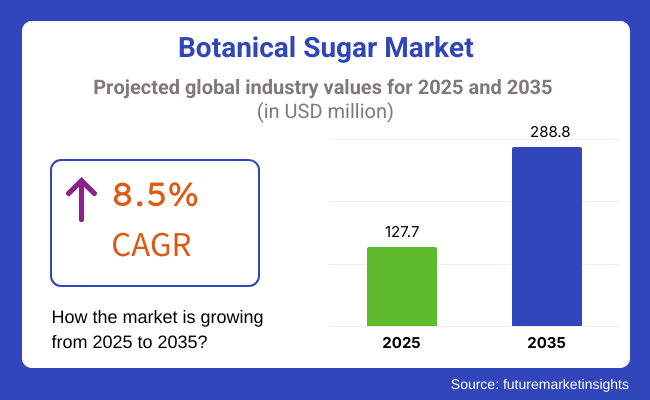

The botanical sugar market is estimated to grow at USD 127.7 million in 2025. During the forecast period, the market is likely to grow at a CAGR of 8.5%. If the current trend continues, the market will be worth USD 288.8 million by 2035.

The plant-derived sugar, which is botanical sugar, is gaining the attention of more and more consumers who consider it to be a good choice from the side of health and the environment instead of regular sugar. One of the major factors influencing the market is the consumer tendency to shift towards natural sucralose and plant sources, stemming from the increase in health awareness and problems related to the consumption of artificial additives.

The market progress is notably affected by the impact of increasing diseases related to lifestyle, i.e., hypertension and diabetes, which drove the public to look for possible substitutes for sugar. On the other hand, botanical sugars, being the type of carbohydrates that are resistant to some extent, are even healthier because of them: they have a lower glycemic index and contain additional amounts of micronutrients. Nowadays, botanical sugar savers are no longer available only in the foodstuffs sector but also in functional foods, dietary supplements, and natural beverages.

The market is definitely propelled by the regulatory support available for plant-based and organic food ingredients. Around the world, governments and health organizations are supporting the natural sugar alternatives initiative by cutting down on artificial sweeteners and promoting the mission. The investment in innovative sugar formulations that not only have reduced caloric content but also improved taste and texture has been increased.

The market's rapid development is confronted with some challenges. Producers face the problem of high production costs and a limited availability of raw materials. Another factor is the fact that the botanical sugar's flavor and texture do not compare well with those of commonly used sweeteners, which may lead to difficulties in being accepted by the main food producers.

Nevertheless, there are a lot of development opportunities. The pursue of s sustainability thought food supply chain links through natural products and ethically consumed ingredients will lead to further adoption of botanical sugars. More variety in distribution channels, such as online retail shops and health food shops, has made it easier for consumers to get hold of these natural sweeteners, thus planting the seeds of growth in sales.

The botanical sugar market is expanding with increasing demand for plant-derived and natural sweeteners in food & beverage, pharmaceuticals, personal care, and nutraceuticals. Customers are showing a trend towards alternatives for refined sugars in favor of plant extracts such as monk fruit, coconut sugar, and stevia.

Botanical sugars in the food and beverage market are being added to organic and clean-label products with the push from health-oriented consumers. Botanical sugars are used by the pharmaceutical industry in syrups and coatings, emphasizing regulatory compliance and sweetness level balance.

Personal care products utilize botanical sugars for hydrating and mild exfoliation properties, specifically in cosmetics and skincare. The nutraceutical market experiences increased usage in dietary supplements and functional foods. But cost sensitivity and low scalability of production are issues. The market will grow as sustainable sourcing and new extraction methods enhance availability and affordability.

During 2020 to 2024, the botanical sugar market grew slowly as consumers moved towards natural and plant-based sweeteners. Growing concerns about the health impact of artificial sweeteners and high-fructose corn syrup fueled the use of botanical sweeteners such as stevia, monk fruit, agave, and coconut sugar.

Food and beverage companies responded by reformulating products to reduce the use of sugar without changing taste, using botanical sugars as healthy alternatives. Clean-label consumerism and the trend towards organic and non-GMO contributed to market growth even more. Botanical sugars also became popular for their lower glycemic index and natural sweetness and, more importantly, for the health benefits attributed to them. However, consistency in taste, production scalability, and higher cost stopped wider application.

During the forthcoming 202- 2035 decade, the botanical sugar market will grow exponentially with technological advancements facilitating extraction processes, enhancing stability and flavor of botanical sweeteners. Greater investment in sustainable farming and environmentally friendly production techniques will fuel market growth. Consumers' emphasis on low-calorie, functional, and natural ingredients will drive the demand for botanical sugars in functional foods, beverages, and dietary supplements.

Backing from regulators for sugar reduction and clear labeling will enhance market positioning. Artificial intelligence-based product formulation and personalized nutrition will yield opportunities for customized sweetening solutions. Intensifying competition and market consolidation by partnerships and acquisitions will drive towards diversification in the product portfolio and better market reach.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Slow growth is on account of the growing demand for natural sweeteners. | Faster growth due to technological innovation and sustainability. |

| Growing awareness about artificial sweeteners and excessive sugar consumption. | Robust demand for low-calorie, functional, and health-enhancing sweeteners. |

| Emergence of stevia, monk fruit, agave, and coconut sugar in packaged food and drinks. | Increased portfolio diversification with fresh combinations of plants and stronger taste profiles. |

| Strong demand in developed economies and growing demand in emerging economies. | Increased activity in international markets with locally specific product formats. |

| Greater emphasis on sugar reduction and compliance with clean-labeling standards. | Sugar content regulations are getting stringent, and labeling is becoming more detailed. |

| Growth in sales in health food stores, online retailers, and supermarkets. | Expansion into consumer-direct and special occasion health-focused channels. |

| Improved extraction methods and flavor optimization. | Artificial intelligence-formulation, tailor-made sweetening alternatives, and biotechnology developments. |

| New competitors vs. incumbents rivalry. | Market consolidation through acquisitions and strategic partnerships. |

| Natural origin, health advantage, and reduced glycemic index emphasize. | Customized marketing on food preferences and health goals. |

| Taste consistency, production cost, and supply chain limitation. | Enhancing manufacturing, maintaining quality, reducing cost, and improving sustainability. |

The regulatory rules regarding food labeling, health claims, and sugar substitutes remain a major issue. Companies' programming should fulfill the requirements of international food safety rules, do a thorough test, and get the approval first, then they can enter the market and avoid legal consequences.

The production stability is affected by supply chain vulnerabilities, such as dependence on certain plant sources, the effects of climate change, and seasonal fluctuations. The variability in crop outputs molding the market, sometimes due to weather and agricultural policies, may lead to the absence of some market tools.

The high costs of production and the complexity of processing are obstacles to the growth of the market. The extraction and refining of plant sugar often require a special style of operation, which can lead to an increase in operational expenses. Companies must focus on cost-efficient mass production, research and development, as well as digital partnerships to promote affordability and thus facilitate the interactive diffusion of the technology.

The challenges of consumer perception and awareness are that people might have misconceptions about the taste, efficacy, and nutritional benefits. The problems that the companies must solve are the issues of effective marketing, ingredient sourcing that is transparent, and also scientific validation, which can be anchored as a basis to build trust and support the customers to have a notion about the botanical sugar products.

The possibility of the market being affected by the competition from synthetic sweeteners and other natural alternatives is a clear and present danger. Companies need to compete with superior quality, innovation, and environmentally friendly products to move forward. The survival of the botanical sugar market is reliant upon adherence to the rules, a solid supply chain, and continuous creativity in the products to accommodate the changes in consumer demand.

The Botanical Sugar Market is classified into Stevia Sugar, Agave Sugar, etc., which are becoming popular as a substitute for sugar. The stevia-based segment emerged as the most dominant segment in 2025, with a market share of 38%, which is driven by the ingredients derived from the stevia rebaudiana plant. That zero-calorie, intense (300 times sweeter than regular sugar) sweetness is what keeps demand for it higher in health and diabetes-friendly products.

From Coca-Cola Life to PepsiCo’s Pure Via, great name brands are incorporating stevia into soft drinks, dairy, bakery, and confectionery formulations, and there is great usage of stevia among manufacturers. Important producers include the following: Tate & Lyle, Ingredion, Cargill (Truvia), GLG Life Tech, and Stevia First Corporation. North America and Europe are the biggest consumer markets, while China and India dominate global production.

Agave sugar is a parent ingredient of Agave tequilana (90% against and 10% glucose). It is climbing 23.7% market share in the year 2025 as a glucose supplier and is gaining traction on account of being a low glycemic index (GI) sugar (1.5x regular sugar) (forest hills strangle) with low processing (or no molasses). It is popular in organic foods, drinks, and health products, especially vegan and diabetic-friendly diets.

Key players in the Agave Sugar segment include Wholesome Sweeteners, Madhava, The Agave Sweetener Company, and NOW Foods. Demand is strongest in North America and Europe, where consumers increasingly want natural, minimally processed sweeteners. Driven by the demand for clean-label, plant-based sweeteners, both Stevia and Agave Sugar are slated to bolster growth in the botanical sugar market.

The global botanical sugar market is segmented on the basis of application, wherein the applications of botanical sugar are the food & beverage industry (plant-based sweeteners are plant-based alternatives to sugar) and the pharmaceutical industry (such as having better oral health when applied).

Food & Beverage is the largest application segment, capturing a large share of the demand for botanical sugar in 2025. Such an increasing consumer preference towards low-calorie, natural, and organic sweeteners has led to the increasing use of Stevia and Agave Sugar in products such as bakery, dairy, confectionery, beverages, and snacks.

Major beverage players, including The Coca-Cola Company (Coca-Cola Life), PepsiCo (Pure Via), and Nestlé, are substituting artificial sweeteners with stevia-based options. Likewise, organic and health-minded brands like Wholesome Sweeteners and Madhava are broadening their agave-based portfolios.

The Pharmaceutical industry is steadily gaining momentum in terms of the demand for botanical sugars, specifically for medicinal syrups, chewable tablets, and herbal formulations. Thus, the biological sweeteners have low and zero glycemic index and are used as an alternative to synthetic sugars; as a natural product, these sweeteners are ideal for diabetes and sugar-sensitive consumers. Pharma companies are working alongside firms such as Cargill, Tate & Lyle, and Ingredion to explore and develop botanical sugar formulations to increase patient compliance with their medicines.

The botanical sugar market is blooming rapidly under consumer preference for natural and plant-based sugar alternatives to refined sugars. Health consciousness, clean label trends, and regulatory pressure on artificial sweetening agents underpin the supply. Increased use of various botanical sugars, namely coconut sugar, stevia, monk fruit, agave nectar, and date sugar, finds its way into beverages, bakery products, confectionery, and functional foods.

Major players such as Cargill, ADM, Tate & Lyle, Ingredion, and PureCircle invest in sustainable sourcing, formulation improvements, and the expansion of their product portfolios to satiate the insatiable consumer demand. New startups and some niche providers that are innovating include organic, minimally processed, and area-specific botanical sugars to serve the health-conscious markets or the diabetic-friendly food segment.

The market is further being advanced in extraction and processing techniques that are aimed at improving sweetness profiles, solubility, and shelf stability, without eliminating nutritional benefits. Companies are also focusing on blended formulations combining various botanical sugars. Companies have realized optimal taste, texture, and caloric reduction without a compromise in flavor through blending botanical sugars.

Strategic parameters that are set to shape competition will include cost-effectiveness, transparency along the supply chain, initiatives toward sustainability, and compliance with regulations. Due to the rising interest in sweeteners with a plant origin and low glycaemic effects, these companies have shifted their attention towards R&D investment along with partnerships with food manufacturers and clean-label product innovations.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill, Inc. | 18-22% |

| Archer Daniels Midland Company (ADM) | 14-18% |

| Tate & Lyle PLC | 10-14% |

| Ingredion Incorporated | 8-12% |

| PureCircle (A Subsidiary of Ingredion) | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Cargill, Inc. | Supplies a broad portfolio of botanical sweeteners, including stevia and monk fruit, with a focus on sustainability and supply chain transparency. |

| Archer Daniels Midland (ADM) | Develops plant-based sugar alternatives, leveraging its expertise in agricultural processing and food innovation. |

| Tate & Lyle PLC | Specializes in stevia, allulose, and soluble fibers, integrating sweetness solutions into reduced-calorie formulations. |

| Ingredion Incorporated | Expands its plant-based ingredient portfolio, focusing on sugar reduction and clean-label solutions for the food and beverage industries. |

| PureCircle | Pioneers in stevia-based innovations, with proprietary breeding programs to enhance sweetness profiles and reduce bitterness. |

Key Company Insights

Cargill, Inc. (18-22%)

A global leader in stevia and monk fruit sweeteners, Cargill invests in research on future sweeteners and sustainability.

Archer Daniels Midland (ADM) (14-18%)

ADM concentrates on botanical sugar development, adding natural sweetener capacity with clean-label solutions.

Tate & Lyle PLC (10-14%)

With its robust sugar reduction strategy, Tate & Lyle combines botanical sugars and other sweetening solutions within functional food solutions.

Ingredion Incorporated (8-12%)

One of the leading players in sugar substitutes, Ingredion invests in state-of-the-art extraction technology for stevia, monk fruit, and other botanical sugars.

PureCircle (6-10%)

Being a part of Ingredion, PureCircle stevia varieties with better taste profiles are created to cater to the increasing demand for sugar reduction.

Other Key Players

Includes natural sweeteners like cane sugar, coconut sugar, date sugar, maple sugar, palm sugar, stevia sugar, agave sugar, honey, monk fruit, and yacon syrup, catering to diverse consumer preferences for organic and plant-based alternatives.

Widely used across food and beverage industry (confectionery, beverages, dairy, bakery), pharmaceutical industry, personal care & cosmetics, and other sectors, driven by rising demand for natural sweeteners.

The market spans North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa, with growth influenced by regional dietary habits, regulatory policies, and increasing health-conscious consumers.

The industry is currently valued at USD 127.7 million in 2025.

The industry is likely to record a valuation of USD 288.8 million by 2035.

The botanical sugar industry is likely to register a CAGR of 8.5% during the forecast period.

Stevia-based botanical sugar remains the dominant segment.

Food and beverages are anticipated to remain key end-use segment.

Table 1: Global Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 4: Global Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Value (US$ million) Forecast by Application, 2018 to 2033

Table 6: Global Volume (MT) Forecast by Application, 2018 to 2033

Table 7: North America Value (US$ million) Forecast by Country, 2018 to 2033

Table 8: North America Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 10: North America Volume (MT) Forecast by Product Type, 2018 to 2033

Table 11: North America Value (US$ million) Forecast by Application, 2018 to 2033

Table 12: North America Volume (MT) Forecast by Application, 2018 to 2033

Table 13: Latin America Value (US$ million) Forecast by Country, 2018 to 2033

Table 14: Latin America Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Volume (MT) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Value (US$ million) Forecast by Application, 2018 to 2033

Table 18: Latin America Volume (MT) Forecast by Application, 2018 to 2033

Table 19: Europe Value (US$ million) Forecast by Country, 2018 to 2033

Table 20: Europe Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 22: Europe Volume (MT) Forecast by Product Type, 2018 to 2033

Table 23: Europe Value (US$ million) Forecast by Application, 2018 to 2033

Table 24: Europe Volume (MT) Forecast by Application, 2018 to 2033

Table 25: East Asia Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: East Asia Volume (MT) Forecast by Country, 2018 to 2033

Table 27: East Asia Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 28: East Asia Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: East Asia Value (US$ million) Forecast by Application, 2018 to 2033

Table 30: East Asia Volume (MT) Forecast by Application, 2018 to 2033

Table 31: South Asia Value (US$ million) Forecast by Country, 2018 to 2033

Table 32: South Asia Volume (MT) Forecast by Country, 2018 to 2033

Table 33: South Asia Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia Volume (MT) Forecast by Product Type, 2018 to 2033

Table 35: South Asia Value (US$ million) Forecast by Application, 2018 to 2033

Table 36: South Asia Volume (MT) Forecast by Application, 2018 to 2033

Table 37: Oceania Value (US$ million) Forecast by Country, 2018 to 2033

Table 38: Oceania Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Oceania Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 40: Oceania Volume (MT) Forecast by Product Type, 2018 to 2033

Table 41: Oceania Value (US$ million) Forecast by Application, 2018 to 2033

Table 42: Oceania Volume (MT) Forecast by Application, 2018 to 2033

Table 43: Middle East & Africa Value (US$ million) Forecast by Country, 2018 to 2033

Table 44: Middle East & Africa Volume (MT) Forecast by Country, 2018 to 2033

Table 45: Middle East & Africa Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East & Africa Volume (MT) Forecast by Product Type, 2018 to 2033

Table 47: Middle East & Africa Value (US$ million) Forecast by Application, 2018 to 2033

Table 48: Middle East & Africa Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Value (US$ million) by Product Type, 2023 to 2033

Figure 2: Global Value (US$ million) by Application, 2023 to 2033

Figure 3: Global Value (US$ million) by Region, 2023 to 2033

Figure 4: Global Value (US$ million) Analysis by Region, 2018 to 2033

Figure 5: Global Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 10: Global Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Value (US$ million) Analysis by Application, 2018 to 2033

Figure 13: Global Volume (MT) Analysis by Application, 2018 to 2033

Figure 14: Global Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Attractiveness by Application, 2023 to 2033

Figure 18: Global Attractiveness by Region, 2023 to 2033

Figure 19: North America Value (US$ million) by Product Type, 2023 to 2033

Figure 20: North America Value (US$ million) by Application, 2023 to 2033

Figure 21: North America Value (US$ million) by Country, 2023 to 2033

Figure 22: North America Value (US$ million) Analysis by Country, 2018 to 2033

Figure 23: North America Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 28: North America Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Value (US$ million) Analysis by Application, 2018 to 2033

Figure 31: North America Volume (MT) Analysis by Application, 2018 to 2033

Figure 32: North America Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Attractiveness by Application, 2023 to 2033

Figure 36: North America Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Value (US$ million) by Product Type, 2023 to 2033

Figure 38: Latin America Value (US$ million) by Application, 2023 to 2033

Figure 39: Latin America Value (US$ million) by Country, 2023 to 2033

Figure 40: Latin America Value (US$ million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Value (US$ million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Volume (MT) Analysis by Application, 2018 to 2033

Figure 50: Latin America Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Attractiveness by Country, 2023 to 2033

Figure 55: Europe Value (US$ million) by Product Type, 2023 to 2033

Figure 56: Europe Value (US$ million) by Application, 2023 to 2033

Figure 57: Europe Value (US$ million) by Country, 2023 to 2033

Figure 58: Europe Value (US$ million) Analysis by Country, 2018 to 2033

Figure 59: Europe Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 63: Europe Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 64: Europe Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Europe Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Europe Value (US$ million) Analysis by Application, 2018 to 2033

Figure 67: Europe Volume (MT) Analysis by Application, 2018 to 2033

Figure 68: Europe Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Attractiveness by Product Type, 2023 to 2033

Figure 71: Europe Attractiveness by Application, 2023 to 2033

Figure 72: Europe Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Value (US$ million) by Product Type, 2023 to 2033

Figure 74: East Asia Value (US$ million) by Application, 2023 to 2033

Figure 75: East Asia Value (US$ million) by Country, 2023 to 2033

Figure 76: East Asia Value (US$ million) Analysis by Country, 2018 to 2033

Figure 77: East Asia Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: East Asia Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 81: East Asia Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 82: East Asia Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: East Asia Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: East Asia Value (US$ million) Analysis by Application, 2018 to 2033

Figure 85: East Asia Volume (MT) Analysis by Application, 2018 to 2033

Figure 86: East Asia Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: East Asia Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: East Asia Attractiveness by Product Type, 2023 to 2033

Figure 89: East Asia Attractiveness by Application, 2023 to 2033

Figure 90: East Asia Attractiveness by Country, 2023 to 2033

Figure 91: South Asia Value (US$ million) by Product Type, 2023 to 2033

Figure 92: South Asia Value (US$ million) by Application, 2023 to 2033

Figure 93: South Asia Value (US$ million) by Country, 2023 to 2033

Figure 94: South Asia Value (US$ million) Analysis by Country, 2018 to 2033

Figure 95: South Asia Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: South Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia Value (US$ million) Analysis by Application, 2018 to 2033

Figure 103: South Asia Volume (MT) Analysis by Application, 2018 to 2033

Figure 104: South Asia Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia Attractiveness by Application, 2023 to 2033

Figure 108: South Asia Attractiveness by Country, 2023 to 2033

Figure 109: Oceania Value (US$ million) by Product Type, 2023 to 2033

Figure 110: Oceania Value (US$ million) by Application, 2023 to 2033

Figure 111: Oceania Value (US$ million) by Country, 2023 to 2033

Figure 112: Oceania Value (US$ million) Analysis by Country, 2018 to 2033

Figure 113: Oceania Volume (MT) Analysis by Country, 2018 to 2033

Figure 114: Oceania Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Oceania Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Oceania Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 117: Oceania Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 118: Oceania Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: Oceania Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: Oceania Value (US$ million) Analysis by Application, 2018 to 2033

Figure 121: Oceania Volume (MT) Analysis by Application, 2018 to 2033

Figure 122: Oceania Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: Oceania Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: Oceania Attractiveness by Product Type, 2023 to 2033

Figure 125: Oceania Attractiveness by Application, 2023 to 2033

Figure 126: Oceania Attractiveness by Country, 2023 to 2033

Figure 127: Middle East & Africa Value (US$ million) by Product Type, 2023 to 2033

Figure 128: Middle East & Africa Value (US$ million) by Application, 2023 to 2033

Figure 129: Middle East & Africa Value (US$ million) by Country, 2023 to 2033

Figure 130: Middle East & Africa Value (US$ million) Analysis by Country, 2018 to 2033

Figure 131: Middle East & Africa Volume (MT) Analysis by Country, 2018 to 2033

Figure 132: Middle East & Africa Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East & Africa Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East & Africa Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East & Africa Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East & Africa Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East & Africa Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East & Africa Value (US$ million) Analysis by Application, 2018 to 2033

Figure 139: Middle East & Africa Volume (MT) Analysis by Application, 2018 to 2033

Figure 140: Middle East & Africa Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East & Africa Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East & Africa Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East & Africa Attractiveness by Application, 2023 to 2033

Figure 144: Middle East & Africa Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Botanical Flavors Market Size and Share Forecast Outlook 2025 to 2035

Botanical Extracts Market Size and Share Forecast Outlook 2025 to 2035

Botanical Bioactives Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Botanical Ingredient Business

Botanical CO2 Extracts Market Analysis by Cranberry Seed, Blackcurrant, Oat, Carrot, and Rice Bran through 2035.

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Botanical Packaging Market Analysis & Future Outlook 2024 to 2034

Food Botanicals Market Outlook – Growth, Demand & Forecast 2024 to 2034

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Sugarcane Bottle Market Forecast and Outlook 2025 to 2035

Sugarcane-Derived Squalane Market Size and Share Forecast Outlook 2025 to 2035

Sugared Egg Yolk Market Size and Share Forecast Outlook 2025 to 2035

Sugar Toppings Market Size, Growth, and Forecast for 2025 to 2035

Sugarcane Fiber Bowls Market – Growth & Demand 2025 to 2035

Sugar-Free Gummy Market Insights - Consumer Trends & Growth 2025 to 2035

Sugar-Free Syrups Market Insights - Innovations & Consumer Demand 2025 to 2035

Sugar-Free White Chocolate Market Trends - Demand & Growth 2025 to 2035

Sugar-Free Sweets Market Growth - Trends & Consumer Preferences 2025 to 2035

Sugar Beet Pectin Market Growth - Functional Applications & Demand 2025 to 2035

Sugar-Free Cookies Market Insights - Consumer Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA