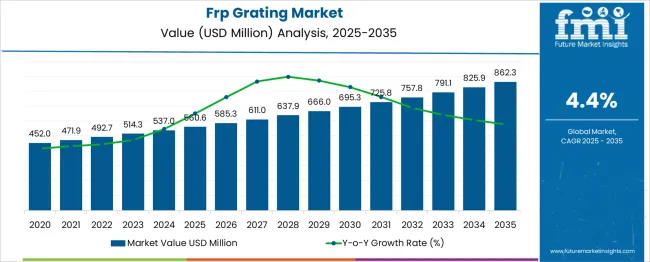

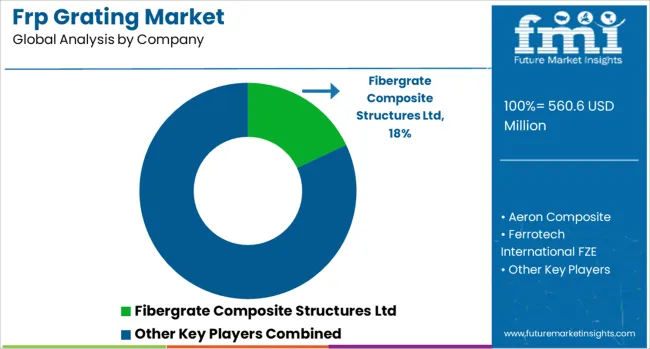

The FRP Grating Market is estimated to be valued at USD 560.6 million in 2025 and is projected to reach USD 862.3 million by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period. Analysis of the trajectory suggests a gradual deceleration as the market approaches potential saturation in the later phase. The first half of the period, from 2025 to 2030, accounts for an increase of USD 134.7 million, reaching USD 695.3 million, while the second half contributes USD 167 million, pushing the total closer to the upper growth ceiling. Although absolute gains remain positive, incremental additions decline on a percentage basis, indicating a maturing demand curve.

Early-stage growth is supported by infrastructure projects, the adoption of corrosion-resistant materials, and oil and gas applications. The narrowing gap between annual increments from USD 22.4 million in initial years to roughly USD 33 million in later years reflects steady but controlled expansion rather than aggressive acceleration. Market maturity signals stronger competition and pricing pressures, requiring differentiation through enhanced resin systems, modular designs, and compliance with safety standards. As saturation approaches USD 800 million and beyond, strategic innovation in lightweight, high-strength variants and expanded usage in marine and offshore platforms will be critical to offset slower organic growth and profitability.

| Metric | Value |

|---|---|

| FRP Grating Market Estimated Value in (2025 E) | USD 560.6 million |

| FRP Grating Market Forecast Value in (2035 F) | USD 862.3 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The FRP grating market occupies a strategically meaningful niche across several larger industrial and infrastructure domains. In the composite materials market, FRP grating accounts for roughly 4–5%, reflecting its role within the broader category of structural composites used for industrial and architectural applications. Within the industrial flooring & access systems market, it contributes approximately 15–18%, driven by preferences for lightweight, non-slip platforms and stair treads in factories and plants. In the corrosion-resistant infrastructure & equipment market, its share rises to about 20–22%, given its extensive use in chemical processing facilities, wastewater plants, and offshore structures where durability in corrosive settings is essential.

For public works & utility infrastructure, FRP grating holds around 10–12%, as it is deployed in substation access platforms, pedestrian walkways, and maintenance zones where low maintenance and long life cycles are priorities. Within the automotive, food, and manufacturing processing environments market, its share is close to 8–10%, supporting hygienic flooring and drainage applications under heavy loads and frequent washdowns. Growth in this segment is underpinned by rising demand for safety-compliant, low-maintenance walkways; increasing infrastructure investments in utilities and water treatment; and the shift toward advanced composites replacing traditional metal grating in harsh environments.

The FRP grating market is witnessing strong momentum due to rising demand for corrosion-resistant, lightweight, and maintenance-free alternatives to traditional metal grating. Regulatory mandates emphasizing workplace safety, especially in industrial and marine settings, are encouraging the adoption of FRP solutions that offer anti-slip surfaces and long-term durability.

Infrastructure upgrades across energy, chemical processing, and wastewater treatment sectors are further boosting product integration. Additionally, advancements in resin systems and fabrication techniques are expanding application possibilities, while greater awareness around lifecycle costs is influencing material selection.

As industries continue to prioritize structural safety, installation ease, and operational efficiency, the market for FRP gratings is expected to scale steadily through both public and private sector projects.

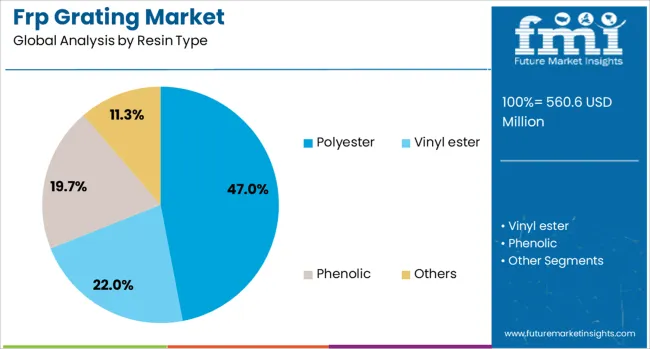

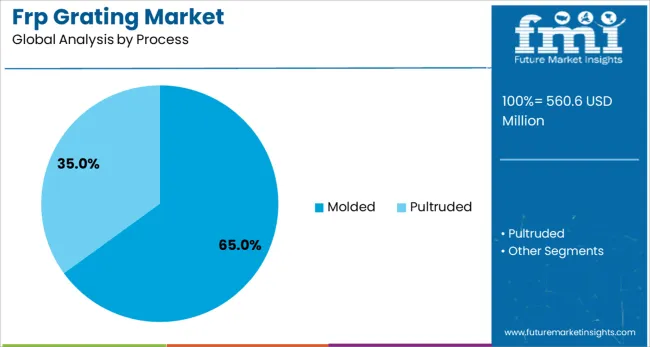

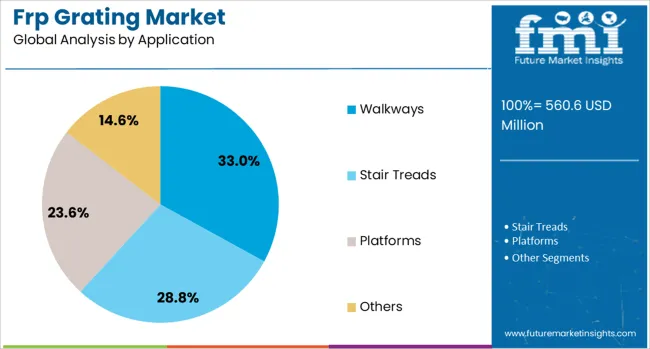

The FRP grating market is segmented by resin type, process, application, and end-user and geographic regions. By resin type, the FRP grating market is divided into Polyester, Vinyl ester, Phenolic, and Others. In terms of the process, the FRP grating market is classified into Molded and Pultruded. Based on the application, the FRP grating market is segmented into Walkways, Stair Treads, Platforms, and Others. The end-user of the FRP grating market is segmented into Industrial, Marine, Waste & water treatment, Cooling towers, and Others. Regionally, the FRP grating industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polyester-based FRP gratings are projected to account for 47.0% of total revenue in 2025, positioning this resin type as the market leader. This growth is being fueled by the resin’s balanced performance in terms of strength, chemical resistance, and affordability, which makes it suitable for a wide range of medium-duty industrial applications.

Polyester resins also offer flexibility in formulation, enabling manufacturers to tailor performance characteristics while maintaining cost competitiveness. Their compatibility with both molded and pultruded manufacturing processes further enhances scalability and customization.

As end-users seek durable and cost-effective solutions for non-critical yet high-frequency usage areas, polyester-based FRP gratings are gaining preference across sectors.

Molded FRP gratings are expected to hold a 65.0% revenue share in 2025, making this the dominant manufacturing process in the market. This leadership is underpinned by the method’s ability to deliver superior bi-directional strength and flexibility in load distribution.

Molded gratings are preferred for corrosive environments due to their uniform resin composition, which ensures durability and low maintenance needs. The process also supports complex grating configurations and panel sizes, reducing the need for additional fabrication on-site.

Industrial operators in sectors like petrochemicals, marine, and food processing are increasingly opting for molded gratings to enhance structural integrity while minimizing installation and lifecycle costs.

Walkways are projected to contribute 33.0% of total market revenue in 2025, positioning them as the leading application area. Stringent workplace safety standards and the increasing focus on durable, slip-resistant, and low-maintenance surfaces in hazardous and wet environments drive their prominence.

FRP gratings used in walkways provide enhanced mechanical strength, corrosion resistance, and UV stability, making them ideal for outdoor and industrial facilities. Industries such as oil & gas, marine, and utilities are adopting FRP walkways to reduce accident risks, simplify installation in remote or corrosive settings, and extend maintenance intervals.

This application’s versatility and compliance with international safety norms continue to support its strong adoption.

FRP (Fiber Reinforced Plastic) gratings are composite materials widely used in industrial flooring, platforms, walkways, and stair treads due to their corrosion resistance, lightweight nature, and high strength-to-weight ratio. These gratings are preferred in environments exposed to chemicals, moisture, or extreme temperatures, such as marine, oil and gas, water treatment, and construction sectors. Growth has been supported by increased demand for non-conductive and slip-resistant materials in safety-critical applications. Manufacturers are focusing on advanced resin systems, modular configurations, and automated molding processes to enhance durability and application flexibility.

Adoption of FRP gratings has been driven by their superior resistance to corrosion compared to traditional materials such as steel, making them ideal for chemical processing and marine environments. Industries handling corrosive substances, including oil and gas, wastewater treatment, and desalination plants, have increasingly deployed FRP products to ensure long service life and safety compliance. Lightweight construction reduces installation costs and simplifies handling, further promoting adoption in remote and offshore installations. The growing emphasis on slip-resistant and fire-retardant surfaces for walkways and platforms in industrial facilities continues to strengthen demand for these products globally.

Market growth has been restricted by the relatively high upfront cost of FRP gratings compared to conventional metal alternatives, which impacts their acceptance in cost-sensitive sectors. Lack of familiarity among contractors and engineers with composite material performance has slowed adoption in some regions. Concerns regarding mechanical strength under extreme loads or impact conditions have limited usage in heavy-duty applications. The complexity of recycling FRP products creates additional disposal challenges, influencing procurement decisions for projects prioritizing lifecycle management. Variability in product quality due to the presence of unorganized manufacturers in emerging markets has also affected buyer confidence.

Significant opportunities exist in offshore oil platforms, shipbuilding, and coastal infrastructure where exposure to saltwater and humidity accelerates metal corrosion. Adoption of FRP gratings in pedestrian bridges, modular structures, and architectural applications is growing due to their design flexibility and aesthetic appeal. Development of high-performance resin systems for fire resistance and UV stability creates added value for specialized environments. Growth in water treatment facilities and renewable energy installations, particularly offshore wind platforms, further supports demand. Integration of prefabricated FRP components into modular construction workflows offers a scalable solution for large infrastructure projects.

Recent trends highlight the adoption of automated molding and pultrusion techniques to improve dimensional accuracy and reduce manufacturing time. Custom color options and surface finishes are being introduced to meet architectural and branding requirements. Hybrid designs combining FRP with metallic inserts are emerging to enhance load-bearing capacity without compromising corrosion resistance. Manufacturers are investing in advanced resin formulations to improve fire retardancy and chemical resistance for industrial environments. Digital modeling tools and CAD-based customization services are being deployed to facilitate accurate integration of gratings into complex facility layouts.

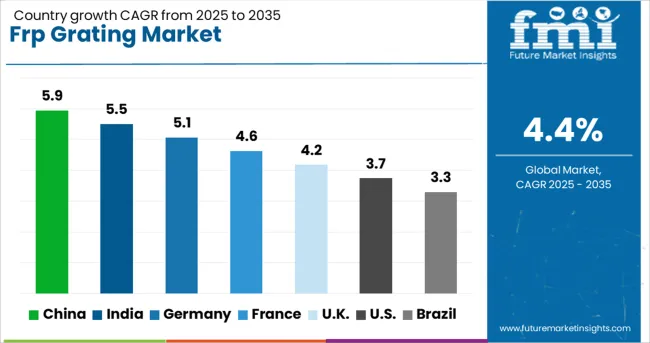

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

FRP grating demand is projected to rise at a CAGR of 4.4% from 2025 to 2035. Among the top five profiled markets, China leads at 5.9%, followed by India at 5.5%, while Germany posts 5.1%, the United Kingdom records 4.2%, and the United States stands at 3.7%. These growth rates represent a premium of +34% for China and +25% for India compared to the global baseline, whereas Germany is slightly ahead at +16%, while the UK and the US fall behind at –5% and –16%, respectively. The divergence reflects regional dynamics: BRICS economies such as China and India benefit from large-scale infrastructure investments and industrial development, while OECD nations including Germany, the UK, and the US display steady adoption driven by retrofitting projects, safety compliance, and preference for low-maintenance materials. The analysis spans over 40 countries, with the leading markets detailed below.

China is projected to grow at a CAGR of 5.9% through 2035, driven by significant infrastructure investments and expansion in chemical, marine, and construction industries. FRP gratings are increasingly replacing steel alternatives in walkways, drainage systems, and offshore platforms due to their corrosion resistance and long service life. Domestic manufacturers are focusing on high-load-bearing gratings to serve heavy industrial applications, while global suppliers introduce modular designs for rapid installation. The integration of fire-retardant formulations and UV-resistant coatings is improving performance for outdoor installations. With increasing government focus on modernizing industrial facilities, the adoption of FRP solutions across petrochemical plants and wastewater management projects is expected to accelerate.

India is forecasted to achieve a CAGR of 5.5% through 2035, supported by industrial diversification and infrastructure modernization. Strong adoption of FRP gratings is evident in power plants, chemical facilities, and public utilities, particularly where corrosion and slip resistance are critical. Government investments in wastewater treatment and renewable energy projects further expand the scope for FRP grating installations in walkways, platforms, and safety-critical structures. Domestic suppliers are targeting cost-effective designs with integrated anti-skid features, while international brands are introducing premium variants for high-performance industrial environments. Market potential is amplified by initiatives to replace traditional steel structures with lightweight alternatives to reduce maintenance costs and extend service life.

Germany is expected to post a CAGR of 5.1% through 2035, benefiting from a robust industrial base and stringent safety regulations across energy, transportation, and chemical sectors. FRP gratings are gaining traction in oil refineries, automotive manufacturing, and utility plants where corrosion resistance and lightweight properties deliver operational efficiency. German manufacturers are adopting precision molding techniques to create gratings with enhanced mechanical strength and dimensional stability. Integration of flame-resistant and UV-stabilized properties supports adoption in outdoor and offshore environments. Additionally, the automotive and renewable energy industries are driving new demand for FRP structures that meet compliance with European safety and durability standards.

The United Kingdom is projected to grow at a CAGR of 4.2% through 2035, supported by offshore energy projects, marine infrastructure upgrades, and compliance with workplace safety norms. FRP gratings are widely used in oil & gas platforms, public utilities, and bridge maintenance walkways due to their low maintenance and corrosion resistance. British suppliers are introducing modular systems designed for quick installation and minimal downtime in high-risk environments. Investments in offshore wind and coastal defense infrastructure are creating significant opportunities for premium FRP gratings with enhanced durability. Demand from transportation and rail sectors for lightweight solutions adds further market momentum.

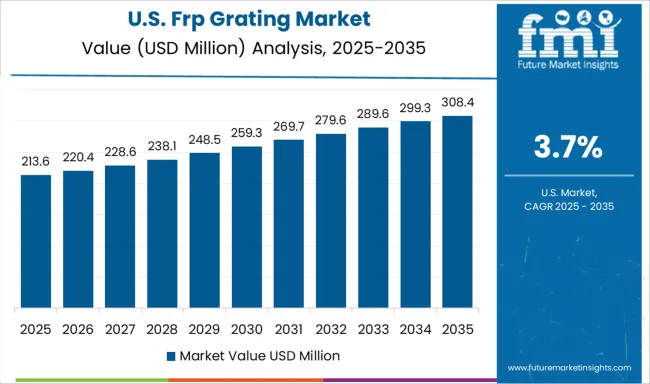

The United States is anticipated to record a CAGR of 3.7% through 2035, supported by steady demand from oil & gas, water treatment, and industrial manufacturing sectors. FRP gratings are increasingly replacing steel alternatives in chemical processing facilities and utility platforms to minimize maintenance costs. The adoption of non-conductive gratings in power distribution environments strengthens safety compliance. Domestic producers are focusing on developing heavy-duty gratings suitable for load-bearing industrial applications, while imports continue to supply specialized designs for offshore projects. Market prospects remain strong in municipal wastewater facilities and renewable energy projects where corrosion resistance is critical.

The FRP (Fiber Reinforced Plastic) grating market is driven by leading composite manufacturers offering lightweight, corrosion-resistant, and high-strength grating solutions for industrial, marine, and infrastructure applications. Fibergrate Composite Structures Ltd dominates globally with a comprehensive portfolio of molded and pultruded FRP gratings designed for chemical plants, water treatment facilities, and offshore platforms. Aeron Composite and Ferrotech International FZE serve Asian and Middle Eastern markets with cost-competitive FRP gratings customized for oil & gas and industrial sectors. Bedford Reinforced Plastics and Creative Pultrusions maintain strong positions in North America, focusing on premium gratings with advanced resin systems for durability in harsh environments. Delta Composites, LLC, Fibrolux GmbH, and Exel Composites specialize in pultruded profiles and structural components, supporting applications requiring superior load-bearing performance.

Eurograte Fiberglass Grating and National Grating offer comprehensive solutions for infrastructure, wastewater plants, and pedestrian walkways. Strongwell Corporation differentiates through proprietary pultrusion technology, ensuring high-quality standards for industrial and transportation projects. Regional players such as Webforge and Sea Safe Inc provide integrated solutions combining FRP gratings with metal-based products for hybrid installations. Competitive differentiation relies on corrosion resistance, mechanical strength, UV stability, and compliance with global safety standards such as OSHA and ASTM. Barriers to entry include specialized manufacturing technologies, resin formulation expertise, and certification requirements for critical infrastructure projects. Strategic initiatives include developing fire-retardant and conductive FRP gratings, expanding production for marine applications, and incorporating automated pultrusion for consistent quality.

| Item | Value |

|---|---|

| Quantitative Units | USD 560.6 Million |

| Resin Type | Polyester, Vinyl ester, Phenolic, and Others |

| Process | Molded and Pultruded |

| Application | Walkways, Stair Treads, Platforms, and Others |

| End-User | Industrial, Marine, Waste & water treatment, Cooling towers, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Fibergrate Composite Structures Ltd, Aeron Composite, Ferrotech International FZE, Bedford Reinforced Plastics, Creative Pultrusions, Delta Composites, LLC, AGC Matex Co. Ltd, Eurograte Fiberglass Grating, Fibrolux GmbH, National Grating, Sea Safe Inc, Exel Composites, Strongwell Corporation, and Webforge |

| Additional Attributes | Dollar sales by grating type (molded FRP grating, pultruded FRP grating) and application (industrial flooring, walkways, offshore platforms, water treatment). Demand dynamics are driven by the replacement of steel gratings in corrosive environments, increasing safety requirements, and reduced maintenance costs. Regional trends highlight Asia-Pacific as the fastest-growing market due to rapid industrialization and infrastructure expansion, while North America and Europe lead in adoption for chemical and wastewater sectors. Innovation trends include anti-slip coatings, custom resin formulations for fire resistance, and integration of FRP gratings with structural profiles for modular platforms. |

The global frp grating market is estimated to be valued at USD 560.6 million in 2025.

The market size for the frp grating market is projected to reach USD 862.3 million by 2035.

The frp grating market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in frp grating market are polyester, vinyl ester, phenolic and others.

In terms of process, molded segment to command 65.0% share in the frp grating market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA