Offshore Wind Market Size and Share Forecast Outlook 2025 to 2035

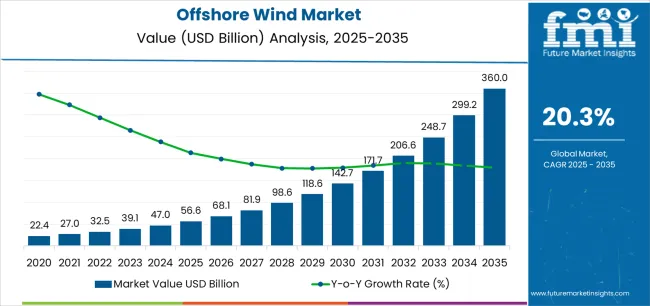

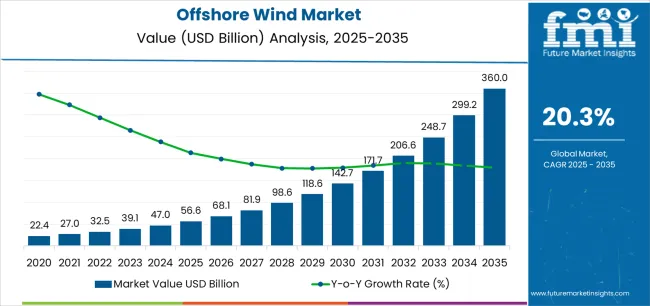

The Offshore Wind Market is estimated to be valued at USD 56.6 billion in 2025 and is projected to reach USD 360.0 billion by 2035, registering a compound annual growth rate (CAGR) of 20.3% over the forecast period.

The offshore wind market is expanding rapidly due to global commitments toward renewable energy transition and decarbonization goals. Increasing investments in large-scale offshore wind farms, coupled with supportive government policies and technological advancements, are driving market growth. Current developments are being shaped by improved turbine designs, enhanced grid connectivity, and cost reductions achieved through economies of scale.

Growing demand for sustainable power generation in coastal economies and the push for energy independence are accelerating capacity additions. The future outlook remains strong as new offshore projects are being commissioned across Europe, Asia-Pacific, and North America, supported by favorable regulatory frameworks and financing models.

Growth rationale is built on increasing energy demand, declining levelized cost of electricity from offshore wind, and rising corporate power purchase agreements Continued innovation in installation techniques, floating wind technology, and maintenance optimization is expected to strengthen market competitiveness and ensure long-term expansion across global renewable energy portfolios.

Quick Stats for Offshore Wind Market

- Offshore Wind Market Industry Value (2025): USD 56.6 billion

- Offshore Wind Market Forecast Value (2035): USD 360.0 billion

- Offshore Wind Market Forecast CAGR: 20.3%

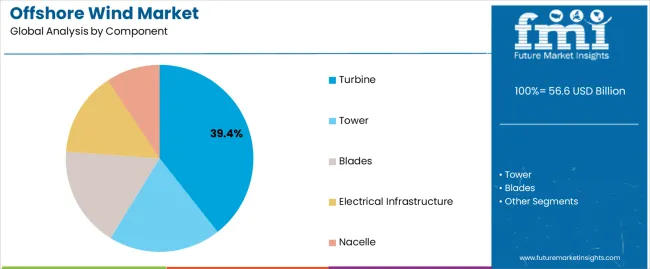

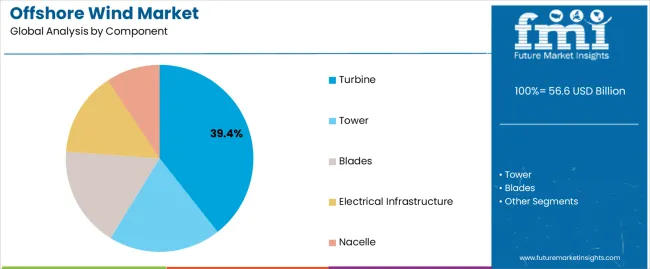

- Leading Segment in Offshore Wind Market in 2025: Turbine (39.4%)

- Key Growth Region in Offshore Wind Market: North America, Asia-Pacific, Europe

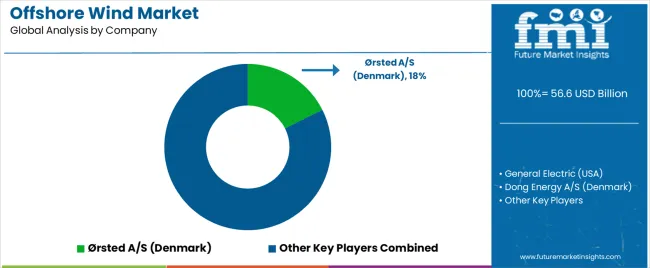

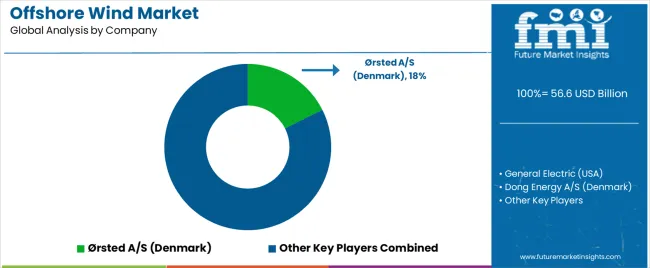

- Top Key Players in Offshore Wind Market: Ørsted A/S (Denmark), General Electric (USA), Dong Energy A/S (Denmark), ABB (Switzerland), Senvion SA (Luxembourg), Engie (France), EEW GROUP (Germany), Goldwind Wind Energy GmbH (China)

| Metric |

Value |

| Offshore Wind Market Estimated Value in (2025 E) |

USD 56.6 billion |

| Offshore Wind Market Forecast Value in (2035 F) |

USD 360.0 billion |

| Forecast CAGR (2025 to 2035) |

20.3% |

Segmental Analysis

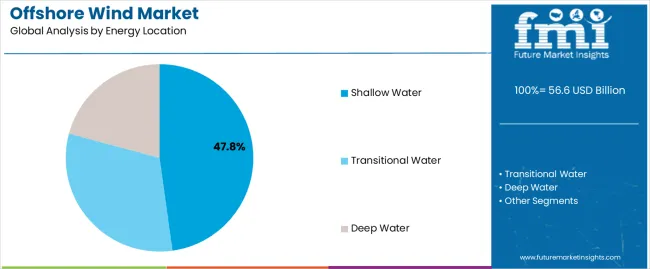

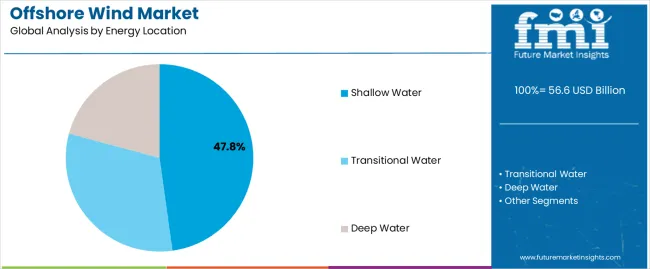

The market is segmented by Component and Energy Location and region. By Component, the market is divided into Turbine, Tower, Blades, Electrical Infrastructure, and Nacelle. In terms of Energy Location, the market is classified into Shallow Water, Transitional Water, and Deep Water. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Component Segment

The turbine segment, accounting for 39.40% of the component category, has been leading the market owing to its pivotal role in overall system efficiency and energy yield. Technological advancements in blade design, generator capacity, and digital monitoring systems have significantly improved power output and reliability.

Manufacturers are focusing on the development of larger and more durable turbines that can withstand harsh offshore conditions while minimizing maintenance costs. The segment’s dominance is also being supported by declining turbine costs through mass production and supply chain optimization.

Integration of smart sensors and predictive maintenance solutions has enhanced performance monitoring and reduced downtime The growing shift toward high-capacity turbines exceeding 15 MW is expected to further consolidate this segment’s position, enabling higher power generation from fewer installations and supporting long-term cost competitiveness in offshore wind development.

Insights into the Energy Location Segment

The shallow water segment, representing 47.80% of the energy location category, continues to dominate the offshore wind market due to favorable installation conditions and lower capital expenditure compared to deepwater projects. Its leadership is supported by mature project development frameworks and established infrastructure that simplify logistics and maintenance operations.

The proximity of shallow water sites to coastal demand centers has ensured efficient grid connectivity and reduced transmission losses. Developers are increasingly leveraging these regions for large-scale deployment due to predictable wind patterns and accessible seabed conditions.

The segment’s strong share is further reinforced by policy incentives and streamlined permitting processes that facilitate faster project execution Over the forecast period, continued deployment in shallow coastal zones, combined with incremental improvements in foundation and cabling technologies, is expected to sustain this segment’s dominance and underpin stable growth across global offshore wind capacity additions.

Key Trends Shaping the Offshore Wind Market

- Offshore wind projects are expanding in size and capacity, with developers deploying larger turbines and wind farms with higher total megawatt capacities.

- Technological advancements, such as larger rotor diameters and taller towers, contribute to increased energy generation and efficiency.

- Cost reductions in the offshore wind sector have made it more competitive with conventional energy sources, attracting investment and driving deployment.

- Offshore wind development is expanding beyond traditional markets, with increasing interest and investments in regions like the United States, Asia-Pacific, and emerging markets.

- Governments and policymakers are setting ambitious offshore wind targets to support renewable energy transition and stimulate economic growth.

- Technological innovation focuses on enhancing the efficiency, reliability, and sustainability of offshore wind projects, with advancements in floating wind turbine technology, enabling the harnessing of wind resources in deeper waters.

- Investments in grid infrastructure and transmission networks are being addressed to accommodate the growing capacity of offshore wind projects.

- Supportive regulatory frameworks, such as feed-in tariffs, auctions, and renewable energy targets, drive offshore wind deployment and investment.

- The offshore wind industry is stimulating the growth of a robust supply chain, creating opportunities for manufacturers, suppliers, and service providers.

- Environmental sustainability and social responsibility are integral aspects of offshore wind development, with stakeholders emphasizing the importance of minimizing environmental impacts and engaging local communities.

Dynamics of the Offshore Wind Market

- Offshore wind projects are being developed in various regions globally. The industry is experiencing technological advancements such as larger turbines, floating offshore wind platforms, and improved installation and maintenance techniques, which are driving down costs and expanding the geographical reach of offshore wind development.

- The offshore wind supply chain comprises various segments, including turbine manufacturers, project developers, engineering firms, vessel operators, and maintenance service providers.

- The offshore wind market is characterized by a mix of established and new entrants, including energy companies, utilities, independent power producers, and financial investors.

- Government policies, incentives, and regulations significantly shape the market, with supportive frameworks like feed-in tariffs, renewable energy targets, and carbon pricing mechanisms driving investment in offshore wind projects.

- Offshore wind projects must navigate environmental and regulatory challenges, including wildlife conservation, marine habitat protection, and stakeholder engagement.

- Cost and financing for offshore wind projects have been steadily declining due to technological advancements, economies of scale, and increased competition.

- Financing structures vary depending on project size, location, and market conditions, With a mix of debt, equity, and government subsidies often used to fund development.

- Integration with existing electricity grids presents technical and logistical challenges, including grid stability, transmission infrastructure, and interconnection capacity.

- Grid modernization and investment in smart grid technologies are essential for maximizing the value of offshore wind energy.

- The offshore wind market is poised for continued growth and expansion in the coming years, driven by the global transition to clean energy and the need to mitigate climate change.

Potential for Offshore Energy Generation

- Offshore wind companies are expanding as people observe the potential for wind energy resources in offshore places.

- Offshore wind farms have higher, more constant wind speeds, making them more efficient for energy generation.

- Set closer to important urban areas, decreasing transmission losses and land limitations, the market also seeks to show scalability and cost-effectiveness.

- Advancements in technology, such as bigger turbines and unique floating platforms, have made offshore wind projects competitive with traditional energy sources.

Analysis of Top Countries Involved in Offshore Wind Energy Production, Distribution, and Utilization

Advanced Technology and Sustainable Wind Resource Utilization within the Offshore Wind Industry

| Attributes |

Details |

| Top component |

Turbine |

| CAGR (2025 to 2035) |

21.1% |

- Offshore wind turbines have significant scale and capacity, ranging from several megawatts to over ten megawatts per turbine.

- Despite their size and scale, offshore wind turbines have a relatively low environmental impact compared to conventional energy sources.

- They drive economic growth and job creation through manufacturing, installation, and maintenance activities associated with offshore wind projects.

- Governments and policymakers worldwide are increasingly recognizing the importance of offshore wind energy in achieving climate and energy goals, encouraging investment in offshore wind projects, and promoting the expansion of the turbine offshore market.

Shallow Water is a Prime Energy Location

| Attributes |

Details |

| Top Energy Location |

Shallow Water |

| CAGR (2025 to 2035) |

20.8% |

- Shallow water regions are ideal for offshore wind farms due to their abundant wind resources, efficient energy capture, cost-effective turbine installation, proximity to infrastructure, support for diverse marine ecosystems, reduced ecological sensitivity, enhanced economic viability, lower installation costs, higher energy yields, and reduced operational risks.

- These regions also offer lower installation costs for offshore wind farms, higher energy outputs due to optimal wind conditions, and reduced operational risks.

- Policy support, regulatory incentives, and strategic planning initiatives prioritize the exploration and utilization of shallow water areas, accelerating the transition toward renewable energy.

- The favorable conditions in shallow water areas also contribute to reduced operational risks for offshore wind projects. Overall, shallow water regions offer strategic development opportunities for governments and energy stakeholders, contributing to the transition towards renewable energy.

Offshore Wind Industry Analysis by Top Investment Segments

| Countries |

CAGR through 2035 |

| United States |

21.8% |

| United Kingdom |

22.8% |

| China |

22.2% |

| Japan |

20.1% |

| South Korea |

24.0% |

Rapid Growth in the United States Offshore Wind Market Renewable Energy Initiatives

- States along the East Coast, including Massachusetts, New York, and New Jersey, have set ambitious renewable energy targets, including offshore wind capacity goals. These targets are enshrined in state legislation or executive orders, signaling a commitment to expanding renewable energy generation.

- Federal and state governments have implemented favorable regulatory policies, facilitating offshore wind development through streamlined permitting processes and lease auctions. This has attracted significant investor interest, with the potential for long-term revenue streams and alignment with environmental, social, and governance principles.

- The United States possesses abundant offshore wind resources along its Atlantic coastline, particularly in shallow waters with favorable wind speeds. Advances in turbine technology have expanded the feasible areas for offshore wind development, making the US a prime location for offshore wind deployment.

- Major offshore wind projects, such as Vineyard Wind off Massachusetts and South Fork Wind Farm near Long Island, demonstrate the feasibility and potential of offshore wind to contribute to the nation's clean energy transition.

Significant Advancements in Renewable Energy Technologies in the United Kingdom

- The United Kingdom has a robust offshore wind project pipeline, including the Hornsea and Dogger Bank wind farms, which are some of the world's largest installations.

- A leader in deploying innovative offshore wind technologies, such as next-generation turbine designs, floating wind platforms, and advanced grid integration solutions.

- Consistently supported offshore wind development through strategic policies and initiatives, such as the Offshore Wind Sector Deal, which aims to increase offshore wind capacity to 30 GW by 2035.

- The upcoming Round 4 leasing round demonstrates the UK's proactive approach to expanding its offshore wind footprint and maintaining its leadership position in the global market.

- The UK has also made significant investments in floating wind technology, such as the Floating Offshore Wind Centre of Excellence and the Hywind Scotland project, to access deeper waters and expand offshore wind deployment areas.

China's Dominance in the Offshore Wind Market

- China leads the world in offshore wind capacity, with its vast coastline, shallow waters, and favorable wind conditions providing ample opportunities for large-scale installations.

- The country has made strategic investments in offshore wind infrastructure, manufacturing capabilities, and technology innovation, aiming to accelerate the deployment of offshore wind capacity and support the country's energy transition goals.

- The country's growing dominance in the offshore wind market extends beyond its borders, with Chinese companies participating in international projects and collaborations.

Expansion of the Market in Japan Due to Various Factors Reshaping the Country's Energy Landscape

- Japan has implemented regulatory reforms to promote offshore wind development and streamline project approval processes.

- These changes include simplifying permitting procedures, facilitating grid connection, and providing financial incentives for renewable energy projects.

- Japan is also fostering industry partnerships between government entities, industry players, and international partners to drive innovation and capacity expansion in the offshore wind sector.

- Offshore wind is increasingly recognized as a key source of energy security and climate change mitigation. Japan is promoting both fixed-bottom and floating offshore wind technologies to harness its diverse marine environments.

- The government has set ambitious targets for offshore wind capacity deployment, aiming to install 10 gigawatts (GW) of capacity and 30-45 GW.

- Strategic investments in infrastructure, research and development, and project financing support these targets and position Japan as a prominent player in the Asia-Pacific offshore wind market.

Ambitious Targets Drive Momentum in the Offshore Wind Market in South Korea

- The South Korean government has shown strong support for offshore wind development as part of its renewable energy transition strategy.

- The government has set ambitious targets for offshore wind capacity expansion, with renewable energy.

- This ambitious target drives momentum in the offshore wind market, promoting investments, project developments, and technology innovation.

- Strategic investments in technology and infrastructure, such as domestic manufacturing capabilities, port infrastructure, and R&D initiatives, are also being prioritized. South Korea is also developing a robust domestic manufacturing and supply chain ecosystem to support its offshore wind ambitions.

- This includes fostering partnerships between industry players, research institutions, and government agencies to localize production, reduce project costs, and enhance project resilience.

- South Korea is also fostering a culture of technological innovation and collaboration to drive advancements in offshore wind technology and deployment practices.

Competitive Landscape of the Offshore Wind Market

The offshore wind market's maturity and growth potential are analyzed by examining offshore wind farms' installed capacity and deployment rates in different regions. Comparing the policy and regulatory frameworks governing offshore wind development helps understand government support, incentives, and barriers to entry. Technological advancements and innovation initiatives reveal trends in turbine design, foundation types, and installation techniques.

Market participants and industry players provide insights into market dynamics, competition, and collaboration. Resource potential and environmental considerations help identify favorable offshore wind sites and potential challenges for development. Investment trends, financing mechanisms, and project economics reveal funding sources, risk factors, and opportunities in the offshore wind market.

Understanding grid infrastructure capabilities and integration challenges is essential for ensuring efficient transmission and integration of offshore wind energy into existing power grids.

Recent Developments

- In October 2025, Shell and BP plan to invest heavily in offshore wind ventures, while RWE and EDF Renewables have finalized agreements for offshore wind farms, marking significant progress in renewable energy development.

- In June 2025, Orsted and Vestas partnered on offshore wind projects, while Siemens Gamesa and EnBW have announced joint ventures to drive innovation in wind energy technology.

- In September 2024, Equinor and BP strengthened their offshore wind partnership to accelerate renewable energy projects, while Orsted secured key contracts for offshore wind farms, solidifying its industry leadership.

Leading Companies in the Offshore Wind Market

- General Electric (USA)

- Ørsted A/S (Denmark)

- Dong Energy A/S (Denmark)

- ABB (Switzerland)

- Senvion SA (Luxembourg

- Engie (France)

- EEW GROUP (Germany)

- Goldwind Wind Energy GmbH (China)

Key Coverage in the Offshore Wind Market Report

By Component:

- Turbine

- Tower

- Blades

- Electrical Infrastructure

- Nacelle

By Energy Location:

- Shallow Water

- Transitional Water

- Deep Water

By Region:

- North America

- Latin America

- Asia Pacific

- Middle East and Africa (MEA)

- Europe

Frequently Asked Questions

How big is the offshore wind market in 2025?

The global offshore wind market is estimated to be valued at USD 56.6 billion in 2025.

What will be the size of offshore wind market in 2035?

The market size for the offshore wind market is projected to reach USD 360.0 billion by 2035.

How much will be the offshore wind market growth between 2025 and 2035?

The offshore wind market is expected to grow at a 20.3% CAGR between 2025 and 2035.

What are the key product types in the offshore wind market?

The key product types in offshore wind market are turbine, tower, blades, electrical infrastructure and nacelle.

Which energy location segment to contribute significant share in the offshore wind market in 2025?

In terms of energy location, shallow water segment to command 47.8% share in the offshore wind market in 2025.