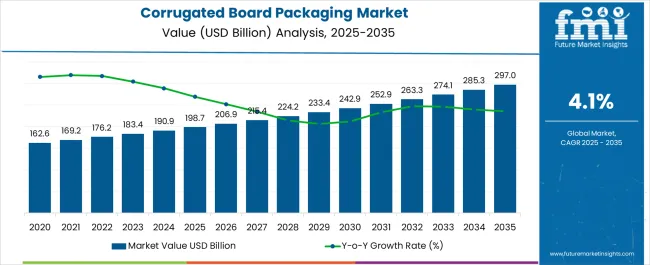

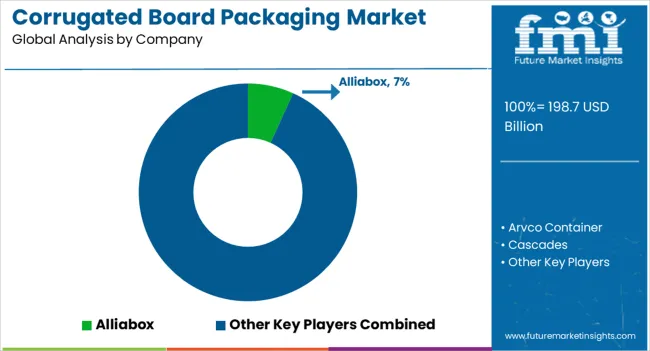

The corrugated board packaging market is estimated to be valued at USD 198.7 billion in 2025 and is projected to reach USD 297.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

The corrugated board packaging market is expected to grow from USD 198.7 billion in 2025 to USD 297.0 billion by 2035, registering a 4.1% CAGR and generating an absolute dollar opportunity of USD 98.3 billion. Growth is driven by rising demand from e-commerce, retail, and industrial sectors, where corrugated packaging provides cost-effective, durable, and recyclable solutions for shipping, storage, and branding. Increasing adoption of sustainable packaging practices, lightweight designs, and enhanced print quality further supports market expansion globally.

Rolling CAGR analysis highlights fluctuations in annual growth over the forecast period. From 2025 to 2028, rolling CAGR remains close to the decade-long average, supported by steady demand in North America and Europe, where packaging requirements are driven by e-commerce expansion and replacement of outdated solutions. Between 2029 and 2032, rolling CAGR rises slightly above the average as Asia Pacific and Latin America experience accelerated industrial growth, urbanization, and rising consumer goods production, increasing packaging demand.

From 2033 to 2035, rolling CAGR moderates as mature markets reach higher penetration, with incremental revenue increasingly derived from premium corrugated designs, customized packaging, and specialized solutions for fragile or high-value products. Overall, the USD 98.3 billion opportunity reflects consistent market expansion, with rolling CAGR analysis demonstrating early stability, mid-period acceleration, and late-stage moderation, highlighting the long-term trajectory of the corrugated board packaging market between 2025 and 2035.

| Metric | Value |

|---|---|

| Corrugated Board Packaging Market Estimated Value in (2025 E) | USD 198.7 billion |

| Corrugated Board Packaging Market Forecast Value in (2035 F) | USD 297.0 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The corrugated board packaging market is driven by five primary parent markets with specific shares. E-commerce leads with 40%, as corrugated packaging provides durability, protection, and lightweight solutions for shipping. Food and beverages account for 25%, using boards for cartons, trays, and protective packaging for perishable and processed products. Consumer electronics contribute 15%, requiring shock-resistant and customized packaging. Pharmaceuticals represent 10%, where corrugated boards ensure secure and hygienic delivery of medicines and medical devices. Industrial and automotive applications hold 10%, leveraging boards for parts, machinery, and component transport. These segments collectively define global demand for corrugated board packaging.

Recent developments in the corrugated board packaging market focus on sustainability, digital printing, and functional innovation. Manufacturers are adopting recycled materials, eco-friendly adhesives, and lightweight designs to reduce environmental impact. Enhanced board strength, moisture resistance, and customized structures are improving product protection and performance. Integration of smart packaging technologies, such as QR codes and RFID tags, is enabling supply chain traceability and consumer engagement. Growing e-commerce penetration, stricter environmental regulations, and demand for sustainable packaging solutions are driving market adoption. These trends are fostering innovation, operational efficiency, and the expansion of corrugated board applications globally.

The corrugated board packaging market is experiencing consistent growth, driven by the expansion of e-commerce, demand for sustainable packaging solutions, and the need for durable materials in logistics and transportation. Corrugated board offers high strength-to-weight ratio, recyclability, and versatility, making it suitable for a broad range of industries, from food and beverages to consumer electronics.

The market has benefited from shifting consumer preferences toward eco-friendly materials and increased adoption of lightweight yet protective packaging to reduce shipping costs. Technological advancements in printing and converting processes have enhanced customization capabilities, supporting brand differentiation.

With supply chain globalization and heightened focus on environmental compliance, the market is projected to expand further, supported by continuous innovation in design, strength optimization, and recyclability improvements.

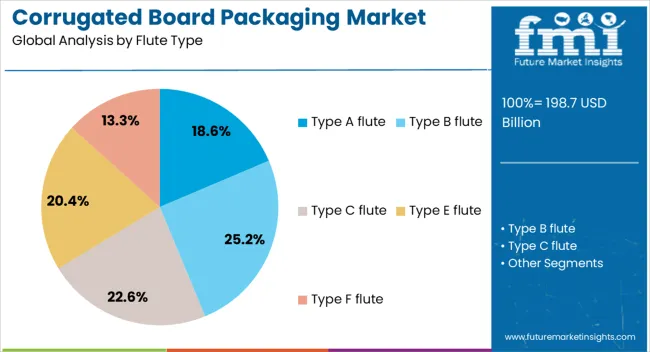

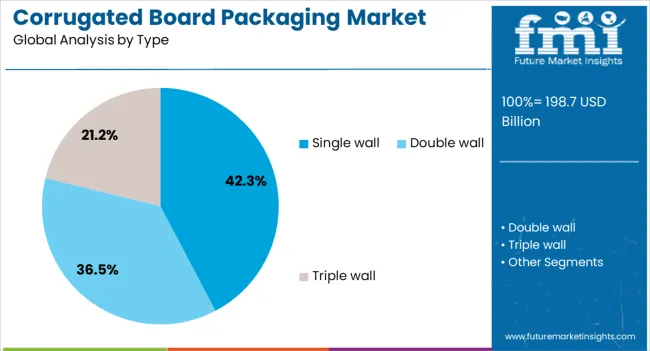

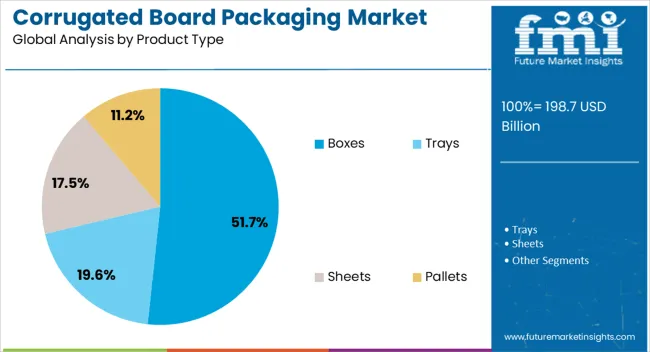

The corrugated board packaging market is segmented by flute type, type, product type, end use industry, and geographic regions. By flute type, corrugated board packaging market is divided into Type A flute, Type B flute, Type C flute, Type E flute, and Type F flute. In terms of type, corrugated board packaging market is classified into Single wall, double wall, and triple wall. Based on product type, corrugated board packaging market is segmented into boxes, trays, sheets, and pallets. By end use industry, corrugated board packaging market is segmented into food & beverages, pharmaceuticals, cosmetics & personal care, automotive, transportation & logistics, and others. Regionally, the corrugated board packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Type B flute segment represents approximately 25.2% share of the flute type category in the corrugated board packaging market. Known for its high crush resistance and compact profile, this flute type is favored for packaging canned goods, small appliances, and retail-ready products.

Its relatively thinner structure provides excellent print surface and rigidity, making it suitable for applications where brand visibility, shelf presentation, and structural strength are equally important. The segment’s strong demand is sustained by fast-moving consumer goods (FMCG) and e-commerce packaging, where space efficiency and durability are critical.

With the continued rise of online retail, compact shipping formats, and point-of-sale packaging requirements, Type B flute is expected to remain highly relevant. Supported by broad adoption in both consumer and retail packaging markets, the segment is positioned to maintain its strong and growing share.

The single wall segment dominates the type category, accounting for approximately 42.3% of the market share. Its widespread adoption is driven by cost-effectiveness, versatility, and sufficient strength for the majority of retail and shipping applications.

Single wall boards are extensively used in industries ranging from packaged foods to consumer electronics, where a balance between protection, weight, and cost is essential. Easy manufacturability and lower material usage contribute to its competitive advantage.

Advances in corrugated board technology have improved the durability of single wall designs, further broadening their use. With steady demand from e-commerce and retail sectors, this segment is projected to sustain its leadership in the market.

The boxes segment leads the product type category, with approximately 51.7% share of the corrugated board packaging market. This dominance is driven by the universal utility of boxes for storage, transport, and retail display.

The segment benefits from its adaptability across multiple sizes, shapes, and strength grades, enabling broad industry coverage. E-commerce growth has significantly boosted demand for corrugated boxes, as they offer lightweight protection and branding opportunities.

Recyclability and eco-friendly appeal have further solidified their role in sustainable packaging strategies. With global logistics expansion and rising consumer demand for protective yet cost-efficient packaging, the boxes segment is expected to retain its top position in the foreseeable future.

The global corrugated board packaging market was valued at USD 120–125 billion in 2024, with projected growth to USD 160–180 billion by 2032. North America accounted for 25–30% of market value, while Europe and Asia Pacific lead in volume due to large e-commerce and FMCG sectors. Key product formats include single-wall, double-wall, and triple-wall boards. Food and beverage applications dominate, followed by electronics, industrial goods, and e-commerce packaging. Rising demand for sustainable, recyclable packaging, combined with growth in online retail and logistics, is driving the adoption of corrugated board solutions globally.

The primary driver of the food packaging machines market is automation across food processing and packaging operations. High-speed form-fill-seal machines capable of 150–300 packs per minute increase productivity and reduce labor dependency. Vacuum and modified atmosphere packaging systems extend shelf life by 20–40%, ensuring product safety and freshness. Growing adoption of packaging robots in confectionery, bakery, and dairy industries streamlines workflow and reduces contamination risks. Expansion of ready-to-eat, frozen, and snack food sectors globally drives demand for versatile packaging machines. Investment in automation reduces operational costs by up to 15% and improves compliance with hygiene standards, accelerating adoption in commercial, industrial, and retail food sectors worldwide.

Opportunities in the corrugated board market arise from innovations in recycling, lightweight design, and high-strength grades. Double-wall and triple-wall boards offer improved protection for electronics and fragile goods, while paperboard made from 100% recycled fibers reduces environmental impact. Asia Pacific shows growth potential due to rising FMCG production and logistics modernization. Advances in coated and laminated corrugated sheets improve moisture resistance and shelf life. Retailers and e-commerce platforms are increasingly requiring standardized packaging for automated warehouses. Companies providing modular, customizable, and sustainable corrugated solutions can capture demand from large-scale industrial clients, e-commerce operators, and food and beverage manufacturers globally.

Key trends include automated corrugated board production, digital printing, and smart packaging integration. High-speed flexo and digital presses allow on-demand branding, product differentiation, and variable print runs. Smart packaging features such as QR codes, augmented reality labels, and anti-counterfeit markers are increasingly used in pharmaceuticals, electronics, and premium food products. Europe and North America lead in automated plants and digital finishing technology, while Asia Pacific is rapidly adopting high-speed corrugators to meet e-commerce demand. Lightweighting reduces material consumption by 10–15%, enhancing sustainability. Growth of multi-tier packaging systems, sustainable adhesives, and recyclable coatings are shaping global demand and operational efficiency.

Despite growth, the corrugated board packaging market faces constraints from fluctuating pulp prices, energy costs, and supply chain limitations. Virgin paperboard costs vary by 15–20% annually, affecting margins. Recycling infrastructure is uneven in emerging markets, limiting the availability of high-quality recycled fibers. Transportation and storage require moisture-controlled environments, adding operational complexity. Small and mid-sized converters may lack capital for automation or high-speed production, reducing competitiveness. Environmental regulations and certification standards increase compliance costs. Manufacturers must optimize raw material sourcing, invest in energy-efficient production, and improve recycling capabilities to overcome these challenges and maintain global market growth.

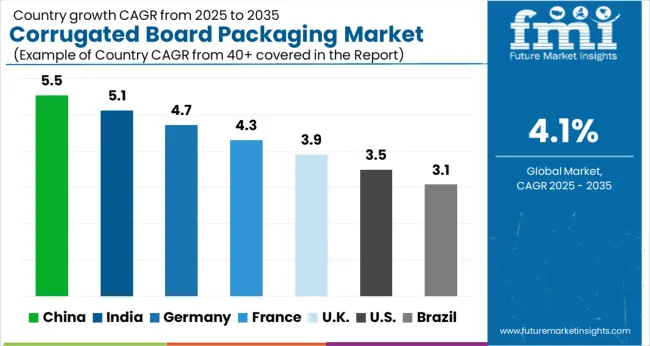

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The corrugated board packaging market is projected to expand at a global CAGR of 4.1% through 2035, supported by rising demand for protective packaging, e-commerce growth, and industrial shipping requirements. China leads at 5.5%, a 1.34× multiple of the global benchmark, fueled by BRICS-driven manufacturing, logistics expansion, and retail packaging adoption. India follows at 5.1%, a 1.25× multiple, reflecting growing e-commerce penetration and industrial packaging needs.

Germany records 4.7%, a 1.15× multiple, shaped by OECD-supported efficiency improvements and high-quality packaging standards. The United Kingdom posts 3.9%, slightly below the global rate, with adoption focused on commercial and retail shipping. The United States stands at 3.5%, 0.85× the benchmark, supported by steady demand from logistics and consumer goods sectors. BRICS nations drive volume growth, OECD countries emphasize quality and innovation, while ASEAN markets contribute through rising regional shipping activities. This report includes insights on 40+ countries; the top markets are shown here for reference.

The corrugated board packaging market in China is projected to grow at a CAGR of 5.5%, driven by expanding e-commerce, retail, and industrial shipping sectors. Manufacturers such as Nine Dragons Paper, Lee & Man Paper, and Sun Paper are developing lightweight, high-strength corrugated solutions for packaging consumer goods and electronics. Adoption is concentrated in urban centers and manufacturing hubs where high-volume packaging and shipping efficiency are critical. Investment in automation and digital printing technologies enhances product differentiation and production efficiency. Environmental regulations encouraging recyclable packaging further reinforce market growth. Demand is also supported by logistics companies seeking durable, cost-effective solutions for last-mile delivery.

The corrugated board packaging market in India is expected to expand at a CAGR of 5.1%, supported by rising consumer goods production, online retail growth, and industrial shipping needs. Companies such as TCPL Packaging, DS Smith India, and international players are offering high-strength, lightweight corrugated solutions for food, electronics, and FMCG products. Adoption is concentrated in urban and industrial hubs, with growing demand from e-commerce and logistics sectors. Investments in automated production lines and high-quality recycled paper improve efficiency and sustainability. Regional expansion into tier-2 and tier-3 cities is increasing market penetration, while brands focus on eco-friendly packaging to appeal to environmentally conscious consumers.

The corrugated board packaging market in Germany is projected to grow at a CAGR of 4.7%, driven by demand from industrial, food, and retail packaging sectors. Companies including Smurfit Kappa, DS Smith, and International Paper focus on high-quality, recyclable corrugated solutions for shipping and storage. Adoption is concentrated in manufacturing hubs, logistics centers, and urban retail networks. Technological trends include lightweight design, digital printing, and automated production for efficiency and customization. German regulations promoting recyclable packaging and waste reduction reinforce market growth. Demand is further supported by e-commerce and industrial logistics, which require durable packaging solutions for bulk and high-value goods.

The corrugated board packaging market in the United Kingdom is expected to expand at a CAGR of 3.9%, supported by retail, e-commerce, and food packaging demand. Companies such as DS Smith, Smurfit Kappa, and local converters are offering lightweight, high-strength corrugated solutions with sustainable features. Urban and industrial areas are the primary adoption hubs, with increasing interest from e-commerce logistics and FMCG sectors. Environmental regulations encouraging recycled packaging and reduction of virgin materials reinforce growth. Technological advancements in automation, die-cutting, and digital printing are further driving efficiency and customization for brand packaging requirements.

Competition in the corrugated board packaging market is driven by global paper and packaging companies and specialized regional players focusing on strength, design flexibility, and production efficiency. International Paper, Georgia-Pacific, and DS Smith lead with large-scale manufacturing capabilities, emphasizing durable, lightweight boards suitable for diverse shipping and storage applications. Mondi Group, Green Bay Packaging, and Packaging Corporation of America highlight innovation in board composition and structural design, appealing to industries requiring reliable protective packaging.

Alliabox, Arvco Container, and Cascades focus on custom solutions, offering tailored sizes, printing options, and material specifications for e-commerce and consumer goods packaging. Nine Dragons Paper, Oji Holdings, and Rengo emphasize recycled content and eco-friendly processes, positioning products around compliance with environmental regulations. Pratt Industries and Progroup target fast turnaround and niche applications, supporting clients with specialized requirements in both domestic and international markets.

Product brochures are central to competition, featuring technical specifications, load testing results, and visual layouts to communicate quality and performance. Companies update materials regularly to reflect new designs, material improvements, and client success stories. Larger firms leverage scale and global reach, while smaller players focus on flexibility, customization, and speed. Market advantage is determined by how clearly brochures convey durability, material reliability, and overall packaging value in the corrugated board segment.

| Items | Values |

|---|---|

| Quantitative Units | USD 198.7 billion |

| Flute Type | Type A flute, Type B flute, Type C flute, Type E flute, and Type F flute |

| Type | Single wall, Double wall, and Triple wall |

| Product Type | Boxes, Trays, Sheets, and Pallets |

| End Use Industry | Food & beverages, Pharmaceuticals, Cosmetics & personal care, Automotive, Transportation & logistics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alliabox, Arvco Container, Cascades, DS Smith, Georgia-Pacific, Green Bay Packaging, International Paper, Mondi Group, Nine Dragons Paper, Oji Holdings, Packaging Corporation of America, Pratt Industries, Progroup, Rengo, and SCG Packaging |

| Additional Attributes | Dollar sales by board type and end use, demand dynamics across e-commerce, retail, and food sectors, regional trends in sustainable and protective packaging, innovation in strength, printability, and recyclability, environmental impact of paper sourcing and disposal, and emerging use cases in customized, lightweight, and smart packaging solutions. |

The global corrugated board packaging market is estimated to be valued at USD 198.7 billion in 2025.

The market size for the corrugated board packaging market is projected to reach USD 297.0 billion by 2035.

The corrugated board packaging market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in corrugated board packaging market are type a flute, type b flute, type c flute, type e flute and type f flute.

In terms of type, single wall segment to command 42.3% share in the corrugated board packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corrugated Box Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Equipment Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Market Analysis - Size, Share, and Forecast 2025 to 2035

Corrugated Pallet Wrap Market Growth - Demand & Forecast 2025 to 2035

Corrugated Plastic Box Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Market Size, Share & Forecast 2025 to 2035

Corrugated Bubble Wrap Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Paper Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Printer Slotter Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pallet Containers Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Mailers Market Size, Share & Forecast 2025 to 2035

Corrugated Open-head Drums Market Growth - Size & Forecast 2025 to 2035

Corrugated Bin Boxes Market by Dividers, Totes, Jumbo, Kraft Open Top Forecast 2025 to 2035

Corrugated Wraps Market Analysis from 2025 to 2035

Corrugated Plastic Trays Market Growth, Trends and Outlook from 2025 to 2035

Evaluating Corrugated Bin Boxes Market Share & Provider Insights

Breaking Down Market Share in the Corrugated Box Industry

Market Share Insights of the Corrugated Plastic Box Industry

Market Share Breakdown of Leading Corrugated Bubble Wrap Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA