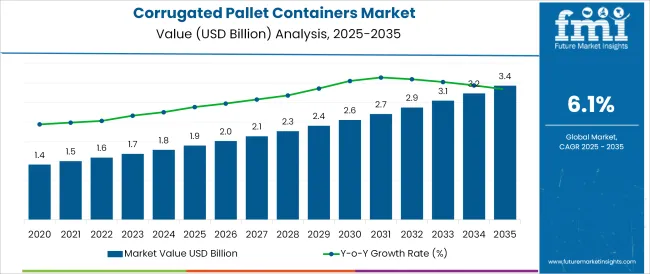

The Corrugated Pallet Containers Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 3.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

The corrugated pallet containers market is undergoing steady growth as sustainability imperatives, cost optimization, and evolving logistics demands redefine industrial packaging preferences. Rising concerns over wooden pallet disposal, weight limitations, and hygiene challenges have accelerated the adoption of corrugated alternatives.

Businesses are increasingly valuing the lightweight yet durable nature of corrugated containers, which reduce shipping costs and meet regulatory standards for export packaging. Advancements in material engineering and structural design are enhancing load bearing capacity while maintaining recyclability, thereby meeting both operational and environmental requirements.

Future growth is anticipated to be fueled by expanding e-commerce, stricter sustainability goals within supply chains, and the shift toward modular, standardized packaging formats. Collaborative initiatives between manufacturers and logistics providers are paving the way for broader acceptance and innovation within the market.

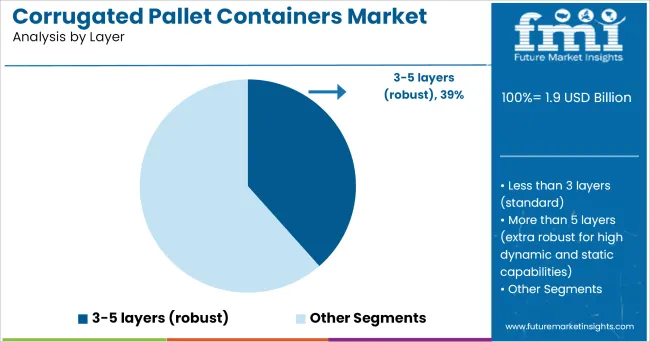

The market is segmented by Layer, Size, Pallet Type, and End-use Industry and region. By Layer, the market is divided into 3-5 layers (robust), Less than 3 layers (standard), and More than 5 layers (extra robust for high dynamic and static capabilities). In terms of Layer, the market is classified into 3-5 layers (robust), Less than 3 layers (standard), and More than 5 layers (extra robust for high dynamic and static capabilities).

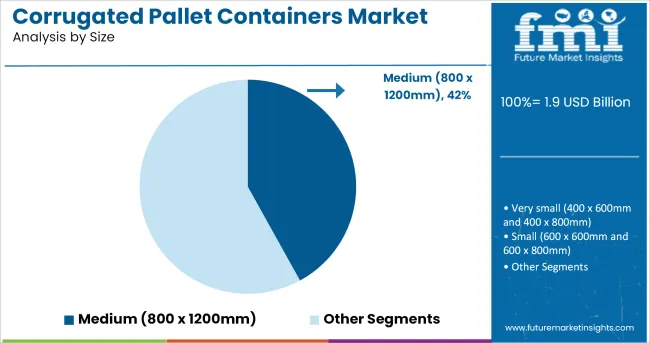

Based on Size, the market is segmented into Medium (800 x 1200mm), Very small (400 x 600mm and 400 x 800mm), Small (600 x 600mm and 600 x 800mm), Large (1000 x 1100mm and 1000 x 1200mm), and Very Large (1220 x 1520mm).

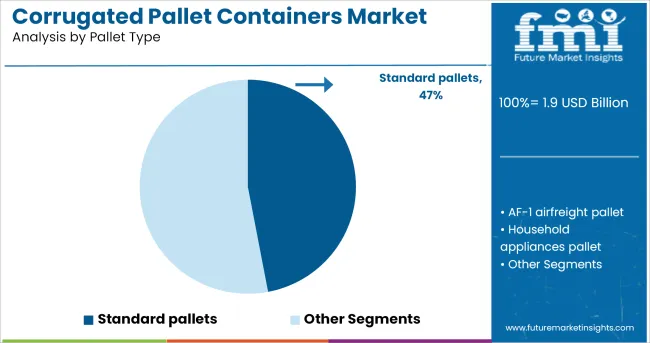

By Pallet Type, the market is divided into Standard pallets, AF-1 airfreight pallet, Household appliances pallet, X-pallet, and M-pallet. By End-use Industry, the market is segmented into Food & Beverages, Logistics, Pharmaceutical, Cosmetics & Personal Care, Consumer Electronics, Automotive, and Others (Chemical, etc.).

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by layer, the 3-5 layers (robust) configuration is projected to account for 38.5% of the total market revenue in 2025, emerging as the leading layer choice. This preference is shaped by its optimal balance of strength, durability, and cost-effectiveness.

The robust construction has been enabling reliable protection of goods during long-haul transportation and handling while maintaining manageable weight. Its widespread adoption has been further supported by the ability to withstand stacking pressures and varying climatic conditions without compromising structural integrity.

The layered design has facilitated customization for diverse industrial applications, particularly where heavier loads and higher safety standards are required. These advantages have reinforced its leadership, aligning with operational priorities across manufacturing, automotive, and FMCG industries.

Segmented by size, the medium (800 x 1200mm) format is expected to command 42.0% of the market revenue in 2025, maintaining its top position. This dominance has been driven by its compatibility with global logistics systems and standardized shipping containers, which has simplified inventory management and optimized warehouse space utilization.

The medium size has provided an effective compromise between load capacity and ease of handling, which has been appealing for a wide range of products. Its alignment with European and international pallet standards has ensured smoother cross-border transportation and reduced the need for resizing or repacking, minimizing operational inefficiencies.

The continued preference for this size is being reinforced by the push toward harmonized supply chains and improved pallet pooling practices.

When segmented by pallet type, standard pallets are projected to hold 47.0% of the market revenue in 2025, securing their position as the dominant segment. This leadership has been shaped by their universal acceptance, cost efficiency, and adaptability to automated material handling systems.

The standardized dimensions have ensured compatibility with existing racking systems, forklifts, and conveyor belts, reducing operational disruptions. The simplicity of standard pallets has enabled economies of scale in production, contributing to their affordability and consistent availability.

Their established role in facilitating predictable and reliable logistics operations has further strengthened their market share. The enduring preference for standard pallets reflects the industry’s emphasis on streamlined processes, reduced complexity, and dependable performance under diverse operational scenarios.

Corrugated pallet containers reduced shipping costs which consistently decrease fuel consumption and results in cost savings in several industries. The rising demand for online shopping through e-commerce sites of consumer electronics by the logistics companies is driving the growth of the heavy-duty corrugated pallet containers market.

Various countries have imposed strict regulations against the usage of single-use plastic packaging as it harms the environment. The corrugated pallet containers can be 100% recycled and reused which stands ahead in the market where strict regulations are imposed on single-use plastic packaging.

The increasing industrial trade activities across various countries will generate the growth opportunity for corrugated pallet containers due to their environmentally friendly feature.

The major factor which can limit the growth of corrugated pallet containers is the cost of pallet containers. The prices of corrugated pallet containers are slightly high which can afford by small scale manufacturers. The increasing prices of raw materials, especially paper and pulp can hamper the growth of the corrugated pallet containers market.

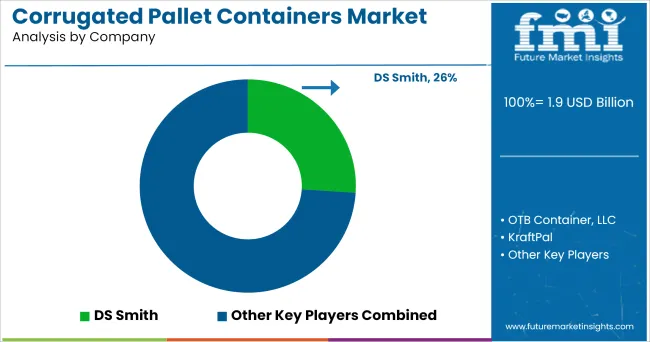

Global Players in the corrugated pallet containers

Asian Players in the industry

In Germany, the extensive applications of corrugated pallet containers across the pharmaceutical and automotive industry have increased followed by escalating logistics industry is fuelling the adoption of corrugated pallet containers which is expected to show substantial growth for the corrugated pallet containers market during the forecast period.

The global corrugated pallet containers market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the corrugated pallet containers market is projected to reach USD 3.4 billion by 2035.

The corrugated pallet containers market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in corrugated pallet containers market are 3-5 layers (robust), less than 3 layers (standard) and more than 5 layers (extra robust for high dynamic and static capabilities).

In terms of layer, 3-5 layers (robust) segment to command 38.5% share in the corrugated pallet containers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Corrugated Pallet Containers Providers

Corrugated Box Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Automotive Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Equipment Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Market Analysis - Size, Share, and Forecast 2025 to 2035

Corrugated and Folding Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pharmaceutical Packaging Market Analysis Size, Share & Forecast 2025 to 2035

Corrugated Plastic Box Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Market Size, Share & Forecast 2025 to 2035

Corrugated Bubble Wrap Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Paper Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Printer Slotter Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Corrugated Mailers Market Size, Share & Forecast 2025 to 2035

Corrugated Open-head Drums Market Growth - Size & Forecast 2025 to 2035

Corrugated Fiberboard Market Analysis - Size, Demand & Forecast 2025 to 2035

Corrugated Bin Boxes Market by Dividers, Totes, Jumbo, Kraft Open Top Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA