The Interactive Packaging Market is estimated to be valued at USD 33.5 billion in 2025 and is projected to reach USD 60.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. During the early adoption phase from 2020 to 2024, the market expanded from USD 24.9 billion to USD 31.6 billion, driven by pilot implementations in premium consumer goods and FMCG sectors. Key breakpoints included the introduction of QR codes, NFC tags, and AR/VR integrations that enhanced consumer engagement and brand experience. Early adopters focused on testing technological feasibility and gauging consumer response, laying the foundation for broader commercialization.

From 2025 to 2030, the market entered a scaling phase, growing from USD 33.5 billion to USD 45.1 billion. Breakpoints in this period included wider adoption across mass-market products, cost-effective integration of interactive technologies, and strategic partnerships between packaging providers and technology firms. As the market moved into consolidation between 2030 and 2035, reaching USD 60.6 billion, emphasis shifted to standardization, sustainability, and operational efficiency. Leading players strengthened market share through mergers and acquisitions, while innovative solutions by smaller companies maintained differentiation. These breakpoints illustrate a clear transition from experimental adoption to scalable growth and eventual market consolidation.

| Metric | Value |

|---|---|

| Interactive Packaging Market Estimated Value in (2025 E) | USD 33.5 billion |

| Interactive Packaging Market Forecast Value in (2035 F) | USD 60.6 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

As physical packaging transforms into a digital touchpoint, brands are increasingly adopting interactive technologies to enhance user experience, facilitate traceability, and build loyalty.

The integration of connected technologies such as near-field communication, QR codes, and augmented reality into packaging has enabled dynamic storytelling, instant feedback collection, and gamified promotions. The demand is further supported by the growing penetration of smartphones and digital infrastructure in both developed and emerging economies, making interactive packaging a scalable solution.

Brands are leveraging this channel not only for marketing but also for compliance, authentication, and customer education. In the coming years, increased focus on personalization, sustainability messaging, and direct-to-consumer data collection is expected to sustain the upward trajectory of interactive packaging adoption across industries, aiming for a tech-enabled consumer interface.

The interactive packaging market is segmented by type, technology, packaging type, end-use industry, and geographic regions. By type, interactive packaging market is divided into Promotional packaging, Informational packaging, and Educational packaging. In terms of technology, interactive packaging market is classified into QR code, Barcode, RFID/NFC, Augmented reality (AR), and Others.

Based on packaging type, interactive packaging market is segmented into Flexible packaging and Rigid packaging. By end-use industry, interactive packaging market is segmented into Food & beverages, Personal care & cosmetics, Healthcare, Electronics, Automotive, and Others. Regionally, the interactive packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Promotional packaging is projected to contribute 44.6% of the overall revenue in the interactive packaging market in 2025, making it the leading type segment. Its dominance is being shaped by growing investments in experiential marketing and the demand for differentiated shelf appeal in competitive retail environments.

The ability of promotional packaging to drive limited-time offers, loyalty programs, and seasonal campaigns has made it a preferred tool for brand engagement. Integration of scannable content and gamified experiences within the packaging surface has enabled companies to generate higher consumer interaction without altering distribution logistics.

The segment has further gained momentum through the adoption of smart labeling and embedded digital content, which enhances brand recall and customer conversion. As brand visibility becomes increasingly dependent on personalized outreach and immersive communication, promotional packaging has emerged as an effective channel to trigger impulse buying and build an emotional connection with consumers across both online and offline platforms.

QR code technology is anticipated to represent 39.2% of the interactive packaging market's revenue share in 2025, positioning it as the most dominant technological enabler in this domain. This prominence is attributed to the widespread compatibility of QR codes with smartphones and their ability to deliver real-time, contextual content. QR codes are being used extensively for directing consumers to product origin stories, authenticity verification, digital coupons, instructional videos, and feedback forms.

Their low cost, ease of deployment, and dynamic configurability without hardware alterations have enabled mass adoption across brands regardless of scale. The technology supports multi-lingual and geo-targeted content, enhancing personalization at the point of sale.

Furthermore, its growing application in post-sale engagement, such as refill reminders and cross-selling strategies, has strengthened its role in consumer retention. As data-driven marketing and contactless engagement models continue to evolve, QR code-based interactive packaging is expected to maintain its relevance and expand into more nuanced customer journeys.

Flexible packaging is expected to capture 53.7% of the interactive packaging market’s total revenue share in 2025, establishing itself as the most utilized packaging format. Its lead is reinforced by advantages in material efficiency, lightweight structure, and adaptability to various shapes and printing technologies. The segment’s growth has been supported by the increasing integration of smart features into pouches, sachets, and wraps that serve as primary containers in food, personal care, and healthcare products.

Flexible packaging formats allow greater design flexibility for embedding scannable graphics, conductive inks, and dynamic messaging without compromising product integrity. Enhanced barrier properties combined with digital engagement tools have made this format ideal for both single-use and resealable applications.

In addition, the segment benefits from sustainability trends, as recyclable and bio-based flexible materials are increasingly used in tandem with interactive functionalities. With growing emphasis on portable, smart, and eco-conscious packaging, flexible formats are expected to remain the preferred choice for interactive engagement across consumer goods categories.

The interactive packaging market is growing rapidly as brands seek innovative ways to engage consumers and enhance the unboxing experience. Technologies like QR codes, NFC chips, AR/VR integration, and smart sensors allow consumers to access digital content, track products, and verify authenticity. Rising e-commerce sales, brand differentiation strategies, and anti-counterfeiting requirements drive adoption. North America and Europe lead due to advanced digital infrastructure, while Asia-Pacific is expanding with rising smartphone penetration and retail modernization. Companies focus on combining sustainability with interactive technology to capture consumer attention and loyalty.

Interactive packaging transforms traditional packaging into a platform for brand-consumer interaction. QR codes, NFC tags, and augmented reality experiences allow consumers to access promotional content, product instructions, or loyalty programs. This enhances engagement, brand recall, and customer satisfaction. Companies integrating gamification, social media sharing, and personalized experiences can increase repeat purchases and strengthen brand loyalty. The challenge lies in creating seamless, user-friendly interfaces while maintaining packaging functionality and aesthetics. Until standardized technologies are widely adopted, consumer education and technological reliability remain critical for market success.

Interactive packaging plays a vital role in combating counterfeit goods, particularly in pharmaceuticals, luxury goods, and consumer electronics. Embedded NFC tags, RFID chips, and blockchain-enabled QR codes provide secure product verification for consumers and supply chain stakeholders. These solutions help trace product origin, prevent fraud, and protect brand reputation. The increasing prevalence of counterfeit products globally is pushing manufacturers to invest in secure, tamper-proof interactive packaging. Until integration costs decrease and adoption becomes widespread, anti-counterfeiting features will remain a key differentiator for premium and high-value products.

Eco-efficiency is becoming a core focus alongside interactivity in packaging. Companies are developing recyclable, biodegradable, and compostable materials that support embedded technologies such as printed electronics or smart sensors. Challenges include ensuring the durability and functionality of electronic components while maintaining eco-friendly standards. Advanced inks, conductive adhesives, and low-energy NFC chips are enabling environmentally responsible interactive packaging. Brands combining sustainability with interactive technology can appeal to eco-conscious consumers and align with global green initiatives. Until cost-effective, scalable solutions emerge, balancing interactivity and sustainability remains a critical market consideration.

The surge in e-commerce and direct-to-consumer sales is driving the adoption of interactive packaging. With limited physical store interaction, brands use packaging to engage consumers digitally, provide product information, and create memorable unboxing experiences. Interactive packaging enhances the online retail experience by linking physical products to apps, websites, or loyalty programs. Retailers also benefit from real-time data collection, tracking consumer behavior, and inventory management. Companies investing in scalable, easy-to-implement interactive solutions gain a competitive edge in the rapidly expanding e-commerce sector. Until interactive packaging becomes standard across product categories, adoption will be influenced by cost, ease of integration, and measurable consumer engagement.

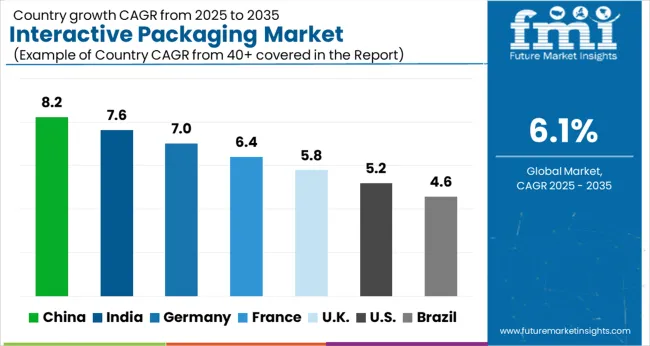

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The global Interactive Packaging Market is projected to grow at a CAGR of 6.1% through 2035, supported by increasing demand across food, beverage, and consumer goods applications. Among BRICS nations, China has been recorded with 8.2% growth, driven by large-scale production and deployment in retail and packaging solutions, while India has been observed at 7.6%, supported by rising utilization in consumer product and promotional packaging. In the OECD region, Germany has been measured at 7.0%, where production and adoption for interactive and consumer-oriented packaging have been steadily maintained. The United Kingdom has been noted at 5.8%, reflecting consistent use in product labeling and packaging applications, while the USA has been recorded at 5.2%, with production and utilization across food, beverage, and consumer goods sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The interactive packaging market in China is growing at a CAGR of 8.2%, fueled by increasing demand for engaging, smart, and connected packaging solutions in food, beverage, pharmaceutical, and consumer goods sectors. Brands are adopting interactive technologies such as QR codes, NFC tags, augmented reality, and smart labels to enhance consumer engagement and brand loyalty. Chinese manufacturers focus on innovative materials, cost-effective production, and scalable solutions to meet domestic and international demand. Rising e-commerce, retail modernization, and the shift toward premium and personalized packaging drive market expansion. Government initiatives encouraging digital adoption and advanced manufacturing also support growth. Interactive packaging improves consumer experience, product tracking, and anti-counterfeit measures, increasing its appeal across industries. The market is further strengthened by collaborations between packaging technology providers and brands to integrate advanced digital features into traditional packaging formats.

The interactive packaging market in India is expanding at a CAGR of 7.6%, driven by the increasing adoption of smart labels, QR codes, and augmented reality features in food, beverages, and personal care products. Rising e-commerce and organized retail sectors push brands to innovate with packaging that enhances consumer experience and brand interaction. Indian manufacturers are focusing on cost-efficient, scalable solutions to meet domestic demand. Anti-counterfeit and product traceability solutions also boost adoption in the pharmaceuticals and FMCG sectors. Government policies encouraging digital technologies and quality standards further support market growth. Interactive packaging provides opportunities for personalized marketing campaigns, product authentication, and real-time consumer engagement. The convergence of innovative packaging technologies and the need for improved consumer experiences ensures steady market growth in India.

The interactive packaging market in Germany is growing at a CAGR of 7.0%, driven by increasing demand for smart and connected packaging in food, pharmaceuticals, and premium consumer goods. German manufacturers focus on high-quality, sustainable, and innovative packaging solutions integrating QR codes, NFC, and augmented reality to engage consumers and enhance brand value. Anti-counterfeit technologies and traceability solutions are highly valued in pharmaceutical and high-value product segments. Digitalization in retail and increasing e-commerce penetration also support market growth. Collaboration between packaging technology providers and brands ensures seamless integration of interactive features. The emphasis on consumer experience, regulatory compliance, and sustainability drives consistent demand for interactive packaging solutions. Germany’s mature packaging industry and strong technological base support continuous innovation in interactive packaging products.

The interactive packaging market in the United Kingdom is expanding at a CAGR of 5.8%, supported by the growing use of smart labels, QR codes, and augmented reality in FMCG, pharmaceuticals, and luxury products. Retailers and brands are focusing on packaging that improves consumer engagement, ensures traceability, and strengthens brand loyalty. Technological advancements in digital printing and IoT-enabled packaging solutions are facilitating interactive features. The e-commerce boom and evolving consumer expectations encourage adoption of personalized and feature-rich packaging. Government initiatives promoting digitalization and safety compliance in packaging further support market expansion. Integration of interactive packaging with marketing campaigns and supply chain management provides additional growth opportunities across industries.

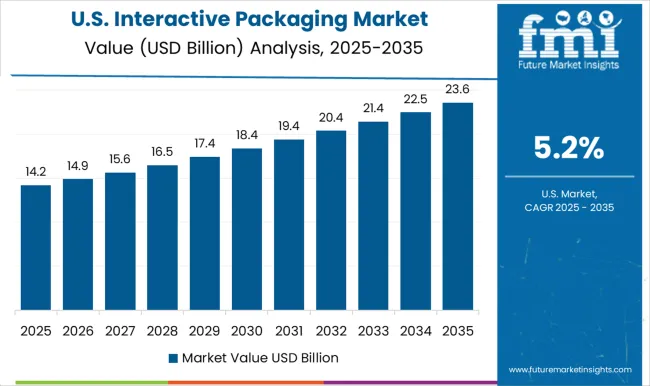

The interactive packaging market in the United States is growing at a CAGR of 5.2%, driven by demand for engaging, connected, and secure packaging across food, beverage, pharmaceutical, and consumer goods industries. Brands are leveraging QR codes, NFC tags, augmented reality, and smart labels to enhance consumer experience and promote loyalty. Retailers adopt interactive packaging to improve product traceability, prevent counterfeiting, and deliver personalized marketing campaigns. Advancements in digital printing, IoT, and packaging materials support innovation in interactive features. Rising e-commerce, premium product launches, and consumer preference for convenience and engagement further fuel market growth. Collaborations between technology providers and brands ensure seamless integration of interactive packaging across supply chains. Continuous innovation in design, functionality, and digital integration ensures a positive growth trajectory for interactive packaging in the USA.

The interactive packaging market is evolving rapidly as brands seek innovative ways to engage consumers, enhance product experiences, and provide smart, connected solutions. Interactive packaging integrates technologies such as QR codes, NFC chips, AR/VR experiences, and smart labels into traditional packaging, offering enhanced consumer engagement, product information, and traceability.

Key players in this market include Amcor, a global leader in flexible and rigid packaging solutions, known for integrating digital features and sustainable designs. Tetra Pak provides innovative liquid food packaging with interactive elements for consumer engagement and brand storytelling. WestRock and Graphic Packaging International deliver carton and paper-based packaging solutions incorporating smart labels and interactive features to improve brand visibility.

Ball Corporation and Crown Holdings focus on metal packaging with embedded digital technologies for beverage and food products. Constantia Flexibles and Multi-Color Corporation provide flexible packaging and labeling solutions that integrate augmented reality and QR code functionalities. Asteria Group and Toppan specialize in high-quality printing and smart packaging technologies that enhance consumer experiences.

Emerging players like Netpak, Nuprint, Gopsons, and Polymerall offer niche solutions in interactive and sustainable packaging, targeting small and medium-sized brands looking to leverage technology for marketing and engagement. The market growth is driven by increasing demand for personalized packaging, rising smartphone penetration, and the need for traceability in the food, beverage, healthcare, and luxury goods sectors. Innovations in smart labels, augmented reality, and IoT-enabled packaging are expected to further expand market adoption, making interactive packaging a cornerstone of modern branding strategies.

| Item | Value |

|---|---|

| Quantitative Units | USD 33.5 Billion |

| Type | Promotional packaging, Informational packaging, and Educational packaging |

| Technology | QR code, Barcode, RFID/NFC, Augmented reality (AR), and Others |

| Packaging Type | Flexible packaging and Rigid packaging |

| End-Use Industry | Food & beverages, Personal care & cosmetics, Healthcare, Electronics, Automotive, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, TetraPak, WestRock, GraphicPackagingInternational, Ball, ConstantiaFlexibles, Crown, Multi-Color, AsteriaGroup, Toppan, Netpak, Nuprint, Gopsons, and Polymerall |

| Additional Attributes | Dollar sales vary by packaging type, including smart labels, QR codes, NFC-enabled packaging, and augmented reality packaging; by application, such as food & beverages, pharmaceuticals, personal care, and electronics; by technology, spanning IoT-enabled, printed electronics, and mobile app-integrated solutions; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for consumer engagement, brand differentiation, and smart packaging adoption. |

The global interactive packaging market is estimated to be valued at USD 33.5 billion in 2025.

The market size for the interactive packaging market is projected to reach USD 60.6 billion by 2035.

The interactive packaging market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in interactive packaging market are promotional packaging, informational packaging and educational packaging.

In terms of technology, qr code segment to command 39.2% share in the interactive packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Interactive Tables Market Size and Share Forecast Outlook 2025 to 2035

Interactive Projector Market Report - Trends & Forecast 2025 to 2035

Interactive Whiteboard Market – Trends & Forecast through 2034

Interactive Wound Dressing Market Insights – Growth & Forecast 2024-2034

Smart and Interactive Textiles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Trends and Growth 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA