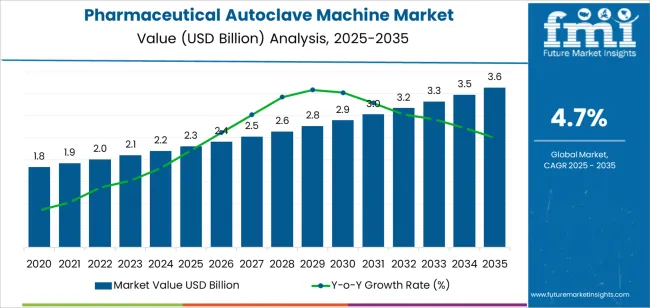

The pharmaceutical autoclave machine market is valued at USD 2.3 billion in 2025 and is forecasted to reach USD 3.6 billion by 2035, advancing at a CAGR of 4.7%. Market growth is driven by increasing sterilization requirements in pharmaceutical manufacturing, rising production of biologics and injectable drugs, and stricter regulatory compliance for aseptic processing. The expansion of research laboratories and cleanroom facilities, coupled with automation in sterilization cycles, continues to strengthen demand for advanced autoclave systems designed for precision, reliability, and validation consistency.

Fixed autoclave systems represent the leading product segment, favored for their large-capacity chambers, programmable control systems, and compatibility with high-volume sterilization of instruments, glassware, and biopharmaceutical components. These systems provide superior pressure and temperature uniformity, ensuring microbial inactivation in critical production environments. Technological advancements in steam generation, monitoring sensors, and data traceability are improving process efficiency and compliance with GMP and FDA standards.

Asia Pacific leads global market growth, supported by rapid expansion of pharmaceutical manufacturing in China and India. Europe and North America maintain steady demand through established sterilization standards and continuous modernization of production facilities. Key players include STERIS, Getinge, Steelco, Wego Medical, Miele, Fedegari, Tuttnauer, and 3M, focusing on automation integration, cycle optimization, and energy-efficient sterilization solutions.

The pharmaceutical autoclave machine market is projected to expand from USD 2.3 billion in 2025 to USD 3.6 billion by 2035, creating an absolute dollar opportunity of approximately USD 1.3 billion during the forecast period. This incremental value reflects consistent demand for high-capacity sterilization equipment driven by pharmaceutical manufacturing, laboratory research, and biotechnology applications. From 2025 to 2030, a major portion of this opportunity will arise from facility expansions and compliance upgrades to meet Good Manufacturing Practice (GMP) and regulatory sterilization standards. The growing focus on contamination control in vaccine and biologics production will further accelerate equipment replacement cycles.

Between 2030 and 2035, the remaining opportunity will stem from process optimization, digital integration, and the adoption of automated validation systems within production facilities. Emerging markets in Asia-Pacific and Latin America will contribute a significant share of incremental growth through investments in pharmaceutical infrastructure. The absolute dollar opportunity highlights the market’s steady expansion potential supported by modernization of sterile processing environments, increased throughput requirements, and the continuous evolution of energy-efficient and programmable autoclave systems in the global pharmaceutical sector.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.3 billion |

| Market Forecast Value (2035) | USD 3.6 billion |

| Forecast CAGR (2025-2035) | 4.7% |

The pharmaceutical autoclave machine market is growing as regulatory and quality-assurance demands increase for sterilisation of equipment, containers and process tools in drug manufacturing facilities. Autoclaves are required to deliver validated steam sterilisation cycles that ensure microbial inactivation and bioburden reduction for pharmaceutical production systems, including single-use logistics, glass vials and lyophilisation equipment. Expansion in biologics, vaccines and aseptic fill-finish operations drives investment in larger capacity and higher precision autoclave machines.

Stricter compliance with good manufacturing practice (GMP), ISO standards and regulatory inspections encourages upgrades to modern autoclave models with digital cycle monitoring, traceable data logging and automated validation sequences. Emerging markets investing in pharmaceutical-manufacturing infrastructure further raise demand for autoclave machines designed for clean-room and containment environments. Constraints include high acquisition and validation cost of pharmaceutical-grade autoclaves, long installation and qualification timeframes, and competition from alternate sterilisation technologies such as dry-heat, hydrogen peroxide vapour or gamma irradiation.

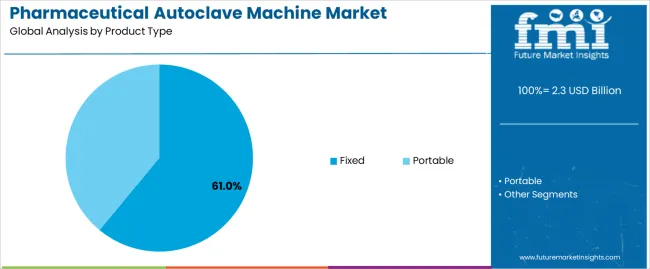

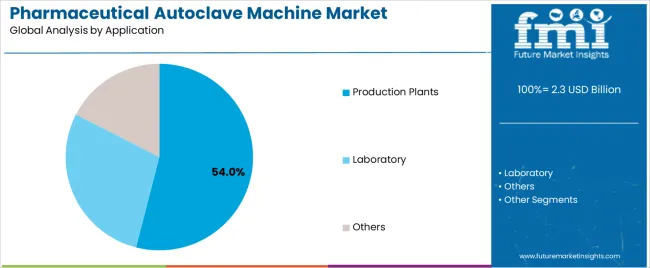

The Pharmaceutical Autoclave Machine Market is segmented by product type and application. By product type, the market is divided into fixed and portable autoclaves. Based on application, it is categorized into production plants, laboratories, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

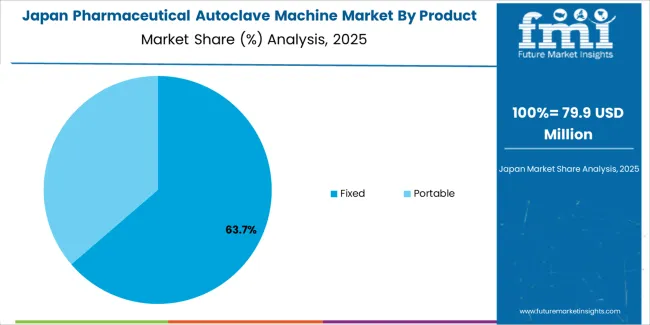

The fixed segment holds the leading position in the pharmaceutical autoclave machine market, representing an estimated 61.0% of total market share in 2025. Fixed autoclave systems are predominantly installed in large-scale pharmaceutical manufacturing facilities for sterilization of production equipment, culture media, and reusable instruments under high-pressure steam conditions. These units provide superior sterilization uniformity, automation compatibility, and capacity for continuous operation compared to portable models.

The dominance of this segment is supported by growing regulatory focus on validated sterilization procedures across pharmaceutical production environments. Fixed autoclaves are designed to meet stringent Good Manufacturing Practice (GMP) and ISO sterilization standards, ensuring contamination control and consistent product quality. The portable segment, estimated at 39.0%, remains significant in laboratories, small-scale production facilities, and research institutions where mobility and space efficiency are key considerations.

Key factors supporting the fixed segment include:

The production plants segment accounts for approximately 54.0% of the pharmaceutical autoclave machine market in 2025. This dominance reflects the widespread adoption of autoclave sterilization in pharmaceutical and biopharmaceutical manufacturing processes, where sterilization of equipment, glassware, and liquid media is critical to maintaining aseptic production conditions.

The laboratory segment follows, representing an estimated 34.0% share, supported by the need for consistent sterilization in analytical testing, microbiological research, and pharmaceutical development. Laboratory-scale autoclaves are extensively used for decontaminating culture media, instruments, and biological waste. The others category, accounting for about 12.0%, includes hospitals, diagnostic centers, and contract sterilization facilities.

Primary dynamics driving demand from the production plants segment include:

Increasing pharmaceutical production, stringent sterilisation standards for drug manufacture, and growing biologics/vaccine manufacturing requirements are accelerating market growth.

The pharmaceutical autoclave machine market is propelled by expanding global pharmaceutical manufacturing, driven by higher demand for sterile injectable drugs, vaccines and biologics which require validated sterilisation processes. Regulatory authorities impose rigorous sterilisation protocols, including defined cycle parameters, documentation and traceability, which elevates the need for specialised autoclave equipment. Technological advances in machine design (such as vacuum-assisted steam, rapid cycle times and integrated monitoring systems) improve throughput, compliance and operational reliability within pharmaceutical production lines.

High capital cost, complex validation requirements, and long equipment lifecycles limit rapid adoption.

Autoclave machines for pharmaceutical use involve substantial capital investment, including chambers capable of meeting specific pressure/temperature profiles and integrated instrumentation for process recording, which may restrict procurement especially for smaller manufacturers. Each installed machine must undergo qualification (IQ/OQ/PQ) and regulatory validation, adding time and cost before full operation. The long service life of established autoclave systems reduces replacement cycles, which can slow market refresh rates in mature markets.

Smart automation, modular configuration for multi-format production, and growth in emerging manufacturing regions define market direction.

Manufacturers are increasingly offering autoclave machines with digital controls, remote monitoring, and data analytics for predictive maintenance and traceable sterilisation. Modular autoclave systems capable of handling different load sizes, multiple product formats and rapid reconfiguration are rising in demand to accommodate agile production environments. Regionally, growth is strongest in Asia-Pacific and Latin America, where pharmaceutical manufacturing capacity is expanding, regulatory frameworks are strengthening and demand for vaccines and biologics is growing.

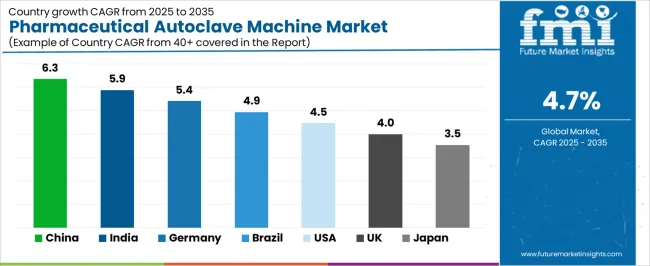

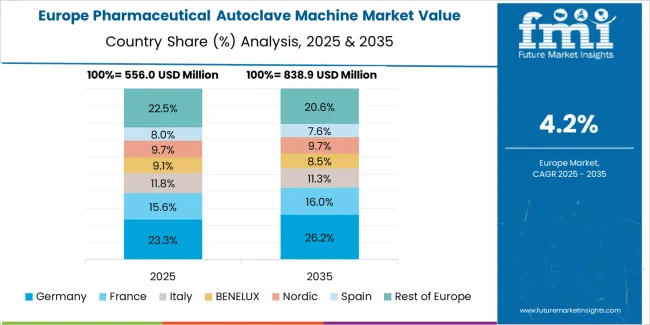

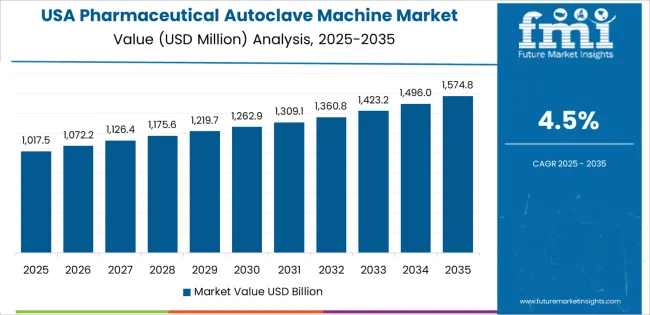

The global pharmaceutical autoclave machine market is expanding steadily through 2035, supported by growing biopharmaceutical production, sterilization standards, and advances in equipment automation. China leads with a 6.3% CAGR, followed by India at 5.9%, reflecting expanding drug manufacturing capacity and healthcare infrastructure. Germany grows at 5.4%, driven by precision engineering and regulatory compliance in sterile processing. Brazil records 4.9%, supported by public healthcare expansion and localized production. The United States grows at 4.5%, led by innovation in automation and validation systems, while the United Kingdom (4.0%) and Japan (3.5%) sustain stable growth through R&D integration and quality control advancements.

| Country | CAGR (%) |

|---|---|

| China | 6.3 |

| India | 5.9 |

| Germany | 5.4 |

| Brazil | 4.9 |

| USA | 4.5 |

| UK | 4.0 |

| Japan | 3.5 |

China’s pharmaceutical autoclave machine market grows at 6.3% CAGR, driven by the expansion of drug manufacturing facilities and stricter regulatory requirements for sterile production. The Made in China 2025 initiative promotes equipment modernization and domestic manufacturing of high-pressure sterilization systems. Local autoclave producers are investing in PLC-controlled systems and stainless steel chamber design improvements. Growing biopharmaceutical research accelerates adoption in vaccine and biologics facilities. Integration with data logging and process validation software enhances compliance with GMP (Good Manufacturing Practice) standards.

Key Market Factors:

India’s market grows at 5.9% CAGR, supported by expansion in generic drug production and contract manufacturing. The Pharma Vision 2030 and Make in India initiatives encourage domestic production of sterilization equipment. Manufacturers are focusing on energy-efficient, high-capacity autoclaves with programmable sterilization cycles. Growth in biopharmaceutical plants and hospital-based research centers increases equipment demand. Local firms collaborate with global technology suppliers to improve temperature uniformity and validation control systems. Enhanced export activity to Africa and Southeast Asia supports scaling of production capacity.

Market Development Factors:

Germany’s market grows at 5.4% CAGR, supported by advanced engineering standards, strict sterilization regulations, and precision manufacturing. Compliance with EU GMP and EN 285 standards drives demand for high-reliability autoclave systems. German manufacturers specialize in vacuum-assisted and continuous sterilization technologies. The rise of biopharmaceutical contract manufacturing and laboratory automation supports high-throughput autoclave installations. Integration of IoT-based monitoring systems enhances process validation and traceability. Government-backed investment in life sciences research facilities continues to drive long-term market demand.

Key Market Characteristics:

Brazil’s market grows at 4.9% CAGR, driven by healthcare sector expansion, public pharmaceutical programs, and local industrial manufacturing. The National Health Industrial Complex (NHIC) supports investment in pharmaceutical production and supporting equipment. Manufacturers are adopting vertical and horizontal autoclaves suited for small- and medium-scale facilities. Import substitution policies encourage localized assembly and component sourcing. Rising vaccine and antibiotic production reinforces sterilization system demand. Government investment in clinical infrastructure modernization supports continuous equipment upgrades.

Market Development Factors:

The United States grows at 4.5% CAGR, supported by strict regulatory compliance, innovation in automation, and bioprocess expansion. The Food and Drug Administration (FDA) mandates validated sterilization for all aseptic manufacturing environments. Manufacturers are integrating digital control systems, automated loading, and data-driven quality verification tools. Adoption of high-capacity autoclaves in biopharmaceutical production and clinical laboratories is increasing. Innovation in chamber design, load efficiency, and heat distribution ensures uniform sterilization outcomes. The use of advanced materials such as corrosion-resistant alloys improves system longevity.

Key Market Factors:

The United Kingdom’s market grows at 4.0% CAGR, supported by expanding pharmaceutical R&D, laboratory automation, and GMP compliance initiatives. The UK Life Sciences Vision promotes modernization of research and manufacturing facilities. Domestic and European equipment suppliers provide advanced autoclaves with programmable pressure cycles and process validation software. Growth in biologics manufacturing and academic laboratories drives consistent demand. Integration of cloud-based monitoring platforms ensures traceable sterilization records and regulatory alignment.

Market Development Factors:

Japan’s market grows at 3.5% CAGR, reflecting precision manufacturing, pharmaceutical process standardization, and technological refinement. Domestic firms focus on compact, energy-efficient autoclaves for cleanroom and biopharmaceutical facilities. Compliance with the Pharmaceutical and Medical Device Act (PMD Act) ensures high-quality process control. R&D in material coatings and thermal uniformity enhances operational consistency. Integration of smart control systems allows remote operation and predictive maintenance. Continuous collaboration between equipment manufacturers and pharmaceutical companies promotes long-term technological advancement.

Key Market Characteristics:

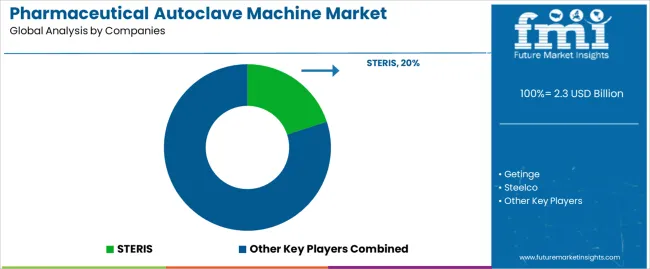

The pharmaceutical autoclave machine market is moderately consolidated, with approximately fifteen global and regional manufacturers providing sterilization systems for pharmaceutical, biotechnology, and laboratory applications. STERIS leads the market with an estimated 20.0% global share, supported by its extensive sterilization equipment portfolio, high compliance with GMP and FDA standards, and established presence in large-scale pharmaceutical manufacturing facilities. Its leadership is reinforced by advanced automation, validated process control technologies, and global service infrastructure.

Getinge, Steelco, and Fedegari follow as major competitors, focusing on high-capacity autoclave systems integrated with cleanroom and aseptic production environments. Their competitive strengths lie in process repeatability, customized chamber design, and documentation traceability for regulatory audits. Tuttnauer, Belimed, and MATACHANA maintain strong positions through modular mid-scale autoclaves designed for laboratories, clinical production, and contract manufacturing organizations. Wego Medical, Eryiğit, and ECMC represent key regional players, offering cost-efficient sterilization solutions tailored to emerging pharmaceutical hubs in Asia and the Middle East. 3M, Sterigenics International, and Johnson & Johnson contribute to market innovation through sterilization validation systems and integrated service offerings.

Competition in this market is defined by sterilization reliability, cycle efficiency, documentation accuracy, and equipment validation capability. Growth is driven by expanding pharmaceutical manufacturing capacity, stricter global hygiene regulations, and the adoption of automated, energy-efficient autoclave systems that ensure sterility assurance levels consistent with international standards for injectable and biological product manufacturing.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Fixed, Portable |

| Application | Production Plants, Laboratory, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | STERIS, Getinge, Steelco, Wego Medical, Miele, Fedegari, Tuttnauer, 3M, Belimed, MATACHANA, Sterigenics International, Johnson and Johnson, Consolidated Sterilizer Systems, Eryiğit, ECMC |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of pharmaceutical sterilization and autoclave equipment manufacturers; advancements in fixed and portable autoclave technology; integration with GMP-compliant sterilization processes and pharmaceutical quality assurance systems. |

The global pharmaceutical autoclave machine market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the pharmaceutical autoclave machine market is projected to reach USD 3.6 billion by 2035.

The pharmaceutical autoclave machine market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in pharmaceutical autoclave machine market are fixed and portable.

In terms of application, production plants segment to command 54.0% share in the pharmaceutical autoclave machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceutical Excipient SNAC Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Zinc Powder Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Manufacturing Equipment Market Forecast and Outlook 2025 to 2035

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Pharmaceutical Grade Sodium Carbonate Market Forecast and Outlook 2025 to 2035

Pharmaceutical Industry Analysis in Saudi Arabia Forecast and Outlook 2025 to 2035

Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Pots Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Pouch Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Unit Dose Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Mini Batch Blender Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Continuous Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Liquid Prefilters Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade P-Toluenesulfonic Acid Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Container Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA