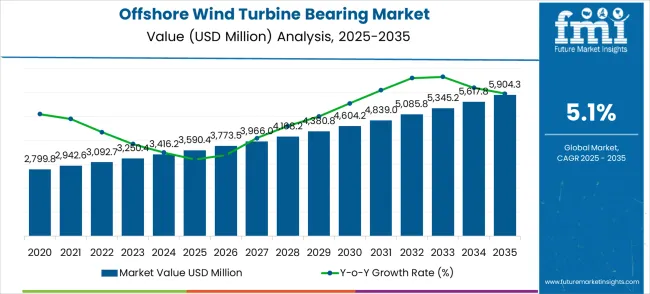

The offshore wind turbine bearing market is forecasted to grow from USD 3,590.4 million in 2025 to USD 5,904.3 million by 2035, with a CAGR of 5.1%. From 2025 to 2030, the market shows gradual year-on-year growth, moving from USD 2,799.8 million in 2025 to USD 3,590.4 million by 2030. The market experiences steady increases in annual values, starting at USD 2,942.6 million in 2026, reaching USD 3,092.7 million in 2027, USD 3,250.4 million in 2028, and USD 3,416.2 million in 2029. This steady growth can be attributed to the growing global emphasis on renewable energy and the increasing demand for efficient offshore wind turbine technologies.

From 2030 to 2035, the market accelerates, with values rising from USD 3,773.5 million in 2031 to USD 5,904.3 million by 2035. This period witness's significant annual growth, as the market expands from USD 3,966.0 million in 2032 to USD 4,380.8 million in 2033 and USD 4,604.2 million in 2034. The acceleration is driven by increased investments in offshore wind projects, as governments and corporations focus on meeting renewable energy targets. Innovations in bearing technologies and improvements in offshore wind turbine efficiency contribute to higher demand. As the adoption of offshore wind energy systems becomes more widespread, the market continues to expand significantly, reflecting the broader growth in the global renewable energy sector.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3,590.4 million |

| Forecast Value in (2035F) | USD 5,904.3 million |

| Forecast CAGR (2025 to 2035) | 5.1% |

The offshore wind turbine bearing market is growing rapidly as the global push for renewable energy, particularly offshore wind power, continues to accelerate. In the renewable energy market, offshore wind turbine bearings contribute approximately 3-5% of the total market share, reflecting their importance in offshore wind power generation. As countries invest heavily in offshore wind farms, the demand for robust, high-performance bearings that can withstand harsh marine environments is growing. The offshore wind energy market itself accounts for around 6-8% of the total bearing market, driven by increasing offshore wind turbine installations globally, particularly in Europe, North America, and Asia.

In the marine equipment market, offshore wind turbine bearings represent about 4-6% of the share, as these specialized bearings are crucial for the functionality and longevity of turbines exposed to harsh weather conditions at sea. The industrial equipment market sees offshore wind turbine bearings contributing around 2-4%, as they play a vital role in the operation of large-scale machinery. The automotive market contributes indirectly to innovation in bearing technology, accounting for around 1-2% of the share, as advancements in bearings for heavy-duty vehicles and electric motors influence offshore wind turbine bearing designs.

Market expansion is being supported by the exceptional performance requirements of offshore wind installations and the corresponding demand for bearing solutions that can withstand harsh marine conditions while maintaining long service life. Modern offshore wind developers are increasingly focused on turbine systems that can operate reliably for 20-25 years in corrosive saltwater environments with minimal maintenance intervention. The proven capability of specialized offshore wind turbine bearings to deliver superior corrosion resistance, load capacity, and operational reliability makes them essential components of successful offshore wind projects.

The growing emphasis on energy independence and carbon reduction targets is driving demand for large-scale renewable energy installations that can support national decarbonization goals and energy security objectives. Industry preference for turbine systems that can maximize energy generation while minimizing operational and maintenance costs is creating opportunities for advanced bearing technology development. The rising influence of floating offshore wind platforms and deep-water installations is also contributing to increased demand for specialized bearing solutions across different marine environments and deployment scenarios.

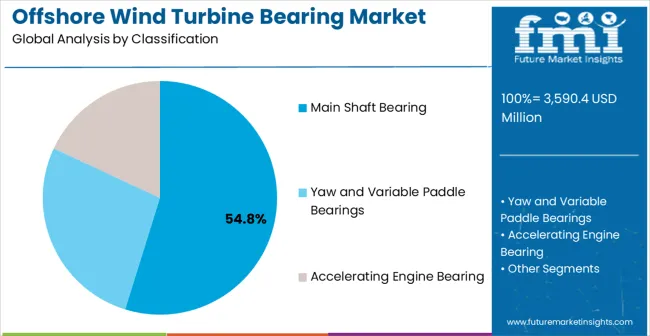

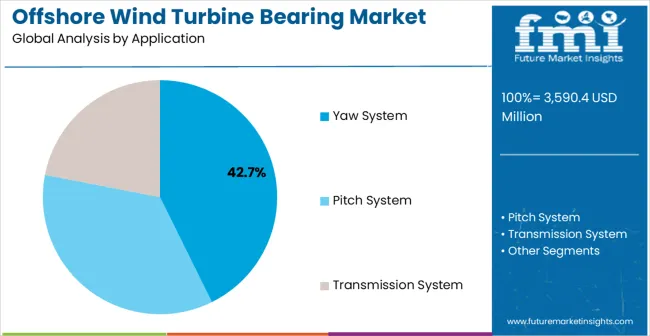

The market is segmented by classification, application, and region. By classification, the market is divided into main shaft bearing, yaw and variable paddle bearings, accelerating engine bearing, and others. Based on application, the market is categorized into yaw system, pitch system, transmission system, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

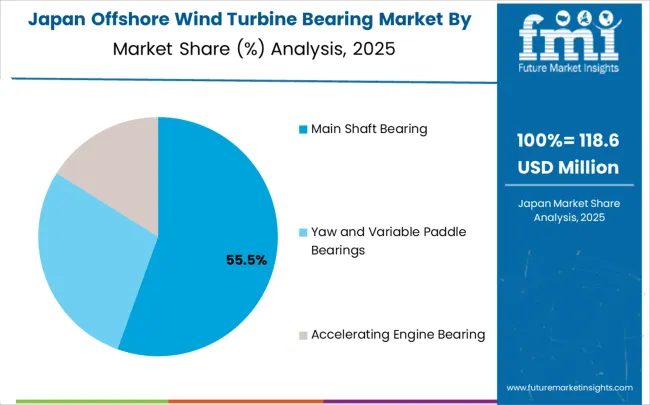

The main shaft bearing classification is projected to account for 54.8% of the offshore wind turbine bearing market in 2025, reaffirming its position as the category's dominant product type. Wind turbine manufacturers increasingly recognize the critical importance of main shaft bearings in supporting rotor loads and enabling efficient power transmission in offshore environments. This classification addresses the most demanding load and environmental requirements while providing essential operational reliability for offshore wind systems.

This classification forms the foundation of all offshore wind turbine designs, as it represents the most structurally critical and technically demanding bearing application in wind turbine systems. Engineering advancement and materials development continue to strengthen confidence in main shaft bearing performance for offshore applications. With increasing recognition of the importance of reliable power transmission and structural integrity, main shaft bearings align with both current turbine design requirements and long-term durability objectives. Their essential role across all turbine configurations ensures sustained market dominance, making them the central growth driver of offshore wind turbine bearing adoption.

Yaw system applications are projected to represent 42.7% of offshore wind turbine bearing demand in 2025, underscoring their role as the primary application driving market development. Wind turbine operators recognize that yaw system reliability is critical for optimal wind tracking and energy capture efficiency in offshore environments. Yaw system applications demand exceptional durability and precise positioning capabilities that specialized offshore wind turbine bearings are uniquely positioned to deliver.

The segment is supported by the continuous evolution of larger offshore turbines requiring increasingly sophisticated yaw control systems and the growing deployment of advanced turbine control technologies across offshore wind farms. Offshore wind projects are increasingly adopting enhanced yaw system designs that can optimize energy production while minimizing maintenance requirements. As understanding of offshore wind turbine operational requirements advances, yaw system applications will continue to serve as a primary commercial driver, reinforcing their essential position within the offshore wind turbine bearing market.

The offshore wind turbine bearing market is advancing steadily due to increasing offshore wind capacity deployment and growing demand for reliable renewable energy generation systems. The market faces challenges including harsh marine operating conditions, high replacement costs, and requirements for specialized maintenance procedures. Innovation in bearing materials and protective coating technologies continue to influence product development and market expansion patterns.

The growing development of floating offshore wind platforms is enabling access to deeper water locations with enhanced wind resources and reduced visual impact. Advanced floating platforms offer comprehensive stability systems, including dynamic positioning and motion compensation, that create unique bearing requirements for floating applications. Deep-water installations provide access to stronger and more consistent wind resources that can optimize energy generation and project economics.

Modern bearing companies are incorporating specialized corrosion-resistant materials, advanced seal systems, and protective coating technologies to enhance offshore wind turbine bearing performance and service life. These technologies improve saltwater resistance, enable better lubrication retention, and provide enhanced protection against marine environmental factors. Advanced material integration also enables optimized load distribution and improved fatigue resistance characteristics.

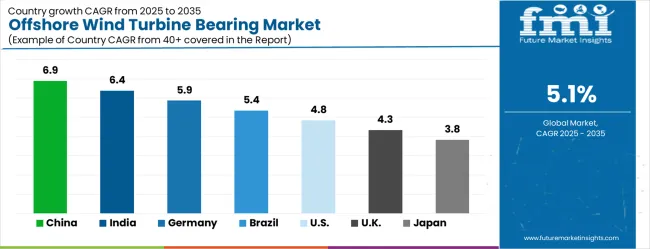

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| USA | 4.8% |

| UK | 4.3% |

| Japan | 3.8% |

The offshore wind turbine bearing market is experiencing solid growth globally, with China leading at a 6.9% CAGR through 2035, driven by ambitious offshore wind capacity targets, government support for renewable energy development, and rapidly expanding coastal wind farm installations. India follows at 6.4%, supported by emerging offshore wind sector development, increasing renewable energy commitments, and growing investment in coastal wind resources. Germany shows growth at 5.9%, emphasizing established offshore wind leadership and continued expansion of North Sea installations. Brazil records 5.4% growth, focusing on developing offshore wind potential and expanding renewable energy capacity. The USA shows 4.8% growth, representing accelerating offshore wind development along Atlantic and Pacific coasts.

The report covers an in-depth analysis of 40+ countries with top-performing countries highlighted below.

Revenue from offshore wind turbine bearings in China is projected to exhibit strong growth with a CAGR of 6.9% through 2035, driven by unprecedented offshore wind capacity expansion and comprehensive government support for renewable energy development. The country's aggressive offshore wind installation targets and increasing capabilities in large-scale marine wind projects are creating substantial opportunities for specialized bearing solutions. Major domestic and international bearing manufacturers are establishing comprehensive production and service facilities to serve the rapidly expanding offshore wind market.

Sale of offshore wind turbine bearings in India is expanding at a CAGR of 6.4%, supported by emerging offshore wind sector initiatives, increasing renewable energy capacity targets, and growing investment in coastal wind resource development. The country's extensive coastline and commitment to clean energy expansion are driving demand for offshore wind technologies. International wind energy companies and domestic manufacturers are establishing partnerships to serve the growing demand for offshore wind equipment.

The offshore wind turbine bearings in market Germany is projected to grow at a CAGR of 5.9%, supported by the country's established leadership in offshore wind technology and continued expansion of North Sea wind installations. German wind energy companies and bearing manufacturers consistently invest in advanced offshore wind technologies and specialized marine applications. The market is characterized by technical excellence, comprehensive environmental standards, and established relationships between wind developers and bearing suppliers.

Demand for offshore wind turbine bearings in Brazil is projected to grow at a CAGR of 5.4% through 2035, driven by developing offshore wind resource potential, increasing renewable energy investment, and growing focus on coastal clean energy projects. Brazilian energy companies are increasingly exploring offshore wind opportunities to support renewable energy targets and energy security objectives.

Revenue from offshore wind turbine bearings in the USA is expected to grow at a CAGR of 4.8%, supported by accelerating offshore wind development along Atlantic and Pacific coastlines, substantial federal investment in renewable energy infrastructure, and comprehensive state-level offshore wind targets. American wind energy companies and bearing manufacturers are advancing offshore wind technologies through established innovation programs and industry collaboration.

The offshore wind turbine bearings market in the UK is projected to expand at a CAGR of 4.3% through 2035, supported by established North Sea offshore wind leadership and continued expansion of coastal wind installations. British wind energy companies emphasize advanced offshore wind technologies within comprehensive renewable energy frameworks that prioritize performance optimization and environmental stewardship.

Sale of offshore wind turbine bearings in Japan is growing at a CAGR of 3.8% through 2035, supported by the country's focus on offshore wind development and comprehensive approach to marine renewable energy technologies. Japanese wind energy companies and bearing manufacturers emphasize technology-driven development of offshore wind solutions within established frameworks that prioritize technical excellence and environmental compatibility.

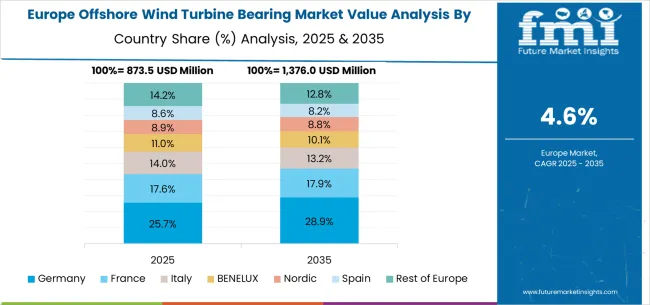

The offshore wind turbine bearing market in Europe is projected to expand steadily through 2035, supported by established offshore wind leadership, rising investment in North Sea development, and ongoing expansion of coastal wind installations. Germany will continue to lead the regional market, accounting for 28.4% in 2025 and rising to 29.1% by 2035, supported by strong North Sea offshore wind development, advanced marine technology capabilities, and comprehensive renewable energy infrastructure. The United Kingdom follows with 21.7% in 2025, maintaining 21.9% by 2035, driven by established offshore wind sector leadership, North Sea project expansion, and continued coastal development.

France holds 18.3% in 2025, edging up to 18.6% by 2035 as offshore wind development accelerates and demand grows for coastal renewable energy projects. Italy contributes 11.8% in 2025, remaining stable at 12.0% by 2035, supported by Mediterranean offshore wind potential and growing renewable energy investment. Spain represents 9.1% in 2025, moving upward to 9.3% by 2035, underpinned by expanding Atlantic coast wind development and increasing investment in offshore renewable technologies.

Nordic countries together account for 6.9% in 2025, maintaining their position at 7.0% by 2035, supported by established offshore wind initiatives and continued coastal development programs. The Rest of Europe represents 3.8% in 2025, declining slightly to 2.1% by 2035, as larger markets capture greater investment focus and established offshore wind infrastructure advantages.

The offshore wind turbine bearing market is characterized by competition among established bearing manufacturers, specialized wind energy component suppliers, and innovative marine technology companies. Companies are investing in advanced materials development, corrosion protection technologies, strategic partnerships, and service capabilities to deliver high-performance, reliable, and cost-effective bearing solutions for offshore wind applications. Technology development, quality assurance, and customer relationship strategies are central to strengthening competitive advantages and market presence.

SCHAEFFLER AG leads the market with significant expertise in industrial bearing technologies and wind energy applications, offering comprehensive offshore wind turbine bearing solutions with focus on durability optimization and marine environment compatibility. SKF GROUP provides established bearing technology capabilities with emphasis on advanced materials and offshore applications. NTN Corporation focuses on precision bearing manufacturing with comprehensive wind energy expertise. JTEKT Corporation delivers advanced bearing technologies with strong focus on industrial and renewable energy applications.

NSK operates with focus on high-precision bearing solutions and comprehensive quality systems. The Timken Company provides specialized bearing capabilities with emphasis on heavy-duty and marine applications. Thyssen Krupp AG leverages industrial technology expertise to provide integrated wind energy solutions. Zwz Bearing, Luoyang LYC Precision Bearing, Jingye Bearing, Luoyang Xinqianglian Slewing Bearing, Zhejiang Tianma Bearing Group, Dalian Metallurgical Bearing, Luoyang Xinneng Bearing Manufacturing, and Luoyang Bearing Research Institute provide diverse manufacturing approaches and regional market access strategies to enhance overall market development and cost competitiveness.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3,590.4 million |

| Classification | Main Shaft Bearing, Yaw and Variable Paddle Bearings, Accelerating Engine Bearing, Others |

| Application | Yaw System, Pitch System, Transmission System, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan and 40+ countries |

| Key Companies Profiled | SCHAEFFLER AG, SKF GROUP, NTN Corporation, JTEKT Corporation, NSK, The Timken Company, Thyssen Krupp AG, Zwz Bearing, Luoyang LYC Precision Bearing, Jingye Bearing, Luoyang Xinqianglian Slewing Bearing, Zhejiang Tianma Bearing Group, Dalian Metallurgical Bearing, Luoyang Xinneng Bearing Manufacturing, Luoyang Bearing Research Institute |

| Additional Attributes | Dollar sales by bearing type and application, regional wind energy development trends, competitive landscape, wind turbine manufacturer partnerships, integration with offshore wind systems, innovations in marine-grade materials and coatings, reliability analysis, and maintenance optimization strategies |

The global offshore wind turbine bearing market is estimated to be valued at USD 3,590.4 million in 2025.

The market size for the offshore wind turbine bearing market is projected to reach USD 5,904.3 million by 2035.

The offshore wind turbine bearing market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in offshore wind turbine bearing market are main shaft bearing, yaw and variable paddle bearings and accelerating engine bearing.

In terms of application, yaw system segment to command 42.7% share in the offshore wind turbine bearing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Offshore Fibre Optic Cable Lay Market Size and Share Forecast Outlook 2025 to 2035

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Offshore Drilling Riser Market Size and Share Forecast Outlook 2025 to 2035

Offshore Crane Market Size and Share Forecast Outlook 2025 to 2035

Offshore Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Offshore Structural Analysis Software Market Size and Share Forecast Outlook 2025 to 2035

Offshore ROV Market Growth – Trends & Forecast 2024-2034

Offshore Equipment Market

Offshore Wind Market Forecast and Outlook 2025 to 2035

Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Energy Infrastructure Market

Offshore Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Fixed Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Export Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

Floating Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Inter Array Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

Wind Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Window Air Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Wind Power Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA