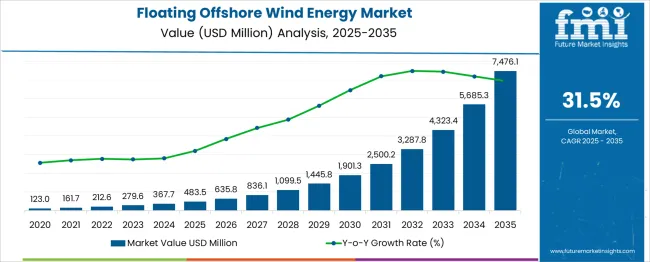

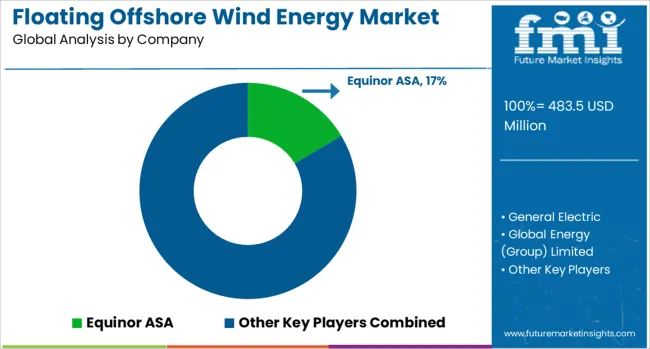

The Floating Offshore Wind Energy Market is estimated to be valued at USD 483.5 million in 2025 and is projected to reach USD 7476.1 million by 2035, registering a compound annual growth rate (CAGR) of 31.5% over the forecast period.

| Metric | Value |

|---|---|

| Floating Offshore Wind Energy Market Estimated Value in (2025 E) | USD 483.5 million |

| Floating Offshore Wind Energy Market Forecast Value in (2035 F) | USD 7476.1 million |

| Forecast CAGR (2025 to 2035) | 31.5% |

Advancements in mooring technologies, turbine design, and floating platform stability have accelerated project feasibility, attracting strong public and private investment. Rising energy demand, coupled with decarbonization commitments from major economies, has positioned floating wind as a strategic contributor to long-term renewable energy targets. The market is further supported by favorable regulatory frameworks, feed-in tariffs, and offshore leasing rounds that incentivize project development.

Future growth is expected to be driven by large-scale demonstration projects transitioning into commercial deployments, reducing the levelized cost of energy (LCOE) through economies of scale. As technology matures and global supply chains expand, floating wind is set to play a critical role in the renewable energy mix, particularly for countries with deep-water coastlines and limited land availability.

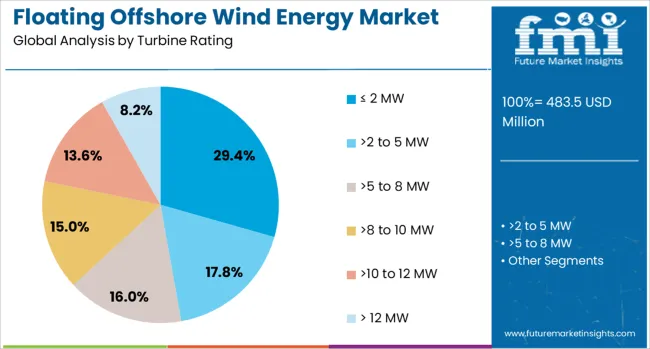

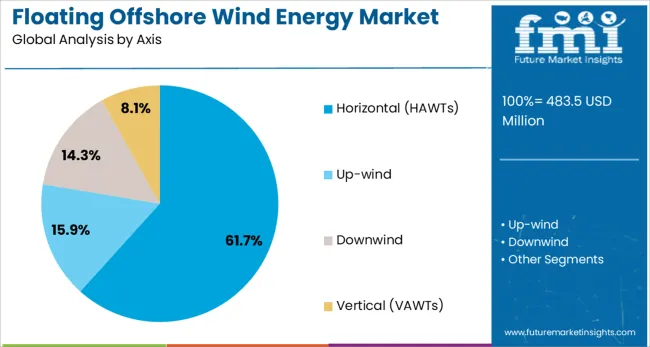

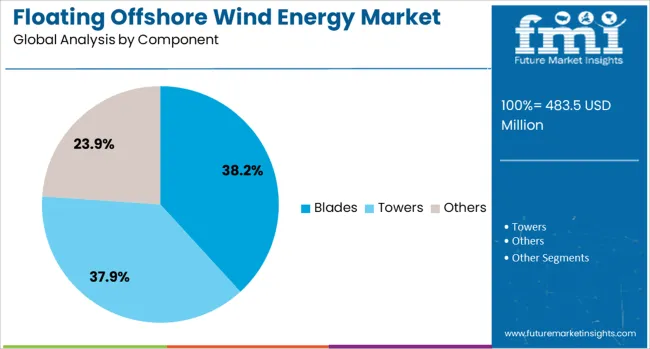

The floating offshore wind energy market is segmented by turbine rating, axis, component, and depth, as well as geographic regions. The turbine rating of the floating offshore wind energy market is divided into ≤ 2 MW, >2 to 5 MW, >5 to 8 MW, >8 to 10 MW, >10 to 12 MW, and > 12 MW. In terms of the axis, the floating offshore wind energy market is classified into Horizontal (HAWTs), Up-wind, Downwind, and Vertical (VAWTs). The floating offshore wind energy market is segmented into Blades, Towers, and Others. The depth of the floating offshore wind energy market is segmented into ≤ 30 m, >30 m to ≤ 50 m, and > 50 m. Regionally, the floating offshore wind energy industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≤ 2 MW turbine rating segment accounted for 29.4% of the floating offshore wind energy market, largely driven by pilot-scale projects, small-grid applications, and early-stage deployments focused on technology validation. This segment serves as the entry point for testing floating platforms, mooring systems, and integration with grid infrastructure before scaling to higher-capacity installations.

Despite being lower in power output, these turbines offer greater flexibility for research institutions and developers seeking to optimize design under real-sea conditions. Their compact size enables easier transportation, installation, and maintenance, making them suitable for isolated coastal grids and remote island systems.

As floating wind technology matures and confidence builds through these smaller-scale installations, the ≤ 2 MW segment is expected to remain relevant for educational, R&D, and hybrid energy projects, even as the market shifts toward larger turbine capacities.

The horizontal axis wind turbine (HAWT) segment dominates the axis category with a commanding 61.7% market share, reflecting its technological maturity, higher efficiency, and widespread industry acceptance. HAWTs are favored in floating offshore wind applications due to their proven track record in fixed offshore installations, standardized manufacturing processes, and optimized blade aerodynamics.

Their horizontal rotor orientation enables better alignment with prevailing winds, maximizing power generation and operational stability. Additionally, the availability of engineering expertise, supply chain infrastructure, and performance data makes HAWTs the preferred configuration for utility-scale projects.

Most of the floating demonstration and pre-commercial arrays currently under development utilize horizontal-axis systems, further reinforcing their dominance. As the market scales and developers prioritize risk mitigation and reliability, HAWTs are expected to retain their leading position in floating offshore wind deployments globally.

The blades segment leads the component category with a 38.2% market share, emphasizing its critical role in determining turbine efficiency, load handling, and aerodynamic performance. In floating offshore applications, blades are subjected to complex dynamic forces from wind, waves, and platform motion, requiring advanced material engineering and structural optimization.

Manufacturers are increasingly investing in lightweight, high-strength composite materials and modular blade designs to enhance performance and reduce logistical challenges. Longer blades with higher aspect ratios are being deployed to capture low-speed winds efficiently, thereby improving energy yield in deep-sea locations.

As turbines grow in size and capacity, the demand for durable, efficient, and low-maintenance blades continues to rise. The segment is expected to maintain strong momentum as innovation in blade technology remains central to cost reduction and performance improvement in floating offshore wind systems.

Floating offshore wind continues to expand into deeper waters, accounting for 18 % of new offshore turbine installations in 2024. Activity is concentrated in Pacific and North Atlantic zones where seabed constraints limit fixed-bottom use. Higher wind availability and foundation flexibility are key drivers. Innovations in mooring and platform design remain central.

Floating wind farms are now sited beyond 60 m depth using spar, semi-submersible, and tension-leg platforms. These locations provide steadier wind conditions, boosting capacity factors by up to 12 % over fixed-bottom units. Trials in Scotland, Japan, and Portugal have recorded improved platform stability and minimal seabed impact. Dynamic mooring sensors and real-time ballast systems are enabling automated tilt correction. Developers use modular interconnects and preassembled topsides to reduce offshore hook-up time by 27 %. Platforms are shipped with pre-certified structures for site-specific wave and wind loads, shortening commissioning timelines and lowering risk during mobilization.

Floating wind installations face higher costs and logistical hurdles. Platform deployment averages 25–30 % more than fixed foundations due to mooring systems, buoyant substructures, and dynamic export cabling. Mooring arrays require precise tensioning, increasing turbine-level installation time by up to 18 %. Vessel shortages often delay campaigns in remote waters, with project timelines slipping 14–20 %. There are few fabrication yards capable of building floaters at scale, and oversized unit transport can extend lead times by 8–10 weeks. Onshore permitting and offshore grid readiness assessments add 4–6 months to the pre-build phase.

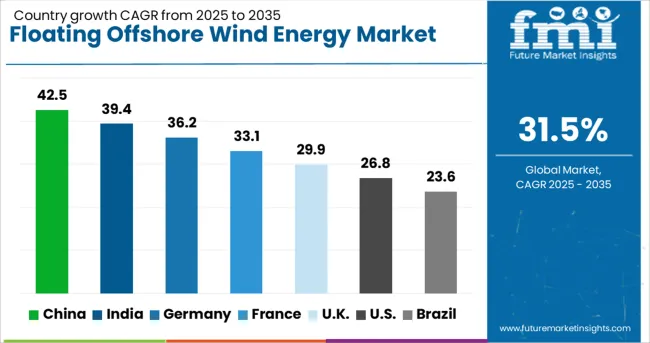

| Country | CAGR |

|---|---|

| China | 42.5% |

| India | 39.4% |

| Germany | 36.2% |

| France | 33.1% |

| UK | 29.9% |

| USA | 26.8% |

| Brazil | 23.6% |

Global floating offshore wind energy market is projected to grow at a 31.5% CAGR from 2025 to 2035. Among the top five markets, China leads with a 42.5% CAGR, exceeding the global average by +35% due to accelerated project commissioning and favorable coastal geography. India follows at 39.4%, offering a +25% premium, driven by supportive government frameworks and technology partnerships. Germany, at 36.2%, maintains a +15% margin, anchored by North Sea capacity additions. The UK records 29.9%, slightly trailing the global trend (–5%) amid grid access constraints. The US stands at 26.8%, or –15% below average, impacted by regulatory lags and interconnection bottlenecks. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

Demand o floating offshore wind sector is expanding at 42.5% CAGR, driven by activity along Fujian and Guangdong coasts. Over 4.6 GW of projects have cleared pilot approvals from the National Energy Administration. China State Shipbuilding Corporation increased floater output at its Guangzhou yard. Deployment is shifting to 16 MW+ turbines. Two eastern ports completed upgrades to manage spar-buoy transport logistics.

The market in India is advancing at 39.4% CAGR, led by MNRE-backed tenders and joint ventures with Dutch and Norwegian firms. Gujarat and Tamil Nadu are priority regions, with over 2.1 GW in pre-feasibility. Prototype testing began at BHEL and Cochin Shipyard. Policy measures require grid compatibility for floating systems before 2027.

Gemany market for the floating segment is growing at a 36.2% CAGR, focused on Baltic Sea sites. Fraunhofer IWES completed model testing of TLP and barge configurations in the North Sea. New OEM partnerships support floaters co-designed for hydrogen coupling. Regulatory approval was granted for dynamic offshore cable protocols in 2024.

UK floating wind is expanding at 29.9% CAGR, led by ScotWind and INTOG leases. Fourteen floating-specific awards were granted by Crown Estate Scotland. Hybrid TLP and semi-submersible foundations are under testing in Moray Firth and Western Isles. Port of Nigg and Port Talbot received over £340 million in infrastructure investment.

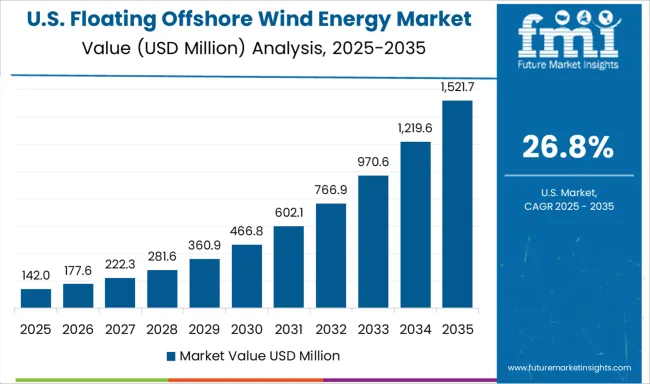

The USA floating wind market is advancing at 26.8% CAGR, supported by BOEM lease activity in Pacific and Northeast waters. California sites exceed 900 m depth, favoring semi-submersible platforms. Equinor and Ocean Winds established USA joint ventures for hull manufacturing. Redwood Coast and Morro Bay projects are piloting AI-based mooring tension control. The DoE allocated USD 275 million to floating wind R&D in 2024.

Equinor ASA holds a significant share of the floating offshore wind sector, leading early commercial deployment. Ørsted and RWE are scaling investments, supported by turbine OEMs such as Siemens Gamesa and Vestas, both developing 15 MW+ models tailored for floating integration. Platform firms like Hexicon are advancing twin-turbine configurations, while Prysmian Group and Nexans supply dynamic export cabling for deep-water connection. The industry is transitioning from pilot-scale installations to full utility-scale projects, targeting 150 GW globally by 2035. Cost-reduction efforts center on modular substructure design and hybrid steel–concrete platforms, aiming for a 40 % decrease by 2030. Deployment remains constrained by limited access to floater-capable vessels and staging ports. Co-location opportunities with hydrogen generation and offshore aquaculture are being incorporated in project planning across Asia, Europe, and North America.

In April 2024, the UK approved the 560 MW Green Volt project, Europe’s first large-scale floating wind farm. Located 80 km off Aberdeen, it will use 35 turbines of 16 MW each. Developed by Flotation Energy and Vårgrønn, it secured a CfD for 400 MW at £139.93/MWh. Commissioning is set for 2029.

| Item | Value |

|---|---|

| Quantitative Units | USD 483.5 Million |

| Turbine Rating | ≤ 2 MW, >2 to 5 MW, >5 to 8 MW, >8 to 10 MW, >10 to 12 MW, and > 12 MW |

| Axis | Horizontal (HAWTs), Up-wind, Downwind, and Vertical (VAWTs) |

| Component | Blades, Towers, and Others |

| Depth | ≤ 30 m, >30 m to ≤ 50 m, and > 50 m |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Equinor ASA, General Electric, Global Energy (Group) Limited, Hexicon, Nexans, Ørsted A/S, Prysmian Group, RWE, Sumitomo Electric Industries, Ltd., Simply Blue Group, Siemens Gamesa Renewable Energy, Vattenfall AB, and Vestas |

| Additional Attributes | Dollar sales by platform type (spar-buoy, semi-submersible, tension-leg) and application (utility-scale power, hybrid energy parks, island electrification), demand dynamics across deepwater leasing, power purchase agreements, and hydrogen co-location, regional trends led by Europe with Asia‑Pacific advancing domestic turbine integration, innovation in dynamic cable design and mooring system optimization, and environmental impact of seabed disturbance limits and marine biodiversity preservation. |

The global floating offshore wind energy market is estimated to be valued at USD 483.5 million in 2025.

The market size for the floating offshore wind energy market is projected to reach USD 7,476.1 million by 2035.

The floating offshore wind energy market is expected to grow at a 31.5% CAGR between 2025 and 2035.

The key product types in floating offshore wind energy market are ≤ 2 mw, >2 to 5 mw, >5 to 8 mw, >8 to 10 mw, >10 to 12 mw and > 12 mw.

In terms of axis, horizontal (hawts) segment to command 61.7% share in the floating offshore wind energy market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Floating Microelectrode Array (FMA) Market Size and Share Forecast Outlook 2025 to 2035

Floating Docks Market Size and Share Forecast Outlook 2025 to 2035

Floating Fountains Market Size and Share Forecast Outlook 2025 to 2035

Floating Valve Trays Market Size and Share Forecast Outlook 2025 to 2035

Floating Solar PV Market Size and Share Forecast Outlook 2025 to 2035

Floating Covers Market Size and Share Forecast Outlook 2025 to 2035

Floating Power Plant Market Growth – Trends & Forecast 2025 to 2035

Floating Hotel Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region – Forecast for 2025-2035

Market Share Distribution Among Floating Hotel Providers

Floating LNG Power Vessel Market Growth – Trends & Forecast 2024-2034

Solar Floating Pool Lights Market Insights – Trends, Demand & Growth 2025-2035

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Offshore Drilling Riser Market Size and Share Forecast Outlook 2025 to 2035

Offshore Crane Market Size and Share Forecast Outlook 2025 to 2035

Offshore Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Offshore Structural Analysis Software Market Size and Share Forecast Outlook 2025 to 2035

Offshore ROV Market Growth – Trends & Forecast 2024-2034

Offshore Equipment Market

Offshore Wind Market Forecast and Outlook 2025 to 2035

Offshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA