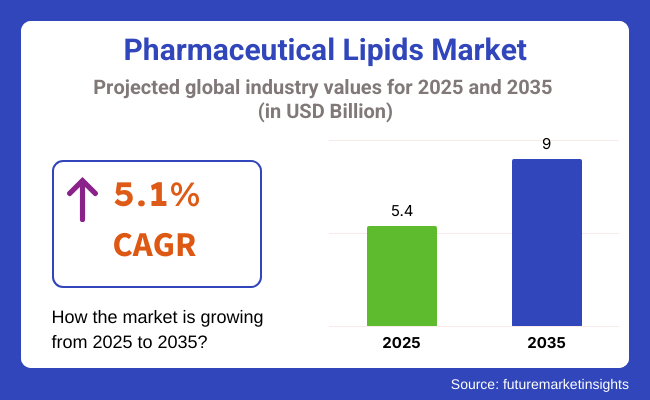

The global pharmaceutical lipids market is valued at USD 5.4 billion in 2025, registering Y-o-Y growth of 5.1% attaining market value of USD 9.0 billion by 2035. The revenue generated by allergy immunotherapy in 2024 was USD 5,209.3 million.

The pharmaceutical lipids market represents one of the major segments. Lipid contains oils, fats, and derivatives that have immense importance in improving the solubility, stability, and bioavailability of APIs, particularly in cases where APIs show poor water-soluble characteristics.

A need for appropriate therapy, combined with increased incidence of various chronic diseases and advancing technology in developing and delivering drugs based on lipids, has thus caused the exponential growth of this market.

The factors that have aided this exponential growth rate of the market include the designing of advanced drug delivery systems to improve the therapeutic response for such a continuously increasing incidence of chronic diseases, including cardiovascular disorders, cancer, and metabolic disorders.

Lipid-based formulation strategies have proved successful in enhancing the in vivo efficacy through the improvement of drug bioavailability. Other new developments also include innovative LBDDS like liposomes, solid lipid nanoparticles, and self-emulsifying drug delivery systems that possess site-specific delivery with controlled release profiles.

The increasing adoption of advanced delivery systems further propels market growth. There's also growth because the prevalence of life-threatening and chronic diseases-which include cardiovascular disorders, cancers, and metabolic diseases-is an increasingly common presence; in that scenario, too, lipid-based drugs improve both efficacy and compliance.

While in the past several years, interest has focused more on gene therapy, oncology, and development of new vaccines, biologics, and RNA-based treatments spur the rapid growth of this market.

Application of lipid nanoparticles in mRNA vaccination against COVID-19 underlined not only relevance of carriers themselves but opened up perspectives for totally new therapeutic indication. Nanotechnology, biotechnology, and, finally, personalized medicine most of the future innovative pharmaceuticals would certainly include at least a reasonable share of formulation based on lipids.

A comparative analysis of fluctuations in compound annual growth rate (CAGR) for the pharmaceutical lipids industry outlook between 2024 and 2025 on a six-month basis is shown below.

By this examination, major variations in the performance of these markets are brought to light, and trends of revenue generation are captured hence offering stakeholders useful ideas on how to carry on with the market’s growth path in any other given year. January through June covers the first part of the year called half1 (H1), while half2 (H2) represents July to December.

The table below compares the compound annual growth rate of the global pharmaceutical lipids market for the first halves of 2024 and 2025. It offers essential perspectives on how this sector functions by highlighting major changes and trends in revenue generation.

Half H1: January through June H2: July through December. In the first half (H1) of the decade from the year 2024 to 2034, the company is expected to grow at a CAGR of 5.2%. While, in the later years of that decade, it is anticipated to rise by about 5.6%.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.2% |

| H2 (2024 to 2034) | 5.6% |

| H1 (2025 to 2035) | 5.1% |

| H2 (2025 to 2035) | 5.5% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 5.1% in the first half and projected to lower at 5.5% in the second half. In the first half (H1) the market witnessed a decrease of 10 BPS while in the second half (H2), the market witnessed a decrease of 6.0 BPS.

The section contains information about the leading segments in the industry. Based on product type, triglycerides are expected to account 44.0% of the global share in 2025.

| Product Type | Value Share (2025) |

|---|---|

| Triglycerides | 44.0% |

Under product-type, the pharmaceutical lipids market is projected to be dominated by triglycerides reaching 44.0% in 2025. Triglycerides are most commonly used because of their high biocompatibility and excellent solubility properties, and their wide application range in drug formulations.

Those lipids are used especially to enhance the absorption of lipophilic drugs, making them among the preferred ingredients for oral, parenteral, and injectable formulations.

Triglycerides are also used in liposomal drug delivery systems quite widely. The provided stability, along with enhanced drug entrapment and improved bioavailability features, has made triglycerides a perfect candidate as a formulation vehicle. Their nontoxicity and metabolic safety enable long-term formulation use for cancer, neurological, and cardiovascular treatments.

With growing importance attached to sustained-release drug delivery systems and personalized medicines, triglycerides shall continue to lead the pharmaceutical lipids market in the future, aided by continuous progress in lipid-based drug delivery technologies.

| By Application | Value Share (2025) |

|---|---|

| Conventional Lipid-based Drug Delivery Systems (LBDDS) | 64.1% |

Conventional lipid-based drug delivery systems possess the highest market share in the pharmaceutical lipid category because of their tediously enough proven efficacy, established regulatory approvals, and saturated range of therapeutic applications. They have been liposomes, lipid emulsions, and soft lipid nanoparticles that have improved bioavailability of the investigated drugs, improved solubility, and controlled release characteristics.

While in cancer treatment they have become very typical, liposomes, through their implementation of higher drug targeting, reduced systemic toxicity, and prolonged drug release, are yet again seen present in treatment settings with infectious diseases and vaccines formulations. Intravenous nutrition and drug administration deliver to burning patients a continuous and safe supply of lipid emulsions.

These conventional LBDDS assure enhanced therapeutic performance, patient safety, and formulation stability across a wide range of medical applications as pharmaceutical companies continue the quest for novel lipid excipients.

The Advancements In The Lipid Nanotechnology For Drug Delivery Continue To Drive Pharmaceutical Lipids Demand.

Nanotechnology has transformed the aspects of stability, absorption, and targeted release of therapeutics for drug delivery. Controlled release, augmented systemic circulation, and reduced toxicity in these lipid formulations make them more effective for the treatment of diseases related to oncology, neurology, and infectious diseases.

Moreover, the targeted drug delivery by lipid-based nanocarriers makes sure therapeutic agents reach specific tissues and cells with a view to reducing side effects. The technology also finds its application in gene therapy, cancer treatment, including mRNA-based drug formulation vaccines.

In like manner, next-generation biologics and cell-based therapies drive research into lipid-based nanoparticles and hybrid carriers developed by combining lipids and polymers and have therefore placed nanotechnology as one of the top influential drivers in the market growth.

Further, research into the areas of bioengineering and lipidomics has come out with the design of smart lipid carriers that can respond to biological stimuli such as pH, temperature, or enzymatic activity.

With pharmaceutical companies continuing to increase investments in nanotechnology-driven drug delivery platforms, the growth of the pharmaceutical lipids market should be well supported in development.

Rising Demand for Lipid-Based Excipient Solutions Drive Pharmaceutical Lipids Sales

Excipients based on lipids find increasing acceptance in pharmaceutical formulations due to enhancing properties for drugs regarding solubility, stability, and compliance.

Highly lipophilic APIs are liable to show low aqueous solubility, thus presenting a problem with poor bioavailability. Such excipients will hence include phospholipids, sterols, triglycerides, and fatty acids, which help in enhancing drug dissolution rates and absorption efficiency.

The other reason for such high demand of the lipid excipients is sustained-release and long-acting formulation trends in drugs. Parenteral lipid emulsions and liposome-based drugs enable prolonged therapeutic effects due to the avoidance of frequent dosing, which has, in turn, improved patient compliance. This is especially handy in oncology, pain management, and neurological disorders, where consistent drug levels in the blood are of essence.

Another factor driving the demand for plant-derived phospholipids and other lipid-based stabilizers is the growing preference for natural and bio-based excipients. As pharmaceutical companies continue to work on complex, highly targeted formulations, lipid-based excipients will form the basis of advanced drug delivery technologies and thus assure drugs of improved performance and better patient outcomes.

Expansion of Lipid-Based Drug Delivery in Personalized Medicine Opens Market Opportunities

The movement towards personalized medicine offers a real chance for the field of lipid-based drug formulation. For example, lipid carriers have unique possibilities of drug release in tailored profiles, tissue-specific targeting, and decreased side effects-features all so vital in precision therapies concerning oncology, neurology, and metabolic disorders.

This is especially of importance in cancer therapy, where such targeted drug delivery protects most of the healthy tissue while increasing the effectiveness of the chemotherapeutic agents.

Further, the treatments for neurodegenerative diseases are being explored by using lipid nanoparticles and liposomes since they can cross the blood-brain barrier, which makes them ideal for drugs targeting Alzheimer's, Parkinson's, and epilepsy.

Furthermore, the development of gene therapies, mRNA vaccines, and CRISPR-based treatments continues to extend the uses of the carriers based on lipids. Success has already been witnessed regarding the utilization of LNP in mRNA COVID-19 vaccines that will facilitate next-generation genetic and immune therapy.

Due to increasing demand, precision formulations are causing exponential growth in the pharmaceutical lipids market. Continuous investment in customized AI-driven lipid formulation techniques, bioengineered lipid carriers, and therapeutics are the future in shaping personalized medicine.

Challenges in Scalability and Manufacturing Consistency Shows High Market Challenge to the Pharmaceutical Lipids

One of the biggest challenges for general application of lipid-based drug delivery systems (LBDDS) remains some problems related to its scale-up processes at the same time of maintaining product consistency.

While lipid-based formulation dramatically enhances the drug solubility and bioavailability of drugs, their process methodologies are immensely complicated, necessitating specialized technology, strict quality control, and precise formulation modification.

Transitioning from laboratory-scale production to large-scale commercial manufacturing is highly challenging, as small changes in the composition of lipids, the size of particles, or encapsulation efficiency may greatly influence the stability and therapeutic efficacy of the final drug product.

Homogenization, emulsification, and stabilization are some of the techniques involved in the preparation of LNPs, liposomes, and SLNs, respectively; these require highly controlled and very expensive equipment.

Also, most of the lipid-based formulation drugs are susceptible to environmental conditions like temperature, pH, and oxidation, which may result in degradation and lesser shelf life. Specialized storage and handling conditions, especially temperature-sensitive vaccines and biologics, add further to the supply chain complexities.

These will be overcome with the development of superior formulation technologies for lipids, better enhancers of stability, besides cost-effectiveness and large-scale production methods to widen access and ensure commercial viability within global markets.

Tier 1 players in this market holds 39.1%. In the tier 1 are companies with a significant global presence, such as Merck KGaA, Larodan AB (ABITEC Corporation), Evonik Industries AG, Cargill, Incorporated, Musim Mas, NOF CORPORATION.

These firms focus on the uniqueness and advancement of lipid-based drug products. As a result, they heavily invest in research and development, as well as infrastructure expansion. Rather than relying on competitive pricing, they prioritize expanding into emerging markets.

In the tier 2, companies like DuPont de Nemours, Inc., Croda International Plc., Nippon Fine Chemical Co., Ltd., CordenPharma International, RuixiBiotechCo.Ltd, Stepan Company are prominent players.

These prominent players hold approximately 11.8% of the market share and maintain a strong presence in specific regional markets. They focus on sustaining their position in established markets and actively compete on product pricing.

The section below covers the allergy immunotherapy industry analysis for the sales for different countries. Market analysis for several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa and its countries are provided.

The United States remain leading country in the world, with a growth rate of 3.8% through 2035. In South Asia & Pacific, India to witness the highest growing rate in the market of 6.1% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 5.5% |

| Germany | 5.4% |

| UK | 5.1% |

| Japan | 5.4% |

| India | 5.2% |

| China | 5.7% |

The USA function market is poised to register a growth rate of 5.5% between 2025 to 2035 owing to increasing demand for lipid-based formulations in oncology and RNA-based therapies, among others. Success with the mRNA vaccines using LNPs has accelerated investment in lipid excipients for RNA therapeutics.

Major pharmaceuticals and biotechnology companies in the USA include Pfizer, Moderna, Johnson & Johnson, and Amgen, which contribute to the increasing adoption of targeted drug delivery through the usage of lipid-based formulation. Liposomes and carriers find their wide application in cancer immunotherapies, treatments for gene editing, and those for rare diseases, assuring high bioavailability with lower toxicity.

Also, an FDA-friendly regulatory environment, along with growing financing of research for lipid-based pharmaceuticals, attracted investment by biotech startups and big pharmaceutical companies into nanolipid carriers, liposomal chemotherapy drugs, and antiviral formulations based on lipids. The expanded development of oncology drugs and precision medicine will drive growth in the USA market for more sophisticated ways of delivery based on lipids.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.4%.

Germany leads in research into lipid-based drug delivery, especially concerning lipid nanoparticles for the biopharmaceuticals market, including RNA-based drugs, vaccines, and gene therapy applications. German pharmaceutical companies and research institutes are rapidly advancing lipidomics and nanomedicine, thereby ensuring that Germany is a global hub for pharmaceutical lipid innovation.

In particular, Germany's highly developed pharmaceutical manufacturing infrastructure together with supportive regulations from Elia CE has succeeded in making it one of the few countries to produce pharmaceutical lipids with very high purity.

Rapidly evolving precision medicine and personalized drug formulations create an increasing demand for liposomal carriers and solid lipid nanoparticles. Companies like Evonik, and Merck KGaA wield great power to expand and improve the process developing lipid-based excipient manufacturing.

The investments supported by the German government toward nanotechnology and the development of lipid-based drug formulations create a conducive environment to stimulate lipid-based pharmaceutical innovation, which is strongly focused on oncology, neurology, and metabolic disorders. Such innovative-driven approaches continually cement Germany's leadership in lipid-based biopharmaceutical research and drug delivery solutions.

India occupies a leading value share in South Asia & Pacific market in 2024 and is expected to grow with a CAGR of 5.2% during the forecasted period.

Due to low-cost industrialization and a great position in generic and biosimilar drug production, India is fast-becoming a major player in the manufacture of pharmaceutical lipids around the world. Investment has been on an upswing for developing liposomal formulations, lipid emulsions, as well as self-emulsifying drug delivery systems (SEDDS).

Many Indian pharmaceutical companies have their individual alkanoids-based formulations for oncology, infectious diseases, and metabolic disorders up and running.

India is poised to be a very good supplier of high-quality Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs), thus conferring the great stature of a supplier of lipid excipients for big global pharmaceutical arms.

Apart from this, various government initiatives now running in India to further biotechnology, nanomedicine, and biopharmaceutical research are responsible for the further accelerating drug development of lipids.

India is expected to play a key role in providing lipid-based excipients and formulations for the global pharmaceuticals market, especially for lipid-based vaccines, gene therapies, and sustained-release formulations.

| Report Attributes | Details |

|---|---|

| Estimated Market Size (2025) | USD 5.4 billion |

| Projected Market Size (2035) | USD 9.0 billion |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion |

| By Product Types Analyzed | Triglycerides, Phospholipids, Sphingolipids, Cholesterol, Fatty Acids, Others (e.g., Glycolipids, Lipopolysaccharides) |

| By Forms Analyzed | Liquid, Semi-solid, Solid |

| By Sources Analyzed | Synthetic, Semi-synthetic, Natural |

| By Applications Analyzed | Conventional LBDDS, Advanced LBDDS |

| By Routes of Administration | Oral, Parenteral, Topical |

| By End Users | Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Homecare Settings |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Merck KGaA, Larodan AB (ABITEC Corporation), Evonik Industries AG, Cargill, Incorporated, Musim Mas, NOF CORPORATION, DuPont de Nemours, Inc., Croda International Plc., Nippon Fine Chemical Co., Ltd., CordenPharma International, Ruixi Biotech Co. Ltd, Stepan Company, SEPPIC, Biosynth, Gattefossé, Cayman Chemical, LECICO GmbH, Tokyo Chemical Industry (India) Pvt. Ltd., Creative Biolabs, VAV Life Sciences Pvt Ltd, Santa Cruz Biotechnology, Inc., Stearinerie Dubois, Lipoid GmbH, FUJIFILM Wako Pure Chemical Corporation |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

| Customization & Pricing | Available upon request |

In terms of product type, the industry is divided into triglycerides, phospholipids, sphingolipids, cholesterol, fatty acids, others (glycolipids, lipopolysaccharides, etc.)

In terms of form, the industry is divided into liquid, semi-solid, and solid

In terms of application, the industry is divided into synthetic, semi-synthetic, and natural

In terms of applications, the industry is segregated into hospitals, specialty clinics, ambulatory surgical centers and homecare settings.

In terms of route of administration, the industry is segregated into oral, parenteral and topical.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA) have been covered in the report.

The global market is expected to reach USD 9 billion by 2035, growing from USD 5.4 billion in 2025, at a CAGR of 5.1% during the forecast period.

The Triglycerides segment is expected to lead the market, driven by their superior solubility and biocompatibility, making them ideal for drug formulations.

The conventional lipid-based drug delivery systems (LBDDS) segment holds the largest share, with a focus on enhancing bioavailability, solubility, and sustained-release drug formulations.

Key drivers include the rising prevalence of chronic diseases, advancements in lipid-based drug delivery systems, and the increasing demand for personalized medicine and targeted therapies.

Top companies include Merck KGaA, Larodan AB (ABITEC Corporation), Evonik Industries AG, Cargill, Incorporated, Musim Mas, and NOF CORPORATION, offering innovative lipid solutions for drug delivery systems.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Form , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Route of Administration:, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Form , 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Route of Administration:, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Form , 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Route of Administration:, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 22: Europe Market Value (US$ Million) Forecast by Form , 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Value (US$ Million) Forecast by Route of Administration:, 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: South Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 27: South Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 28: South Asia Market Value (US$ Million) Forecast by Form , 2018 to 2033

Table 29: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: South Asia Market Value (US$ Million) Forecast by Route of Administration:, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Form , 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: East Asia Market Value (US$ Million) Forecast by Route of Administration:, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 40: Oceania Market Value (US$ Million) Forecast by Form , 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: Oceania Market Value (US$ Million) Forecast by Route of Administration:, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 46: MEA Market Value (US$ Million) Forecast by Form , 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Value (US$ Million) Forecast by Route of Administration:, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Form , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Route of Administration:, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Form , 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Form , 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Form , 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Route of Administration:, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by Route of Administration:, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by Route of Administration:, 2023 to 2033

Figure 25: Global Market Attractiveness by Product, 2023 to 2033

Figure 26: Global Market Attractiveness by Source, 2023 to 2033

Figure 27: Global Market Attractiveness by Form , 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by Route of Administration:, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Form , 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Route of Administration:, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Form , 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Form , 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Form , 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Route of Administration:, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Route of Administration:, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Route of Administration:, 2023 to 2033

Figure 55: North America Market Attractiveness by Product, 2023 to 2033

Figure 56: North America Market Attractiveness by Source, 2023 to 2033

Figure 57: North America Market Attractiveness by Form , 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by Route of Administration:, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Form , 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Route of Administration:, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Form , 2018 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Form , 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Form , 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Route of Administration:, 2018 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by Route of Administration:, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration:, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Form , 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Route of Administration:, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Form , 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Route of Administration:, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 101: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 102: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 103: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 104: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 105: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 106: Europe Market Value (US$ Million) Analysis by Form , 2018 to 2033

Figure 107: Europe Market Value Share (%) and BPS Analysis by Form , 2023 to 2033

Figure 108: Europe Market Y-o-Y Growth (%) Projections by Form , 2023 to 2033

Figure 109: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Route of Administration:, 2018 to 2033

Figure 113: Europe Market Value Share (%) and BPS Analysis by Route of Administration:, 2023 to 2033

Figure 114: Europe Market Y-o-Y Growth (%) Projections by Route of Administration:, 2023 to 2033

Figure 115: Europe Market Attractiveness by Product, 2023 to 2033

Figure 116: Europe Market Attractiveness by Source, 2023 to 2033

Figure 117: Europe Market Attractiveness by Form , 2023 to 2033

Figure 118: Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Europe Market Attractiveness by Route of Administration:, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Form , 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) by Route of Administration:, 2023 to 2033

Figure 126: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 128: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: South Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 134: South Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 135: South Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 136: South Asia Market Value (US$ Million) Analysis by Form , 2018 to 2033

Figure 137: South Asia Market Value Share (%) and BPS Analysis by Form , 2023 to 2033

Figure 138: South Asia Market Y-o-Y Growth (%) Projections by Form , 2023 to 2033

Figure 139: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 140: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: South Asia Market Value (US$ Million) Analysis by Route of Administration:, 2018 to 2033

Figure 143: South Asia Market Value Share (%) and BPS Analysis by Route of Administration:, 2023 to 2033

Figure 144: South Asia Market Y-o-Y Growth (%) Projections by Route of Administration:, 2023 to 2033

Figure 145: South Asia Market Attractiveness by Product, 2023 to 2033

Figure 146: South Asia Market Attractiveness by Source, 2023 to 2033

Figure 147: South Asia Market Attractiveness by Form , 2023 to 2033

Figure 148: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 149: South Asia Market Attractiveness by Route of Administration:, 2023 to 2033

Figure 150: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Form , 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Route of Administration:, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 158: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 163: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 164: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 165: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 166: East Asia Market Value (US$ Million) Analysis by Form , 2018 to 2033

Figure 167: East Asia Market Value Share (%) and BPS Analysis by Form , 2023 to 2033

Figure 168: East Asia Market Y-o-Y Growth (%) Projections by Form , 2023 to 2033

Figure 169: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 170: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: East Asia Market Value (US$ Million) Analysis by Route of Administration:, 2018 to 2033

Figure 173: East Asia Market Value Share (%) and BPS Analysis by Route of Administration:, 2023 to 2033

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration:, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 176: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 177: East Asia Market Attractiveness by Form , 2023 to 2033

Figure 178: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 179: East Asia Market Attractiveness by Route of Administration:, 2023 to 2033

Figure 180: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Product, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Source, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Form , 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Route of Administration:, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 191: Oceania Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 192: Oceania Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 193: Oceania Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 194: Oceania Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 195: Oceania Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 196: Oceania Market Value (US$ Million) Analysis by Form , 2018 to 2033

Figure 197: Oceania Market Value Share (%) and BPS Analysis by Form , 2023 to 2033

Figure 198: Oceania Market Y-o-Y Growth (%) Projections by Form , 2023 to 2033

Figure 199: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Route of Administration:, 2018 to 2033

Figure 203: Oceania Market Value Share (%) and BPS Analysis by Route of Administration:, 2023 to 2033

Figure 204: Oceania Market Y-o-Y Growth (%) Projections by Route of Administration:, 2023 to 2033

Figure 205: Oceania Market Attractiveness by Product, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Source, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Form , 2023 to 2033

Figure 208: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Route of Administration:, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 212: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 213: MEA Market Value (US$ Million) by Form , 2023 to 2033

Figure 214: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 215: MEA Market Value (US$ Million) by Route of Administration:, 2023 to 2033

Figure 216: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 217: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 221: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 222: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 223: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 224: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 225: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 226: MEA Market Value (US$ Million) Analysis by Form , 2018 to 2033

Figure 227: MEA Market Value Share (%) and BPS Analysis by Form , 2023 to 2033

Figure 228: MEA Market Y-o-Y Growth (%) Projections by Form , 2023 to 2033

Figure 229: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 232: MEA Market Value (US$ Million) Analysis by Route of Administration:, 2018 to 2033

Figure 233: MEA Market Value Share (%) and BPS Analysis by Route of Administration:, 2023 to 2033

Figure 234: MEA Market Y-o-Y Growth (%) Projections by Route of Administration:, 2023 to 2033

Figure 235: MEA Market Attractiveness by Product, 2023 to 2033

Figure 236: MEA Market Attractiveness by Source, 2023 to 2033

Figure 237: MEA Market Attractiveness by Form , 2023 to 2033

Figure 238: MEA Market Attractiveness by Application, 2023 to 2033

Figure 239: MEA Market Attractiveness by Route of Administration:, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceutical Excipient SNAC Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Zinc Powder Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Manufacturing Equipment Market Forecast and Outlook 2025 to 2035

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Pharmaceutical Grade Sodium Carbonate Market Forecast and Outlook 2025 to 2035

Pharmaceutical Industry Analysis in Saudi Arabia Forecast and Outlook 2025 to 2035

Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Pots Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Pouch Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Unit Dose Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Mini Batch Blender Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Continuous Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Liquid Prefilters Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade P-Toluenesulfonic Acid Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Container Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA