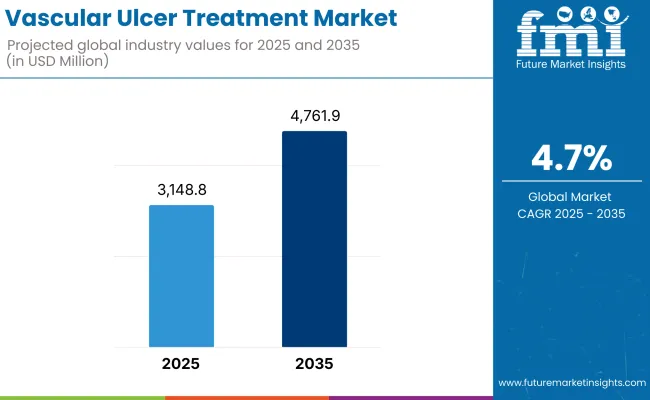

The Vascular Ulcer Treatment Market is expected to reach approximately USD 3,148.8 million in 2025 and expand to around USD 4,761.9 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.7% over the forecast period.

The rising prevalence of chronic wounds that are due to diabetes, geriatric population, and venous insufficiency has led to steady to moderate growth in the vascular ulcer treatment market from 2025 to 2035. Managing vascular ulcers (venous leg ulcer, arterial ulcers, and mixed-etiologies) is still a great challenge in wounds because of long healing times, infections, and recurrences.

Developing awareness of advanced wound care globally, coupled with invention of new possibilities in the dressing aid, compression therapy, debridement techniques, and biologics are changing the treatment protocols. Major factors contributing to growth include the increase in home healthcare service adoption and rising hospitalization due to peripheral vascular diseases, and adoption of multidisciplinary wound care programs.

Key Market Metrics

| Metric | Value (USD Million ) |

|---|---|

| Industry Size (2025E) | USD 3,148.8 million |

| Industry Value (2035F) | USD 4,761.9 Million |

| CAGR (2025 to 2035) | 4.7% |

The global vascular ulcer treatment market has been growing a modest yet steady pace over the years, which has been in tandem with the ever-increasing prevalence of chronic diseases such as diabetes, peripheral artery disease (PAD), and venous insufficiency.

The traditional wound care products still had the market edge, however, it is slowly shifting towards advanced wound care products including hydrocolloid dressings, negative pressure wound therapy (NPWT), and biologics. The evolution of the market offers a hint of an increasing emphasis on personalized and evidence-based treatment, resulting in the creation of products directed towards enhancing healing times and decreasing recurrence rates.

Rising healthcare expenditure in emerging economies, increased awareness and enhanced diagnostic capabilities have also bolstered the market growth, and the adoption of advanced therapies is expected to become the standard of care (SOC) for managing vascular ulcers.

The vascular ulcers treatment market share is highest for North America due to rising prevalence of diabetes, obesity, and chronic venous disorders. The advanced wound-care infrastructure in the USA is evidenced by the common implementation of evidence-based protocols and strong reimbursement for compression therapy, dressings, and adjunctive treatments such as negative pressure wound therapy (NPWT).

Attention has been shifted to outpatient wound clinics and home-based wound management in an effort to increasing accessibility to care. An investment is also being made in chronic wound care pathways for Canada along with provincial programs supporting earlier intervention and multidisciplinary care. Adoption of AI-powered wound imaging tools and point-of-care diagnostics is also on the rise across the region.

Europe is another well-developed market for the treatment of vascular ulcers, as Europe is home to universal healthcare systems, condensed wound care protocols, and an aging population. Compression therapy, autolytic debridement, and advanced wound dressings are prevalent in Germany, the UK, France, and the Netherlands.

The region discourages high-cost wound care practices and favors integrated care models that minimize readmission rates. Specialized field nurses, local community outreach programs, and digital platforms for monitoring wounds are becoming increasingly popular. Despite uneven access to care and procurement, Europe is projected to consistently grow, as chronic diseases management and limb preservation receive increasing focus from regulatory policies.

High growth potential for the Asia-Pacific region spanning from increasing incidence of chronic diseases, improved healthcare infrastructure, and the growing awareness of wound care solutions. Countries, such as China and India, are burdened with an emerging epidemic in the form of dramatic rises in diabetic foot ulcers and vascular complications, especially due to urbanization, sedentary lifestyles and poor glycemic controls.

Japan and South Korea are pouring money into wound care innovation and elderly care infrastructure. Wound clinics, mobile health care services, and telemedicine are improving access in the sticks. The market growth in the next decade will be driven by government support of chronic disease prevention and partnerships with global wound care manufacturers.

The Vascular Ulcer Treatment Market Growth Is Restrained by High Treatment Costs and Limited Specialist Access

The vascular ulcer treatment market is challenged by inconsistent adherence to strict clinical guidelines, delayed diagnosis, and insufficient training among GPs and nurses. Clinical outcomes for venous ulcer disease are reliant on patient adherence with treatment, particularly with compression therapy.

Biologics, skin substitutes, and advanced devices are costly and may be limited in cost-sensitive settings. Wound recurrence and infection continue to be major burdens, frequently necessitating multiple interventions. Moreover, divergent reimbursement policies and absence of shared outcomes further complicate health system preparations and resource distribution. Addressing these challenges will require investment in clinical education, integrated wound care models, and scalable technologies.

Rising Emphasis On Early Diagnosis and Home-Based Wound Management Systems Opens New Avenues for Reducing Hospitalization

At the same time there are still tremendous opportunities for innovation in the next generation of wound care products including antimicrobial dressings, bioengineered skin grafts, growth factor therapies, and stem-cell based approaches. Emerging mobile health applications and smart wound monitoring systems allow for real-time evaluation and personalized treatment plans. Wearable compression systems and digital adherence trackers enhance therapy compliance.

Home-based wound care services and nurse-led clinics provide scalable solutions to rising demand. Machine learning and predictive analytics also help improve predictions of wound healing and with early detection of complications. Companies willing to invest in packaged therapy platforms, patient education, and outcome-based reimbursement models will have a solid footing for sustainable growth.

Bioactive Dressings and Skin Substitutes

Bioactive dressings and skin substitutes are actually emerging as instruments in the sophisticated management of hard vascular ulcers, especially those which are poorly healing in diabetic patients. Collagen-based dressings promote the migration of cells and their regeneration, providing an optimal environment for closure of the wound. Hydrocolloids act to convert conditions within the wound space to favour moist healing and autolytic debridement while shielding it from external contaminants.

Bioengineered skin substitutes include living cells or growth factor enriched matrices to give a construction that mimics natural skin architecture and subsequently stimulate the repair mechanisms of the body itself. Such therapies are of great benefit for chronic or non-healing ulcers as such cases appear to be unresponsive to usual treatment. In fact, as supporting clinical evidence for their efficacy proliferates, increasing numbers of these biologically active solutions are being adopted as part of vascular ulcer care, offering effective outcomes, shorter healing time, and fewer recurrence rates.

Compression Therapy Innovation

Compression therapy is the mainstay of the treatment of venous leg ulcers, and the recent innovations in compression are greatly enhancing both its clinical effectiveness and patient compliance. The present-day compression systems have introduced user-friendliness devices namely adjustable wraps and digitally controlled wearable pumps, which make application easy and ensure constant pressure levels.

Such advances will benefit the elderly patients who, regardless of their conditions, usually cannot cope with the complexities of the traditional multi-layer bandaging because of restricted mobility and reduced dexterity. More comfort, convenience, and wear ability will furthermore promote better adherence to treatment protocols, which is an important factor in ensuring optimal healing outcomes.

While the global market for vascular ulcer treatment has steadily increased between 2020 and 2024 due to rising cases of chronic diseases such as diabetes and peripheral artery disease, which are considered among the major causative factors for vascular ulcers, this phase of growth was also spurred on with innovations in dressings, compression therapies, skin-grafting products, etc., all of which played a part in improving the outcome of our patients.

High treatment costs, lack of access to specialized care, and the complexities of chronic wound management in the healthcare system have hampered the wider uptake of the technology in certain regions.

The forward-looking market for the period 2025 to 2035 is postulated to follow the existing growth path, with innovations flowing into wound management, investments being made in healthcare infrastructure, and increased emphasis being placed on early intervention and preventive care serving as the retaining factors for growth.

Novel therapies such as bioengineered skin substitutes and regenerative technologies are expected to work toward faster healing. The other probable enabler of the long-term growth of the market would be increased access to healthcare and rising awareness of vascular health.

| Market Aspect | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Implementation of guidelines assuring safety and efficacy in vascular ulcers treatment, thereby standardizing protocols and increasing scrutiny in this sector. |

| Technological Advancements | Advanced wound-care products such as hydrocolloid and foam dressings, with better compression therapy devices, have been introduced to improve patient comfort and healing prospects. |

| Consumer Demand | Enhanced use of the advanced wound care solution by health-care professionals and patients for the effective management of chronic wounds and for improved living conditions. |

| Market Growth Drivers | In rising diabetes and peripheral artery diseases, technological development in wound care, and an operational shift aimed at improving patient outcomes and shortening hospital days. |

| Sustainability | The first stride toward integrating environmentally sound practices in the design and production of medical devices, using environmentally safe materials and energy-saving production processes. |

| Supply Chain Dynamics | Concentration of production and supply on specialized suppliers to provide premium-rated wound care products and materials, and the search for a localization production culture to quell the supply chain disruptions experienced during world events. |

| Market Aspect | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Continuous regulatory monitoring and possible harmonization across countries so as to weigh patient safety against technological progress with the fast-tracking of approvals for new therapies for unmet medical needs. |

| Technological Advancements | The development of bioengineered skin substitutes, regenerative medicines, and smart dressings equipped with sensors that observe wound healing in real-time so as to improve treatment efficacy and patient compliance. |

| Consumer Demand | Growing patient choice for personalized and minimally invasive treatment options has, thus, influenced its broad acceptance across various populations of patients as a result of the advancements in medical technology and a firm focus on patient-centered care. |

| Market Growth Drivers | Expansion of health services in the developing world, increasing investment into research and development, ceaseless technological innovations improving treatment efficacy, and a global focus on prevention and early interventions to manage vascular health. |

| Sustainability | Environmentally friendly manufacturing processes and biodegradable wound care product lines would address global sustainability efforts and mitigate medicine's environmental impact. |

| Supply Chain Dynamics | Strengthening the local manufacturing capabilities through technology and partnership-based initiatives has led to lesser dependency on imports, greater resilience in supply chain management, and a quicker response to the emerging patient needs in vascular ulcer treatment. |

Market Outlook

This market constitutes mature and innovation-driven market for venous ulcer treatment with sophisticated healthcare infrastructure, better awareness, and the presence of significant industry players in the U.S. The increasing incidence of obesity, diabetes, and peripheral vascular diseases have.

The evolving reimbursement landscape and rising use of home-based care as well as telemedicine to treat chronic wounds will bolster the market's growth. The USA has also established itself as a major center of R&D for new wound healing technologies for the commercialization of next-generation solutions. But rural or uninsured populations still face cost and access disparities related to treatment.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

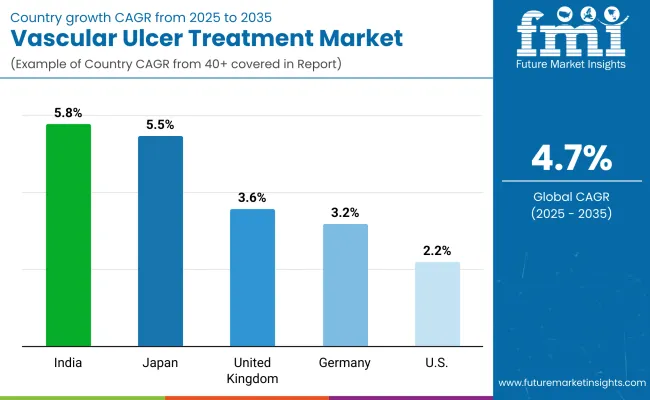

| United States | 2.2 % |

Market Outlook

Germany is a leading market in Europe for venous ulcer treatment, supported by a play of a strong public healthcare system, early diagnosis protocols, and access to advanced wound care services. The growing cases of chronic venous insufficiency and related ulcers are also primarily driven by high disease burden among the aging population and rising diabetes rates.

A well-established reimbursement system promotes a high adoption rate of advanced therapies including compression systems, antimicrobial dressings, and skin substitutes within this country. Strong uptake of clinically validated solutions in Germany, owing to a background of evidence-based practice in addition to rigorous clinical guidelines. Adoption of innovative approaches is relatively high, although disparities by region in access to specialist care remain a concern.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.2 % |

Market Outlook

With a large population of elderly patients, venous leg ulcers in the UK have a considerable chronic wound care burden, creating a attractive opportunity within chronic wound care. In the UK, the National Health Service (NHS) has championed the standardization of wound care and the provision of community-based treatment pathways, expanding patient access to innovative dressings and compression treatments.

Government-supported initiatives that encourage early diagnosis, prevention, and primary care-led management have aided market maturity. Other innovative treatment modalities are possible through academic collaborations and wound healing research.

However, economic restrictions within the National Health Service (NHS) and some regional disparities in procurement practices may hamper the universal adoption of premium therapies, especially bioengineered and regenerative products for wound care.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.6 % |

Market Outlook

Rising geriatric population and increased incidence of chronic vascular diseases are the major factors fueling the growth of Japan venous ulcer treatment market. This nation has led the way in lots of innovations within the wound care space, including hydrocolloid dressings, skin substitutes, and NPWT devices designed especially for the home setting. America's healthcare system focuses on patient-centered and preventive care, which facilitates early intervention approaches for chronic wounds.

In Japan, this is reflected in: The integration of digital health and smart wound-monitoring technologies into rebuilding patient treatment, mainly in-line with the government’s emphasis on reducing hospital readmissions. However, cultural aversion to invasive procedures and a relatively slow uptake of Western biologics may moderate the growth of regenerative therapies in the near term.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.5 % |

Market Outlook

India is a high-growth, underpenetrated market with rising awareness, increasing diabetes prevalence and greater access to modern wound care products in urban centers driving the segment of venous ulcer in the country. Government programs to increase healthcare infrastructure through public health campaigns are slowly improving early diagnosis and outpatient management of vascular ulcers. Despite this, low adoption of advanced therapies in rural regions and lack of standardized care protocols and affordability still present major obstacles.

Compression and antimicrobial dressings are witnessing the gradual entry of global players as well as local manufacturers that provide relatively cheaper offerings. Home care models and digital wound care solutions have high growth potential.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.8 % |

Venous Leg Ulcers (VLUs) Dominated The Market Due to Their High Prevalence Among Aging and Diabetic Populations

Venous leg ulcers, which are the most common type of vascular ulcer, generally arise from chronic venous insufficiency. Most of the cost of chronic wound care, especially in the elderly, comes from these ulcers. Standard of care includes compression therapy that may be combined with advanced wound dressings (eg, hydrocolloids, foams, alginates) and topical antimicrobials.

Increasing incidence of obesity and sedentary lifestyle factor, along with growing ageing population, is also driving the growth of the market due to a higher risk of developing venous insufficiency.

North America and Western Europe hold a major market share due to well-established wound care protocols and reimbursement channels. While Asia-Pacific, and Latin America are experiencing rising diagnosis and treatment rates as the spectrum of access to primary care and wound management services are being addressed. Emerging trends are smart compression devices, bioactive wound matrices and Artificial Intelligence based wounds progression monitoring.

Arterial Ulcers Held a Significant Market Share Due to Their Association with Peripheral Artery Disease and Diabetes

Arterial (ischemic) ulcers are less common than VLUs, but they result from peripheral artery disease (PAD), which decreases blood circulation to the limbs at rest; they are more severe and often require revascularization, debridement, and oxygen therapy. This is due to the growing global burden of atherosclerosis, diabetes, and smoking-induced PAD, which is driving the demand for multidisciplinary treatment strategies that marry vascular intervention with advanced wound therapy by the able hands of wound specialist.

Europe and USA are two major regions of interest in the peripheral artery ulcer management as there are a well-established number of other specialty vascular clinics and effective integrated care models in place. Future innovations include gene therapies for topical delivery to mediate angiogenesis, tissue-engineered grafts, and AI-integrated EHR-derived personalized vascular risk profiling.

Advanced Wound Dressings Dominated the Market as They Offer Superior Infection Control and Faster Healing Outcomes

Advanced dressings such as hydrocolloids, foams, hydrofibers, alginates, and antimicrobial dressings (eg, silver, iodine) are the mainstay of management but primarily focus on setting the vascular ulcers as outpatients and as home-based therapy. These products assist with exudate management, minimize the risk of infection, and promote autolytic debridement. Shifting from conventional gauze to evidence-based dressings, along with the growing need for economical wound management in geriatric population, is estimated to accelerate market growth.

North America is the leader in adoption, followed closely by Europe as clinical guidelines and reimbursement incentives have catalyzed adoption. Future trends involve the use of smart dressings embedded with sensors to measure moisture and bacterial load, bioactive materials for stimulation of healing, and customized 3D printed wound dressings adapting to wound contours.

Compression Therapy and Adjunctive Modalities Dominated the Market Owing to Their Proven Clinical Efficacy in Promoting Venous Return

Compression therapy is essentially the treatment of choice for venous ulcers that use compression bandages, stockings, or pneumatic compression devices to enhance venous return. The availability of multilayer compression kits and patient-compliant wearable compression systems is massively increasing the use of compression in the home and outpatient settings.

Adjunct therapies such as negative pressure wound therapy (NPWT), hyperbaric oxygen therapy (HBOT), and biological therapies (e.g., platelet-rich plasma, skin substitutes) have gained traction in the treatment of such refractory ulcers or during postoperative recovery.

The vascular ulcer treatment market is witnessing steady growth as the global burden of chronic wounds increases, majorly amid the geriatric population and patients suffering from diabetes, venous insufficient, and peripheral artery disease. The increased awareness about evidence-based wound management and the rising need for cost-effective risk-adjusted treatment solutions are driving the growth of advanced dressings, skin substitutes and compression therapies.

Competitive dynamics are also changing due to technological innovations such as bioengineered products, negative pressure wound therapy (NPWT) and smart wound monitoring systems. Some of the key market participants are global manufacturers of wound care, biotechnological companies engaged in developing regenerative solutions, and the integrated healthcare system that is expanding their outpatient and at-home wound care services.

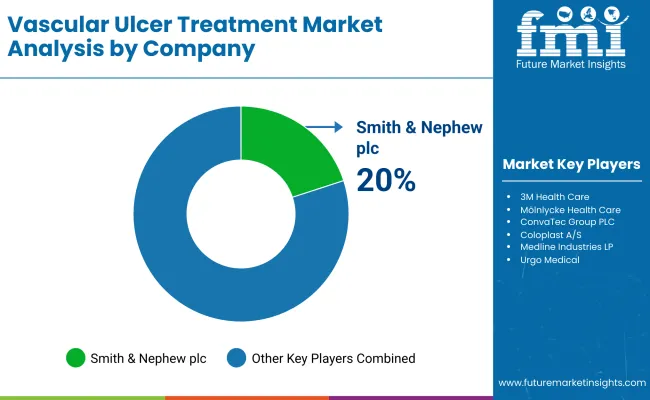

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Smith & Nephew plc | 20-24% |

| 3M Health Care | 16-20% |

| Mölnlycke Health Care | 12-16% |

| ConvaTec Group PLC | 10-14% |

| Coloplast A/S | 8-12% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Smith & Nephew plc | Provides advanced wound dressings, negative pressure wound therapy (NPWT), and bioactive products for venous and diabetic ulcers. |

| 3M Health Care | Offers NPWT systems and antimicrobial dressings for complex vascular wounds post-acquisition of Acelity . |

| Mölnlycke Health Care | Develops atraumatic dressings and foam products designed to manage exudate and accelerate healing of leg ulcers. |

| ConvaTec Group PLC | Supplies hydrocolloid and foam dressings, as well as skin protection solutions for chronic wound care. |

| Coloplast A/S | Focuses on wound healing products with emphasis on moist wound healing, pain management, and skin-friendly materials. |

Key Company Insights

Smith & Nephew plc (20-24%)

Smith & Nephew dominates the vascular ulcer treatment space with its Allevyn dressings and NPWT systems, delivering superior exudate management, faster wound closure, and broad clinical adoption across care settings.

3M Health Care (16-20%)

Leveraging the KCI legacy, 3M Health Care offers advanced NPWT devices and antimicrobial dressings that reduce bioburden, accelerate healing, and strengthen its leadership in evidence-based vascular ulcer management solutions.

Mölnlycke Health Care (12-16%)

Mölnlycke’sMepilex foam dressings provide gentle silicone adhesion, high absorbency, and low trauma removal—ensuring optimal healing outcomes and patient comfort in both acute and chronic vascular ulcer scenarios.

ConvaTec Group PLC (10-14%)

ConvaTec delivers integrated wound care through hydrocolloid and hydrofiber-based products supporting autolytic debridement, moisture balance, and sustained performance in long-duration vascular ulcer treatment across clinical environments.

Coloplast A/S (8-12%)

Coloplast emphasizes user-friendly wound care with silicone-coated dressings, promoting adherence, comfort, and healing efficiency—backed by robust clinical data and tailored for vascular ulcer patients with complex care needs.

Other Key Players (20-30% Combined)

Additional companies contributing to the vascular ulcer treatment market include:

These players contribute through innovative wound care technologies, biologically active dressings, and expansion of treatment access across home healthcare and outpatient settings.

Arterial Ulcers, Neurotrophic Ulcers, Venous Ulcers and Diabetic Ulcers.

Compression, Gradual Compression, Intermittent Pneumatic Compression, Drugs, Antibiotics, Pentoxifylline, Topical Steroids, Aspirin, Dressings, Surgical Therapy and Skin Grafting.

Hospital Pharmacies, Retail Pharmacies, Online Pharmacies & E-Commerce and Drugstores.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa.

The global Vascular Ulcer Treatment industry is projected to witness CAGR of 4.7% between 2025 and 2035.

The global Vascular Ulcer Treatment industry stood at USD 2,866.1 million in 2024.

The global Vascular Ulcer Treatment industry is anticipated to reach USD 4,761.9 million by 2035 end.

India is expected to show a CAGR of 5.8% in the assessment period.

The key players operating in the global Vascular Ulcer Treatment industry are Smith & Nephew plc, 3M Health Care, Mölnlycke Health Care, ConvaTec Group PLC, Coloplast A/S, B. Braun Melsungen AG, Medline Industries LP, Organogenesis Holdings Inc., Urgo Medical, Integra LifeSciences Corporatio and Others

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 17: Global Market Attractiveness by Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Treatment, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 37: North America Market Attractiveness by Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Treatment, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Treatment, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Treatment, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Treatment, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Treatment, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Treatment, 2023 to 2033

Figure 139: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Treatment, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vascular Dementia Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel, and Region through 2035

Ulcerative Colitis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Neovascular AMD Treatment Market Growth, Analysis & Forecast by Drug Type, Disease Type, Age Group, Gender, Stage of Disease, Distribution Channel and Region through 2035

Venous Ulcer Treatment Market Overview - Growth, Trends & Forecast 2025 to 2035

Corneal Ulcer Treatment Market Size, Growth, and Forecast for 2025 to 2035

Decubitus Ulcer Treatment Market Growth – Innovations & Forecast 2023-2033

Disseminated Intravascular Coagulation (DIC) Treatment Market Analysis – Size, Share & Forecast 2025 to 2035

Vascular Sheath Group Market Size and Share Forecast Outlook 2025 to 2035

Vascular Patches Market Forecast and Outlook 2025 to 2035

Vascular Access System Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Vascular Parkinsonism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vascular Boot Market Trends and Forecast 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Ulcerated Necrobiosis Lipoidica Management Market Trends - Growth & Forecast 2025 to 2035

Vascular Imaging Systems Market Growth - Trends & Forecast 2025 to 2035

Vascular Closure Devices Analysis by Product Type by Product, By Age Group and by Distribution Channel through 2035

Vascular Access Catheters Market - Growth & Forecast 2025 to 2035

Vascular Endothelial Growth Factor Inhibitor Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA