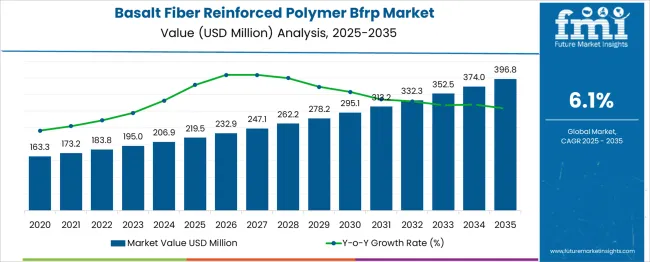

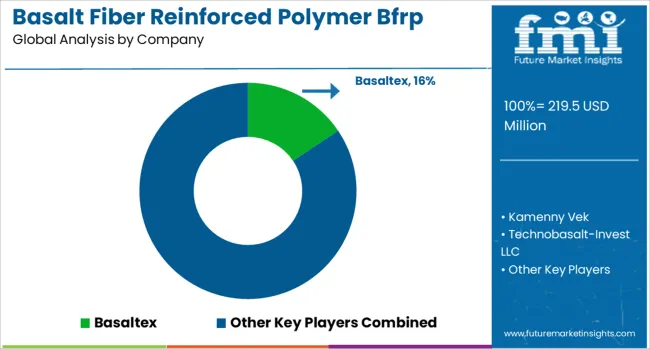

The Basalt Fiber Reinforced Polymer (BFRP) Market is estimated to be valued at USD 219.5 million in 2025 and is projected to reach USD 396.8 million by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| Basalt Fiber Reinforced Polymer (BFRP) Market Estimated Value in (2025 E) | USD 219.5 million |

| Basalt Fiber Reinforced Polymer (BFRP) Market Forecast Value in (2035 F) | USD 396.8 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

As industries seek lightweight, durable, and cost-effective alternatives to steel and glass fiber composites, BFRP is gaining traction, especially in structural applications where longevity and resistance to harsh environments are critical.

The market is further supported by growing awareness of green building standards and infrastructure resilience, particularly in seismic and coastal zones. Advancements in fiber processing technology and improved compatibility with concrete and other materials are enhancing product performance and broadening use cases.

Over the coming years, the BFRP market is expected to witness steady growth, supported by global infrastructure development, environmental regulations, and rising investment in innovative construction materials.

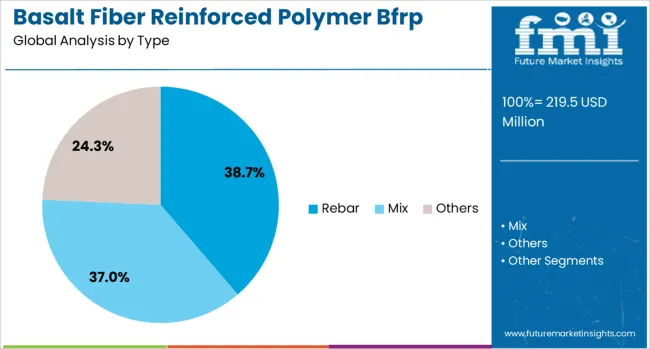

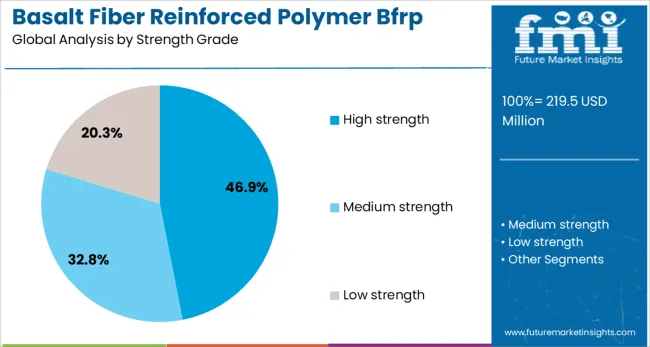

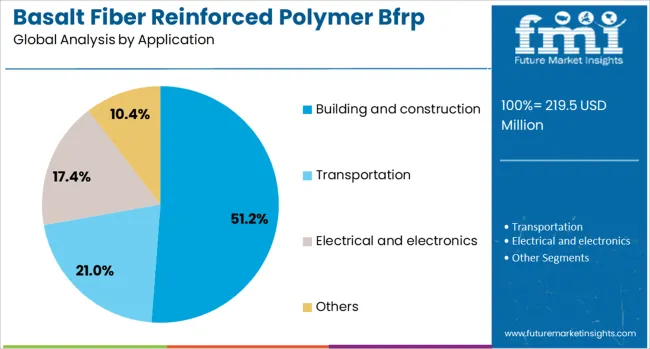

The basalt fiber reinforced polymer BFRP market is segmented by type, strength grade, and application and geographic regions. The basalt fiber reinforced polymer BFRP market is divided by type into Rebar, Mix, and Others. In terms of strength grade, the basalt fiber reinforced polymer BFRP market is classified into High strength, Medium strength, and Low strength. Based on the application of the basalt fiber reinforced polymer BFRP market is segmented into Building and construction, Transportation, Electrical and electronics, and Others. Regionally, the basalt fiber reinforced polymer BFRP industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rebar segment commands a leading 38.7% share in the BFRP market, underpinned by its high applicability in reinforcing concrete structures exposed to corrosive or high-stress environments. BFRP rebar offers significant advantages over steel, including high tensile strength-to-weight ratio, resistance to chemical degradation, and non-conductivity, making it particularly suitable for applications such as bridges, marine infrastructure, and tunnels.

The segment’s growth is supported by increasing use in civil engineering projects that demand long service life and minimal maintenance. Government initiatives promoting sustainable infrastructure are further accelerating adoption, as BFRP rebar contributes to reduced lifecycle costs and environmental impact.

Manufacturers are investing in standardized product lines and compatibility testing with various concrete mixes, which enhances confidence among structural engineers and contractors. The rebar segment is expected to maintain its dominance due to its essential role in enabling durable and high-performance construction solutions.

The high strength grade holds a significant 46.9% share of the BFRP market, reflecting the growing need for reinforcement materials that meet stringent load-bearing and stress-resistance requirements. High strength BFRP products are preferred in applications where structural integrity, weight reduction, and extended service life are critical factors. This includes usage in large-scale infrastructure, transportation networks, and military-grade construction where safety and durability cannot be compromised.

The segment has benefited from technical improvements in fiber alignment, resin compatibility, and surface bonding treatments that enhance mechanical performance. As more regulatory bodies and design codes begin to recognize and incorporate high strength composites, demand is expected to accelerate.

Ongoing research and pilot projects demonstrating BFRP’s resilience under extreme conditions are also boosting market confidence. The high strength segment is poised to expand further as construction and engineering sectors prioritize materials that balance performance, sustainability, and total cost of ownership.

The building and construction segment leads the application category with a 51.2% share, underscoring BFRP’s growing importance in modern infrastructure projects. The sector is increasingly leveraging BFRP materials for reinforcement in residential, commercial, and public construction due to their resistance to corrosion, low maintenance requirements, and ability to extend structural lifespan.

The shift toward sustainable and durable building practices has intensified demand for non-metallic reinforcement alternatives, particularly in regions with aggressive environmental conditions or high moisture levels. Contractors and developers are adopting BFRP for foundations, slabs, walls, and other structural components to improve lifecycle performance and reduce repair costs.

The alignment of BFRP with green building certifications and evolving construction standards further supports its integration into mainstream practices. As urbanization and investment in smart infrastructure continue to rise, the building and construction segment is expected to remain the largest and most influential driver of BFRP market growth.

Market growth results from increasing preference for lightweight structural materials that offer high tensile strength and resist corrosion. New opportunities arise through modular prefabrication, localized production, and infrastructure partnerships.

Infrastructure developers and civil engineers are adopting basalt fiber-reinforced polymer composites due to their high strength-to-weight ratio and resistance to environmental degradation, such as rust and chemical exposure. These materials are especially valued in bridge reinforcement, water pipeline wrap, and concrete beam retrofits where steel corrosion and heavy load are concerns. Contractors appreciate BFRP’s longer service life compared to traditional reinforcements, helping avoid frequent maintenance. Since basalt fibers are made from abundant volcanic rock, materials brim with uniform quality and consistent mechanical performance. As infrastructure agencies seek materials that deliver durability with reduced structural thickness, BFRP composites offer a compelling alternative to steel or glass fiber based systems in demanding engineering contexts.

Significant opportunity lies in producing prefabricated composite panels and rods made from basalt fiber reinforced polymer that can be installed quickly on job sites. Local fabrication hubs near project zones reduce delivery lead times and allow rapid customization by engineering firms. Partnerships with construction contractors, infrastructure authorities and prefabrication specialists enable pilot installations for bridges, sea walls or earthquake repair systems. Offering bundled packages that include material, installation guidance and inspection services simplifies adoption for engineering teams. Launching refill or expansion kits for existing BFRP systems makes retrofits more economical. Localized supply chains combined with technical support packages help overcome adoption barriers, accelerating uptake in major civil projects while reducing cost and project complexity.

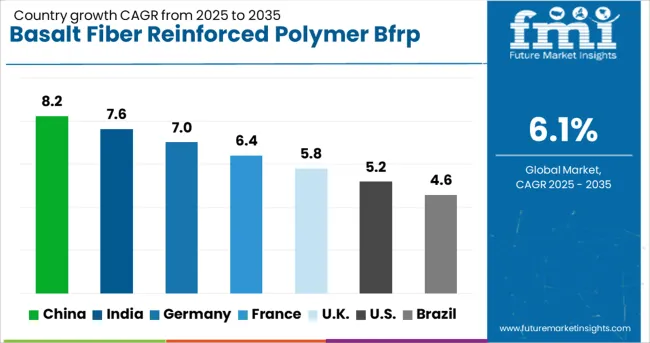

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The Basalt Fiber Reinforced Polymer (BFRP) Market is expected to expand at a CAGR of 6.1% between 2025 and 2035, fueled by the demand for high-strength, lightweight, and corrosion-resistant composites across construction, automotive, and aerospace sectors. BRICS nations are leading global momentum, with China registering the highest CAGR of 8.2% and India at 7.6%, both supported by infrastructure upgrades and sustainability policies. Germany, part of the OECD, follows at 7.0%, driven by industrial applications and automotive innovation. The United Kingdom (5.8%) and the United States (5.2%) are progressing steadily, focusing on structural retrofitting and defense uses. As BRICS and ASEAN economies ramp up composite material adoption, international competition around BFRP technologies is intensifying. Public-private R&D and standardization efforts remain key to global scalability. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China is expanding in the BFRP market with an impressive 8.2% CAGR, driven by ongoing infrastructure projects and construction material optimization efforts. Bridge decks, tunnels, and marine structures are incorporating BFRP bars and rebars to improve corrosion resistance and reduce lifecycle maintenance. Domestic producers are increasing capacity for pultruded BFRP profiles to meet rising public sector demand. Civil engineering contractors are choosing BFRP as a lighter alternative to traditional steel, especially in regions with high humidity and salt exposure. Industry consortiums are also conducting field trials for BFRP in highway reinforcement. This continued emphasis on structural durability and reduced material fatigue is allowing BFRP solutions to gain ground in both public and private sector developments.

India is showing consistent progress in the BFRP market, recording a 7.6% CAGR, as infrastructure modernization meets demand for corrosion-resistant composites. Several metro rail projects and elevated highways are adopting BFRP rebars in place of steel to counter rebar degradation from water exposure. Domestic suppliers are also scaling up production of basalt-based mesh and sheets used in structural rehabilitation. Interest is rising in the irrigation sector, where BFRP pipes and reinforcements offer strength without rusting. Engineering colleges and public works departments are collaborating on pilot projects for BFRP bridge decks. These real-world applications are encouraging broader adoption across states focused on durable and long-term civil assets.

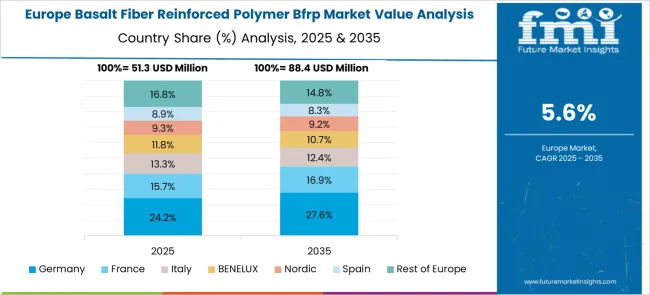

Germany is advancing steadily in the BFRP sector with a 7.0% CAGR, largely driven by precision construction standards and evolving material benchmarks in infrastructure design. Municipalities are introducing BFRP bars and plates in utility infrastructure and water management structures where corrosion has long been a cost driver. Engineering firms are also applying BFRP in the retrofitting of aging concrete bridges to extend service life without excessive weight addition. Local material science labs are working on improving resin bonding for enhanced load distribution. BFRP is further being used in architectural applications such as façade panels, contributing to weight-efficient structural elements in modern buildings.

The United Kingdom is growing at a 5.8% CAGR in the BFRP market, where demand is rising in marine construction and heritage structure repair. Coastal protection schemes are incorporating BFRP components to resist salt-induced wear without needing replacement cycles common with steel. Universities are testing BFRP for reinforcement in historical structures, given its non-magnetic, non-corrosive nature. Local manufacturers are promoting pre-formed BFRP bars for modular housing frameworks where quick assembly and structural flexibility are essential. Transportation departments are also exploring BFRP grating systems in railway maintenance pathways. These focused applications are positioning BFRP as a durable option where environmental challenges or preservation standards require non-metal alternatives.

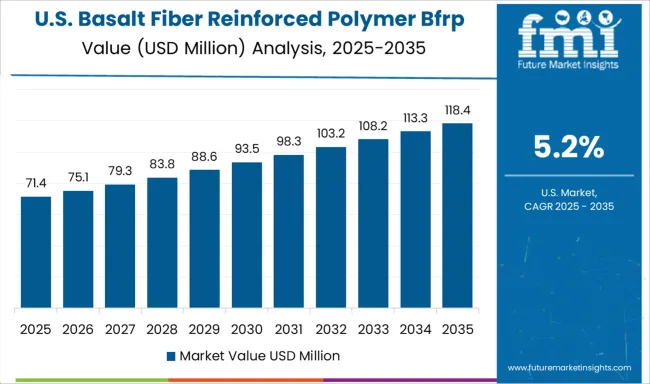

The United States is witnessing moderate growth in the BFRP market at a 5.2% CAGR, supported by pilot programs across state transportation agencies. Departments of transportation are testing BFRP in bridge deck overlays and culvert reinforcements to reduce corrosion-related maintenance. BFRP rebars are being introduced in parking garages, piers, and retaining walls where exposure to de-icing salts or coastal air accelerates steel deterioration. Universities and engineering bodies are evaluating performance data under heavy load and freeze-thaw cycles to support wider code inclusion. USA-based manufacturers are also producing BFRP grid mesh panels for slope stabilization and shotcrete reinforcement.

The BFRP market features a specialized set of manufacturers classified into Tier 1, Tier 2, and Tier 3, each serving key roles in construction, infrastructure, and composite material applications. Basaltex leads the Tier 1 category with its advanced basalt fiber technology, consistent product quality, and well-established client base across Europe and North America. Kamenny Vek and Technobasalt-Invest LLC also operate at the top tier, focusing on high-performance reinforcement solutions for bridges, tunnels, and marine structures.

Tier 2 suppliers like Pultrall and Arab Basalt Fiber Company offer region-specific products, concentrating on cost-effective alternatives to traditional steel reinforcements. Tier 3 players such as Beyond Materials Group and Kodiak BFRP cater to emerging markets and R&D-focused clients, providing flexible, lightweight composite solutions for both civil engineering and automotive applications.

As mentioned in Arab Basalt Fiber Company’s official release on July 2025, H.H. Sheikh Hamad bin Mohammed Al Sharqi inaugurated the MENA region’s first and largest integrated basalt fiber and BFRP rebar production facility in Fujairah. It will support global growth.

| Item | Value |

|---|---|

| Quantitative Units | USD 219.5 Million |

| Type | Rebar, Mix, and Others |

| Strength Grade | High strength, Medium strength, and Low strength |

| Application | Building and construction, Transportation, Electrical and electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Basaltex, Kamenny Vek, Technobasalt-Invest LLC, Pultrall, Arab Basalt Fiber Company, Beyond Materials Group, and Kodiak BFRP |

| Additional Attributes | Dollar sales by product type, application area, and region; demand driven by corrosion resistance needs, infrastructure upgrades, and sustainability goals; innovation in composite processing and hybrid reinforcement; cost dynamics influenced by raw basalt sourcing and production scale; environmental impact from reduced steel usage; and emerging use cases in bridges, marine structures, and lightweight transport systems. |

The global basalt fiber reinforced polymer bfrp market is estimated to be valued at USD 219.5 million in 2025.

The market size for the basalt fiber reinforced polymer bfrp market is projected to reach USD 396.8 million by 2035.

The basalt fiber reinforced polymer bfrp market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in basalt fiber reinforced polymer bfrp market are rebar, mix and others.

In terms of strength grade, high strength segment to command 46.9% share in the basalt fiber reinforced polymer bfrp market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Basalt Rock Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fibre Market Size & Forecast 2024-2034

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Fiber to the Home Market Size and Share Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Testing Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Coding System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA