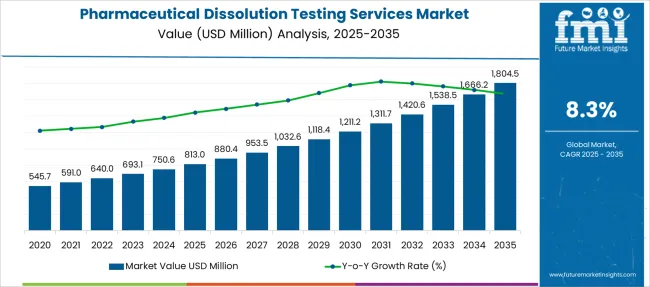

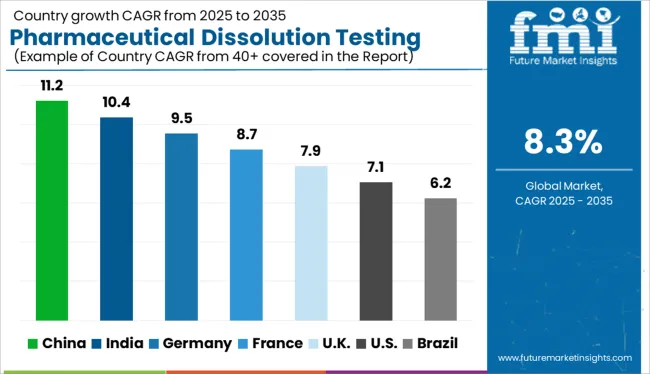

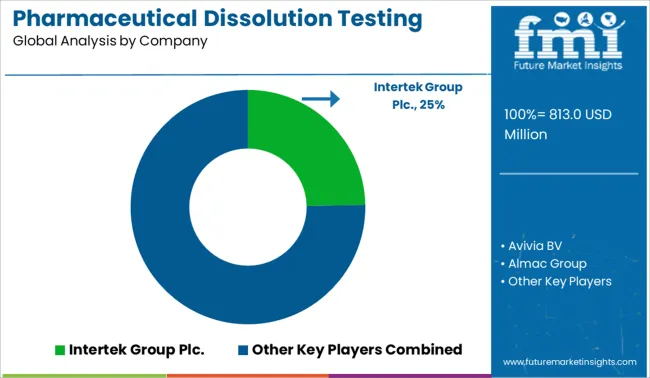

The Pharmaceutical Dissolution Testing Services Market is estimated to be valued at USD 813.0 million in 2025 and is projected to reach USD 1804.5 million by 2035, registering a compound annual growth rate (CAGR) of 8.3% over the forecast period.

| Metric | Value |

|---|---|

| Pharmaceutical Dissolution Testing Services Market Estimated Value in (2025 E) | USD 813.0 million |

| Pharmaceutical Dissolution Testing Services Market Forecast Value in (2035 F) | USD 1804.5 million |

| Forecast CAGR (2025 to 2035) | 8.3% |

The pharmaceutical dissolution testing services market is expanding steadily due to increasing regulatory scrutiny, greater focus on bioequivalence studies, and the rising number of generic drug approvals globally. With the need to ensure consistent drug release and absorption profiles, pharmaceutical manufacturers are relying more on dissolution testing to meet compliance and quality assurance standards.

Outsourcing these services allows firms to reduce operational burden, accelerate time to market, and access specialized expertise. The market is also benefiting from the growing trend of personalized medicine, where dissolution testing plays a crucial role in evaluating custom dosage forms and controlled release formulations.

As the pharmaceutical industry continues to evolve with novel therapeutics and complex formulations, demand for precise and standardized dissolution testing services is expected to remain strong.

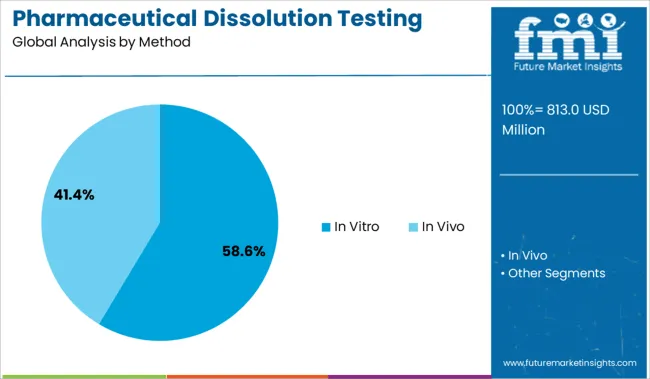

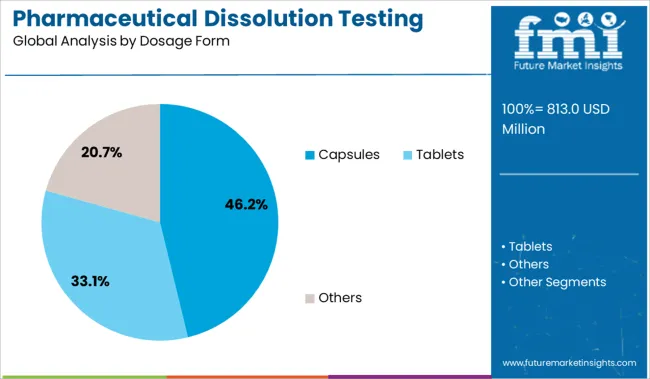

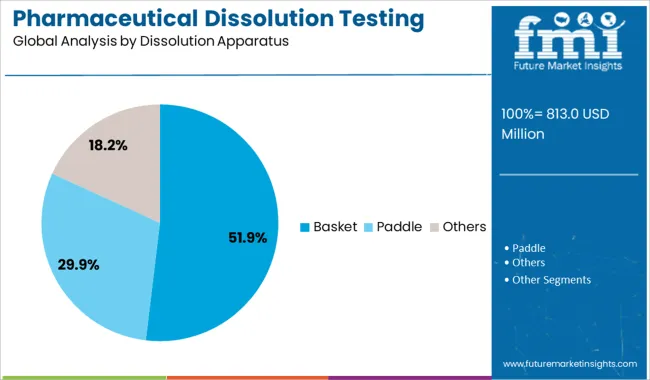

The market is segmented by Method, Dosage Form, and Dissolution Apparatus and region. By Method, the market is divided into In Vitro and In Vivo. In terms of Dosage Form, the market is classified into Capsules, Tablets, and Others. Based on Dissolution Apparatus, the market is segmented into Basket, Paddle, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The in vitro method segment is expected to represent 58.60% of total market revenue by 2025 within the method category, establishing itself as the leading segment. This dominance is driven by its non invasive nature, cost efficiency, and its alignment with regulatory guidelines for early phase drug screening and formulation development.

In vitro testing enables rapid, reproducible, and ethical assessment of dissolution characteristics without involving clinical subjects. It also provides critical data that supports product development decisions and regulatory submissions.

With increasing pressure to streamline drug development while maintaining high quality standards, in vitro methods are widely preferred, strengthening their leadership in the pharmaceutical dissolution testing services market.

The capsules segment is projected to account for 46.20% of market revenue by 2025 in the dosage form category, placing it as the dominant format. This is largely due to the widespread use of capsules across both branded and generic pharmaceuticals, driven by their ease of administration, flexible formulation potential, and enhanced patient compliance.

Capsules often require dissolution testing to assess shell disintegration and active ingredient release timing, making them a focus area for pharmaceutical quality control.

With increased R and D in modified release capsule technologies and complex drug delivery systems, the demand for targeted dissolution testing services for capsule formulations continues to grow, reinforcing the segment’s market share.

The basket dissolution apparatus segment is projected to contribute 51.90% of total market revenue by 2025 under the dissolution apparatus category, marking it as the leading segment. This apparatus is particularly suited for testing solid oral dosage forms like capsules and tablets, providing consistent agitation and accurate measurement of drug release profiles.

Its standardized design and widespread regulatory acceptance have made it the apparatus of choice for many pharmaceutical testing protocols. Additionally, its compatibility with automation and high throughput workflows enhances its utility in large scale drug testing environments.

The sustained preference for basket apparatus reflects its reliability, efficiency, and critical role in ensuring product performance and regulatory compliance.

According to market research and competitive intelligence provider Future Market Insights- the market for pharmaceutical dissolution testing services reflected a value of 5.2% during the historical period, 2020 to 2025.

The COVID-19 pandemic has significantly impacted the global industry. Pharmaceutical firms, biotech firms, and other end-user demands were primarily served during the crisis by developing coronavirus prevention drugs. Since the end of 2020, these organizations have been actively working toward the development of medications that can be used as a treatment for COVID-19 patients who have only minor symptoms.

And these drug developments require dissolution testing at each stage to access safety, stability, and efficacy, thus contributing to industry growth. Thus, the market for pharmaceutical dissolution testing services is expected to register a CAGR of 8.3% in the forecast period 2025 to 2035.

Research for Prevention of COVID-19 leading to demand for Pharmaceutical Dissolution Testing Services

The pandemic created an increased workload and a reduction in the internal lab testing capacities of various pharmaceutical companies. However, to mitigate or prevent these challenges, various strategies, like rotational shifts, reducing manpower, and working from home were adopted by companies. By the second half of the pandemic, the research studies for drug development started for the prevention of COVID-19 led to a rise in demand for pharmaceutical dissolution testing services. Dissolution testing is an essential tool for assessing the effectiveness of oral solid dose forms.

Its importance is rising due to the fact that medicine must first be released from the product and dissolved in the gastrointestinal fluids before it can be absorbed into the blood vessels to be effective. In other words, how quickly and how much of a medicine is absorbed depends on how easily it dissolves from the dosage form. According to The Food and Drug Administration Dissolution Database, there are 1444 drug products (July 2025) in the database that are in oral solid dose form. The oral solid dose is relatively simple to administer and it is simple to differentiate one oral solid dose product from another.

Marketing Efforts and Awareness regarding Healthcare Products bolstering demand for Pharmaceutical Dissolution Testing Services

Oral solid dose manufacturing approaches are well-developed. Each has a repeatable distribution of ingredients, as well as uniformity in dissolution and bioavailability, to verify that the drug product is safe and effective. The performance of key companies is highly influenced by the level of demand from end users.

Due to intense market efforts, increasing awareness levels, improving accessibility, and government initiatives; consumers, these days, are more concerned about self-care, resulting in higher consumption of healthcare products. The consumption levels are anticipated to rise exponentially over the forecast period.

Unskilled Workforce affecting the growth of the Pharmaceutical Dissolution Testing Services Market

The pharmaceutical dissolution testing services are at a nascent stage. Thus, the trial-and-error format of the industry is hampering the overall growth of the market. Moreover, the absence of unskilled labor to perform various testing services tasks is retaining the growth of the market. Although key players are using technology to increase production and testing services, the unavailability of skilled labor is causing losses to the industry.

Research and Development for Novel Therapeutics accelerating market growth in North America

North America is expected to dominate the global industry in 2025 and account for the maximum share exceeding 50% of the overall revenue. The high share of this segment can be attributed to the presence of major companies providing pharmaceutical dissolution testing services and rising investments in Research and Development by them for the development of novel therapeutics for chronic diseases.

In addition, the development of the healthcare system and a rise in the burden of disease have increased the demand for novel therapeutics and, in turn, the demand for laboratory dissolution testing. All these factors are propelling the growth of the pharmaceutical dissolution testing services market in North America.

Government Initiatives for Research and Development supporting the growth of the market in Asia Pacific

The Asia Pacific region is expected to grow at the fastest CAGR during the forecast period owing to the rising investments by companies from developed economies in enhancing regional healthcare. Furthermore, service providers are establishing new facilities and forming alliances to increase the reach of their offerings to various locations in the region.

In addition, the government of the region is focusing on offering investments for research and development that will accelerate the manufacturing of medicines for different ailments. Thus, Asia Pacific is expected to possess a 33% market share for the pharmaceutical dissolution testing services market in Asia Pacific.

In-vitro dissolution testing is used to evaluate the security of medicines

The in-vitro method segment is expected to dominate the global market in 2025 and account for the largest share of more than 58% of the overall revenue.

The segment is projected to expand further at the fastest growth rate maintaining its leading industry position throughout the forecast period. Two key factors driving the segment growth include an increase in preclinical pipeline capacity and growing awareness about dissolution testing.

In addition, the market for in-vitro pharmaceutical dissolution testing is anticipated to rise as a result of the traditional rising costs of animal tests as well as their socio-ethical problems. Market expansion is predicted to be supported by significant developments in the in-vitro dissolution testing assays used to evaluate the security of medicines and the potential impacts of those drugs on cells and tissues.

To accommodate the rising demand for these assays, businesses are increasing their product lines as the market for in-vitro pharmaceutical dissolution testing expands.

Easy formulation and availability of tablets increasing production of capsules

Based on dosage form, the global industry has been further categorized into capsules, tablets, and others. The other segment includes syrup, ointments, eye/ear/nasal drops, powders, and aerosols.

The tablet dosage form segment is expected to dominate the global industry in 2025 and account for the maximum share of 65% of the overall revenue. The segment is also anticipated to register the fastest CAGR maintaining its leading industry position throughout the forecast period.

This rapid growth can be attributed to the fact that tablets are simple to produce in large quantities, have excellent physical and chemical stability, and can be adjusted for the amount of medicine supplied to the body. The capsules segment is anticipated to register the second-fastest CAGR during the forecast period. Capsules are solid dosage forms. Some of the major drivers of this segment are the stability, easy availability of storage conditions, and easy formulation & development of capsules.

Easy Allowance of pH change maximizing use of paddle for manufacturing tablets

Based on dissolution apparatus, the global industry has been further categorized into basket, paddle, and others. The other segment includes a reciprocating cylinder, flow-through cell, paddle-over disc, rotating cylinder, and reciprocating disc. The paddle segment is expected to dominate the industry and account for the largest revenue share of 70% in 2025.

The paddle is fixed vertically to a motor with variable speed and controlled speed. The tablet or capsule is put into a flask with a circular bottom for dissolving, and the equipment is kept at a steady temperature. This is widely used for the oral solid dosage form.

It is easy to use, can change pH, and can be easily automated for a routine check-up. The basket dissolution apparatus segment is likely to register the second-fastest CAGR during the forecast period. New equipment is positioned at the revolving shaft's end when using the basket dissolution method.

It is made of non-reactive mesh and has a cylindrical form to avoid any unintended chemical interactions that might change the outcome. The main driver for the wide-scale adoption of this method is it can change its pH during the test.

Businesses are undertaking strategies like product launches, M&A agreements, regional expansions, and product launches to gain a competitive edge. Some of the prominent players in the global pharmaceutical dissolution testing services market include Intertek Group Plc, Avivia BV, Almac Group, Agilent Technologies, Inc., Catalent, Inc., Thermofisher Scientific Inc, Cambrex, Charles River Laboratories, Boston Analytical, Pace Analytical Life Sciences, SOTAX, AMRI, SGS SA

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 813.0 million |

| Market Value in 2035 | USD 1804.5 million |

| Growth Rate | CAGR of 8.3% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Method, Dosage Form, Dissolution Apparatus, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, China, Japan, South Korea, Singapore, Thailand, Indonesia, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Intertek Group Plc.; Aviva BV; Almac Group; Agilent Technologies, Inc.; Catalent, Inc.; Thermo Fisher Scientific Inc.; Cambrex; Charles River Laboratories; Boston Analytical; Pace Analytical Life Sciences; SOTAX; AMRI; SGS SA |

| Customization | Available Upon Request |

The global pharmaceutical dissolution testing services market is estimated to be valued at USD 813.0 million in 2025.

The market size for the pharmaceutical dissolution testing services market is projected to reach USD 1,804.5 million by 2035.

The pharmaceutical dissolution testing services market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in pharmaceutical dissolution testing services market are in vitro and in vivo.

In terms of dosage form, capsules segment to command 46.2% share in the pharmaceutical dissolution testing services market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Examining Food Testing Services Market Share & Industry Outlook

Seed Testing Services Market Growth – Trends & Forecast 2018-2028

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Residue Testing Services Market Size, Growth, and Forecast for 2025 to F2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

Biofuel Testing Services Market Growth – Trends & Forecast 2018-2028

Pharmaceutical Sterility Testing Market Size and Share Forecast Outlook 2025 to 2035

USA Food Testing Services Market Outlook – Share, Growth & Forecast 2025–2035

Chemical Testing Services Market Trends and Forecast 2025 to 2035

Nematode Testing Services Market

Pharmaceutical Dosage Form Testing Systems Market

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Corrosion Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Packaging Testing Services Industry

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Biosimilar Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Outsourced Testing Services Market Insights – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA