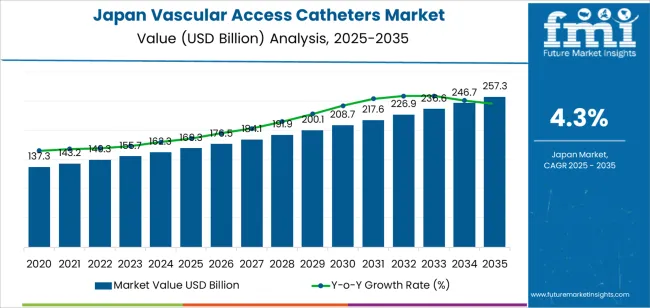

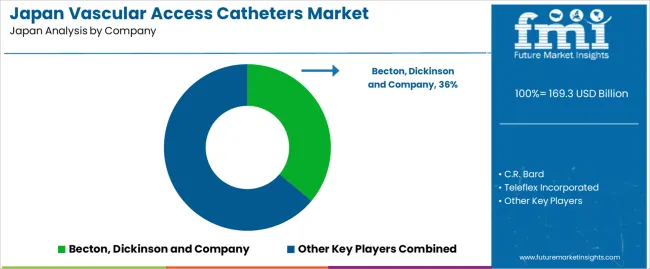

The demand for vascular access catheters in Japan is expected to grow from USD 169.3 million in 2025 to USD 257.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.3%. Vascular access catheters are essential in medical procedures that require long-term or short-term access to the bloodstream, such as dialysis, chemotherapy, and intravenous drug administration. As the healthcare sector continues to prioritize patient care, efficiency, and safety, the demand for high-quality vascular access catheters will rise. Factors such as an aging population, increased prevalence of chronic diseases, and advancements in catheter technologies are expected to drive this growth.

The Japanese healthcare system’s focus on improving treatment outcomes, along with the growing need for minimally invasive medical devices, will further increase the adoption of vascular access catheters. Innovations in catheter designs, such as those aimed at reducing infection risks and improving patient comfort, will contribute to the growing demand. As Japan’s healthcare system continues to modernize and expand its infrastructure, the need for reliable and efficient vascular access solutions will remain a key priority.

Between 2025 and 2030, the demand for vascular access catheters in Japan is expected to rise from USD 169.3 million to USD 176.5 million. This period will see steady growth, driven by the increasing need for vascular access in treatments for chronic conditions such as kidney disease and cancer. However, industry saturation will begin to approach as a large portion of the healthcare system adopts vascular access catheters, especially in major hospitals and outpatient facilities.

From 2030 to 2035, the demand is projected to increase from USD 176.5 million to USD 257.3 million. While this represents a strong growth rate, it also reflects the industry approaching its saturation point. As the majority of healthcare institutions adopt vascular access catheters and implement the latest innovations in catheter technologies, the pace of growth will slow down toward the end of the forecast period. However, continued advancements in product offerings, such as improved safety features and ease of use, will ensure that demand remains robust. The saturation point will be marked by more widespread adoption and a shift toward specialized applications, such as home care and personalized medicine, driving sustained but slower growth in the sector.

| Metric | Value |

|---|---|

| Demand for Vascular Access Catheters in Japan Value (2025) | USD 169.3 billion |

| Demand for Vascular Access Catheters in Japan Forecast Value (2035) | USD 257.3 billion |

| Demand for Vascular Access Catheters in Japan Forecast CAGR (2025 to 2035) | 4.3% |

The demand for vascular access catheters in Japan is on the rise as healthcare providers address the increasing need for prolonged intravenous therapies. These catheters are critical in treatments such as chemotherapy, parenteral nutrition, and complex infusion regimens, particularly in light of an aging population and rising incidence of chronic illnesses. Healthcare facilities are focusing more on devices that enable extended access with fewer insertions, thus enhancing patient comfort and reducing procedural risks.

Technological advances are further supporting the uptake of these devices. Modern catheters feature improvements such as antimicrobial surfaces, refined wall construction for better flow dynamics, and enhanced securement systems. These developments contribute to fewer complications like infection or thrombosis, making the devices more appealing to clinicians and hospital administrators. In addition, catheter designs that facilitate outpatient or home‑based care are gaining preference as treatment models evolve beyond traditional inpatient settings.

The transition in Japan’s healthcare delivery toward ambulatory and home care also plays a significant role. As more treatments move out of conventional hospital settings, the requirement for reliable, long‑term vascular access devices become more pronounced. Catheters designed for durability, convenience, and minimal disruption align well with evolving patient care pathways. With these factors in play, the demand for vascular access catheters in Japan is expected to grow steadily through 2035.

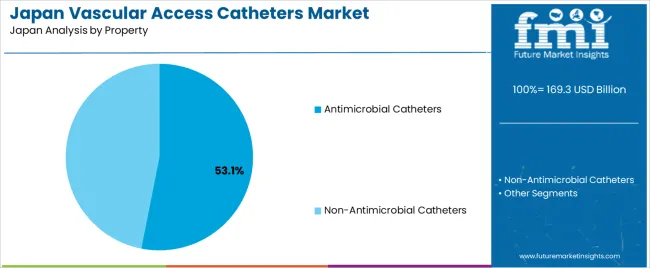

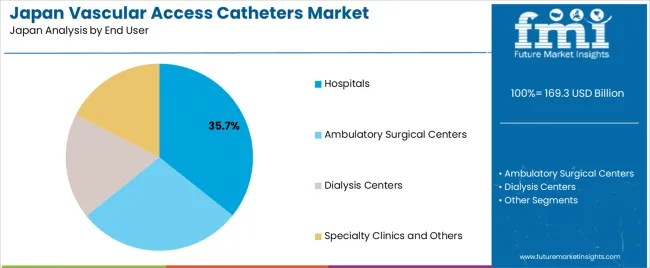

Demand for vascular access catheters in Japan is segmented by property, end user, product, and design. By property, demand is divided into antimicrobial catheters and non-antimicrobial catheters. The demand is also segmented by end user, including hospitals, ambulatory surgical centers, dialysis centers, and specialty clinics. In terms of products, demand is divided into dialysis catheters, PICC catheters, implantable ports, and CVC catheters. Regarding design, demand is divided into single lumen, double lumen, and multiple lumen. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

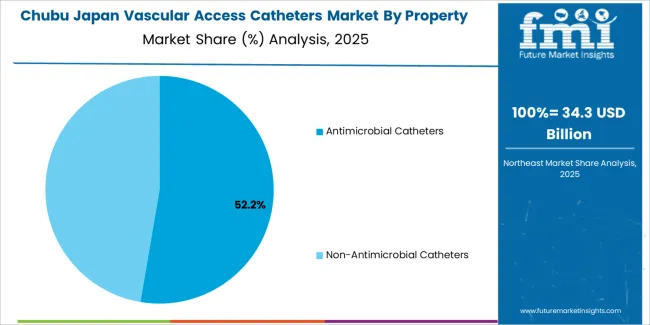

Antimicrobial catheters account for 53.1% of the demand for vascular access catheters in Japan. These catheters are specifically designed to reduce the risk of infection, which is a significant concern in medical procedures requiring vascular access. Antimicrobial coatings help prevent the growth of bacteria and other microorganisms, ensuring that the catheter remains sterile during use, which is crucial for patient safety. As the healthcare industry in Japan continues to prioritize infection control and patient safety, antimicrobial catheters are increasingly favored. These catheters are particularly vital in high-risk environments like dialysis centers and hospitals, where patients may have weakened immune systems and are at higher risk for infections. With the growing focus on minimizing hospital-acquired infections (HAIs), antimicrobial catheters will continue to dominate the market.

Hospitals account for 36% of the demand for vascular access catheters in Japan. Hospitals are the primary settings for patients requiring vascular access for procedures such as dialysis, chemotherapy, or fluid administration. Due to the complexity and high volume of patients, hospitals require a wide range of catheter types, including dialysis catheters, PICC catheters, and CVC catheters. Hospitals also have specialized staff and infrastructure to handle more complex catheter procedures, which drives the demand for high-quality, reliable vascular access devices. The increasing number of patients requiring long-term treatments, such as dialysis, along with the growth of chronic diseases, ensures that hospitals remain the leading end-user segment. As healthcare services continue to evolve, the demand for vascular access catheters in hospitals will remain strong, ensuring their ongoing dominance in the market.

Key drivers include Japan’s ageing population and rising prevalence of chronic illnesses (such as cancer, cardiovascular disease and renal failure) that require long‑term intravenous therapy and vascular access. Healthcare facility upgrades, growth in ambulatory and outpatient treatment settings, and increasing focus on infection control and procedural safety also support demand. Restraints include the shift toward minimally invasive procedures and alternative access technologies which may reduce catheter usage, cost‑control pressures in the healthcare system leading to pricing constraints, and the challenge of integrating new catheter technologies (e.g., coated or antimicrobial catheters) into older hospital workflows.

Why is Demand for Vascular Access Catheters Growing in Japan?

In Japan, demand for vascular access catheters is growing because hospitals and clinics face higher volumes of patients needing intravenous access for treatments including chemotherapy, dialysis, parenteral nutrition and fluid/drug administration. The move toward outpatient and home‑care services means more devices are needed that are reliable, safe and can support extended‑dwell therapy. Also, healthcare providers are increasingly replacing older catheter systems with newer devices that offer better patient outcomes, safety features and catheter‑associated infection reduction, which drives volume and value growth of catheter products.

How are Technological Innovations Driving Growth of Vascular Access Catheters in Japan?

Technological innovations are boosting adoption of vascular access catheters in Japan by advancing product design, safety and usability. Innovations include antimicrobial or antithrombogenic coatings to reduce catheter‑related bloodstream infections and thrombosis, advanced tip‑positioning and ultrasound‑guided insertion systems for improved placement accuracy, and catheter systems designed for longer dwell times or home‑infusion use. In addition, catheter manufacturers are developing thinner or more flexible materials and integrated connector systems to enhance patient comfort and reduce complications. These improvements make vascular access solutions more attractive to hospitals and clinics aiming to improve care quality and efficiency.

What are the Key Challenges Limiting Adoption of Vascular Access Catheters in Japan?

Despite strong demand, adoption of advanced vascular access catheters in Japan faces several challenges. First, cost pressure is significant premium catheters with advanced features cost more, and in a healthcare environment focused on cost effectiveness these may be harder to justify. Secondly, regulatory and reimbursement frameworks in Japan are stringent, delaying uptake of new device types. Third, training and procedural changes are needed for newer technologies (e.g., ultrasound‑guided placement), which creates adoption barriers. Finally, competition from less costly alternatives or legacy catheter systems and the move toward non‑catheter based interventions may slow penetration of higher‑end catheter devices.

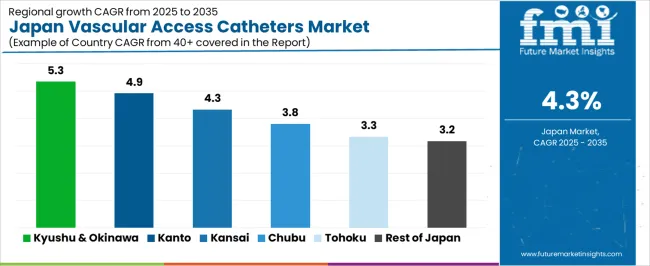

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.3 |

| Kanto | 4.9 |

| Kinki | 4.3 |

| Chubu | 3.8 |

| Tohoku | 3.3 |

| Rest of Japan | 3.2 |

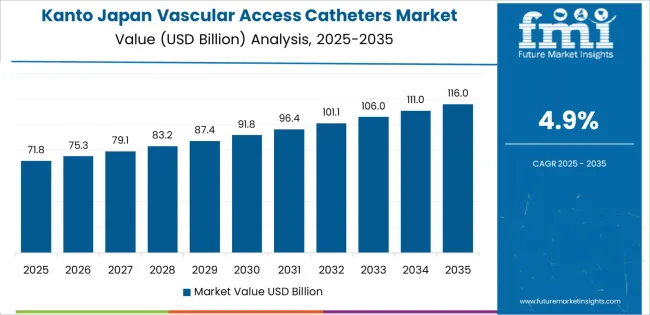

Demand for vascular access catheters in Japan is increasing across all regions, with Kyushu & Okinawa leading at a 5.3% CAGR. This growth is driven by the region’s expanding healthcare sector and increasing medical procedures requiring vascular access. Kanto follows with a 4.9% CAGR, supported by its large concentration of hospitals, clinics, and research institutions. Kinki shows a 4.3% CAGR, driven by its well-established healthcare infrastructure and rising demand for medical treatments. Chubu experiences a 3.8% CAGR, with steady demand from the region’s healthcare providers. Tohoku sees a 3.3% CAGR, fueled by increasing healthcare awareness and medical facility expansion. The Rest of Japan shows the lowest growth at 3.2%, but demand remains steady due to the healthcare sector's ongoing needs.

Kyushu & Okinawa are experiencing the highest demand for vascular access catheters in Japan, with a 5.3% CAGR. The growth is primarily driven by the region’s expanding healthcare sector, particularly in cities like Fukuoka and Okinawa, which are seeing an increase in medical treatments and procedures requiring vascular access. The region's aging population is contributing to a rise in chronic conditions that necessitate frequent medical interventions, such as dialysis and chemotherapy, where vascular access catheters are essential. Furthermore, Kyushu & Okinawa’s healthcare infrastructure is improving, with new medical facilities and hospitals being established. As medical awareness increases, and as healthcare services continue to expand, the demand for vascular access catheters in the region will continue to rise, supported by advancements in medical technology and growing healthcare needs.

Kanto is experiencing steady demand for vascular access catheters in Japan, with a 4.9% CAGR. The region, which includes major cities like Tokyo and Yokohama, is home to Japan’s largest concentration of hospitals and healthcare facilities. With an increasing aging population and a growing prevalence of chronic conditions, there is a higher demand for medical treatments such as dialysis and chemotherapy, which require reliable vascular access catheters. Kanto’s leading medical research and healthcare infrastructure ensure that the latest medical technologies are widely adopted. The region also benefits from significant investments in healthcare innovation, contributing to more advanced and efficient catheter products. As the healthcare needs of Kanto’s diverse population continue to rise, particularly among elderly patients, the demand for vascular access catheters is expected to remain strong, making it a key region for growth.

Kinki is experiencing moderate demand for vascular access catheters in Japan, with a 4.3% CAGR. The region’s well-established healthcare infrastructure, especially in cities like Osaka and Kyoto, plays a crucial role in driving demand. As healthcare services expand and more advanced medical treatments are provided, the need for vascular access catheters is growing. Kinki’s aging population is contributing to an increase in chronic diseases such as renal failure and cancer, which require frequent use of vascular access catheters. The region’s hospitals and medical centers are increasingly adopting state-of-the-art medical technologies, including innovative catheter solutions, to meet patient needs. The region’s focus on healthcare quality and patient care is ensuring that vascular access catheters remain in high demand, driven by an expanding healthcare sector and a growing awareness of vascular health.

Chubu is experiencing steady demand for vascular access catheters in Japan, with a 3.8% CAGR. The region is home to major medical facilities in cities like Nagoya, which are experiencing increased patient volume due to aging demographics and the growing incidence of chronic diseases. As healthcare providers in Chubu adopt more advanced technologies, including vascular access catheters, the demand for these essential devices continues to rise. Chronic conditions such as kidney failure and cancer, which require dialysis and chemotherapy, are becoming more prevalent in the region, further driving demand. Chubu’s healthcare sector is evolving, with a focus on improving treatment outcomes and enhancing patient care, which contributes to the ongoing adoption of advanced catheter solutions. As medical practices in Chubu continue to improve, the need for high-quality vascular access catheters is expected to grow.

Tohoku is experiencing moderate demand for vascular access catheters in Japan, with a 3.3% CAGR. The region’s growing healthcare needs, particularly in areas like Sendai, are driving the adoption of medical devices such as vascular access catheters. Tohoku’s aging population and increasing rates of chronic illnesses such as kidney failure and cancer are contributing to higher demand for medical treatments that require these catheters. In addition, Tohoku’s healthcare infrastructure has been improving, with new hospitals and clinics being established to meet the growing demand for healthcare services. The region is also placing more emphasis on improving patient outcomes and expanding access to essential medical treatments. As Tohoku’s healthcare system continues to evolve, the demand for vascular access catheters is expected to grow steadily, fueled by advances in medical technology and a continued focus on improving care for chronic disease patients.

The Rest of Japan is seeing the lowest demand for vascular access catheters, with a 3.2% CAGR. While this region does not have the same high concentration of medical facilities as Kanto or Kyushu, there is still steady demand for these devices. Smaller healthcare facilities and hospitals in the Rest of Japan, particularly in rural areas, are increasingly adopting vascular access catheters as part of their efforts to improve medical treatment and patient care. The rise in chronic illnesses, such as kidney disease and cancer, is contributing to this demand, as more patients require dialysis and chemotherapy. As healthcare infrastructure improves in regional areas and awareness of medical technologies grows, the adoption of vascular access catheters continues to increase. Though growth is slower in this region, steady demand remains as local healthcare systems continue to modernize and expand.

In Japan the demand for vascular access catheters is driven by an aging population, rising incidences of chronic illness (such as cancer, kidney disease and cardiovascular conditions), and an increasing need for intravenous therapies, dialysis and minimally invasive procedures. Catheters used for vascular access play a critical role in drug delivery, fluid administration, diagnostics and long‑term care, making them integral to hospital and clinic operations in Japan.

Major suppliers competing in this space include Becton, Dickinson and Company with 36.1% share, C.R. Bard, Teleflex Incorporated, B. Braun Melsungen AG and Kimal. These companies differentiate by offering broad product portfolios (including central venous, peripheral intravenous and dialysis catheters), technological improvements (such as antimicrobial coatings, securement systems and imaging‑compatible placement), and strong distribution and service alliances within Japan. Becton Dickinson’s position reflects its global reputation, scale of operations and established relationships with healthcare providers in Japan.

Competitive dynamics are shaped by several factors. One driver is the sustained growth of outpatient therapies, home‑care infusion and dialysis services, increasing the need for reliable vascular access solutions. Another driver is the emphasis on device innovations—such as materials that reduce complications, compatibility with ultrasound‑guided insertion and enhanced patient comfort. Restraints include pricing pressures from healthcare payers and hospitals in Japan, regulatory and reimbursement challenges, and competition from alternative access technologies. Companies that combine clinical‑trial‑backed performance, responsive service capability and cost‑efficient catheter systems are best positioned to maintain and grow their presence in Japan’s vascular access catheter ecosystem.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product | Dialysis Catheters, PICC Catheters, Implantable Port, CVC Catheters |

| Property | Antimicrobial Catheters, Non-Antimicrobial Catheters |

| Design | Single Lumen, Double Lumen, Multiple Lumen |

| End User | Hospitals, Ambulatory Surgical Centers, Dialysis Centers, Specialty Clinics, Others |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Becton, Dickinson and Company, C.R. Bard, Teleflex Incorporated, B. Braun Melsungen AG, Kimal |

| Additional Attributes | Dollar sales by product type and application; regional CAGR and adoption trends; demand trends in vascular access catheters; growth in hospitals, dialysis centers, and specialty clinics; technology adoption for medical procedures; vendor offerings including hardware, software, and services; regulatory influences and industry standards |

The demand for vascular access catheters in japan is estimated to be valued at USD 169.3 billion in 2025.

The market size for the vascular access catheters in japan is projected to reach USD 257.3 billion by 2035.

The demand for vascular access catheters in japan is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in vascular access catheters in japan are dialysis catheters, picc catheters, implantable port and cvc catheters.

In terms of property, antimicrobial catheters segment is expected to command 53.1% share in the vascular access catheters in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vascular Access Catheters Market - Growth & Forecast 2025 to 2035

Neurovascular Access Catheters Market

Vascular Access System Market Size and Share Forecast Outlook 2025 to 2035

Japan Mobile Phone Accessory Market Analysis - Size, Share & Trends 2025 to 2035

Demand for Cardiovascular Repair & Reconstruction Devices in Japan Size and Share Forecast Outlook 2025 to 2035

Vascular Sheath Group Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Vascular Patches Market Forecast and Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Access Control as a Service Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Access Control Market Analysis - Size, Share, and Forecast 2025 to 2035

Vascular Parkinsonism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA