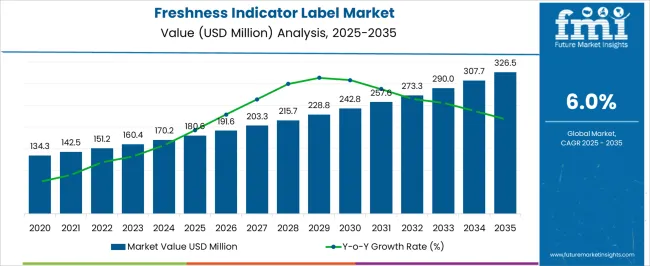

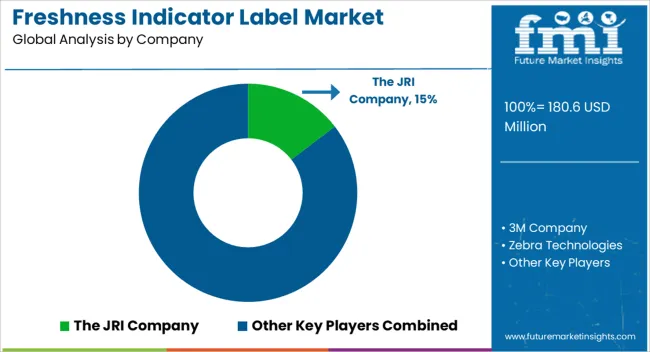

The Freshness Indicator Label Market is estimated to be valued at USD 180.6 million in 2025 and is projected to reach USD 326.5 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Freshness Indicator Label Market Estimated Value in (2025 E) | USD 180.6 million |

| Freshness Indicator Label Market Forecast Value in (2035 F) | USD 326.5 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The freshness indicator label market is gaining traction, driven by the increasing demand for smart packaging solutions that enhance food safety and reduce wastage. Rising awareness of food quality and shelf-life monitoring has accelerated adoption across multiple industries, particularly food and beverages.

The current landscape is shaped by technological advances in indicator materials and printing methods that improve accuracy and cost-efficiency. Integration of these labels into packaging not only builds consumer trust but also supports regulatory compliance related to transparency and traceability.

The market benefits from sustainability initiatives aimed at minimizing food waste, which further supports investment in smart labeling solutions. With expanding applications across food, pharmaceuticals, and logistics, the market is projected to witness sustained growth over the forecast horizon.

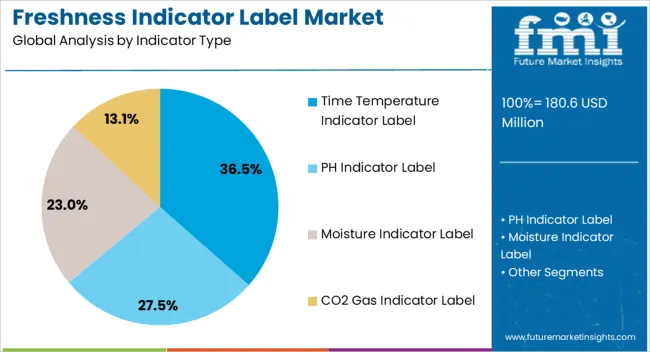

The time temperature indicator label segment dominates the indicator type category, holding approximately 36.50% share. Its leadership is supported by the ability to provide real-time monitoring of product exposure to temperature variations during storage and transit.

The segment addresses critical concerns of food safety and spoilage prevention, making it widely adopted in perishable goods packaging. Cost-effectiveness and compatibility with existing packaging designs enhance its market appeal.

The segment also benefits from regulatory emphasis on cold-chain monitoring, particularly in food and pharmaceutical sectors. With growing consumer demand for visible freshness indicators, this segment is expected to retain its dominance.

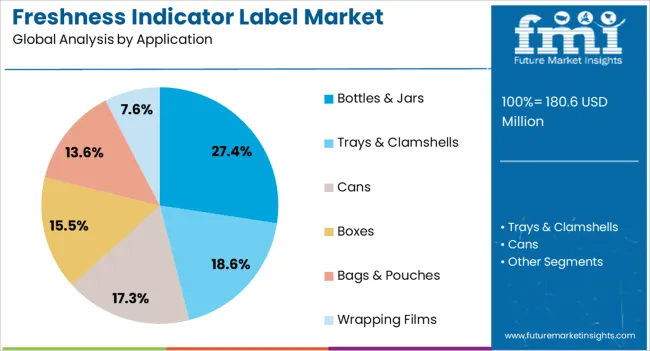

The bottles & jars segment holds approximately 27.40% share of the application category, reflecting its widespread use in packaged foods, beverages, and condiments. The segment’s growth is supported by the rising popularity of single-serve packaging and consumer preference for freshness assurance in packaged products.

Freshness indicators integrated into bottles and jars enhance transparency and build consumer confidence in product quality. Adoption is reinforced by strong demand in sauces, dairy, and ready-to-drink beverages.

With increasing packaging innovation and premiumization trends, this segment is projected to maintain its relevance in the overall market.

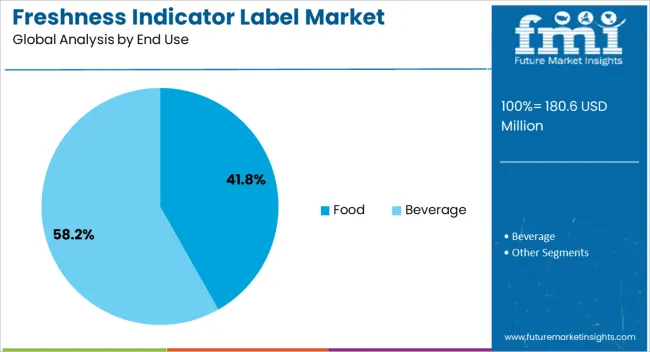

The food segment dominates the end-use category with approximately 41.80% share, owing to the critical importance of shelf-life monitoring in reducing wastage and ensuring consumer safety. The segment benefits from strong demand in meat, seafood, dairy, and packaged foods, where real-time freshness tracking adds significant value.

Adoption is reinforced by regulatory mandates for improved labeling and quality control in food industries. Increasing consumer demand for transparency and trust in packaged food has further driven uptake.

With the global focus on minimizing food waste and improving cold-chain efficiency, the food segment is expected to sustain its leadership.

| CAGR from 2020 to 2025 | 3.9% |

|---|---|

| CAGR from 2025 to 2035 | 6.1% |

The historical performance of the freshness indicator label market, supported by a 3.9% CAGR, reflects a period of steady growth and market maturation. Looking ahead from 2025 to 2035, the market is projected to experience a notable increase in growth, with a CAGR of 6.1%.

The market is expected to witness a surge in demand for freshness indicator label that offer customization features. Tailoring freshness preferences to individual tastes, dietary needs, and cultural considerations is likely to resonate with consumers, promoting increased adoption and market growth.

Smart Packaging with RFID Tags

Incorporating RFID tags into freshness labels is a strategic move in response to the industry's call for enhanced traceability and real-time supply chain monitoring. Companies are proactively adopting this trend, investing in RFID infrastructure to reinforce their commitment to supply chain efficiency.

Responsive Packaging Labels

In the ever-evolving consumer landscape, Responsive Packaging Labels emerge as a market-savvy response to external factors affecting product freshness. Companies are integrating sensor technologies and data analytics into label design, recognizing the market demand for responsiveness to environmental fluctuations.

Customizable Freshness Profiles

The trend of Customizable Freshness Profiles epitomizes a consumer-centric approach, allowing individuals to tailor their freshness preferences. Companies are strategically responding to this market trend by developing label technologies that seamlessly accommodate customization.

Odor Sensing Labels

The introduction of odor sensing labels marks a strategic move towards enhancing consumer engagement and sensory evaluation. Companies are actively investing in refining odor-sensing technologies to ensure reliability, recognizing the growing importance of the olfactory experience in influencing consumer perception and preference.

Intelligent QR Code Labels

The evolution of QR codes into intelligent QR code labels is a market-driven response to the escalating demand for transparent product information. Equipped with embedded intelligence, these labels act as gateways to comprehensive online platforms, catering to consumers seeking detailed insights on freshness metrics, sourcing details, and recommended product usage. Companies are aligning with this trend by enhancing their digital infrastructure, recognizing the crucial role of digital connectivity in meeting consumer expectations for detailed and accessible product information.

Eco-friendly Dissolvable Labels

The emergence of eco-friendly dissolvable labels reflects a shift toward sustainability within the freshness indicator label industry. These labels, designed to dissolve in water, provide a sustainable solution to reduce packaging waste without compromising freshness monitoring. Companies are strategically embracing this eco-conscious trend by exploring innovative, biodegradable materials for label production.

The section sheds light on category-wise insights for the freshness indicator label industry. With a commanding share of 24.7% in 2025, this indicator type plays a crucial role in the industry. By end use, the food industry captures a substantial share of 32.7% in 2025.

| Attributes | Detail |

|---|---|

| By Indicator Type | Moisture Content Indicator |

| Market Share in 2025 | 24.7% |

In 2025, moisture content indicators command a significant share of 24.7% of the freshness indicator label industry.

| Attributes | Detail |

|---|---|

| Dominating End Use | Food |

| Market Share in 2025 | 32.7% |

With a substantial share of 32.7% in 2025, the food end-use segment dominates the freshness indicator label industry.

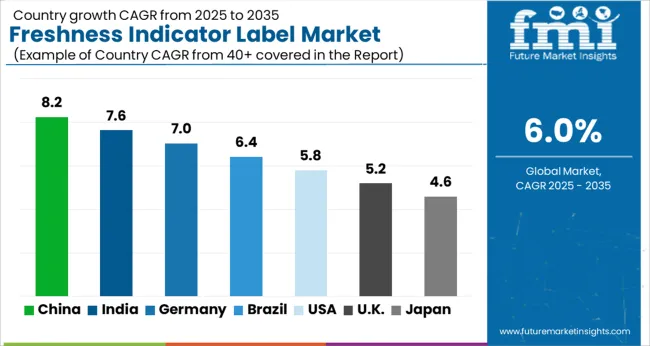

This section provides a country-wise analysis of the freshness indicator label industry, focusing on key countries and their respective CAGRs through 2035. Notably, the freshness indicator label industry in India showcases remarkable potential, projecting a robust CAGR of 7.9%, while China is anticipated to witness a notable CAGR of 7.1% through 2035.

The freshness indicator label industry in the United States is likely to record a moderate CAGR of 4.2% through 2035.

The Germany freshness indicator label industry is expected to witness a CAGR of 4.0% through 2035.

The China freshness indicator label industry is projected to register a CAGR of 7.1% through 2035.

The freshness indicator label industry in India is anticipated to rise at a CAGR of 7.9% through 2035.

The freshness indicator label industry in the United Kingdom is expected to garner a CAGR of 5.4% through 2035.

Several well-established companies dominate the freshness indicator label industry. These companies often have a wide range of products, strong distribution networks, and extensive experience in the industry.

New entrants and startups bring innovation to the industry, introducing novel technologies and approaches to freshness indicators. These companies focus on niche markets or specific product categories.

Companies that invest in cutting-edge technologies, such as smart sensors, nanotechnology, and biodegradable materials, gain a competitive edge. These advancements contribute to more accurate freshness indicators and environmental sustainability.

The trend towards eco-friendly and sustainable packaging is influencing the freshness indicator label industry. Companies that adopt environmentally friendly materials and production processes are likely to appeal to conscious consumers and contribute to a positive brand image.

Tailoring freshness indicators to specific products and consumer preferences is a growing trend. Companies offering customizable solutions may have an edge in meeting diverse demands.

Recent Developments in the Freshness Indicator Label Industry

The global freshness indicator label market is estimated to be valued at USD 180.6 million in 2025.

The market size for the freshness indicator label market is projected to reach USD 326.5 million by 2035.

The freshness indicator label market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in freshness indicator label market are time temperature indicator label, ph indicator label, moisture indicator label and co2 gas indicator label.

In terms of application, bottles & jars segment to command 27.4% share in the freshness indicator label market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Freshness Monitoring Packaging Market Size and Share Forecast Outlook 2025 to 2035

Temperature and Freshness Sensors Market Size and Share Forecast Outlook 2025 to 2035

Flow Indicator Market Size and Share Forecast Outlook 2025 to 2035

Oxygen Indicator Labels Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in Oxygen Indicator Labels Manufacturing

Grating Indicator Calibrator Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Humidity Indicator Plugs Market

Ripeness Indicator Labels Market Size and Share Forecast Outlook 2025 to 2035

Biological Indicator Vial Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down Market Share in Biological Indicator Vial Industry

Colorimetric Indicator Labels Market Trends – Growth & Forecast 2024-2034

Rotation Speed Indicators Market Size and Share Forecast Outlook 2025 to 2035

Steam Chemical Indicator Market

Pharmaceutical Indicator Strips Market

Cable Line Fault Indicator Market Size and Share Forecast Outlook 2025 to 2035

Time Temperature Indicator Labels Market Size and Share Forecast Outlook 2025 to 2035

Time Temperature Indicator Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Evaluating Time Temperature Indicator Labels Market Share & Provider Insights

Blood Temperature Indicator Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA