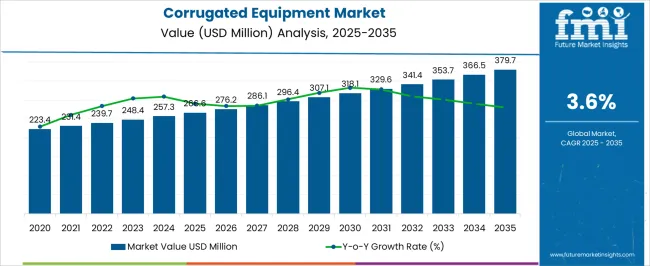

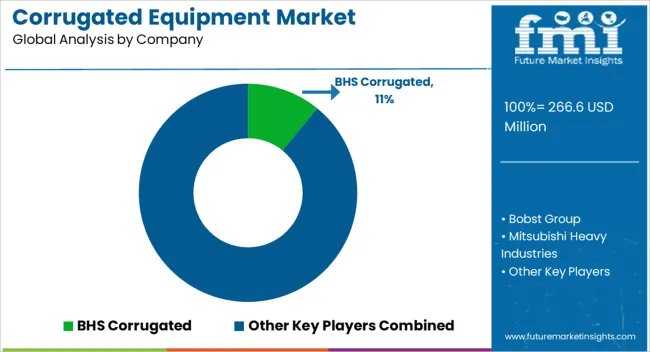

The corrugated equipment market is estimated to be valued at USD 266.6 million in 2025 and is projected to reach USD 379.7 million by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period. Core equipment technologies such as rotary die-cutters, flexo-folder-gluers, and high-speed corrugators contribute significantly to market value, forming the backbone of production processes. Rotary die-cutting systems, which ensure precision and high output, account for a notable share in early market revenues, supporting USD 266.6 million in 2025, while investments in flexo-folder-gluer technology enhance finishing capabilities, reducing manual intervention and improving throughput.

High-speed corrugators, integrated with advanced control systems, gradually increase contribution over the forecast period, reflecting the market’s emphasis on automation and energy-efficient operations. By 2030, as the market scales to approximately USD 318.1 million, incremental adoption of digital monitoring, remote diagnostics, and predictive maintenance tools strengthens the role of smart technology within the value chain. Integration of IoT sensors and real-time analytics allows equipment operators to optimize machine uptime and reduce waste, contributing materially to technology-based value addition.

Toward 2035, as the market approaches USD 379.7 million, hybrid systems combining mechanical efficiency with digital controls capture a higher proportion of market revenue. Contribution from emerging technologies in precision cutting, energy optimization, and automated material handling increasingly drives the overall technology composition, reflecting a market trajectory centered on efficiency, reduced operational costs, and scalable production.

| Metric | Value |

|---|---|

| Corrugated Equipment Market Estimated Value in (2025 E) | USD 266.6 million |

| Corrugated Equipment Market Forecast Value in (2035 F) | USD 379.7 million |

| Forecast CAGR (2025 to 2035) | 3.6% |

The corrugated equipment market represents a specialized segment within the global packaging and paper machinery industry, emphasizing efficiency, automation, and production quality. Within the broader packaging machinery sector, it accounts for about 5.4%, driven by rising demand for corrugated boxes in e-commerce, retail, and food distribution. In the paper converting and manufacturing segment, its share is approximately 4.9%, reflecting adoption of cutting, printing, and folding machinery for high-speed operations. Across the corrugated board production industry, it holds around 4.2%, supporting both single-wall and multi-wall packaging solutions. Within the industrial automation and material handling sector, the market represents about 3.8%, highlighting integration with automated stacking, feeding, and quality inspection systems. In the overall packaging and logistics equipment segment, it contributes nearly 3.3%, emphasizing enhanced productivity, cost optimization, and consistent output quality. Recent developments in the market have focused on automation, digital integration, and energy efficiency.

Key players are introducing high-speed corrugators with precision cutting, automated stacking systems, and smart sensors for defect detection. Adoption of IoT-enabled monitoring platforms allows real-time tracking of production performance, predictive maintenance, and process optimization. Companies are also developing modular and flexible equipment to handle varying sheet sizes and board types efficiently. Energy-efficient motors and eco-friendly components are being incorporated to reduce power consumption and operational costs. The integration with digital printing systems is gaining traction, enabling customization and shorter production runs.

The corrugated equipment market is experiencing steady expansion, driven by the growing demand for sustainable and cost-efficient packaging solutions across diverse industries. As global trade and e-commerce activity continue to accelerate, corrugated packaging has emerged as a preferred choice due to its recyclability, lightweight nature, and durability. This rising demand is prompting packaging manufacturers to invest in advanced corrugated equipment to enhance production speed, reduce waste, and ensure high-quality output.

Additionally, advancements in automation, printing precision, and integration of digital technologies are enabling greater operational efficiency and flexibility across production lines. Heightened focus on food safety and logistics efficiency is also influencing investments in high-performance corrugated machinery to meet strict packaging standards.

As environmental regulations tighten globally, demand is shifting toward equipment that supports the production of eco-friendly corrugated materials With increasing urbanization, population growth, and consumer demand for packaged goods, the corrugated equipment market is poised for long-term growth, supported by technology upgrades and the shift toward sustainable packaging practices in both developed and emerging economies.

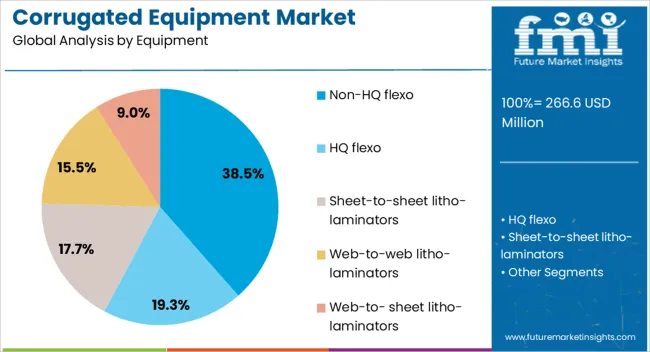

The corrugated equipment market is segmented by equipment, end use industry, distribution channel, and geographic regions. By equipment, corrugated equipment market is divided into Non-HQ flexo, HQ flexo, Sheet-to-sheet litho-laminators, Web-to-web litho-laminators, and Web-to- sheet litho-laminators.

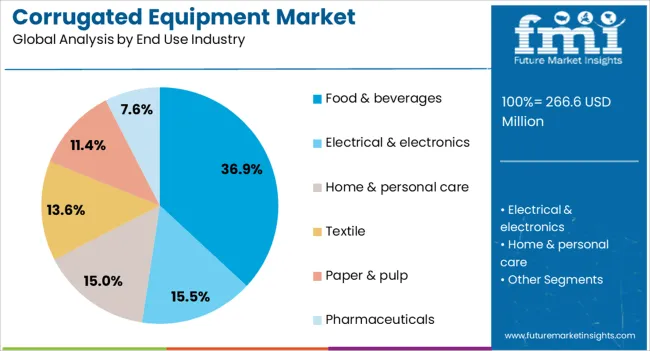

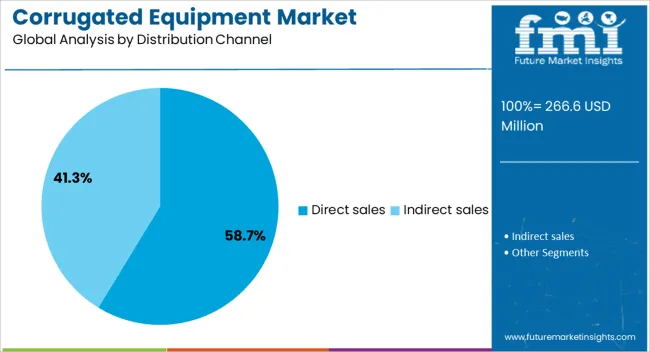

In terms of end use industry, corrugated equipment market is classified into Food & beverages, Electrical & electronics, Home & personal care, Textile, Paper & pulp, and Pharmaceuticals. Based on distribution channel, corrugated equipment market is segmented into Direct sales and Indirect sales. Regionally, the corrugated equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The non-HQ flexo equipment segment is projected to hold 38.5% of the corrugated equipment market revenue share in 2025, establishing itself as the leading equipment type. This leadership is being driven by the segment’s cost-effectiveness, operational simplicity, and suitability for a wide range of standard printing needs in corrugated packaging production.

Non-HQ flexo machines offer efficient performance for medium- to high-volume runs without the added complexity or cost of high-quality print enhancements, making them an ideal choice for everyday packaging applications. The growing demand for basic corrugated boxes in sectors such as food packaging, logistics, and bulk goods is reinforcing the use of non-HQ flexo technology.

Manufacturers are also increasingly opting for these systems due to their shorter setup times, ease of maintenance, and energy efficiency, which collectively contribute to lower production costs. As many end users continue to prioritize function over premium print quality in large-scale production environments, non-HQ flexo equipment is expected to retain its strong market position in the coming years.

The food and beverages segment is expected to represent 36.9% of the corrugated equipment market revenue share in 2025, making it the largest end use industry. This dominance is being reinforced by the high volume of corrugated packaging used across food processing, packaging, storage, and distribution. Corrugated boxes offer advantages such as product protection, hygiene compliance, and printability for branding, which are critical in the food and beverages industry.

With growing demand for packaged food, frozen meals, ready-to-eat products, and beverage containers, production volumes are increasing and fueling investments in corrugated machinery. The ability of corrugated equipment to produce moisture-resistant and structurally strong packaging solutions is particularly beneficial in this sector.

Additionally, the rise in e-commerce grocery and direct-to-consumer delivery models is boosting demand for customized corrugated packaging solutions tailored to food safety and logistical efficiency. As food and beverage companies seek sustainable and scalable packaging formats, the segment’s reliance on corrugated equipment is projected to remain strong across global markets.

The direct sales segment is anticipated to account for 58.7% of the corrugated equipment market revenue share in 2025, positioning it as the dominant distribution channel. This leadership is being driven by the preference of manufacturers to engage directly with equipment providers for customized solutions, tailored service agreements, and long-term technical support.

Direct sales models enable better communication between manufacturers and clients, resulting in faster response times, clearer alignment on performance specifications, and stronger after-sales service. As corrugated equipment involves significant capital investment and long-term operational planning, end users prefer dealing directly with suppliers to negotiate pricing, ensure compatibility with existing systems, and access training programs.

The segment is also benefiting from strategic partnerships between manufacturers and major end users that involve co-development of production lines or machinery upgrades. With the increasing complexity of packaging operations and rising demand for automation, direct engagement with trusted manufacturers is reinforcing this channel’s dominance, particularly in regions with established industrial infrastructure.

The market is driven by the expanding need for efficient production of corrugated packaging across e-commerce, retail, and industrial sectors. Automated machinery, including flexo folder gluers, rotary die cutters, and corrugators, has enhanced production speed, consistency, and customization capabilities. Rising demand for sustainable and lightweight packaging solutions has further fueled adoption, as manufacturers seek to optimize material usage while meeting environmental regulations. Technological advancements such as inline printing, quality monitoring systems, and digital control units have improved operational efficiency and reduced waste.

Automation in corrugated equipment has transformed production processes, enabling high-speed manufacturing with minimal manual intervention. Digital control systems, automated feeders, and servo-driven machinery improve precision and reduce human error in operations. Inline printing and die-cutting integration allow simultaneous packaging customization, which supports rapid market responsiveness. Sensors and quality monitoring modules ensure defect detection and consistent output, reducing waste and operational costs. Adoption of data-driven systems allows manufacturers to optimize production schedules and track machine performance remotely. These improvements drive productivity, lower labor dependency, and enhance operational efficiency. The combination of automation and digitalization has made modern corrugated equipment a key enabler of cost-effective and scalable packaging solutions across industries worldwide.

Growing emphasis on sustainable packaging solutions has influenced corrugated equipment adoption. Lightweight corrugated board production reduces raw material consumption, while advanced machinery enables efficient use of recycled fibers. Energy-efficient motors, waste reduction systems, and closed-loop water management are integrated to meet environmental standards and reduce operational costs. Demand from e-commerce and consumer goods sectors for eco-friendly packaging solutions has increased adoption of machinery capable of producing recyclable and biodegradable products. Companies are investing in technologies that minimize carbon footprint while maintaining throughput and quality. This focus on sustainability aligns with regulatory trends and consumer preferences, ensuring that corrugated equipment remains central to environmentally responsible packaging manufacturing.

Corrugated equipment enables manufacturers to produce highly customized packaging solutions for diverse industries, including electronics, food and beverage, and pharmaceuticals. Machinery capable of producing specialized box designs, multi-wall boards, and printed graphics meets growing demand for brand differentiation. Inline finishing processes, variable box sizes, and advanced folding techniques allow businesses to meet unique customer requirements. Equipment flexibility supports short-run production and rapid changeovers, providing a competitive advantage in fast-moving markets. R&D efforts focus on improving versatility and reducing setup times, allowing manufacturers to respond to shifting market trends. The capability to produce premium, durable, and visually appealing corrugated packaging strengthens demand across multiple end-use sectors.

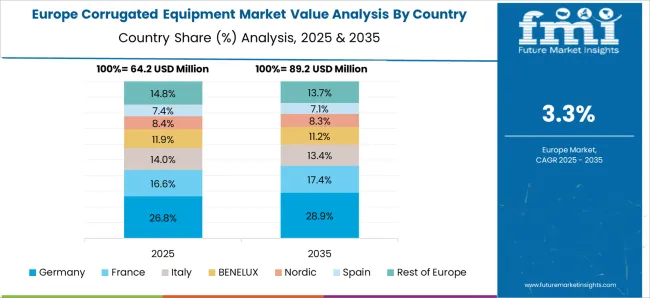

Asia Pacific dominates corrugated equipment manufacturing due to high-volume packaging production, cost advantages, and growing e-commerce sectors. North America and Europe exhibit steady demand for advanced machinery, driven by high automation adoption, quality standards, and sustainability initiatives. Competitive strategies emphasize product innovation, integration of IoT-enabled monitoring, and energy-efficient machinery. Strategic partnerships between equipment manufacturers and packaging companies enhance market penetration and after-sales support. Infrastructure investments, growing logistics networks, and regulatory incentives for sustainable manufacturing shape regional dynamics. The interplay of technology advancement, regional production capabilities, and rising demand for high-quality packaging ensures the continued growth of the corrugated equipment market globally.

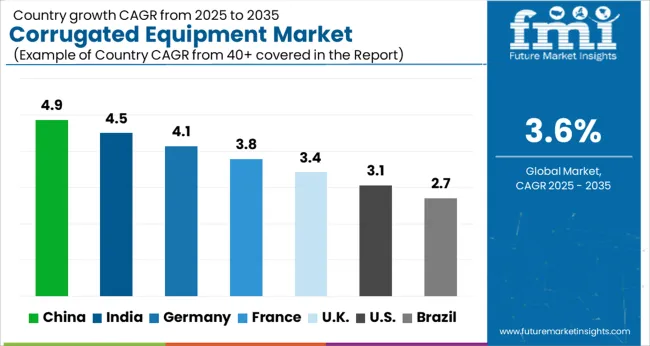

| Country | CAGR |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| France | 3.8% |

| UK | 3.4% |

| USA | 3.1% |

| Brazil | 2.7% |

The market is projected to grow at a CAGR of 3.6% from 2025 to 2035. Germany accounted for 4.1%, supported by modernization of packaging lines and automation initiatives. China led with 4.9%, driven by rising demand for corrugated packaging in e-commerce and manufacturing sectors. India recorded 4.5%, where investment in high-speed corrugators and quality control systems has been increasing. The United Kingdom reached 3.4%, reflecting gradual adoption of automated equipment in packaging industries. The United States stood at 3.1%, where incremental upgrades in production efficiency and sustainability-focused machinery have shaped market growth. These countries are progressively advancing, scaling, and innovating in corrugated equipment solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

China, growing at a CAGR of 4.9%, remains the largest driver of corrugated equipment demand in Asia Pacific. The expansion of e-commerce, FMCG, and industrial exports fuels the need for automated corrugated machinery including flexo printers, die cutters, and folder gluers. Domestic manufacturers are upgrading systems with high-speed, energy-efficient designs and integrating digital monitoring solutions to optimize production. Collaborations with European and Japanese technology providers enhance precision and reliability. Increasing adoption in both domestic packaging and international supply chains reinforces China’s position as a leading producer and consumer of corrugated equipment.

India, expected to grow at a CAGR of 4.5%, benefits from rapid expansion of e-commerce, FMCG, and food packaging industries. Adoption of semi-automated and fully automated corrugated machinery reduces labor dependency while improving production efficiency and quality consistency. Manufacturers are increasingly investing in flexo printing, die-cutting, and stacking solutions to meet growing customization and branding needs. Rising government support for packaging technology modernization in industrial clusters accelerates software-enabled and smart machinery adoption.

Germany, with a CAGR of 4.1%, demonstrates consistent demand due to stringent packaging standards, high-quality printing requirements, and sustainability regulations. German packaging companies emphasize precision, durability, and energy-efficient designs in corrugated machinery. Adoption is largely concentrated in pharmaceuticals, automotive parts packaging, and specialty consumer goods. Integration of digital monitoring, waste reduction, and automated handling systems ensures optimized production processes. Local R&D investments strengthen capabilities in high-speed folding, die-cutting, and multi-color printing applications.

The United Kingdom, forecast to grow at a CAGR of 3.4%, is influenced by packaging needs in consumer goods, e-commerce, and healthcare industries. Smaller and mid-sized packaging firms increasingly adopt flexible machinery to enable short-run and customized production. Import of high-precision equipment from Europe dominates supply, while local players provide installation, maintenance, and retrofit solutions. Sustainable and low-energy systems are gaining preference due to regulatory emphasis on reducing industrial energy consumption and packaging waste.

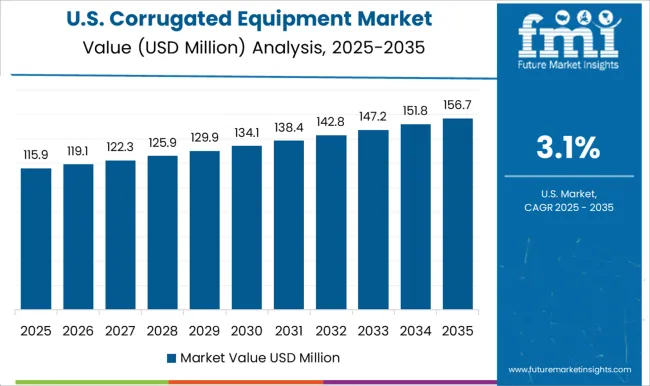

The United States, growing at a CAGR of 3.1%, sees moderate growth due to mature market conditions with high penetration of automated corrugated equipment. Large-scale packaging firms and contract packers prioritize integration of digital monitoring, predictive maintenance, and energy-saving technologies. Demand is driven by e-commerce packaging, food and beverage production, and cold-chain logistics. Adoption of modular and scalable equipment ensures flexibility for short-run jobs while maintaining high throughput. Domestic manufacturers emphasize aftermarket services, machine upgrades, and specialized solutions to retain competitiveness.

The market is characterized by a combination of global machinery manufacturers and specialized equipment providers, focusing on production efficiency, automation, and quality of corrugated board output. Leading players such as BHS Corrugated, Bobst Group, Mitsubishi Heavy Industries, and Barry-Wehmiller dominate through technologically advanced production lines, offering high-speed, fully automated solutions that integrate printing, converting, and material handling. These companies leverage decades of engineering expertise, global service networks, and after-sales support to secure large-scale manufacturing contracts, ensuring consistent performance and reliability. Mid-sized and niche suppliers, including Sun Automation, Simon Corrugated Machinery, MPS Systems, Mark Andy, OMET, and Walco, differentiate themselves by providing modular, customizable solutions suitable for specific production requirements or regional markets. Their focus on cost-efficient automation, digital monitoring systems, and flexible machinery designs caters to small-to-medium corrugated manufacturers seeking productivity without large-scale capital investments.

Competitive strategies emphasize automation, digital integration, energy efficiency, and service support. OEMs invest in advanced technologies such as inline printing, automated die-cutting, and predictive maintenance to reduce downtime and improve throughput. Companies also focus on regional expansion and strategic partnerships to enhance market presence. Increasing adoption of smart manufacturing and Industry 4.0-enabled solutions is expected to further intensify competition, driving continuous innovation and differentiation across global and regional players.

| Item | Value |

|---|---|

| Quantitative Units | USD 266.6 Million |

| Equipment | Non-HQ flexo, HQ flexo, Sheet-to-sheet litho-laminators, Web-to-web litho-laminators, and Web-to- sheet litho-laminators |

| End Use Industry | Food & beverages, Electrical & electronics, Home & personal care, Textile, Paper & pulp, and Pharmaceuticals |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BHS Corrugated, Bobst Group, Mitsubishi Heavy Industries, Barry-Wehmiller, Sun Automation, Heidelberger Druckmaschinen, Manroland, Simon Corrugated Machinery, MPS Systems, Mark Andy, OMET, Walco, Wolverine Flexographic, Automatan, Edale UK, EMBA, Lamina System, Oppliger SRL, Star Flex International, and Rotatek |

| Additional Attributes | Dollar sales by equipment type and application, demand dynamics across packaging, printing, and industrial sectors, regional trends in corrugated board adoption, innovation in automation, speed, and precision, environmental impact of energy use and material waste, and emerging use cases in e-commerce packaging, sustainable material handling, and custom box production. |

The global corrugated equipment market is estimated to be valued at USD 266.6 million in 2025.

The market size for the corrugated equipment market is projected to reach USD 379.7 million by 2035.

The corrugated equipment market is expected to grow at a 3.6% CAGR between 2025 and 2035.

In terms of end use industry, food & beverages segment to command 36.9% share in the corrugated equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corrugated Box Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Automotive Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Market Analysis - Size, Share, and Forecast 2025 to 2035

Corrugated and Folding Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pharmaceutical Packaging Market Analysis Size, Share & Forecast 2025 to 2035

Corrugated Pallet Wrap Market Growth - Demand & Forecast 2025 to 2035

Corrugated Plastic Box Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Market Size, Share & Forecast 2025 to 2035

Corrugated Bubble Wrap Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Paper Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Printer Slotter Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pallet Containers Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Corrugated Mailers Market Size, Share & Forecast 2025 to 2035

Corrugated Open-head Drums Market Growth - Size & Forecast 2025 to 2035

Corrugated Fiberboard Market Analysis - Size, Demand & Forecast 2025 to 2035

Corrugated Bin Boxes Market by Dividers, Totes, Jumbo, Kraft Open Top Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA