offshore Wind Market Forecast and Outlook 2025 to 2035

Off-Highway Vehicle Telematics Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Office Boiler Market Size and Share Forecast Outlook 2025 to 2035

Off-highway EV Component Market Size and Share Forecast Outlook 2025 to 2035

Off-highway Vehicle Engines Market Size and Share Forecast Outlook 2025 to 2035

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Off Highway Radar Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Off-highway Electric Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Offset Ink Market Size and Share Forecast Outlook 2025 to 2035

Offshore Drilling Riser Market Size and Share Forecast Outlook 2025 to 2035

Offshore Crane Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Offshore Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Offshore Structural Analysis Software Market Size and Share Forecast Outlook 2025 to 2035

Off-Highway Vehicle Telematics Market - Growth, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA