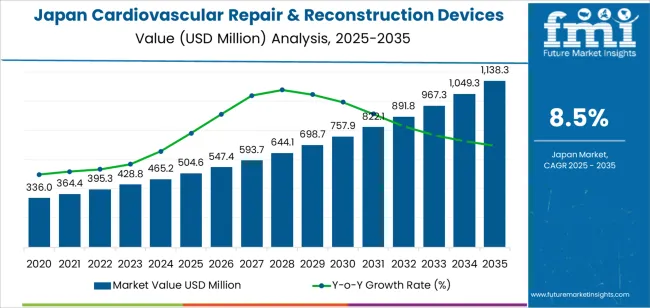

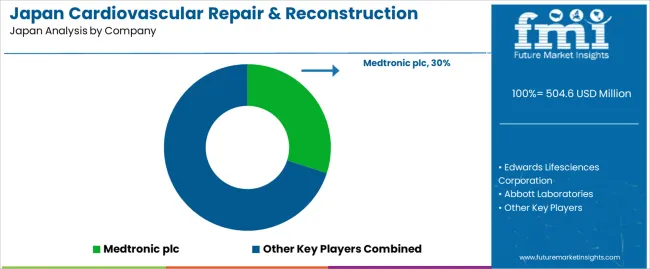

The demand for cardiovascular repair & reconstruction devices in Japan is projected to grow from USD 504.6 million in 2025 to USD 1,138.3 million by 2035, reflecting a CAGR of 8.5%. These devices are crucial in treating cardiovascular diseases, such as valvular heart disease, coronary artery disease, and vascular disorders, which are prevalent in the aging population. As Japan’s population continues to age, the need for cardiovascular interventions will grow, driving demand for repair devices like stents, heart valves, patches, and vascular grafts. The demand for minimally invasive procedures and improvements in device technology will also contribute to market growth, as these devices offer faster recovery times and reduced patient discomfort.

Advancements in biocompatible materials, robotic-assisted surgeries, and customized treatment options will increase the effectiveness of cardiovascular devices. Additionally, the focus on patient-specific care and personalized treatments will support the adoption of advanced devices that can improve clinical outcomes. With a growing focus on preventive care and early diagnosis, cardiovascular repair devices will see increased demand across clinical trials, hospitals, and surgical centers.

From 2025 to 2030, the demand for cardiovascular repair and reconstruction devices in Japan will grow from USD 504.6 million to USD 757.9 million, adding USD 253.3 million in value. During this phase, volume growth will contribute significantly to the market expansion. The rising prevalence of cardiovascular diseases due to Japan’s aging population, coupled with increasing demand for minimally invasive surgeries and biocompatible materials, will drive volume adoption of these devices. The focus on early detection and preventive healthcare will also promote higher adoption rates, as the need for preemptive interventions and repair procedures becomes more common. This phase will also see improvements in the manufacturing process, reducing costs and making devices more accessible, contributing to higher volume growth.

From 2030 to 2035, the market will grow from USD 757.9 million to USD 1,138.3 million, contributing an additional USD 380.4 million in value. During this phase, price growth will become more prominent as the market matures. Technological innovations such as advanced bioengineered devices, robotic-assisted surgery systems, and customizable treatments will drive higher device pricing and profitability. While volume growth will continue, the premiumization of cardiovascular devices and the increasing demand for personalized solutions will ensure steady price growth. With an emphasis on quality, precision, and long-term patient outcomes, this phase will experience growth contributions from both price and volume as the market reaches new levels of sophistication.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 504.6 million |

| Industry Forecast Value (2035) | USD 1,138.3 million |

| Industry Forecast CAGR (2025-2035) | 8.5% |

Demand for cardiovascular repair and reconstruction devices in Japan is rising in response to increased incidence of cardiovascular diseases (CVDs), particularly among older adults and those with chronic comorbidities. Hospitals and surgical centres are deploying devices such as vascular grafts, cardiac patches, and repair systems for valve, aortic and structural heart disorders. The market value in Japan is estimated at USD 504.6 million and is projected to reach USD 1,138.3 million, with a compound annual growth rate (CAGR) of 8.5%.

Technological innovation and procedural shifts support demand. Minimally invasive and catheter based systems are enabling broader patient eligibility and faster recovery. Collaboration between device manufacturers, hospitals and research institutions is promoting use of sophisticated implants and bio engineered materials in high complexity cases. At the same time, challenges such as reimbursement constraints, regulatory complexities and high clinical trial costs affect market pace. Nonetheless, the convergence of demographic trends, clinical capacity expansion and device advancement suggests sustained growth for cardiovascular repair and reconstruction devices in Japan.

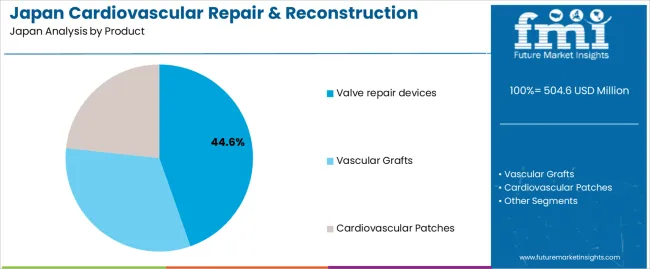

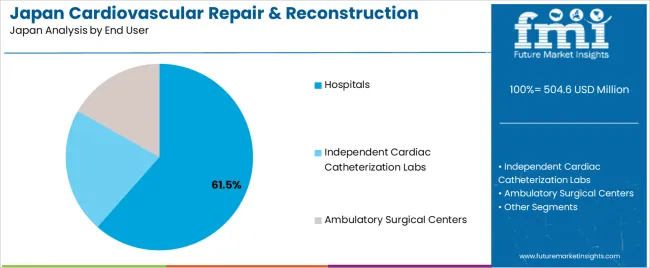

The demand for cardiovascular repair & reconstruction devices in Japan is primarily driven by product type and end-user segment. The leading product type is valve repair devices, capturing 45% of the market share, while hospitals are the dominant end-user segment, accounting for 61.5% of the demand. These devices are essential in the treatment of cardiovascular diseases, especially in patients undergoing surgeries to repair or replace heart valves or restore blood flow through damaged vessels. As Japan’s aging population grows and the need for heart disease treatment increases, the demand for these devices continues to rise.

Valve repair devices lead the market for cardiovascular repair & reconstruction devices in Japan, holding 45% of the demand. Valve repair procedures are critical for patients with valve diseases such as stenosis or regurgitation, and these devices are used to repair or replace damaged heart valves to restore normal heart function. Valve repair devices are an integral part of both open-heart surgeries and minimally invasive procedures.

The demand for valve repair devices is driven by the increasing prevalence of heart valve disorders, which often result from aging, congenital defects, or other cardiovascular conditions. Japan’s aging population has led to a growing number of patients requiring valve repair surgeries. Additionally, advances in device technology, including more effective materials and minimally invasive procedures, are making valve repair more accessible and improving patient outcomes. As heart valve disease remains a leading cause of morbidity and mortality, valve repair devices are expected to continue to dominate the cardiovascular repair & reconstruction device market in Japan.

Hospitals are the largest end-user segment for cardiovascular repair & reconstruction devices in Japan, capturing 61.5% of the demand. Hospitals are the primary settings for cardiovascular surgeries, where devices such as valve repair tools, vascular grafts, and cardiovascular patches are used extensively. Hospitals are equipped with the necessary surgical infrastructure and expertise to handle complex heart surgeries, making them the key players in the cardiovascular device market.

The demand from hospitals is driven by the high volume of patients with cardiovascular conditions requiring treatment. Hospitals play a critical role in performing both emergency and elective cardiovascular surgeries, including valve replacements and vascular repairs. The increasing number of procedures, along with advancements in cardiovascular treatments and technology, ensures that hospitals will continue to be the primary driver of demand for cardiovascular repair & reconstruction devices in Japan. With the continued focus on improving cardiac care, hospitals will remain central to the market’s growth.

Demand for cardiovascular repair and reconstruction devices in Japan is driven by the ageing population, rising prevalence of cardiovascular disease (CVD), and growing demand for minimally invasive procedures that restore or reconstruct cardiac and vascular structures. Japan’s healthcare system invests in advanced surgical technologies and has expanding capacity in structural heart disease treatment. At the same time, tight regulatory approval pathways, cost pressures on the healthcare system, and need for highly specialised devices moderate the pace of adoption. These interacting factors shape how device manufacturers and healthcare providers engage in this market.

Several factors support growth. First, Japan has one of the highest shares of population aged 65 and older, which increases incidence of valvular heart disease, aneurysms and vascular defects, raising demand for devices such as heart valve repair systems, vascular grafts and patches. Second, technological advances in transcatheter and endovascular repair, hybrid operating rooms and imaging guided interventions support higher uptake of structural heart repair devices. Third, government policy and healthcare reimbursement reform increasingly promote earlier treatment and lesser invasive approaches, facilitating device usage in outpatient or hybrid settings. Fourth, Japan’s skilled physician base and hospital infrastructure enable adoption of sophisticated repair and reconstruction technologies.

Despite supportive conditions, several constraints apply. The cost of advanced devices including implants, grafts and valves is high, which puts pressure on hospital budgets and reimbursement systems. Approval and clinical trial requirements in Japan are stringent, prolonging time to market for new device generations. Some regional hospitals still lack access to hybrid OR facilities, limiting adoption of minimally invasive procedures in rural areas. Additionally, competition from generic and low cost device offerings and budget constraints in public healthcare may slow penetration of premium technologies.

Key trends include increasing use of patient specific and custom designed implants (for example 3D printed grafts and prostheses) to better match anatomical variations in Japanese patients. Another trend is the growth of fully percutaneous and transcatheter repair options for valve and vessel reconstruction, which reduce hospital stay time and recovery. There is also emphasis on digital integration devices and systems with embedded sensors, remote monitoring, and data analytics to track implant performance and patient outcomes over time. Finally, sustainability and lifecycle support are gaining importance, as device makers and hospitals in Japan look to reduce revision rates and improve durable outcomes in repair and reconstruction settings.

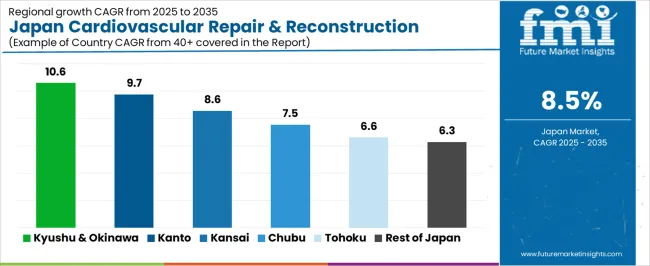

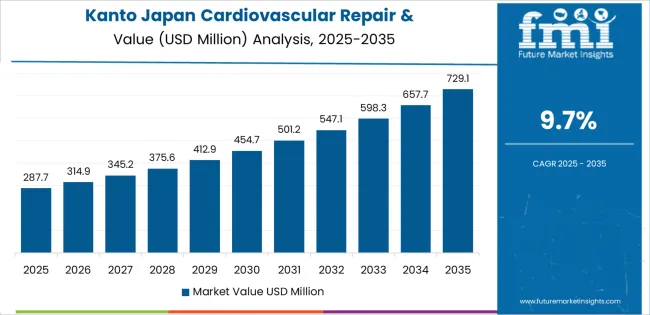

The demand for cardiovascular repair and reconstruction devices in Japan is showing strong growth across various regions, with Kyushu & Okinawa leading the way at a CAGR of 10.6%. Kanto follows closely with a CAGR of 9.7%, supported by its large population and strong healthcare infrastructure. The Kinki region shows a solid growth rate of 8.6%, while Chubu, Tohoku, and the Rest of Japan exhibit more moderate growth, with respective CAGRs of 7.5%, 6.6%, and 6.3%. These regional differences are influenced by factors such as population density, healthcare facilities, and the prevalence of cardiovascular conditions, with the most significant demand concentrated in urbanized areas and regions with more advanced medical infrastructure.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 10.6 |

| Kanto | 9.7 |

| Kinki | 8.6 |

| Chubu | 7.5 |

| Tohoku | 6.6 |

| Rest of Japan | 6.3 |

The demand for cardiovascular repair and reconstruction devices in Kyushu & Okinawa is projected to grow at a CAGR of 10.6%, reflecting the region's strong focus on healthcare improvements and an aging population. Kyushu & Okinawa have been investing heavily in healthcare infrastructure, which includes state-of-the-art medical technologies and cardiovascular treatment centers. As the population in these regions ages, the prevalence of cardiovascular diseases, such as heart disease and hypertension, continues to rise, which drives the demand for repair and reconstruction devices.

Moreover, Kyushu & Okinawa’s emphasis on improving medical care and accessibility, especially in rural and remote areas, has contributed to an increased adoption of advanced cardiovascular devices. This growing focus on health management and chronic disease prevention further supports the significant demand for cardiovascular repair and reconstruction technologies in this region.

In Kanto, the demand for cardiovascular repair and reconstruction devices is expected to grow at a CAGR of 9.7%, driven by the region’s advanced healthcare system and large urban population. Kanto, which includes Tokyo, is Japan's medical and economic hub, with extensive access to world-class healthcare facilities, research centers, and specialized treatment options. The region's high population density and the increasing number of elderly individuals with cardiovascular conditions contribute to the rising demand for cardiovascular treatments.

As Japan’s healthcare industry continues to adopt cutting-edge technologies, Kanto remains at the forefront of integrating advanced cardiovascular repair and reconstruction devices. Furthermore, the region's large number of medical professionals and institutions specializing in heart health ensures that demand for these devices remains strong and is expected to continue growing, driven by innovations in cardiovascular treatment and surgical techniques.

The demand for cardiovascular repair and reconstruction devices in the Kinki region is projected to grow at a CAGR of 8.6%, supported by the region’s well-developed healthcare infrastructure. Kinki, which includes major cities such as Osaka and Kyoto, has a strong presence of medical institutions that specialize in cardiovascular care. As the region’s population ages, the demand for cardiovascular treatments and surgical interventions increases, particularly for repair and reconstruction procedures related to heart disease.

Additionally, Kinki has seen an increasing adoption of minimally invasive surgical techniques, which often require advanced repair devices. The region's healthcare focus on improving patient outcomes, combined with its growing number of hospitals and medical centers, contributes to the rising demand for cardiovascular repair and reconstruction devices. While growth in Kinki is somewhat slower than in Kyushu & Okinawa and Kanto, the region remains a key market for these medical technologies.

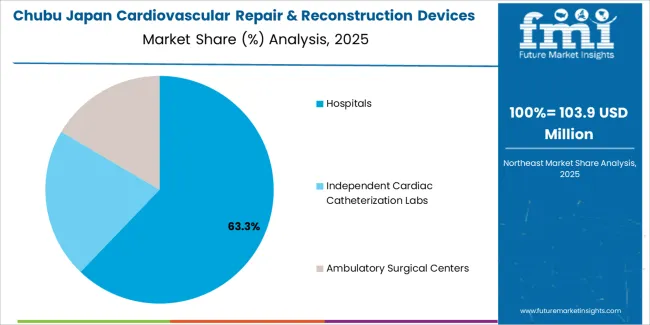

The demand for cardiovascular repair and reconstruction devices in Chubu is expected to grow at a CAGR of 7.5%, reflecting a moderate but steady increase in adoption. Chubu, home to key industrial cities such as Nagoya, has a strong healthcare network with an increasing focus on improving medical care and expanding cardiovascular treatment options. The region’s aging population and the rising incidence of cardiovascular conditions are contributing to the demand for devices needed in surgeries and treatments.

However, Chubu’s growth rate is slower compared to more urbanized regions like Kanto and Kyushu & Okinawa, due to the region's more traditional healthcare market and the relatively slower adoption of new technologies. Nevertheless, as healthcare access improves and more advanced treatment centers are established, the demand for cardiovascular repair and reconstruction devices in Chubu is expected to grow steadily over time.

In Tohoku, the demand for cardiovascular repair and reconstruction devices is projected to grow at a CAGR of 6.6%, driven by the region's aging population and increasing healthcare investments. Tohoku, known for its rural landscape and lower population density compared to other regions, faces challenges in providing specialized care, but there has been a concerted effort to enhance cardiovascular treatment infrastructure.

The growing prevalence of cardiovascular diseases in the aging population is contributing to the demand for repair and reconstruction devices. Additionally, as healthcare facilities in Tohoku modernize and expand, more advanced treatment options are becoming available, leading to higher adoption rates of cutting-edge cardiovascular devices. Although the growth rate is slower than in more urbanized regions, the continued investment in healthcare infrastructure and the increasing need for cardiovascular treatments support steady growth in the demand for these devices in Tohoku.

In the Rest of Japan, the demand for cardiovascular repair and reconstruction devices is expected to grow at a CAGR of 6.3%, reflecting a gradual increase across less urbanized areas. While the healthcare infrastructure in these regions is improving, the rate of adoption of advanced medical technologies, including cardiovascular devices, tends to be slower compared to larger metropolitan areas. However, the aging population in rural and suburban Japan is contributing to a steady rise in the demand for cardiovascular care.

As the Rest of Japan continues to invest in healthcare modernization and as more hospitals and clinics adopt advanced treatment methods, demand for cardiovascular repair and reconstruction devices is expected to grow. Though slower, this gradual adoption ensures that cardiovascular devices will become more prevalent across these regions as the need for specialized treatments continues to rise.

Demand for cardiovascular repair and reconstruction devices in Japan is driven by the ageing population, the prevalence of cardiovascular disease, and growing adoption of minimally invasive surgical procedures. Companies such as Medtronic plc (with about 30% share), Edwards Lifesciences Corporation, Abbott Laboratories, Terumo Corporation, and Getinge AB are major players. These firms supply devices such as vascular grafts, cardiac patches, heart valve repair systems, and interventional reconstruction tools. Hospitals and surgical centres in Japan evaluate solutions based on clinical outcomes, ease of implantation, and device reliability.

Competition in this industry is shaped by innovation in materials, procedure compatibility, and post market support. Suppliers develop biocompatible grafts and patches offering improved durability and reduced thrombosis risk. Another key area is devices compatible with catheter based delivery and hybrid operating suite workflows, which are growing in Japan’s surgical landscape. Additionally, companies emphasise local regulatory support, clinician training, and service availability to gain hospital adoption. Marketing materials typically focus on device performance metrics, long term patient outcomes, and procedural efficiency. By aligning their offerings to the clinical and operational needs of Japanese cardiovascular surgery centres, these companies aim to strengthen their position in Japan’s cardiovascular repair and reconstruction devices industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Product | Valve Repair Devices, Vascular Grafts, Cardiovascular Patches |

| End User | Hospitals, Independent Cardiac Catheterization Labs, Ambulatory Surgical Centers |

| Key Companies Profiled | Medtronic plc, Edwards Lifesciences Corporation, Abbott Laboratories, Terumo Corporation, Getting AB |

| Additional Attributes | The market analysis includes dollar sales by product type, end-user, and company categories. It also covers regional demand trends in Japan, particularly driven by the increasing adoption of cardiovascular repair and reconstruction devices for surgical and minimally invasive procedures. The competitive landscape highlights key manufacturers focusing on innovations in valve repair devices, vascular grafts, and cardiovascular patches. Trends in the growing demand for advanced biomaterials, improved patient outcomes, and less invasive procedures in hospitals and surgical centers are explored, along with advancements in device performance and integration with other cardiovascular technologies. |

The demand for cardiovascular repair & reconstruction devices in japan is estimated to be valued at USD 504.6 million in 2025.

The market size for the cardiovascular repair & reconstruction devices in japan is projected to reach USD 1,138.3 million by 2035.

The demand for cardiovascular repair & reconstruction devices in japan is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in cardiovascular repair & reconstruction devices in japan are valve repair devices, vascular grafts and cardiovascular patches.

In terms of end user, hospitals segment is expected to command 61.5% share in the cardiovascular repair & reconstruction devices in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cardiovascular Repair & Reconstruction Devices Market – Growth & Trends 2025 to 2035

Cardiovascular Devices Market Size and Share Forecast Outlook 2025 to 2035

Hernia Repair Devices Market Insights - Trends & Forecast 2025 to 2035

Cardiovascular Surgical Devices Market Size and Share Forecast Outlook 2025 to 2035

Knee Reconstruction Devices Market Growth – Trends & Forecast 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Prosthetic Devices Market Size and Share Forecast Outlook 2025 to 2035

Joint Reconstruction Devices Market Size and Share Forecast Outlook 2025 to 2035

Demand for Blood Collection Devices in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Ultrasound Market - Demand & Innovations 2025 to 2035

Cardiovascular Enterprise Viewer Market Insights – Growth & Forecast 2025 to 2035

Cardiovascular Needle Market – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA