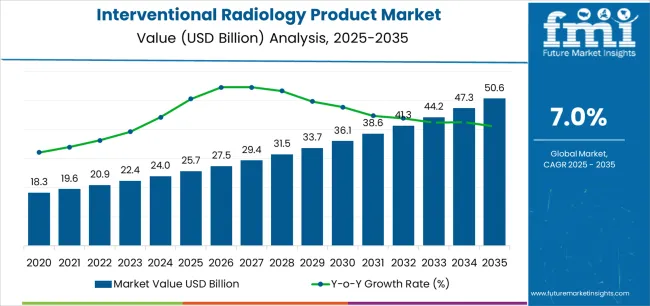

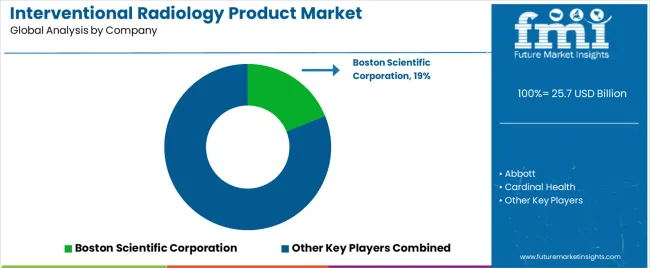

The Interventional Radiology Product Market is estimated to be valued at USD 25.7 billion in 2025 and is projected to reach USD 50.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

The interventional radiology product market is experiencing steady expansion. Increasing demand for minimally invasive procedures, technological advancements in imaging modalities, and rising prevalence of chronic diseases are driving market growth. Current market dynamics are defined by the growing adoption of image-guided treatments that offer reduced recovery times, lower procedural risks, and improved patient outcomes.

Manufacturers are investing in advanced materials, precision engineering, and digital integration to enhance device performance and clinical efficiency. The future outlook is supported by expanding healthcare infrastructure, higher diagnostic accuracy, and greater procedural accessibility in both developed and emerging regions. Regulatory approvals for next-generation interventional systems are further accelerating commercialization and global adoption.

The growth rationale is built upon the rising shift toward outpatient and day-care procedures, improved reimbursement scenarios, and strategic collaborations between device manufacturers and healthcare providers These factors collectively position the market for sustained expansion and increased technological integration across clinical specialties.

| Metric | Value |

|---|---|

| Interventional Radiology Product Market Estimated Value in (2025 E) | USD 25.7 billion |

| Interventional Radiology Product Market Forecast Value in (2035 F) | USD 50.6 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

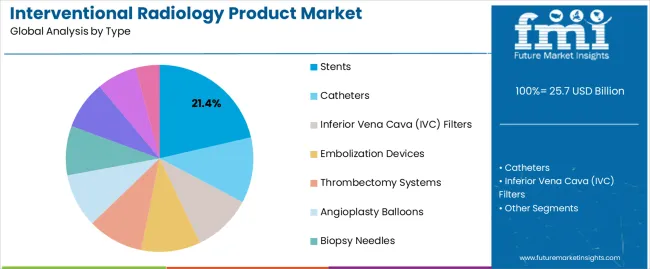

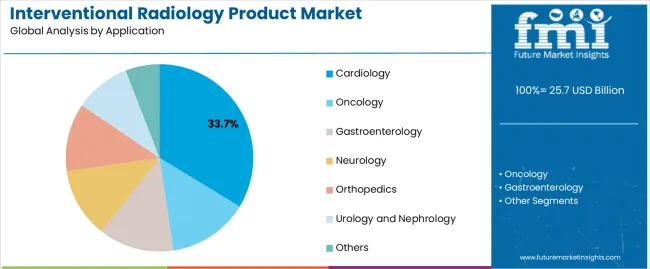

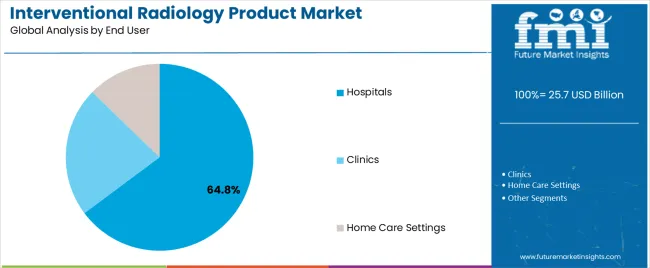

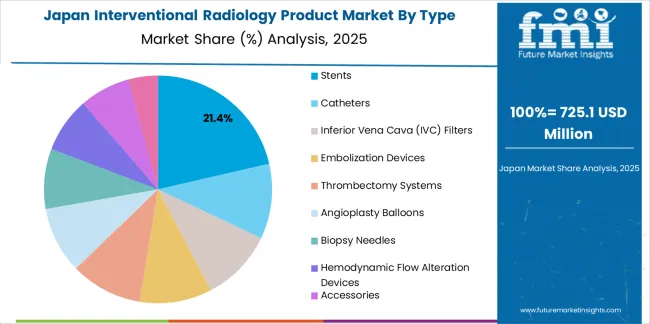

The market is segmented by Type, Application, and End User and region. By Type, the market is divided into Stents, Catheters, Inferior Vena Cava (IVC) Filters, Embolization Devices, Thrombectomy Systems, Angioplasty Balloons, Biopsy Needles, Hemodynamic Flow Alteration Devices, Accessories, and Other. In terms of Application, the market is classified into Cardiology, Oncology, Gastroenterology, Neurology, Orthopedics, Urology and Nephrology, and Others. Based on End User, the market is segmented into Hospitals, Clinics, and Home Care Settings. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stents segment, accounting for 21.40% of the type category, has been leading the market due to its critical role in restoring vessel patency and enabling minimally invasive interventions. Demand has been driven by the growing incidence of cardiovascular and peripheral artery diseases. Advancements in stent materials, including bioresorbable and drug-eluting variants, have enhanced clinical outcomes and reduced post-procedural complications.

The segment’s prominence is supported by continuous innovation focused on flexibility, durability, and biocompatibility. Widespread use in both vascular and non-vascular procedures has reinforced market stability.

Increased availability across healthcare facilities and consistent regulatory support for new product launches are sustaining growth momentum The ongoing trend toward personalized treatment and precision-guided interventions is expected to further strengthen the stents segment’s share over the forecast period.

The cardiology segment, representing 33.70% of the application category, has maintained its leadership position owing to the high prevalence of cardiovascular disorders and the growing preference for minimally invasive cardiac procedures. Rising patient awareness and advancements in real-time imaging technologies have enhanced diagnostic accuracy and therapeutic outcomes.

Integration of interventional radiology in cardiac care has reduced surgical risks and improved recovery timelines, driving procedural volume across hospitals and specialty clinics. Strong research focus on catheter-based therapies and image-guided stent placements has accelerated adoption in both developed and emerging markets.

Favorable reimbursement policies and supportive clinical guidelines have ensured consistent utilization of interventional products in cardiology Continued technological innovation, combined with clinical efficacy and safety improvements, is expected to sustain the segment’s dominant role throughout the forecast period.

The hospitals segment, holding 64.80% of the end-user category, has been dominating the market due to the concentration of advanced imaging infrastructure and availability of skilled interventional specialists. Hospitals remain primary centers for complex procedures, supported by integrated diagnostic and therapeutic facilities.

High patient inflow, efficient equipment maintenance, and superior post-operative care have reinforced their preference among patients and healthcare providers. Increasing hospital investments in hybrid operating rooms and image-guided surgical suites have further strengthened procedural efficiency.

The segment’s stronghold is also attributed to collaborations between hospitals and medical device companies aimed at continuous technology upgrades Expansion of multispecialty hospital networks in emerging economies and rising government healthcare spending are expected to sustain dominance and enhance overall procedural capacity within this category.

The interventional radiology product market accounted for a 9% CAGR from 2020 to 2025. A growing focus on improving medical facilities may result in growth in the interventional radiology market in emerging markets. Equipment and product used in interventional radiology may be in higher demand.

Regulatory and healthcare policy changes can have an impact on the market. Stringent regulatory approvals can slow the introduction of new product, while manufacturers can gain an advantage by implementing favorable regulations.

The prevalence of chronic diseases, such as cardiovascular diseases and cancer, often drives the demand for interventional radiology procedures and related product. These conditions will become more common with an aging population, contributing to market growth. A CAGR of 7.4 % is forecast between 2025 and 2035.

| Historical CAGR from 2020 to 2025 | 9% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 7.4% |

The section analyzes the interventional radiology product market across key countries, including the United States, United Kingdom, China, Japan, and South Korea. The analysis delves into the specific factors driving the demand for interventional radiology product in these countries.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 7.7% |

| The United Kingdom | 6% |

| China | 8.3% |

| Japan | 6.6% |

| South Korea | 5% |

The United States is expected to expand at a CAGR of 7.7% between 2025 and 2035. Continuous technological advancements drive the demand for interventional radiology product in the United States. Interventional radiology product manufacturers in the United States are quickly adopting new and innovative technologies to improve patient outcomes.

The United States is one of the countries with the highest healthcare expenditures in the world. Due to their financial strength, healthcare facilities can invest in the latest interventional radiology equipment and procedures. In the United States, interventional radiology products are in high demand because chronic conditions like cardiovascular disease and cancer are prevalent. Regulatory environments strictly enforces safety and efficacy standards, widening sales prospects.

This section illustrates the market's leading segment. the stent segment is expected to exhibit a CAGR of 7.2% in 2025. Cardiology is expected to experience a CAGR of 6.9% from 2025 to 2035.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Stent | 7.2% |

| Cardiology | 6.9% |

Stents have gained considerable market share as the incidence of heart disease and cancer is on the rise. In addition, the number of angioplasty procedures performed worldwide continues to grow. A CAGR of 7.2% is expected for the stent market from 2025 to 2035.

Increasing patient outcomes and reducing complications also contribute to the demand for stents, as bioresorbable and drug-eluting devices are being developed. Due to the growing popularity of minimally invasive procedures that reduce patient trauma and recovery time, the demand for stents is on the rise.

With the growing geriatric population and the increasing prevalence of cardiovascular diseases (CVD), interventional cardiology devices are in demand. Technological advances have LED to significant advances in cardiology, including robotic surgical techniques and advanced imaging. Improvements in diagnostic accuracy and treatment precision aim to improve patient outcomes.

Cardiology is increasingly focused on personalized medicine. Personalized treatment plans are tailored for each individual based on genetic characteristics, lifestyle factors, and medical histories. Optimizing treatment effectiveness and minimizing side effects are the goals of personalized medicine. A CAGR of 6.9% is projected for the market during the forecast period.

Integrated healthcare technologies and telemedicine are gaining traction in cardiology. Using these technologies, cardiovascular health can be monitored remotely, teleconsulted, and managed using mobile applications. Early detection of cardiac conditions can be facilitated, and access to care can be improved.

Partnerships and collaborations between market players, research organizations, and healthcare organizations are common. Through these collaborations, knowledge is shared, technology is transferred, and new product are developed together. Innovation can be accelerated, and interventional radiology demand can be driven by leveraging collective expertise and resources.

Key Market Developments

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 23.9 billion |

| Projected Market Valuation in 2035 | USD 48.8 billion |

| Value-based CAGR 2025 to 2035 | 7.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Type, Application, End User, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Boston Scientific Corporation; Abbott; Cardinal Health; Cook; Stryker; Braun Melsungen AG; Terumo Corporation; General Electric; Koninklijke Philips N.V.; Carestream Health; ESAOTE SPA; Hitachi. Ltd.; Hologic, Inc.; Shimadzu Corporation; Siemens Healthcare GmbH |

The global interventional radiology product market is estimated to be valued at USD 25.7 billion in 2025.

The market size for the interventional radiology product market is projected to reach USD 50.6 billion by 2035.

The interventional radiology product market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in interventional radiology product market are stents, catheters, inferior vena cava (ivc) filters, embolization devices, thrombectomy systems, angioplasty balloons, biopsy needles, hemodynamic flow alteration devices, accessories and other.

In terms of application, cardiology segment to command 33.7% share in the interventional radiology product market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Interventional Radiology Market Growth - Trends & Forecast 2025 to 2035

Nonvascular Interventional Radiology Device Market Trends – Growth & Forecast 2024-2034

Product Tour Software for SaaS Market Size and Share Forecast Outlook 2025 to 2035

Interventional X - ray Systems Market Size and Share Forecast Outlook 2025 to 2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Product Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Production Logistics Market Size and Share Forecast Outlook 2025 to 2035

Interventional Cardiology Devices Market Size and Share Forecast Outlook 2025 to 2035

Radiology Information System RIS Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

Product Design Verification And Validation Solution Market Size and Share Forecast Outlook 2025 to 2035

Production Printer Market - Growth, Demand & Forecast 2025 to 2035

Product Information Management Market Growth – Trends & Forecast 2024-2034

Product Dispensing Machinery Market

Product Cost Management Market

AI Radiology Tool Market Insights – Growth, Demand & Forecast 2024-2034

Teleradiology Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

CBD Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA