The vascular access system market is experiencing steady expansion, fueled by the rising prevalence of chronic illnesses, increased hospitalization rates, and the growing demand for safe and efficient drug delivery systems. Clinical practice guidelines and hospital procurement trends have emphasized the need for reliable vascular access technologies to minimize complications such as infections and catheter-related bloodstream infections (CRBSIs).

Innovations in catheter design, including anti-thrombogenic coatings and needle-free connectors, have improved patient safety and reduced insertion-related risks. Healthcare systems globally are investing in the standardization of vascular access procedures, supported by updated clinical training and protocol adoption in acute and long-term care settings.

Industry reports and manufacturer disclosures have also outlined increased spending on vascular access products due to the rising volume of intravenous therapy in both emergency and routine care. The market outlook remains positive, with continued demand driven by procedural efficiency, patient comfort, and the integration of advanced materials and digital tracking systems. Growth is expected to remain strongest across hospital environments and for devices that offer ease of use, reduced dwell time complications, and enhanced infection control.

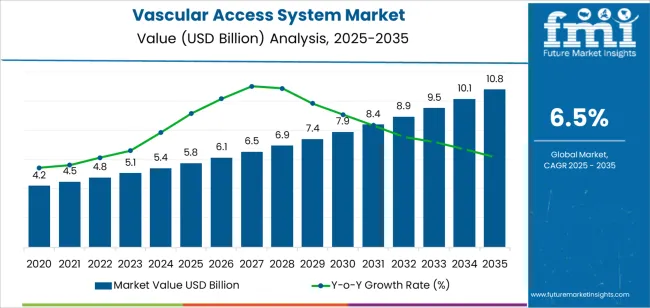

| Metric | Value |

|---|---|

| Vascular Access System Market Estimated Value in (2025 E) | USD 5.8 billion |

| Vascular Access System Market Forecast Value in (2035 F) | USD 10.8 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

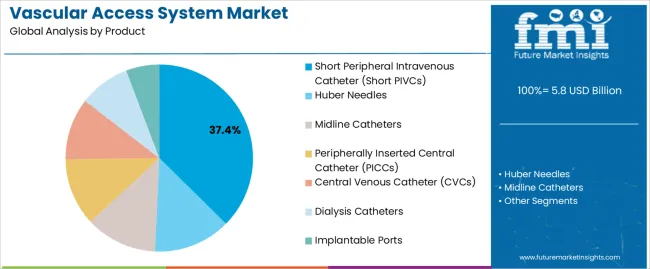

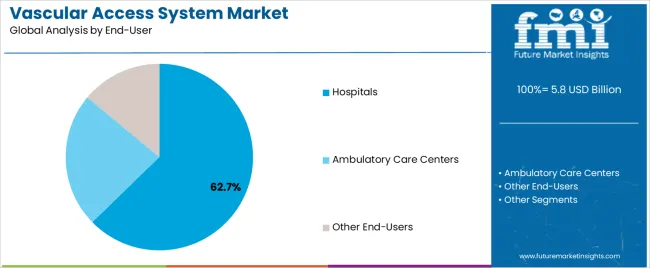

The market is segmented by Product and End-User and region. By Product, the market is divided into Short Peripheral Intravenous Catheter (Short PIVCs), Huber Needles, Midline Catheters, Peripherally Inserted Central Catheter (PICCs), Central Venous Catheter (CVCs), Dialysis Catheters, and Implantable Ports. In terms of End-User, the market is classified into Hospitals, Ambulatory Care Centers, and Other End-Users. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Short Peripheral Intravenous Catheter (Short PIVCs) segment is projected to contribute 37.4% of the vascular access system market revenue in 2025, making it the leading product category. This growth has been influenced by the widespread clinical use of Short PIVCs for short-term therapy in acute care settings.

Healthcare professionals have favored these catheters due to their ease of insertion, lower cost compared to central lines, and suitability for rapid fluid or medication administration. Clinical standards and nursing protocols have increasingly adopted Short PIVCs as the first-line option for peripheral venous access, particularly in emergency departments, outpatient surgeries, and general wards.

Additionally, product innovations such as safety-engineered PIVCs and integrated stabilization features have enhanced user confidence and patient safety. As the majority of hospitalized patients require some form of peripheral access during their stay, and with training programs focusing on efficient catheter placement, the Short PIVCs segment is expected to retain its market dominance.

The Hospitals segment is projected to account for 62.7% of the vascular access system market revenue in 2025, maintaining its lead among end-user categories. Growth of this segment has been supported by the high procedural volume and diverse clinical settings that require consistent use of vascular access systems.

Hospitals have remained the primary site for surgeries, emergency interventions, and intensive care treatments, all of which necessitate reliable vascular access. Clinical workflow efficiency and infection prevention initiatives have driven demand for advanced catheter systems within hospital settings.

Institutional investments in standardized vascular access training, along with procurement of safety-enhanced devices, have contributed to high product turnover in hospitals. Furthermore, hospital infrastructure enables rapid response to complications such as phlebitis or infiltration, making them optimal environments for the deployment of advanced vascular access technologies. As healthcare providers continue to emphasize patient safety and cost-effective therapy delivery, the Hospitals segment is expected to drive sustained adoption of vascular access systems.

With the aging global population, the prevalence of chronic diseases requiring vascular access, such as renal failure and cancer, also increases.

There is also a notable trend toward growing home healthcare, spurred by the convenience and cost-effectiveness of the methods used. This shift is boosting the demand for vascular access systems that are easy to use and manage outside of traditional healthcare settings.

Advances in vascular access technology enhance the safety, efficacy, and comfort of such devices. This helps devices gain the attention of patients as well as healthcare professionals.

Global vascular access systems market analysis suggests that the increasing healthcare expenditure globally, particularly in developing regions, is expanding access to advanced medical treatments, including vascular access systems.

Market growth of peripheral IV catheters is responsible for the development of the industry, fueling the vascular access system market size. Supportive government policies and initiatives aimed at improving healthcare infrastructure and access are providing a favorable for the future of vascular access devices in healthcare.

Technological innovations, including the development of antimicrobial and anti-thrombogenic coatings, are anticipated to enhance device safety and efficacy, thereby boosting demand.

One significant challenge is the risk of complications associated with vascular access devices, such as infections and thrombosis, which can lead to increased healthcare costs and patient morbidity. This is an adverse regulatory impact on the vascular access systems market. Apart from this, a lack of skilled healthcare professionals trained in the insertion and maintenance of these devices can hinder industry growth.

The United States represents a significant market for vascular access systems, driven by multiple factors. The first driver is the high prevalence of chronic diseases, such as cardiovascular diseases and cancer, which necessitate frequent and long-term vascular access.

Substantial investments in healthcare research and development are leading to continuous innovations in this field. This bolsters the healthcare industry, which promises a better market forecast for vascular access devices.

Favorable reimbursement policies and the emphasis on reducing healthcare-associated infections are boosting the adoption of advanced vascular access solutions. With the effect of such factors, the advanced healthcare infrastructure in the United States supports the widespread adoption of sophisticated vascular access devices.

The high prevalence of chronic diseases, such as diabetes and cancer, is increasing the demand for vascular access devices in the United Kingdom. This requires more attention to reduce the risk of life-threatening diseases.

The United Kingdom's aging population is creating a sustained need for such systems, coupled with the abovementioned factors, particularly for long-term treatments. This drives the demand for central venous catheters, peripheral IV catheters, and other vascular access devices.

National Health Service (NHS) initiatives focused on improving patient outcomes and reducing hospital stay durations are promoting the use of efficient vascular access systems.

The increasing burden of chronic diseases is set to fuel trends in the central venous catheter market. The rising requirement for catheters to mitigate critical diseases like renal failure will drive the industry heavily.

The growing population in the country will likely elevate the number of critically ill patients with such life-threatening diseases. To cater to the demand for such constant medical assistance, more production of vascular access systems must be made.

Peripheral vascular access systems are also expected to rise during the forecast period in India due to the abovementioned factors. The growing medical tourism industry in India is creating additional demand for high-quality vascular access systems.

Central Venous Catheters are anticipated to secure a significant share in the sector due to the critical role of CVCs in many medical treatments. Advances in vascular access technology will effectively drive the segment.

CVCs are widely used in intensive care units (ICUs) and for patients requiring long-term intravenous therapy, such as chemotherapy, total parenteral nutrition, and the administration of medications that are irritating to peripheral veins. The increasing prevalence of chronic diseases, particularly cancer and cardiovascular diseases, which require prolonged and intensive treatment, drives the demand for CVCs.

PICCs are favored for ease of insertion and lower complication rates compared to traditional central venous catheters. PICCs are commonly used for patients who require extended intravenous therapy, including antibiotic administration, chemotherapy, and parenteral nutrition.

The increasing trend towards home healthcare and outpatient treatments is boosting the demand for PICCs, as such devices are suitable for long-term use outside the hospital environment. As a result, the said segment contributes satisfactorily to the share of global vascular access systems.

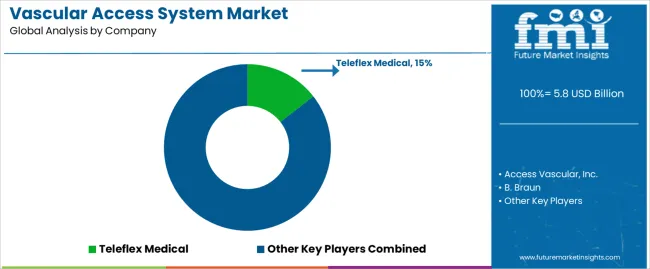

With the presence of several key players, the competitive landscape exerts a high force on new entrants. To mitigate this force, product innovation can be an effective solution, which also helps new businesses gain a respectable share. Existing players expand using different strategies, including diversification, new product launches, mergers, and acquisitions.

The following are some key recent developments helping the competitive space enhance in terms of the size and share of the industry:

Teleflex Medical, Access Vascular, Inc., B. Braun, Smith’s Medical (ICU Medical, Inc), Cook Medical, AngioDynamics, Medtronic, Medical Components, Inc., Nipro Medical Corporation, and Terumo Medical Corporation are key competitors in the ecosystem.

Short Peripheral Intravenous Catheters (Short PIVCs), Huber Needles, Midline Catheters, Peripherally Inserted Central Catheters (PICCs), Central Venous Catheters (CVCs), Dialysis Catheters, and Implantable Ports are some key product categories in the sector.

Based on the end-user industry, the competitive landscape can be categorized into Hospitals, Ambulatory Care Centres, and Other End-users.

North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and The Middle East and Africa are the key contributing regions to the industry.

The global vascular access system market is estimated to be valued at USD 5.8 billion in 2025.

The market size for the vascular access system market is projected to reach USD 10.8 billion by 2035.

The vascular access system market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in vascular access system market are short peripheral intravenous catheter (short pivcs), huber needles, midline catheters, peripherally inserted central catheter (piccs), central venous catheter (cvcs), dialysis catheters and implantable ports.

In terms of end-user, hospitals segment to command 62.7% share in the vascular access system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vascular Access Catheters Market - Growth & Forecast 2025 to 2035

Vascular Imaging Systems Market Growth - Trends & Forecast 2025 to 2035

Neurovascular Access Catheters Market

Spinal Access Systems Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Intravascular Ultrasound Systems Market Size and Share Forecast Outlook 2025 to 2035

Demand for Vascular Access Catheters in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Vascular Access Catheters in Japan Size and Share Forecast Outlook 2025 to 2035

Pharmacy Accessory Bagging System (PABS) Market

Pedestrian Access Control System Market Size and Share Forecast Outlook 2025 to 2035

Robotic Assisted Endovascular Systems Market Size and Share Forecast Outlook 2025 to 2035

Spectroscopy Intravascular Imaging System Market

Card-Based Electronic Access Control Systems Market Growth - Forecast 2025 to 2035

North America Keyless Vehicle Access Control Market - Growth & Forecast through 2035

Vascular Sheath Group Market Size and Share Forecast Outlook 2025 to 2035

Vascular Patches Market Forecast and Outlook 2025 to 2035

Access Control as a Service Market Size and Share Forecast Outlook 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Access Control Market Analysis - Size, Share, and Forecast 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA