The polyethylene corrugated packaging market is growing fast as industries tend towards lightweight yet robust and eco-friendly packaging materials. Companies look for high impact resistance, cheap material, and eco-friendly material to meet their regulatory requirement along with consumer preferences. Polyethylene Corrugated Packaging market includes Tier 1, Tier 2 and Tier 3 players, through which the dynamics of the market shape.

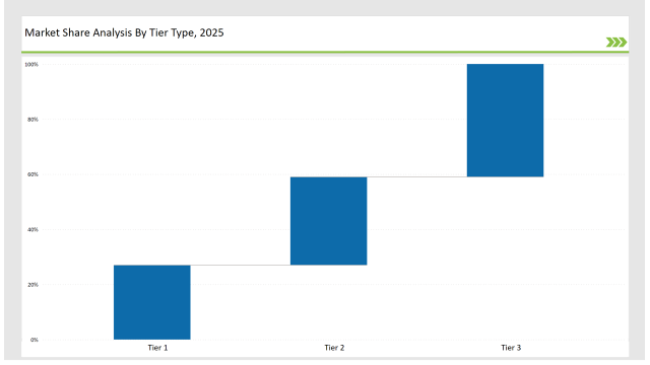

DS Smith, Smurfit Kappa, and Amcor have a market share of 27% under tier 1. They benefit from economies of scale, investing in sustainability, and have a global distribution network that helps them compete with the other players in the market.

Tier 2 players, including Sealed Air, Mondi, and Pregis, hold 32% of the market. These firms focus on cost-effective, high-performance polyethylene corrugated packaging solutions for mid-scale applications while continually innovating in sustainable packaging.

Tier 3 manufacturers and niche brands such as NEFAB, Coroplast, and Universal Package account for 42% of the market. These companies specialize in customized solutions, regional supply chains, and advancements in polyethylene corrugated packaging.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (DS Smith, Smurfit Kappa, Amcor) | 14% |

| Rest of Top 5 (Sealed Air, Mondi) | 8% |

| Next 5 of Top 10 (Pregis, NEFAB, Coroplast, Universal Package, ORBIS Corporation) | 5% |

The Polyethylene Corrugated Packaging Market serves key industries, including:

To meet industry needs, manufacturers provide solutions such as:

Sustainability is a key focus, with companies investing in recyclable polyethylene, lightweight alternatives, and energy-efficient production methods.

Such leading manufacturers set industry benchmarks with advanced polyethylene formulations, AI-driven production optimizations, and smart packaging solutions. Companies are developing lightweight but robust materials, improving recyclability and increasing manufacturing efficiency. Moreover, they work on ways to reduce carbon footprints through energy-efficient production and optimized packaging designs for stacking and storage efficiency. Other firms also collaborate with raw material suppliers in order to develop novel, sustainable solutions for polyethylene.

Technology suppliers in the Polyethylene Corrugated Packaging Market must prioritize sustainability, durability, and automation to remain competitive. Key investment areas include:

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | DS Smith, Smurfit Kappa, Amcor |

| Tier 2 | Sealed Air, Mondi, Pregis |

| Tier 3 | NEFAB, Coroplast, Universal Package, ORBIS Corporation |

| Manufacturer | Latest Developments |

|---|---|

| DS Smith | Launched fully recyclable polyethylene corrugated packaging (January 2024). |

| Smurfit Kappa | Developed moisture-resistant, high-impact industrial packaging (March 2024). |

| Amcor | Expanded biodegradable and compostable packaging production (April 2024). |

| Sealed Air | Introduced ultra-lightweight, high-strength corrugated solutions (May 2024). |

| Mondi | Innovated with enhanced barrier protection packaging (July 2024). |

| Pregis | Implemented AI-driven automated packaging lines (August 2024). |

| NEFAB | Designed reusable and collapsible polyethylene packaging (September 2024). |

Leading companies in the Polyethylene Corrugated Packaging Market focus on sustainability, efficiency, and performance.

Polyethylene Corrugated Packaging Market Evolves with Sustainable Materials, Smart Manufacturing Techniques, and Improved Logistics Tracking. The companies are focusing on biodegradable solutions, AI-powered automation, and recyclable innovations. Future trends involve enhanced durability by using lighter materials, plant-based polymer applications for more extended fields, and digital traceability of packaging for the efficiency of it.

Leading manufacturers include DS Smith, Smurfit Kappa, and Amcor.

The top 10 players hold approximately 27% of the global market.

By investing in biodegradable plastics, reducing waste, and improving recyclability.

Enhancing durability, cost-efficiency, and environmental responsibility.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyethylene Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Assessing Corrugated Packaging Market Share & Industry Trends

Leading Providers & Market Share in Shaped Corrugated Packaging

Breaking Down Market Share in Corrugated Automotive Packaging

Market Share Breakdown of the Heavy Duty Corrugated Packaging Market

Corrugated Board Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Automotive Packaging Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down Market Share in the Corrugated Box Industry

Global Packaging Tapes Market Share Analysis – Size, Growth & Forecast 2025–2035

Market Share Distribution Among Packaging Films Suppliers

Market Share Insights of Leading Packaging Tube Providers

Shaped Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Tea Packaging Providers

Market Leaders & Share in the Egg Packaging Industry

Corrugated Pharmaceutical Packaging Market Analysis Size, Share & Forecast 2025 to 2035

Market Positioning & Share in Corrugated Fanfold Industry

Industry Share & Competitive Positioning in Packaging Laminate Market

Analyzing Meat Packaging Market Share & Industry Growth

Competitive Overview of Gift Packaging Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA