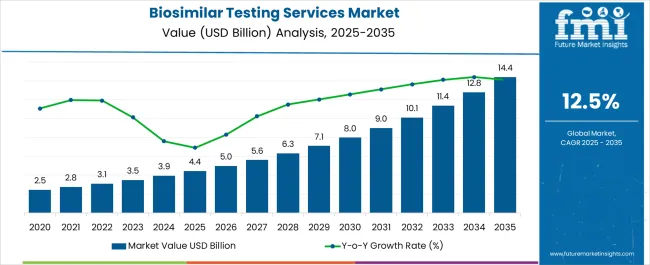

The Biosimilar Testing Services Market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 14.4 billion by 2035, registering a compound annual growth rate (CAGR) of 12.5% over the forecast period.

| Metric | Value |

|---|---|

| Biosimilar Testing Services Market Estimated Value in (2025E) | USD 4.4 billion |

| Biosimilar Testing Services Market Forecast Value in (2035F) | USD 14.4 billion |

| Forecast CAGR (2025 to 2035) | 12.5% |

The Biosimilar Testing Services market is expanding steadily, fueled by the increasing demand for cost-effective therapeutic alternatives and the rising number of biosimilars entering global pipelines. Growing patent expirations of biologics and heightened focus on regulatory compliance are reinforcing the adoption of testing services to ensure safety, efficacy, and comparability with reference products. Market players are integrating advanced analytical platforms, next-generation sequencing, and bioassay technologies to meet evolving regulatory requirements across regions.

The ability to provide comprehensive end-to-end testing solutions, covering preclinical through post-approval phases, is enhancing competitiveness among service providers. Increasing clinical trial activity and the need for pharmacovigilance monitoring are also shaping the market. Governments and regulatory authorities are placing stronger emphasis on quality assurance, which is driving demand for standardized testing services.

The rising prevalence of chronic diseases such as cancer and autoimmune disorders is creating continuous demand for biosimilars, further reinforcing the importance of accurate testing As biopharmaceutical pipelines expand, biosimilar testing services are expected to play a pivotal role in ensuring quality, safety, and global market acceptance.

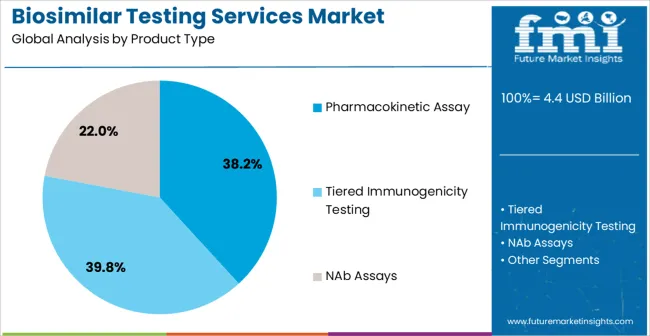

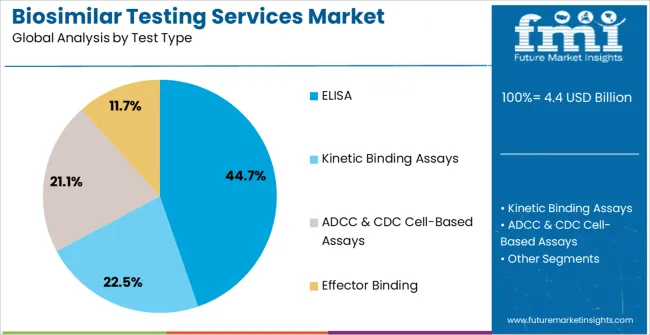

The biosimilar testing services market is segmented by product type, test type, and geographic regions. By product type, biosimilar testing services market is divided into Pharmacokinetic Assay, Tiered Immunogenicity Testing, and NAb Assays. In terms of test type, biosimilar testing services market is classified into ELISA, Kinetic Binding Assays, ADCC & CDC Cell-Based Assays, and Effector Binding. Regionally, the biosimilar testing services industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pharmacokinetic assay segment is projected to account for 38.2% of the Biosimilar Testing Services market revenue in 2025, establishing itself as the leading product type. Its dominance stems from the critical role pharmacokinetic studies play in evaluating drug absorption, distribution, metabolism, and excretion to confirm biosimilar comparability with originator biologics. These assays are essential for establishing dose equivalence, therapeutic interchangeability, and regulatory approval.

The segment’s growth is further supported by technological advancements in bioanalytical methods, such as LC-MS/MS platforms, which enhance sensitivity and accuracy. Service providers are investing in automation and high-throughput testing capabilities to meet rising demand from clinical trial sponsors. Increasing regulatory scrutiny, coupled with the growing number of biosimilar approvals, is amplifying the importance of pharmacokinetic assays.

Moreover, the ability to generate reliable data for bridging studies across diverse populations is driving adoption With continued innovation in bioanalytical techniques and the rising global uptake of biosimilars, pharmacokinetic assays are expected to remain central to biosimilar testing workflows.

The ELISA segment is expected to capture 44.7% of the Biosimilar Testing Services market revenue in 2025, making it the leading test type. ELISA methods are widely preferred for their high sensitivity, cost-effectiveness, and ability to quantify proteins and antibodies in complex biological samples. Their application in immunogenicity testing and bioanalytical characterization has reinforced their importance in biosimilar development and regulatory submissions.

ELISA’s adaptability to high-throughput workflows allows service providers to manage large-scale clinical trial data with consistency and reliability. Continuous improvements in assay design, including sandwich and competitive formats, have enhanced performance and reduced variability. Demand is further fueled by the requirement to detect anti-drug antibodies, a crucial element in demonstrating biosimilar safety.

Service providers are increasingly integrating ELISA platforms with digital data management systems to improve efficiency and compliance reporting As biosimilar pipelines expand and regulatory requirements intensify, ELISA testing is projected to remain a cornerstone of biosimilar testing, supported by its versatility, scalability, and proven track record in biopharmaceutical research.

Biosimilar are the biological based products used for various use in healthcare industry. Biosimilar products are very helpful to the patients and also offer therapeutic options. Biosimilar have a unique properties, which is used to study the biological functions and structures complexity of the sample. As the diseases type are increasing over the global, with various effect on human and animals which can cause death also.

Public and private associations are working to develop various preventive methods and pre-identifying methods to detect the cause and type disease. Biosimilar testing are used in all the industry related to healthcare and other industry such as diagnoses, clinical and etc.

Biosimilar improvement is used for medication, which is why the accurate analysis at every single stage activities are been recorded and analyzed, to determine the arrangement, structure and value qualities of the initiator to virtual one-on-one biosimilarity testing of the biosimilar with the inventor, biosimilar testing services provide vital analytics to easily understand the process and come-up with better results in short duration of time.

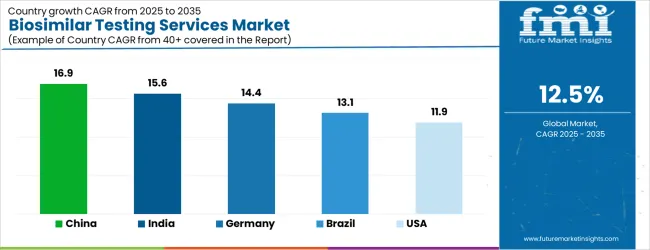

| Country | CAGR |

|---|---|

| China | 16.9% |

| India | 15.6% |

| Germany | 14.4% |

| Brazil | 13.1% |

| USA | 11.9% |

| UK | 10.6% |

| Japan | 9.4% |

The Biosimilar Testing Services Market is expected to register a CAGR of 12.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 16.9%, followed by India at 15.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 9.4%, yet still underscores a broadly positive trajectory for the global Biosimilar Testing Services Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 14.4%. The USA Biosimilar Testing Services Market is estimated to be valued at USD 1.7 billion in 2025 and is anticipated to reach a valuation of USD 1.7 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 225.7 million and USD 130.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.4 Billion |

| Product Type | Pharmacokinetic Assay, Tiered Immunogenicity Testing, and NAb Assays |

| Test Type | ELISA, Kinetic Binding Assays, ADCC & CDC Cell-Based Assays, and Effector Binding |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

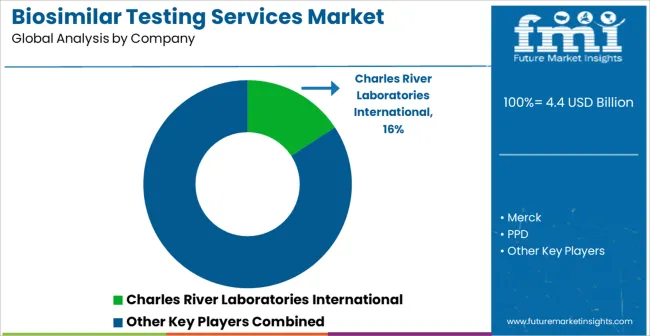

| Key Companies Profiled | Charles River Laboratories International, Merck, PPD, LAB Holdings, Eurofins Scientific, Intertek, SGS, Profacgen, Antibody Analytics, Kymos Pharma Services, Medicilon, Pacific BioLabs, and Sartorius |

The global biosimilar testing services market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the biosimilar testing services market is projected to reach USD 14.4 billion by 2035.

The biosimilar testing services market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in biosimilar testing services market are pharmacokinetic assay, tiered immunogenicity testing and nab assays.

In terms of test type, elisa segment to command 44.7% share in the biosimilar testing services market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Examining Food Testing Services Market Share & Industry Outlook

Seed Testing Services Market Growth – Trends & Forecast 2018-2028

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Residue Testing Services Market Size, Growth, and Forecast for 2025 to F2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

Biofuel Testing Services Market Growth – Trends & Forecast 2018-2028

USA Food Testing Services Market Outlook – Share, Growth & Forecast 2025–2035

Chemical Testing Services Market Trends and Forecast 2025 to 2035

Nematode Testing Services Market

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Corrosion Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Packaging Testing Services Industry

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Outsourced Testing Services Market Insights – Trends & Forecast 2025 to 2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

Food Safety Testing Services Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Europe Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA