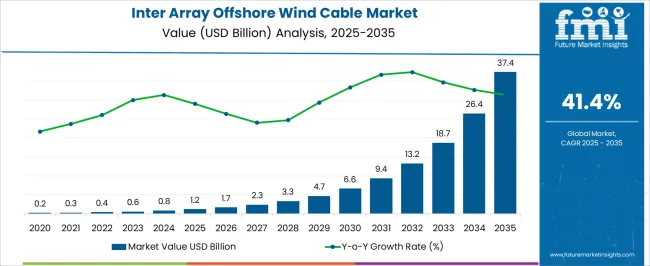

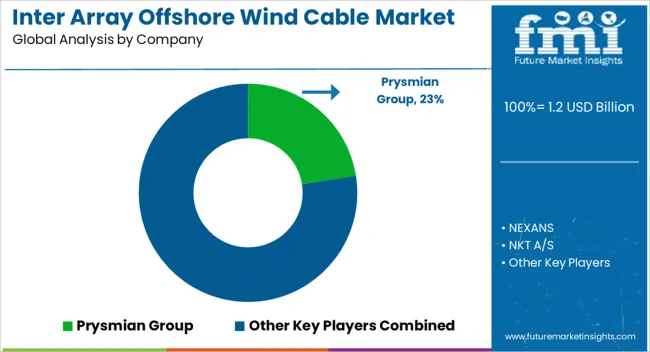

The global inter array offshore wind cable market is projected to grow from USD 1.2 billion in 2025 to USD 37.4 billion by 2035, representing a remarkable CAGR of 41.4%. Over the decade, the market demonstrates significant share gains, driven by the rapid deployment of offshore wind farms, advancements in high-voltage subsea cabling, and strong government support for renewable energy infrastructure.

In the first half of the period (2025–2030), the market expands from USD 1.2 billion to USD 6.6 billion, reflecting early-stage adoption and entry of both emerging players and established manufacturers capturing incremental market share. Europe, particularly the UK, Germany, and the Netherlands, dominates initial demand, while Asia-Pacific begins establishing a foothold with increasing project installations. From 2030 to 2035, growth accelerates sharply from USD 6.6 billion to USD 37.4 billion, with top-tier suppliers consolidating their market positions through large-scale offshore wind projects in Asia-Pacific and North America. Technological innovations such as superconducting cables, modular designs, and lightweight high-performance materials enhance efficiency, reliability, and project economics, enabling leading companies to capture a larger portion of the expanding market.

Smaller players face erosion due to high capital requirements, stringent technical standards, and complex project execution, resulting in a more concentrated and innovation-driven competitive landscape. Overall, the decade-long growth highlights substantial market share gains for leading suppliers while transforming the offshore wind cable sector into a high-barrier, technologically advanced market.

| Metric | Value |

|---|---|

| Inter Array Offshore Wind Cable Market Estimated Value in (2025 E) | USD 1.2 billion |

| Inter Array Offshore Wind Cable Market Forecast Value in (2035 F) | USD 37.4 billion |

| Forecast CAGR (2025 to 2035) | 41.4% |

The inter array offshore wind cable market derives its growth from multiple parent markets, each contributing varying shares to overall demand. The inter array offshore wind cable market is primarily driven by the offshore wind power market, which accounts for approximately 45–50% of total demand, as these cables are essential for connecting turbines within wind farms and transmitting electricity efficiently. The power transmission and distribution market contributes around 20–22%, reflecting the role of subsea cabling in transferring offshore-generated electricity to onshore grids and substations. The renewable energy equipment manufacturing market, including turbine, substation, and cable component producers, holds roughly 15–17%, as demand for high-performance, durable inter array offshore wind cables aligns with global renewable energy expansion.

The marine and subsea engineering market contributes approximately 10–12%, driven by installation, maintenance, and subsea deployment services essential for cable integrity and operational reliability. Lastly, the smart grid and energy management systems market accounts for 5–6%, reflecting the integration of inter array offshore wind cables with real-time monitoring, predictive maintenance, and energy optimization platforms. Collectively, these parent markets define the investment, technological, and operational ecosystem of the inter array offshore wind cable market, enabling it to meet the rising demand for renewable energy infrastructure worldwide.

The inter array offshore wind cable market is experiencing robust expansion, supported by accelerating offshore wind energy installations and increasing investment in renewable infrastructure. Demand is being reinforced by governmental decarbonization commitments, grid modernization strategies, and the shift toward higher-capacity offshore wind farms requiring advanced cabling solutions.

Manufacturers are focusing on enhancing product durability, corrosion resistance, and operational efficiency to meet the harsh environmental conditions of subsea applications. Supply chain optimization, strategic raw material sourcing, and technological advancements in insulation and armoring are ensuring consistent quality and extended service life.

The market outlook remains positive as large-scale projects in Europe, Asia-Pacific, and North America continue to progress, with policy incentives driving capacity additions. Over the forecast period, rising demand for high-voltage, large-capacity cables, combined with advancements in installation techniques, is expected to sustain market growth, while competitive differentiation will be influenced by innovation, compliance with international standards, and the ability to deliver turnkey solutions in challenging offshore environments.

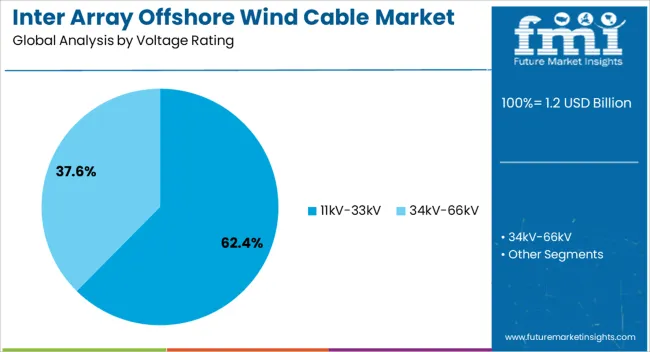

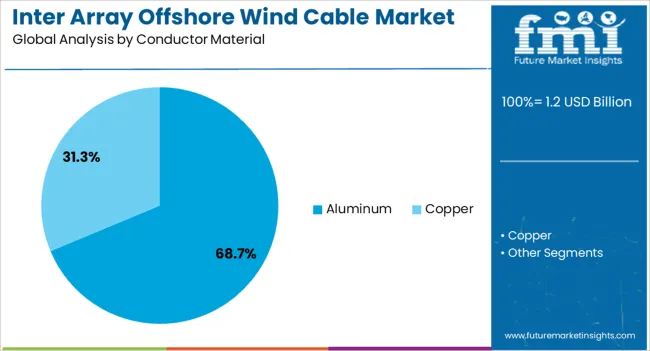

The inter array offshore wind cable market is segmented by voltage rating, conductor material, and geographic regions. By voltage rating, inter array offshore wind cable market is divided into 11kV-33kV and 34kV-66kV. In terms of conductor material, inter array offshore wind cable market is classified into Aluminum and Copper. Regionally, the inter array offshore wind cable industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 11kV–33kV segment, holding 62.40% of the voltage rating category, has been leading the market due to its compatibility with the majority of existing offshore wind farm configurations. Its dominance is being supported by proven reliability, cost efficiency, and adaptability to medium-scale and large-scale projects alike.

Installation processes for this voltage range are well established, reducing operational risks and enabling predictable project timelines. The segment benefits from standardized manufacturing practices, ensuring ease of maintenance and interoperability with existing grid systems.

Furthermore, the balance between transmission efficiency and economic feasibility has strengthened its adoption among developers seeking optimal lifecycle performance. Ongoing offshore capacity expansion, coupled with the segment’s compatibility with modular project designs, is expected to sustain demand, while incremental technological enhancements will continue to improve efficiency and resilience under demanding subsea conditions.

The aluminum segment, representing 68.70% of the conductor material category, has maintained its leading position due to its favorable weight-to-conductivity ratio, which significantly reduces overall cable mass and eases offshore installation processes. Cost advantages over copper have reinforced its selection, particularly in large-scale projects where material expenditures are substantial.

Aluminum’s corrosion resistance, when paired with advanced protective sheathing and insulation technologies, has improved operational longevity in marine environments. The segment’s share is also supported by its compatibility with high-capacity transmission requirements, enabling efficient energy transfer over extended distances without excessive thermal losses.

Standardization in design and established supply chains have ensured steady availability and predictable performance metrics, making aluminum the preferred choice for a wide range of offshore wind applications. Continued advancements in alloy compositions and extrusion techniques are expected to further enhance mechanical strength and reliability, ensuring the segment remains a critical component in meeting the global expansion of offshore wind infrastructure.

The inter array offshore wind cable market is expanding as renewable energy developers prioritize efficient power transmission between offshore wind turbines and substations. Demand is driven by the growth of offshore wind farms in Europe, Asia-Pacific, and North America, focusing on large-scale capacity additions and grid connectivity.

Challenges include high capital costs, complex installation in harsh marine environments, and compliance with stringent regulatory and safety standards. Opportunities exist in high-voltage, durable cables, dynamic and flexible designs, and integration with monitoring technologies for reliability. Trends highlight longer cable lengths, improved corrosion and abrasion resistance, and turnkey installation services.

Developers of offshore wind farms are increasingly adopting advanced inter-array cables to ensure continuous and reliable power transmission between turbines and offshore substations. These cables must endure extreme marine environments, including high hydrostatic pressure, saltwater corrosion, strong currents, and dynamic mechanical loading from waves. As offshore wind capacity rapidly grows in Europe’s North Sea, Asia-Pacific coastal regions, and emerging markets in North America, the reliability of inter array cabling becomes a critical factor for minimizing operational downtime and optimizing energy output.

Key priorities for project developers include electrical performance, mechanical durability, ease of installation, and long-term operational stability. Expanding large-capacity wind farms, coupled with government mandates for renewable energy integration, are driving sustained demand for high-quality, resilient offshore power cables, making them an indispensable component of modern offshore wind infrastructure.

The inter array offshore wind cable market faces significant constraints arising from high manufacturing and installation costs, long lead times, and dependence on specialized raw materials such as high-purity copper, cross-linked polyethylene, and high-performance insulation compounds. Offshore installation presents logistical and technical challenges, including laying cables in deep water, mitigating marine environmental risks, and ensuring structural integrity under continuous loading. Compliance with international and regional regulations for electrical safety, marine protection, and environmental standards adds further complexity. Technical challenges involve maintaining thermal performance under variable load conditions, mechanical stress resistance, fatigue management, and long-term insulation integrity. Buyers increasingly prioritize suppliers with certified cables, proven installation expertise, and lifecycle support to mitigate operational risks, reduce downtime, and meet stringent offshore wind project requirements efficiently.

Opportunities in the inter array cable market are focused on high-voltage and flexible cable solutions capable of handling increased turbine outputs and extended offshore distances. Flexible designs reduce mechanical stress on turbine structures and improve system longevity, while embedded monitoring systems provide real-time diagnostics for cable health, load performance, and early fault detection. Growth of offshore wind capacity across Europe, Asia-Pacific, and North America is accelerating adoption of these advanced cable systems. Developers increasingly seek turnkey solutions encompassing design, manufacturing, installation support, and technical guidance. Suppliers offering customizable, high-performance cables with embedded monitoring capabilities, along with training and maintenance services, are well positioned to capture expanding opportunities across new offshore projects, retrofits, and grid connection expansions globally.

Digital integration, including embedded sensors and predictive maintenance systems, allows operators to monitor cable health in real time, optimize performance, and proactively prevent unplanned outages. Prefabricated and pre-tested cable assemblies, combined with turnkey installation services, reduce marine operational risks and accelerate project timelines. Emphasis on reliability, performance, and ease of installation is driving adoption of advanced cable materials and designs. Suppliers providing application-ready, digitally monitored, high-durability cable solutions are best positioned to meet the growing demands of large-scale offshore wind farm developers, ensuring operational efficiency and long-term energy transmission stability.

| Country | CAGR |

|---|---|

| China | 55.9% |

| India | 51.8% |

| Germany | 47.6% |

| France | 43.5% |

| UK | 39.3% |

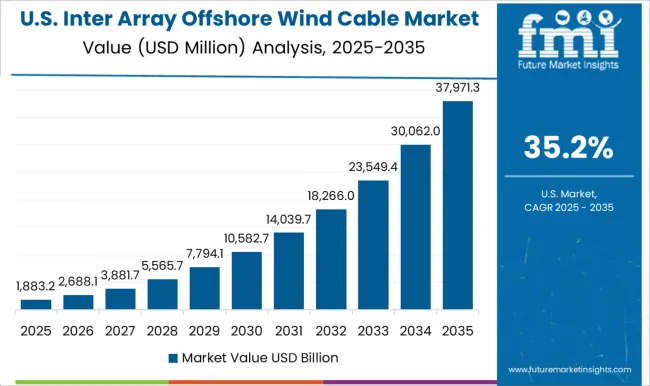

| USA | 35.2% |

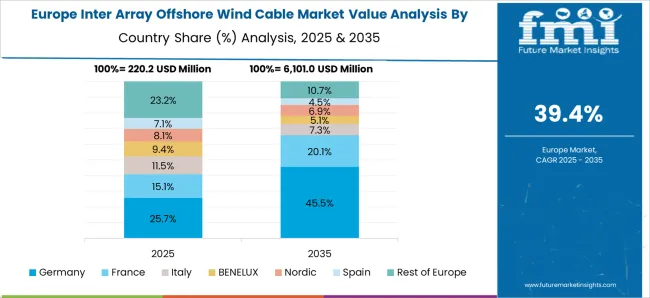

| Brazil | 31.1% |

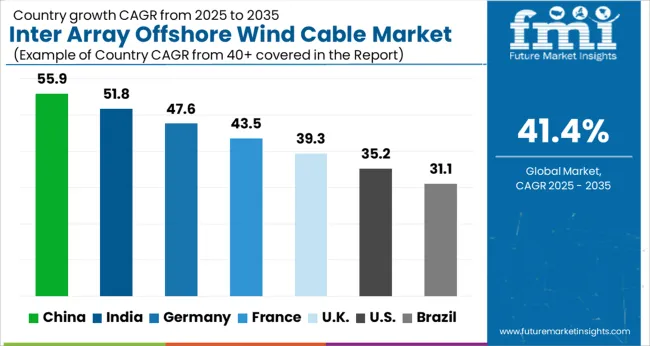

The global inter array offshore wind cable market is projected to grow at a CAGR of 41.4% from 2025 to 2035. China leads at 55.9%, followed by India at 51.8%, France at 43.5%, the UK at 39.3%, and the USA at 35.2%. Rapid offshore wind farm development, government renewable energy targets, and technological advancements in high-voltage, corrosion-resistant cables are key growth drivers. Market expansion is supported by domestic manufacturing, international collaborations, grid modernization, and offshore project pipelines. Rising demand for reliable, high-capacity cables to connect turbines to offshore substations and the onshore grid further accelerates adoption globally. The analysis includes over 40+ countries, with the leading markets detailed below.

The inter array offshore wind cable market in China is projected to grow at a CAGR of 55.9% from 2025 to 2035, driven by rapid expansion of offshore wind farms, government renewable energy targets, and domestic manufacturing capacity. Rising investments in large-scale wind parks along the eastern and southern coasts are increasing demand for high-voltage inter array cables. Domestic manufacturers are integrating advanced insulation, high-capacity conductors, and corrosion-resistant technologies to meet project-specific requirements. Collaboration with international suppliers enables technology transfer and improved reliability. Government incentives for renewable energy infrastructure, combined with the push for grid modernization, support market growth. The focus on high-capacity, durable cables for deep-water installations further enhances adoption.

The inter array offshore wind cable market in India is expected to expand at a CAGR of 51.8% from 2025 to 2035, propelled by government initiatives to increase offshore wind capacity along the Gujarat and Tamil Nadu coasts. Rising renewable energy targets and commitments to reduce carbon intensity are driving demand for high-voltage inter array cables. Domestic manufacturers are upgrading capabilities in cable insulation, conductor performance, and durability for offshore conditions. International partnerships facilitate adoption of proven cable technologies. Investments in grid integration and offshore substations create additional market opportunities. The growing focus on large-scale offshore wind parks, along with industrial incentives for local production, is further supporting the market.

The inter array offshore wind cable market in France is projected to expand at a CAGR of 43.5% from 2025 to 2035, supported by ambitious offshore wind energy plans along the northern and western coasts. French utilities are investing in high-voltage inter array cables for connecting turbines to offshore substations and the onshore grid. Manufacturers focus on robust insulation, corrosion resistance, and high-current capacity to optimize efficiency and lifespan. Strategic partnerships with European and global technology providers enable integration of advanced materials and installation techniques. Regulatory support, combined with rising offshore project pipelines, creates significant growth potential.

The UK market is anticipated to grow at a CAGR of 39.3% from 2025 to 2035, fueled by expansion of offshore wind capacity in the North Sea and Irish Sea. Utilities and project developers are deploying inter array cables to connect turbines with offshore substations and onshore grids. Domestic and international manufacturers focus on high-voltage, insulated, and corrosion-resistant cables to ensure reliability in harsh offshore environments. Government incentives, renewable energy targets, and competitive bidding for offshore wind projects drive demand. Technological collaboration and adoption of best practices for cable installation, monitoring, and maintenance further strengthen the market outlook.

The USA market is expected to rise at a CAGR of 35.2%, driven by enterprise digitization, smart manufacturing, and secure communication requirements. Companies in healthcare, aerospace, logistics, and critical infrastructure are adopting private 5G networks for high-bandwidth, low-latency applications. Telecom providers collaborate with technology firms to offer managed private networks with network slicing, cloud integration, and edge computing capabilities. Enterprise deployments focus on operational efficiency, automation, predictive maintenance, and secure data management. Growing demand from smart campuses, industrial automation, and data-intensive applications ensures continued market expansion.

The inter array offshore wind cable market is driven by rapid offshore wind farm expansion, increasing renewable energy adoption, and the need for reliable power transmission between turbines and offshore substations. High-voltage, medium-voltage, and dynamic inter array cables are increasingly deployed to ensure minimal energy loss, withstand harsh marine environments, and meet long-term operational reliability. Technological improvements in insulation, conductor materials, and corrosion protection enhance system efficiency and service life. Competition is shaped by cable performance, durability, and installation capabilities. Prysmian Group and NEXANS lead with high-capacity, cross-linked polyethylene (XLPE) insulated cables, flexible dynamic designs, and turnkey project support. NKT A/S and ZTT compete through tailored cable solutions with advanced armoring, high-temperature tolerance, and compatibility with automated laying systems. LS Cable & System Ltd., Sumitomo Electric Industries, and FURUKAWA ELECTRIC CO., LTD differentiate via hybrid and lightweight cables designed for deep-water and high-current applications. JDR Cable Systems Ltd., LEONI, Seaway7, and Orient Cable focus on marine-grade solutions with corrosion-resistant sheathing and fatigue-resistant conductors. Smaller suppliers like TFK Group, Hellenic Cables, NSW Technology, and Hydro Group target niche offshore and nearshore projects with cost-efficient and rapid-deployment designs.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Voltage Rating | 11kV-33kV and 34kV-66kV |

| Conductor Material | Aluminum and Copper |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Prysmian Group, NEXANS, NKT A/S, ZTT, LS Cable & System Ltd., Sumitomo Electric Industries, Ltd., FURUKAWA ELECTRIC CO., LTD, TFK Group, Hellenic Cables, NSW Technology, LEONI, JDR Cable Systems Ltd., Seaway7, Orient Cable, and Hydro Group |

| Additional Attributes | Dollar sales by cable type (high-voltage, medium-voltage, low-voltage), insulation type (XLPE, EPR, other), and application (offshore wind farms, inter-array, grid connections). Demand is driven by the global expansion of offshore wind capacity, renewable energy mandates, and technological advances in subsea transmission. Regional trends highlight strong growth in Europe, particularly the North Sea, while Asia-Pacific shows rapid expansion with increasing offshore wind installations in China, Taiwan, and Japan. |

The global inter array offshore wind cable market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the inter array offshore wind cable market is projected to reach USD 37.4 billion by 2035.

The inter array offshore wind cable market is expected to grow at a 41.4% CAGR between 2025 and 2035.

The key product types in inter array offshore wind cable market are 11kv-33kv and 34kv-66kv.

In terms of conductor material, aluminum segment to command 68.7% share in the inter array offshore wind cable market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Intermediate Bulk Container (IBC) Market Forecast and Outlook 2025 to 2035

Interventional Radiology Product Market Size and Share Forecast Outlook 2025 to 2035

Intercity Bus Travel Market Size and Share Forecast Outlook 2025 to 2035

Interventional X - ray Systems Market Size and Share Forecast Outlook 2025 to 2035

Interference Mitigation Filters Market Size and Share Forecast Outlook 2025 to 2035

Interrogation Table Market Size and Share Forecast Outlook 2025 to 2035

Interview Scheduling Software Market Size and Share Forecast Outlook 2025 to 2035

Internet Protocol Television Market Size and Share Forecast Outlook 2025 to 2035

Internet Of Things In Farm Management Market Size and Share Forecast Outlook 2025 to 2035

Internet Security Market Size and Share Forecast Outlook 2025 to 2035

Internet Of Things IoT Monetization Market Size and Share Forecast Outlook 2025 to 2035

Internal Bifold Door Market Size and Share Forecast Outlook 2025 to 2035

Interactive Packaging Market Size and Share Forecast Outlook 2025 to 2035

International Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Interferometric Synthetic Aperture Radar Market Size and Share Forecast Outlook 2025 to 2035

Interceptor Missiles Market Size and Share Forecast Outlook 2025 to 2035

Interventional Radiology Market Growth - Trends & Forecast 2025 to 2035

Internal Olefins Market Size and Share Forecast Outlook 2025 to 2035

Interventional Cardiology Devices Market Size and Share Forecast Outlook 2025 to 2035

International Wholesale Voice Carrier Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA