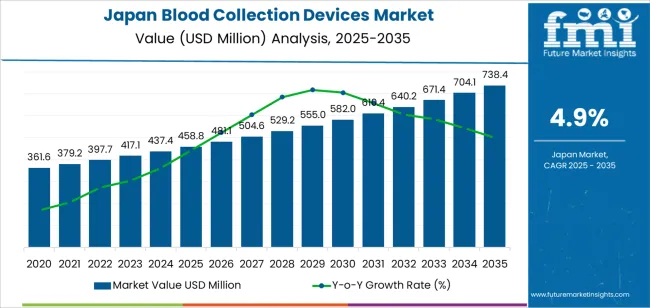

The demand for blood collection devices in Japan is projected to grow from USD 458.8 million in 2025 to USD 738.4 million by 2035, reflecting a CAGR of 4.9%. Blood collection devices, including needles, vacutainers, syringes, and blood bags, are essential in various medical procedures, including diagnostic testing, blood donations, and clinical interventions. The growing demand for blood collection devices in Japan is driven by the increasing need for healthcare services, rising prevalence of chronic diseases, and an aging population that requires regular medical monitoring and treatment.

Furthermore, technological advancements in needle design, safety mechanisms, and automation are improving the efficiency and safety of blood collection, which will encourage broader adoption. Regulatory requirements and growing awareness of infection control will also support the adoption of safer blood collection systems, fueling demand for these devices. The overall expansion of the healthcare system in Japan, coupled with advancements in medical diagnostics and blood donation programs, will ensure consistent growth in the demand for blood collection devices over the next decade.

From 2025 to 2030, the demand for blood collection devices in Japan will grow from USD 458.8 million to USD 555.0 million, adding USD 96.2 million in value. This phase represents the first breakpoint, characterized by moderate acceleration in demand driven by increased healthcare access, rising health awareness, and more frequent diagnostic testing. The focus during this phase will be on enhanced patient safety, particularly with the increased adoption of safety needles and minimally invasive blood collection techniques. The healthcare sector’s increasing shift towards preventive care will also drive this growth, as routine and diagnostic testing become more integrated into patient care practices.

From 2030 to 2035, the market will grow from USD 555.0 million to USD 738.4 million, adding USD 183.4 million in value. The second breakpoint will reflect a maturation phase where the market stabilizes and grows at a slower, more steady pace. Demand will continue to be strong, but the rate of increase will moderate as the technology behind blood collection devices becomes widely adopted. During this phase, innovations such as automated blood collection systems and advanced diagnostics will further improve efficiency, and regulatory standards for safety and infection control will continue to influence market dynamics. Although growth may slow, continuous demand from both clinical and outpatient settings, along with population health management, will sustain the market.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 458.8 million |

| Industry Forecast Value (2035) | USD 738.4 million |

| Industry Forecast CAGR (2025-2035) | 4.9% |

Demand for blood collection devices in Japan is rising as the country’s healthcare sector adapts to an aging population and a growing incidence of chronic diseases that require routine blood sampling, such as diabetes, cardiovascular conditions, and renal disorders. Hospitals, diagnostic laboratories, and outpatient clinics are increasing use of devices including vacutainers, safety engineered needles, and automated collection systems to support higher test volumes and streamline workflows. The market value in Japan is estimated at USD 458.8 million and is projected to reach USD 738.4 million, corresponding to a compound annual growth rate (CAGR) of approximately 4.9 %.

Another factor influencing demand is the move toward home based and point of care testing, which drives need for user friendly, compact collection devices compatible with mobile health settings. Technology improvements include barcode scanning, integrated sample tracking, and single use safety designs that reduce pre analytical errors and occupational risk. On the supply side, device manufacturers are adapting to Japanese regulatory standards, local procurement practices, and the preference for high precision systems. Constraints include regulatory hurdles, cost pressures in the healthcare system, and competition from alternative diagnostic pathways. Despite these challenges, the demographics, healthcare model changes, and technological readiness indicate ongoing demand growth for blood collection devices in Japan.

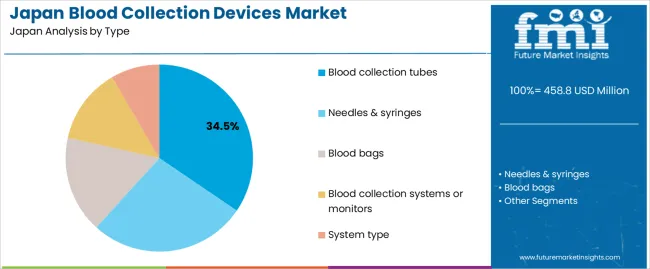

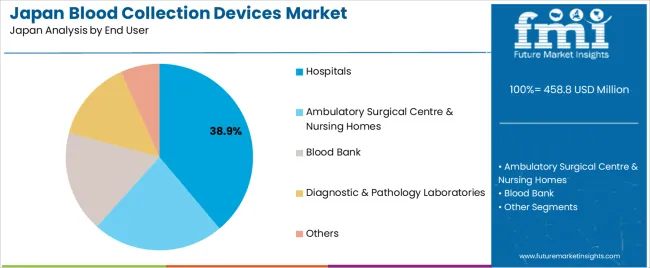

The demand for blood collection devices in Japan is primarily driven by type and end-user segment. The leading type is blood collection tubes, accounting for 35% of the market share, while hospitals dominate the end-user segment, capturing 38.9% of the demand. Blood collection devices are essential tools for healthcare settings, used to collect, store, and transport blood samples for diagnostics, treatment, and research purposes. As Japan's healthcare sector continues to expand and prioritize high-quality patient care, the demand for these devices is expected to grow across both clinical and research applications.

Blood collection tubes lead the market for blood collection devices in Japan, holding 35% of the demand. These tubes are essential for collecting blood samples for laboratory tests, ensuring that the samples are safely contained for analysis. Blood collection tubes are available in various formulations, including those designed for plasma, serum, or whole blood collection, and are widely used across different medical settings.

The demand for blood collection tubes is driven by their essential role in diagnostic procedures, where accurate and safe collection of blood samples is critical. They are used in routine testing, emergency care, and specialized testing in areas such as oncology, cardiology, and infectious disease monitoring. The rise in health awareness, coupled with the growing focus on early diagnosis and disease prevention, is expected to sustain the demand for blood collection tubes in Japan. These devices remain essential due to their cost-effectiveness, ease of use, and wide applicability in medical diagnostics.

Hospitals are the largest end-user segment for blood collection devices in Japan, accounting for 38.9% of the demand. Hospitals require a wide range of blood collection devices to conduct routine diagnostic tests, pre-surgical screenings, blood transfusions, and research. Blood collection devices, such as needles, syringes, tubes, and blood bags, are integral to various hospital procedures, especially in emergency and inpatient care.

The demand from hospitals is driven by the high volume of diagnostic testing and blood work conducted in these settings. As healthcare continues to prioritize patient care and efficiency, hospitals rely on high-quality, reliable blood collection devices to ensure accurate results and safe patient outcomes. Additionally, hospitals’ involvement in clinical trials, disease management programs, and blood donation services further fuels their significant demand for blood collection devices. As the healthcare system in Japan continues to modernize and expand, the demand for blood collection devices in hospital settings is expected to remain strong.

Demand for blood collection devices in Japan is driven by the country's ageing population, rising prevalence of chronic diseases, and growing focus on diagnostics, monitoring, and preventive health. A shift toward home based and remote sample collection is gaining traction in response to healthcare system capacity constraints. At the same time, market saturation in major hospital settings, cost pressures, and stringent regulatory requirements moderate growth. These factors shape the landscape for blood collection devices in Japan.

What Are the Primary Growth Drivers for Blood Collection Device Demand in Japan?

Several drivers support growth. First, Japan's large elderly population leads to higher incidences of cardiovascular disease, diabetes, and cancer, increasing demand for blood draws and collection consumables. Second, the expansion of home testing services and remote patient monitoring programmes creates new demand for self collection kits and capillary blood collection devices. Third, advancements in diagnostic technology and multi parameter blood testing systems increase the need for high quality collection devices to maintain sample integrity. Fourth, government initiatives to strengthen preventive health programmes and the growing use of health check services support device usage in outpatient and screening settings.

What Are the Key Restraints Affecting Blood Collection Device Demand in Japan?

Despite favourable drivers, several constraints apply. The market in primary hospital and clinical settings is mature, limiting significant volume growth. High regulatory and certification requirements for new collection technologies increase development time and cost, making it difficult for smaller suppliers to enter the market. Cost sensitivity among buyers and intense competition among device manufacturers reduce margin potential. Additionally, transitioning to home based collection formats is hindered by logistical, training, and reimbursement challenges in remote or underserved areas.

What Are the Key Trends Shaping Blood Collection Device Demand in Japan?

Key trends include the growing acceptance of capillary blood collection devices and lancets for home or point of care settings, with the capillary device market in Japan projected to reach about USD 192 million by 2030, with an estimated 10% CAGR. The increasing use of self collection and remote sampling technologies, with regulatory approval, is enabling decentralized diagnostics. Device makers are also focusing on safety engineered features, minimal volume sampling, and integration with digital health platforms to enhance usability and compliance. Finally, sustainability concerns are influencing design choices, as Japanese buyers increasingly favour products with reduced waste and improved lifecycles.

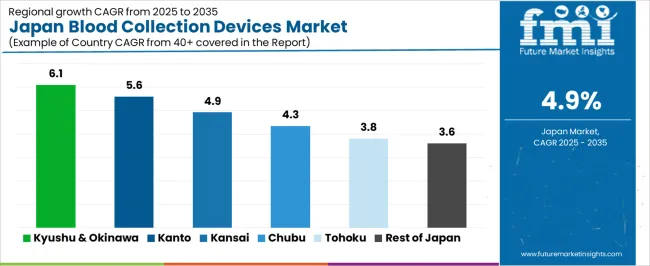

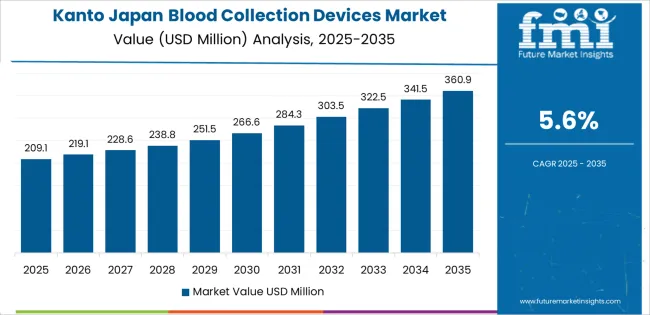

The demand for blood collection devices in Japan shows a steady growth pattern across regions, with Kyushu & Okinawa leading at a CAGR of 6.1%. Kanto follows closely with a 5.6% CAGR, driven by its strong healthcare infrastructure and large population. The Kinki region exhibits a moderate growth rate of 4.9%, while Chubu, Tohoku, and the Rest of Japan show more modest growth, with CAGRs of 4.3%, 3.8%, and 3.6%, respectively. These regional differences reflect varying levels of healthcare investment, population density, and adoption of medical technologies across Japan, with the largest demand centered in the more urbanized areas.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 6.1% |

| Kanto | 5.6% |

| Kinki | 4.9% |

| Chubu | 4.3% |

| Tohoku | 3.8% |

| Rest of Japan | 3.6% |

The demand for blood collection devices in Kyushu & Okinawa is projected to grow at a CAGR of 6.1%, reflecting the region’s increasing investment in healthcare and medical technology. Kyushu & Okinawa have a strong presence of healthcare facilities, including regional hospitals and medical centers, that require modern blood collection systems to meet the rising demand for diagnostic testing. As the population ages and the need for routine health check-ups and chronic disease management increases, the demand for efficient blood collection devices has risen. Additionally, the region’s emphasis on improving healthcare access and services has led to increased adoption of advanced medical technologies, supporting the growth in blood collection device demand. The region’s growing focus on healthcare modernization and the increasing number of patients requiring blood tests for various medical conditions contribute to a favorable market environment for these devices.

In the Kanto region, the demand for blood collection devices is expected to grow at a CAGR of 5.6%, driven by the region's highly developed healthcare infrastructure and large population centers, including Tokyo. Kanto is Japan’s economic and medical hub, home to numerous hospitals, research institutions, and private clinics that require advanced medical devices for diagnostics and treatment. The region's healthcare systems are increasingly adopting state-of-the-art technologies, including automated blood collection systems, to streamline medical procedures and improve patient care. The growing prevalence of chronic diseases and the aging population in Kanto also contribute to the rising demand for blood tests and routine health screenings, further driving the need for blood collection devices. As a result, Kanto remains one of the largest markets for blood collection devices in Japan, with robust demand across both public and private healthcare sectors.

The demand for blood collection devices in the Kinki region is projected to grow at a CAGR of 4.9%, reflecting steady growth driven by the region's strong healthcare network. Kinki, which includes major cities such as Osaka and Kyoto, has a well-established medical infrastructure that supports the increasing need for diagnostic tools, including blood collection devices. The region’s aging population and the rising prevalence of lifestyle diseases such as diabetes and hypertension are key factors driving the demand for routine blood tests. Additionally, the growing healthcare investments in Kinki, aimed at improving diagnostic accuracy and patient care, contribute to the adoption of more advanced blood collection technologies. While the region’s growth rate is slower compared to Kyushu & Okinawa and Kanto, the steady increase in demand for medical diagnostics ensures consistent growth in the market for blood collection devices in Kinki.

The demand for blood collection devices in Chubu is expected to grow at a CAGR of 4.3%, reflecting moderate but steady growth. Chubu, home to industrial cities like Nagoya, has a robust healthcare system supported by both public and private medical institutions. As the region's population ages and the need for routine medical tests increases, demand for efficient and reliable blood collection systems rises. However, the growth rate in Chubu is slightly slower compared to more urbanized regions like Kanto and Kyushu & Okinawa. The region’s more industrial focus and a slightly lower rate of healthcare innovation may contribute to this more moderate growth. Nevertheless, as medical facilities in Chubu continue to expand and upgrade their services, the demand for blood collection devices is expected to increase steadily, particularly in hospitals and diagnostic centers catering to an aging population.

In Tohoku, the demand for blood collection devices is projected to grow at a CAGR of 3.8%, reflecting slower adoption compared to other regions. Tohoku’s healthcare infrastructure is improving, with a growing number of regional medical centers and hospitals investing in modern diagnostic equipment. However, the region’s rural nature and lower population density compared to urban areas like Kanto and Kyushu contribute to slower growth. Despite this, Tohoku's aging population and increasing demand for health screenings and diagnostics are driving steady growth in the demand for blood collection devices. As medical facilities expand and modernize, there is potential for further growth in the market for these devices, although the pace will likely remain moderate due to the region’s demographic and economic factors.

The demand for blood collection devices in the Rest of Japan is expected to grow at a CAGR of 3.6%, reflecting modest growth across more rural and less densely populated areas. While healthcare facilities in these regions are steadily adopting modern technologies, the demand for blood collection devices is more stable and less dynamic compared to urban centers. The Rest of Japan’s healthcare market is influenced by an aging population that requires routine blood tests for monitoring various chronic conditions. However, the slower pace of technological adoption and fewer specialized medical institutions may contribute to the more modest growth rate. Despite these challenges, ongoing improvements in healthcare access and the increasing need for diagnostic testing will continue to support gradual growth in the demand for blood collection devices in these regions.

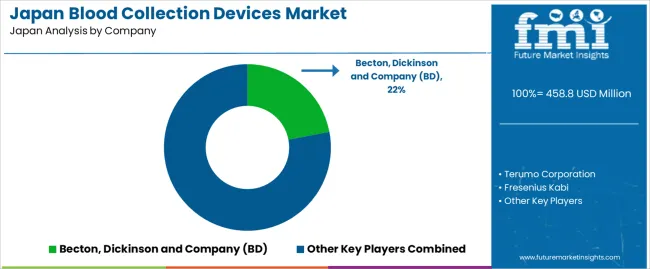

Demand in Japan for blood collection devices is influenced by growth in diagnostic testing, aging population trends, and the expansion of outpatient care services. Key companies in this sector include Becton, Dickinson and Company (BD) with approximately 22% market share, Terumo Corporation, Fresenius Kabi, Haemonetics Corporation, and Greiner Bio One. These manufacturers supply components such as collection tubes, needles, bag systems and accessories that are essential for reliable sample collection and laboratory workflows.

Competition in the Japanese blood collection devices market is centred on safety features, workflow compatibility and regulatory compliance. Companies develop devices with enhanced needle safety mechanisms, reduced contamination risk and improved ergonomics for phlebotomists. Another competitive dimension is compatibility with automated laboratory systems, as higher throughput and reduction of manual handling are priorities in clinical pathology settings. Firms also differentiate on material quality, storage stability of collected samples and traceability features that support laboratory accreditation. Marketing materials typically emphasise device sterility, system compatibility, sample integrity and standards compliance. By aligning their product development with the requirements of Japanese healthcare institutions—including operational efficiency and rigorous safety standards—these companies aim to strengthen their position in Japan’s blood collection devices industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Type | Blood Collection Tubes, Needles & Syringes, Blood Bags, Blood Collection Systems or Monitors |

| End User | Hospitals, Ambulatory Surgical Centers & Nursing Homes, Blood Bank, Diagnostic & Pathology Laboratories, Others |

| Method | Manual Blood Collection, Automated Blood Collection |

| Application | Diagnostic, Therapeutic |

| Key Companies Profiled | Becton, Dickinson and Company (BD), Terumo Corporation, Fresenius Kabi, Haemonetics Corporation, Greiner Bio-One |

| Additional Attributes | The market analysis includes dollar sales by type, end-user, method, application, and company categories. It also covers regional demand trends in Japan, driven by the increasing need for blood collection devices in hospitals, blood banks, and diagnostic laboratories. The competitive landscape highlights key manufacturers focusing on innovations in blood collection technologies, including automated systems and advanced blood collection monitors. Trends in the growing demand for blood collection systems in therapeutic and diagnostic applications are explored, along with advancements in needle and syringe design, safety features, and automation for efficient blood collection. |

The demand for blood collection devices in japan is estimated to be valued at USD 458.8 million in 2025.

The market size for the blood collection devices in japan is projected to reach USD 738.4 million by 2035.

The demand for blood collection devices in japan is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in blood collection devices in japan are blood collection tubes, needles & syringes, blood bags, blood collection systems or monitors and system type.

In terms of end user, hospitals segment is expected to command 38.9% share in the blood collection devices in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blood Collection Devices Market Insights – Trends & Forecast 2025 to 2035

Assessing Vacuum Blood Collection Devices Market Share & Industry Trends

Blood Warmer Devices Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Blood Collection Device Market Analysis - Size, Share & Forecast 2025 to 2035

Blood Clot Retrieval Devices Market Size and Share Forecast Outlook 2025 to 2035

Home Blood Testing Devices Market Insights - Trends, Growth & Forecast 2025 to 2035

Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Pet Blood Pressure Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Point Of Care Blood Testing Devices Market Size and Share Forecast Outlook 2025 to 2035

Non-Invasive Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Demand for Cardiovascular Repair & Reconstruction Devices in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Blood Compatible Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Blood Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Blood Sugar Tester Market Size and Share Forecast Outlook 2025 to 2035

Blood Flow Restriction Bands Market Size and Share Forecast Outlook 2025 to 2035

Blood-based Biomarker For Alzheimer's Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA