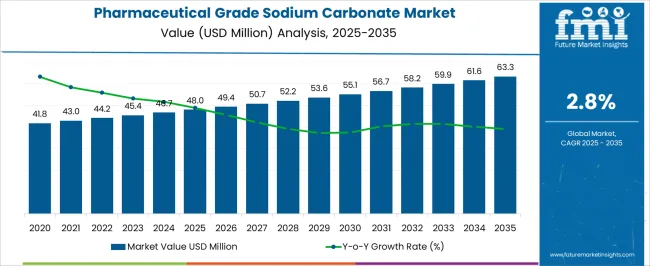

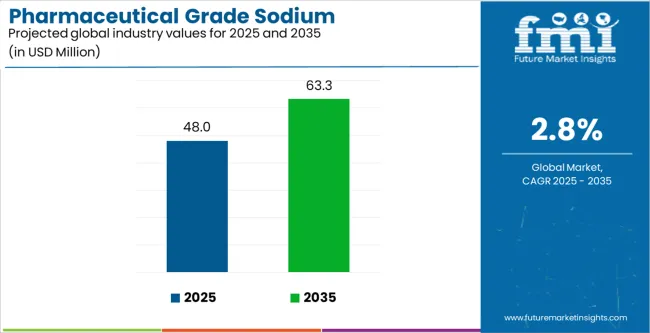

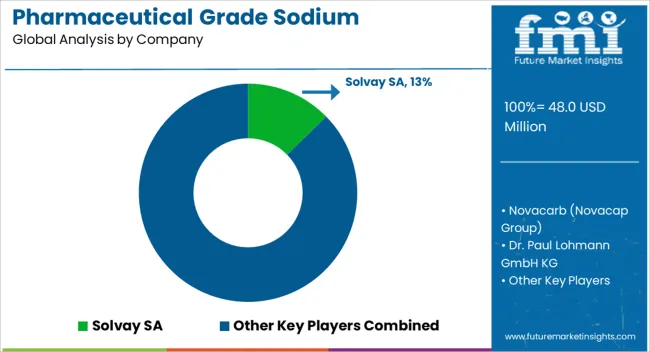

The pharmaceutical grade sodium carbonate market is projected to grow from USD 48.0 million in 2025 to USD 63.3 million by 2035, at a CAGR of 2.8%. This steady pace highlights the compound’s continued relevance in pharmaceutical excipients and formulation processes, where consistency, quality, and compliance are indispensable. Market expansion is being shaped by evolving supply and demand dynamics that are influenced by pharmaceutical manufacturing trends, regulatory frameworks, and advancements in drug development technologies. Supply-side improvements are intersecting with growing demand across established and emerging markets, creating a balanced yet competitive trajectory for the industry.

On the supply side, producers are focusing on enhancing purification technologies to deliver sodium carbonate that complies with pharmacopoeia standards such as USP, EP, and JP. Stringent regulatory expectations are pushing suppliers to maintain high-purity profiles, which in turn demand sophisticated production processes and stringent quality controls. Manufacturing facilities are also investing in process efficiencies and automation to reduce production costs while maintaining compliance. The availability of pharmaceutical grade sodium carbonate has been further influenced by the expansion of global excipient production capacities, particularly in Asia-Pacific, where lower operating costs and government-backed pharmaceutical initiatives are encouraging local manufacturing. These supply-side investments ensure that the compound remains consistently available to support large-scale drug production.

On the demand side, pharmaceutical manufacturers are increasingly seeking reliable excipients that can ensure consistent drug formulation, stability, and scalability. Sodium carbonate’s versatility in applications such as buffering, pH adjustment, and neutralization makes it essential across a wide range of drug classes. With the rise in chronic disease treatment and expanding generic drug output, demand for excipients has risen steadily, creating strong momentum for sodium carbonate consumption. The growing scale of contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs) has also added a new layer of demand, as these players require bulk and consistent supplies of high-quality excipients to meet large international contracts.

Another demand driver is the increasing pharmaceutical activity in emerging economies such as India, China, and Brazil, where investments in healthcare infrastructure and drug production are expanding rapidly. These regions are contributing to the global demand pool, supported by rising healthcare access and greater reliance on generic formulations. At the same time, mature markets in North America and Europe continue to show stable demand, driven by regulatory compliance, innovation in dosage formats, and sustained R&D spending.

| Metric | Value |

|---|---|

| Pharmaceutical Grade Sodium Carbonate Market Estimated Value in (2025 E) | USD 48.0 million |

| Pharmaceutical Grade Sodium Carbonate Market Forecast Value in (2035 F) | USD 63.3 million |

| Forecast CAGR (2025 to 2035) | 2.8% |

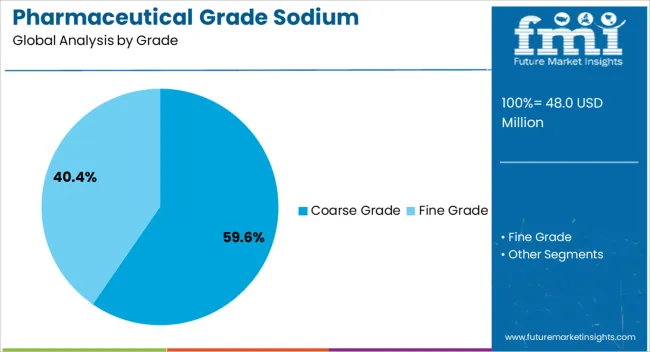

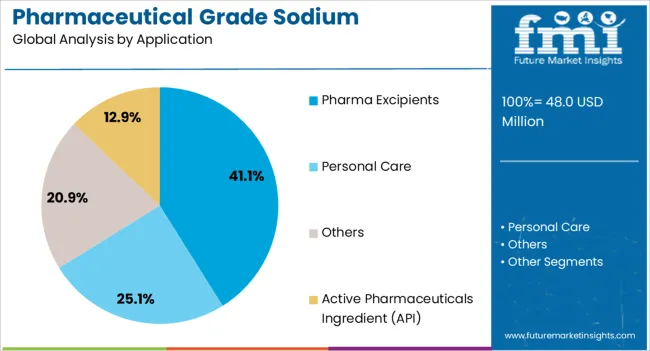

The pharmaceutical grade sodium carbonate market is segmented by Grade and Application and region. By Grade, the pharmaceutical grade sodium carbonate market is divided into Coarse Grade and Fine Grade. In terms of Application, the pharmaceutical grade sodium carbonate market is classified into Pharma Excipients, Personal Care, Others, and Active Pharmaceuticals Ingredient (API). Regionally, the pharmaceutical grade sodium carbonate market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Coarse Grade segment is projected to contribute 59.6% of the pharmaceutical grade sodium carbonate market revenue in 2025, maintaining its position as the leading grade type. This dominance has been driven by its widespread use in tablet formulation, buffering systems, and as a stabilizing agent in drug manufacturing.

Coarse grade sodium carbonate has been favored by formulators due to its superior flowability, ease of handling, and compatibility with large-scale pharmaceutical blending operations. Manufacturing process data have highlighted that this grade’s granular consistency minimizes dust generation, improving safety and operational efficiency within production facilities.

Additionally, the grade’s purity and compliance with international pharmacopoeia standards have reinforced its acceptance among major drug producers. As pharmaceutical companies continue to prioritize efficiency and quality consistency in excipient sourcing, the Coarse Grade segment is expected to sustain its growth, supported by strong adoption across both generic and branded drug manufacturing environments.

The Pharma Excipients segment is projected to hold 41.1% of the pharmaceutical grade sodium carbonate market revenue in 2025, establishing itself as the leading application category. This growth has been influenced by the compound’s critical role as a pH modifier, buffering agent, and stabilizer in numerous drug formulations.

Pharmaceutical manufacturers have increasingly utilized sodium carbonate to maintain the chemical stability of active ingredients and ensure controlled dissolution in various dosage forms. Industry reports and production audits have underscored the compound’s importance in enhancing bioavailability and formulation performance, particularly in oral and effervescent drug products.

Its use as an excipient has also been supported by favorable regulatory recognition for safety and inertness in medicinal applications. Furthermore, the rise in large-scale production of over-the-counter and prescription medications has amplified demand for high-quality excipient materials. With ongoing expansion of pharmaceutical manufacturing capacities and advancements in formulation science, the Pharma Excipients segment is expected to continue leading market adoption.

Manufacturers in Asia Cleanses the Demand for Cleaning Products

The pharmaceutical grade sodium carbonate market is thriving in Asian countries like India and China. This is due to the upsurge in demand for sodium carbonate, which is used in cleaning products. A Singaporean company named TFL, a member of AM International's green energy solutions division, produced green soda ash in November 2025. The firm uses cutting-edge carbon-capture technology, setting a global sustainable manufacturing record.

The advanced usage of cleaning products in various industries has created significant opportunities for development. The higher demand has resulted in improved profits for sodium carbonate manufacturers and has also highlighted the important role these companies play in meeting industry standards.

Global Trend of Oil Recovery and Novel Applications in Multiple Sectors

The demand for sodium carbonate is on the rise due to the recent trend of augmenting oil recovery and emerging plant capacities. Such advancements have led to a constantly evolving industry. This is further fueled by the presence of prominent companies in the oil recovery sector. To improve medicine capacity, the pharmaceutical industry needs pharmaceutical-grade sodium carbonate for drug manufacturing. This is used in toothpaste, hair colors, and skincare goods.

The pharmaceutical grade sodium carbonate market is envisioned to undergo significant shifts in the upcoming years. It continues to find new applications in the fields of chemicals and metallurgy. The demand for pharma-grade soda ash from multiple industries is anticipated to lead to a boom in the sector, creating opportunities for industry participants.

Food and Beverage Sector Ferments the Demand for Pharma-grade Sodium Carbonate

Sodium carbonate of pharmaceutical grade, commonly known as soda ash or washing soda, has recently been more used in the food and drink industry. Specifically, the substance has found common applications in the manufacture of soft drinks and beer. The effectiveness of sodium carbonate in its applications is due to its capability to regulate the pH levels of beverages. This leads to an improved taste of the product and makes the output more stable.

Sales of pharmaceutical-grade sodium carbonate are also boosted as a powerful cleaning agent that effectively removes impurities and contaminants from the brewing process. The use in the food and beverage industry has been demonstrated to be both effective and safe, highlighting the integral role in enhancing the quality and consistency of widely consumed products such as craft beer.

The global demand for pharmaceutical-grade sodium carbonate has historically developed at a CAGR of 2.3%. However, the sales of pharma-grade sodium carbonate have started to advance at a slightly better pace, displaying a CAGR of 2.8% from 2025 to 2035.

The global pandemic had a crucial effect on the healthcare sector, which raised the need for pharmaceuticals and sodium carbonate of pharmaceutical grade. Post-pandemic sales are anticipated to rise despite the reduced production capabilities of the biopharma companies. Researchers have started to develop novel ways to induce sodium carbonate in multiple medications. Several regional governments admire such endeavors, and key players have contributed to further research.

The use of sodium carbonate has seen a rise in demand, particularly from the pharmaceutical industry. It is used as an Active Pharmaceutical Ingredient (API) in drug synthesis to increase the capacity of medicine. This has improved sales of pharmaceutical-grade sodium carbonate.

The demand for customized medicines has led to the developed use of sodium carbonate in medication production. Research and development have broadened the applications of sodium carbonate due to the anticipated increase in demand between 2025 and 2035.

The high cost of procurement and manufacture is limiting the potential of the pharmaceutical grade sodium carbonate market. This may impede the growth of the sodium carbonate industry in the coming years. Nevertheless, the demand for better medicines is projected to helm the development of the pharmaceutical grade sodium carbonate market in the long run.

The following section depicts the development of the pharmaceutical-grade sodium carbonate sectors in different regions. According to recent findings, the demand for pharmaceutical-grade sodium carbonate from China and India is highlighting prominent progress in the forthcoming decade. The demand from Japan and Germany is establishing their consumer base in the global market. The industry in the United States is progressing toward maturation.

| Countries | CAGR 2025 to 2035 |

|---|---|

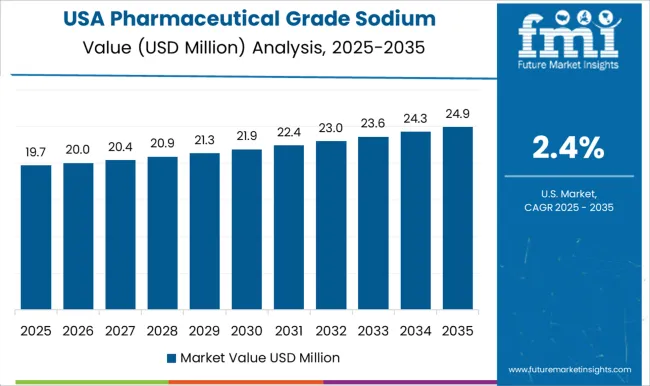

| United States | 1.6% |

| Germany | 1.3% |

| Japan | 1.2% |

| China | 3.1% |

| India | 4.1% |

The United States pharmaceutical grade sodium carbonate market is envisioned to register a CAGR of 1.6% between 2025 and 2035. Manufacturers in the consumer goods industry are increasingly recognizing the advantages of using pharma-grade sodium carbonate as the demand for organic consumer goods products rises. These products include soaps, bathing salts, detergents, and other household cleaning agents.

The demand for pharma grade sodium carbonate is likely to continue growing in the United States over the next decade as more manufacturers aim to create and sell organic consumer goods that are safe, effective, and eco-friendly.

To develop the business in the United States, manufacturers are using various trade techniques. For instance, Solvay and Vancouver Bulk Terminal collaborated in October 2025 to build a soda ash shipping facility in the United States, redeveloping Terminal 2, Berth 7, at the Port of Vancouver.

China, considered a prime manufacturing industry, is predicted to experience a 3.1% CAGR in pharmaceutical grade sodium carbonate market from 2025 to 2035. This is helmed by its robust manufacturing sector and significant role as a key supplier of pharmaceutical drug raw materials.

Chinese suppliers are enhancing production capacity to meet global demand for sodium carbonate. This pharmaceutical-grade substance is used in medicines such as antacids, antibiotics, and painkillers. The government's support and international investments in the pharmaceutical industry have boosted exports, a trend expected to continue.

India's rapid urbanization and industrialization are pushing the pharmaceutical grade sodium carbonate market growth, with a projected 4.1% CAGR through 2035. Pharmaceutical soap and detergents, healthcare activities, residential, chemical, and industrial sectors contrive regional growth. India's profitability for pharmaceutical-grade sodium carbonate is due to expansion in research, food processing, and paper industries, making it a profitable province.

Details on the apex industrial segments are provided in the next section. Coarse pharmaceutical grade sodium carbonate is estimated to have a 59.6% revenue share of the industry, depending on the product's grade. Furthermore, in 2025, pharma excipients are projected to account for 41.1% of the pharmaceutical grade sodium carbonate market.

| Segment | Coarse Pharmaceutical Grade Sodium Carbonate (Grade) |

|---|---|

| Value Share (2025) | 59.6% |

The global revenue share of coarse pharmaceutical grade sodium carbonate is anticipated to account for 59.6% in 2025 due to the rising demand from multiple pharmaceutical companies. The segment is foreseen to thrive due to the superior suitability of coarse-grade soda ash for research and development.

The demand for coarse sodium carbonate is envisioned to be widespread, particularly in the pharmaceutical industry. This is constantly used for researching treatments for cardiovascular disease (CVD). The demand for coarse grade sodium carbonate is significant because of its application in various medical applications, including the production of antacids, analgesics, and anti-inflammatory medications.

| Segment | Pharma Excipients (Application) |

|---|---|

| Value Share (2025) | 41.1% |

Due to enhanced development and research efforts by key organizations, pharmaceutical-grade sodium carbonate is a versatile chemical component that is in great demand in the pharmaceutical business.

The substance is mostly used to make pharmaceutical excipients, which are anticipated to account for 41.1% of the industry. The authority is projected to last since many pharmaceutical firms utilize these excipients extensively.

Pharmaceutical-grade sodium carbonate is predicted to grasp a rise in sales. This is due to its flexibility as a drug enhancer and excipient, enhancing bioavailability and stability, and acting as a buffering agent to maintain a safe medicine pH during storage and transit.

The pharmaceutical grade sodium carbonate market is encountering a ripple in demand, prompting providers to invest in developing production capabilities. Such operations activities are aimed at ensuring that there is a sufficient supply to meet the increasing demand for the product.

Manufacturers of pharmaceutical-grade sodium carbonate are interested in mergers, acquisitions, and product launches. These strategic moves pledge to broaden their geographic reach and market share globally. Such efforts aim to increase the industry's productivity and competitiveness. They also strive to ensure that consumers obtain high-quality goods and services, thus supporting the improvement of the sector's prospects for the future.

Industry Updates

As per grade, the industry has been bifurcated into fine pharmaceutical grade sodium carbonate and coarse pharmaceutical grade sodium carbonate.

Pharmaceutical grade sodium carbonates find application as API, for pharma excipients, personal care, and others.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa.

The global pharmaceutical grade sodium carbonate market is estimated to be valued at USD 48.0 million in 2025.

The market size for the pharmaceutical grade sodium carbonate market is projected to reach USD 63.3 million by 2035.

The pharmaceutical grade sodium carbonate market is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in pharmaceutical grade sodium carbonate market are coarse grade and fine grade.

In terms of application, pharma excipients segment to command 41.1% share in the pharmaceutical grade sodium carbonate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceuticals Grade Sodium Bicarbonate Market Insights - Size, Share & Industry Growth 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Manufacturing Equipment Market Forecast and Outlook 2025 to 2035

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Pharmaceutical Industry Analysis in Saudi Arabia Forecast and Outlook 2025 to 2035

Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Pots Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Pouch Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Unit Dose Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Mini Batch Blender Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Continuous Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Liquid Prefilters Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Container Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Contract Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Container Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Sterility Testing Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Preservative Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Track and Trace Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA