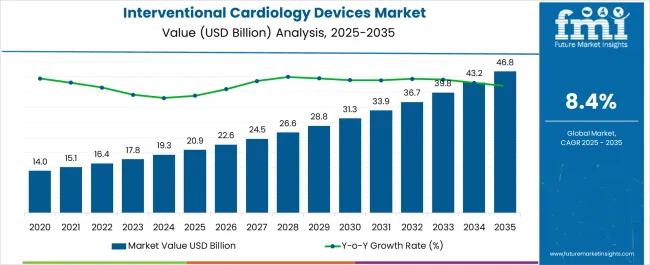

The Interventional Cardiology Devices Market is estimated to be valued at USD 20.9 billion in 2025 and is projected to reach USD 46.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| Interventional Cardiology Devices Market Estimated Value in (2025 E) | USD 20.9 billion |

| Interventional Cardiology Devices Market Forecast Value in (2035 F) | USD 46.8 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The interventional cardiology devices market is witnessing steady growth, driven by rising prevalence of cardiovascular diseases, advancements in minimally invasive procedures, and increasing adoption of novel device technologies. Growing awareness about early diagnosis and treatment options, coupled with favorable reimbursement policies, has facilitated widespread use of interventional devices in both developed and emerging markets.

Technological innovations, including enhanced balloon catheters and drug-eluting systems, are improving clinical outcomes and reducing procedure times, thus encouraging adoption by healthcare providers. Increasing investment in healthcare infrastructure and growing patient preference for less invasive treatment alternatives further support market expansion.

Future growth is expected to be propelled by ongoing research, expanding applications in complex cardiovascular conditions, and evolving regulatory frameworks emphasizing patient safety and efficacy..

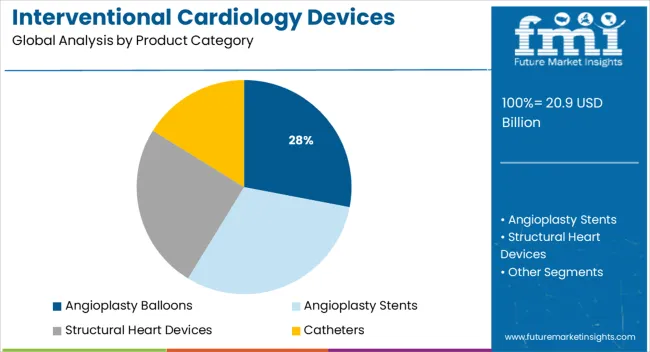

The market is segmented by Product Category and region. By Product Category, the market is divided into Angioplasty Balloons, Angioplasty Stents, Structural Heart Devices, Catheters, Plaque Modification Devices, Hemodynamic Flow Alteration Devices, and Other Devices. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Angioplasty balloons are projected to hold 28.0% of the total revenue share in the interventional cardiology devices market in 2025, making them the leading product category. This segment’s growth is driven by its critical role in percutaneous coronary interventions (PCI) aimed at treating arterial blockages.

Advances in balloon catheter materials and design, such as improved flexibility, trackability, and inflation precision, have enhanced procedural safety and effectiveness. The segment benefits from broad clinical acceptance as a first-line treatment for coronary artery disease, supported by continuous improvements in balloon technology to address restenosis and complex lesions.

Moreover, the ability to deliver drug-coated balloons that reduce tissue proliferation without leaving permanent implants has positioned this category as a preferred option for various patient groups. Ongoing innovation and growing procedural volumes continue to underpin the segment’s leading market position..

According to the American Heart Association, by 2035, around 45% of the USA population is likely to suffer from heart disease due to factors like high obesity, high smoking, and unhealthy lifestyles, which may lead to heart attacks and other related issues.

In the USA alone, 1.5 million Americans are diagnosed with diabetes each year. Growth in diabetes prevalence can largely be attributed to the growth in the geriatric population; it is estimated that 25% of all geriatric individuals (aged 60 years and above) suffer from diabetes in the US (Source: ADA)

The presence of sophisticated healthcare infrastructure, favorable government product development initiatives, and high patient awareness levels are some of the key drivers for the interventional cardiology devices market growth in the region. Moreover, strategic initiatives by key players have also fueled market growth.

For instance, in June 2024, Abbott received the USA Food and Drug Administration’s approval for its XIENCE family of stents for its one-month dual-antiplatelet therapy (DAPT) labeled for high bleeding risk (HBR) patients in the USA.

Similarly, in March 2024, the USA Food and Drug Administration approved the first in the world non-surgical heart valve to treat pediatric and adult patients with a native or surgically repaired right ventricular outflow tract (RVOT), the part of the heart that carries blood out of the right ventricle to the lungs.

Manufacturers are working hard for research and development of innovative offerings to serve a large customer base and that will allow the interventional cardiology devices market to grow.

Hence, manufacturers are adopting strategies such as mergers & acquisitions to expand their global footprint and add disruptive packaging advancements to their product portfolio. Further, a number of international market participants are entering into acquisitions and mergers and implementing new technology to increase commercial capacity to gain a major revenue share.

For instance, in July 2024, Abbott launched its XIENCE family of stents, which received the US Food and Drug Administration’s (FDA) approval for one-month DAPT labeling for high-bleeding risk (HBR) patients in the USA. In addition, XIENCE stents recently received the CE Mark approval for DAPT in 28 days, thus, ensuring XIENCE stents have the shortest DAPT indication in the world.

The interventional cardiology devices market is expected to be valued at USD 20.9 Billion in 2025 and is likely to reach USD 46.8 Billion by 2035.

The trajectory of interventional cardiology device adoption trends is on the rise owing to the numerous advantages associated with minimally invasive surgeries, such as reduced surgical pain, injury, and faster recovery time when compared to conventional surgeries, thereby proving to be a viable alternative to open surgery.

In addition, the interventional cardiology devices market is growing due to technological advancements in the areas of vascular closure devices, coronary guidewires, and drug-eluting stents, which increase the efficiency of interventional cardiology devices.

Diabetes and hypertension are primary risk factors that drive the demand for interventional cardiology devices.

Diabetes is more likely to be associated with other conditions that increase the risk of coronary heart disease, and high blood sugar levels can damage the blood vessels that control the heart over time, thereby spiking the sales of interventional cardiology devices.

The adoption of interventional cardiology devices is on the surge as diabetes prevalence is increasing due to an increase in the geriatric population; it is estimated that 25% of all geriatric individuals (aged 60 and above) in the USA have diabetes.

In addition, cardiology medical devices can be used to treat a variety of heart and artery problems, encouraging people from around the world to opt for the same.

Technological advancements have greatly boosted the interventional cardiology devices market share.

The rapid growth of the healthcare industry in developing countries has a positive impact on the interventional cardiology devices market growth, and the rising demand for minimally invasive treatment are the major factors fostering the interventional cardiology devices market key trends & opportunities.

One of the vital factors propelling the interventional cardiology devices market opportunities is advancements in developing-country healthcare facilities.

Favorable government initiatives for product development, as well as high patient awareness levels, augur well for the interventional cardiology devices market outlook.

There are cardiology medical device companies competing to launch advanced products for better treatment and have invested in research and development to improve their existing products and launch new platforms, and the same has facilitated the interventional cardiology devices market trends and forecasts.

However, a stringent regulatory environment and a lack of effective first-line treatments limit the interventional cardiology devices market growth.

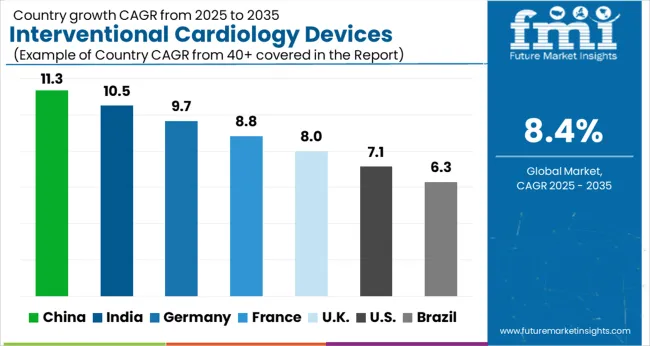

| Regions | CAGR (2025 to 2035) |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

| USA | 7.1% |

| Brazil | 6.3% |

The US interventional cardiology devices market is likely to lead the market globally with a CAGR of 8.2% during the forecast period.

The presence of sophisticated healthcare infrastructure, favorable government product development initiatives, and high patient awareness levels are some of the key drivers for the interventional cardiology devices market growth in the region.

The US has a high consumption rate of premium-priced interventional cardiology devices, and it is the region that can accommodate a high rate of medical device innovation, thus holding a large interventional cardiology devices market share globally.

Relatively high healthcare expenditures in the region are also considered a vital factor in opening up a wide array of interventional cardiology device market opportunities in the region.

A few of the region's key cardiology medical device companies are developing novel products and technologies to compete with existing products, while others are acquiring and partnering with other companies trending in the market.

The UK is projected to hold the second-largest interventional cardiology devices market share on account of rising obesity rates and changing lifestyle habits such as dietary irregularities, and an increasing number of global smokers driving the rise in cardiovascular disease prevalence.

The expansion of these products in this region is also dependent on the reimbursement policies established by other individual European countries.

The interventional cardiology devices market growth in China, Japan, and South Korea is primarily due to the rising prevalence of cardiovascular disorders in both the geriatric and pediatric populations, rising awareness about the cost-effectiveness and convenience offered by cardiology medical devices, and rising healthcare expenditure levels.

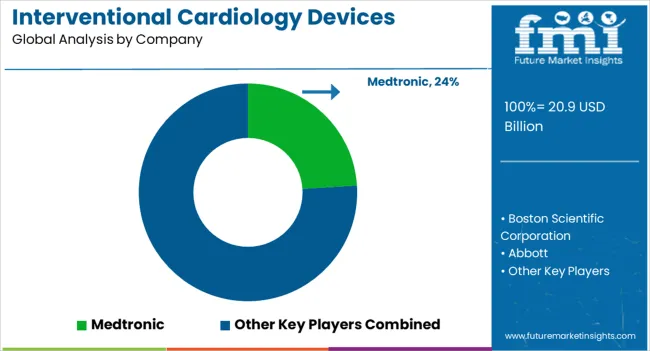

The market for interventional cardiology devices is moderately competitive.

To secure their position in the global competitive market, various cardiology device companies are implementing strategies such as investment in Research and Development activities, forming alliances such as acquisitions and collaborations, and new product launches.

Key market players are attempting to gain a competitive advantage by capitalizing on untapped opportunities thereby enlarging their interventional cardiology devices market share.

Some of the recent developments in the interventional cardiology devices market are as follows:

The global interventional cardiology devices market is estimated to be valued at USD 20.9 billion in 2025.

The market size for the interventional cardiology devices market is projected to reach USD 46.8 billion by 2035.

The interventional cardiology devices market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in interventional cardiology devices market are angioplasty balloons, _old/normal balloons, _drug-eluting balloons, _cutting and scoring balloons, angioplasty stents, _drug-eluting stents, _bare-metal stents, _bioabsorbable stents, structural heart devices, _aortic valve therapy devices, _other therapy devices, catheters, _angiography catheters, _guiding catheters, _ivus/oct catheters, plaque modification devices, _atherectomy devices, _thrombectomy devices, hemodynamic flow alteration devices, _embolic protection devices, _chronic total occlusion devices, other devices, _guidewires, _vascular closure devices, _introducer sheaths, _hemostasis valves and _balloon inflation devices.

In terms of , segment to command 0.0% share in the interventional cardiology devices market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Interventional Radiology Product Market Size and Share Forecast Outlook 2025 to 2035

Interventional X - ray Systems Market Size and Share Forecast Outlook 2025 to 2035

Interventional Radiology Market Growth - Trends & Forecast 2025 to 2035

Neurointerventional Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nonvascular Interventional Radiology Device Market Trends – Growth & Forecast 2024-2034

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiology PACS Market

Portable Cardiology Ultrasound Systems Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Casts and Splints Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA