The vascular closure devices (VCDs) market continues to show growth as hospitals and surgical centers are starting to choose these devices over traditional compression methods. The preference of surgeons and interventional cardiologists for VCDs is due to the minimized procedure time, improved patient recovery, and the reduction of complications.

Manufacturers are creating next-generation closure devices which are biodegradable and which will improve patient's safety and post-procedure outcomes. The increasing number of cardiovascular diseases, the old population, and the requirement for better healthcare services are the main causes for the growth of VCDs.

The approval of new products and continuous product improvements are the two major factors making the market expansion strong. In North America, revenues from surgeries are high, while the healthcare system is advanced, and this is why it is the leader in the market.

However, Asia-Pacific is experiencing the quickest development of technologies that make it easier to treat heart diseases, as well as better knowledge of diseases. The development of the R&D sector and the trend of applying less invasive techniques will further enhance the adoption of the VCD devices and thus, VCD will become a major part of interventional cardiology.

The North American vascular closure devices market is being developed with the help of major medical device manufacturers, hospitals, and healthcare providers who are initiating the adoption of catheter-based interventions and at the same time are addressing the growing peripheral vascular diseases.

The USAA. was in the leading position traditionally, as it is well-equipped with healthcare facilities that are always in need of fast and effective vascular access closure complications and support with the use and FDA approvals for new bioabsorbable designs. On the contrary, factors like high procedural costs, rigor reimbursement policies, and device-related problems present obstacles to the market's growth.

Medical institutions and technology firms are at the forefront of innovation with the integration of AI-powered vascular imaging, the advancement of same-day discharge protocols for catheterization procedures, and the reinforcement of collaborations between hospitals and med-tech companies.

These improvements in efficiency and patient care will allow the North American vascular closure devices market to progress and consequently become a pioneer in interventional cardiology and vascular access management

Fostering investments in interventional cardiology and progressing towards the adoption of less invasive procedures, vascular closure devices market in Europe is being propelled by healthcare providers, regulatory bodies and medical device manufacturers. The introduction of advanced closure technologies and strong regulatory frameworks has support medical device innovation.

Germany, France, and the UK are the front runners in this sector, Cardiovascular treatment settings are actively using suture-based and bioabsorbable passive devices to have femoral access. Hospitals settings in collaboration with the governments offering patient safety initiatives in catheterization procedures.

The market growth is also hindered by complicated MDR regulations, expensive next-generation closure devices and the slow embracing of bioresorbable technologies in public healthcare institutions.

The key players and the research institutes spur the growth by integrating hybrid closure systems and cardiovascular management systems. The demand for disposable vascular closure devices and low-profile closure techniques that are modern in the industry to avoid complications in the patient's healing process have made Europe a top spot for the vascular closure innovation drive.

The Asia-Pacific region is currently enjoying a flourishing market for vascular closure devices due to investments in healthcare infrastructure, increased incidences of cardiovascular diseases, and mandated rise in demand for economical closure products.

Catheter-based interventions that are now widely available, government support with regard to cardiac care that is on the rise, along with increased interest in and the demand for less invasive closure products are the key aspects of the potential growth markets in countries like China, Japan, and India.

However, barriers like the inability to afford the costs, lack of formal vascular closure training, and delayed regulatory approval of new closure technologies can slow down the market entry. Moreover, merging technology such as self-expanding closure device and exploration of hybrid vascular heat-sealing technologies are augmenting procedural efficacy and patient comfort in the region.

Challenges

The vascular closure devices market encounters difficulties that include steep expenses for the latest closure technologies, the probability of vascular complications like hematomas and pseudo-aneurysms, and the legal barriers hindering the introduction of new materials for the closure.

The necessity for the better training of vascular access management, the complications of the closure devices being compatible with different sheath sizes, and the unequal adoption of technology between high-tech and low-infrastructure hospitals that are additional barriers to the market growth.

Furthermore, the problems in obtaining the proper closure for large access vessels, the high costs to incorporate the closure system in the outpatient procedure and the reluctance to shift from manual compression to device-based closure, hinder the growth of the market.

Opportunities

The deployment of hybrid vascular closure systems serves as a breakthrough marketing strategy for the industry as it directly deals with the drawbacks of the presently available closure devices. Hybrid systems composed of suture-based components, collagen plugs, and bioresorbable materials have several advantages compared to the standalone suture-based or standalone collagen plug polymer.

They are more versatile, faster to stop the bleeding, and have fewer complications. While hospitals and ambulatory surgical centers are looking for cost-efficient and effective closure devices, hybrid apparatuses have the advantage due to the fact that they can fit different arterial access sizes and also can treat high-risk patient groups.

The producers of medical devices as well as the governing bodies in health care are coming to the realization of this multi-component system's advantages, which in turn encourages their use in interventional cardiology and peripheral vascular procedures.

Moreover, the continuous clinical trials and technological progress are the key factors of an ongoing development in hybrid closure technology. By becoming a universal solution, hybrid closure technologies can not only reduce the complications after the procedures but also lead to better vascular access management.

Between 2020 and 2024, the vascular closure devices (VCDs) market showed an upward trend as a result of the increased popularity of catheter-based operations and the need for effective hemostasis solutions. Preferred by hospitals and ambulatory surgical centers VCDs instead of manual compression, thereby reducing both patient recovery time and procedure duration.

The introduction of technological innovations such as biodegradable and active closure devices, which rendered surgical procedures safer and more effective, was a breakthrough. The regulatory challenges and high cost have caused the adoption of biodegradable less in the emerging markets.

North America was the major player thanks to the amount of surgical procedures, while Asia-Pacific registered the most dynamic growth due to the increased interest of the public and the healthcare improvements. Although the pandemic slowed down the process at first, the market began to flourish as more patients sought interventional treatment.

Between 2025 and 2035, The market will be heading towards artificial intelligence-based vascular access management, bioresorbable materials and hybrid closure systems using suture, collagen and polymer technologies. Drug-eluting and nanotechnology-based VCDs will reduce infection risks and vascular inflammation.

As same-day discharge protocols increase, there will be a need for simple, cheap, and effective closure devices. Manufacturers will go to the smart, data-driven solutions by making stricter regulatory oversight and real-time monitoring.

Ethical sourcing, sustainability, and supply chain efficiency will gain importance, thus will lead to a more affordable and fairer product. Aging population and the prevalence rate of cardiovascular cases will render the VCD market to be in a constant boost, with countless breakthroughs.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Adoption of regulations that will ensure the efficacy and safety of vascular closure devices, resulting in standard operating protocols and usage directives |

| Technological Advancements | Introduction of new-generation VCDs with better efficacy and safety profiles, improving patient outcomes and decreasing recovery times |

| Consumer Demand | Greater familiarity with and acceptance of VCDs, resulting in greater demand in many healthcare environments, especially for minimally invasive medical procedures |

| Market Growth Drivers | Increase in cardiovascular disease prevalence, technology innovations in VCD technologies, and a trend towards cost-effective and efficient vascular closure solutions |

| Sustainability | First attempts at eco-friendly production processes and the evolution of VCDs with lower environmental footprints. |

| Supply Chain Dynamics | Reliance on expert suppliers of device components, with attempts at localizing manufacturing to avoid supply chain interruptions witnessed in international events. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Ongoing oversight and potential modifications of guidelines to balance the patient safety advantage against technological advance, coupled with enhanced quality evaluation measures to maximize product performance |

| Technological Advancements | Creation of next-generation VCDs with better portability, easy-to-use interfaces, and compatibility with artificial intelligence for customized vascular closure solutions |

| Consumer Demand | Increase in the demand for integrated VCDs and patient-focused care, fuelled by advances in device technologies and concerns for patient safety and cost efficiency in operations |

| Market Growth Drivers | Development of healthcare infrastructure in emerging markets, growth in healthcare spending, and ongoing technological advancements that boost procedural efficiency and patient outcomes |

| Sustainability | Embracing green practices in manufacturing and distribution, such as the utilization of recyclable materials and energy-saving processes, conforming to international environmental standards |

| Supply Chain Dynamics | Local manufacturing capabilities are being improved through technology development and collaborative partnerships, and as a result, the dependence on imports has decreased and the supply chain has become more robust. |

The vascular closure devices market is expected to grow over the forecast period, fuelled by advancements in vascular technology, increasing use of these devices in catheterization labs and outpatient settings, and a move towards patient-centric care. Manufacturers need to prioritize innovation, adherence to changing regulations, and measures to make it more affordable and accessible to take advantage of future opportunities in this dynamic market.

Market Outlook

The United States holds the largest share in the vascular closure devices (VCDs) market due to high procedure volumes, robust hospital infrastructure, and quick adoption of sophisticated closure technologies. VCDs are favoured by healthcare providers over manual compression due to quicker recovery and fewer complications. The availability of top medical device firms and FDA approvals for newer-generation devices are fuelling the market growth

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.0% |

Market Outlook

The European vascular closure devices market is primarily ruled by Germany because of its strict regulatory compliance, developed hospital infrastructures, and the extensive use of minimally invasive procedures.

Cardiovascular interventions are being performed with the help of hospitals now using bioresorbable closure devices as well as the continuation of product innovation driven by government-sponsored research programs. The use of hybrid closure systems is on the rise in the high-tech medical sector of Germany, especially at the high-tech medical facilities.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.2% |

Market Outlook

Japan's vascular closure device market is growing fast due to technological advancement, the high rate of minimally invasive procedures, and healthcare practices centered on precision. Medical facilities employ AI-powered closure devices for enhancing vascular access management. Japan's growing geriatric population and increasing burden of cardiovascular diseases are speeding up the demand for more efficient and safe VCDs.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

Market Outlook

China's market for vascular closure devices is on the rise due to rising health care access, growing interventional cardiology, and significant healthcare investments by the government. Key local medical device companies are working on low-cost, high-performance VCDs, as urbanization and increasing cases of heart disease keep vascular interventions and closing solutions in the demand limelight.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.3% |

Market Outlook

The Indian market for vascular closure devices is having a really strong development rate because of the increase in the number of cardiovascular disease cases, the rise of Catherization lab procedures, and the better quality offered by the health facilities.

Government-funded health programs alongside the growing private sector investments are facilitating the supply of vascular closure devices that are affordable to the mass population, while Tier 1 medical centers are specializing in advanced minimally invasive procedures.

Market Growth Factors

Increasing demand for Suture-Based and Minimally Invasive Hemostasis Systems driving Active Vascular Closure Devices

Active vascular closure devices are designed to offer instant hemostasis post catheterization procedures via either mechanical, suture-based, or collagen-based technologies. VCDs result in reduced recovery times, fewer complications, and better mobility for patients after the procedure.

The interventional cardiology and peripheral vascular interventions boom, the change of trend towards close to no invasive hemostasis for patients and usage of suture-based closure systems are the main drivers for growth in the market. North America and Europe dominate active VCD adoption due to the presence of cardiovascular care centers, while Asia-Pacific is expanding due to the increase in catheterization lab investments.

Passive Vascular Closure Devices are Affordable Haemostasis Solutions for Outpatient and Radial Access Procedures

Passive VCDs utilize external compression, gel-type sealants, or manual compression devices to ensure hemostasis after arterial access procedures. Passive VCDs are used as the first option in low-risk patients and scenarios where cost-saving is a focus.

The expanding demand for cost-effective alternatives for active closure devices, expanding adoption in outpatient sites, and enhancing trend towards radial artery access procedures are driving the growth of the market.

North America and Europe lead in passive VCD use as a result of robust uptake of radial closure methods, whereas Asia-Pacific is observing increased demand as interventional cardiology grows. Future developments are headed towards more sophisticated hemostatic agents for greater closure, intelligent compression devices with real-time pressure feedback, and AI-driven vascular access site management systems

Rising Cardiovascular Cases and Technological Innovations Fuelling Growth in Hospitals and Catheterization Labs

Hospitals and Catherization labs are the major customers of vascular closure devices, as they perform high volumes of percutaneous coronary intervention (PCI), angioplasty, and diagnostic catheterization procedures. These centres reap the benefits of sophisticated closure technologies that minimize hospital stays, improve patient outcomes, and decrease post-procedure bleeding risks.

The growing incidence of cardiovascular diseases, increasing volume of catheter-based procedures, and expanding need for effective haemostasis solutions are fueling market demand.

North America and Europe are the leaders in hospital-based adoption because of robust reimbursement policies, whereas Asia-Pacific is witnessing growth because of increasing healthcare infrastructure. Future developments involve robot-assisted vascular closure and integrated closure devices with automated sealing systems.

Ambulatory Surgical Centers are Expanding Outpatient Cardiovascular Procedures and Demand for Fast, Cost-Effective Closure Solutions

ASCs are turning out to be the primary adopters of vascular closure devices, especially for same-day peripheral vascular and angiographic interventions. They appreciate portable and simple-to-use closure systems for quicker patient discharge and enhanced efficiency in workflow.

The increasing tendency towards outpatient vascular procedures, improving availability of miniature closure devices, and heightened concern for cost-saving healthcare solutions are driving market growth. North America and Europe lead in ASC-based vascular closure uptake because of good regulatory support, whereas Asia-Pacific is witnessing growing demand with an increase in outpatient cardiovascular services.

Future directions include miniaturized vascular closure systems for ASC procedures, patient recovery tracking, and bioresorbable closure technology for improved patient comfort.

The market for vascular closure devices is competitive, with the rising number of minimally invasive cardiovascular procedures, the evolution of hemostasis technologies, and the increased use of femoral artery closure solutions. Bioabsorbable closure systems, suture-based devices, and fast hemostasis solutions are being invested in by companies to stay competitive.

The market is influenced by established medical device companies, cardiovascular solution providers, and new interventional technology companies, all of which contribute to the changing landscape of vascular closure systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Abbott Laboratories | 15-20% |

| Terumo Corporation | 12-15% |

| Medtronic Plc | 8-12% |

| Teleflex Incorporated | 8-10% |

| Johnson & Johnson | 5-9% |

| Other Companies (combined) | 52-34% |

| Company Name | Key Offerings/Activities |

|---|---|

| Abbott Laboratories | Market leader offering Perclose ProGlide and StarClose SE suture-based and clip-mediated closure systems. |

| Terumo Corporation | Develops Angio-Seal vascular closure devices designed for rapid hemostasis and patient comfort. |

| Medtronic Plc | Specializes in VenaSeal™ Closure System with vascular closure technology. |

| Teleflex Incorporated | Provides MANTA large-bore vascular closure systems optimized for structural heart and endovascular procedures. |

| Johnson & Johnson | Focuses on EXOSEAL™ Vascular Closure Device and aims to maintain a diverse and innovative product portfolio to meet the changing needs of cardiovascular healthcare professionals and patients |

Key Company Insights

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

These companies focus on expanding the reach of vascular closure solutions, offering competitive pricing and cutting-edge innovations to meet diverse interventional cardiology and radiology needs.

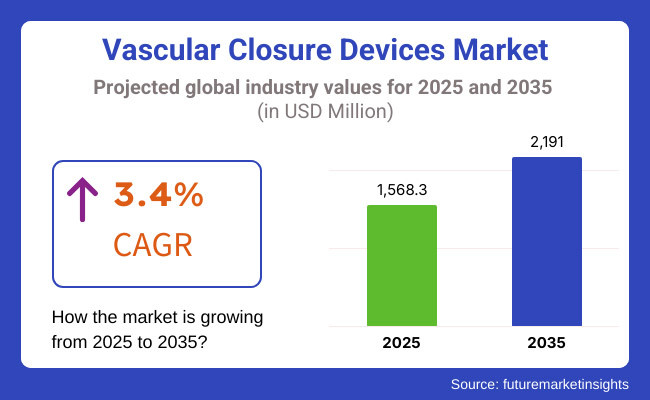

The global Vascular Closure Devices industry is projected to witness CAGR of 3.4% between 2025 and 2035.

The global Vascular Closure Devices industry stood at USD 1,503.1 million in 2024.

The global Vascular Closure Devices industry is anticipated to reach USD 2,191.0 million by 2035 end.

China is expected to show a CAGR of 8.2% in the assessment period.

The key players operating in the global Vascular Closure Devices industry are Teleflex Incorporated, Abbott, Johnson & Johnson, Merit Medical Systems, Medtronic plc, Terumo Medical Corporation, TZ Medical, Inc., Forge Medical, Transluminal Technologies, LLC, VENOCK INC / VENOCK MEDICAL GMBH, Vascular Perspectives, Changzhou Weiyuan Medical Device Co., Ltd., Beijing Demax Technology Co. Ltd., Lepu Medical Technology(Beijing)Co.,Ltd. and Mediterra.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vascular Testing Devices Market

Heart Closure Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Devices Market Size and Share Forecast Outlook 2025 to 2035

Endovascular Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Surgical Devices Market Size and Share Forecast Outlook 2025 to 2035

Peripheral Vascular Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Prosthetic Devices Market Size and Share Forecast Outlook 2025 to 2035

Transradial Closure Devices Market Size and Share Forecast Outlook 2025 to 2035

Cranial Closure And Fixation Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Repair & Reconstruction Devices Market – Growth & Trends 2025 to 2035

Demand for Cardiovascular Repair & Reconstruction Devices in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Cardiovascular Repair & Reconstruction Devices in Japan Size and Share Forecast Outlook 2025 to 2035

Vascular Sheath Group Market Size and Share Forecast Outlook 2025 to 2035

Vascular Patches Market Forecast and Outlook 2025 to 2035

Vascular Access System Market Size and Share Forecast Outlook 2025 to 2035

Vascular Parkinsonism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vascular Boot Market Trends and Forecast 2025 to 2035

The Vascular Ulcer Treatment Market Is Segmented by Ulcer Type, Treatment and Distribution Channel from 2025 To 2035

Vascular Dementia Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel, and Region through 2035

Vascular Imaging Systems Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA