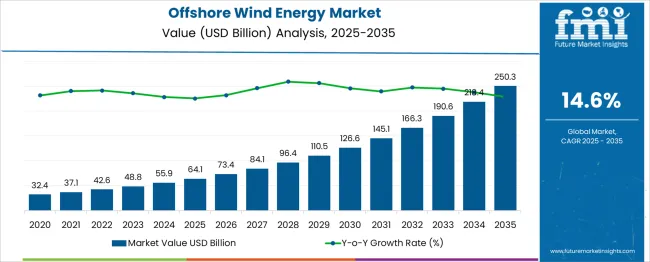

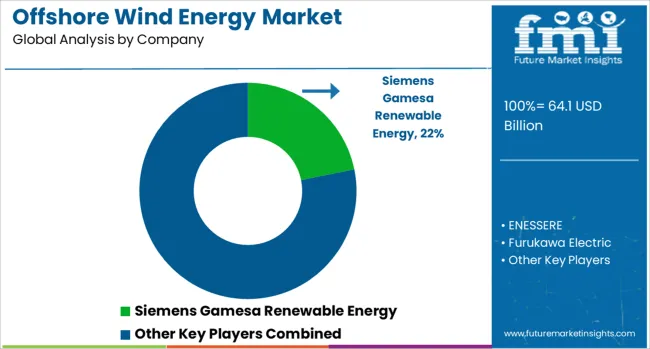

The Offshore Wind Energy Market is estimated to be valued at USD 64.1 billion in 2025 and is projected to reach USD 250.3 billion by 2035, registering a compound annual growth rate (CAGR) of 14.6% over the forecast period.

| Metric | Value |

|---|---|

| Offshore Wind Energy Market Estimated Value in (2025 E) | USD 64.1 billion |

| Offshore Wind Energy Market Forecast Value in (2035 F) | USD 250.3 billion |

| Forecast CAGR (2025 to 2035) | 14.6% |

Governments and energy providers are investing heavily in offshore wind projects to diversify energy sources and meet sustainability targets. Advances in technology have led to larger and more efficient turbines capable of generating higher outputs at competitive costs. The expanding offshore infrastructure supports easier installation and maintenance, further accelerating market growth. Favorable policies, subsidies, and falling costs of wind power generation have also made offshore wind a more attractive option.

Growing concerns over climate change and energy security have pushed utilities to adopt cleaner energy alternatives. The market outlook remains positive as countries with extensive coastlines increase their offshore wind capacity, particularly in shallow waters where installation is less complex. Growth is expected to be driven by turbine components, representing the largest segment, and projects located in water depths up to 30 meters.

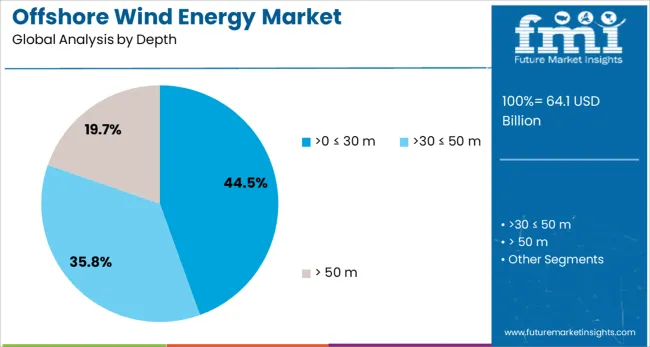

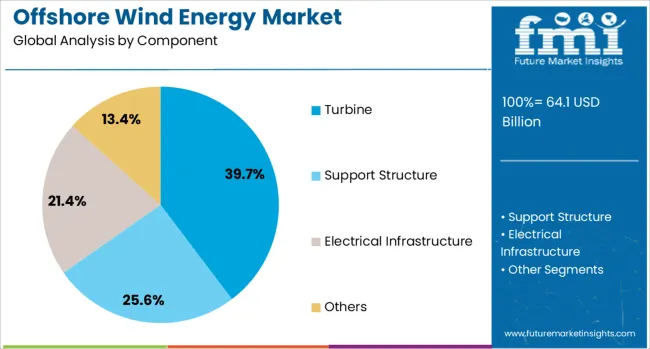

The offshore wind energy market is segmented by component and depth, and geographic regions. The offshore wind energy market is divided into Turbines, Support Structures, Electrical Infrastructure, and Others. In terms of depth, the offshore wind energy market is classified into < 30 m, 30-50 m, and > 50 m. Regionally, the offshore wind energy industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Turbine segment is projected to hold 39.7% of the offshore wind energy market revenue in 2025, maintaining its lead as the largest component category. Turbines are critical to the generation of electricity from wind, and innovations in turbine blade design and capacity have enhanced energy efficiency. Manufacturers have focused on improving turbine durability and reducing maintenance needs to ensure consistent power output in harsh offshore environments.

The adoption of larger turbines with higher capacity ratings has supported economies of scale and lowered the cost per megawatt. The Turbine segment benefits from continued research and development aimed at optimizing aerodynamics and integrating smart monitoring systems.

As the core technology in offshore wind farms, turbines will remain the primary driver of market value.

The shallow water depth segment, greater than zero and up to 30 meters, is expected to contribute 44.5% of the offshore wind energy market revenue in 2025, holding the largest share among depth categories. Projects in this depth range benefit from easier access for installation and maintenance compared to deeper waters, which reduces operational complexities and costs.

Shallow water sites are often closer to shorelines, facilitating grid connection and lowering transmission losses. Many early-stage and existing offshore wind farms are situated in this depth band due to favorable seabed conditions and established supply chains.

As offshore wind continues to expand, shallow waters provide ideal locations for rapid deployment and cost-effective energy generation. This segment’s growth is supported by technological advancements in foundation designs suited for these depths and increasing governmental support for near-shore renewable projects.

Offshore wind energy has gained traction as utility-scale fleets are deployed in coastal regions to increase power output and diversify energy portfolios. Foundation types such as monopile, jacket, and floating platforms have been selected based on water depth and geological conditions. Turbine capacity scaling and high-voltage undersea cabling have improved delivery efficiency to mainland grids. Governing bodies and energy operators have collaborated to enable project development through leasing rounds, strategic route planning, and auction-based tariff mechanisms.

Deepwater floatable foundation technologies have been adopted to allow offshore wind farms to be located beyond shallow coastal zones, making stronger wind resource capture possible. Turbine power rating increases and rotor diameter expansion have improved capacity factors, reducing overall levelised cost of energy. Grid interconnection has been strengthened via high-voltage direct current cabling and offshore substations, enabling stable bulk power transfer. Supply chain expansion through vessel leasing, in-situ assembly yards, and port infrastructure upgrades has supported accelerated installation timelines. Offshore wind zone leasing and tariff-based auctioning by regulators have brought clarity to project developers and investors. Commercial structures involving power purchase agreements, corporate off-take deals, and green financing packages have been used to de-risk project returns and secure capital.

Offshore wind farm progress has been impeded by complex environmental impact evaluations affecting marine ecosystems, fishing activity and coastal habitats. Permitting delays and stakeholder consultation pauses have postponed project schedules and increased costs. Turbine component supply chain bottlenecks have been observed due to global demand concentration for blades, nacelles and foundations. Transportation limitations for oversized parts have affected ports lacking heavy-lift capacity or staging areas. Grid integration complexity has been increased by intermittent power profiles requiring synchronous backup and dynamic stability systems. Vessel scheduling conflicts and weather downtime windows have added to installation uncertainty. As tariff rounds and auction timelines have been tightened, developers have faced cost inflation for leased zones and logistical arrangements, raising levelised cost projections.

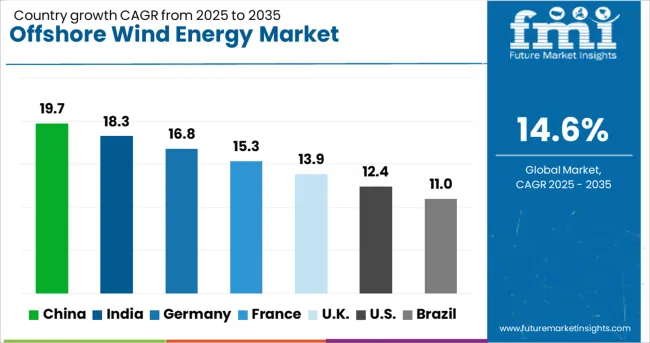

| Country | CAGR |

|---|---|

| China | 19.7% |

| India | 18.3% |

| Germany | 16.8% |

| France | 15.3% |

| UK | 13.9% |

| USA | 12.4% |

| Brazil | 11.0% |

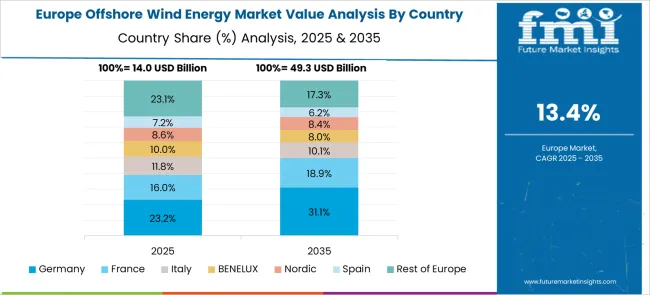

The global offshore wind energy market is expected to grow at a 14.6% CAGR from 2025 to 2035, driven by decarbonization initiatives and large-scale investments in renewable energy infrastructure. Among the 40 countries analyzed, China leads at 19.7%, followed by India at 18.3% and Germany at 16.8%, while France posts 15.3% and the United Kingdom records 13.9%. Growth premiums reflect aggressive offshore capacity targets, technological advancements in turbine design, and favorable policy frameworks. BRICS nations show rapid deployment through public-private partnerships, while OECD economies focus on floating wind platforms and grid integration. The report includes analysis of over 40 countries, with five profiled below for reference.

China is projected to grow rapidly, supported by ambitious offshore wind capacity targets and favorable renewable energy policies. Coastal provinces such as Guangdong and Jiangsu lead deployment, while floating wind projects gain prominence in deep-water locations. Domestic manufacturers are scaling production of large-capacity turbines exceeding 14 MW to reduce levelized costs and enhance efficiency. Investment in subsea cabling and grid infrastructure ensures stable integration with the power network. Public-private partnerships and green financing tools such as bonds are accelerating large-scale offshore projects. Strategic initiatives in floating platforms and high-voltage transmission systems further position China as a global leader in offshore wind energy development and technology-driven expansion.

India is expected to register strong growth, driven by project development along Gujarat and Tamil Nadu coastlines. Government tenders, viability gap funding mechanisms, and favorable tariff structures are attracting major international developers. Partnerships with European firms accelerate technology transfer for floating wind solutions suited to Indian marine conditions. Offshore wind is increasingly linked to green hydrogen production, enhancing energy diversification strategies. Port modernization initiatives support efficient turbine assembly and logistics for large-scale deployment. Investment in subsea cabling and grid connectivity further strengthens project feasibility, while policy-driven incentives ensure steady investor participation in this emerging renewable segment.

Germany is forecast to expand significantly under EU renewable targets and national energy transition plans. Offshore wind auctions for zero-subsidy projects encourage private sector investment in competitive large-scale developments. German firms lead innovation in floating foundation technologies and high-voltage direct current (HVDC) systems for efficient long-distance power transmission. Digital twin platforms are increasingly deployed to optimize predictive maintenance and reduce operational costs for offshore assets. The integration of hydrogen-based storage and offshore hybrid energy hubs supports industrial decarbonization objectives. Policy-driven frameworks combined with robust engineering expertise position Germany as a pioneer in offshore wind energy innovation and integrated energy solutions.

France anticipates strong growth supported by state-backed auctions and concessions for offshore wind projects. Floating wind technology deployment in deep-water zones is advancing under government-led pilot programs. Emphasis on local manufacturing of turbines and floating platforms promotes industrial capability development. Hybrid renewable hubs combining offshore wind and tidal systems are being tested to enhance energy output. Grid reinforcement projects, including subsea interconnectors, improve integration with national and cross-border power networks. Strategic policies designed to reduce dependence on fossil fuels and promote energy diversification further encourage long-term investment in offshore wind infrastructure across France’s coastal regions.

The United Kingdom remains a leading European offshore wind market with sustained investments in large-scale projects such as Dogger Bank and Hornsea. Floating wind projects in the Celtic Sea complement existing fixed-bottom capacity, strengthening the energy mix. Offshore-to-hydrogen hubs are emerging as strategic assets aligned with national net-zero commitments. Partnerships between utilities and technology providers accelerate digital monitoring systems for improved operational efficiency. Government mechanisms like the Contracts for Difference (CfD) scheme continue to secure investor confidence and project stability. Expansion of grid connectivity and innovation in floating foundation systems support ongoing capacity additions across multiple offshore zones.

The offshore wind energy market is driven by leading turbine manufacturers and technology providers. Siemens Gamesa remains a key player with advanced turbine platforms and a robust installation pipeline, while Vestas strengthens its presence through competitive offshore offerings alongside its strong onshore portfolio. General Electric, under its GE Vernova division, competes with large-scale offshore turbine solutions through the Haliade series. Chinese companies such as Goldwind and Shanghai Electric Wind Power are rapidly increasing installations across Asia-Pacific, supported by strong domestic policies. Other notable participants include Nordex SE, Doosan Heavy, and Hitachi, focusing on project-specific innovations. Competitive strategies emphasize reducing cost per megawatt, enhancing reliability, and scaling floating wind solutions to address deep-water project requirements globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 64.1 Billion |

| Component | Turbine, Support Structure, Electrical Infrastructure, and Others |

| Depth | >0 ≤ 30 m, >30 ≤ 50 m, and > 50 m |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens Gamesa Renewable Energy, ENESSERE, Furukawa Electric, General Electric, Global Energy (Group) Limited, Goldwind, IMPSA, LS Cable & System, Nexans, Nordex SE, Prysmian Group, Sumitomo Electric Industries, Southwire Company, Suzlon Energy Limited, Vestas, and WEG |

| Additional Attributes | Dollar sales in the offshore wind energy market are driven by rising demand for renewable energy and favorable government policies. Growth is supported by large-scale investments in offshore projects and advancements in turbine technology. Fixed-bottom installations dominate current deployments, while the shift toward floating platforms and high-capacity turbines continues to accelerate global market expansion across Europe and Asia-Pacific. |

The global offshore wind energy market is estimated to be valued at USD 64.1 billion in 2025.

The market size for the offshore wind energy market is projected to reach USD 250.3 billion by 2035.

The offshore wind energy market is expected to grow at a 14.6% CAGR between 2025 and 2035.

The key product types in offshore wind energy market are turbine, _rating, _installation, support structure, _substructure (steel), _foundation, _others, electrical infrastructure, _wires & cables, _substation, _others and others.

In terms of depth, >0 ≤ 30 m segment to command 44.5% share in the offshore wind energy market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Offshore Wind Energy Infrastructure Market

Fixed Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Floating Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Offshore Drilling Riser Market Size and Share Forecast Outlook 2025 to 2035

Offshore Crane Market Size and Share Forecast Outlook 2025 to 2035

Offshore Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Offshore Structural Analysis Software Market Size and Share Forecast Outlook 2025 to 2035

Offshore ROV Market Growth – Trends & Forecast 2024-2034

Offshore Equipment Market

Offshore Wind Market Forecast and Outlook 2025 to 2035

Offshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Export Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

Inter Array Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

Window Air Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Wind Power Coatings Market Size and Share Forecast Outlook 2025 to 2035

Windsurf Foil Board Market Size and Share Forecast Outlook 2025 to 2035

Windscreen Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA