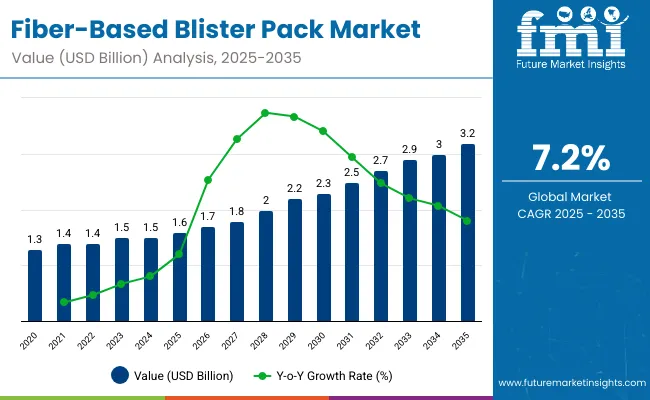

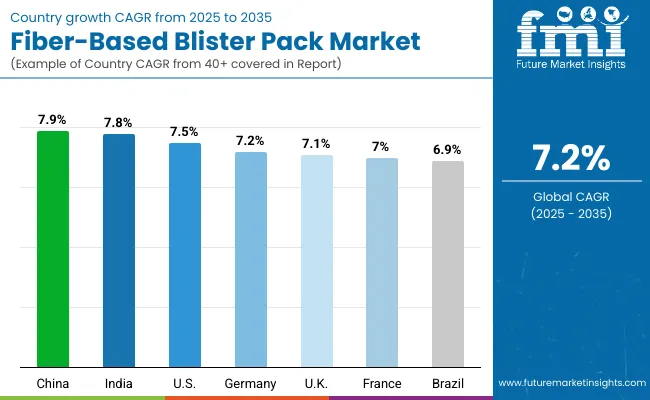

The fiber-based blister pack market is expected to grow from USD 1.6 billion in 2025 to USD 3.2 billion by 2035, resulting in a total increase of USD 1.6 billion over the forecast decade. This represents a 100.0% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 7.2%. Over ten years, the market grows by a 2.0 multiple.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.6 billion |

| Industry Value (2035F) | USD 3.2 billion |

| CAGR (2025 to 2035) | 7.2% |

In the first five years (2025-2030), the market progresses from USD 1.6 billion to USD 2.2 billion, contributing USD 0.6 billion, or 37.5% of total decade growth. This phase is shaped by demand in pharmaceuticals and personal care packaging, supported by eco-friendly fiber alternatives to plastics. Early growth is further reinforced by regulatory support for recyclable materials.

In the second half (2030-2035), the market grows from USD 2.2 billion to USD 3.2 billion, adding USD 1.0 billion, or 62.5% of the total growth. This acceleration is supported by innovations in molded fiber technology, barrier coatings, and printing capabilities. Expanding use in food and consumer goods packaging strengthens the market, positioning fiber-based blister packs as a sustainable mainstream solution.

From 2020 to 2024, the fiber-based blister pack market expanded from USD 1.2 billion to USD 1.5 billion, driven by regulatory pressure to replace plastics with recyclable and biodegradable alternatives. Nearly 70% of revenues were dominated by OEMs and packaging converters advancing molded fiber and paperboard solutions. Leaders such as Huhtamaki, Stora Enso, and Sonoco emphasized strength, formability, and compliance with food and pharma standards. Differentiation centered on barrier coatings, sealing compatibility, and machinability, while embedded smart indicators remained secondary. Service-driven offerings such as material audits and sustainability certifications contributed less than 15% of revenues, with most producers investing directly in eco-packaging formats.

By 2035, the fiber-based blister pack market will reach USD 3.2 billion, growing at a CAGR of 7.20%, with recyclable, bio-coated fiber solutions representing over 40% of market value. Competitive dynamics will intensify as suppliers introduce compostable coatings, nanocellulose barriers, and digital traceability features. Established players are pivoting toward hybrid models that pair sustainable materials with automation-ready formats. Emerging companies such as PaperFoam, PulPac, and Ecobliss are gaining traction with modular blister pack solutions, fully recyclable fibers, and scalable designs, meeting consumer demand for sustainable alternatives while aligning with global regulatory frameworks for reduced plastic use.

The rising demand for sustainable and recyclable packaging is driving growth in the fiber-based blister pack market. These packs replace plastic with renewable fiber materials, reducing environmental impact while maintaining product protection. Expanding adoption in pharmaceuticals, consumer goods, and electronics is further supported by regulatory pressure on plastic reduction.

Blister packs designed with molded fiber, paperboard, and specialty recyclable coatings are gaining traction for their strength, biodegradability, and branding flexibility. Their compatibility with automated sealing processes enhances efficiency, while lightweight structures lower logistics costs. Alignment with circular economy goals and eco-conscious consumer preferences reinforces their growing importance in global packaging markets.

The market is segmented by material, blister type, closure type, application, end-use industry, and region. Material segmentation includes molded fiber, paperboard, corrugated fiber, and specialty recyclable fiber, emphasizing eco-friendly alternatives to plastic. Blister type covers carded blisters, clamshell blisters, and tray-style blisters, offering versatile formats for different product categories. Closure type includes heat-sealed, pressure-sensitive, and adhesive bonded blisters, ensuring secure packaging and product safety.

Applications span pharmaceutical packaging, food and beverage packaging, consumer goods packaging, personal care and cosmetics packaging, and electronics packaging, reflecting broad adoption across industries. End-use industries include pharmaceuticals and healthcare, food and beverages, retail and consumer goods, cosmetics and personal care, and electronics. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

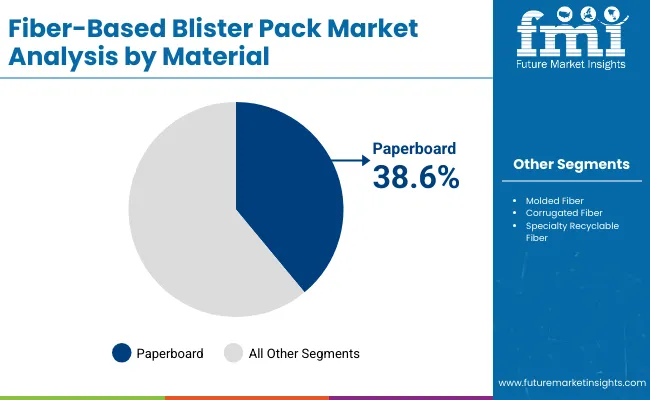

Paperboard is projected to account for 38.6% of the market in 2025, driven by its recyclability, lightweight structure, and cost-effectiveness compared to plastic-based options. It provides sufficient durability and printability, making it suitable for pharmaceutical, personal care, and consumer goods packaging. Its compatibility with existing blister machinery enhances adoption.

Growing consumer and regulatory pressure to replace plastics with fiber-based solutions reinforces paperboard’s role. Brands leverage paperboard blister packs for enhanced branding through high-quality graphics and eco-friendly positioning. As circular economy initiatives expand, paperboard continues to lead as the primary material choice.

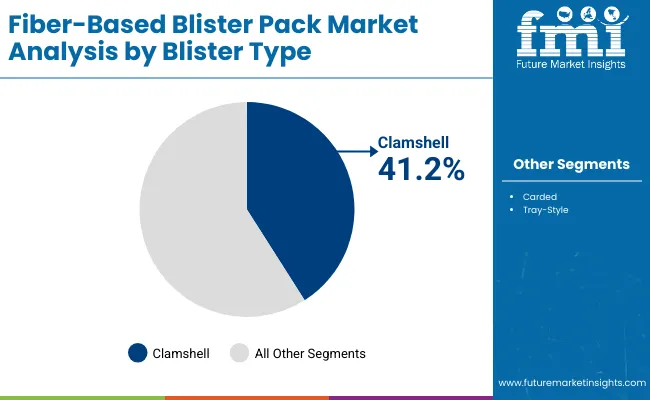

Clamshell blisters are forecast to hold 41.2% of the market in 2025, valued for their tamper resistance and product visibility. Their rigid fiber structure provides strength while supporting sustainable alternatives to plastic. These packs are widely used across healthcare, consumer electronics, and personal care categories.

Adoption is reinforced by retailers prioritizing theft prevention and shelf appeal. Fiber-based clamshells balance protection with recyclability, aligning with eco-conscious consumer demand. With expanding applications in high-value products, clamshell blisters remain the leading segment by type.

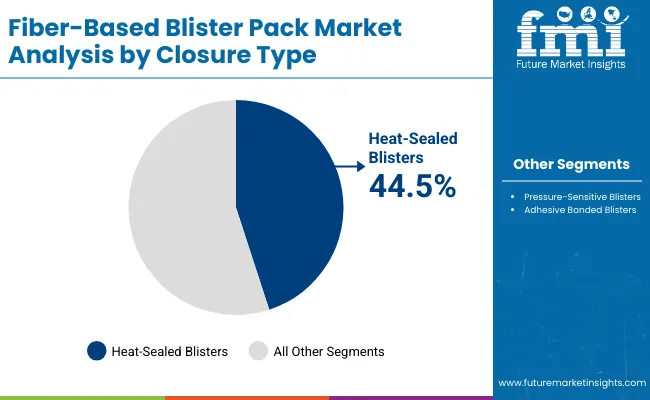

Heat-sealed blisters are expected to account for 44.5% of the market in 2025, as they ensure strong tamper evidence and barrier performance. The sealing method enhances product safety by protecting against contamination and ensuring compliance with healthcare packaging standards.

Their compatibility with pharmaceutical and food applications supports large-scale use. Heat sealing also enables integration with coatings and laminates that extend shelf life. As regulations for secure packaging tighten, this closure type maintains its dominance.

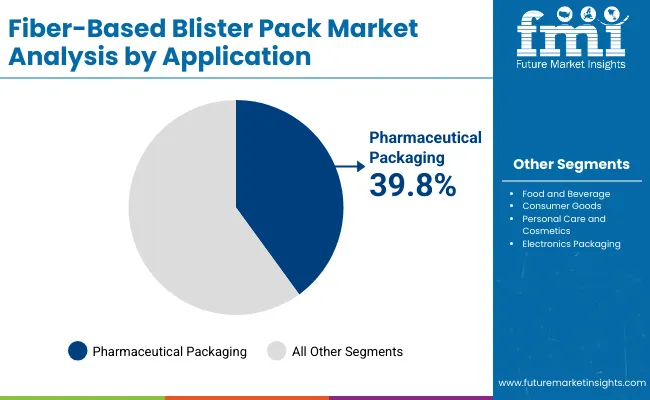

Pharmaceutical packaging is projected to represent 39.8% of the market in 2025, reflecting the industry’s demand for secure, traceable, and eco-friendly packaging. Fiber-based blister packs offer child-resistant, tamper-evident solutions that align with regulatory compliance.

Their lightweight structure reduces logistics costs while supporting recyclability goals. With increasing global demand for medicines and over-the-counter products, fiber-based solutions provide a sustainable alternative to plastic blisters. This application continues to anchor demand growth.

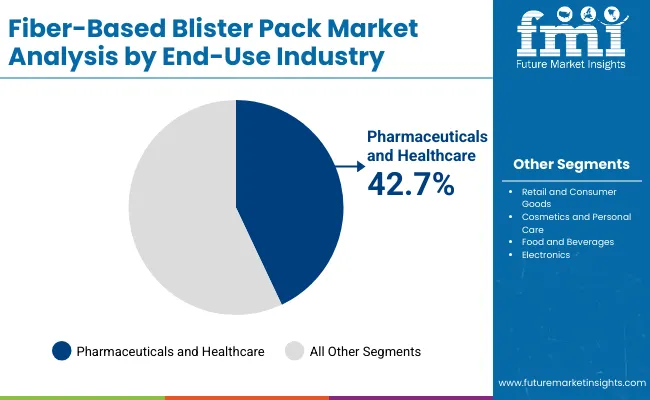

Pharmaceuticals and healthcare are expected to account for 42.7% of the market in 2025, as the sector emphasizes packaging safety, sustainability, and patient compliance. Fiber-based blister packs support labeling requirements and meet strict regulatory standards.

Adoption is reinforced by healthcare providers and manufacturers seeking alternatives to single-use plastics. Their role in reducing environmental impact while maintaining product safety drives uptake. With global healthcare expansion, this sector remains the primary end-user of fiber-based blister packs.

The fiber-based blister pack market is expanding as industries adopt eco-friendly alternatives to plastic packaging. Growth is driven by rising sustainability regulations, consumer demand for recyclable solutions, and brand commitments to reducing plastic use. However, high production costs and limited barrier properties restrain adoption. Advances in coating technologies, hybrid pack designs, and automation compatibility are creating new growth avenues.

Sustainability, Regulatory Support, and Brand Commitments Driving Adoption

Fiber-based blister packs are increasingly used in pharmaceuticals, consumer goods, and food packaging due to their recyclable and biodegradable properties. Governments and regulatory bodies are encouraging fiber packaging as part of anti-plastic initiatives. Brands are leveraging these packs to align with consumer preferences for environmentally friendly products. Their versatility allows use in both primary and secondary packaging, while innovations in forming techniques are expanding application potential. These drivers are positioning fiber blister packs as a viable plastic substitute.

High Production Costs, Limited Performance, and Supply Challenges Restraining Growth

Despite sustainability advantages, manufacturing fiber-based blister packs involves higher costs than traditional plastics due to advanced processing and coating requirements. Limited barrier properties against moisture, oxygen, and light restrict their use in highly sensitive pharmaceutical or food applications without additional protection. Supply chain challenges in sourcing high-quality fiber materials also add cost and complexity. Furthermore, retrofitting packaging lines to handle fiber materials requires investment, slowing adoption among cost-sensitive manufacturers. These factors create hurdles despite growing demand.

Advanced Coatings, Hybrid Designs, and Automation Trends Emerging

Key trends include the development of fiber blister packs with bio-based or water-based barrier coatings that improve performance against moisture and oxygen. Hybrid designs combining fiber with thin recyclable films are also gaining attention to balance sustainability with functionality. Automation-compatible fiber packs are being introduced, supporting faster production without compromising formability. Customizable printing and branding capabilities are enhancing retail appeal. These innovations are positioning fiber-based blister packs as high-potential solutions for sustainable, scalable, and consumer-friendly packaging.

The global fiber-based blister pack market is expanding rapidly, supported by demand for sustainable, plastic-free packaging across pharmaceuticals, food, and consumer goods. Asia-Pacific is emerging as the fastest-growing region, with China and India leading adoption due to government-backed eco-packaging policies and rising FMCG demand. Developed markets such as the USA, Germany, and Japan are prioritizing recyclable, compostable blister solutions while investing in automation-ready machinery, helping companies meet strict environmental regulations and consumer expectations for eco-friendly packaging formats.

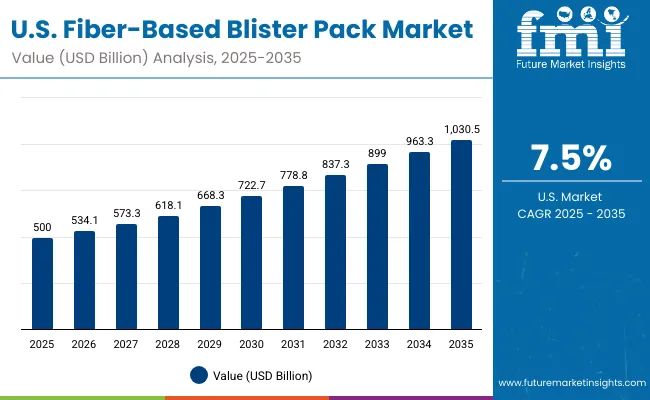

The USA market is projected to grow at a CAGR of 7.5% from 2025 to 2035, driven by rising demand in pharmaceuticals, healthcare devices, and food packaging. Strict sustainability regulations and consumer awareness are pushing adoption of fiber-based alternatives over plastics. Manufacturers are developing automation-compatible, high-barrier fiber packs to ensure durability and safety. Growth is further supported by pharmaceutical firms adopting fiber packs for compliance while aligning with FDA regulations and corporate sustainability goals.

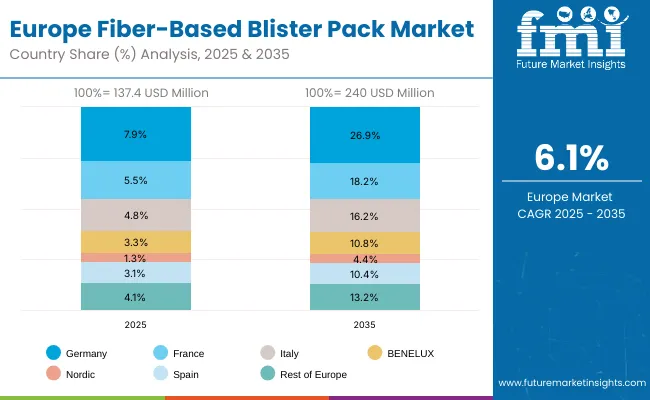

Germany’s market is expected to grow at a CAGR of 7.2%, supported by strong adoption in pharmaceuticals, consumer goods, and premium foods. EU sustainability directives are a major growth driver, encouraging the transition to fiber-based packaging. German OEMs are innovating barrier-coated fiber blister packs to balance sustainability with product safety. Increasing demand for recyclable packaging across industries positions Germany as a hub for eco-friendly blister pack production and engineering innovation in Europe.

The UK market is forecast to grow at a CAGR of 7.1%, driven by sustainability regulations and demand from healthcare, personal care, and FMCG. Companies are adopting fiber-based blister packs to reduce plastic usage and meet packaging waste reduction mandates. SMEs and startups are innovating with compact, cost-efficient blister formats. With growing consumer preference for eco-friendly solutions, fiber blister packs are becoming a strategic packaging choice for both domestic and export markets.

China’s market is projected to grow at a CAGR of 7.9%, fueled by government restrictions on plastics and rapid growth in pharmaceuticals and consumer goods. Local OEMs are scaling mass production of affordable fiber-based blister packs. Export industries, including electronics and healthcare, are adopting fiber formats to comply with international sustainability standards. Strong consumer demand for environmentally friendly packaging is further reinforcing adoption across China’s large-scale manufacturing ecosystem.

India is forecast to grow at a CAGR of 7.8%, driven by expanding pharmaceutical exports, FMCG demand, and government-led plastic reduction initiatives. SMEs are adopting cost-effective fiber blister solutions to replace traditional plastic formats. Rising awareness of sustainable packaging among urban consumers is accelerating adoption. Export-focused healthcare and food companies are also investing in fiber blister packs to meet international compliance, positioning India as a fast-growing eco-packaging hub.

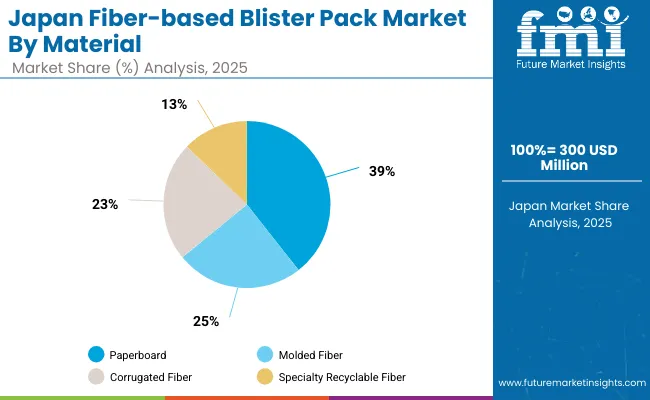

Japan’s market is projected to grow at a CAGR of 7.0%, supported by demand in electronics, healthcare, and high-end consumer goods. Companies are adopting fiber blister packs for their sustainability and premium appeal. Manufacturers are focusing on compact, recyclable formats that meet strict safety and hygiene standards. Innovation in multilayer coatings for moisture and oxygen barriers is driving adoption, aligning with Japan’s emphasis on quality, sustainability, and precision packaging solutions.

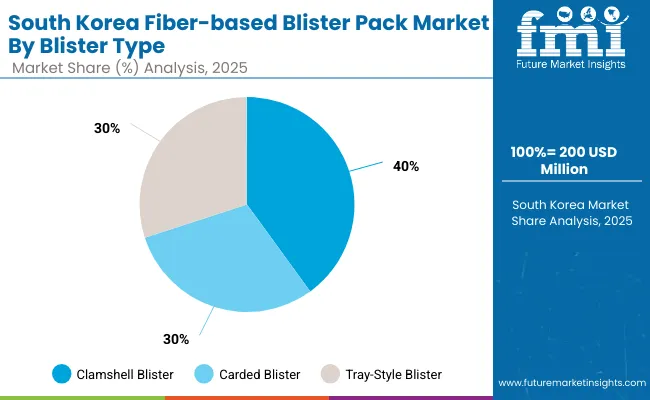

South Korea’s market is expected to grow at a CAGR of 7.2%, supported by demand in cosmetics, healthcare, and food products. Export-oriented industries are adopting fiber-based blister packs to meet international sustainability standards. Local OEMs are focusing on premium fiber packs compatible with automated packaging lines. Growing consumer demand for eco-conscious packaging in domestic markets, particularly in K-beauty and premium foods, is further fueling adoption of recyclable, biodegradable blister solutions.

Japan’s fiber-based blister pack market, valued at USD 300 million in 2025, is dominated by paperboard, which holds 39.4% share due to its recyclability, cost-effectiveness, and wide adoption in food and consumer goods packaging. Molded fiber follows with 24.7%, offering durability and protection for electronics and personal care items. Corrugated fiber accounts for 23.1%, valued for heavy-duty packaging applications, while specialty recyclable fibers represent 12.8%. Paperboard’s leadership underscores Japan’s focus on sustainable and eco-friendly packaging. However, molded and corrugated fibers are gaining importance as industries shift to stronger, biodegradable options, balancing sustainability with functionality in consumer-driven packaging solutions.

South Korea’s fiber-based blister pack market in 2025, worth USD 200 million, is led by clamshell blisters, capturing 40.3% share due to their strong protective qualities and visibility in retail packaging. Carded blisters hold 24.0%, while tray-style blisters account for 22.5%. Clamshells dominate in electronics, toys, and consumer goods packaging where product protection and display are critical. Carded blisters remain popular for pharmaceutical and personal care packaging, offering lightweight and low-cost solutions. Tray-style blisters, though smaller, serve premium and specialty products. This distribution highlights South Korea’s balanced demand across blister formats, with clamshells leading as industries emphasize security and presentation.

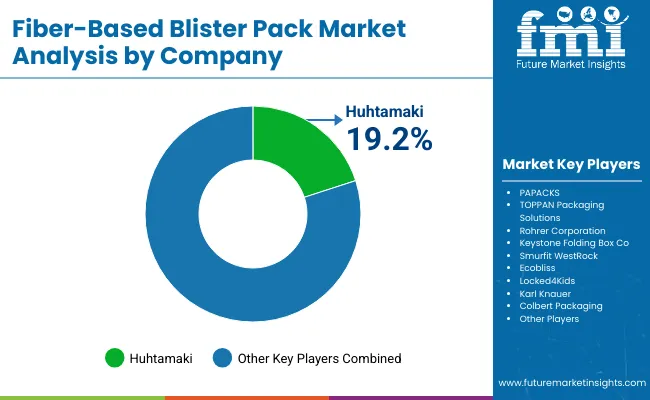

The fiber-based blister pack market is moderately fragmented, with global packaging leaders, eco-material innovators, and regional converters competing across pharmaceuticals, consumer goods, electronics, and personal care sectors. Global leaders such as Huhtamaki, PAPACKS, and TOPPAN Packaging Solutions hold notable market share, driven by molded fiber innovations, recyclable barrier coatings, and compliance with FDA and EU packaging standards. Their strategies increasingly emphasize plastic reduction, renewable sourcing, and integration with automated filling lines.

Established mid-sized players including Rohrer Corporation, Keystone Folding Box Co., and Smurfit WestRock are supporting adoption of hybrid blister packs featuring paperboard structures, eco-friendly sealing layers, and child-resistant designs. These companies are especially active in healthcare and personal care packaging, offering durable fiber alternatives, high-quality graphics, and enhanced shelf appeal while meeting sustainability goals.

Specialized providers such as Ecobliss, Locked4Kids, Karl Knauer, and Colbert Packaging focus on tailored fiber-based blister solutions for regional and niche markets. Their strengths lie in child-resistant designs, custom engineering, and rapid prototyping capabilities, enabling brands to reduce environmental impact while ensuring regulatory compliance and strong consumer acceptance of fiber alternatives to plastic blister formats.

Key Development

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| By Material | Molded Fiber, Paperboard, Corrugated Fiber, Specialty Recyclable Fiber |

| By Blister Type | Carded Blisters, Clamshell Blisters, Tray-Style Blisters |

| By Closure Type | Heat-Sealed Blisters, Pressure-Sensitive Blisters, Adhesive Bonded Blisters |

| By Application | Pharmaceutical Packaging, Food and Beverage Packaging, Consumer Goods Packaging, Personal Care and Cosmetics Packaging, Electronics Packaging |

| By End-Use Industry | Pharmaceuticals and Healthcare, Food and Beverages, Retail and Consumer Goods, Cosmetics and Personal Care, Electronics |

| Key Companies Profiled | Huhtamaki, PAPACKS, TOPPAN Packaging Solutions, Rohrer Corporation, Keystone Folding Box Co., Smurfit WestRock, Ecobliss, Locked4Kids, Karl Knauer, Colbert Packaging |

| Additional Attributes | Increasing adoption of molded fiber and paperboard blister packs to replace plastics, driven by sustainability regulations, strong uptake in pharmaceuticals and healthcare for eco-friendly compliance packaging, rising use in personal care and electronics for premium recyclable solutions, and growth in retail and consumer goods favoring cost-effective, lightweight, and customizable fiber -based alternatives to enhance brand identity and reduce carbon footprint. |

The global fiber-based blister pack market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the fiber-based blister pack market is projected to reach USD 3.2 billion by 2035.

The fiber-based blister pack market is expected to grow at a CAGR of 7.2% between 2025 and 2035.

The key blister types in the fiber-based blister pack market include carded blisters, clamshell blisters, and tray-style blisters.

The clamshell blisters segment is projected to account for the highest share of 41.2% in the fiber-based blister pack market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Assessing Fiber-Based Packaging Market Share & Industry Trends

Blister Card Market Analysis by Product Type, Technology Type, Material Type, End-use Industry, and Region Forecast Through 2035

Blister Paper Market

Blister Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Blister Packaging Companies

Deblistering Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Leading Deblistering Machine Providers

USA Blister Packaging Market Trends – Demand & Growth 2025-2035

PVC Blister Packs Market

Japan Blister Packaging Market Trends – Demand & Growth 2025-2035

Welded Blisters Market Size and Share Forecast Outlook 2025 to 2035

Pharma Blister Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Pharma Blister Packaging Machines Industry Share

Leading Providers & Market Share in Pharma Blister Packaging

Carded Blister Packaging Market

Sliding Blister Packaging Market Size and Share Forecast Outlook 2025 to 2035

Alu Alu Blister Packaging Machine Market Insights - Trends & Forecast 2025 to 2035

Understanding Market Share Trends in Alu-Alu Blister Packaging Machines

Germany Blister Packaging Market Size – Demand & Growth 2025-2035

Global Medicine Blister Market Analysis – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA