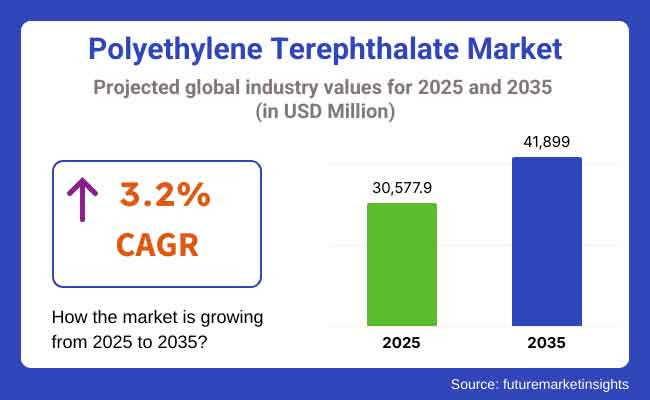

The global polyethylene terephthalate (PET) market is projected to expand from USD 30,577.9 million in 2025 to USD 41,899.0 million by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period. Growth is expected to be supported by sustained demand from the packaging, textile, and consumer goods industries, where PET’s attributes such as strength, transparency, lightweight profile, and recyclability continue to meet operational and environmental requirements.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 30,577.9 Million |

| Projected Market Size in 2035 | USD 41,899.0 Million |

| CAGR (2025 to 2035) | 3.2% |

In 2024, strong PET consumption was observed in the packaging industry, where food and beverage manufacturers continue to adopt PET for rigid and flexible containers, especially for bottled water, carbonated drinks, and ready-to-eat products. The pharmaceutical and personal care sectors also increased their reliance on PET due to its barrier properties and compliance with hygiene standards. These trends are particularly prominent in emerging markets, where urbanization and rising disposable incomes are shaping consumption habits.

Beyond packaging, the use of PET in polyester fiber production remains a significant driver. PET fibers are extensively used in apparel, home furnishings, and industrial applications due to their durability and cost-efficiency. The global textile industry, supported by e-commerce retail and rising demand for performance fabrics, has played a central role in sustaining PET demand.

Efforts to transition toward a circular economy are prompting industry stakeholders to prioritize recycled PET (rPET) and explore alternative bio-based PET formulations. The implementation of recycled content mandates in the EU and North America, along with rising consumer awareness about single-use plastics, is compelling converters and brand owners to secure closed-loop systems and invest in chemical and mechanical recycling technologies.

In automotive and electronics industries, PET is being utilized for under-the-hood components, 3D printing filaments, and flexible circuit boards due to its thermal resistance and structural integrity. These applications, although smaller in volume compared to packaging and textiles, are contributing to the development of specialty PET grades.

The packaging segment is projected to hold approximately 64% of the global PET market share in 2025 and is expected to grow at a CAGR of 3.3% through 2035. PET is widely used in manufacturing bottles, containers, and flexible packaging for beverages, food products, and household chemicals. Its high strength-to-weight ratio, clarity, and ability to form airtight seals make it the preferred material for carbonated drinks, water, and ready-to-eat items.

As regulatory bodies and consumers push for sustainable packaging, the use of recyclable and food-grade PET continues to expand. Growth in e-commerce packaging and demand for lightweight logistics solutions are also contributing to broader adoption across global supply chains.

The food and beverage segment is estimated to account for approximately 57% of the global PET market share in 2025 and is projected to grow at a CAGR of 3.4% through 2035. PET is widely used in the packaging of bottled water, soft drinks, dairy products, sauces, and edible oils due to its non-reactive nature and compliance with global food safety standards.

Rising urbanization, shifting consumer preferences toward convenience foods, and growing focus on hygienic packaging are reinforcing demand in this segment. Additionally, beverage brands are investing in recycled PET (rPET) packaging solutions to meet sustainability targets and circular economy goals, further strengthening PET’s role in the global food and beverage industry.

Plastic waste backlash, price volatility, and recycling inefficiencies hinder market potential.

While PET is recyclable, it is increasingly being criticized as a contributor to global plastic waste, particularly in countries without effective waste management systems. Many regions are only able to achieve effective circularity due to inconsistent collection, contamination in recycling streams and not enough rPET capacity.

In addition to PET production, the cost of its raw materials, namely purified terephthalic acid (PTA) and monoethylene glycol (MEG), are subject to price fluctuations, which in turn affect production margins. Furthermore, impending regulatory, by which single-use plastics are being phased out down, is leading some of the brands to develop alternatives to packaging materials, which may, in turn, change demand away from PET from certain end-use categories.

Growth in rPET, bio-PET, and sustainable textiles unlock new pathways.

There are major opportunities to develop and scale food-grade recycled PET (rPET) and bio-based PET made from renewable feedstocks, like sugarcane or corn. International beverage companies are pledging 100% recyclable packaging and more rPET, ensuring strong demand for quality recycled resins.

PET is also playing an increasingly prominent role in the production of polyester fibre for garments, automotive and technical textiles, all of which provide long-term growth opportunities. Depolymerization and solvent-based purification are among the advanced recycling technologies that are improving PET recovery rates. Innovation in reusable PET containers, refill systems, and closed-loop logistics part of the government/industry partnerships to come up with zero-waste packaging.

The growing use of polyethylene terephthalate (PET) in the manufacturing of beverage bottles, food packaging, and textile fiber is driving the USA market. According to the UN, the shift towards sustainable packaging is driving demand for rPET (recycled PET) as leading beverage brands commit to using 50-100% recycled content by 2030.

State laws such as bottle deposit programs and extended producer responsibility laws in places like California and Oregon are helping to upgrade recycling infrastructure.Also industrial demand for PET resins is growing in thermoforming and 3D printing.

| Country | CAGR (2025 to 2035) |

|---|---|

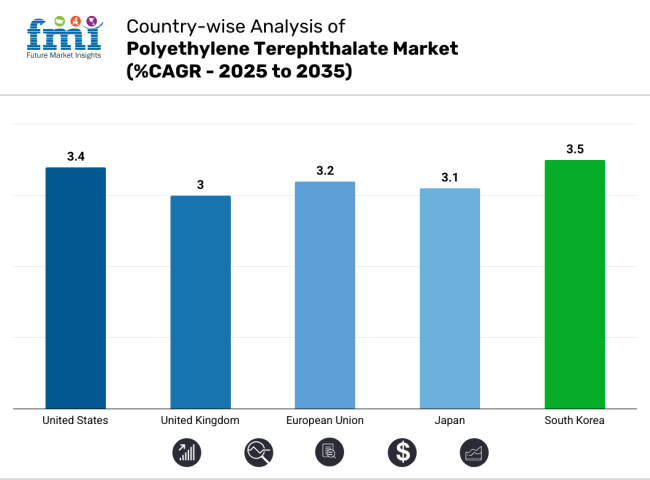

| United States | 3.4% |

PET beverage use in the UK primarily comes from bottled water, ready-meal trays, and personal-care containers. The Plastic Packaging Tax from the UK government and the newly planned Deposit Return Scheme (DRS) are incentivizing the use of recycled PET and circular packaging solutions.

To improve recyclability, supermarkets are moving to mono-material PET trays as well as clear containers. Innovation hubs in London and Manchester are developing bio-PET and enzymatic recycling techniques to reduce our reliance on virgin feedstock. Yet, demand stemming from e-commerce-ready packaging also follows consumer convenience trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.0% |

The EU is still a major manufacturer and recycling region for PET due to strict environmental regulations as part of the European Green Deal. Germany, Italy, and France have the most advanced closed-loop recycling infrastructure focusing on bottle-to-bottle applications for PET.

Additionally, the EU Single-Use Plastics Directive requires minimum recycled content in plastic bottles, stimulating demand for food-grade rPET. There are regional players investing in mechanical and the chemical recycling capacity. Developments in R&D are also progressing the creation of high-clarity PET for the pharmaceutical and electronics packaging sector.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.2% |

PET demand across bottled beverages, convenience food trays, and functional fibers drives Japan’s market. Thanks to widespread deposit systems and public awareness campaigns, the country has one of the highest PET bottle recycling rates in the world over 85 percent. Domestic companies are at the forefront for developing bio-based PET from renewable feedstocks like molasses and corn.

In fact, PET is also commonly used in electronics and automotive components where heat resistance and dimensional stability are required. Leading retail chains are adopting smart packaging solutions using PET films.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.1% |

South Korea has a strong PET market with advanced manufacturing in its systems range in packaging its textile and industrial films. The gov (green new deal that promotes the use of recycled plastics. Standards in food delivery have raised drastically, caused by e-commerce and urban consumption, hence, the demand for PET trays and bottles will remain high.

For its thermal and mechanical properties, PET has also increased its presence in Korea’s electronics and construction sector. Top firms are creating high-strength PET variants for industrial uses, and public-private partnerships are addressing rPET collection systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.5% |

The global PET market is highly competitive and vertically integrated, with key players prioritizing sustainable innovation and regional growth. Companies are investing in closed-loop recycling, bio-based PET, and chemical recycling technologies to support circular economy goals. Strategic partnerships are emerging throughout the PET value chain, from collection and washing to resin production and bottle manufacturing.

Government grants and ESG-driven funding are facilitating technological advancements and capacity expansion. The market is increasingly focused on reducing carbon footprints, enhancing food-grade recyclability, and ensuring compliance with global packaging regulations.

The overall market size for the polyethylene terephthalate market was USD 30,577.9 Million in 2025.

The polyethylene terephthalate market is expected to reach USD 41,899.0 Million in 2035.

The demand for polyethylene terephthalate (PET) is rising due to its extensive use in packaging solutions, particularly in the food and beverage industry. Increasing demand for lightweight, recyclable, and cost-effective materials for bottles and containers is further accelerating market growth.

The top 5 countries driving the development of the polyethylene terephthalate market are China, the USA, India, Germany, and Brazil.

PET for packaging and food & beverage end use are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyethylene Terephthalate Catalyst Size and Share Forecast Outlook 2025 to 2035

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Bio-Polyethylene Terephthalate for Packaging Market

Recycled Polyethylene Terephthalate (rPET) Packaging Market Growth and Trends 2025 to 2035

Polyethylene (PE) Thermoform Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Naphthalate (PEN) Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Films Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Mailers Market Insights - Growth & Trends Forecast 2025 to 2035

Competitive Breakdown of Polyethylene Corrugated Packaging Manufacturers

Polyethylene Glycol Market Growth – Trends & Forecast 2024-2034

Polyethylene Pipe Market Growth – Trends & Forecast 2024-2034

Polyethylene Market Growth – Trends & Forecast 2024-2034

Polyethylene furanoate Market

Polyethylene Orthopaedic Insert Market

Renewable Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Bio Based Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Metallocene Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA