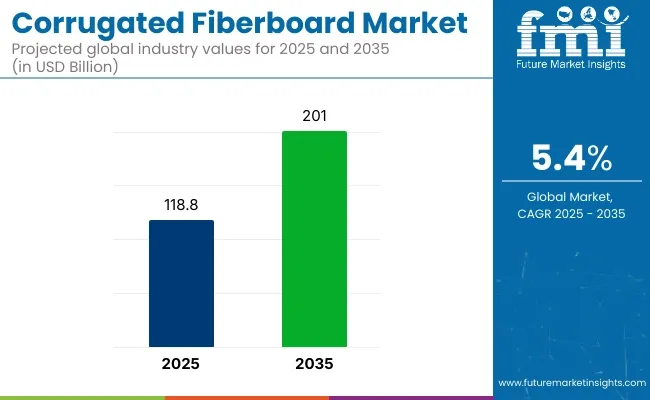

The corrugated fiberboard market is projected to grow from USD 118.8 billion in 2025 to USD 201.0 billion by 2035, registering a CAGR of 5.4% during the forecast period. Growth was supported by increased demand for recyclable shipping materials and sustainable secondary packaging formats. Surge in grocery delivery, electronics distribution, and regulatory focus on plastic reduction contributed to this rise.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 118.8 billion |

| Projected Market Size in 2035 | USD 201.0 billion |

| CAGR (2025 to 2035) | 5.4% |

In 2024, Smurfit Kappa has demonstrated its commitment to delivering on its sustainability goals through the recent inauguration of two state-of-the-art investments in Spain. Javier Rivas, COO of Smurfit Kappa Paper & Board Europe, said: “The recent inauguration of both the Sangüesa and the Nervión investments are milestones for the Smurfit Kappa paper division and aligned with the EU Green Deal’s transition to climate neutrality through increasing clean energy technologies.

Garrett Quinn, Chief Sustainability Officer at Smurfit Kappa, added: “These two projects demonstrate the Group’s continued investment to deliver on its sustainability goals with over €30 million in these two projects alone, delivering reduced emissions, and increasing the circularity of our production process.”

In the USA, box shipments reported by the Fibre Box Association in Q1 2025 showed an uptick in demand for recycled content grades. Member companies noted greater adoption of lightweight corrugated products in omnichannel retail packaging. In its April 2025 bulletin, the Confederation of European Paper Industries (CEPI) highlighted increased output of corrugated containers in France and Germany, driven by bans on single-use plastic trays and films. The market is moving toward smart and functional solutions.

DS Smith announced in 2024 the rollout of smart corrugated trays embedded with scannable codes, designed to track grocery shelf life and optimize inventory management. Customizable features like humidity protection coatings and tamper-evident fluting have also been introduced across pharmaceutical-grade fiberboard SKUs.

Sustainability is shaping procurement policies. In 2024, the Ministry of Commerce and Industry in India issued state procurement guidelines favouring recycled and virgin kraft liners. Fiberboard manufacturers supplying packaging to agricultural exporters were among the first to benefit.

Meanwhile, Japan Packaging Institute reports continued innovation in plastic-free coating solutions for corrugated trays in fresh produce exports. The corrugated fiberboard market is expected to grow steadily. Stricter environmental regulations, especially in Europe and Asia, are expected to mandate the use of biodegradable and recyclable packaging materials. Manufacturers who prioritize bio-based adhesives, compostable liners, and digital traceability are expected to gain long-term strategic advantage.

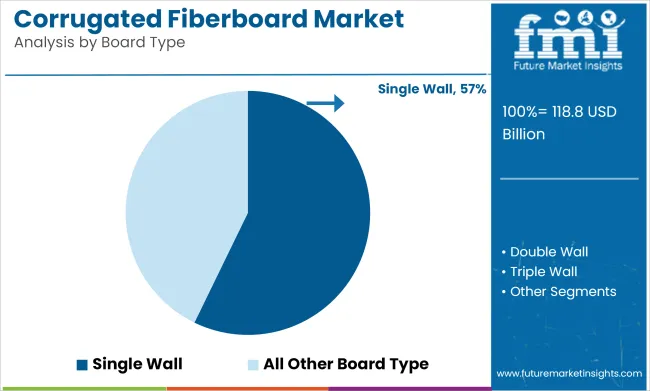

By board type, double wall corrugated fibreboards are expected to dominate with a market share of around 57.2% by 2025, owing to their superior strength-to-weight ratio and ability to withstand stacking pressure. These boards consist of two fluted mediums and three linerboards, offering enhanced protection and cushioning during transit. As a result, they are heavily used in packaging heavy items such as electronics, machinery components, bulk food products, and beverages.

Double wall boards are particularly favoured in export-oriented packaging and e-commerce shipping due to their structural integrity and shock resistance. With the rising demand for protective, eco-friendly, and cost-effective secondary packaging, manufacturers have continued to increase the production of double wall variants, particularly in customizable formats for automated packaging lines. While triple wall boards offer even higher durability, their usage remains limited to niche industrial segments, and their share is expected to remain below 15% in 2025.

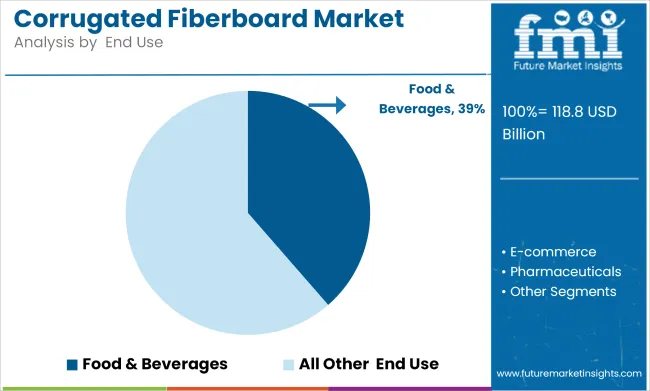

By end use, the food & beverage segment is projected to hold approximately 38.6% of the corrugated fiberboard market by 2025, driven by rapid growth in packaged food, takeaway meals, frozen foods, and bottled beverages. Corrugated fiberboard is widely used for secondary and tertiary packaging of products such as cereal boxes, beverage carriers, and fruit and vegetable trays.

The ability of corrugated fiberboard to offer thermal insulation, high printability, and moisture resistance makes it ideal for the food and beverage supply chain, especially under cold-chain logistics and shelf-ready packaging. The increasing penetration of quick service restaurants (QSRs) and online food delivery platforms has also contributed to the segment’s demand for lightweight and cost-effective box formats.

Sustainable packaging regulations and rising consumer preference for recyclable materials are encouraging companies to replace plastic-based solutions with fiber-based alternatives. Consequently, the food & beverage sector continues to be the largest consumer of corrugated fiberboard packaging, supporting consistent growth in the global market.

Fluctuating Raw Material Costs, Recycling Limitations, and Competition from Alternative Packaging

One of the significant challenges of the corrugated fiberboard market is the rising prices of raw materials like wood pulp and recycled paper, which are affected by deforestation issues, global supply chain disruptions, and energy costs. Though widely recyclable, there are sustainability challenges surrounding corrugated packaging in terms of moisture resistance, retaining strength through multiple recycling cycles, and contamination from food or chemicals.

Competition from alternative packaging materials poses another important challenge, with biodegradable plastics, molded pulp and lightweight foam solutions, among others, providing functionalities such as reduced weight and better durability or protection for specific applications.

Growth in E-Commerce, Sustainable Packaging Innovations, and Smart Logistics Solutions

However, the corrugated fiberboard market also faces challenges during these times, including sustainability challenges and a shifting packaging landscape. The rise of online shopping, home deliveries and subscription-based retail is boosting demand for shipping materials that are lightweight, recyclable and inexpensive.

And also new materials from water-resistant, reinforced, biodegradable fiberboards to more eco-friendly options are tackling sustainability issues. Utilization of AI-based logistics, IoT-supported tracking and smart packaging solutions are an added driver of the efficiency of corrugated fiberboard in supply chains.

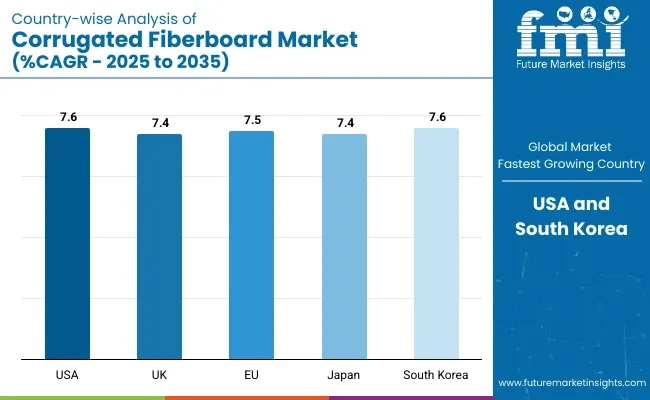

Corrugated fiberboard market in the USA is driven by increasing demand for sustainable and lightweight packaging solutions in various industries such as e-commerce, food & beverage, and electronics. Demand is also driven consistently by the increasing adoption of recyclable and biodegradable fiberboard materials by manufacturers in line with corporate sustainability initiatives and government regulations on packaging waste reduction. Moreover, developing printing technology and smart packaging encasing are trending the market towards growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.6% |

Another reason driving the market in the United Kingdom is the growing emphasis on sustainable packaging solutions and the rapid growth of online retail in the country. New stringent regulations on single-use plastics have catalyzed many businesses to turn to corrugated fiberboard as a replacement. Furthermore, advances in moisture-resistant and high-strength corrugated packaging are expanding its scope of application across numerous industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.4% |

With companies across the European Union concentrating on circular economy initiatives and sustainable packaging solutions, the corrugated fiberboard market is rapidly growing. Tight EU environmental rules and recycled packaging materials incentives are driving demand in the market. In addition, a surge in demand for personalized, lightweight, and consumable packaging solutions, especially from e-commerce and consumer goods sectors, is propelling the industry landscape.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.5% |

The market for corrugated fiberboard in Japan is growing at a stalemate and is supported by the highlight of precision packaging in the country along with its manufactured premium materials and forming market i.e., the corrugated fiberboard. Market growth is attributed to the rising need for protective and lightweight packaging solutions in the electronics, automotive, and food sectors. Moreover, smart packaging and automation related technical advancements are aiding to enhance the efficiency of the packaging industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.4% |

The Corrugated Fiberboard market in South Korea certainly considerations of regional distribution, and the specialists situated there may likewise have restrictions on current arrangements. The market growth is additionally driven by government policies supporting green packaging and rising use of digitally-printed corrugated fiberboard as a branding tool. Furthermore, the growing need for high-performance corrugated materials in logistics and supply chain industries is promoting industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.6% |

The corrugated fiberboard has been segmented into product and application. To make packaging more durable, cost-effective and environmentally sustainable, businesses are investing in AI-based corrugated board optimization, development of high-strength fiberboard, recyclable packaging products and more.

Paperboard manufacturers, packaging solution providers, and industrial shipping material companies can leverage opportunities from the advancements in fiberboard production technology, AI-based material efficiency, and packaging sustainability innovations.

International Paper (18-22%)

International Paper is a top player in the corrugated fiberboard market, providing strong, lightweight packaging for customers and an AI-powered material sustainability assessment, as well as cost-effective packaging for logistics and retail applications.

WestRock Company (12-16%)

WestRock, a leader in recycling-focused corrugated fiberboard, is committed to helping brands reduce costs at every step of the supply chain while providing tailored packaging solutions powered by artificial intelligence.

Smurfit Kappa Group (10-14%)

Smurfit Kappa stalks sustainable supply streams with its specialized AI to produce optimized solutions for corrugated fiberboard durability analysis and sustainable material sourcing.

Mondi Group (8-12%)

Mondi is a practitioner of premium corrugated fiberboard packaging, building in AI-driven structural improvements and ultra-lightweight packaging innovations.

DS Smith Plc (5-9%)

DS Smith creates biodegradable fiberboard packaging that is integrated with AI, ensuring production efficiency and optimum box performance for shipping around the world.

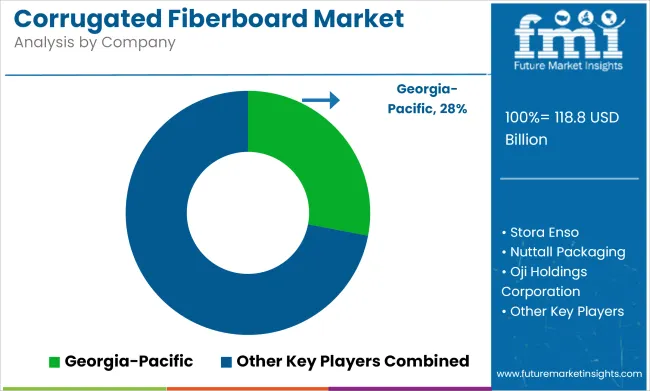

Other Key Players (30-40% Combined)

Several paper packaging firms, logistics solution providers, and sustainable packaging companies contribute to next-generation corrugated fiberboard innovations, AI-powered production advancements, and eco-friendly material development. These include:

The overall market size for corrugated fiberboard market was USD 118.8 billion in 2025.

Corrugated fiberboard market is expected to reach USD 201.0 billion in 2035.

The demand for corrugated fiberboard is expected to rise due to increasing e-commerce activities, growing demand for sustainable and recyclable packaging solutions, and expanding applications in food, electronics, and consumer goods packaging.

The top 5 countries which drives the development of corrugated fiberboard market are USA, UK, Europe Union, Japan and South Korea.

Flute C and Double Wall Fiberboards to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corrugated Box Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Automotive Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Equipment Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Market Analysis - Size, Share, and Forecast 2025 to 2035

Corrugated and Folding Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pharmaceutical Packaging Market Analysis Size, Share & Forecast 2025 to 2035

Corrugated Pallet Wrap Market Growth - Demand & Forecast 2025 to 2035

Corrugated Plastic Box Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Market Size, Share & Forecast 2025 to 2035

Corrugated Bubble Wrap Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Paper Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Printer Slotter Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pallet Containers Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Corrugated Mailers Market Size, Share & Forecast 2025 to 2035

Corrugated Open-head Drums Market Growth - Size & Forecast 2025 to 2035

Corrugated Bin Boxes Market by Dividers, Totes, Jumbo, Kraft Open Top Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA