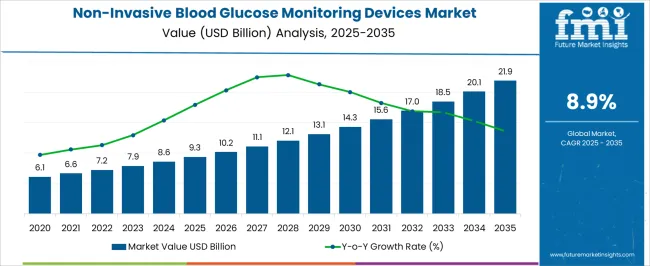

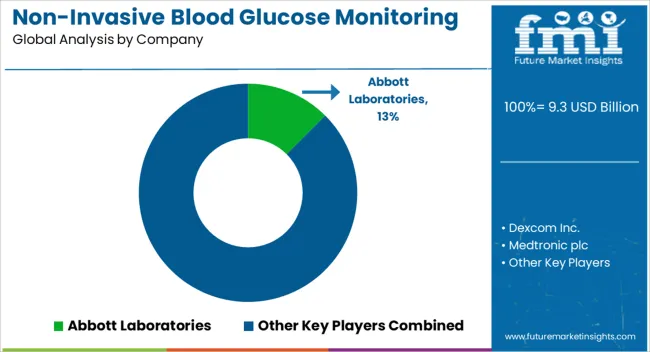

The Non-Invasive Blood Glucose Monitoring Devices Market is estimated to be valued at USD 9.3 billion in 2025 and is projected to reach USD 21.9 billion by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period.

| Metric | Value |

|---|---|

| Non-Invasive Blood Glucose Monitoring Devices Market Estimated Value in (2025 E) | USD 9.3 billion |

| Non-Invasive Blood Glucose Monitoring Devices Market Forecast Value in (2035 F) | USD 21.9 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The Non-Invasive Blood Glucose Monitoring Devices market is gaining rapid traction as the global burden of diabetes continues to increase and patients demand less painful, more convenient monitoring solutions. Traditional blood glucose testing methods that rely on finger pricking are associated with discomfort and low adherence, which has accelerated the shift toward non-invasive alternatives. Advancements in sensor technologies, including optical spectroscopy, electromagnetic sensing, and transdermal detection, are improving accuracy and reliability, making them more appealing to both patients and healthcare providers.

Wearable devices with wireless connectivity and integration into smartphones are further driving adoption, as they enable real-time monitoring and remote management by physicians. Growing awareness of preventive healthcare, along with the expansion of telemedicine, is also fueling demand.

Regulatory bodies are encouraging innovation in this space, and investment in research and development is steadily increasing As the need for continuous and user-friendly glucose monitoring rises, the market is positioned for robust growth, driven by technology-enabled convenience and patient-centric care.

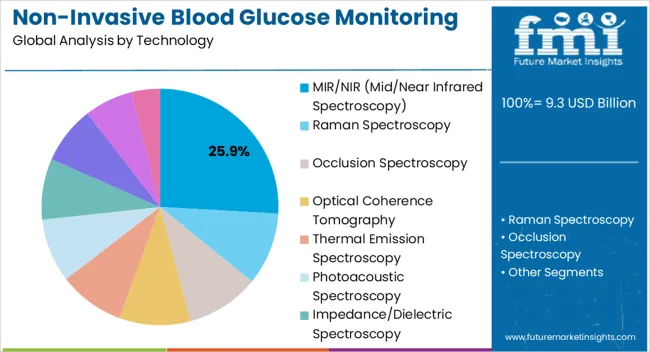

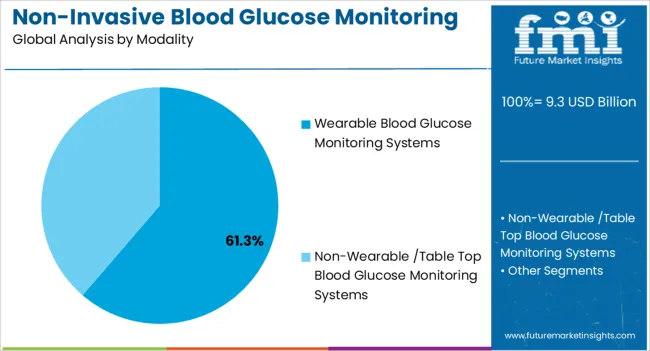

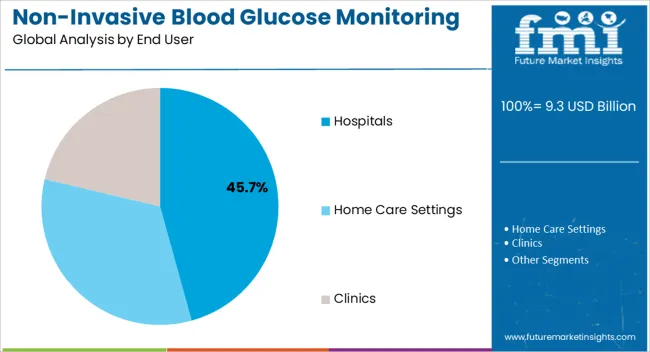

The non-invasive blood glucose monitoring devices market is segmented by technology, modality, end user, and geographic regions. By technology, non-invasive blood glucose monitoring devices market is divided into MIR/NIR (Mid/Near Infrared Spectroscopy), Raman Spectroscopy, Occlusion Spectroscopy, Optical Coherence Tomography, Thermal Emission Spectroscopy, Photoacoustic Spectroscopy, Impedance/Dielectric Spectroscopy, Electromagnetic, Polarimetry, and Fluorescence. In terms of modality, non-invasive blood glucose monitoring devices market is classified into Wearable Blood Glucose Monitoring Systems and Non-Wearable /Table Top Blood Glucose Monitoring Systems. Based on end user, non-invasive blood glucose monitoring devices market is segmented into Hospitals, Home Care Settings, and Clinics. Regionally, the non-invasive blood glucose monitoring devices industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The MIR/NIR technology segment is expected to account for 25.9% of the market revenue in 2025, highlighting its significance among emerging non-invasive solutions. This technology is being adopted due to its ability to measure glucose concentrations through light absorption patterns in blood and interstitial fluids, offering reliable and pain-free testing. Ongoing advancements in miniaturized sensors and calibration algorithms are enhancing the precision and consistency of MIR/NIR-based devices, making them suitable for daily use by diabetic patients.

Manufacturers are focusing on integrating this technology into compact and cost-effective devices, enabling broader accessibility across both developed and emerging markets. The appeal of this segment is reinforced by its compatibility with wearable platforms, allowing real-time monitoring and seamless data transfer to healthcare providers.

As diabetes prevalence grows globally, the MIR/NIR segment is expected to play a critical role in addressing unmet needs for painless glucose monitoring The combination of technological innovation and increasing patient acceptance positions this segment for long-term growth.

The wearable blood glucose monitoring systems segment is projected to hold 61.3% of the market revenue in 2025, positioning it as the dominant modality. Growth in this segment is driven by the increasing demand for continuous glucose monitoring solutions that provide convenience and real-time insights. Wearable devices are being preferred by patients due to their ability to eliminate the need for frequent finger-prick testing, thereby improving compliance and quality of life.

Integration with mobile applications, cloud platforms, and telehealth services enables real-time data sharing and remote monitoring, empowering healthcare professionals to make timely interventions. The segment is also benefitting from lifestyle integration, as wearable designs are discreet, lightweight, and compatible with fitness ecosystems.

Additionally, the ability of wearable systems to deliver trend analysis and alerts for hypoglycemia or hyperglycemia enhances patient safety As healthcare shifts toward preventive management and patient empowerment, the wearable segment is expected to sustain its leadership, supported by innovation in device accuracy, comfort, and interoperability.

The hospitals segment is anticipated to account for 45.7% of the market revenue in 2025, establishing itself as the leading end-user group. Growth in this segment is driven by the increasing adoption of advanced glucose monitoring technologies in inpatient and outpatient settings to improve diabetes management outcomes. Hospitals are leveraging non-invasive monitoring devices to reduce the burden on nursing staff, enhance patient comfort, and streamline continuous monitoring processes.

The ability to integrate these devices into hospital information systems and electronic health records allows for better clinical decision-making and treatment personalization. Hospitals are also serving as primary validation environments for new devices, accelerating clinical adoption and patient trust.

Growing investments in healthcare infrastructure, coupled with rising demand for real-time data accuracy in critical care and surgical settings, are further boosting adoption As diabetes care becomes a central focus of hospital-based chronic disease management programs, this segment is expected to remain the largest revenue contributor, supported by clinical reliability and institutional trust.

Diabetes has evolved as one of the primary healthcare epidemic characterized by high sugar levels and principle cause of mortality worldwide. In 2025, World Health Organization (WHO) estimated 8.5% of adults living with diabetes. A diabetic person cannot either synthesize enough insulin (type 1 diabetes) or either does not make enough insulin or cannot effectively use the insulin produced by the body (type 2 diabetes).

Another type of diabetes that occur in women during her pregnancy is gestational diabetes. However, gestational diabetes is usually resolved after delivery but can precede towards type 2 diabetes later in a women’s life. Most of the continuous glucose monitoring devices are invasive and involves use of needles leading to increased chance of infection. Furthermore, the invasive glucose monitoring device is considered to be discrete glucose measurement system which cannot be practically used for continuous monitoring of blood glucose.

Certain evidences of hyperglycemia between measurements are however not recorded thus resulting in false or no representation of the blood glucose pattern. Noninvasive monitoring of glucose levels eliminates the need of painful pricking with increased risk of infection, and amount of damage caused to the finger tissue.

Therefore, non-invasive continuous glucose monitoring devices are being widely investigated and studied over the past few years for their ability to monitor glucose continuously under highly controlled (e.g. in-clinic) conditions. Various techniques that involves measurement of blood glucose levels non-invasively includes, Near Infrared Spectroscopy (NIRS), Mid -Infrared Spectroscopy (Mid-IRS), Raman Spectroscopy, Photo-acoustic Spectroscopy (PA), Optical Coherence Tomography (OCT) and many more.

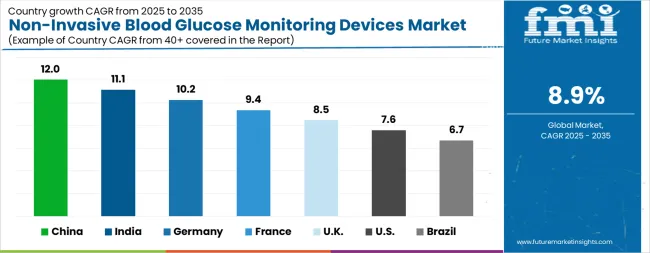

| Country | CAGR |

|---|---|

| China | 12.0% |

| India | 11.1% |

| Germany | 10.2% |

| France | 9.4% |

| UK | 8.5% |

| USA | 7.6% |

| Brazil | 6.7% |

The Non-Invasive Blood Glucose Monitoring Devices Market is expected to register a CAGR of 8.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 12.0%, followed by India at 11.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.7%, yet still underscores a broadly positive trajectory for the global Non-Invasive Blood Glucose Monitoring Devices Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.2%. The USA Non-Invasive Blood Glucose Monitoring Devices Market is estimated to be valued at USD 3.2 billion in 2025 and is anticipated to reach a valuation of USD 6.7 billion by 2035. Sales are projected to rise at a CAGR of 7.6% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 467.3 million and USD 267.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.3 Billion |

| Technology | MIR/NIR (Mid/Near Infrared Spectroscopy), Raman Spectroscopy, Occlusion Spectroscopy, Optical Coherence Tomography, Thermal Emission Spectroscopy, Photoacoustic Spectroscopy, Impedance/Dielectric Spectroscopy, Electromagnetic, Polarimetry, and Fluorescence |

| Modality | Wearable Blood Glucose Monitoring Systems and Non-Wearable /Table Top Blood Glucose Monitoring Systems |

| End User | Hospitals, Home Care Settings, and Clinics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Abbott Laboratories, Dexcom Inc., Medtronic plc, Senseonics Holdings, Nemaura Medical, OrSense Ltd., DiaMonTech GmbH, MediWise / Occuity Ltd., Know Labs Inc., Integrity Applications (GlucoTrack), OptiScan Biomedical, CNOGA Medical, Biolinq Inc., Movano Health, Verily Life Sciences, GlucoSense Diagnostics, Apple Inc., Scanbo Corp., DiaMonTech GmbH, and RSP Systems |

The global non-invasive blood glucose monitoring devices market is estimated to be valued at USD 9.3 billion in 2025.

The market size for the non-invasive blood glucose monitoring devices market is projected to reach USD 21.9 billion by 2035.

The non-invasive blood glucose monitoring devices market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in non-invasive blood glucose monitoring devices market are mir/nir (mid/near infrared spectroscopy), raman spectroscopy, occlusion spectroscopy, optical coherence tomography, thermal emission spectroscopy, photoacoustic spectroscopy, impedance/dielectric spectroscopy, electromagnetic, polarimetry and fluorescence.

In terms of modality, wearable blood glucose monitoring systems segment to command 61.3% share in the non-invasive blood glucose monitoring devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Pet Blood Pressure Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Demand for Glucose Monitoring Devices in EU Size and Share Forecast Outlook 2025 to 2035

Glucose Monitoring Device Market Overview – Growth, Trends & Forecast 2024-2034

Blood Warmer Devices Market Size and Share Forecast Outlook 2025 to 2035

RFID Blood Monitoring Systems Market Insights - Trends & Forecast 2024 to 2034

Blood Collection Devices Market Insights – Trends & Forecast 2025 to 2035

Pain Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Clot Retrieval Devices Market Size and Share Forecast Outlook 2025 to 2035

Dose Monitoring Devices Market - Growth & Demand 2025 to 2035

Noise Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Nerve Monitoring Devices Market Insights - Growth & Forecast 2025 to 2035

Dynamic Glucose Monitoring Patch Market Size and Share Forecast Outlook 2025 to 2035

Home Blood Testing Devices Market Insights - Trends, Growth & Forecast 2025 to 2035

Lactate Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Epilepsy Monitoring Devices Market Growth - Trends & Forecast 2025 to 2035

Continuous Glucose Monitoring Device Market - Demand & Future Trends 2025 to 2035

Continuous Glucose Monitoring Systems Market is segmented by transmitters and monitors, sensors and insulin pump from 2025 to 2035

Assessing Vacuum Blood Collection Devices Market Share & Industry Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA