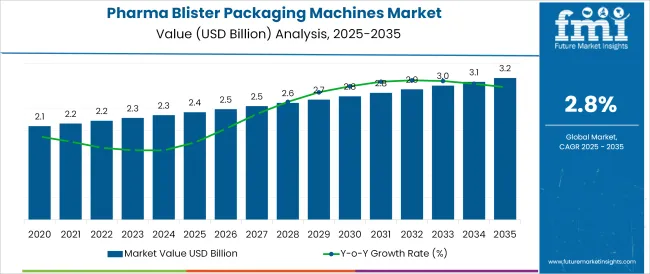

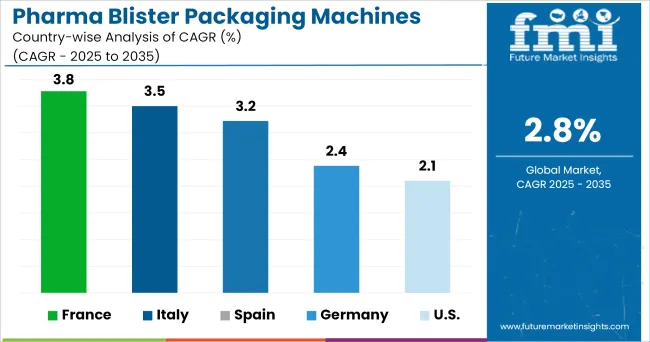

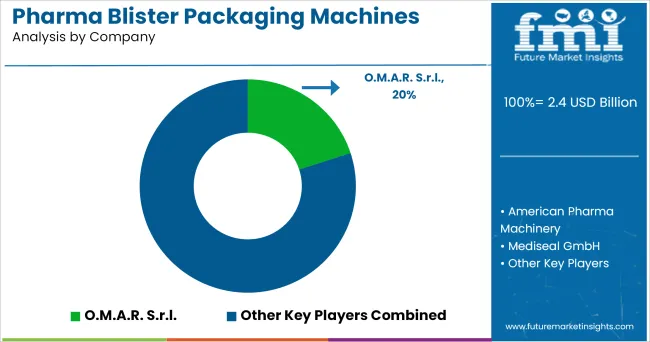

The Pharma Blister Packaging Machines Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 2.8% over the forecast period.

The pharma blister packaging machines market is expanding steadily, propelled by the growing demand for secure, tamper evident, and patient compliant packaging formats across global pharmaceutical manufacturing. Increased production of solid oral dosage forms coupled with rising regulatory scrutiny around traceability and product integrity, is prompting investments in high-performance blister packaging systems.

Automation, real-time quality checks, and serialization readiness have become integral to packaging workflows, particularly as manufacturers target scalability and cost efficiency. Moreover, the adoption of multi material compatibility, sustainable films, and quick-change tooling systems has facilitated flexible production lines capable of handling frequent SKU changes.

The increasing penetration of contract manufacturing organizations and the proliferation of over the counter (OTC) products are further supporting demand for high-throughput, validated packaging lines. Future growth is expected to be driven by modular systems equipped with vision inspection, smart sensors, and Industry 4.0 features, enabling pharma companies to maintain GMP compliance, reduce human error, and enhance packaging line efficiency.

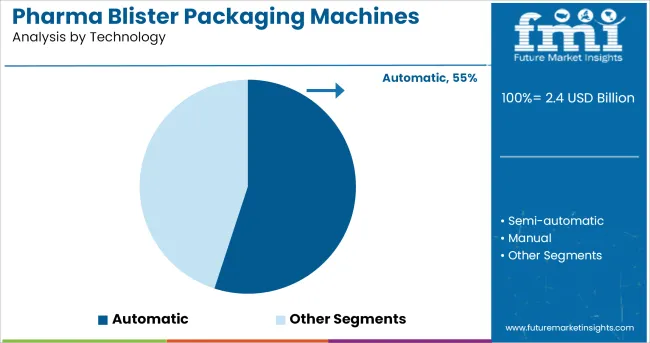

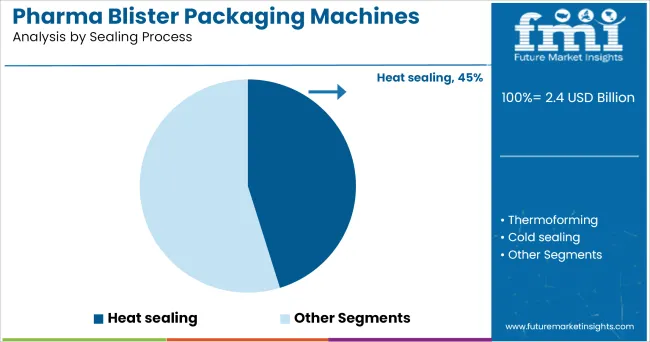

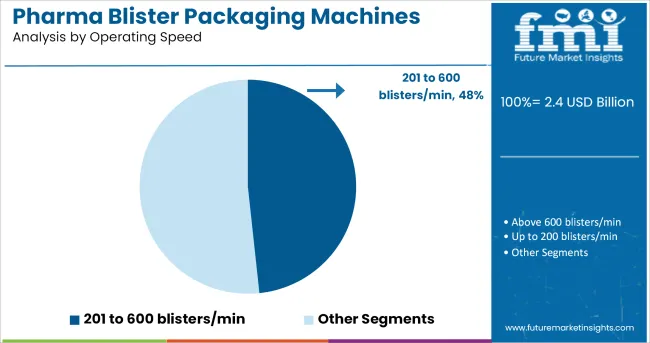

The market is segmented by Technology, Sealing Process, and Operating Speed and region. By Technology, the market is divided into Automatic, Semi-automatic, and Manual. In terms of Sealing Process, the market is classified into Heat sealing, Thermoforming, and Cold sealing. Based on Operating Speed, the market is segmented into 201 to 600 blisters/min, Above 600 blisters/min, and Up to 200 blisters/min. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automatic segment is projected to account for 55.6% of the total revenue in 2025 under the technology category, establishing it as the leading operational mode. This dominance has been driven by the pharmaceutical sector’s requirement for uninterrupted, high-volume production with consistent accuracy and regulatory adherence.

Automatic blister packaging machines are equipped with servo-controlled systems, real-time monitoring, and integration with downstream cartoning lines features that have collectively enhanced efficiency and reduced manual intervention. Their ability to ensure repeatability, reduce material waste, and maintain stringent hygiene standards has made them essential in large-scale manufacturing facilities.

With demand rising for multi-lane configurations and zero-defect output, automatic machines have become the standard choice for pharma companies seeking compliant, scalable, and data-integrated packaging solutions.

Heat sealing is projected to hold 45.2% of revenue share within the sealing process category in 2025, making it the predominant sealing method. This leadership is attributed to its compatibility with a wide range of thermoformable and lidding materials, including PVC PVDC, and aluminum.

Heat sealing enables consistent, hermetic closure which is vital for maintaining the integrity and shelf-life of pharmaceutical products. Its ability to operate efficiently at high speeds while meeting regulatory sealing standards has made it a preferred technology in blister line configurations.

Moreover, advancements in temperature control systems and pressure calibration have minimized the risk of seal degradation, ensuring product protection across diverse climates and storage conditions. As pharmaceutical companies place greater emphasis on unit-dose protection and anti-counterfeiting measures heat sealing remains central to production strategies in both branded and generic drug segments.

The operating speed segment of 201 to 600 blisters per minute is expected to command 48.3% of market revenue in 2025, positioning it as the leading speed range. This dominance stems from its optimal balance between throughput, format flexibility, and cost efficiency.

Machines within this range are widely adopted by medium to large pharmaceutical manufacturers aiming for consistent production volumes without incurring the high capital costs of ultra-high-speed machinery. These systems often support quick tool changeovers integration with inspection systems, and modular upgrades enabling manufacturers to respond swiftly to market demands and SKU proliferation.

The speed bracket also aligns with batch-size variability seen in both prescription and OTC drug segments, making it suitable for regional as well as global supply chains. As manufacturers prioritize lean production and operational agility, this speed range has emerged as the most versatile and widely implemented across pharma blister packaging operations.

Pharma blister packaging machines are used to pack unit-dose packaging for capsules, gels, tablets, syringes, vials and throat lozenges. These machines typically use a 3-step process for packaging, which includes forming, sealing, and perforating & cutting respectively.

Forming uses thermoforming or cold-forming to make the product-specific packaging. Sealing is lidding and closing the product packaging using heat sealing or cold sealing, and the last step perforating & cutting uses precision die cutter to shape the packaging.

Blister packaging is tamper-proof and is relatively less expensive than foil packaging and plastic packaging used in the pharmaceutical sector. Also, single-unit consumption and hygiene of the products are the main factors that are responsible for the growth of the pharma blister packaging machines market during the forecast period.

High performance and productivity equipment designed with plug-in expansions, better flexibility and application over numerous materials are taking the market by storm. These features not only help manufacturers create better products but also help them with mass customized blister packaging.

The pharma blister packaging machines market is expected to develop at a high pace due to ongoing innovations and technological improvements.

Robotic integration and total customization are a few of the features that are expected to shape the market for pharma blister packaging machines. Transfer lines, machine learning and artificial intelligence are expected to carry out disruptive changes in the market. The introduction of new technologies and scientific breakthroughs play an important role in reshaping the pharma blister packaging machines market.

Advance motion control, modular software design and touch-sensitive built-in hardware are few factors that are reshaping the market for pharma blister packaging machines.

Other than these factors, digital counter inputs, embedded USB programming and HMI connectivity in machines are few other aspects that are rapidly influencing machine design and capabilities.

Every technological machine and equipment become obsolete with time. Companies incur additional costs due to the inevitable need for replacing their pharma blister packaging machines with the latest technologies. This leads to the shrinking of ROI and affects profit margins.

It could be avoided only by pre-planning and readiness to accept the changes in technology over time with rapid technological advancement, especially in the pharma blister packaging machines.

Constant technological changes have also led to an increase in company expenses on an individual’s training. Additionally, the company’s time and efforts are also spent on ensuring that its employees learn how to operate advanced models of pharma blister packaging machines. These factors might hinder the market demand for pharma blister packaging machines in the market.

Key players are investing in technological upgradation and usage of better machines to enhance their production capacity in the market. New players are entering the market due to enormous growth opportunities due to pandemic that has led to an increasing demand in healthcare and pharmaceutical sector.

Heino Ilsemann GmbH launched the BS-300, a new compact and sophisticated blister packaging machine that enhances adaptability while occupying minimal space. This machine is designed to meet the specific needs of the pharmaceutical industry with a focus on efficiency and space-saving.

Germany is an automation-centric and highly progressing nation in Europe. Machine & Equipment (M&E) industry is one of the most lucrative and second-largest industries in the country. Technological development and high exports are the factors for the sector growth in the country.

According to the insights provided by Germany Trade & Invest, USD 2.1 billion has been spent on research and development of machines and equipment in the country during the period 2020 to 2020. Machine & Equipment (M&E) industry stands in the first position based on the degree of innovation in Germany.

Germany provides advanced technology development and excellent improvement to current state-of-art facilities in pharma blister packaging machines and is expected to remain a key player in the market.

Key players operating in the pharma blister packaging machines market are Heino Ilsemann GmbH

Major players operating in the Asian market are

The global pharma blister packaging machines market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the pharma blister packaging machines market is projected to reach USD 3.2 billion by 2035.

The pharma blister packaging machines market is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in pharma blister packaging machines market are automatic, semi-automatic and manual.

In terms of sealing process, heat sealing segment to command 45.2% share in the pharma blister packaging machines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Pharma Blister Packaging Machines Industry Share

Leading Providers & Market Share in Pharma Blister Packaging

High Barrier Pharmaceutical Packaging Films for Blister Market Size and Share Forecast Outlook 2025 to 2035

Blister Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Blister Packaging Companies

Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Deblistering Machines Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Packaging Equipment Market Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Leading Deblistering Machine Providers

Market Share Breakdown of Pharmaceutical Packaging Companies

USA Blister Packaging Market Trends – Demand & Growth 2025-2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Japan Blister Packaging Market Trends – Demand & Growth 2025-2035

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Pharmaceutical Glass Packaging Manufacturers

Pharma Grade Plastic Packaging Market Growth – Forecast 2024-2034

Pouch Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Biopharmaceuticals Packaging Market Growth – Forecast 2025 to 2035

Carded Blister Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA