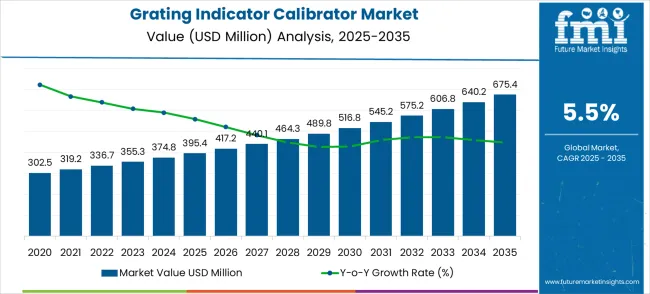

The grating indicator calibrator market is valued at USD 395.4 million in 2025 and is expected to reach USD 675.4 million by 2035, with a CAGR of 5.5%. From 2021 to 2025, the market grows from USD 302.5 million to USD 395.4 million, passing through intermediate values of USD 319.2 million, USD 336.7 million, USD 355.3 million, and USD 374.8 million. This early growth is primarily driven by the increasing adoption of grating indicator calibrators across industries such as aerospace, automotive, and manufacturing, where accurate calibration of optical instruments and systems is essential for ensuring high precision in measurements. The market sees steady growth as industries continue to prioritize quality control and the need for reliable calibration tools to maintain operational efficiency.

Between 2026 and 2030, the market is expected to continue its expansion, growing from USD 395.4 million to USD 516.8 million, with values passing through USD 417.2 million, USD 440.1 million, and USD 464.3 million. During this period, the market witnesses an inflection point, where growth accelerates due to increased demand for advanced calibration solutions, particularly in industries that rely on high-precision equipment, such as telecommunications, semiconductors, and research laboratories. By 2030, the market is expected to reach USD 545.2 million, and from 2031 to 2035, it is projected to progress towards USD 675.4 million, with intermediate values of USD 575.2 million, USD 606.8 million, and USD 640.2 million.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 395.4 million |

| Forecast Value in (2035F) | USD 675.4 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

Market expansion is being supported by the increasing demand for precision measurement and calibration equipment that ensures accuracy and traceability in manufacturing processes. Modern industrial applications require sophisticated measurement systems that can deliver consistent and reliable results while maintaining compliance with international quality standards. Advances in digital technology and automation have significantly improved calibration accuracy, measurement speed, and data management capabilities, making grating indicator calibrators essential tools for quality control operations across diverse industries.

The growing emphasis on quality assurance and regulatory compliance is driving demand for certified calibration equipment that enables manufacturers to maintain measurement traceability and meet stringent accuracy requirements. Rising manufacturing complexity, increased precision requirements, and growing adoption of lean manufacturing principles are contributing to expanded use of calibration equipment in production environments. The automotive, aerospace, and electronics industries are increasingly requiring precise measurement capabilities that support product development, quality control, and manufacturing process optimization.

The grating indicator calibrator market (USD 395.4M → 675.4M by 2035, CAGR ~5.5%) is being driven by rising demand for high-precision metrology systems, automation in quality control, and expansion of aerospace and automotive manufacturing. Together, operation-type innovation and application specialization unlock USD 260–285M in incremental revenue opportunities by 2035 (aligned with the ~USD 280M market expansion).

Growing need for automated calibration in metrology labs and production lines to ensure accuracy and reduce manual errors.

Largest near-term pool: USD 80–90M

Semi-automatic calibrators balance cost efficiency with precision, addressing automotive component makers and tier-1 suppliers.

Incremental Pool: USD 55–65M

Niche demand in aerospace R&D and specialized labs where manual oversight is critical for experimental reliability.

Opportunity Pool: USD 35–40M

Integration with Industry 4.0, IoT, and digital twin platforms enhances predictive maintenance and calibration traceability.

Expected Pool: USD 40–45M

China, India, and Japan driving local calibrator manufacturing, supported by regional metrology standards and industrial automation.

Regional Pool: USD 30–35M

Expanding defense and aerospace programs in the USA, Europe, and Asia require ultra-precise calibrators for mission-critical components.

Specialized Pool: USD 20–25M

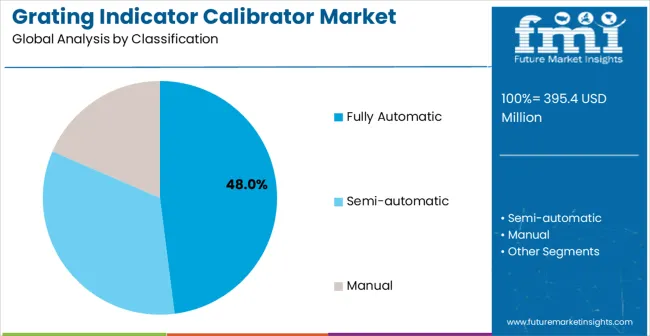

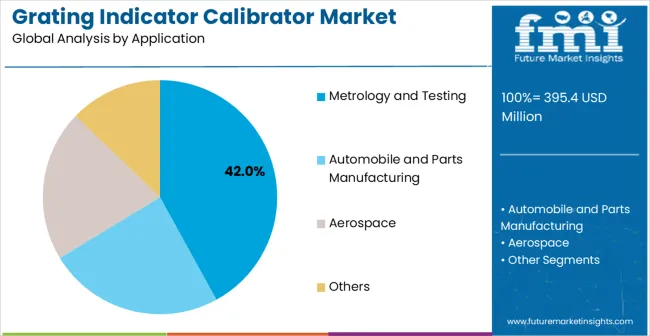

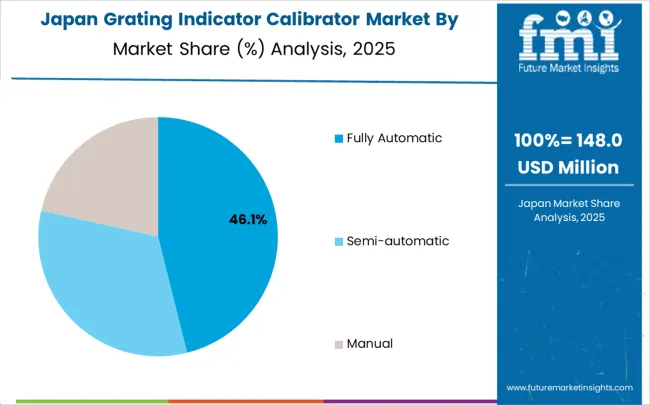

The market is segmented by operation type, end-use industry, and region. By operation type, the market is divided into fully automatic, semi-automatic, manual, and others. Based on end-use industry, the market is categorized into metrology and testing, automobile and parts manufacturing, aerospace, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Fully automatic grating indicator calibrators are projected to account for 48% of the market in 2025. This leading share is supported by the widespread adoption of automated calibration systems that provide enhanced accuracy and reduced operational time. Fully automatic systems offer consistent measurement results while minimizing human error and improving overall calibration efficiency. The segment benefits from technological advancements in automation and comprehensive integration capabilities with existing manufacturing systems. Manufacturing facilities are increasingly adopting fully automatic calibrators to streamline quality control processes and reduce dependency on skilled operators.

The segment growth is further supported by declining equipment costs and improved reliability of automated measurement systems across diverse industrial applications. Modern fully automatic systems incorporate artificial intelligence algorithms that enable predictive maintenance scheduling and optimize calibration procedures based on historical performance data. These calibrators feature integrated environmental compensation systems that automatically adjust for temperature, humidity, and vibration effects on measurement accuracy. Advanced automation capabilities include automatic tool recognition, measurement sequence optimization, and real-time quality control feedback that enhances operational efficiency.

Metrology and testing applications are expected to represent 42% of grating indicator calibrator demand in 2025. This dominant share reflects the critical role of precision measurement in quality control and calibration laboratories. Modern metrology facilities require sophisticated calibration equipment that can deliver traceable measurement results and maintain certification compliance. The segment benefits from growing quality assurance requirements and increasing demand for certified measurement standards across various industries. Metrology laboratories are expanding their calibration capabilities to serve multiple industry sectors including automotive, aerospace, electronics, and medical device manufacturing.

The segment is supported by increasing regulatory compliance requirements and international standardization initiatives that mandate regular calibration activities and certified measurement traceability. Primary metrology institutes and national laboratories are driving demand for ultra-precision calibrators that establish measurement standards and support international comparison programs. Secondary calibration facilities require equipment that maintains traceability chains while providing cost-effective services to industrial customers across diverse sectors. Advanced metrology applications incorporate statistical process control capabilities that monitor calibration stability and identify systematic measurement errors.

The grating indicator calibrator market is advancing steadily due to increasing precision manufacturing requirements and growing recognition of calibration importance in quality control processes. The market faces challenges including high equipment costs, need for specialized technical expertise, and varying calibration standards across different industries. Technological advancement and certification programs continue to influence equipment development and market growth patterns.

The growing implementation of digital measurement technologies and automated calibration processes is enabling improved accuracy and reduced measurement time. Advanced calibration equipment incorporating digital displays, automated measurement cycles, and comprehensive data logging capabilities provide enhanced precision and operational efficiency. Smart measurement systems are particularly valuable for high-volume manufacturing operations that require frequent calibration activities and detailed measurement documentation while supporting predictive maintenance and quality management initiatives.

Calibration equipment manufacturers are developing advanced connectivity features and digital integration capabilities that support smart manufacturing initiatives and comprehensive quality management systems. Integration of IoT sensors, cloud-based data management, and real-time monitoring systems enables automated calibration scheduling, predictive maintenance, and comprehensive measurement data analytics. These technological advances support integration with manufacturing execution systems and enable advanced quality control protocols that improve operational efficiency and measurement traceability.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| Brazil | 5.8% |

| United States | 5.2% |

| United Kingdom | 4.7% |

| Japan | 4.1% |

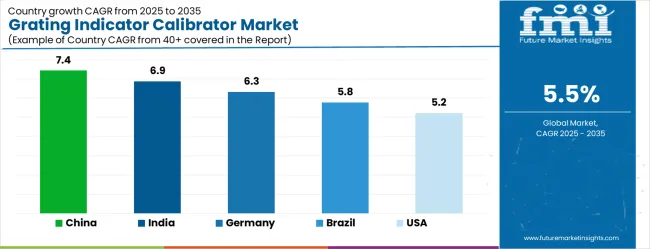

The grating indicator calibrator market demonstrates varied growth patterns across key countries, with China leading at a 7.4% CAGR through 2035, driven by expanding manufacturing capabilities, growing precision requirements, and increasing adoption of quality control systems across diverse industrial applications. India follows at 6.9%, supported by rising manufacturing activities, expanding automotive and aerospace sectors, and growing emphasis on quality certification. Germany records 6.3% growth, emphasizing precision engineering excellence, advanced manufacturing capabilities, and strong metrology infrastructure development. Brazil shows steady growth at 5.8%, driven by expanding industrial sector and increasing quality control awareness. The United States maintains 5.2% growth, focusing on technological innovation and advanced manufacturing applications. The United Kingdom demonstrates 4.7% expansion, supported by aerospace and automotive industry requirements. Japan records 4.1% growth, leveraging technological innovation and precision manufacturing expertise.

The report covers an in-depth analysis of 40+ countries with top-performing countries are highlighted below.

The grating indicator calibrator market in China is projected to expand at the highest growth rate with a CAGR of 7.4% through 2035, driven by massive manufacturing sector expansion, growing precision requirements, and increasing adoption of quality control systems across automotive, aerospace, and electronics industries. The country's comprehensive manufacturing strategy includes significant investments in precision measurement equipment, calibration laboratories, and quality control infrastructure that require advanced calibration solutions. Major manufacturing companies and metrology facilities are implementing sophisticated calibration systems to improve measurement accuracy and maintain international certification standards while supporting growing domestic and export production requirements.

Revenue from grating indicator calibrators in India is projected to grow at a CAGR of 6.9%, supported by expanding manufacturing industries, growing automotive and aerospace sectors, and increasing adoption of quality control systems across diverse applications. The country's emphasis on industrial development and manufacturing excellence is driving demand for precision measurement equipment that supports product quality, process optimization, and certification compliance requirements. Government programs promoting manufacturing development and skill enhancement are creating favorable conditions for calibration equipment adoption across precision manufacturing and quality control applications. Educational initiatives and technical training programs are developing workforce capabilities that support advanced calibration equipment operation and maintenance requirements.

Demand for grating indicator calibrators in Germany is projected to expand at a CAGR of 6.3%, supported by the country's leadership in precision engineering, advanced manufacturing capabilities, and comprehensive quality management systems across diverse industrial sectors. German manufacturers and metrology facilities are implementing sophisticated calibration solutions that meet stringent quality standards while supporting advanced manufacturing operations and precision measurement requirements. The country's extensive automotive, aerospace, and machinery manufacturing industries are driving significant calibrator demand for precision work and quality assurance operations. Advanced engineering partnerships are facilitating technology development and knowledge sharing across calibration equipment manufacturing and precision measurement sectors.

Revenue from grating indicator calibrators in Brazil is projected to grow at a CAGR of 5.8%, driven by expanding manufacturing industries, growing automotive sector, and increasing quality control awareness across diverse applications. Brazilian manufacturers and quality control facilities are investing in calibration solutions to enhance measurement accuracy and compliance while supporting domestic industrial development and export competitiveness. Government programs supporting industrial development are facilitating access to modern calibration equipment and technical expertise. Regional manufacturing centers are developing specialized capabilities that support calibration equipment distribution and technical support across diverse geographic markets. Economic development initiatives are creating opportunities for both professional and industrial calibration equipment adoption across expanding manufacturing and quality control sectors.

The sale for grating indicator calibrators in the United States is projected to expand at a CAGR of 5.2%, driven by technological innovation, advanced manufacturing applications, and ongoing quality control advancement initiatives across aerospace, automotive, and electronics sectors. American manufacturers and metrology facilities are implementing sophisticated calibration solutions to maintain measurement accuracy and compliance while supporting diverse precision manufacturing and quality control applications. The aerospace and defense industries are driving significant calibrator demand for precision measurement, quality assurance, and certification compliance requirements. Government initiatives supporting domestic manufacturing are creating opportunities for advanced calibration equipment development and production.

Demand for grating indicator calibrators in the United Kingdom is projected to grow at a CAGR of 4.7%, supported by strong aerospace and automotive industries, expanding precision manufacturing capabilities, and increasing quality control requirements across diverse applications. British manufacturers and metrology facilities are investing in calibration solutions to support advanced manufacturing projects, quality assurance operations, and certification compliance requirements. The country's established aerospace and automotive sectors are facilitating calibration equipment adoption through comprehensive quality standards and precision measurement requirements. Advanced manufacturing initiatives and technology development programs are creating demand for precision measurement equipment that enables manufacturers to meet stringent quality and performance standards.

Revenue from grating indicator calibrators in Japan is projected to grow at a CAGR of 4.1%, supported by technological innovation capabilities, precision manufacturing expertise, and emphasis on quality excellence across professional and industrial markets. Japanese manufacturers and metrology facilities are implementing sophisticated calibration solutions that demonstrate superior performance characteristics while supporting diverse precision manufacturing applications requiring accuracy and reliability. The country's advanced automotive and electronics manufacturing sectors are driving demand for high-quality calibration equipment that supports precision operations and comprehensive quality management systems. Quality management principles and continuous improvement programs are driving adoption of calibration equipment that enhances operational excellence and measurement accuracy across diverse applications.

The grating indicator calibrator market in Europe is projected to grow from USD 89.5 million in 2025 to USD 152.7 million by 2035, registering a CAGR of 5.5% over the forecast period. Germany is expected to maintain its leadership with 32.8% market share in 2025, projected to grow to 33.4% by 2035, supported by its strong manufacturing sector, advanced metrology infrastructure, and comprehensive quality control requirements. France follows with 19.2% market share in 2025, expected to reach 19.6% by 2035, driven by aerospace manufacturing activities and precision engineering applications.

The Rest of Europe region is projected to maintain stable share at 17.4% throughout the forecast period, attributed to growing manufacturing activities in Eastern European countries and expanding quality control requirements. United Kingdom contributes 15.8% in 2025, projected to reach 15.3% by 2035, supported by strong aerospace and automotive industries. Italy maintains 14.8% share in 2025, expected to grow to 15.7% by 2035, while other European countries demonstrate steady growth patterns reflecting regional manufacturing development and precision measurement adoption trends.

The grating indicator calibrator market is characterized by competition among established precision measurement equipment manufacturers, specialized metrology providers, and advanced technology companies. Companies are investing in digital calibration technologies, automated measurement systems, precision engineering improvements, and comprehensive calibration solutions to deliver accurate, reliable, and efficient measurement equipment. Strategic partnerships, technological innovation, and market expansion initiatives are central to strengthening product portfolios and market presence.

Mitutoyo Corporation, Japan-based, offers comprehensive precision measurement solutions with focus on accuracy, reliability, and advanced calibration capabilities across diverse measurement applications. HEIDENHAIN GmbH, Germany, provides sophisticated measurement technologies emphasizing precision, innovation, and digital integration for advanced manufacturing and metrology applications. Mahr GmbH, Germany, delivers precision measurement equipment with focus on quality, accuracy, and comprehensive calibration solutions for diverse industrial requirements.

Sylvac SA, Switzerland, emphasizes digital measurement technologies with focus on precision, user-friendly operation, and comprehensive data management capabilities. Renishaw plc, United Kingdom, provides advanced metrology solutions with focus on innovation, precision, and integrated measurement systems. Other key players including Suzhou Yuancheng, Jiangsu Tongheng, Beijing TIME High Technology, Dalian Zhonghe, Qingdao Rixin Metrology, Solartron Metrology, and Taian Demei Electromechanical Equipment contribute specialized expertise and diverse product offerings across global and regional markets.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 395.4 million |

| Operation Type | Fully Automatic, Semi-automatic, Manual |

| End-Use Industry | Metrology and Testing, Automobile and Parts Manufacturing, Aerospace, and Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Mitutoyo Corporation, HEIDENHAIN GmbH, Mahr GmbH, Sylvac SA, Renishaw plc, Solartron Metrology, Suzhou Yuancheng, Jiangsu Tongheng, Beijing TIME High Technology, Dalian Zhonghe, Qingdao Rixin Metrology, Taian Demei Electromechanical Equipment Co., Ltd. |

| Additional Attributes | Dollar sales by operation type and end-use industry segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established precision measurement manufacturers and specialized metrology providers, buyer preferences for different automation levels and calibration systems, integration with comprehensive quality management systems and Industry 4.0 platforms, innovations in measurement accuracy and digital calibration features, and adoption of smart measurement technologies and advanced data management systems for enhanced precision and operational efficiency |

The global grating indicator calibrator market is estimated to be valued at USD 395.4 million in 2025.

The market size for the grating indicator calibrator market is projected to reach USD 675.4 million by 2035.

The grating indicator calibrator market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in grating indicator calibrator market are fully automatic, semi-automatic and manual.

In terms of application, metrology and testing segment to command 42.0% share in the grating indicator calibrator market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA