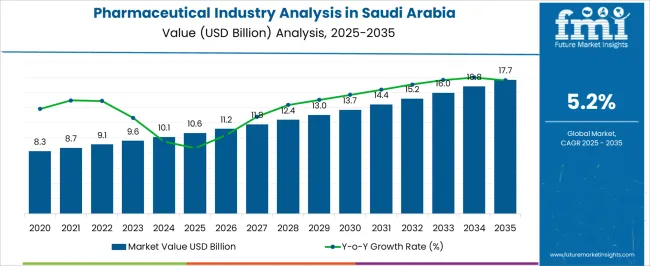

The Pharmaceutical Industry Analysis in Saudi Arabia is estimated to be valued at USD 10.6 billion in 2025 and is projected to reach USD 17.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

The pharmaceutical industry in Saudi Arabia is undergoing robust expansion driven by rising healthcare expenditure, supportive government initiatives, and a growing burden of chronic diseases. Increasing investment in local manufacturing and regulatory reforms under Vision 2030 are transforming the market landscape. Demand for advanced therapeutics, biologics, and specialty drugs is being strengthened by improved access to healthcare facilities and expanding insurance coverage.

Strategic collaborations between multinational and domestic firms are enhancing production capacity and technology transfer. The future outlook remains positive as policy emphasis on self-sufficiency, coupled with the development of research-driven pharmaceutical zones, is expected to accelerate growth.

Expanding healthcare infrastructure and digitalization initiatives are also improving supply chain efficiency and patient access The growth rationale is supported by strong demand for prescription-based therapies, the prevalence of lifestyle-related diseases, and the continuous modernization of retail and hospital distribution networks, collectively driving sustainable market performance across the Kingdom.

| Metric | Value |

|---|---|

| Pharmaceutical Industry Analysis in Saudi Arabia Estimated Value in (2025 E) | USD 10.6 billion |

| Pharmaceutical Industry Analysis in Saudi Arabia Forecast Value in (2035 F) | USD 17.7 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

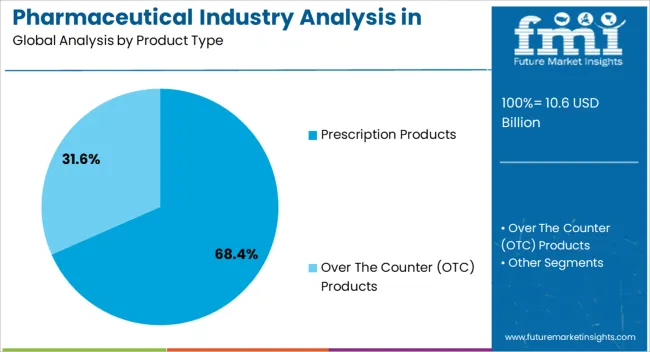

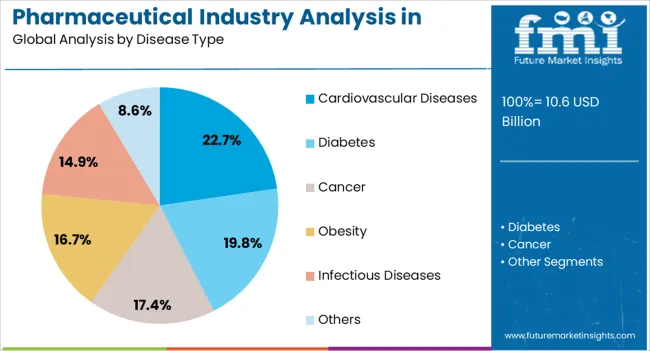

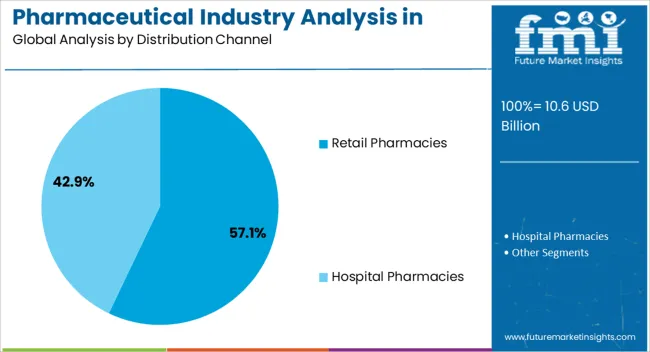

The market is segmented by Product Type, Disease Type, and Distribution Channel and region. By Product Type, the market is divided into Prescription Products and Over The Counter (OTC) Products. In terms of Disease Type, the market is classified into Cardiovascular Diseases, Diabetes, Cancer, Obesity, Infectious Diseases, and Others. Based on Distribution Channel, the market is segmented into Retail Pharmacies and Hospital Pharmacies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The prescription products segment, holding 68.40% of the product type category, is leading the Saudi Arabian pharmaceutical market due to increasing demand for advanced and regulated therapies. Rising prevalence of chronic and complex conditions has necessitated prescription-based interventions, ensuring strong demand through hospital and clinical channels.

Regulatory frameworks supporting safe drug dispensing and physician-led treatment protocols have further reinforced market dominance. Pharmaceutical companies are prioritizing high-value therapeutic categories, focusing on biologics, oncology, and cardiovascular medications to strengthen their portfolios.

Increased healthcare funding and national health awareness programs are supporting wider access to prescription drugs Continuous R&D investments and the introduction of innovative treatment options are expected to sustain the segment’s share while maintaining its leadership position across both public and private healthcare systems.

The cardiovascular diseases segment, representing 22.70% of the disease type category, has remained dominant due to the high incidence of hypertension, obesity, and diabetes among the Saudi population. Increasing government initiatives for preventive healthcare and early disease management are driving consistent pharmaceutical demand.

Strong awareness programs and improved diagnostic capabilities are enhancing early intervention and treatment rates. The availability of advanced cardiovascular medications and improved patient monitoring systems are reinforcing this segment’s prominence.

Growth is also supported by evolving healthcare infrastructure and the expansion of specialist cardiology centers across major cities Pharmaceutical manufacturers are focusing on introducing next-generation therapies and fixed-dose combinations to improve treatment adherence, thereby ensuring continued dominance of cardiovascular drugs within the overall market landscape.

The retail pharmacies segment, accounting for 57.10% of the distribution channel category, has emerged as the leading distribution network due to its extensive accessibility and consumer trust. Widespread pharmacy chains across urban and semi-urban areas have improved product reach and patient convenience. Regulatory reforms have strengthened pharmacy licensing, ensuring quality control and compliance in drug dispensing.

Increasing consumer preference for convenient purchasing and personalized consultation has enhanced retail pharmacy traffic. The segment’s performance is also being supported by e-pharmacy adoption, online ordering platforms, and digital health integration.

Strategic partnerships between pharmaceutical manufacturers and pharmacy operators are optimizing inventory management and delivery efficiency Continued expansion of organized retail networks and digitalized pharmacy services is expected to sustain the segment’s leadership and support consistent growth in the Saudi pharmaceutical market.

| Attributes | Details |

|---|---|

| Historical CAGR (2020 to 2025) | 9.0% |

| Forecasted CAGR (2025 to 2035) | 5.20% |

The Saudi Arabian pharmaceutical industry expanded at a 9.0% CAGR from 2020 to 2025. The Saudi government has aggressively promoted economic diversification and the growth of the healthcare industry. Initiatives like Vision 2035, unveiled in 2020, attempt to minimize the Kingdom’s reliance on oil while also focusing on developing a more varied and sustainable economy. The expansion of the pharmaceutical sector in Saudi Arabia is facilitated by investments in research and development as well as infrastructure related to healthcare.

Saudi Arabia's population is expanding quickly, and the country is seeing a rise in the frequency of chronic illnesses and pharmaceutical products. Due to the expanding healthcare demands, pharmaceutical firms now have more opportunities to grow and satisfy the demand for drugs.

By enacting reforms, Saudi Arabia has liberalized its economy and opened it up to international investment, particularly in the pharmaceutical industry. As a result, more foreign pharmaceutical businesses are now present in the Saudi pharmaceutical sector, contributing knowledge, funds, and technology.

Access to healthcare services has increased throughout Saudi Arabia due to investments in the country's healthcare infrastructure, which includes clinics, hospitals, and pharmacies. As a result, there is now a greater need than ever for pharmaceuticals to satisfy the demands of an expanding patient base.

The demand for pharmaceuticals in Saudi Arabia is predicted to rise at 5.20% through 2035. Although the growth rate is lower than the historical period, ongoing investments in healthcare infrastructure are likely to bolster pharmaceutical demand in Saudi Arabia.

Saudi Arabia can anticipate an increase in medical tourism as the nation works to establish itself as a regional center for healthcare. As a result, pharmaceutical enterprises are going to have more chances to offer medical services and goods to a global patient population.

| Leading Drug Type for Pharmaceuticals in Saudi Arabia | Branded Drugs |

|---|---|

| Total Value Share (2025) | 72% |

Eighty percent of Saudi Arabia's pharmaceuticals are imported from foreign nations. Merely thirty percent of Saudi Arabia's medicines and a small fraction of branded medication output are domestically manufactured. Branded drugs from various leading giants are highly preferred in Saudi Arabia due to their perceived quality and efficacy over generic drugs.

Even when generic medications have the same active components as their branded equivalents, consumers tend to see branded medications as more inventive and potent. In economies where consumers place a premium on perceived efficacy, the notion that branded medications provide better outcomes can increase demand.

Certain pharmaceutical firms provide patients discounts or financial help through their loyalty programs or assistance programs for branded medications. These initiatives affect patient decisions and raise the demand for branded pharmaceuticals.

| Leading Drug Class for Pharmaceuticals in Saudi Arabia | Small Molecules |

|---|---|

| Total Value Share (2025) | 86% |

It is normal practice to treat common health issues, including infections, diabetes, and cardiovascular illnesses, with small molecules. Since these illnesses are becoming more common in Saudi Arabia, there is likely to be an enormous demand for small-molecule medications that target these medical disorders.

Small molecule medications are often accessible and available, particularly in generic form. When it comes to healthcare systems that strive for universal coverage and availability of pharmaceutical treatments, this accessibility guarantees a consistent supply of necessary pharmaceuticals, which adds to their appeal.

Complex biologics are typically more expensive to develop than small molecules, especially generic variants. Small molecules' affordability fuels demand in healthcare systems where cost is an integral factor, particularly when treating common health issues.

Regulatory bodies around the globe, including Saudi Arabia, typically have well-defined procedures implemented for examining and approving small molecule medications. Small molecules are in high demand in this sector because their regulatory routes are well-known, which helps speed up and simplify the clearance procedure.

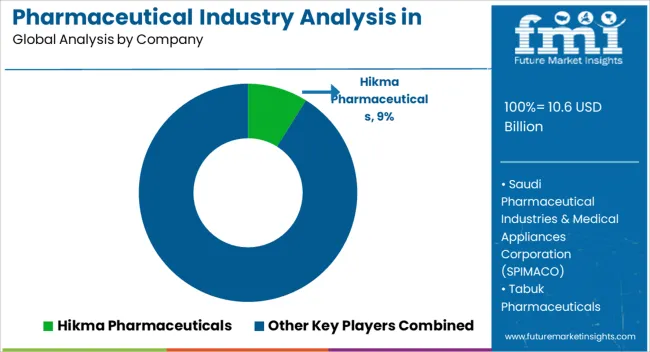

The pharmaceutical industry in Saudi Arabia is marked by a competitive and dynamic environment that both domestic and foreign firms fuel. Various businesses compete for dominance in this industry, hoping to take advantage of the nation's changing healthcare requirements.

Companies like Tabuk Pharmaceuticals, Jamjoom Pharma, and Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO) are important participants in the domestic market and significantly affect the sector's expansion. These businesses use their knowledge of the local market, well-established distribution networks, and compliance with laws and regulations to stay one step ahead of the competition.

Strategies for Key Players to Tap into Potential Growth Opportunities

Recent Developments:

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 10.6 billion |

| Projected Industry Size in 2035 | USD 17.7 billion |

| Anticipated CAGR between 2025 to 2035 | 5.2% CAGR |

| Historical Analysis of Demand for Pharmaceuticals in Saudi Arabia | 2020 to 2025 |

| Demand Forecast for Pharmaceuticals in Saudi Arabia | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing Pharmaceuticals Adoption in Saudi Arabia, Insights on Global Players and their Industry Strategy in Saudi Arabia, Ecosystem Analysis of Local and Regional Saudi Arabia Manufacturers |

| Key Companies Profiled | Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO); Tabuk Pharmaceuticals; Hikma Pharmaceuticals; Julphar Saudi Arabia; Jamjoom Pharma; Modern Pharmaceutical Company (MPC); Ameco Pharmaceutical Company; Tadawi; Al Nahdi Medical Company; Sipco (Saudi Industrial Products Company) |

The global pharmaceutical industry analysis in saudi arabia is estimated to be valued at USD 10.6 billion in 2025.

The market size for the pharmaceutical industry analysis in saudi arabia is projected to reach USD 17.7 billion by 2035.

The pharmaceutical industry analysis in saudi arabia is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in pharmaceutical industry analysis in saudi arabia are prescription products, _branded drugs, _generic drugs and over the counter (otc) products.

In terms of disease type, cardiovascular diseases segment to command 22.7% share in the pharmaceutical industry analysis in saudi arabia in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Saudi Arabia Hajj Tourism Market Forecast and Outlook 2025 to 2035

Pharmaceutical Glass Container Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Cold Chain Packaging Industry Analysis in United States - Size, Share, and Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Drinking Water in Saudi Arabia Forecast and Outlook 2025 to 2035

Pharmaceutical Autoclave Machine Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Excipient SNAC Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Outbound Tourism in Germany Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Zinc Powder Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Manufacturing Equipment Market Forecast and Outlook 2025 to 2035

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Pharmaceutical Grade Sodium Carbonate Market Forecast and Outlook 2025 to 2035

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Pots Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Pouch Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA