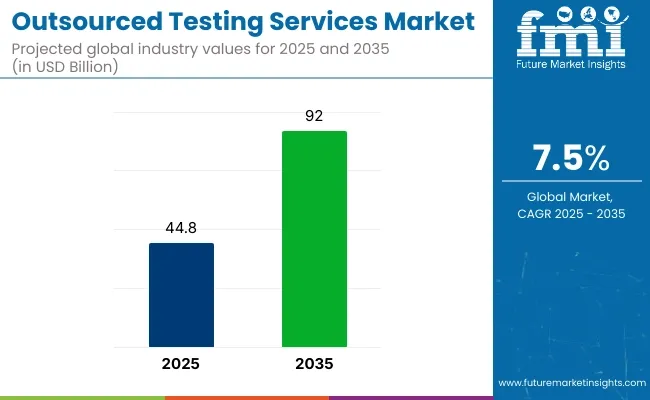

The global outsourced testing services market is projected to be valued at approximately USD 44.8 billion in 2025 and is expected to expand to USD 92.0 billion by 2035, registering a CAGR of 7.5% during the forecast period. In 2024, the market was estimated at USD 42.1 billion.

This growth is being driven by the increasing demand for cost-effective and scalable testing solutions, particularly in the pharmaceutical, biotechnology, and medical device sectors. The adoption of advanced diagnostic technologies and automation has been accelerated to improve accuracy and turnaround time.

Greater reliance on contract research and testing organizations has been observed, influenced by stringent regulatory frameworks and complex quality standards. Emerging markets have been targeted for expansion, supported by infrastructure development and rising healthcare investments.

The outsourced testing services market in 2025 is being propelled by significant advancements and strategic initiatives undertaken by leading manufacturers. Key players such as Eurofins Scientific, Labcorp, Thermo Fisher Scientific, IQVIA, SGS SA, Sotera Health, Intertek Group plc, and Parexel International Corporation are at the forefront of this growth, leveraging innovation, strategic collaborations, and technological developments to enhance their market positions.

In March 2025, Sotera Health, through its subsidiary Nelson Labs, launched Rapid Sterility Testing to accelerate microbiological analysis for medical devices and pharmaceutical products. The method reduces the standard sterility testing timeline from 14 days to as little as 6 days, enhancing time-to-market capabilities while ensuring compliance with USP standards.

As stated by Michael B. Petras Jr., CEO of Sotera Health, “Our commitment to safeguarding global health drives us to innovate continuously. The Rapid Sterility Testing method exemplifies our dedication to providing faster and reliable solutions to our clients.” The market is being driven by increasing regulatory compliance requirements, which necessitate the use of specialized outsourced testing services to ensure product safety and efficacy.

North America has been recognized as the dominant market for outsourced testing services, driven by the presence of advanced healthcare infrastructure, a high concentration of CROs, and increased reliance on cost-efficient diagnostic solutions. In the United States, greater adoption of outsourced testing has been observed due to rising pharmaceutical R&D spending and the need to reduce operational burdens within healthcare institutions.

In Europe, steady growth has been recorded, supported by stringent regulatory standards enforced by the European Medicines Agency (EMA) and the growing requirement for quality assurance in diagnostics. Countries such as Germany, France, and the United Kingdom have been influenced by government-backed initiatives and innovation in healthcare delivery. Widespread adoption has been enabled across laboratories, hospitals, and biotech firms through collaborative frameworks and technological integration.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 42.1 billion |

| Estimated Size, 2025 | USD 44.8 billion |

| Projected Size, 2035 | USD 92.0 billion |

| CAGR (2025 to 2035) | 7.5% |

The health market outsourcing of testing services refers to the process of delegating testing diagnostic, clinical, and specialty testing activities conducted by health providers-the hospitals, clinics, pharmaceutical firms, and research organizations-to a third-party provider outside of their establishments.

These services accommodate many fields: for example, molecular diagnostics involving gene and genomic tests, microbiology, toxicology, immunology, and pathology.

The outsourcing framework will enable a healthcare organization to leverage the skills, cutting-edge technologies, and operational efficiency of service providers that enable them to focus on core functions, such as patient care and treatment.

These requirements are also facilitated by the diagnostic and testing service complexity of today, which demand highly specialized tools and trained people.

Outsourcing to diagnostic laboratories, contract research organizations (CROs), and niche service providers allows the healthcare organization access to up-to-date instruments and technologies-that is, to the best current tools and approaches-without taking on the acquisition and maintenance expense of expensive equipment.

Health regulations, including the duty to ensure that the company continues to operate in conformity with industry norms, encourage outsourcing: to ensure the delivery of services in a uniform quality and regulatory framework.

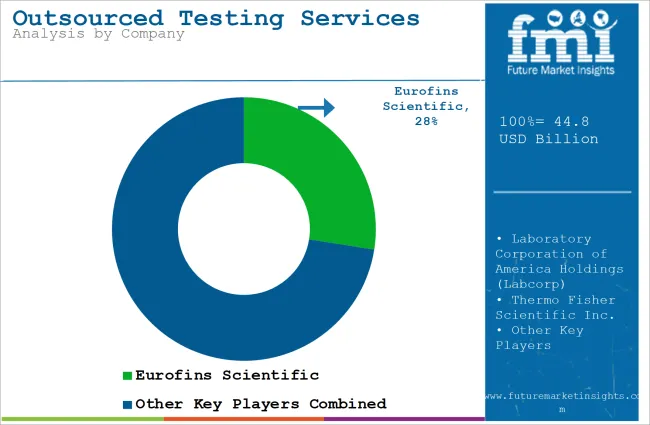

Key players in this market include global diagnostic leaders like Labcorp, Eurofins Scientific, and ICON plc, who have vast testing portfolios and multiple healthcare domains. They are collaborating with hospitals, pharmaceutical companies, and clinical research organizations to standardize testing and enhance diagnostics outcomes.

Outsourced testing services are increasingly taking the center stage of the future of healthcare, as precision medicine and regulatory compliance are increasingly becoming integral components of the modern healthcare delivery system.

The global outsourced testing services market compound annual growth rate (CAGR) for the first half of 2024 and 2025 is compared in the table below. This analysis provides important insights into the performance of the industry by highlighting significant shifts and trends in revenue generation. The first half (H1) is the period from January to June, and the second half (H2) is July to December.

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 8.5%, followed by a slightly lower growth rate of 8.0030% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 8.5% |

| H2 (2024 to 2034) | 8.0% |

| H1 (2025 to 2035) | 7.5% |

| H2 (2025 to 2035) | 7.1% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 7.5% in the first half and remain relatively lower at 7.1% in the second half. In the first half (H1) the industry witnessed a decrease of 100 BPS while in the second half (H2), the industry witnessed a decrease of 100 BPS.

In 2025, clinical trials testing and bioanalytical testing are expected to cumulatively hold 21.7% of the revenue share in the outsourced testing market. This segment’s dominance is attributed to the essential role these tests play in the drug development lifecycle.

Clinical trials testing is critical for ensuring the safety and efficacy of new therapies before they are released to the market. Bioanalytical testing, which involves the precise measurement of drug concentration and metabolites in biological samples, supports regulatory submissions and ensures compliance with safety standards.

The growth of this segment has been driven by the increasing complexity of clinical trials, as well as the need for accurate, high-quality testing to meet stringent regulatory requirements. The outsourcing of these services to specialized providers has allowed pharmaceutical and biotechnology companies to reduce costs, enhance testing capabilities, and accelerate the time-to-market for new drugs. Furthermore, the increasing demand for personalized medicine, coupled with the rise of biologics, has further fueled the growth of clinical trials and bioanalytical testing.

In 2025, contract research organizations (CROs) are projected to hold 51.7% of the revenue share in the outsourced testing market. This dominance is driven by the specialized expertise and scalability offered by CROs in the drug development process. CROs provide comprehensive services across various phases of clinical trials, including trial design, regulatory compliance, and data management, making them essential partners for pharmaceutical and biotechnology companies.

The growth of this segment has been driven by the increasing complexity of drug development, the rising costs associated with in-house research, and the need for faster time-to-market. CROs offer significant cost savings and operational efficiency, enabling drug developers to focus on their core competencies while outsourcing testing and research functions.

Rising Demand for Advanced Molecular Diagnostics Populations is driving the Outsourced Testing Services Market Growth

The burden of diseases like cancer and infectious diseases has further increased along with genetic disorders. The increased requirement for these molecular diagnostics technologies comes from advanced next-generation sequencing, polymerase chain reaction, and gene editing in terms of being important for offering precise diagnostic and targeted therapeutics.

Such molecular tests require sophisticated equipment, skilled personnel, and large-scale data analysis; therefore, outsourcing to the dedicated laboratory increases their productivity and efficiency while saving the cost.

In the field of precision medicine, understanding the genotypic makeup of patients is something that becomes indispensable for tailoring proper treatment plans. Generally, external molecular testing services allow doctors access to the latest available knowledge in genomics and molecular biology without having to invest heavily in infrastructure or people.

Increased trends toward personalized treatment and a higher degree of accuracy in diagnosis with respect to specific cancers, genetic disorders, or infectious diseases test the importance of outsourced testing services. In this context, outsourcing is the new market growth area that ensures high-quality results and timely diagnosis.

Cost-Effectiveness and Operational Efficiency is driving Revenue Growth for Outsourced Testing Services

The constant pressure that healthcare providers feel today is on the mounting financial constraints without compromising the quality. Outsourcing testing services might be cost-efficient because it gets rid of having to invest in high-end diagnostic equipment, staffing specialized laboratories, and running complex operational workflows. Healthcare organizations can then shift their resources away from expensive infrastructure by delegating testing functions.

This will benefit the service providers as well in the form of economies of scale; large volumes of tests can be done at cheaper operational costs that are passed on to their clients. Infrastructure allows the scaling up of testing capacity fast as needed based on demand; examples include public health emergencies like pandemics or seasonal increases in infections.

This flexibility makes outsourcing a more attractive and feasible option for healthcare systems that are dealing with fluctuating testing needs and scarce resources.

Growth and Expansion in Emerging Markets is Creating Opportunities in the Market

The outsourced testing services market is likely to grow significantly in emerging markets, especially in India, China, Brazil, and other parts of Southeast Asia. These countries have rapid improvement in health infrastructure due to increased income, increase in the amount of health expenditure, and access to modern diagnostic technologies.

In addition, these regions are also posed with major health problems in the form of chronic diseases that include diabetes, hypertension, and other infectious diseases.

The relatively lower labor and operational expenses in emerging markets make them the most attractive region for global players in diagnostics wishing to expand operations.

Countries like India and China have become hotspots for outsourcing high-end diagnostic tests by forming local partnerships with laboratory services and hiring international service providers.

These countries are also catching up fast on digital healthcare, making them the best areas for the application of telemedicine with outsourced diagnostics services.

Increasing Data Privacy and Regulatory Challenges may Restrict Market Growth

A considerable restraint to the outsourced testing services market is the increasingly stringent data privacy regulations and compliance requirements, especially as related to sensitive healthcare information.

Testing services usually deal with patient information. There exists a body of legislation like HIPAA in the United States and GDPR in Europe to regulate that kind of data. Different levels of regulatory oversight by service providers are operated across regions.

Such non-compliance would attract financial penalties, severe legal consequences, and loss in a company's reputation. A major concern from issues associated with data security that is cyber-attacks or breach in security loses patients' confidence. Thus, individuals involved with testing services being outsourced take it into high regard.

Tier 1 companies are the industry leaders with 62.4% of the global industry. These companies stand out for having a large product portfolio and a high production capacity.

These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries.

The companies within tier 1 have a good reputation and high brand value. Prominent companies within tier 1 include Eurofins Scientific, Laboratory Corporation of America Holdings (Labcorp), Thermo Fisher Scientific Inc. and IQVIA Inc.

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 22.2% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology.

The players are more competitive when it comes to pricing and target niche markets. Key Companies under this category include SGS SA, Sotera Health, Intertek Group plc, Parexel International Corporation among others.

Compared to Tiers 1 and 2, Tier 3 companies offer outsourced testing services, but with smaller revenue spouts and less influence. These companies mostly operate in one or two countries and have limited customer base. They specialize in specific products and cater to niche markets, adding diversity to the industry.

The market analysis for outsourced testing services in various nations is covered in the section below. An analysis of important nations in North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa of the world has been mentioned below.

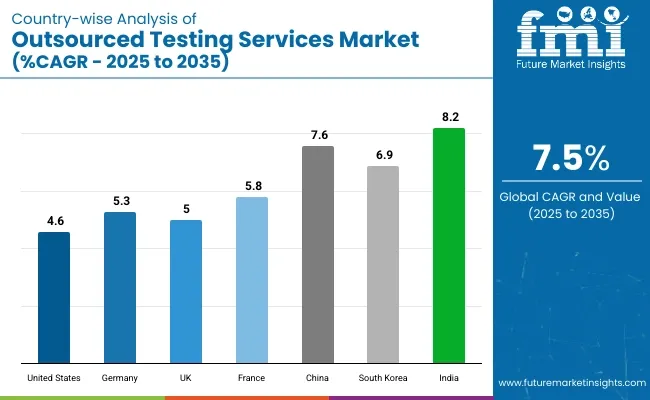

It is projected that the United States will maintain its leading position in North America through 2035, holding a value share of 88.9%. By 2035, China is expected to experience a CAGR of 7.6% in the Asia-Pacific region.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

| Germany | 5.3% |

| UK | 5.0% |

| France | 5.8% |

| China | 7.6% |

| South Korea | 6.9% |

| India | 8.2% |

Germany’s outsourced testing services market is poised to exhibit a CAGR of 5.3% between 2025 and 2035. The Germany holds highest market share in European market due to the rising demands of precision medicine and personalized healthcare in Germany.

The country has been very advanced in terms of developing infrastructure for healthcare while also integrating novel technologies such as next-generation sequencing (NGS) and biomarker testing into its system.

Individualized treatment, especially oncology and rare genetic disorders, has increased requirements for highly specialized diagnostic tests. Outsourcing of testing to well-equipped laboratories fitted with the most modern technologies in the field allow healthcare providers to meet such demands without a huge investment in infrastructure and special personnel.

Regulatory compliance is one of the more prominent drivers in the German market. It is no secret that Germany boasts one of the healthiest healthcare regulations in Europe, so to speak, ensuring patient data remains safe and that all tests comply with international standards.

Thus, many healthcare institutions prefer to outsource testing to these certified laboratories in the country, to avoid the possibility of non-compliance.

Moreover, Germany is in the central position of the European Union, making it a key location for international partnerships; hence, many international players opt to form partnerships with local service providers to exploit the growing demand for outsourced testing services in the region.

United States is anticipated to show a CAGR of 3.4% between 2025 and 2035.

One major reason behind this trend is increasing financial constraints on health institutions in the United States. Health care organizations, including hospitals, clinics, and research facilities, need to cut their operational costs without slowing down the pace or sacrificing accuracy in diagnostic results.

Third-party providers are thus being sought out for the outsourced tests because they would ease the burden on healthcare organizations related to purchasing expensive diagnostic equipment, employing specialized staff, and satisfying demanding regulatory requirements. Providers can also scale testing services based on demand by outsourcing.

It may be due to seasonal fluctuations in times of high seasonal fluctuation or pandemics as part of public health emergencies. Another important factor is the regulatory environment of the United States. The high costs and penalties associated with failing to meet these standards are particularly relevant to this end.

India is anticipated to show a CAGR of 8.2% between 2025 and 2035.

Cost-effectiveness is crucial factor propelling the outsourcing trend in India. India's large population and growing economy contribute to the various challenges it experiences when it comes to healthcare costs. With large capital expenditure, in-house diagnostic capabilities often become too expensive for healthcare providers to implement.

To better handle costs while maintaining access to quality diagnostic services, institutions outsource testing to specialized laboratories and service providers.

Telemedicine is increasingly adopted to reach the underserved population, especially in rural areas where the diagnostic facilities may be limited. Outsourcing testing services can allow healthcare institutions to provide high-quality, accurate diagnostic results remotely, thereby improving access to healthcare in remote regions.

The increasing growth of the Indian healthcare market is expected to require outsourcing testing services to be played as an essential role in fulfilling the demands of the nation.

In terms of this market, the companies involved are resorting to multiple strategies to retain a competitive position. Geographical expansion into the emerging markets, particularly United States and Asia Pacific countries, has been another strategic priority for these companies, where growth in the healthcare infrastructure and awareness is strong.

Recent Industry Developments in Outsourced Testing Services Industry Outlook

In terms of service type, the industry is divided into clinical chemistry testing, immunology & serology testing, molecular diagnostics testing, microbiology testing, hematology testing, anatomic pathology services, toxicology testing among others.

In terms of specialty, the industry is segregated into infectious diseases, oncology, cardiology, neurology, endocrinology, genomics and precision medicine among others.

In terms of end user, the industry is divided into hospitals, specialty clinics, pharmaceutical and biotech companies, diagnostic laboratories, research institutes and academic organizations, contract research organizations (CROs) among others.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

The global outsourced testing services industry is projected to witness CAGR of 7.5% between 2025 and 2035.

The global outsourced testing services industry stood at USD 42.1 billion in 2024.

The global outsourced testing services industry is anticipated to reach USD 92.0 billion by 2035 end.

China is expected to show a CAGR of 7.6% in the assessment period.

The key players operating in the global outsourced testing services industry are Eurofins Scientific, Laboratory Corporation of America Holdings (Labcorp), Thermo Fisher Scientific Inc., IQVIA Inc., SGS SA, Sotera Health, Intertek Group plc, Parexel International Corporation among others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Soil Testing Market Growth - Trends & Forecast 2025 to 2035

Market Share Distribution Among Leak Testing Machine Providers

Examining Market Trends in the Self-Testing Industry Share

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA