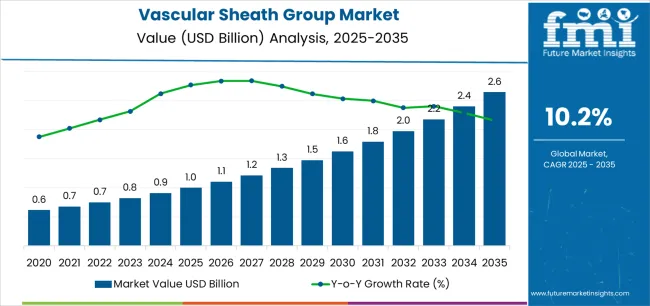

The global vascular sheath group market is projected to grow from USD 1 billion in 2025 to USD 2.6 billion by 2035, reflecting expanding demand for devices that support safe and reliable vascular access in interventional procedures. Key market dynamics are being shaped by the rising prevalence of cardiovascular disease and the increasing shift toward minimally invasive diagnostic and therapeutic interventions. Hospitals and catheterization labs are performing a higher volume of angioplasty, electrophysiology, structural heart, and peripheral vascular procedures, which require vascular sheaths for controlled catheter entry and hemostasis management. As procedural complexity increases, clinicians are prioritizing sheaths that provide stable access while minimizing arterial trauma, bleeding risk, and post-procedure complications.

Technology enhancements are further influencing adoption. Hydrophilic coatings, kink-resistant shaft materials, tapered tips, and improved hemostatic valve mechanisms are enabling smoother vessel entry and better catheter manipulation. Devices designed for radial access are gaining momentum due to reduced patient recovery time and lower complication rates compared to femoral access. Healthcare system expansion in emerging markets is broadening procurement of vascular access devices, supported by increased training of interventional cardiologists and vascular surgeons. The growing focus on procedural efficiency, patient safety, and shorter recovery timelines continues to drive demand for vascular sheaths that are highly reliable and deliver consistent clinical performance.

Regional variations in healthcare spending and procedural volumes significantly influence market development patterns. North American and European markets maintain leadership through established interventional cardiology programs and comprehensive reimbursement frameworks supporting advanced vascular procedures. Asian markets demonstrate accelerating growth driven by healthcare modernization initiatives and expanding middle-class populations seeking quality cardiovascular care. The shift toward outpatient catheterization procedures and same-day discharge protocols is creating demand for vascular sheaths optimized for rapid hemostasis and reduced recovery times.

Manufacturing consolidation continues among major medical device companies pursuing economies of scale and regulatory compliance efficiencies. Supply chain integration between raw material suppliers, device manufacturers, and healthcare distributors is improving product availability and pricing stability. Quality standards enforcement by regulatory authorities in major markets creates barriers for smaller manufacturers while ensuring consistent device performance and patient safety outcomes.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1 billion |

| Market Forecast Value (2035) | USD 2.6 billion |

| Forecast CAGR (2025-2035) | 10.2% |

| HEALTHCARE INFRASTRUCTURE TRENDS | PROCEDURAL REQUIREMENTS | REGULATORY & QUALITY STANDARDS |

|---|---|---|

|

|

|

| Category | Segments Covered |

|---|---|

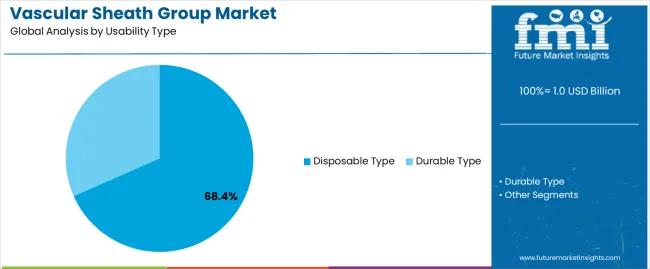

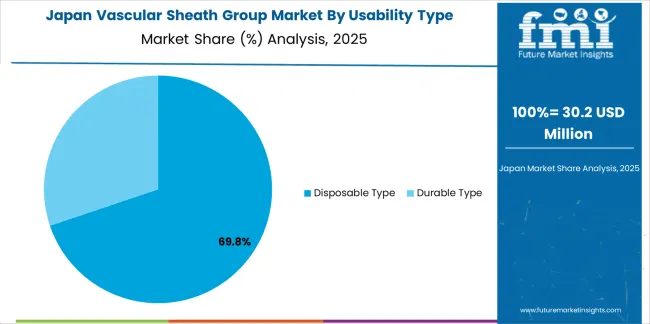

| By Usability Type | Disposable Type, Durable Type |

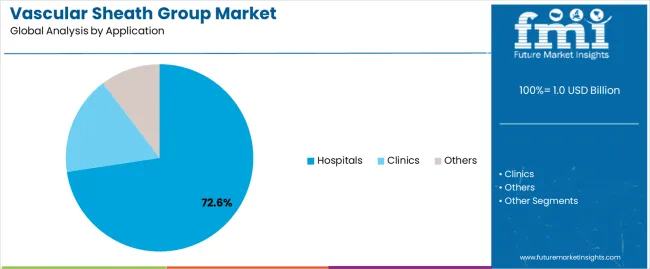

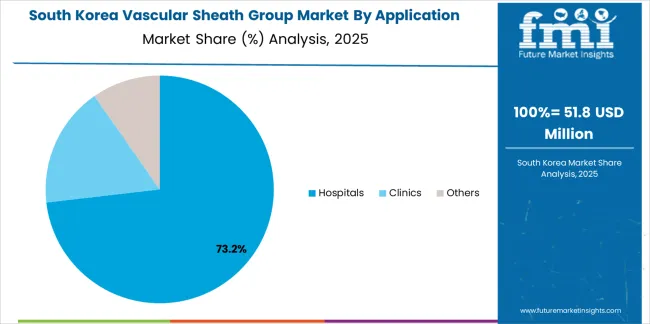

| By Application | Hospitals, Clinics, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Disposable Type |

|

| Durable Type |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Hospitals |

|

| Clinics |

|

| Others |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

|

|

|

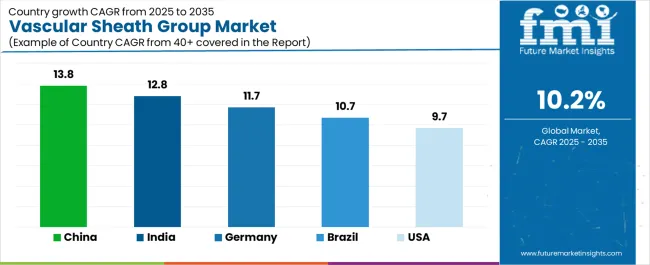

| Country | CAGR (2025-2035) |

|---|---|

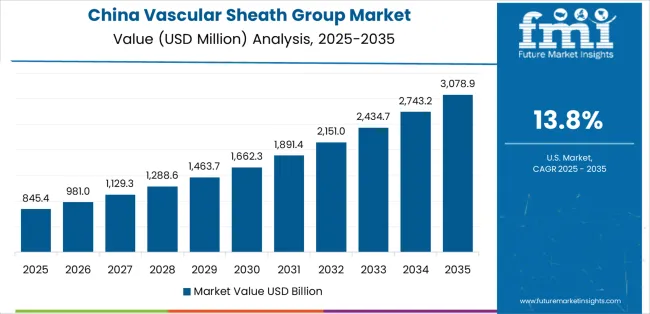

| China | 13.8% |

| India | 12.8% |

| Germany | 11.7% |

| Brazil | 10.7% |

| USA | 9.7% |

Revenue from Vascular Sheath Group in China is projected to exhibit strong growth with a market value of USD 358.9 million by 2035, driven by expanding cardiovascular care infrastructure and comprehensive interventional cardiology program development creating substantial opportunities for medical device suppliers across hospital networks, specialty cardiac centers, and emerging ambulatory facilities. The country's healthcare modernization initiatives and expanding middle-class populations are creating significant demand for both conventional and advanced vascular access devices. Major healthcare systems and medical device distributors are establishing comprehensive local distribution networks to support large-scale hospital operations and meet growing demand for reliable cardiovascular device solutions.

Revenue from Vascular Sheath Group in India is expanding to reach USD 407.0 million by 2035, supported by extensive healthcare infrastructure development and comprehensive medical tourism sector growth creating sustained demand for reliable cardiovascular devices across diverse hospital categories and specialty cardiac facilities. The country's expanding healthcare access and growing awareness of cardiovascular disease management are driving demand for device solutions that provide consistent clinical performance while supporting cost-effective care delivery requirements. Medical device importers and domestic manufacturers are investing in local distribution capabilities to support growing hospital operations and cardiovascular procedure volumes.

Demand for Vascular Sheath Group in Germany is projected to reach USD 1733.3 million by 2035, supported by the country's leadership in interventional cardiology and advanced cardiovascular technologies requiring sophisticated vascular access systems for complex structural heart interventions and peripheral vascular procedures. German hospitals are implementing high-quality device procurement systems that support advanced procedural techniques, operational efficiency, and comprehensive quality protocols. The market is characterized by focus on clinical outcomes, device innovation, and compliance with stringent medical device and patient safety standards.

Revenue from Vascular Sheath Group in Brazil is growing to reach USD 2785.2 million by 2035, driven by healthcare coverage expansion programs and increasing cardiovascular disease awareness creating sustained opportunities for device suppliers serving both public hospital networks and private healthcare operators. The country's developing cardiovascular care infrastructure and expanding health insurance penetration are creating demand for vascular access devices that support diverse clinical requirements while maintaining cost-effective performance standards. Medical device importers and local distributors are developing procurement strategies to support hospital operational efficiency and regulatory compliance requirements.

Demand for Vascular Sheath Group in USA is projected to reach USD 251.6 million by 2035, expanding at a CAGR of 9.7%, driven by advanced procedural innovation and specialty device capabilities supporting structural heart interventions and complex peripheral vascular procedures. The country's established interventional cardiology leadership and sophisticated healthcare delivery systems are creating demand for premium vascular access devices that support procedural performance and clinical outcome standards. Device manufacturers and specialty distributors are maintaining comprehensive development capabilities to support diverse hospital requirements and evolving procedural techniques.

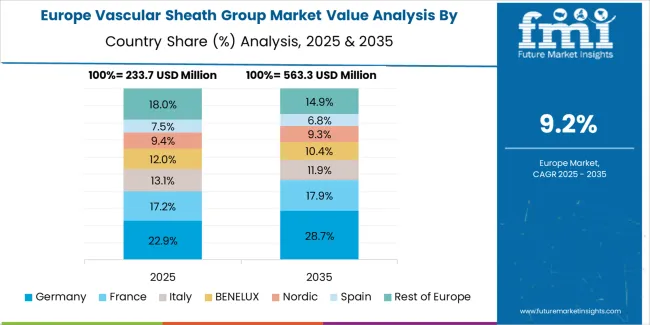

The vascular sheath group market in Europe is projected to grow from USD 189.4 million in 2025 to USD 512.7 million by 2035, registering a CAGR of 10.5% over the forecast period. Germany is expected to maintain its leadership position with a 29.3% market share in 2025, declining slightly to 28.1% by 2035, supported by its advanced interventional cardiology infrastructure and major cardiovascular centers including Berlin Heart Center and German Heart Center Munich.

France follows with a 21.4% share in 2025, projected to reach 22.1% by 2035, driven by comprehensive cardiovascular care modernization programs at Paris cardiac hospitals and regional specialty centers. The United Kingdom holds a 18.7% share in 2025, expected to decrease to 17.9% by 2035 due to National Health Service budget constraints affecting device procurement. Italy commands a 16.2% share, while Spain accounts for 14.4% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 10.8% to 11.6% by 2035, attributed to increasing vascular sheath adoption in Nordic countries and emerging Eastern European hospitals implementing cardiovascular program expansions.

Japanese Vascular Sheath Group operations reflect the country's exacting medical device standards and sophisticated clinical expectations. Major hospital systems including National Cerebral and Cardiovascular Center, Japanese Red Cross Medical Center, and University of Tokyo Hospital maintain rigorous supplier qualification processes that often exceed international standards, requiring extensive documentation, batch testing, and facility audits that can take 12-18 months to complete. This creates high barriers for new suppliers but ensures consistent quality that supports premium clinical positioning.

The Japanese market demonstrates unique application preferences, with significant demand for smaller profile vascular sheaths tailored to Asian patient anatomies and procedural techniques emphasizing radial access approaches. Hospitals require specific dimensional specifications and hemostatic valve performance characteristics that differ from Western applications, driving demand for customized device capabilities.

Regulatory oversight through the Pharmaceuticals and Medical Devices Agency emphasizes comprehensive biocompatibility assessment and traceability requirements that surpass most international standards. The medical device approval system requires detailed clinical data and performance documentation, creating advantages for suppliers with transparent manufacturing processes and comprehensive validation systems.

Supply chain management focuses on relationship-based partnerships rather than purely transactional procurement. Japanese hospitals typically maintain long-term supplier relationships spanning decades, with annual contract negotiations emphasizing device performance consistency over price competition. This stability supports investment in specialized manufacturing processes tailored to Japanese specifications.

South Korean Vascular Sheath Group operations reflect the country's advanced healthcare sector and quality-focused procurement model. Major hospital systems including Seoul National University Hospital, Asan Medical Center, and Samsung Medical Center drive sophisticated device procurement strategies, establishing direct relationships with global manufacturers to secure consistent quality and pricing for their interventional cardiology programs serving both domestic and international patients.

The Korean market demonstrates particular strength in adopting advanced vascular access technologies, with hospitals integrating premium sheaths into comprehensive cardiovascular care pathways designed for optimal clinical outcomes. This clinical excellence approach creates demand for specific device specifications that support procedural efficiency and patient safety objectives, requiring suppliers to demonstrate validated performance capabilities.

Regulatory frameworks emphasize medical device safety and traceability, with Ministry of Food and Drug Safety standards often exceeding international requirements. This creates barriers for smaller device suppliers but benefits established manufacturers who can demonstrate compliance capabilities. The regulatory environment particularly favors suppliers with ISO certification and comprehensive quality management systems.

Supply chain efficiency remains critical given Korea's import dependence for advanced medical devices. Hospitals increasingly pursue long-term contracts with suppliers in USA, Europe, and Japan to ensure reliable access to vascular sheaths while managing foreign exchange risks. Cold chain logistics investments support device quality preservation during extended shipping periods.

The market faces pressure from government healthcare cost containment initiatives and competition from domestic device manufacturers, driving consolidation among smaller importers. The premium positioning of Korean cardiovascular care internationally continues to support demand for high-quality vascular access devices meeting stringent clinical specifications.

Profit pools are consolidating around manufacturers with regulatory compliance capabilities and established hospital relationships. Value is migrating from commodity vascular access devices to differentiated products offering hemostatic valve innovation, hydrophilic coating performance, and kink-resistant designs supporting complex procedures. Several archetypes set the pace: global medical device conglomerates leveraging distribution scale and product portfolios; specialized cardiovascular device companies with procedural expertise and clinical relationships; regional manufacturers serving price-sensitive markets with regulatory-compliant alternatives; and innovation-driven entrants targeting specific procedural niches with differentiated technologies.

Switching costs remain substantial through hospital formulary processes, clinical training requirements, and procedural preference card standardization, stabilizing market shares for incumbent suppliers while creating barriers for new entrants. Supply shocks from raw material availability, regulatory compliance changes, and manufacturing capacity constraints periodically disrupt procurement patterns. Clinical outcome data increasingly influences purchasing decisions as hospitals adopt value-based procurement models emphasizing procedural success rates and complication reduction.

Consolidation continues among mid-tier manufacturers unable to sustain regulatory compliance costs and distribution infrastructure requirements. Vertical integration remains limited given specialized manufacturing capabilities and capital intensity of medical device production. Digital procurement platforms gain traction for standardized device categories while complex vascular access products maintain traditional relationship-driven sales models. Hospital group purchasing organizations consolidate buying power, negotiating volume-based pricing that pressures manufacturer margins while ensuring supply reliability.

Lock long-term hospital contracts with comprehensive training and clinical support programs; establish multi-country regulatory approval portfolios; option to develop procedure-specific sheath variants addressing structural heart and peripheral vascular applications with documented clinical outcome improvements.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Global device conglomerates | Distribution scale, product portfolio breadth, regulatory infrastructure | Long-term hospital contracts, bundled pricing, clinical education programs |

| Specialized cardiovascular companies | Procedural expertise, physician relationships, clinical data | Procedural training, physician preferences, outcome studies |

| Regional manufacturers | Cost competitiveness, local market knowledge, regulatory compliance | Value-based pricing, domestic distribution, emerging market focus |

| Innovation-driven entrants | Differentiated technology, niche procedural focus, clinical collaboration | Procedural partnerships, targeted clinical studies, key opinion leader engagement |

| Items | Values |

|---|---|

| Quantitative Units | USD 1 billion |

| Product | Disposable Type, Durable Type |

| Application | Hospitals, Clinics, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | USA, Germany, China, India, Brazil, and other 40+ countries |

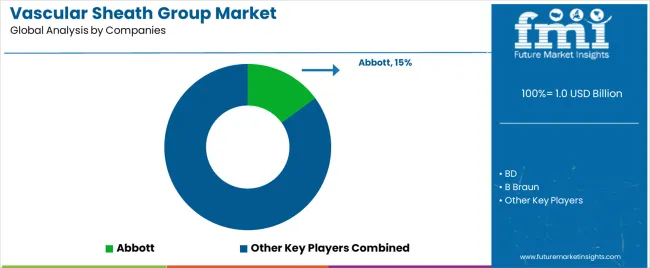

| Key Companies Profiled | Abbott, BD, B Braun, Cordis US Corp, Edwards Lifesciences LLC, Fresenius Kabi AG, Argon Medical Devices Inc., Cook Incorporated, Terumo Corporation, Nanjing Mai Chuang Medical Technology |

| Additional Attributes | Dollar sales by usability type/application, regional demand (NA, EU, APAC), competitive landscape, hospital vs. clinic adoption, manufacturing innovation, and hemostatic valve technologies driving procedural efficiency, patient safety, and clinical outcomes |

The global vascular sheath group market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the vascular sheath group market is projected to reach USD 2.6 billion by 2035.

The vascular sheath group market is expected to grow at a 10.2% CAGR between 2025 and 2035.

The key product types in vascular sheath group market are disposable type and durable type.

In terms of application, hospitals segment to command 72.6% share in the vascular sheath group market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vascular Patches Market Forecast and Outlook 2025 to 2035

Vascular Access System Market Size and Share Forecast Outlook 2025 to 2035

Vascular Parkinsonism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vascular Boot Market Trends and Forecast 2025 to 2035

The Vascular Ulcer Treatment Market Is Segmented by Ulcer Type, Treatment and Distribution Channel from 2025 To 2035

Vascular Dementia Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel, and Region through 2035

Vascular Imaging Systems Market Growth - Trends & Forecast 2025 to 2035

Vascular Closure Devices Analysis by Product Type by Product, By Age Group and by Distribution Channel through 2035

Vascular Access Catheters Market - Growth & Forecast 2025 to 2035

Vascular Endothelial Growth Factor Inhibitor Market

Vascular Dressings Market

Vascular prostheses market

Vascular Screening Market

Vascular Testing Devices Market

Neovascular AMD Treatment Market Growth, Analysis & Forecast by Drug Type, Disease Type, Age Group, Gender, Stage of Disease, Distribution Channel and Region through 2035

Nonvascular Interventional Radiology Device Market Trends – Growth & Forecast 2024-2034

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Endovascular Aneurysm Repair (EVAR) Market Size and Share Forecast Outlook 2025 to 2035

Endovascular Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Non-Vascular Stents Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA