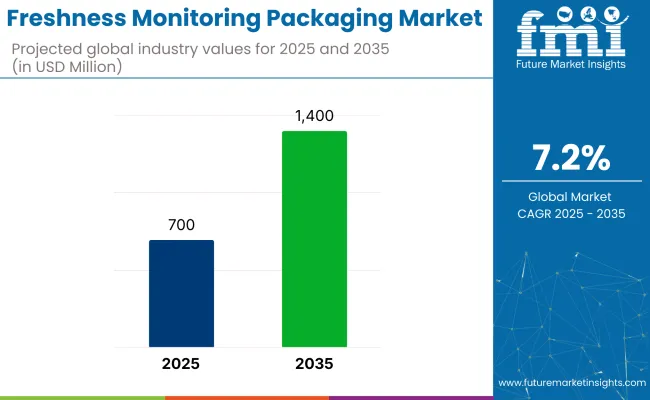

The freshness monitoring packaging market is projected to reach USD 1400 million by 2035, reflecting a 7.2% CAGR. The fresh produce segment will continue to hold the largest share among end-use categories, propelled by perishability concerns and the imperative to reduce post-harvest losses.

The freshness monitoring packaging market has been estimated to account for 5-8% of the smart food packaging segment, highlighting its expanding role in protecting temperature-sensitive products. A 4-6% share has been assigned within the larger intelligent packaging domain, where freshness data are being integrated alongside time-temperature indicators and data-logging units. Over 50% of the freshness-indicator-label niche has been attributed to this industry, as label-embedded chemistry is being regarded as the primary use case.

Just 1-2% of the overall food packaging materials landscape has been recorded, owing to the dominance of conventional barrier and protective formats. Finally, 15-20% of food-freshness sensor deployments have been credited to packaging-integrated systems, underlining their relevance among on-package and external monitoring technologies.

Traceability will play increasingly central roles, fueling demand for next-generation chemical indicators and bio-based packaging alternatives. As industries seek to comply with evolving regulations and address consumer expectations, growth in freshness monitoring packaging is expected to remain strong throughout the period.

In April 2024, a researcher in biomaterials from Auburn University was awarded a USA patent for a novel gas-sensing coating designed for meat packaging. This innovative coating enables packaging stickers to change color progressively, indicating the freshness level of the meat inside. This development aims to reduce food waste by providing consumers and retailers with a clear visual indicator of product freshness, enhancing food safety and reducing spoilage. The technology represents a significant step forward in intelligent packaging solutions, offering a practical application of freshness monitoring in the food industry

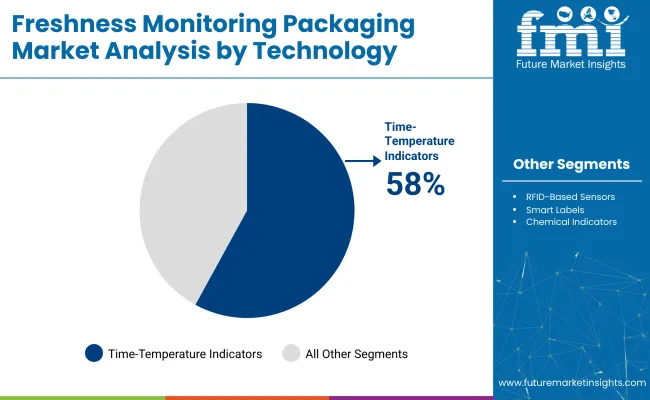

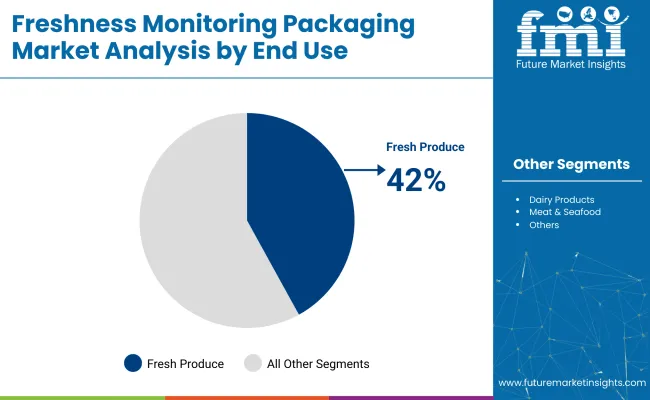

Time-temperature indicators lead the technology segment due to reliability and integration ease; fresh produce drives end-use demand with high perishability needs; and plastic films dominate materials, offering flexibility and sensor compatibility. Continued innovation in TTI chemistry, produce-specific calibration, and green film substrates will underpin industry growth through 2035.

Time-temperature indicators (TTIs) will continue to command 58% of the technology segment in 2025. Their affordability, ease of integration into existing packaging lines, and proven accuracy in monitoring thermal history make them indispensable for cold-chain logistics.

Fresh produce is projected to account for 42% of end-use demand in 2025. High perishability and stringent quality requirements drive growers and distributors to adopt freshness monitoring solutions.

Plastic films will constitute 37.2% of the material segment in 2025, balancing flexibility, barrier performance, and sensor compatibility. Manufacturers like Avery Dennison and Insignia Technologies are developing advanced multi-layer film structures that embed sensors without compromising seal integrity.

Government food-safety mandates and consumer demand for transparency are driving the adoption of freshness-monitoring packaging. Yet, sensor costs and integration complexity pose adoption barriers. Continued regulatory alignment, cost-reduction innovations, and turnkey solutions will be critical to industry expansion through 2035.

Rising Regulatory Pressure Is Driving Monitoring Solution Adoption

Increased regulatory scrutiny across the EU, USA, and Asia is being cited as a key driver behind the adoption of freshness-monitoring technologies. Requirements for temperature tracking and spoilage documentation are being enforced on perishable goods, prompting the integration of sensors such as RFID and time-temperature indicators. Certification standards are being aligned through collaborations between technology providers and regulatory bodies to ensure accuracy and compliance.

Sensor Cost and Integration Barriers Are Being Faced by Producers

Widespread adoption of freshness-monitoring packaging is being hindered by high sensor costs and complex integration demands. Upgrades to packaging infrastructure are required to accommodate multi-layer film and embedded electronics. Smaller producers are being impacted disproportionately due to limited capital and technical resources. As a result, modular and pilot-ready systems are being offered by suppliers, though full scalability remains constrained.

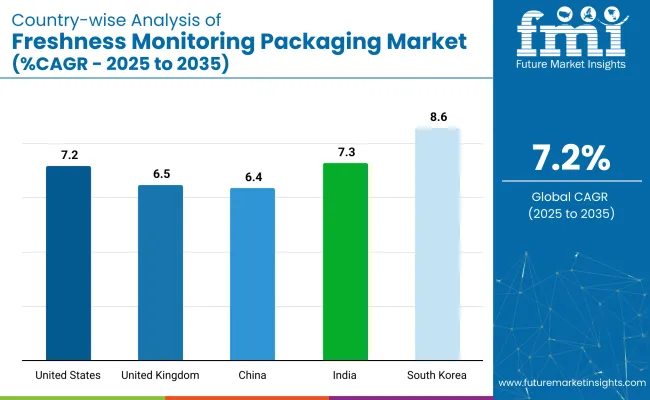

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 7.2% |

| United Kingdom | 6.5% |

| China | 6.4% |

| India | 7.3% |

| South Korea | 8.6% |

In the Freshness Monitoring Packaging industry, group-wise performance has been marked by distinct growth trajectories. Among OECD countries, South Korea has been forecasted to achieve the highest CAGR of 8.6%, driven by the adoption of smart sensors and government-supported cold chain digitization. The United States has been projected at 7.2%, with growth driven by traceability mandates across the pharmaceutical and food sectors.

A slower pace of 6.5% has been recorded in the United Kingdom, where retrofit costs and low small-retailer uptake have limited growth. In BRICS, India’s 7.3% CAGR has been supported by refrigerated transport investment and export-focused infrastructure. China’s 6.4% CAGR has been shaped by uneven technological deployment. OECD growth has been regulation-driven, while BRICS expansion has been led by export readiness.

The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

With a projected CAGR of 7.2%, the United States market will continue to expand as manufacturers and regulators push for greater supply-chain visibility and food safety. The USA leads adoption of freshness monitoring solutions, propelled by stringent FDA and USDA guidelines for perishable goods.

Retailers like Walmart and Kroger are piloting RFID-based sensors and time-temperature indicators on produce and meat, reducing spoilage and waste. Major suppliers-3M Company and Zebra Technologies-partner with food distributors to integrate smart labels into existing packaging lines. Cold-chain logistics firms invest in end-to-end traceability platforms, combining printed sensors with blockchain.

With a 6.5% CAGR, the UK market is expected to see steady growth, driven by regulatory pressure and consumer demand. In the UK, food safety standards and waste-reduction targets are driving freshness monitoring uptake. Retail chains such as Tesco and Sainsbury’s are deploying time-temperature indicators on fresh produce labels and integrating printed sensors in dairy packaging.

Government initiatives, like the Waste and Resources Action Programme (WRAP), provide funding for pilot projects that validate sensor accuracy in real-world conditions. Suppliers such as Avery Dennison and Evigence Sensors collaborate with packaging converters to develop paper-based smart labels that align with the UK’s environmental responsibility goals.

With robust investment in sensor R&D and a projected CAGR of 6.4%, China is becoming a major innovation hub for freshness monitoring technologies. China’s freshness monitoring packaging industry is experiencing rapid growth as domestic food safety incidents underscore the need for better cold-chain controls.

eCcommerce giants like Alibaba and JD.com are integrating smart labels-RFID and printed sensors-into delivery packaging for meat and seafood. Local suppliers, including Keep-it Technologies and NiGK Corporation, are scaling production of chemical indicators tailored to Chinese cold-chain conditions. Government “Food Safety Law” revisions mandate traceability solutions, accelerating adoption.

With a projected CAGR of 7.3%, India's adoption is driven by government infrastructure projects, rising consumer awareness, and private-sector initiatives aimed at reducing spoilage and improving food quality. The industry is growing as retailers and food producers tackle high post-harvest losses in fruits and vegetables.

Time-temperature indicators are being piloted by large cold-chain operators in Maharashtra and Punjab to validate transit conditions. Companies like DeltaTrak Inc. and Timestrip UK are forging partnerships with Indian packaging firms to localize sensor solutions. The Food Safety and Standards Authority of India (FSSAI) is exploring smart-label mandates for dairy and meat products.

With the highest CAGR of 8.6%, South Korea’s market is expected to experience rapid expansion, driven by tech-savvy consumers, robust e-commerce infrastructure, and stringent food safety regulations. The growth is led by consumer electronics applications in smart packaging.

Major conglomerates like Samsung and LG are developing integrated freshness sensors for edible products sold through online platforms. Time-temperature indicators and RFID tags are being tested in e-grocery deliveries to ensure product integrity. Local firms such as Insignia Technologies and LCR Hallcrest are partnering with packaging converters to embed printed sensors in plastic films that meet KFDA standards.

The industry is shaped by key participants such as FreshTrackTech, 3M, Zebra Technologies, SpotSee, and Timestrip UK. 3M has prioritized RFID-enabled freshness solutions, while Zebra Technologies integrates IoT to support real-time monitoring of perishables. SpotSee and Varcode develop advanced time-temperature indicators, and Timestrip UK focuses on time-sensitive labels for food and pharmaceuticals.

These firms maintain competitiveness through continued investment in R&D Emerging players are advancing smart packaging and data-driven models but face high entry barriers due to compliance demands and capital intensity. Consolidation has been observed, with established companies acquiring smaller innovators to enhance product portfolios. This evolving competitive landscape reflects a shift toward scalable, intelligent packaging systems, marked by innovation partnerships and the increasing application of sensor technologies in supply-chain visibility.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Current Total Industry Size (2025) | USD 700 million |

| Projected Industry Size (2035) | USD 1400 million |

| CAGR (2025 to 2035) | 7.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Technology Types Analyzed | Time-Temperature Indicator, RFID-based Sensors, Smart Labels, Printed Sensors, Chemical Indicator |

| End-Use Segmentation | Fresh Produce, Dairy Products, Meat & Seafood, Bakery Products, Processed Foods |

| Material Types Analyzed | Plastic Films, Paper-based Packaging, Bio-based Packaging, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players | FreshTrackTech, 3M, Zebra Technologies Corp., Timestrip UK LTD, SpotSee, Varcode, DeltaTrak Inc., and Insignia Technologies. |

| Additional Attributes | Dollar sales by technology, material type, and end-use, increasing demand for smart packaging solutions in food safety, growing focus on eco-friendly in packaging, regional trends in cold chain logistics, technological advancements in freshness monitoring and packaging design. |

The industry includes time-temperature indicators, RFID-based sensors, smart labels, printed sensors, and chemical indicators.

The industry is segmented into fresh produce, dairy products, meat and seafood, bakery products, and processed foods.

Based on material type, the industry is categorized into plastic films, paper-based packaging, bio-based packaging, and other materials.

The industry coverage includes North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East & Africa (MEA).

The industry is projected to reach USD 700 million in 2025.

The industry is forecasted to grow to USD 1400 million by 2035.

The industry is anticipated to expand at a CAGR of 7.2% during 2025 to 2035.

Time-temperature indicators dominate, capturing 58% of technology adoption.

Fresh produce leads with 42% share.

Plastic films account for 37.2% of materials.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Freshness Indicator Label Market Size and Share Forecast Outlook 2025 to 2035

Temperature and Freshness Sensors Market Size and Share Forecast Outlook 2025 to 2035

Monitoring Tool Market Insights – Growth & Forecast 2024-2034

Pet Monitoring Camera Market Size and Share Forecast Outlook 2025 to 2035

Pain Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Dose Monitoring Devices Market - Growth & Demand 2025 to 2035

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Neuro-monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Media Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Noise Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Nerve Monitoring Devices Market Insights - Growth & Forecast 2025 to 2035

Power Monitoring Market Report - Growth, Demand & Forecast 2025 to 2035

Urine Monitoring Systems Market Analysis - Size, Trends & Forecast 2025 to 2035

Brain Monitoring Systems Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Flare Monitoring Market

Yield Monitoring Systems Market

Driver Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Tunnel Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA