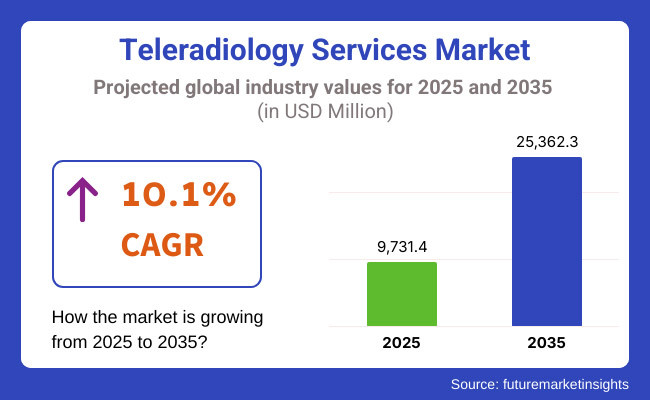

The global market for teleradiology services is forecasted to attain USD 9,731.4 million by 2025, expanding at 10.1% CAGR to reach USD 25,362.3 million by 2035. In 2024, the revenue of teleradiology Services was around USD 8,894.3 million

The greater demand for AI-centered radiology interpretation as well as the increasing number of patients who need frequent imaging for their chronic diseases are the main engines of the market. Furthermore, the advent of cloud-based imaging platforms along with the improvement in PACS (Picture Archiving and Communication Systems), and the increasing the investment in remote diagnostic solutions have the market sailing smoothly.

Nevertheless, issues like the security of data, conformity to rigorous regulations, and the big expenses on teleradiology infrastructure implementation are the ones that may interfere with the market growth. Additionally, very soon enough the use of AI-assisted radiology reporting and the expansion of real-time remote collaboration between the radiologists will also become important to the industry.

Advancements in teleradiology technologies, including improved image processing software, AI-driven diagnostic tools, and cloud-based data management systems, are driving rapid evolution in the market. Emerging innovations such as secure telecommunication platforms, advanced imaging analytics, and enhanced data encryption features are being increasingly explored to improve diagnostic accuracy, workflow efficiency, and patient outcomes.

The North American teleradiology service market is expanding due to high adoption of telehealth solutions, increasing prevalence of chronic diseases requiring imaging, and strong presence of leading medical imaging companies. The USA leads the region, supported by rising demand for AI-assisted radiology diagnostics, growing use of cloud-based PACS systems, and increasing FDA approvals for innovative tele-imaging solutions.

However, challenges such as stringent HIPAA compliance regulations, cybersecurity risks, and reimbursement limitations impact market growth. The increasing integration of AI-driven radiology analytics, expansion of cross-border radiology consultation services, and rising collaborations between hospitals and teleradiology service providers are expected to drive further market growth in North America.

Europe represents a significant market for teleradiology services, driven by increasing healthcare investments in digital diagnostics, growing adoption of AI-assisted imaging interpretation, and strong regulatory frameworks supporting telemedicine expansion.

Countries such as Germany, France, and the UK are key markets, benefiting from well-established radiology networks, increasing demand for 24/7 remote reporting services, and rising government initiatives to improve diagnostic efficiency. However, challenges such as strict general data protection regulation on medical data privacy, high costs of cloud-based imaging infrastructure, and slow adoption of AI-driven teleradiology in public healthcare settings may impact market expansion.

The increasing focus on AI-powered radiology workflow automation, expansion of real-time image-sharing solutions, and rising partnerships between digital health startups and hospital networks are shaping the European market landscape. Additionally, advancements in blockchain based imaging data security and expansion of cross-border radiology reporting are improving diagnostic efficiency and data protection.

The Asia-Pacific region is witnessing rapid growth in the teleradiology service market due to increasing healthcare digitalization, rising prevalence of chronic diseases, and growing demand for cost-effective remote diagnostic solutions. Countries such as China, Japan, and India are key markets, with expanding access to cloud-based imaging platforms, increasing government funding for telemedicine adoption, and rising demand for AI-enhanced radiology services.

However, challenges such as affordability constraints, lack of standardized data-sharing protocols, and slower regulatory approvals for AI-driven imaging solutions may hinder market penetration.

The increasing presence of global medical imaging firms, expansion of cross-border teleradiology networks, and integration of real-time AI-assisted diagnostic support are driving market expansion. Furthermore, advancements in powered imaging transmission and increasing research into federated learning models for secure data-sharing are improving efficiency and accessibility in the region.

Challenges

Key Challenges in Radiology Services to Meet Regulation Standard

The teleradiology service market faces challenges such as stringent data privacy regulations, high costs of implementing cloud-based imaging systems, and interoperability issues between different PACS and RIS (Radiology Information Systems) platforms.

The need for improved cybersecurity measures in remote diagnostics, challenges in ensuring seamless integration of AI-powered radiology tools, and disparities in reimbursement policies for tele-imaging services create barriers to market expansion. Additionally, challenges in addressing radiologist licensing issues across international borders, high costs associated with implementing AI-assisted reporting solutions, and resistance to transitioning from traditional in-hospital radiology to remote teleradiology impact market growth.

Opportunities

Advancements and Innovations Driving Growth in the Radiology Services Market

Growing use of advanced radiology interpretation, growth of cloud-based imaging diagnostic platforms, and growth investment in real-time teleconsultation solutions are high-growth opportunities in the market. Blockchain-based imaging security solutions development, growing interest in incorporating AI-supported diagnostic decision support, and growth of teleradiology services in rural regions are driving market growth.

Also, more research into deep-learning-based imaging analysis, growth of hybrid radiology models integrating AI and human professionals, and increasing partnerships between hospital chains and technology companies for remote diagnostics optimization are likely to open new opportunities for industry growth.

Moreover, the advancement of high speed internet, supported high-speed image transmission and rising consumer demand for real-time remote diagnostic consultations are further increasing accessibility and long-term market potential.

Emerging Trends

The increasing use of AI-driven imaging analytics and cloud-integrated PACS platforms is improving diagnostic efficiency, optimizing radiology workflows, and enhancing cross-border diagnostic collaboration. Moreover, the rising demand for real-time, high-resolution imaging transmission is driving innovation in 5G-enabled remote diagnostics, improving accessibility, and enabling real-time AI-assisted image analysis.

Between 2020 and 2024, the teleradiology service market experienced significant growth, driven by the increasing demand for remote diagnostic services, advancements in telecommunication technologies, and the global adoption of telemedicine, especially during the COVID-19 pandemic.

The market size was valued at approximately USD 12 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 19.7% from 2024 to 2032. Factors such as the shortage of radiologists, the need for rapid diagnosis, and the integration of artificial intelligence (AI) in imaging processes have further propelled market expansion.

Looking forward to 2025 to 2035, the market for teleradiology services is expected to continue growing and the growth is expected to be fuelled by advancements in technology bringing more efficient and user-friendly diagnostic solutions, growing applications in healthcare facilities, and increasing focus on patient-centric care. Moreover, the use of AI and machine learning in diagnosis is expected to improve the efficiency and accuracy of teleradiology services and further fuel market growth

Shifts in the Teleradiology Services Market from 2020 to 2024 and Future Trends 2025 to 2035

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Implementation of guidelines ensuring the safety and efficacy of teleradiology services, leading to standardized protocols and usage regulations. |

| Technological Advancements | Integration of telecommunication technologies with radiology services, enabling remote diagnostics and consultations. |

| Consumer Demand | Increased awareness and acceptance of teleradiology services, leading to higher demand in various healthcare settings, particularly for remote and underserved regions. |

| Market Growth Drivers | Rising prevalence of chronic diseases, advancements in telecommunication technologies, and a shift towards cost-effective and efficient diagnostic solutions. |

| Sustainability | Initial efforts towards eco-friendly practices in teleradiology services, focusing on reducing environmental impact through digitalization and efficient data management. |

| Supply Chain Dynamics | Dependence on reliable telecommunication infrastructure and data management systems, with efforts to enhance cybersecurity measures to protect patient data. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Continuous monitoring and potential adjustments of regulations to balance patient safety with technological innovation, alongside stricter quality assessments to ensure service effectiveness. |

| Technological Advancements | Development of next-generation teleradiology systems with improved interoperability, user-friendly interfaces, and integration with AI for personalized diagnostic solutions. |

| Consumer Demand | Growing preference for integrated teleradiology systems and patient-centered care, driven by improved service technologies and a focus on patient safety and operational efficiency. |

| Market Growth Drivers | Expansion of healthcare infrastructure in emerging markets, increasing healthcare expenditures, and continuous technological innovations enhancing diagnostic efficiency and patient outcomes. |

| Sustainability | Adoption of sustainable practices in service delivery and data management, including the use of energy-efficient data centers and electronic health records, in line with global environmental standards. |

| Supply Chain Dynamics | Strengthening of telecommunication networks and data management capabilities through technological advancements and strategic partnerships, leading to improved service reliability and data security. |

Market Outlook

The United States teleradiology service market is undergoing terrific growth, propelled by advances in digital imaging technologies, rising demand for remote diagnosis, and a shortage of radiologists.

Strong basic health care infrastructure in the United States and a good deal of telehealth applications helped drive the extension of teleradiology services. Moreover, there are regulatory supports and reimbursement policies in place that make these remote diagnosis services all the more accessible to hospitals and clinics.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 11.3% |

Market Outlook

The teleradiology service market in the United Kingdom is moving at a faster pace due to the initiative of the NHS to solve the short supply of radiologists and to increase efficiency in the diagnosis. Increasing caseloads at healthcare facilities and the need for faster reporting turnaround in hospitals and diagnostic facilities is compelling them to adopt teleradiology services. Supportive to market growth is the strong regulatory framework of the UK and its established data security policies.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.1% |

Market Outlook

India's teleradiology service market is experiencing a growth surge, fueled by the increasing burden of chronic illness, growth of healthcare facilities in rural locations, and the expanding use of digital healthcare solutions. Teleradiology is also becoming an essential solution to combat the shortage of radiologists in the country, especially in distant areas. In addition, India's affordable medical services provide the country with the potential to be a desirable site for foreign outsourcing of radiology reporting

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 10.7% |

Market Outlook

Germany’s teleradiology market is evolving steadily, supported by the country’s advanced healthcare infrastructure, strict medical regulations, and increasing reliance on digital health solutions. The high demand for round-the-clock diagnostic services and the need for efficient radiology workflows are pushing hospitals and diagnostic centers to adopt teleradiology solutions. Additionally, Germany’s leadership in AI-powered diagnostics is accelerating the transformation of the radiology sector.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 10.5% |

Market Outlook

China’s teleradiology service market is expanding rapidly due to its large population, increasing healthcare digitalization, and government support for telemedicine initiatives. The country is witnessing a surge in demand for remote radiology services, particularly in underserved rural areas. Additionally, China’s strong investments in AI and machine learning for medical imaging are revolutionizing the teleradiology landscape.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 9.8% |

X-ray Scan

X-ray teleradiology is one of the most widely adopted remote imaging services, providing fast and cost-effective diagnostic solutions for emergency care, trauma cases, and routine screenings. The growing need for remote radiology interpretations, coupled with the increasing adoption of digital X-ray systems and expanding telemedicine networks, is driving market growth.

North America and Europe dominate X-ray teleradiology adoption due to their advanced healthcare IT infrastructure and well-established telehealth frameworks. Meanwhile, the Asia-Pacific region is experiencing significant growth, driven by the digitization of radiology services and rising demand for remote diagnostics, particularly in rural areas. Emerging trends include AI-powered X-ray interpretation, enhanced data security measures, and real-time cloud-based reporting to improve diagnostic efficiency.

Computed Tomography (CT) Teleradiology: The Growing Need to Diagnose Chronic Diseases

CT teleradiology is gaining traction in critical care diagnostics, oncology screenings, and neurological assessments, providing high-resolution imaging for accurate remote diagnosis. The increasing incidence of stroke, cancer, and cardiovascular diseases, coupled with a shortage of on-site radiologists, is driving demand for remote CT scan reporting services.

North America and Europe dominate in CT teleradiology adoption due to strong reimbursement policies and high imaging volumes, while Asia-Pacific is experiencing rising demand due to expanding telehealth initiatives and cross-border radiology collaborations. Future innovations include AI-powered automated CT scan analysis, cloud-integrated 3D imaging platforms, and remote-controlled scanning technologies.

Hospitals & Diagnostic Imaging Centers: The preferred once due to convenience

Hospitals and diagnostic imaging centers are the largest users of teleradiology services, utilizing them for real-time radiology interpretations, second opinions, and after-hours reporting. These facilities benefit from enhanced operational efficiency, reduced turnaround times, and improved access to subspecialty radiologists. The growing demand for 24/7 radiology services, increasing hospital investments in telehealth infrastructure, and rising need for rapid diagnostic reporting are fueling market expansion.

North America and Europe lead in hospital-based teleradiology adoption due to well-established telehealth reimbursement policies, while Asia-Pacific is witnessing rapid growth due to rising healthcare accessibility and increasing radiology outsourcing. Future advancements include AI-driven automated report generation, cloud-based radiology workflow management, and enhanced cybersecurity measures for patient data protection.

Ambulatory Surgical Centers (ASCs) & Telehealth Providers

Ambulatory surgical centers and telehealth providers are increasingly integrating teleradiology services to streamline diagnostic workflows and optimize patient care in outpatient settings. These centers benefit from cost-effective remote radiology solutions, enabling faster decision-making and improved patient management.The growing trend of outpatient imaging services, increasing reliance on teleconsultation platforms, and rising investments in mobile radiology solutions are driving market demand.

North America and Europe dominate in ASC-based teleradiology adoption due to strong regulatory support for telehealth, while Asia-Pacific is witnessing rising adoption due to the expansion of mobile imaging units and digital healthcare transformation. Future trends include AI-integrated remote imaging diagnostics, real-time teleconsultation with radiology specialists, and smart teleradiology platforms with automated triaging systems.

The teleradiology service market is highly competitive, driven by increasing demand for remote diagnostic imaging, advancements in AI-powered radiology tools, and the growing adoption of cloud-based healthcare solutions.

Companies are investing in high-resolution image transmission, secure telecommunication platforms, and AI-assisted diagnostic interpretation to maintain a competitive edge. The market is shaped by well-established healthcare technology providers, radiology service companies, and emerging telemedicine firms, each contributing to the evolving landscape of teleradiology services.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| RadNet, Inc. | 10-13% |

| Teleradiology Solutions | 9-10% |

| Siemens Healthineers | 20-12% |

| GE Healthcare | 15-18% |

| Agfa-Gevaert Group | 4-7% |

| Other Companies (combined) | 30-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| RadNet, Inc. | Market leader offering cloud-based teleradiology services with AI-powered diagnostic support. |

| Teleradiology Solutions | Develops advanced remote radiology interpretation platforms with 24/7 global coverage. |

| Siemens Healthineers | Specializes in AI-driven imaging analytics and cloud-integrated radiology workflows. |

| GE Healthcare | Provides scalable telemedicine imaging solutions and remote radiology services for hospitals and clinics. |

| Agfa-Gevaert Group | Focuses on PACS-integrated teleradiology services designed for seamless workflow optimization. |

Key Company Insights

RadNet, Inc. (10-13%)

A dominant player in the teleradiology service market, RadNet leads with cloud-based imaging platforms and AI-assisted radiology solutions.

Teleradiology Solutions (9-10%)

A leader in remote radiology services, Teleradiology Solutions specializes in global diagnostic interpretation with real-time collaboration.

Siemens Healthineers (20-12%)

A key innovator in imaging informatics, Siemens integrates AI-enhanced radiology solutions with PACS and cloud platforms.

GE Healthcare (15-18%)

A strong competitor in digital radiology, GE Healthcare offers scalable teleradiology services with secure data sharing and advanced imaging tools.

Agfa-Gevaert Group (4-7%)

A major provider of PACS-driven radiology solutions, Agfa focuses on improving teleradiology workflow efficiency and accuracy.

Other Key Players (25-35% Combined)

Beyond the leading companies, several other providers contribute significantly to the market, enhancing service diversity and technological advancements. These include:

These companies focus on expanding the reach of teleradiology services, offering competitive pricing and cutting-edge innovations to meet diverse hospital, diagnostic center, and telemedicine needs.

Certified Reporting Services Process and Preliminary Reporting

Emergency Nighthawk, Day Time Coverage, Subspecialty Reading Others, Second Opinion and Clinical Trials

X-Ray Scans, Computerized Tomograph (CT) Scans, MRI Scans, Ultrasound Scans, Nuclear Scans, Cardiac Echo, Mammography, and Electromammograph

Hospital & Diagnostic Imaging Centers, Clinics, Ambulatory Surgical Centres and Others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for teleradiology services Market was USD 9,731.4 million in 2025.

The teleradiology services Market is expected to reach USD 25,362.3 million in 2035.

The increasing prevalence of chronic diseases such as cancer, cardiovascular conditions, and neurological disorders is driving demand for efficient diagnostic services and this drive the growth of the market.

The top key players that drives the development of teleradiology services Market are RadNet, Inc., Teleradiology Solutions, Siemens Healthineers, GE Healthcare and Agfa-Gevaert Group.

X-ray scan in teleradiology services market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Process Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Modality , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Process Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Modality , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Process Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Modality , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Process Type, 2018 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Modality , 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Process Type, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Modality , 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Process Type, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Modality , 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Process Type, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Modality , 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Process Type, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Modality , 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Process Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Modality , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Process Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Process Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Process Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Modality , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Modality , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Modality , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Process Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Service Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Modality , 2023 to 2033

Figure 24: Global Market Attractiveness by End User, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Process Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Modality , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Process Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Process Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Process Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Modality , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Modality , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Modality , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 46: North America Market Attractiveness by Process Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Service Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Modality , 2023 to 2033

Figure 49: North America Market Attractiveness by End User, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Process Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Modality , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Process Type, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Process Type, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Process Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Modality , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Modality , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Modality , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Process Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Service Type, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Modality , 2023 to 2033

Figure 74: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Process Type, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Modality , 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Process Type, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Process Type, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Process Type, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Modality , 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Modality , 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Modality , 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Process Type, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Service Type, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Modality , 2023 to 2033

Figure 99: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Process Type, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Modality , 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Process Type, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Process Type, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Process Type, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Modality , 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Modality , 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Modality , 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Process Type, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Service Type, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Modality , 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Million) by Process Type, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Million) by Modality , 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Process Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Process Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Process Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Modality , 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Modality , 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Modality , 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Process Type, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by Service Type, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Modality , 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Process Type, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Modality , 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Process Type, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Process Type, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Process Type, 2023 to 2033

Figure 162: East Asia Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 165: East Asia Market Value (US$ Million) Analysis by Modality , 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Modality , 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Modality , 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Process Type, 2023 to 2033

Figure 172: East Asia Market Attractiveness by Service Type, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Modality , 2023 to 2033

Figure 174: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Process Type, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Modality , 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Process Type, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Process Type, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Process Type, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Modality , 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Modality , 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Modality , 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Process Type, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by Service Type, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Modality , 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Teleradiology Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Microservices Orchestration Market Growth - Trends & Forecast 2025 to 2035

VOIP Services Market Analysis - Trends, Growth & Forecast through 2034

Global AI HR Services Market Size and Share Forecast Outlook 2025 to 2035

Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Oracle Services Market Analysis – Trends & Forecast 2024-2034

Seismic Services Market Size and Share Forecast Outlook 2025 to 2035

AR Tour Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tableau Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Walk-in Services Market Growth – Trends & Forecast 2024-2034

The AI Legal Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Podiatry Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Catering Services Market Analysis by Service Type, Application and End User and Region Through 2035

Wellness Services Market Trends - Growth & Forecast 2025 to 2035

Audiology Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA