About The Report

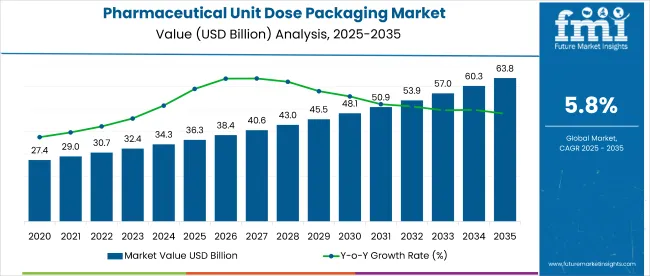

The pharmaceutical unit dose packaging market is expected to be worth about USD 3.5 billion in 2026 and is forecast to grow to USD 9.8 billion by 2036, reflecting a strong CAGR of 10.8%. This growth is closely tied to the healthcare industry’s push for safer, simpler, and more reliable ways to give patients their medications. Unit dose packaging provides each medicine in a ready to use, single serving pack, which helps reduce dosing mistakes, improves hygiene, and makes it easier for nurses, pharmacists, and patients to use medicines correctly.

Demand is rising as hospitals, clinics, and care homes look for better ways to manage large volumes of medications, especially for older patients and those with chronic illnesses. Individually packaged doses make it easier to track what has been given, lower the risk of contamination, and cut down on wasted medicines. The growing use of high value and specialty drugs is also boosting the need for secure, tamper evident packaging that protects product quality.

Producing unit dose packs is more complex and expensive than traditional bottle packaging, and it must meet very strict regulatory standards. To keep up, packaging companies are investing in faster, more automated equipment and smarter packaging features that improve efficiency, support tracking and tracing, and ensure every dose reaches the patient in a safe and reliable way.

| Metric | Value |

|---|---|

| Market Value (2026) | USD 3.5 billion |

| Market Forecast Value (2036) | USD 9.8 billion |

| Forecast CAGR (2026 to 2036) | 10.8% |

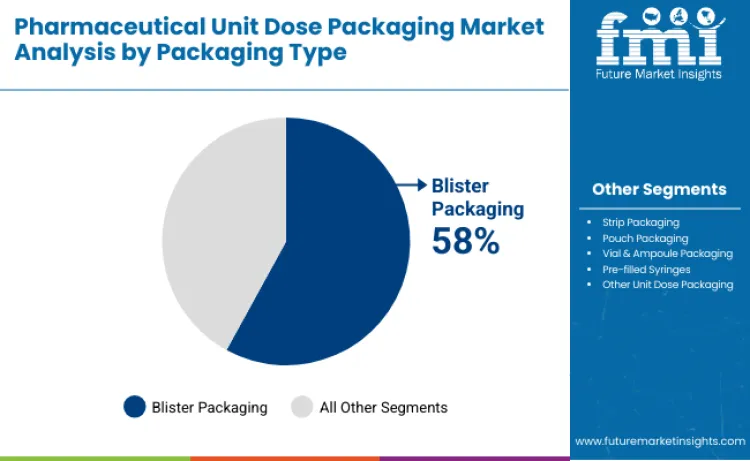

The Pharmaceutical Unit Dose Packaging Market is segmented by packaging type, material type, end use application, and region to support safe, accurate, and efficient medication dispensing. By packaging type, the industry includes blister packaging, strip packaging, pouch packaging, vial and ampoule packaging, pre filled syringes, and other unit dose formats. By material type, solutions use plastic, aluminum foil, paper and paperboard, and glass depending on protection and sterility requirements.

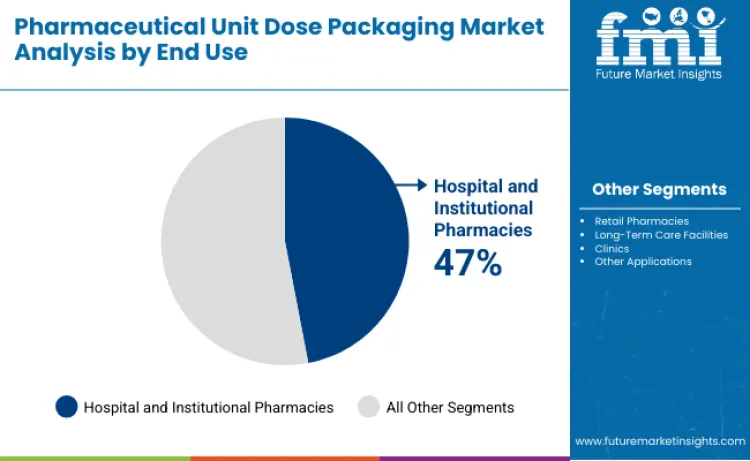

By end use application, demand comes from hospital and institutional pharmacies, retail pharmacies, long term care facilities, clinics, and other healthcare providers. Regionally, the industry covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, reflecting differences in healthcare infrastructure, regulatory standards, and medication distribution systems. This segmentation structure supports precision dosing, patient safety, and regulatory compliance across diverse healthcare environments.

Blister packaging accounts for 58% of total demand because it offers superior protection, tamper resistance, and dose visibility for a wide range of medications. Each tablet or capsule is sealed in its own cavity, protecting it from moisture, oxygen, and contamination while allowing easy identification and tracking. Healthcare providers favor blister packs because they reduce medication errors, simplify inventory management, and support patient adherence through clear labeling. Blister packaging is also highly compatible with automated dispensing and serialization systems, which are increasingly used in hospitals and pharmacies. Manufacturers continue to improve barrier films and sealing technologies, making blister packs suitable for both standard pharmaceuticals and sensitive specialty drugs, reinforcing their leading position in the unit dose packaging market.

Hospital and institutional pharmacies represent 47% of market growth because they handle large volumes of high risk and time critical medications. These settings require precise dose control, strong traceability, and strict safety standards to protect patients and avoid dispensing errors. Unit dose packaging allows hospitals to prepare and distribute medications more efficiently while maintaining accurate records for compliance and auditing. The rise of automated medication dispensing cabinets and centralized pharmacy systems further increases the use of unit dose formats. As hospitals focus more on patient safety, infection control, and workflow efficiency, they continue to be the primary drivers of demand for pharmaceutical unit dose packaging.

The Pharmaceutical Unit Dose Packaging Market is driven by the growing emphasis on medication safety, accuracy, and traceability in modern healthcare systems. Hospitals, long term care facilities, and clinics are under increasing pressure to reduce medication errors, improve patient outcomes, and comply with strict regulatory requirements, all of which favor unit dose formats.

The rising use of high value specialty drugs, biologics, and oncology therapies further increases demand for packaging that ensures precise dosing and product integrity. Key trends include the integration of smart packaging features such as serialization, barcodes, and authentication technologies that support real time tracking, anti counterfeiting, and automated dispensing. There is also strong momentum toward environmentally friendly materials, including recyclable and biodegradable films, as healthcare providers seek to reduce packaging waste.

The industry faces restraints from higher production and material costs compared to bulk packaging, increased waste generation, and complex supply chains that can impact pricing and availability. Compliance with diverse regional regulations also adds operational complexity for manufacturers.

The pharmaceutical unit dose packaging market is playing a growing role in improving how medicines are distributed and administered across healthcare systems. From 2026 to 2036, rising hospital admissions, growth in chronic disease treatment, and expansion of outpatient care are increasing demand for precise and reliable packaging. Unit dose packs reduce the risk of medication errors, improve hygiene, and simplify tracking for both hospitals and pharmacies.

Pharmaceutical companies also benefit because individually packed doses protect product integrity and support accurate labeling. Digital health systems are further increasing the value of unit dose packaging by linking each dose to patient records. These combined trends are turning unit dose packaging into a core part of modern pharmaceutical supply chains across developed and emerging markets.

| Country | CAGR |

|---|---|

| China | 12.9% |

| United States | 11.1% |

| Germany | 10.6% |

| United Kingdom | 10.3% |

| Japan | 10.0% |

China’s pharmaceutical unit dose packaging market is projected to grow at a CAGR of 12.9% from 2026 to 2036, driven by large scale healthcare expansion and rapid pharmaceutical modernization. Hospitals across major cities are shifting toward standardized medication dispensing systems that require unit dose formats. Growing use of biologics, injectables, and specialty drugs further increases the need for individual packaging. Pharmaceutical manufacturers are investing in advanced blister and sachet technologies to serve hospital pharmacies and outpatient clinics. Government efforts to improve medication safety and traceability are accelerating adoption. As China continues to upgrade its healthcare infrastructure, unit dose packaging is becoming essential for efficient drug delivery and patient protection.

The United States pharmaceutical unit dose packaging market is expected to grow at a CAGR of 11.1% from 2026 to 2036, supported by strict safety standards and a highly developed hospital network. Hospitals and long term care facilities depend on unit dose systems to minimize dispensing errors and improve workflow. Pharmaceutical companies increasingly offer ready to administer doses to meet clinical needs. Growth in home healthcare and specialty pharmacy services also supports wider use of individual packaging. Digital prescription and barcoding systems further strengthen the role of unit dose formats. Together, these factors keep the United States at the forefront of unit dose packaging adoption.

Germany’s pharmaceutical unit dose packaging market is forecast to grow at a CAGR of 10.6% from 2026 to 2036, reflecting its strong focus on medication accuracy and healthcare quality. Hospitals and pharmacies are adopting unit dose systems to improve dispensing control and reduce drug waste. Pharmaceutical manufacturers are aligning packaging with European safety and labeling standards, making unit dose formats more common. Centralized pharmacy services and hospital automation also favor individually packed medications. As Germany continues to upgrade its healthcare delivery systems, unit dose packaging is gaining importance as a reliable way to improve efficiency and patient safety.

The United Kingdom pharmaceutical unit dose packaging market is projected to grow at a CAGR of 10.3% from 2026 to 2036 as hospitals and clinics emphasize safer medication practices. NHS facilities are expanding centralized dispensing and ward level distribution systems that rely on unit dose packs. Pharmaceutical suppliers are providing more drugs in ready to use formats, helping to streamline administration. The growing burden of chronic illness and an aging population further support demand. With continued focus on safety, traceability, and efficiency, unit dose packaging is becoming a standard part of the UK healthcare supply chain.

Japan’s pharmaceutical unit dose packaging market is expected to grow at a CAGR of 10.0% from 2026 to 2036, driven by an aging population and strong emphasis on healthcare quality. Hospitals and community pharmacies use unit dose formats to ensure correct dosing and prevent contamination. Pharmaceutical companies design packaging that supports convenience and precision, especially for outpatient and home care. As Japan’s healthcare system adapts to rising demand for long term treatment, individually packaged medicines help maintain safety and efficiency. These trends allow unit dose packaging to remain an important part of Japan’s pharmaceutical infrastructure.

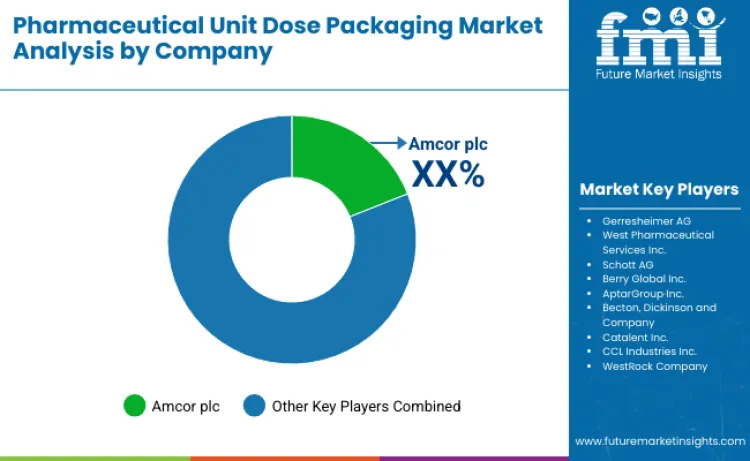

The pharmaceutical unit dose packaging market is defined by competition among a concentrated group of global healthcare packaging suppliers and medication delivery specialists that serve hospital, pharmacy, and clinical distribution channels. Unlike conventional packaging segments, this market is driven by strict regulatory oversight, patient safety requirements, and the need for accurate, tamper evident, and contamination free dosing. As a result, purchasing decisions are influenced more by compliance, reliability, and technical performance than by packaging cost alone.

Leading companies such as Amcor plc, Gerresheimer AG, West Pharmaceutical Services Inc., Schott AG, and Berry Global Inc. occupy dominant positions through their advanced materials, sterile manufacturing environments, and strong regulatory expertise. These firms supply a wide range of unit dose formats including blister packs, vials, ampoules, prefilled syringes, and sachets that protect drug stability while enabling precise and consistent dosing across hospital and retail pharmacy settings. Their global production networks and quality systems allow them to support both large pharmaceutical companies and emerging biotech manufacturers.

AptarGroup Inc. and Becton, Dickinson and Company strengthen competition by integrating packaging with drug delivery technologies such as injectors, inhalers, and dispensing systems. This combination improves patient adherence, dosing accuracy, and healthcare workflow efficiency, making these suppliers highly attractive for complex therapies and self administered medications.

Catalent Inc. and CCL Industries Inc. expand competitive intensity through contract packaging, labeling, and clinical trial services that help pharmaceutical companies manage complex regulatory and serialization requirements. WestRock Company also plays a role through secondary unit dose cartons and pharmacy automation compatible packaging that supports inventory management and automated dispensing.

As healthcare systems increasingly focus on medication safety, traceability, and individualized dosing, competitive advantage in this market will continue to favor companies that can combine material performance, regulatory readiness, and seamless integration into clinical and pharmacy workflows.

Key Players in the Pharmaceutical Unit Dose Packaging Market

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Market Size Reference | Market size in value terms |

| Market Parameter | Revenue in USD billion |

| Packaging Type | Blister packaging, strip packaging, pouch packaging, vial and ampoule packaging, pre filled syringes, other unit dose packaging |

| Material Type | Plastic, aluminum foil, paper and paperboard, glass |

| End Use Application | Hospital and institutional pharmacies, retail pharmacies, long term care facilities, clinics, other applications |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa, other regions |

| Countries Covered | United States, Germany, United Kingdom, China, Japan, and 40+ countries |

| Key Companies Profiled | Amcor plc, Gerresheimer AG, West Pharmaceutical Services Inc., Schott AG, Berry Global Inc., and other leading pharmaceutical packaging companies |

| Additional Attributes | Dollar sales by packaging type, material type, end use application, and region, regional demand trends, competitive landscape, technological advancements in materials engineering, safety design integration initiatives, quality enhancement programs, and premium product development strategies |

The global pharmaceutical unit dose packaging market is valued at USD 3.5 billion in 2026.

The pharmaceutical unit dose packaging market is projected to reach USD 9.8 billion by 2036.

The pharmaceutical unit dose packaging market is expected to grow at a CAGR of 10.8% between 2026 and 2036.

The key product types include blister packaging, strip packaging, pouch packaging, vial and ampoule packaging, pre filled syringes, and other unit dose formats.

Hospital and institutional pharmacies lead with 47% share in 2026 due to high patient volumes and strict medication safety requirements.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Pharmaceutical Unit Dose Packaging Providers

Unit Dose Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Cold Chain Packaging Industry Analysis in United States - Size, Share, and Forecast Outlook 2025 to 2035

Unit Dose Tubes Market Size and Share Forecast Outlook 2025 to 2035

Unit Dose Manufacturing Market Trends – Growth & Industry Outlook 2024-2034

Unit-Dose Respiratory Medications Market

United States Pharmaceutical Intermediate Market Trends – Size, Demand & Forecast 2025-2035

Pharmaceutical Packaging Market Analysis Size and Share Forecast Outlook 2026 to 2036

Pharmaceutical Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Packaging Equipment Market Size, Share & Forecast 2025 to 2035

Oral Dose Packaging Market Trends & Growth Forecast 2025 to 2035

Market Share Breakdown of Pharmaceutical Packaging Companies

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2026 to 2036

Competitive Breakdown of Pharmaceutical Glass Packaging Manufacturers

Biopharmaceuticals Packaging Market Growth – Forecast 2025 to 2035

The Pharmaceutical Plastic Packaging Market is segmented by Material (Polyethylene, Polypropylene, PET, PVC), End Use (Pharmaceuticals, Medical Devices, Biotechnology, Home Healthcare), and Region. Forecast for 2026 to 2036.

Market Share Breakdown of Pharmaceutical Plastic Packaging

USA Pharmaceutical Packaging Market Insights – Demand, Size & Industry Trends 2025-2035

Pharmaceutical Contract Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Pharmaceutical Contract Packaging Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.