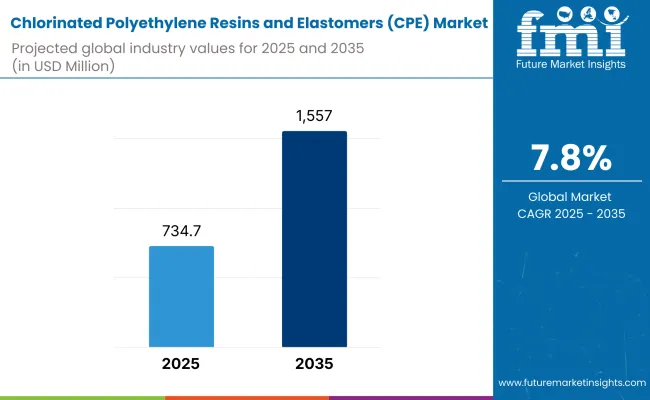

The chlorinated polyethylene resins and elastomers market is valued at USD 734.7 million in 2025 and is expected to nearly double to USD 1557 million by 2035, growing at a CAGR of 7.8%.

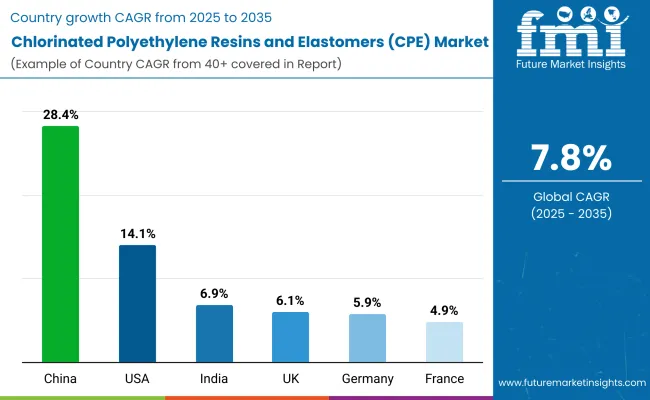

The USA is likely to grow at 14.1% CAGR, driven by technological innovation and increasing demand in the wire and cable, automotive, and construction industries. Together, these regions dominate the global demand landscape and will continue to be primary growth engines over the forecast period.

The market growth is primarily driven by the automotive sector’s increasing demand for durable, flexible, and chemically resistant materials capable of withstanding harsh environments such as high temperature, moisture, and chemical exposure.

CPE’s excellent performance as seals, gaskets, wire insulation, and under-the-hood components makes it a preferred choice among manufacturers. Additionally, the wire and cable industry’s need for materials with superior electrical insulation properties fuels demand.

| Attributes | Description |

|---|---|

| Estimated Global Chlorinated Polyethylene Resins and Elastomers Market Size (2025E) | USD 734.7 million |

| Projected Global Chlorinated Polyethylene Resins and Elastomers Market Value (2035F) | USD 1557 million |

| Value-based CAGR (2025 to 2035) | 7.8% |

However, the market faces challenges from environmental concerns and tightening regulations over chlorine-based products. These restrictions stem from the potential ecological impact of chlorine use and disposal, prompting manufacturers to seek alternatives or innovate safer formulations. Competition from thermoplastic elastomers (TPEs) and synthetic rubbers that offer similar benefits at potentially lower costs also restrains market expansion.

Looking ahead, the CPE market is expected to witness steady growth supported by ongoing automotive innovation, increasing infrastructure projects, and expanding electronics manufacturing in emerging markets. Efforts to improve material performance, reduce environmental impact, and incorporate circular economy principles will drive product development and adoption.

Investment in research and development to create higher-performance, eco-friendly CPE products is anticipated to intensify, positioning the market for long-term resilience and sustainability between 2025 and 2035.

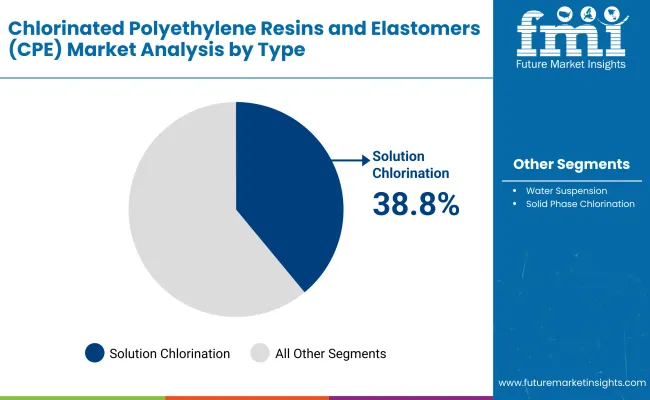

The chlorinated polyethylene resins and elastomers (CPE) market is segmented by type, application, and region. By type, the key segments include solution chlorination, water suspension, and solid phase chlorination process of stirring bed.

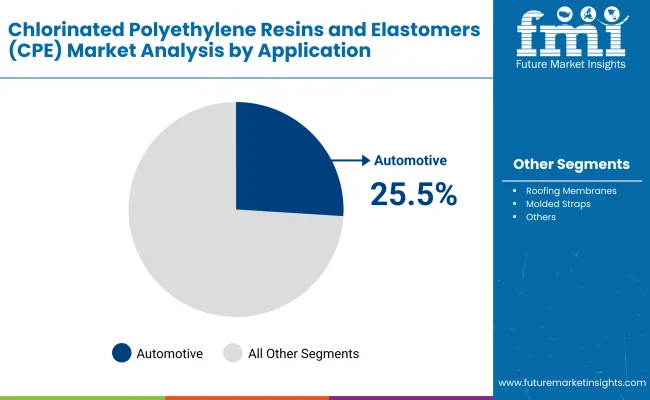

By application, the market is divided into automotive, roofing membranes, molded straps, extruded profiles, cable jacketing, and others, which encompass adhesives, sealants, and various industrial uses. Regionally, the market is categorized into North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The chlorinated polyethylene resins and elastomers market is dominated by the solution chlorination segment, which is poised to be the most lucrative throughout the forecast period. The solution chlorination segment, holding approximately 38.8% market share in 2025, is expected to grow at an accelerated CAGR of around 8.3% between 2025 to 2035.

This growth is underpinned by the segment’s superior process control, enabling consistent chlorination and enhanced product properties such as chemical resistance, flexibility, and scalability, making it highly favored across key end-use industries like automotive and wire & cable. In contrast, the water suspension segment, while significant, is projected to grow at a slightly lower pace due to its less uniform chlorination distribution and comparatively limited applications.

Similarly, the solid phase chlorination process of stirring bed segment is expected to exhibit moderate growth given its niche use and higher production complexities. These segments collectively contribute to the remaining market but lack the volume and scalability benefits that position solution chlorination as the primary driver of value creation in the market. Consequently, investment and innovation activities are concentrated around solution chlorination technologies, reinforcing its position as the key growth lever.

| Type Segment | CAGR (2025 to 2035) |

|---|---|

| Solution Chlorination | 8.3% |

The chlorinated polyethylene resins and elastomers market is segmented into automotive, roofing membranes, molded straps, extruded profiles, cable jacketing, and others (including adhesives, sealants, and miscellaneous industrial applications). The automotive segment stands out as the most lucrative, expected to capture approximately 25.5% of the market share in 2025 and grow at a CAGR of 8.5% through 2035.

This growth is driven by rising demand for durable, heat-resistant, and chemically stable materials in seals, gaskets, wire insulation, and under-the-hood components. Roofing membranes and cable jacketing segments hold significant market positions but are projected to experience moderate growth due to steady construction activity and incremental demand in energy infrastructure. Molded straps and extruded profiles cater to niche industrial needs and are expected to witness slower growth.

The others category, which includes adhesives and sealants, remains stable with consistent demand but lacks aggressive expansion drivers. The focus on innovation and sustainability in automotive applications solidifies its position as the key growth engine.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Automotive | 8.5% |

High Demand in Automotive Sector

Chlorinated Polyethylene (CPE) is widely used in the automotive industry for applications like rubber seals, wiring, and under-the-hood components. Its chemical resistance and flexibility make it ideal for these uses. The demand for CPE is increasing as the automotive industry grows, especially in emerging markets. This growth in the automotive sector is a significant factor driving the need for CPE in various car parts and components.

Increased Demand in Wire and Cable Industry

CPE is also highly valued in the wire and cable industry, where it is used for insulation and jacketing. Because of its strong electrical properties and durability, CPE helps protect cables and wires in various environments. With the rise in energy transmission and communication networks, especially in developing countries, the need for CPE in this industry continues to grow, further boosting its demand.

Environmental Concerns and Regulatory Pressure

Chlorinated Polyethylene (CPE) is made using chlorine, raising environmental concerns. Many governments and environmental groups are pushing to reduce the use of harmful chemicals in products. This growing focus on safety may make CPE harder to use in some applications, which could slow down its growth.

Cost and Competition from Other Materials

The prices of key materials like polyethylene and chlorine can change significantly, affecting the cost of making CPE resins and elastomers. These price changes can make it harder for manufacturers to plan and impact their profits. Also, CPE competes with other materials like thermoplastic elastomers (TPEs) and rubbers, which have similar properties but are cheaper. This competition could lower the share, especially in areas where cost is essential.

Advancements in CPE Production Methods

New techniques are being developed to make Chlorinated Polyethylene (CPE) production more efficient and scalable. These methods aim to reduce energy consumption and improve the overall quality of the material. For example, improvements in chlorination processes and polymerization methods are helping create more uniform and high-performance CPE resins. These innovations make it easier to produce better-quality materials at a larger scale while lowering production costs.

Improving CPE Properties through Blending and Modification

Manufacturers are working to improve the properties of CPE by mixing it with other materials or changing its chemical structure; this makes CPE more flexible, stronger, and resistant to chemicals. These enhanced CPE materials are better for specialized automotive, construction, and electronics use. For example, modified CPE elastomers are being created to have better heat resistance and durability, which makes them perfect for demanding applications like automotive seals and weatherproofing materials.

Focus on Sustainability and Recycling

Sustainability is becoming critical in the CPE industry. Companies are now adopting recycle materials to make CPE eco-friendly by reducing the carbon footprint during production. Also, the development of biodegradable CPE products to reduce environmental impact, especially in industries such as automotive and construction. In addition, new recycling methods are explored to process CPE waste, which helps cut down on waste and costs. Closed-loop recycling systems where CPE waste is reused to create new products are becoming more common, further supporting sustainability efforts.

The Chlorinated Polyethylene Resins and Elastomers (CPE) market supply chain has four main stages: Raw Material Suppliers, Manufacturers, Distributors, And End Users.

Raw material suppliers, such as those providing polyethylene and chlorine, face challenges because the prices of materials can change unexpectedly. Manufacturers, who produce CPE resins deal with high production costs and the need to maintain consistent quality.

Distributors handle the delivery of the products but must also manage complex rules and safety issues related to chemicals. Finally, end users in industries like automotive, construction, and electronics need to balance the performance of CPE with environmental concerns and competition from other materials. These stages show both the opportunities and challenges in keeping the CPE supply chain running smoothly.

| Stage | Key Players and Challenges |

|---|---|

| Raw Material Suppliers | Polyethylene producers, Chlorine suppliers, and Additive manufacturers. Challenge: Volatility in prices of raw materials like polyethylene and chlorine. Sourcing high-quality resins. |

| Manufacturers & Producers | CPE resin manufacturers (e.g., Lanxess, LG Chem, Beijing Hengju), and CPE elastomer producers. Challenge: High production costs due to chlorine-based processes, and maintaining quality consistency at large production scales. |

| Distributors | Global distributors of chemicals and polymers, regional distribution networks. Challenge: Logistics issues, chemical handling regulations, and ensuring efficient supply chains across regions. |

| End Users (Industries) | Automotive, Construction, Wire & Cable, and Electronics industries. Challenge: Environmental concerns about chlorine-based products, competition from alternatives, and balancing performance with cost control. |

| Countries | CAGR |

|---|---|

| India | 6.9% |

| China | 28.4% |

| UK | 6.1% |

| Germany | 5.9% |

| France | 4.9% |

| USA | 14.1% |

The chemical industry in India is growing driven by heavy industrialization. The automotive and construction sectors are expanding, leading to higher demand for CPE materials. Additionally, more companies are using CPE in wire and cable applications for its durability. The government's push for infrastructure development also contributes to the growth, as it creates more opportunities for using CPE in various projects.

China is witnessing a strong demand for CPE because of its growing automotive industry. With the rise in sales of cars, there is a high demand for high-quality materials. The electronics manufacturing sector is also a major driver with CPE used in several electronic products. Furthermore, China's focus on building new infrastructure, such as roads and bridges boosts the need for CPE in construction materials.

In UK, the industry growth is supported by the automotive and construction sectors. As these industries expand, there is a concentrated need for CPE materials for various applications. The rising trend towards sustainable materials, which makes CPE an attractive option as recycled materials are widely used. The UK government's commitment to reducing carbon emissions encourages companies to adopt eco-friendly solutions, further driving the demand for CPE.

Germany accounts for a positive growth driven by its robust infrastructure mainly because it leads the automotive and manufacturing sectors. The country is known for producing high-quality vehicles, many of which use CPE for parts such as seals and gaskets. Technology has become advanced, and plays a key role, as German companies invest in research to improve the performance and properties of CPE in end-use materials.

Such innovations enable manufacturers in Germany to stay globally competitive, which in turn drives a continued demand for CPE in automotive and manufacturing industries.

In France, the automotive sector is responsible for a high trajectory and is driven by a high demand for durable, high-performance materials such as CPE. The construction industry also plays a significant role, as builders require strong and reliable materials for their projects. The focus on sustainability has led to an increased use of CPE made through eco-friendly processes, which helps address the need for automotive and construction industries while supporting environmental goals.

The USA has a strong demand for CPE in many industries, including automotive, construction, and electronics. Companies are focusing more on high-performance materials that can meet the desired quality standards. Also, businesses are looking for solutions that are effective and eco-friendly by nature. This trend drives innovation and development of new CPE products that fulfil these needs.

By type, the market is sub-segmented into solution chlorination, water suspension, solid phase chlorination process of stirring bed

By application, the market is sub-segmented into automotive, roofing membranes, molded straps, extruded profiles, cable jacketing, others

By region, the market is sub-segmented into North America, Latin America, Western Europe, South Asia and Pacific, East Asia, Middle-East

The market was valued at USD 734.7 million in 2025.

The market is predicted to reach a size of USD 1557 million by 2035.

Some of the key companies manufacturing chlorinated polyethylene resins and elastomers include Dow Chemical Company, Sundow Polymers Co. Ltd, Lianda Corporation, Du Pont, and others.

China is a prominent hub for chlorinated polyethylene resins and elastomers manufacturers.

Table 1: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Region, 2017-2032

Table 2: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Region, 2017-2032

Table 3: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Manufacturing Method, 2017-2032

Table 4: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Manufacturing Method, 2017-2032

Table 5: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 6: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Application, 2017-2032

Table 7: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 8: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Country, 2017-2032

Table 9: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Manufacturing Method, 2017-2032

Table 10: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Manufacturing Method, 2017-2032

Table 11: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 12: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Application, 2017-2032

Table 13: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 14: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Country, 2017-2032

Table 15: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Manufacturing Method, 2017-2032

Table 16: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Manufacturing Method, 2017-2032

Table 17: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 18: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Application, 2017-2032

Table 19: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 20: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Country, 2017-2032

Table 21: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Manufacturing Method, 2017-2032

Table 22: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Manufacturing Method, 2017-2032

Table 23: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 24: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Application, 2017-2032

Table 25: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 26: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Country, 2017-2032

Table 27: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Manufacturing Method, 2017-2032

Table 28: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Manufacturing Method, 2017-2032

Table 29: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 30: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Application, 2017-2032

Table 31: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 32: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Country, 2017-2032

Table 33: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Manufacturing Method, 2017-2032

Table 34: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Manufacturing Method, 2017-2032

Table 35: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 36: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Application, 2017-2032

Table 37: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 38: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Country, 2017-2032

Table 39: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Manufacturing Method, 2017-2032

Table 40: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Manufacturing Method, 2017-2032

Table 41: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 42: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Forecast by Application, 2017-2032

Figure 1: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Manufacturing Method, 2022-2032

Figure 2: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Application, 2022-2032

Figure 3: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Region, 2022-2032

Figure 4: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Region, 2017-2032

Figure 5: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Region, 2017-2032

Figure 6: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Region, 2022-2032

Figure 7: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Region, 2022-2032

Figure 8: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Manufacturing Method, 2017-2032

Figure 9: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Manufacturing Method, 2017-2032

Figure 10: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Manufacturing Method, 2022-2032

Figure 11: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Manufacturing Method, 2022-2032

Figure 12: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 13: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Application, 2017-2032

Figure 14: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 15: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 16: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Manufacturing Method, 2022-2032

Figure 17: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Application, 2022-2032

Figure 18: Global Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Region, 2022-2032

Figure 19: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Manufacturing Method, 2022-2032

Figure 20: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Application, 2022-2032

Figure 21: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Country, 2022-2032

Figure 22: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 23: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Country, 2017-2032

Figure 24: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 25: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 26: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Manufacturing Method, 2017-2032

Figure 27: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Manufacturing Method, 2017-2032

Figure 28: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Manufacturing Method, 2022-2032

Figure 29: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Manufacturing Method, 2022-2032

Figure 30: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 31: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Application, 2017-2032

Figure 32: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 33: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 34: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Manufacturing Method, 2022-2032

Figure 35: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Application, 2022-2032

Figure 36: North America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Country, 2022-2032

Figure 37: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Manufacturing Method, 2022-2032

Figure 38: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Application, 2022-2032

Figure 39: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Country, 2022-2032

Figure 40: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 41: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Country, 2017-2032

Figure 42: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 43: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 44: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Manufacturing Method, 2017-2032

Figure 45: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Manufacturing Method, 2017-2032

Figure 46: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Manufacturing Method, 2022-2032

Figure 47: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Manufacturing Method, 2022-2032

Figure 48: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 49: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Application, 2017-2032

Figure 50: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 51: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 52: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Manufacturing Method, 2022-2032

Figure 53: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Application, 2022-2032

Figure 54: Latin America Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Country, 2022-2032

Figure 55: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Manufacturing Method, 2022-2032

Figure 56: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Application, 2022-2032

Figure 57: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Country, 2022-2032

Figure 58: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 59: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Country, 2017-2032

Figure 60: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 61: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 62: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Manufacturing Method, 2017-2032

Figure 63: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Manufacturing Method, 2017-2032

Figure 64: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Manufacturing Method, 2022-2032

Figure 65: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Manufacturing Method, 2022-2032

Figure 66: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 67: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Application, 2017-2032

Figure 68: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 69: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 70: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Manufacturing Method, 2022-2032

Figure 71: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Application, 2022-2032

Figure 72: Europe Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Country, 2022-2032

Figure 73: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Manufacturing Method, 2022-2032

Figure 74: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Application, 2022-2032

Figure 75: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Country, 2022-2032

Figure 76: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 77: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Country, 2017-2032

Figure 78: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 79: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 80: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Manufacturing Method, 2017-2032

Figure 81: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Manufacturing Method, 2017-2032

Figure 82: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Manufacturing Method, 2022-2032

Figure 83: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Manufacturing Method, 2022-2032

Figure 84: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 85: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Application, 2017-2032

Figure 86: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 87: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 88: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Manufacturing Method, 2022-2032

Figure 89: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Application, 2022-2032

Figure 90: East Asia Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Country, 2022-2032

Figure 91: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Manufacturing Method, 2022-2032

Figure 92: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Application, 2022-2032

Figure 93: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Country, 2022-2032

Figure 94: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 95: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Country, 2017-2032

Figure 96: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 97: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 98: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Manufacturing Method, 2017-2032

Figure 99: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Manufacturing Method, 2017-2032

Figure 100: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Manufacturing Method, 2022-2032

Figure 101: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Manufacturing Method, 2022-2032

Figure 102: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 103: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Application, 2017-2032

Figure 104: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 105: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 106: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Manufacturing Method, 2022-2032

Figure 107: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Application, 2022-2032

Figure 108: South Asia & Pacific Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Country, 2022-2032

Figure 109: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Manufacturing Method, 2022-2032

Figure 110: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Application, 2022-2032

Figure 111: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) by Country, 2022-2032

Figure 112: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 113: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Country, 2017-2032

Figure 114: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 115: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 116: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Manufacturing Method, 2017-2032

Figure 117: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Manufacturing Method, 2017-2032

Figure 118: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Manufacturing Method, 2022-2032

Figure 119: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Manufacturing Method, 2022-2032

Figure 120: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 121: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Volume (Tons) Analysis by Application, 2017-2032

Figure 122: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 123: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 124: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Manufacturing Method, 2022-2032

Figure 125: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Application, 2022-2032

Figure 126: MEA Chlorinated Polyethylene Resins and Elastomers (CPE) Market Attractiveness by Country, 2022-2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chlorinated Polyethylene Market Growth - Trends & Forecast 2024 to 2034

Polyethylene Terephthalate Catalyst Size and Share Forecast Outlook 2025 to 2035

Polyethylene (PE) Thermoform Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Naphthalate (PEN) Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Films Market Size and Share Forecast Outlook 2025 to 2035

Chlorinated Methane Market Size and Share Forecast Outlook 2025 to 2035

Chlorinated Paraffin Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Terephthalate Market Growth - Trends & Forecast 2025 to 2035

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Polyethylene Mailers Market Insights - Growth & Trends Forecast 2025 to 2035

Chlorinated Isocyanurates Market Growth - Trends & Forecast 2025 to 2035

Competitive Breakdown of Polyethylene Corrugated Packaging Manufacturers

Polyethylene Pipe Market Growth – Trends & Forecast 2024-2034

Polyethylene Glycol Market Growth – Trends & Forecast 2024-2034

Polyethylene Market Growth – Trends & Forecast 2024-2034

CPET Trays Market

Polyethylene furanoate Market

Polyethylene Orthopaedic Insert Market

PE Resins Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA