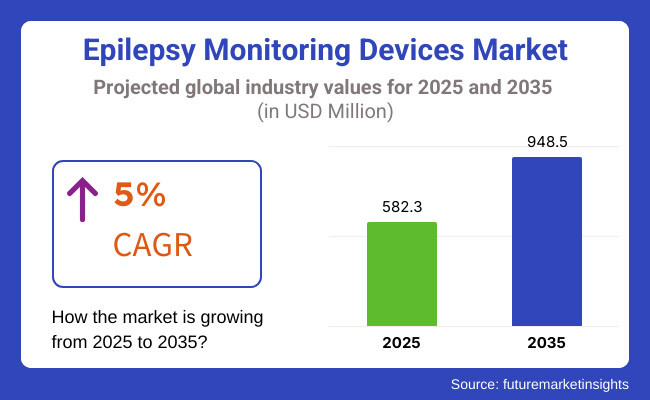

The global epilepsy monitoring devices market is projected to be valued at USD 582.3 million in 2025 and is expected to reach approximately USD 948.5 million by 2035, with a compound annual growth rate (CAGR) of 5.0% during the forecast period. Market growth is being driven by the increasing prevalence of epilepsy and the growing need for accurate and early diagnosis.

The adoption of advanced neurodiagnostic solutions has been accelerated by the integration of AI-based EEG analysis, wearable monitoring systems, and cloud-enabled platforms, allowing for real-time brain activity tracking and improved clinical outcomes.

Supportive policies and investments in neurological healthcare infrastructure have been implemented by governments and healthcare providers. Awareness regarding epilepsy as a chronic condition has been elevated, particularly in developing regions. As a result, consistent demand for epilepsy monitoring solutions is expected to be sustained throughout the forecast period.

In the epilepsy monitoring devices market, key players such as Boston Scientific Corporation, Medtronic Plc, Nihon Kohden Corporation, Abbott Laboratories, and Cadwell Industries Inc. have been recognized as leading manufacturers. Significant growth has been influenced by active investments in technology innovation, global regulatory alignment, and supply chain optimization.

In April 2025, Nihon Kohden launched its second-generation Live View Panel Pro™, a virtual health system designed to enhance remote neurology care through real-time interactive viewing, two-way intercom, and centralized data access. The platform helps reduce patient transfers, streamline decision-making, and improve care delivery across multi-location hospital networks.

As stated by Roy Sakai, President of Nihon Kohden America, LLC, “Incorporating direct clinician feedback into this latest update helps break down physical and logistical barriers, empowering medical professionals to deliver exceptional care with greater ease and efficiency.” In 2025, FDA Grants Authorization to Epiminder’s Implantable Continuous EEG Monitor for Epilepsy Treatment.

"We have worked constructively with the FDA over an extend period of time and we are very pleased that the FDA has approved Minder iCEM for the use in drug resistant epilepsy (DRE). The agency had previously designated Minder a breakthrough technology underscoring the importance of this innovation. The marketing authorization makes brings an important new tool to bear in managing drug resistant epilepsy," Rohan Hoare, PhD, CEO at Epiminder.

North America has been established as a key market for epilepsy monitoring devices, supported by advanced healthcare systems and favourable reimbursement policies. In the USA, increased adoption has been enabled by investments made in neurodiagnostic infrastructure and the development of wearable EEG devices.

In Europe, notable growth has been observed, driven by strict healthcare regulations and a focus placed on early seizure detection. In countries like Germany, France, and the UK, the integration of advanced monitoring systems has been encouraged through supportive policies. Diagnostic accuracy has been enhanced by the adoption of AI-based analytics and cloud platforms.

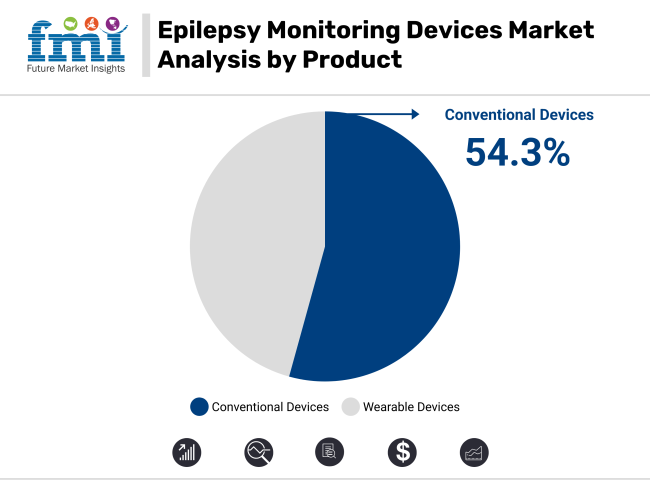

In 2025, conventional devices are projected to account for 54.3% of revenue share in the epilepsy monitoring devices market. This leading position has been attributed to proven reliability and diagnostic precision demonstrated in clinical environments. Preference for their use has been consistently shown by neurologists for both inpatient and outpatient epilepsy monitoring.

High-quality signal acquisition and long-term EEG recording capabilities have been regarded as essential to their adoption. Integration into hospital infrastructures has been facilitated, allowing continuous video-EEG telemetry to be performed for accurate seizure detection.

'Their role in supporting complex diagnostic procedures, including pre-surgical evaluations, has been widely acknowledged. Compatibility with hospital IT systems and data archiving has been improved through digital enhancements. As a result, strong clinical trust has been established. Further reinforcement of the segment’s dominance is expected through increased healthcare investments in neurodiagnostic units and rising demand for effective seizure monitoring solutions.

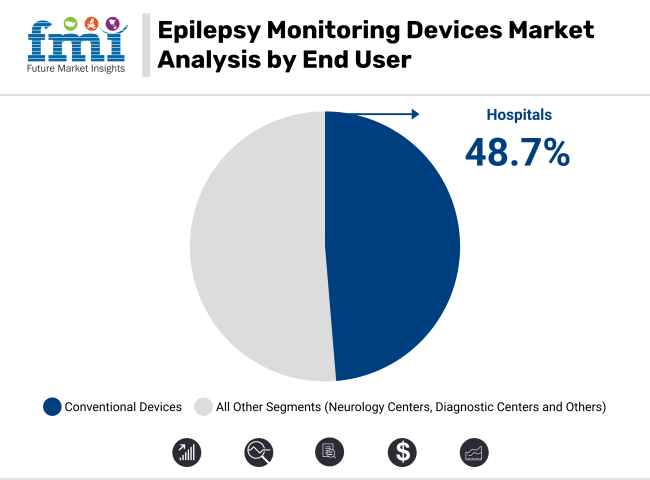

By 2025, Hospitals are expected to represent 48.7% of the total revenue in the epilepsy monitoring devices market. This segment’s growth has been attributed to the increasing number of epilepsy diagnoses and the preference shown for treatment within hospital settings. Patients with recurrent seizures are commonly admitted for prolonged monitoring, where specialized neurology units and round-the-clock medical support are provided.

Continuous EEG monitoring has been enabled by the availability of advanced infrastructure, especially in cases requiring precise seizure pattern evaluation. Devices have been routinely installed in hospital neurology departments, with usage frequently reimbursed under public or private healthcare plans.

Comprehensive patient management has been facilitated by multidisciplinary care teams present in these facilities. Additionally, adoption has been further influenced by government initiatives aimed at expanding neurological care services. As a result, the hospital and clinic segment has been positioned as a vital contributor to the epilepsy monitoring ecosystem.

Challenges

High Cost of Advanced Monitoring Devices, Limited Access in Low-Income Regions, and Data Privacy Concerns

Adopting advanced EEG monitoring systems, wearable sensors, and AI-driven seizure detection solutions involve costs associated with implementation and usage, hindering the Epilepsy monitoring devices market growth. Real-time epilepsy monitoring is limited in many low- and middle-income countries, resulting in disparities in early diagnosis and management for this common neurodegenerative condition.

Data privacy and cybersecurity concerns also pose another significant challenge, as seizure tracking systems based in the cloud and AI-powered monitoring platforms imply an important need for the collection and storage of sensitive patient health data, with the risk of non-HAZ compliance with HIPAA, GDPR, and other regulatory frameworks.

Opportunities

Growth in AI-Powered Seizure Detection, Wearable Epilepsy Monitoring, and Remote Patient Management

However, as many as these factors may seem, there is certainly a huge opportunity market for the epilepsy monitoring devices market to thrive due to AI-based seizure detection and monitoring of the patient in real time, which have been the focal point of many discussions, along with the boom of remote healthcare solutions. Recent advancements in wearable EEG headbands, AI-integrated smartwatches, and smartphone-based seizure alert systems are revolutionizing the monitoring and management of epilepsy, ultimately leading to improved patient outcomes.

Moreover, the rising incorporation of telemedicine, cloud-based predictive analytics, and digital biomarkers is broadening scope of distant epilepsy management, facilitating early opportunity for detection with tailored therapy modifications and pioneering seizure prevention approaches. Advancements in implantable neurostimulation devices, and AI-powered seizure prediction algorithms are too revolutionizing long-term epilepsy care.

The USA epilepsy monitoring devices market is expected witnessing a growth attributable to the rising incidence of epilepsy coupled with technological advancements in neurodiagnostics. This is attributed to the increasing adoption of wearable seizure detection devices and the collaboration of artificial intelligence (AI) and remote monitoring solutions that are driving the market growth. Moreover, the increasing research investment in epilepsy and government initiatives facilitating the management of neurological diseases are facilitating the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.1% |

Epilepsy management and technological advancements in EEG-based monitoring systems are driving the epilepsy monitoring devices market in the United Kingdom. Growing usage of home-based seizure monitoring solutions and artificial intelligence-enabled diagnostic tools are driving the demand in the market. Furthermore, the growth of telemedicine services and integration of digital health solutions are improving access to epilepsy care.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

The epilepsy monitoring devices market in this region is part of a growing trend as healthcare providers increasingly turn to non-invasive, real-time technologies for seizure monitoring. Market demand is driven by established medical device manufacturers and BCI technologies. Moreover, rising expenditures on healthcare concerning neurological disorders coupled with supportive reimbursement strategies for seizure treatments will complement with the epilepsy treatment market expansion.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.0% |

Japan epilepsy monitoring devices market is undergoing a moderate growth phase attributed to the strong emphasis of the country towards medical devices innovation and neurotechnology research. The increasing adoption of smart wearables, home EEG monitoring, and AI-based epilepsy detection systems are driving the market growth. Moreover, the growing adoption of initiatives by governmental bodies to enable effective digital healthcare solutions leading to better patient outcomes is creating lucrative opportunities for the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

The market for epilepsy monitoring devices is growing in South Korea as remote patient monitoring and AI-based seizure detection devices become widely used. Demand is being driven by the country's advancements in digital healthcare infrastructure, combined with strong investments in neurology-focused telemedicine. Moreover, the growing incorporation of epilepsy monitoring solutions in both hospital networks and in-home care settings is expected to propel the market growth even further.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

The rising demand for real-time seizure detection and AI-based neurological monitoring, as well as the use of wearable solutions for brain activity, are contributing to the rapid growth of the epilepsy monitoring devices market. Innovations park is stamped in trace in the field of epilepsy and its management due to development in the areas of electroencephalography (EEG), implantable neurostimulators and telemedicine based epilepsy diagnostics.

Now, companies are also concentrating on AI-driven seizure prediction algorithms, wireless monitoring devices, and cloud-based patient data analysis to help improve accuracy, provide an early warning, and assist in long-term epilepsy management.

The overall market size for the epilepsy monitoring devices market was USD 582.3 Million in 2025.

The epilepsy monitoring devices market is expected to reach USD 948.5 Million in 2035.

Growth is driven by the rising prevalence of epilepsy, increasing adoption of wearable EEG devices, and advancements in AI-driven diagnostics.

The top 5 countries driving the development of the epilepsy monitoring devices market are the USA, Germany, Japan, China, and the UK

Wearable Devices and Hospital End Users are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 13: Global Market Attractiveness by Product, 2023 to 2033

Figure 14: Global Market Attractiveness by End User, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 28: North America Market Attractiveness by Product, 2023 to 2033

Figure 29: North America Market Attractiveness by End User, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 58: Europe Market Attractiveness by Product, 2023 to 2033

Figure 59: Europe Market Attractiveness by End User, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Product, 2023 to 2033

Figure 74: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 89: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Product, 2023 to 2033

Figure 104: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 118: MEA Market Attractiveness by Product, 2023 to 2033

Figure 119: MEA Market Attractiveness by End User, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Monitoring Tool Market Size and Share Forecast Outlook 2025 to 2035

Pet Monitoring Camera Market Size and Share Forecast Outlook 2025 to 2035

Pain Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Dose Monitoring Devices Market - Growth & Demand 2025 to 2035

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Neuro-monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Media Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Monitoring Market Report - Growth, Demand & Forecast 2025 to 2035

Urine Monitoring Systems Market Analysis - Size, Trends & Forecast 2025 to 2035

Brain Monitoring Systems Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Flare Monitoring Market

Yield Monitoring Systems Market

Noise Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Nerve Monitoring Devices Market Insights - Growth & Forecast 2025 to 2035

Driver Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Tunnel Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Accessories Market Size and Share Forecast Outlook 2025 to 2035

Central Monitoring Station Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA