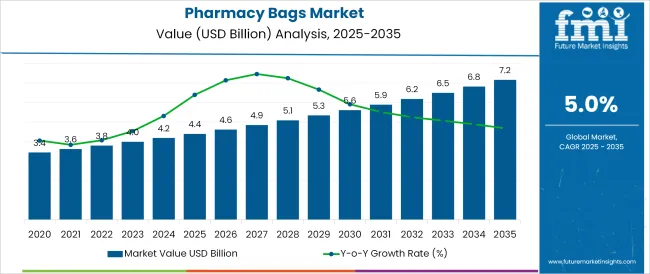

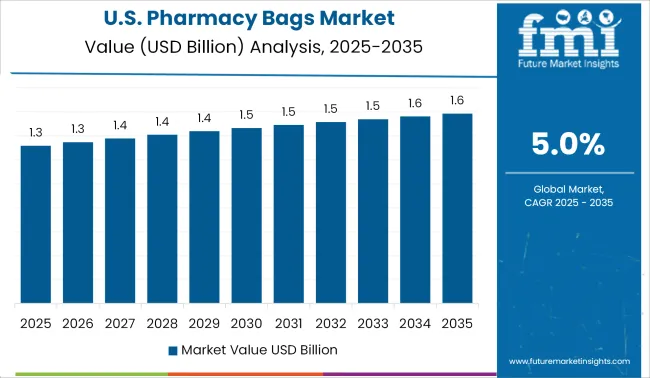

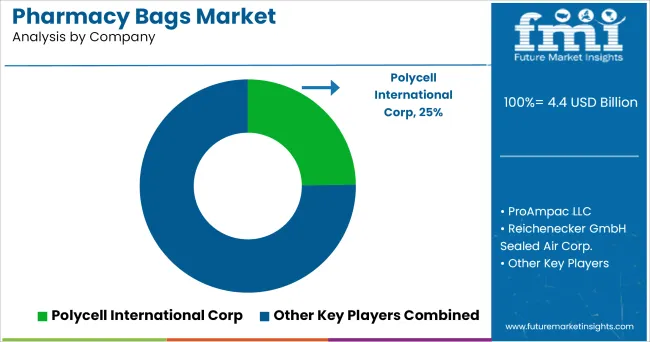

The Pharmacy Bags Market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 7.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The pharmacy bags market is being shaped by rising demands for safe, compliant, and consumer-friendly packaging solutions across healthcare settings. Regulatory frameworks aimed at medication safety and contamination control are stimulating growth of specialized bag formats.

Additionally, the need for transparent dispensing practices, particularly in pharmacies and hospital environments, has increased the adoption of bags that ensure traceability and protect against tampering. Technological advancements in materials-such as barrier-enhanced plastics and antimicrobial coatings-have improved functionality without undermining safety standards.

Moreover, healthcare stakeholders have been emphasizing patient convenience, medication compliance, and brand consistency, which has led to customization in bag design including dosage instructions and branding elements. The market outlook remains favorable as supply chain resilience and patient experience continue to guide packaging innovation, especially in response to evolving healthcare delivery models and patient-centric care initiatives.

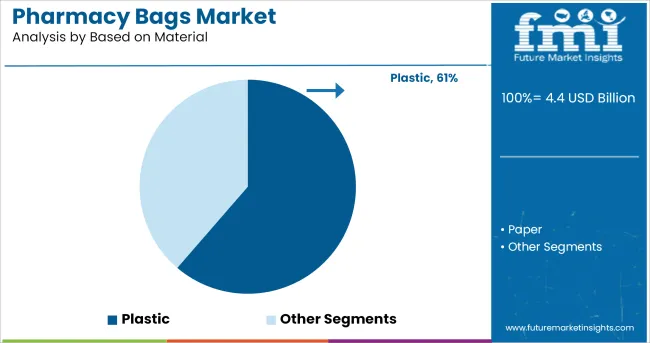

It is observed that the plastic material category accounts for 61.30% of total market revenue, positioning it as the leading material sub-segment. This dominance is attributed to the material’s strength, durability, and capacity to maintain sterility throughout handling and storage.

The lightweight nature of plastic bags has been preferred for reducing shipping costs and enhancing pharmacy workflow efficiency. Additionally, integration with barrier technologies and tamper-evident features has further amplified the suitability of plastic for healthcare use.

Regulatory compliance for medication storage and resistance to moisture and puncture have been recognized as critical benefits. As a result, reliance on plastic pharmacy bags has been reinforced by practical requirements and operational efficiencies, supporting their market leadership

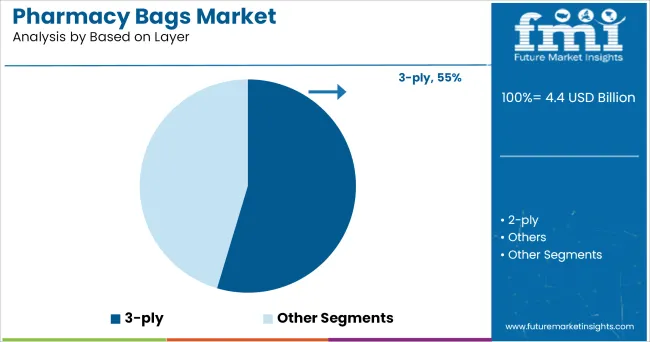

It has been observed that the 3-ply bag configuration holds 54.60% of overall market revenue, marking it as the dominant layer format. This configuration has been preferred due to its layered construction, which balances strength, puncture resistance, and insulation-critical aspects in pharmaceutical packaging.

The ability of 3-ply designs to resist tear and maintain structural integrity has been considered essential for safe handling, particularly for heavier or moisture-sensitive shipments. Additionally, the enhanced protective features offered by this construction align with regulatory mandates for patient safety.

Efficiency in automated bagging systems and improved handling for pharmacists and patients alike have further supported its prominence in the market.

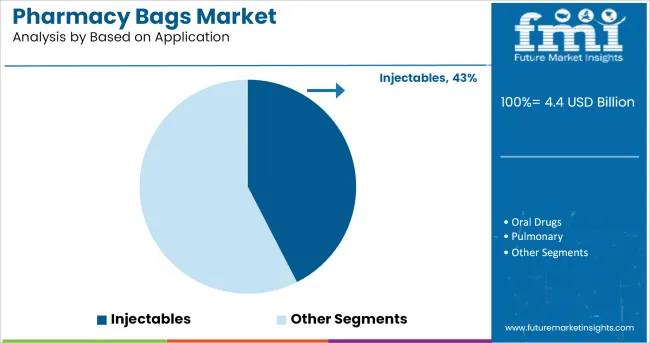

It is noted that the injectables application segment represents 42.50% of total market revenue, making it the leading application category. This leadership is based on the high compliance and safety requirements inherent to injectable drug therapies.

Pharmacy bags intended for injectables have been designed to accommodate vials, syringes, and accessories with reinforced seals and secure closures.

The need to prevent cross-contamination and ensure dosage accuracy has driven widespread use in hospitals, clinics, and outpatient infusion settings. Additionally, the increase in injectable therapies across chronic and acute care, including biologics, vaccines, and specialty medications, has been influential. Consequently, the injectable pharmaceuticals segment continues to anchor demand for advanced pharmacy bag solutions, grounded in safety, traceability, and regulatory alignment.

Nowadays, society and consumers are demanding that the manufacturers and big firms make products in an environmentally responsible manner, which thereby helps in making purchasing decisions. The shift is further attributed due to rising consumers concerns regarding limited environmental regulations and climate change; therefore, manufacturers are incorporating these values into their mission to minimize the environmental footprints.

Moreover, industry experts have highlighted the want to include lifecycle thinking into the design process to optimize design, product cost and functionality, and to make efficient decisions that help improve end-of-life recyclability.

Increased awareness about end of life options, contemplations for assortment logistics, and mounting concern the environmental impacts of challenging single-use plastics.

Moreover, there is a rising affinity to look at the complete product’s lifecycle. This is keen-sighted more thought put into policy, business models, and logistics to ensure a product is recycled. A concentration on the end-of-life options for packaging is seeing improved attentiveness of the value of reutilizing, predominantly over composting.

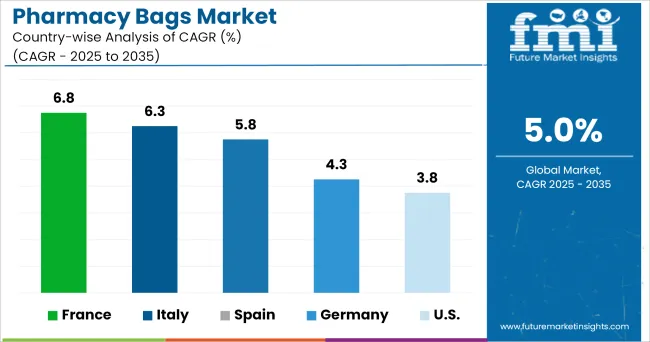

In terms of sales, the North American market is projected to take the lead in the global target market. With growing consumer demand for recyclable packaging, USA and Canadian governments have adopted regulatory approaches on the development of polyethylene terephthalate (PET) resin useful for extrusion blow-molded on shuttle machines.

Moreover, packaging and brand professionals approve the swift advancement of e-commerce that had a greater impact on the technologies, business, supply chain, design, and engineering of packaging globally, hence increasing the pharmacy bags market demand globally.

The European pharmacy bags market is estimated to grow at a moderate pace. Manufacturers are aiming for flexible plastic packaging in the medical and biology industry due to the functional properties offered by pharmacy bags packaging, such as cost-effectiveness, safety, strength, durability, environmental-friendliness, handling convenience, and lightweight.

The market for pharmacy bags is estimated to see swift growth through the projection period driven by huge investments done by market players in social media marketing, and promotional activities towards increasing high-quality packaging trends.

Some of the key players manufacturing pharmacy bags are as follows

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides an in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global pharmacy bags market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the pharmacy bags market is projected to reach USD 7.2 billion by 2035.

The pharmacy bags market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in pharmacy bags market are plastic and paper.

In terms of based on layer, 3-ply segment to command 54.6% share in the pharmacy bags market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Pharmacy Bags Manufacturers

Prescription Pharmacy Bags Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Prescription Pharmacy Bags Market

Pharmacy Refrigerators Market Size and Share Forecast Outlook 2025 to 2035

Pharmacy Automation Market Trend Analysis Based on Product, End-Use, and Regions 2025 to 2035

Pharmacy and Drug Store Franchises Market is segmented by Type and Age Group from 2025 to 2035

Pharmacy Automation System Market Growth – Demand & Forecast 2024-2034

Pharmacy Accessory Bagging System (PABS) Market

ePharmacy Market Overview – Trends, Demand & Forecast 2025 to 2035

Infusion Pharmacy Management Market

Polybags Market Size and Share Forecast Outlook 2025 to 2035

Net Bags Market

VCI Bags Market

Sandbags Market

Leno Bags Market Size and Share Forecast Outlook 2025 to 2035

Silo bags Market Size and Share Forecast Outlook 2025 to 2035

Food Bags Market Share, Size, and Trend Analysis for 2025 to 2035

Competitive Breakdown of Silo Bag Manufacturers

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Jumbo Bags Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA