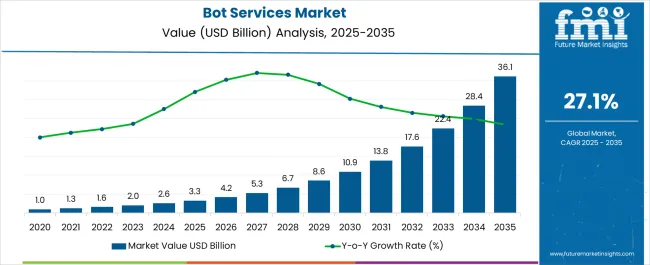

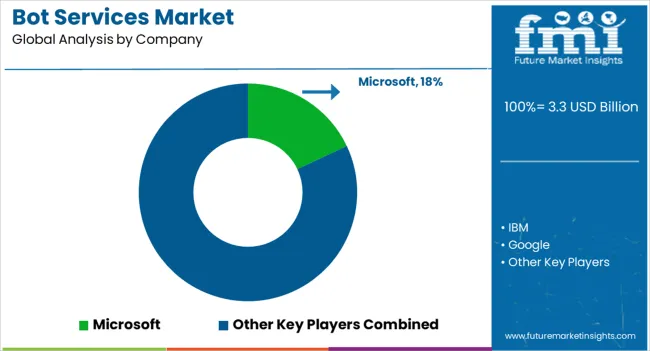

The Bot Services Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 36.1 billion by 2035, registering a compound annual growth rate (CAGR) of 27.1% over the forecast period.

| Metric | Value |

|---|---|

| Bot Services Market Estimated Value in (2025 E) | USD 3.3 billion |

| Bot Services Market Forecast Value in (2035 F) | USD 36.1 billion |

| Forecast CAGR (2025 to 2035) | 27.1% |

The bot services market is expanding steadily, driven by accelerated digital transformation across enterprises, increased customer interaction automation, and advancements in natural language processing. Businesses are deploying conversational interfaces to streamline service delivery, reduce operational costs, and meet round-the-clock engagement expectations.

Cloud-native deployments, integration with CRM and ERP platforms, and multilingual capabilities are boosting enterprise adoption across industries. Furthermore, the convergence of bot frameworks with AI, machine learning, and analytics tools is enabling smarter, more contextual interactions.

Regulatory emphasis on data privacy, secure communication, and compliance-ready architectures is also influencing design and deployment strategies. As businesses adopt omni-channel customer engagement strategies, the demand for scalable, integrated bot services is expected to remain strong across sectors including retail, banking, healthcare, and telecom.

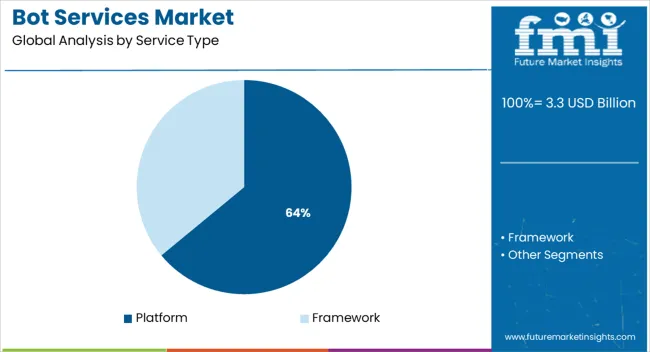

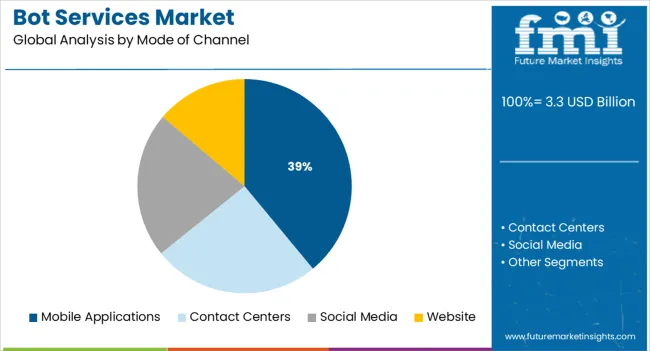

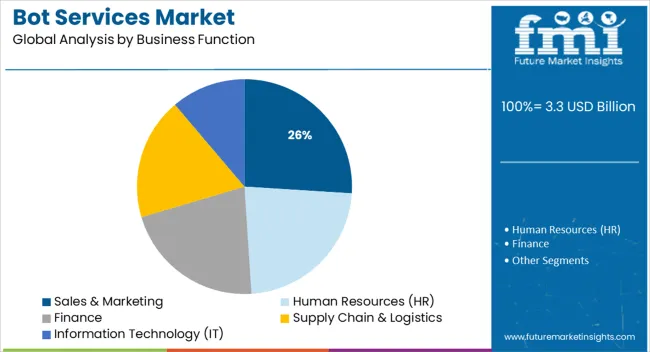

The market is segmented by Service Type, Mode of Channel, Business Function, Application, Deployment Mode, and Organization Size and region. By Service Type, the market is divided into Platform and Framework. In terms of Mode of Channel, the market is classified into Mobile Applications, Contact Centers, Social Media, and Website. Based on Business Function, the market is segmented into Sales & Marketing, Human Resources (HR), Finance, Supply Chain & Logistics, and Information Technology (IT). By Application, the market is divided into Customer Engagement & Retention, Workforce Management, Agent Performance Management, Content Management, Appointment Scheduling, Employee Onboarding, and Other Applications. By Deployment Mode, the market is segmented into Cloud and On-premises. By Organization Size, the market is segmented into Large Enterprises and SMEs. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The platform segment is projected to contribute 64.0% of the total market revenue by 2025, making it the leading service type in the bot services market. Its dominance is being driven by the need for centralized development, deployment, and management of conversational bots across multiple channels.

Platforms offer pre-built NLP capabilities, API integration layers, and drag-and-drop interfaces, reducing the technical barrier for enterprise deployment. These frameworks allow businesses to standardize chatbot architecture and maintain scalability while meeting compliance requirements.

Additionally, platform-based services offer support for version control, user analytics, sentiment tracking, and cross-platform compatibility. As organizations prioritize agility and time-to-market, investment in platform-based bot services continues to rise across both customer-facing and internal automation scenarios.

Mobile applications are expected to hold 39.0% of the revenue share in 2025, positioning them as the top channel mode for bot services deployment. The widespread use of smartphones and messaging apps has made mobile environments a preferred interface for chatbot interaction.

Businesses are embedding bots into mobile apps to provide personalized support, conduct transactions, and deliver notifications in real time. The ability to access bots through native apps enhances user engagement and allows seamless integration with features such as voice assistants, biometric authentication, and geolocation.

As consumers demand faster, app-based interactions for banking, e-commerce, healthcare, and travel services, mobile apps have become a core channel for bot service implementation.

Sales & marketing is forecast to capture 26.0% of the market share in 2025, emerging as the primary business function for bot services utilization. The growth of this segment is being driven by the use of bots for lead qualification, product recommendations, and personalized customer engagement.

Bots enable businesses to scale outreach efforts without increasing headcount, while collecting valuable user insights to refine campaign targeting. Integration with marketing automation tools and CRMs allows for end-to-end tracking and data synchronization, boosting campaign ROI.

Real-time support during product discovery and conversion phases has made bots essential in customer acquisition strategies. As businesses increasingly rely on digital-first selling models, bot services are becoming integral to high-frequency and high-impact sales and marketing operations.

As per the Global Bot Services Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the Bot Services Market increased at around 31.6% CAGR. Bots are becoming popular as a result of their applications across many industries.

As more industries transition to omnichannel platforms to boost operational effectiveness, capitalize on improved consumer data, and put more emphasis on improving customer experience, the market for bots is anticipated to grow.

One of the primary target industries for the bot services market is the retail sector. In order to more precisely cross-sell and upsell products and better analyze customer behavior, many companies, including Amazon, have made significant investments and developed bots used in retail.

According to IBM's most recent reports, Watson Assistant traffic increased by 40% between February 2024 and April 2024. Additionally, in response to rising customer demand, Google in April introduced the Rapid Response Virtual Agent, a particular variation of its Contact Center AI.

Large businesses frequently have too many tasks to complete, such as ordering products, requesting information about them, and paying for supplies. Enterprise-grade chatbots may readily execute these B2B duties, and such chatbot-integrated B2B systems can minimize total effort.

Everything is realigned using the instant messaging platform so that the chatbots may fully automate these processes. Chatbots with AI and NLP capabilities can answer all questions about products, bills, payments, and other subjects.

The local government has been altering its service offerings to match public demand as chatbots, WhatsApp, and live chat become more prevalent in daily life. For instance, the UK government debuted a WhatsApp chatbot for the Coronavirus in March 2024.

A plethora of knowledge regarding the coronavirus is provided by the chatbot. By adding the phone number as a WhatsApp contact and entering hello in the message field, anyone can access it. Additionally, the market is seeing a rise in the use of chatbots in the licensing industry. For instance, The Driver and Vehicle Licensing Agency added a chatbot to its webchat channel in April 2024 to offer millions of users more effective self-service.

In order to cut expenses, several organizations are automating their repetitive and time-consuming tasks. In order to significantly cut expenses, businesses are primarily focusing on automating customer service and sales. Artificial intelligence-enabled chatbots are becoming more prevalent. Businesses will save a large amount of money by implementing chatbots to automate parts of customer care and sales while significantly reducing labor costs.

Instead of making customers wait days for a response, customer support representatives should respond quickly. Using a chatbot to respond can significantly reduce the chance of losing a customer. Chatbots can be used by e-commerce companies for returns and exchanges. Chatbot adoption can drastically save annual costs by automating roughly 35% of tasks that would otherwise require a person to perform them manually.

One of the prominent drawbacks of chatbots is their inability to make timely decisions. Only the information that has been taught to chatbots will be understood by them. They are unable to discriminate between good and bad and cannot comprehend the context of humans, which is a significant gap that is likely to make a client unhappy.

AI-powered intelligent bots can comprehend a variety of circumstances, however, they are unable to accurately interpret 40 out of every 100 client interactions. The poor decision-making abilities of chatbots have caused significant harm to several brands. Microsoft's chatbot Tay received significant backlash after its March 23, 2020, introduction. By tweeting offensive Tweets, the chatbot caused Microsoft enormous embarrassment. They were consequently compelled to briefly disable the chatbot.

Despite incorporating AI-produced NLP or ML technologies into their business processes, companies still struggle with a lack of qualified employees, including teams that can analyze data. However, there also exists a demand for experienced experts who have picked up these abilities.

Acquisition and retention of technical resources have become key organizational concerns. The requisite skill sets are lacking for the development and execution of AI-based initiatives, which call for complex technologies like NLP and ML.

Data scientists, who have a thorough understanding of computer science, mathematics, and domain experience, are the most qualified analytics specialists. Most of the time, large organizations-or even small and medium-sized businesses-cannot afford to hire competent data scientists since they want high salaries and intriguing projects. As a result, it is projected that the current shortage of skilled labor would make it difficult for the market for bot services to grow.

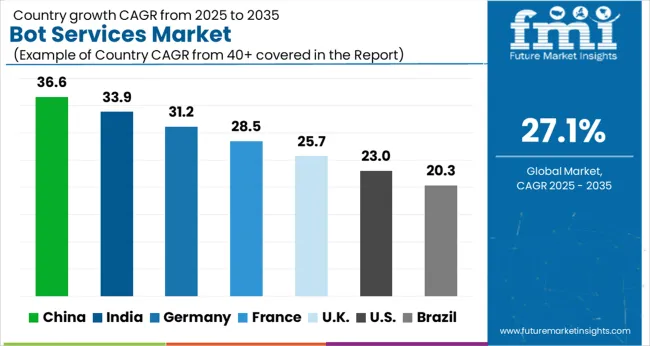

Which Region is projected to Offer the Largest Bot Services Market Opportunity?

During the projection period, Asia Pacific is predicted to lead Bot Services Market. China, Japan, and South Korea are the top three Bot Services markets in the Asia Pacific and are expected to account for a valuation of USD 36.1 Billion by 2.636.12. The Chinese Bot Services market is expected to account for a market of USD 1.36.1 Billion by the end of 2.636.12. Machine learning and chatbot development are being financed by several start-ups.

Due to chatbots$.19; faultless performance, capacity to manage high client volumes, and enhanced customer engagement tactics, small and midsized organizations are swiftly integrating the use of chatbots in their customer care procedures. For Andhra Bank$.19;s 1 Million users, Floatbot developed an artificial intelligence chatbot in July 2.619 for its core banking servers. It was put through a rigorous testing process including more than 1 Thousand inquiries with the goal of providing automated customer support and digital engagement.

Due to the rapidly expanding information and communications technology infrastructures in the region$.19;s prominent economies, notably China and India, the industry is expected to grow even more in the forthcoming years. For instance, AI chatbot firm Yellow Messengers received USD 2.6 Million from an investor in April 2.62.6 to fulfill the growing market need. The company provides organizations with an AI chatbot for consumer engagement. Hence, these factors are driving the demand for Bot Services in Asia Pacific.

The USA is expected to account for the highest market of USD 36.1 Billion by the end of 2035. Also, the market in the country is projected to account for an absolute dollar growth of USD 5.7 Billion.

For instance, in April 2024, Mindsay published AI chatbots on Genesys App Foundry. Agents may quickly engage and leave conversations with customers via the chatbot interface by integrating Mindsay chatbots with Genesys Cloud, responding to requests quickly and around the clock.

Since a large percentage of interactions are voice-based and come from the phone network, the providers are utilizing this opportunity to expand their companies by offering chatbots access to voice and telephony.

For instance, PhoneMyBot will be available in December 2024, according to Interactive Media, a renowned manufacturer of customer experience, conversational AI, and telecom software. These factors are likely to increase the demand for Bot Services in the USA.

Market revenue through the website channel is forecasted to grow at a CAGR of over 27.1% from 2025 to 2035. Bots are pre-programmed chat interfaces that allow website visitors to speak with them. Chatbots can help website users by providing the information they require, whereas interactive bots can convert visitors into customers.

Artificial intelligence is used by chatbots to process language and communicates with users. For messaging systems like Skype, Facebook, Slack, and other key social media networking sites, several chatbots have been installed.

Developers of chatbots can use these messaging platforms for payment services by directly linking the payment gateways with the assistant. One of the key opportunities in the market includes the chance to earn modest commission fees. Since chatbots allow for direct client connection, they are frequently employed in digital marketing to inform current customers about new goods and services.

Players in the market are constantly developing improved analytical solutions as well as extending their product offerings. The companies in the Bot Services market are focused on their alliances, technology collaborations, and product launch strategies. The Tier 2 Players in the market are targeting to increase their Bot Services market share.

Some of the recent developments of key Bot Services providers are as follows:

Similarly, recent developments related to companies in Bot Services Market have been tracked by the team at Future Market Insights, which are available in the full report.

The global bot services market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the bot services market is projected to reach USD 36.1 billion by 2035.

The bot services market is expected to grow at a 27.1% CAGR between 2025 and 2035.

The key product types in bot services market are platform and framework.

In terms of mode of channel, mobile applications segment to command 39.0% share in the bot services market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Botanical Flavors Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sealing Wax Market Size and Share Forecast Outlook 2025 to 2035

Bottom Stacking Cone Market Size and Share Forecast Outlook 2025 to 2035

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Bottle Shippers Market Size and Share Forecast Outlook 2025 to 2035

Botulinum Toxin-coated Microneedles Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bot Security Market Size and Share Forecast Outlook 2025 to 2035

Botulism Market Size and Share Forecast Outlook 2025 to 2035

Botanical Extracts Market Size and Share Forecast Outlook 2025 to 2035

Botnet Detection Market Size and Share Forecast Outlook 2025 to 2035

Botanical Bioactives Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sticker Labelling Machine Market Size and Share Forecast Outlook 2025 to 2035

Bottle Dividers Market Size and Share Forecast Outlook 2025 to 2035

Bottle Jack Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Botanical Ingredient Business

Bottles Market Analysis - Growth & Forecast 2025 to 2035

Botanical CO2 Extracts Market Analysis by Cranberry Seed, Blackcurrant, Oat, Carrot, and Rice Bran through 2035.

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Botanical Sugar Market Analysis by product type, application and by region - Growth, trends and forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA