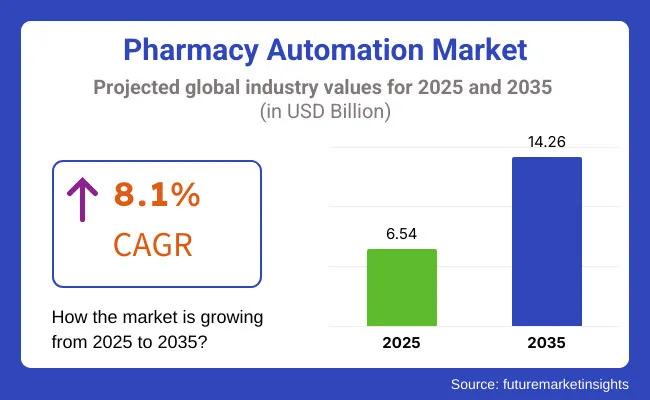

The global pharmacy automation market is estimated to be valued at USD 6.54 billion in 2025 and is projected to reach USD 14.26 billion by 2035, registering a compound annual growth rate of 8.1% over the forecast period.

The pharmacy automation market has experienced sustained growth as healthcare systems seek to enhance medication safety, reduce dispensing errors, and improve workflow efficiency across inpatient and outpatient settings. The widespread adoption of automated dispensing cabinets, medication compounding systems, and robotic packaging solutions has been driven by increasing prescription volumes and chronic disease prevalence.

Regulatory mandates emphasizing accuracy in medication management and stringent compliance requirements have accelerated procurement among hospitals and retail pharmacies. Manufacturers have prioritized integration of barcode verification, RFID tracking, and cloud-based analytics to streamline operations and support inventory optimization.

The Pharmacy Automation Market represents approximately 8.9% of the broader Healthcare Automation Market, reflecting focused adoption in medication management relative to surgical and administrative automation solutions.

Within the Medical Devices Market, pharmacy automation accounts for around 2.4%, underscoring its specialized role in streamlining dispensing, packaging, and inventory processes across hospitals and retail pharmacies. This positioning highlights pharmacy automation as a niche but strategically important segment, improving safety, workflow efficiency, and medication adherence within the evolving landscape of healthcare delivery.

Product Type Analysis: Medical Dispensing Cabinets

Medical Dispensing Cabinets Accounts for an estimated revenue share of 52.4% due their critical role in automating medication storage and retrieval. Utilization has been driven by evidence demonstrating that cabinets significantly reduce human error, enhance security, and improve medication traceability. Hospitals have integrated automated dispensing systems to comply with regulatory requirements around controlled substances and ensure accurate inventory management.

Advancements in cabinet design, including real-time analytics dashboards and user-specific access controls, have strengthened adoption among pharmacy directors and clinical leaders. The widespread emphasis on medication safety initiatives and accreditation standards has further reinforced the segment’s leadership.

Drug Dispensing & Packaging is estimated to hold revenue share of 56.7%. This segment dominance is supported by its escalating prescription volumes, rising prevalence of polypharmacy, and stringent labeling requirements. Hospitals and retail pharmacies have prioritized automated packaging systems to standardize unit-dose and multi-dose preparations while reducing labor costs.

Integration of barcode verification and serialization technologies has further improved traceability and minimized medication errors. Regulatory frameworks across Europe and North America have endorsed automated dispensing as a best practice to ensure compliance with medication safety standards.

Hospital pharmacies have accounted for 61.2% of market revenue, driven by their role in managing large volumes of inpatient medications and ensuring adherence to strict safety protocols. Utilization has been reinforced by accreditation requirements mandating secure storage and documentation of controlled substances.

Hospitals have invested in centralized robotic dispensing systems to reduce turnaround times and enhance workflow efficiency, particularly in high-acuity departments such as oncology and intensive care. Integration with electronic health records and computerized physician order entry systems has enabled seamless data exchange and improved medication reconciliation.

The pharmacy automation industry is categorized under the medical devices and healthcare technology sector, more precisely the healthcare IT and robotics automation. The sector is shaped by various macroeconomic factors, including healthcare expenditure, technological advancements, regulations, and demographic changes.

At the macro level, the sector for pharmacy automation will gain from growing worldwide spending on healthcare as population ages, chronic diseases spread, and people demand better patient safety. A transition to value-based healthcare is also prompting investment in automation for improved efficiency, lower drug dispensing errors, and optimized pharmacy operations.

Further, government measures promoting digital healthcare transformation through the adoption of AI and electronic prescribing mandates are fast-tracking the adoption of the segment. The economic landscape also comes into play.

In the Asia-Pacific and Latin American emerging sectors, they are seeing swift investments going into healthcare infrastructure, which serves as substantial growth drivers. In mature regions such as North America and Europe, on the other hand, automation becomes the need to tackle labor scarcity and operational inefficiencies.

The United States pharmacy automation industry is expected to grow at a compound annual growth rate (CAGR) of 7.9% from 2025 through 2035. This increase is based on the growing necessity of minimizing medication errors, improving workflow efficiency, and coping with the growing number of prescriptions.

The use of sophisticated technologies like automated dispensing cabinets, robotic dispensing systems, and medication management solutions is gaining momentum in hospital as well as retail pharmacies. Major players in the USA industry are organizations like McKesson Corporation, Omnicell, Inc., and Baxter International Inc., which provide end-to-end pharmacy automation solutions.

Furthermore, the use of artificial intelligence (AI) and machine learning in pharmacy operations will continue to improve inventory management and patient safety. Challenges like initial investment expenses and compatibility with existing systems could, however, slow rapid adoption. Generally, though, the future of pharmacy automation in the United States is bright, with ongoing innovations expected over the next few years.

The industry for pharmacy automation in the United Kingdom will have a CAGR of 9.1% during the period from 2025 to 2035. The major drivers of the industry include increasing demands for automated medication dispensing systems, ensuring minimization of human errors, and increased pressures on healthcare services.

The National Health Service (NHS) has been strongly investing in automated technologies to enhance the delivery of services and patients' outcomes. Organizations like Becton, Dickinson and Company (BD) and Swisslog Healthcare are leading automation solution providers in the UK industry.

The attention is on integrating automated systems in hospital and community pharmacies to improve operations and lighten the workload on healthcare professionals. In addition, the concern for patient safety and the effective use of resources are promoting the implementation of technologies such as automated dispensing cabinets and robotic dispensing systems.

The industry for pharmacy automation in China is expected to develop at a CAGR of 9.5% during 2025 to 2035. The urbanization process, growing healthcare spending, and the emphasis of the government on upgrading healthcare infrastructure are driving forces behind the growth. Implementation of automation technology is intended to solve issues of medication errors and inefficiencies of manual dispensing operations.

Chinese firms such as Beijing Sincoheren S&T Development Co., Ltd. and global firms such as Omnicell, Inc. operate in this industry. Adoption of AI and data analytics within pharmacy operations is also picking up, improving inventory management and patient safety.

However, issues of high cost of implementation and the requirement for standardization across heterogeneous healthcare environments may influence the adoption rate. In total, China's industry for pharmacy automation will grow considerably, led by technological innovation and favorable government policies.

The pharmacy automation industry in Japan is expected to develop at a CAGR of 9.3% during the forecast period of 2025 to 2035. The aging population and the resultant growth in medication requirements are the key drivers for the adoption of pharmacy automation in pharmacies. The government of Japan has been encouraging the adoption of cutting-edge technologies to enhance healthcare services.

Tosho Inc. and Panasonic Healthcare are some of the key players in the provision of pharmacy automation solutions in Japan. Focus is placed on improving efficiency, lowering drug errors, and streamlining inventory management.

Despite these improvements, steep upfront costs and workforce training could slow the pace of adoption. Nevertheless, Japan's dedication to technologic advancement places its pharmacy automation industry on the precipice of significant growth in the next few years.

South Korea's pharmacy automation industry will witness the highest CAGR among the mentioned countries, at 10.1% during 2025 to 2035. The advanced technological infrastructure of the country and the government's efforts to update healthcare services are major drivers for this growth.

Pharmacies like JVM Co., Ltd., which is owned by Hanmi Pharmaceutical, are major South Korean players, providing a variety of pharmacy automation solutions. AI and robotics are increasingly being used in pharmacy operations as well, further streamlining processes.

High costs of implementation and the necessity of regulatory clearances can, however, become obstacles to its widespread use. In total, South Korea's pharmacy automation industry is set to grow at a rapid pace due to technological advancements and favorable government policies.

India's pharmacy automation industry is at the nascent stage but will grow at a fast pace in the next few years. Growth drivers include the rising healthcare infrastructure burden, necessity to minimize drug errors, and increasing use of digital technologies. The government initiative towards digitization in healthcare, such as the National Digital Health Mission, is also fueling the growth of the industry.

Omnicell, Inc., and BD are among the companies that are investigating opportunities in the Indian sector with solutions specific to local requirements. Rapid adoption can be hindered by challenges such as budget constraints, unawareness, and infrastructure development needs. India's pharmacy automation sector, though facing such challenges, has high potential and is expected to grow at a CAGR of 8.0% during the forecast period.

Germany's pharmacy automation sector will continue to grow gradually from 2025 to 2035. Germany's highly developed healthcare system and the focus on technological advancements are major drivers of this expansion. The implementation of automation technologies is focused on increasing efficiency, minimizing drug errors, and streamlining pharmacy operations.

BD Rowa and KUKA AG are among the top vendors of pharmacy automation systems in Germany. The convergence of AI and robotics in pharmacy processes is also picking up steam, improving inventory control and patient safety.

Nevertheless, issues like expensive implementation and the requirement for standardization across a wide range of healthcare environments can influence the adoption rate. Germany's pharmacy automation industry as a whole is set to grow steadily, at a CAGR of 6.5% between 2025 to 2035.

The Brazilian industry for pharmacy automation is expected to register a compound annual growth rate (CAGR) of 7% during the period between 2025 and 2035 and reach an estimated value of USD 422.85 million by 2031. The growth is fueled by the escalating requirement to optimize medication dispensing efficiency, minimize errors, and enhance patient safety in the healthcare system.

The use of automated prescription processing software, robots, and automatic packaging systems is increasingly common among hospital and retail pharmacies with a view to accelerating the filling process and minimizing waiting times for customers.

Talyst, LLC and Omnicell, Inc. are some of the major players in the Brazilian industry, among others. They provide end-to-end pharmacy automation solutions that address the unique demands of the Brazilian healthcare industry.

Nonetheless, the potential risks such as high upfront investment and staff training requirements could slow fast adoption. Regardless of these risks, the overall scenario for pharmacy automation in Brazil is bright with ongoing developments projected in the next few years.

FMI surveyed stakeholders in the pharmacy automation sector to evaluate industry trends, challenges, and future prospects. According to the results, there is high optimism regarding the growth of the sector, fueled by the evolution of automation and the rising need for medication safety.

Stakeholders underscored that automated dispensing systems, robotic filling of prescriptions, and AI-based inventory management all cut down significantly on human error and improve efficiency. Many respondents believe these technologies will allow pharmacists to focus more on patient care, improving overall healthcare outcomes.

In spite of the advantages, the survey also pointed out challenges that are preventing large-scale adoption. High upfront investment and compatibility with current healthcare infrastructure were the biggest concerns. Data security threats and the requirement for large-scale staff training were also seen as major obstacles. Most stakeholders emphasized that overcoming these challenges is essential to ensure maximum impact from automation.

Ahead, the respondents had faith in up-and-coming trends like machine learning and AI in pharmacy practices. These will enhance decision-making, streamline inventory, and support personalized patient treatment. The findings of the survey reaffirm the industry's push for the advancement of pharmacy automation despite current barriers to develop an efficient, secure, and tech-oriented pharmaceutical industry.

| Countries | Regulatory Impact on Pharmacy Automation |

|---|---|

| United States | United States set rigorous state and federal standards to ensure efficient dispensing practices keeping in mind the public safety. These laws necessitate pharmacy automation systems, integrated with advanced technologies to protect both patients and healthcare operators. |

| United Kingdom | The UK has enforced sophisticated healthcare standards to facilitate the adoption of automation in pharmacies to improve the treatment accuracy. Systems that maintain patient information must adhere to the data protection laws, such as General Data Protection Regulation (GDPR). |

| China | The regulatory standard of China encourages modernization of healthcare practices, like integration of pharmacy automation. Policies focus on elevating healthcare delivery standards alongside prioritizing patient safety and data security. |

| Japan | Japan is making efforts of encouraging the adoption of advanced technologies in healthcare, including pharmacy automation. The authorities are imposing supportive regulations to elevate the healthcare efficiency. |

| South Korea | South Korea’s regulations promote the integration of automation pharmacies to take the region’s operational services to next level and eradicating the medication errors. |

| India | India is also constantly developing and shaping its regulations to encourage pharmacy automation, focusing on improving medication dispensing accuracy. |

| Germany | Germany has rigid law framework that prioritize patient safety in medication dispensing. The government initiatives are supporting technological developments and data protection laws to adhere to the healthcare guidelines. |

| Brazil | The regulatory environment of Brazil is transforming to accommodate pharmacy automation, aiming to enhance healthcare efficiency and patient safety. The policies are targeting in balancing conventional healthcare infrastructure with the modern technological adoption. |

Pharmacy automation industry holds immense growth prospects, driven by technological advancements in artificial intelligence (AI), machine learning, and digital healthcare transformation. Incorporating AI into pharmacy automation will improve the accuracy of medication dispensing, reduce inventory management complexity, and maximize patient care.

Growth sectors also provide huge opportunity as governments and healthcare providers are investing to upgrade their infrastructure. Businesses can capitalize on these possibilities by adapting solutions to local requirements in a way that complies with local legislation.

Joint collaborations with technology companies, healthcare centers, and research centers can further push innovation to help create sophisticated automation solutions that resolve industry problems successfully. To achieve optimal growth, businesses need to focus on investing in research and development (R&D) that will further develop affordable, user-friendly automation systems.

Cloud-based and AI-based pharmacy management innovations can enhance the efficiency of workflow and increase customer adoption. Regulatory compliance is still important since divergent international standards affect industry entry and growth.

Businesses need to ensure that automation systems are compatible with changing regulations, especially in data security and interoperability. In addition, a customer-focused strategy is essential for success. Creating adaptable automation solutions that can be customized to various pharmacy environments can drive adoption rates.

The competitive landscape has been defined by companies innovating in modular dispensing systems, robotics, and analytics platforms to improve performance and scalability. Leading manufacturers have pursued partnerships with hospital networks to expand adoption and pilot next-generation solutions.

Strategic acquisitions of software firms have enhanced interoperability with electronic medical records. Digital training tools and remote monitoring services have been launched to support ongoing performance optimization. These initiatives are expected to sustain strong competition and drive continuous innovation as pharmacy automation becomes integral to healthcare delivery.

Key Development:

Advancements in AI, robotic dispensing, and digital prescriptions, along with the need for medication safety and workflow efficiency, are key growth factors.

Governments enforce safety, data security, and interoperability standards, influencing investment in automated pharmacy solutions.

High costs, integration with existing systems, data security concerns, and staff training are common obstacles.

AI improves medication accuracy, predicts inventory needs, personalizes patient care, and enables robotic dispensing.

AI-driven management, blockchain for prescription tracking, cloud-based solutions, remote pharmacy services, and sustainability initiatives are shaping the future.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmacy Automation System Market Growth – Demand & Forecast 2024-2034

Pharmacy Refrigerators Market Size and Share Forecast Outlook 2025 to 2035

Pharmacy Bags Market Size and Share Forecast Outlook 2025 to 2035

Pharmacy and Drug Store Franchises Market is segmented by Type and Age Group from 2025 to 2035

Market Share Distribution Among Pharmacy Bags Manufacturers

Pharmacy Accessory Bagging System (PABS) Market

ePharmacy Market Overview – Trends, Demand & Forecast 2025 to 2035

Infusion Pharmacy Management Market

Prescription Pharmacy Bags Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Prescription Pharmacy Bags Market

Automation Testing Market Size and Share Forecast Outlook 2025 to 2035

Automation COE Market Insights by Organization Size, Service Type, End User Verticals, and Region through 2035

Lab Automation Market Growth – Size, Trends & Forecast 2025 to 2035

Home Automation Sensors Market Size and Share Forecast Outlook 2025 to 2035

Home Automation Market Analysis by Product, Application, Networking Technology, and Region Through 2035

Form Automation Software Market – Digitizing Workflows

Hyperautomation Market

Water Automation & Instrumentation Market Trends & Forecast by Process Stage, Automation Technology, Instrumentation, End-User and Region through 2035

Retail Automation Market Size and Share Forecast Outlook 2025 to 2035

Postal Automation Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA