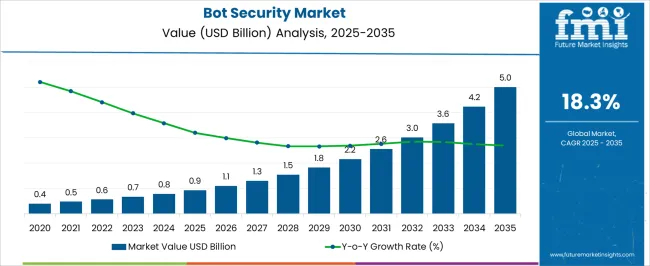

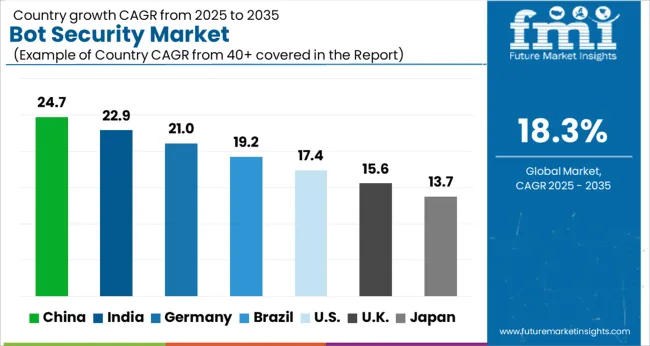

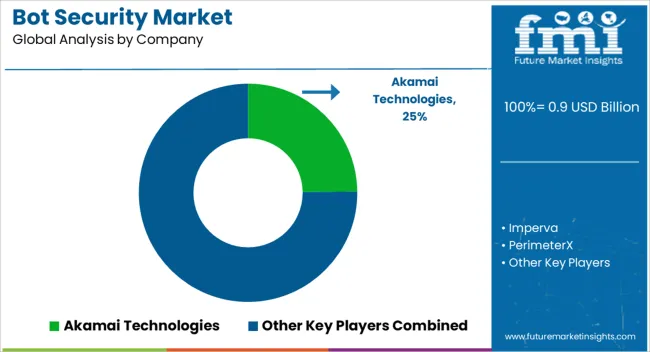

The Bot Security Market is estimated to be valued at USD 0.9 billion in 2025 and is projected to reach USD 5.0 billion by 2035, registering a compound annual growth rate (CAGR) of 18.3% over the forecast period.

| Metric | Value |

|---|---|

| Bot Security Market Estimated Value in (2025 E) | USD 0.9 billion |

| Bot Security Market Forecast Value in (2035 F) | USD 5.0 billion |

| Forecast CAGR (2025 to 2035) | 18.3% |

The bot security market is experiencing accelerated growth driven by the rising frequency of malicious bot attacks targeting digital platforms, e commerce channels, and enterprise applications. Increasing sophistication of automated threats including credential stuffing, account takeover, and data scraping has heightened the demand for advanced bot management solutions.

Enterprises are prioritizing robust security frameworks that can distinguish between legitimate and malicious traffic in real time, safeguarding customer trust and revenue. Integration of AI and machine learning has strengthened detection accuracy and response capabilities, enabling adaptive defense mechanisms.

Regulatory focus on data protection and the expansion of digital ecosystems across banking, retail, and healthcare are also fueling demand. With organizations embracing digital transformation and cloud migration, bot security solutions are expected to remain at the forefront of cybersecurity strategies worldwide.

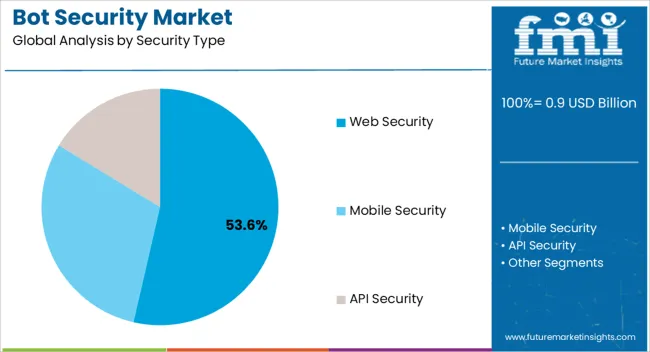

The web security type segment is projected to hold 53.60% of the total market revenue by 2025, positioning it as the leading security type. Its dominance is attributed to the rising volume of bot driven threats against websites, online portals, and e commerce platforms.

Web security solutions provide comprehensive protection against traffic anomalies, automated fraud attempts, and content scraping. Enhanced capabilities such as traffic behavior analysis and real time threat mitigation have reinforced adoption across industries that rely heavily on web based customer interaction.

As enterprises continue to prioritize safeguarding digital channels and customer data, the web security type segment maintains its leadership in the market.

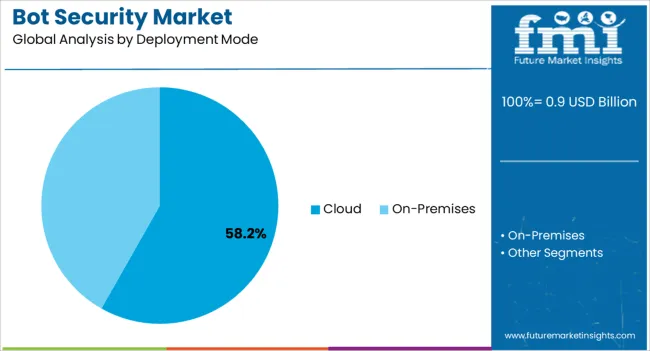

The cloud deployment mode is anticipated to account for 58.20% of total market revenue by 2025, making it the most prominent mode of deployment. Growth is being driven by the scalability, flexibility, and cost efficiency offered by cloud based security solutions.

Enterprises are increasingly shifting to cloud infrastructures to ensure real time threat monitoring across distributed environments. The ability to integrate seamlessly with multi cloud and hybrid setups has further accelerated adoption.

Cloud deployment also allows for rapid updates and adaptive defense capabilities, addressing the constantly evolving nature of bot attacks. These advantages have positioned the cloud deployment mode as the preferred choice for organizations modernizing their cybersecurity frameworks.

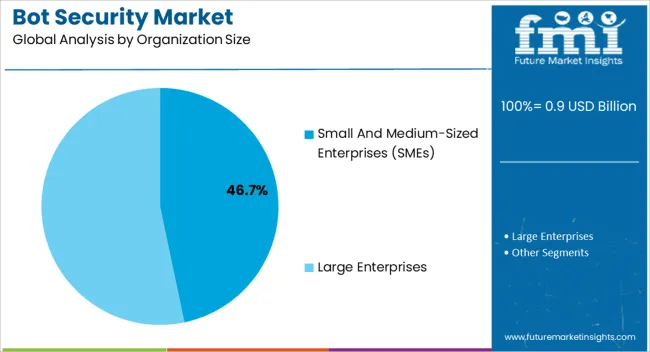

The small and medium sized enterprises segment is expected to account for 46.70% of the market revenue by 2025, making it a significant contributor within the organization size category. SMEs are increasingly targeted by malicious bots due to limited internal security resources, creating a strong need for affordable and scalable solutions.

The adoption of managed bot security services and cloud based protection models has enabled SMEs to strengthen their defenses without incurring heavy infrastructure costs. Growing digital adoption across retail, services, and online platforms has made bot security a critical investment area for SMEs.

As awareness of financial and reputational risks associated with bot attacks increases, SMEs are embracing proactive security measures, driving the growth of this segment.

Growing Cybersecurity Concerns: With the escalating frequency and sophistication of cyber-attacks, organizations are increasingly prioritizing cybersecurity measures.

Protection of Brand Reputation: Bot attacks can harm a company's brand reputation. To protect their brand reputation, organizations are turning to bot security solutions to detect and mitigate such threats.

Rise in E-commerce and Online Services: The increasing popularity of e-commerce platforms, online banking, and digital services has attracted the attention of cybercriminals. Bots are used to automate fraudulent activities, such as account creation, inventory scalping, and fake reviews.

Advancements in Bot Technology: Bots are becoming more sophisticated, capable of mimicking human behavior, and evading traditional security measures. Organizations are investing in these solutions to stay ahead of evolving bot threats.

Awareness and Education: Awareness campaigns, industry events, and educational initiatives have played a role in highlighting the importance of bot security and driving the adoption of appropriate measures.

Scalability and Interoperability: Ensuring interoperability with different telecommunication networks and devices can be a complex task, requiring compatibility across various platforms and systems.

Handling False Positives and Negatives: Bot detection systems may occasionally produce false positives, mistakenly identifying legitimate users as bots, or false negatives, failing to detect malicious bots.

Distributed Bot Networks: Botnets, which are networks of compromised computers controlled by a central command, can launch large-scale bot attacks that are difficult to mitigate.

Compliance and Legal Considerations: Ensuring compliance while implementing effective bot security measures can be a complex challenge.

Technological Advancements: The continuous advancement of technology, including artificial intelligence (AI), machine learning, and behavioral analytics, provides an opportunity to develop more robust and intelligent bot security systems.

Cloud-Based Security: The adoption of cloud computing has opened up new opportunities for bot security market. Companies can develop cloud-based bot security platforms that provide comprehensive protection and seamless integration with existing cloud infrastructures.

Industry-Specific Solutions: Different industries face unique bot security challenges. Companies can focus on developing industry-specific bot security solutions tailored to sectors such as finance, e-commerce, healthcare, and gaming.

Emerging Markets: Companies can tap into these markets by offering localized solutions, adapting to regional requirements, and partnering with local organizations to establish a strong presence.

Behavior-based Analysis: Traditional rule-based approaches to bot detection are being complemented by behavior-based analysis. By monitoring user behavior and establishing baselines for normal activity, systems can identify anomalies that may indicate bot activity.

Intent Recognition: Recognizing the intent behind bot activity is gaining prominence. Instead of solely focusing on identifying bots, security solutions aim to understand the purpose of their actions.

Bot Mitigation-as-a-Service: The rise of cloud-based services has led to the emergence of Bot Mitigation-as-a-Service (BaaS) offerings.

Threat Intelligence Sharing: By exchanging information about emerging bot threats, attack techniques, and botnets, stakeholders can collectively enhance their defenses and proactively respond to evolving bot attacks.

The bot security market witnessed a growth rate of 14.5% between the period of 2020 to 2025.

Historical sales in the market have demonstrated steady growth as organizations recognize the need to protect themselves against the rising threat of malicious bots.

In the past, the demand for bot security solutions has been primarily driven by increasing instances of bot attacks, the growing awareness of the risks associated with bots, and the need for robust cybersecurity measures.

The bot security market size is projected to be worth USD 0.9 million in 2025. The market is likely to surpass USD 3,624.5 million by 2035 at a CAGR of 18.3% during the forecast period of 2025 to 2035.

Mobile and IoT Expansion: The proliferation of mobile devices and the rapid growth of the Internet of Things (IoT) create new attack surfaces for bots. Mobile applications and connected devices are susceptible to bot threats, necessitating the need for specialized mobile and IoT bot security solutions. The growing demand for such solutions is likely to contribute to the overall expansion of the bot security market.

Alongside preventive measures, incident response, and forensic services are gaining importance in the bot security market. Organizations seek assistance in detecting, analyzing, and recovering from bot incidents. The demand for specialized services in incident response and forensics is expected to grow, supporting the overall growth of the bot security market.

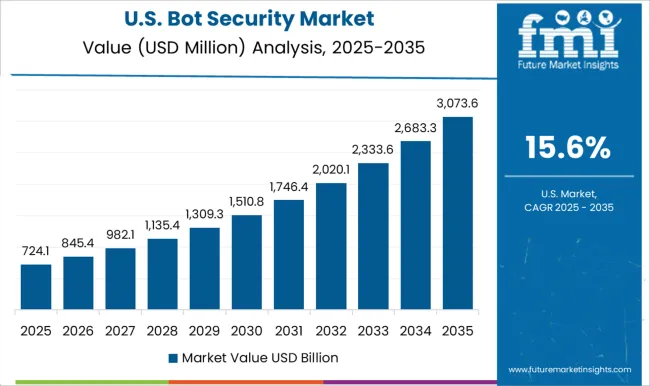

North America contributed a global share of 31.3% in 2025. North America experiences a significant number of bot attacks due to its large online population and the presence of valuable digital assets. Financial institutions, e-commerce platforms, healthcare organizations, and government entities are prime targets for bot attacks in the region. This drives the need for robust bot security solutions.

Government agencies in North America actively engage in cybersecurity initiatives to protect critical infrastructure and combat cyber threats. These initiatives often involve collaborations with the private sector, fostering an environment conducive to the growth of the bot security market.

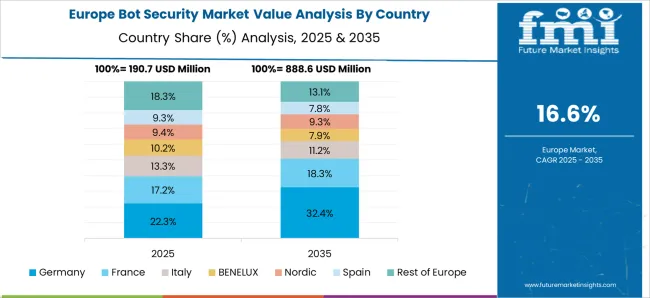

Germany holds a sizeable share of 9.1% in the European bot security market The country has implemented robust regulations, such as the General Data Protection Regulation (GDPR) and the Federal Data Protection Act (BDSG), which mandate organizations to implement stringent security measures, including bot protection, to safeguard user data.

Germany has a culture of continuous improvement when it comes to security measures. Organizations regularly assess and update their security practices to stay ahead of evolving bot threats. This commitment to staying updated and investing in robust security measures contribute to the growth of the bot security market in Germany.

India is one of the potential markets in bot security recording a CAGR of 21.4% between 2025 to 2035. India has a massive online population, making it an attractive target for cybercriminals. This, coupled with the proliferation of affordable smartphones and widespread internet access, contributes to the country's increasing incidence of bot attacks. Organizations and individuals are recognizing the importance of bot security measures to safeguard their digital assets and personal information.

The Indian government has launched several initiatives to strengthen the cybersecurity ecosystem, including efforts to combat bot-related threats. The National Cyber Security Strategy and the Cyber Swachhta Kendra (Botnet Cleaning and Malware Analysis Centre) are examples of government-led initiatives aimed at enhancing cybersecurity resilience, promoting awareness, and mitigating bot attacks.

The United Kingdom is witnessing a growth trajectory of 19.3% in the analysis period due to the numerous tech startups, cybersecurity companies, and research institutions that contribute to the development of cutting-edge bot security solutions. These advancements help address the evolving bot threat landscape.

The United Kingdom emphasizes incident response and recovery capabilities to minimize the impact of bot attacks. Organizations invest in incident response planning, security operations centers (SOCs), and forensic services to effectively detect, analyze, and recover from bot incidents. The demand for incident response and recovery services contributes to the overall bot security market growth in the United Kingdom.

Web security commanded a market share of 47.5% in 2025. Application Programming Interfaces (APIs) act as gateways for data exchange between different systems and are often targeted by bots. Ensuring the security of APIs is paramount to prevent bot-driven attacks, such as API scraping, data breaches, and unauthorized access. API security measures, including authentication, rate limiting, and encryption, contribute to overall web security in the bot security market.

These solutions are specifically designed to protect web assets from various threats, including bot-related attacks. The demand for such solutions continues to grow as organizations prioritize web security in their overall bot protection strategies.

On-premise deployment offers organizations a high level of customization and controls over their bot security infrastructure. They can tailor the solution to meet their specific requirements, integrate it with existing security systems, and have full control over data storage and access. This level of customization and control is particularly important for organizations with unique security needs or strict compliance requirements.

Organizations may choose to deploy certain critical components or sensitive functions on-premise while leveraging cloud-based services for scalability, threat intelligence, or analytics. Hybrid deployments provide a balance between control and flexibility, catering to diverse organizational needs.

The competitive landscape in the bot security market is characterized by a mix of established cybersecurity companies, specialized vendors, cloud service providers, startups, collaboration efforts, focus on research and development, global reach, value-added services, customer-centric approaches, and occasional mergers and acquisitions. As the market evolves, competition continues to drive innovation and the development of more robust bot security solutions.

Recent Developments

The global bot security market is estimated to be valued at USD 0.9 billion in 2025.

The market size for the bot security market is projected to reach USD 5.0 billion by 2035.

The bot security market is expected to grow at a 18.3% CAGR between 2025 and 2035.

The key product types in bot security market are web security, mobile security and api security.

In terms of deployment mode, cloud segment to command 58.2% share in the bot security market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Security Bottles Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Security Bottles Manufacturers

Security Robots Market Size and Share Forecast Outlook 2025 to 2035

AI-Driven Chatbot Security – Protecting Digital Interactions

Cyber Security in Robotics Market Size and Share Forecast Outlook 2025 to 2035

Bottom Mounted Homogenizer Market Size and Share Forecast Outlook 2025 to 2035

Security Tape Market Size and Share Forecast Outlook 2025 to 2035

Security Alarm Communicator Market Size and Share Forecast Outlook 2025 to 2035

Security and Vulnerability Management Market Forecast and Outlook 2025 to 2035

Security Holograms Market Size and Share Forecast Outlook 2025 to 2035

Security Paper Market Size and Share Forecast Outlook 2025 to 2035

Botanical Flavors Market Size and Share Forecast Outlook 2025 to 2035

Security System Tester Market Size and Share Forecast Outlook 2025 to 2035

Security Advisory Services Market Size and Share Forecast Outlook 2025 to 2035

Security Room Control Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sealing Wax Market Size and Share Forecast Outlook 2025 to 2035

Bottom Stacking Cone Market Size and Share Forecast Outlook 2025 to 2035

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Security Operation Centre as a Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA